Credit Suisse, Fitch bullish on Egypt

Egypt’s economic growth will move back towards 5% by the end of the 2021 calendar year, helped by the upcoming vaccine rollout and continued public investment, Fitch Solutions said yesterday. In its latest MENA macroeconomic update, the research house forecasts FY2020-2021 GDP growth to come in at 3%, slightly below the 3.3% it predicted in November.

The country will do “reasonably well over the coming quarters” after experiencing a “relatively shallow” contraction during the covid-19 lockdown in 2Q2020, said Andrine Skjelland, head of MENA country risk at Fitch Solutions, during a webinar yesterday. This will be supported by what Fitch expects to be a “relatively fast vaccine rollout,” sizable government investment in the transport, IT and construction sectors, and growing demand for exports from the EU.

From the region: Fitch expects economic growth to rebound to 3.3% this year after having contracted by an estimated 5.1% in 2020. There will be noticeable divergences as countries access and distribute the vaccine at different speeds and OPEC production cuts hurt oil exporters in the Gulf.

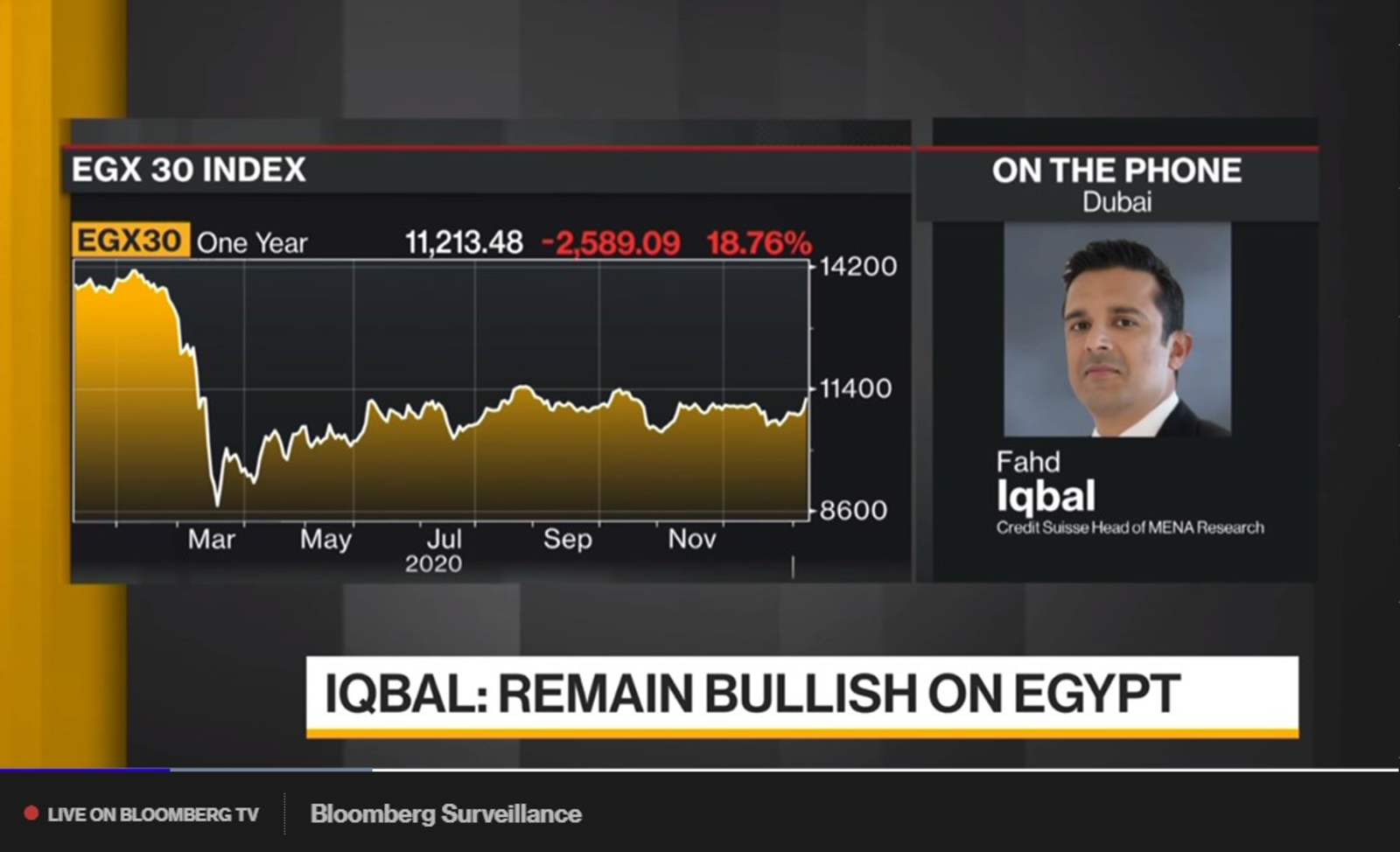

Credit Suisse is sending the hot money our way

A “significant and attractive risk-reward payoff” from Egypt’s t-bill carry trade is keeping Credit Suisse bullish on the Egypt story, head of MENA research Fahd Iqbal said on Bloomberg Daybreak yesterday (watch, runtime: 6:51). Egypt still has one of the highest real rates among emerging markets despite having made the biggest rate cuts among EMs since the outset of the pandemic.

Look for the Central Bank of Egypt to resume its monetary easing cycle at its February or March meetings, as it has “considerable room for continued cuts,” Iqbal said. If the central bank doesn’t cut rates at its next meeting on 4 February, that would make it all the more probable we’ll see lower rates at the following meeting on 18 March.

Less hot: Egyptian equities, whose performance is being held back as a result of liquidity headwinds, despite strong fundamentals, Iqbal said. “If you look at how growth has been developing, valuations, the quality of companies, the structural growth trend in Egypt — all of it adds up to a very, very compelling story. But it simply doesn’t follow through in actual performance,” he said. Without decent liquidity for equities, t-bills remain the “preferred way” to play the Egypt trade thanks to their attractive payoff, he said.