Egypt is still Africa’s top FDI destination despite covid

Foreign direct investment into Egypt fell 39% in 2020 as fears over the coronavirus pandemic caused a historic drop in global investment flows, according to the United Nations Conference on Trade and Development’s (UNCTAD) most recent Investment Trends Monitor (pdf). Egypt attracted USD 5.5 bn of FDI last year, down from USD 8.5 bn in 2019, in what was a sharper drop than the 32% average among North African economies and 18% dip across Africa. Despite this, Egypt remained the top destination for FDI on the continent.

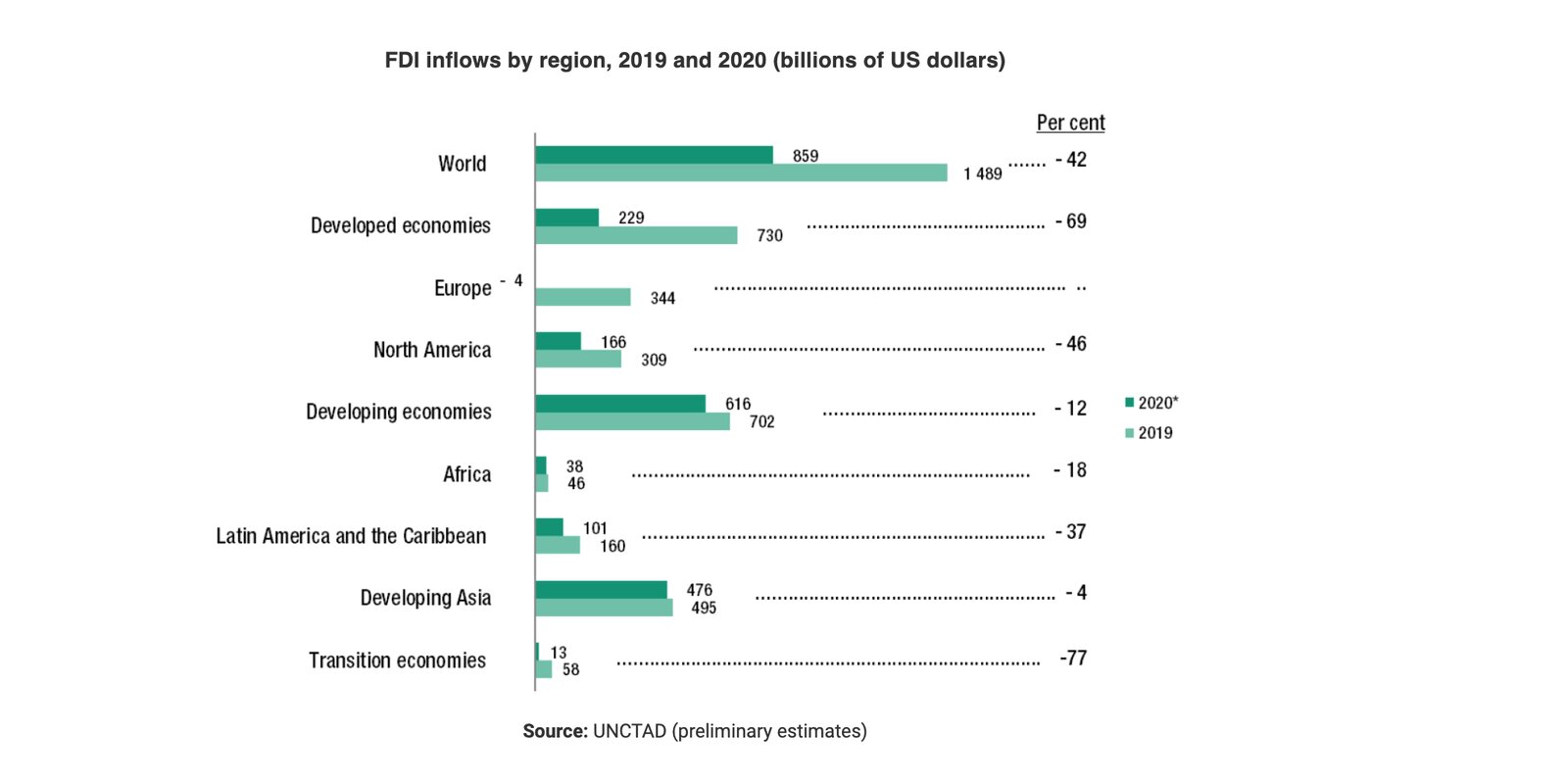

Developing economies got off fairly lightly, seeing a 12% fall in FDI during the year. This compares to the 42% decline in global flows (amounted to some USD 630 bn), which was slightly worse than UNCTAD’s projection for the year made in October. To put that in context: That’s 30% lower than the nadir seen in the aftermath of the global financial crisis.

The pain was felt most by advanced economies in Europe and the US, which saw a 69% plunge in inflows. Overall, developing economies still account for the bulk of global inflows, reaching a record 72%.

FDI will remain weak in 2021 due to low greenfield finance announcements last year—which fell by about 63% in Africa and 46% for developing economies — and continued uncertainty over the rollout of covid-19 vaccines. Growth in 2021 is expected to largely come from less productive cross border M&A — particularly in tech and healthcare — rather than new projects. And as for new industrial investment: the outlook “does not bode well,” the report says.