- Egypt’s vaccine program could start at the beginning of February, Zayed says. (Covid Watch)

- The new parliament sits for the first time today. (What We’re Tracking Today)

- Cleopatra-Alameda mega-merger, dissected. (M&A Watch)

- We could get a decision on the privatization program later this month. (Privatization)

- Egyptian Modern Education Systems wants to follow Speed Medical to the EGX. (Market Watch)

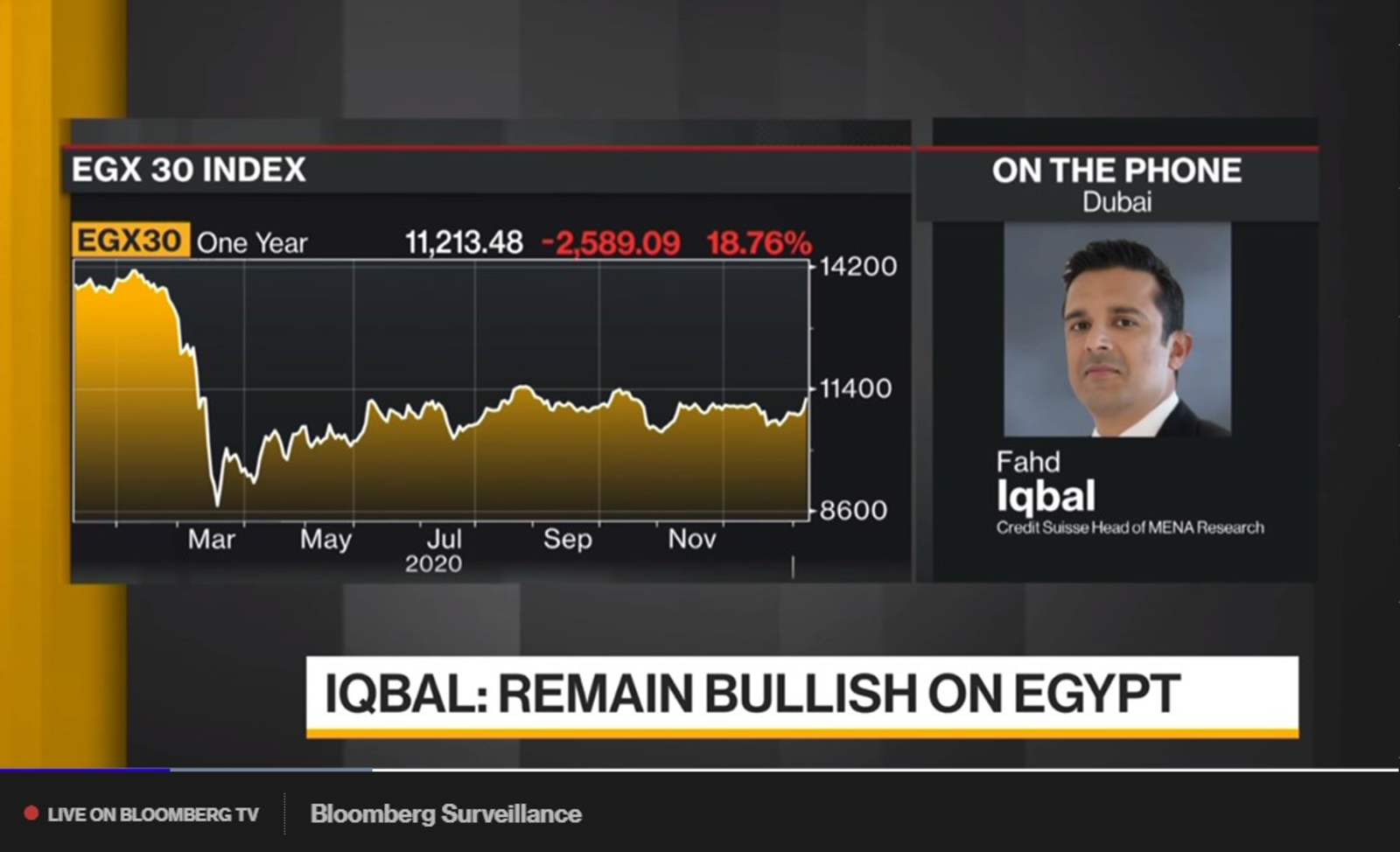

- Fitch + Credit Suisse bullish on Egypt. (Economy)

- Nassef goes long on private jets. (M&A Watch)

- Time to ditch Whatsapp? Here’s what you need to know about the privacy policy change. (What We’re Tracking Today)

- Planet Finance: Bitcoin bubble bursting?

Tuesday, 12 January 2021

Egypt on track to begin vaccine rollout at the start of February

TL;DR

WHAT WE’RE TRACKING TODAY

Happy hump day, everyone.

It’s the first day of the brand new parliament today — and the first order of business is to choose a speaker. Ali Abdel Aal faces challengers in his bid to return as speaker, as does Soliman Wahdan, who’s seeking another term as Abdel Aal’s number two. Abdel Aal’s main competitors are former president of the Supreme Constitutional Court Hanafi El Gibali and former Legal and Parliamentary Affairs Minister Ibrahim El Heneidi, according to Al Watan. Gadfly MP Mostafa Bakry and other members from Mostaqbal Watan, are vying for the deputy speaker post, El Hekaya’s Amr Adib said last night (watch, runtime: 3:33).

And about this rumored cabinet shuffle: It could come in the next 2-3 weeks, with up to 12 ministers reportedly set to leave office, Masrawy reports, quoting unnamed sources. The change in lineup is penciled in for the end of this month or early February, after the men’s Handball World Championship hosted by Egypt wraps up on 31 January, the sources claim.

Who’s likely to stay? Cabinet’s economic group, which includes Finance Minister Mohamed Maait, Trade Minister Nevine Gamea, Planning Minister Hala El Said, and International Cooperation Minister Rania Al Mashat, all of whom have gotten high marks from global institutions for their response to covid and its impact on the economy. Health Minister Hala Zayed, Education Minister Tarek Shawki, and Supply Minister Aly El Moselhy will also likely keep their positions.

Who’s headed for the exit? Environment Minister Yasmine Fouad and Culture Minister Enas Abdel Dayem (who could be succeeded by film director Khaled Galal) according to the sources. The tourism and antiquities ministry will also likely be split back into two separate portfolios current minister Khaled El Anany replaced.

MEANWHILE- Egypt is expected to have opened its airspace to Qatar just a few hours before dispatch this morning, Al Shorouk reports, quoting “high-level” sources. Saudi Arabia, the UAE, and Bahrain — all of whom joined us last week in signing the declaration to restore ties with the statelet — have already restored flights to Doha.

PSA- Expect warm weather today and tomorrow with daytime highs of 28°C today and 27°C tomorrow before the mercury plunges into the teens for the following two weeks.

US politics continue to dominate the international headlines after House Democrats yesterday unveiled an impeachment resolution accusing President Donald Trump of engaging in “high crimes and misdemeanors by inciting violence” against the government during last week’s invasion of the Capitol, according to CBS News. The resolution has the backing of at least 210 Dems, and states that Trump has “gravely endangered” the US government. The Associated Press has the full four-page bill.

The House is poised to begin debating the bill tomorrow — but is giving cabinet and the VP a chance to boot Agent Orange out, first. Lawmakers are attempting to pass a measure calling on VP Mike Pence and the cabinet to invoke the 25th Amendment. The measure was blocked yesterday by House Republicans, but it’s still expected to pass in a roll call vote scheduled for today. The ultimatum as drafted would give Pence 24 hours to act. If he doesn’t, impeachment proceedings would follow.

Reminder: There’s a new administration coming on 20 January. Here’s who Joe Biden has so far tapped to sit around the cabinet table, courtesy the WSJ.

The FinMin wants small businesses to understand the benefits of going legit: The ministry has sent out letters to small firms reminding them of the tax incentives offered in the SMEs Act passed last year. The law offers preferential rates to SMEs and exempts them from having to file their accounts with the Tax Authority.

The tax brackets are follows:

- Businesses with annual sales worth up to EGP 250k will pay a flat EGP 1k;

- Businesses with annual sales between EGP 250k and 500k will pay EGP 2.5k in taxes;

- Businesses with annual sales between EGP 500k and 1 m are subject to an EGP 5k tax;

- Businesses with annual sales between EGP 1 mn and 10 mn will be taxed 0.5-1% on their revenues.

|

What’s happening with El Whats? WhatsApp has rolled out a privacy policy update that will share a lot more of its users’ data with other Facebook companies (primarily Facebook itself and Instagram) “to help them operate.” While the option to share data across the apps isn’t new, it will become mandatory on 8 February. The data that could be tapped includes your phonebook (with data on all your contacts), location, and certain financial information — but the contents of your chats or conversations will remain protected by end-to-end encryption for now.

Should you leave WhatsApp in your rearview mirror? Maybe? Either way, you should be more aware of how you use the messaging app.

The new policy has already prompted a wave of high-profile figures to distance themselves from WhatsApp, including Elon Musk, who tweeted last week that people should “use Signal,” while Turkish government agencies are moving their WhatsApp groups to local messaging app BiP. Signal is the brainchild of the guy who created the world-class encryption system that already backs WhatsApp — and it has seen such a massive influx of new accounts that its registration service crashed. The app has risen to the top of App Store / Google Play charts this week in markets across the world.

Signal is also the choice of most Egyptians who (like us) are debating signing up for the tinfoil hat brigade — at least if our notifications are anything to go by.

BONUS- Signal’s in-app voice calls are clear as a bell. You can check out Signal’s very pro-user privacy policy here, or read this profile of the genius behind its encryption algo, one Mr. Moxie Marlinspike, in the New Yorker).

Get Signal here: Apple’s App Store or Google Play for Android.

Oh, and if you’re going to trade the news: Make sure you get the right stock.

(Remember back in 2015 when shares of never-traded, EGX-listed Natural Gas and Mining Project popped? Investors looked at the company’s ticker — EGAS — and mistook it for state natural gas giant Egyptian Gas (EGAS), which had just announced Eni’s massive Zohr discovery.)

MORNING MUST READS-

“Is this the end of the wallet?” Sales data is suggesting that people are buying fewer wallets and coin purses as “an increasingly cashless society, combined with Covid-19, raises existential questions about the accessory.” (Financial Times)

A USD is a USD is a USD. Except in our minds. The form of money—salary vs. bonus, income vs. capital—affects the way we treat that money. Sometimes that helps us financially. And sometimes it hurts us. (WSJ)

US retailers want buyers to keep the impulse purchases they regret: Amazon, Walmart and a number of other retailers have found it is more cost effective to ask consumers to keep and donate inexpensive or bulky items rather than pay shipping costs for returns, the Wall Street Journal reports.

CIRCLE YOUR CALENDAR-

The men’s Handball World Championship will get underway tomorrow, albeit without an audience due to covid-19. The tournament will conclude on 31 January. Egypt has allocated EGP 3.7 bn for the championship, said Sports Minister Ashraf Sobhy.

Samsung will unveil its latest Galaxy flagship, the S21 on Thursday, coinciding with the virtual-only Consumer Electronics Show, which began yesterday. Meanwhile, the new Microsoft Surface Pro 7+ for Business will be on the market soon, though only for business and education buyers at the start.

Not interested ‘cause you’re an iSheep? Try this: Apple’s next-gen iPad Mini is likely coming in March and has an 8.4-inch display and slimmer bezels.

COVID WATCH

Vaccine program starting in February?

Egypt is expecting to receive vaccines from Gavi, the Vaccine Alliance, within two or three weeks, Health Minister Hala Zayed said at a press briefing yesterday (watch, runtime: 11:27). Gavi will provide doses covering 20% of the country’s needs, and will largely supply Oxford-AstraZeneca vaccines, she said.

We’re also signing an agreement with AstraZeneca to purchase the Oxford jab directly once the pharma regulator greenlights it for emergency use, which is expected to happen in about a week’s time, Zayed said. The British company will supply 40 mn doses, enough for 20 mn people, the minister told El Hekaya’s Amr Adib last night (watch, runtime: 2:03). The minister said last week that the first shipment of the jabs will arrive by the third or fourth week of this month.

More shipments of vaccines from Sinopharm, meanwhile, will arrive “within days,” the minister added. Egypt received the first shipment of vaccines from the Chinese company in December, but reports later in the month had suggested further shipments faced delays of supply chain issues in China.

This will allow the government to start the vaccination program at the beginning of February, Zayed told Kelma Akhira’s Lamees El Hadidi last night (watch, runtime: 33:04). Healthcare workers and the country’s most vulnerable citizens will be first in line for the vaccine when the program eventually gets up and running.

Daily cases fall again: The Health Ministry reported 961 new covid-19 infections yesterday, down from 993 the day before. Egypt has now disclosed a total of 150,753 confirmed cases of covid-19. The ministry also reported 52 new deaths, bringing the country’s total death toll to 8249.

COVID AROUND GLOBE-

Lebanon has declared a state of emergency and will impose a 24-hour curfew for 11 days. Lebanese media report that the emergency measures will come into force this Thursday and end on 25 January, and come in response to rapidly rising cases. The country has so far reported more than 222k cases and some 1.6k deaths.

Vaccine makers are readying themselves for inevitable future mutations of covid-19 in the event a strain develops that does not respond to currently available inoculations, the Financial Times reports. Vaccines that rely on mRNA technology like Oxford/AstraZeneca and Johnson & Johnson are well positioned to be tweaked, and scientists could have new vaccines ready within three to six months, while variants of protein-based vaccines could take up to 9 months to be developed.

The BioNTech / Pfizer vax looks to be effective against the latest strains of the virus: The jab was found by Pfizer in a study to work against the recent mutations discovered in the UK and South Africa, Reuters reports.

BioNTech and Pfizer plan to boost their vaccine output goal for this year by more than 50%, pledging to make 2 bn doses of their jab, according to Bloomberg. The companies had previously expected to make 1.3 bn doses, but now plan to enlist more contract manufacturers to help out.

Making covid-19 vaccinations a prerequisite for travel is not sitting well with the World Travel and Tourism Council, whose CEO Gloria Guevara said at a Reuters panel yesterday is akin to workplace discrimination. Guevara’s opinion was not popular among the rest of panel participants, however, even as scientists indicate that herd immunity is still a distant milestone as countries see staggered vaccination rollouts.

China is finally allowing the World Health Organization (WHO) to investigate the origins of covid-19, with WHO experts to start their mission on Thursday in Wuhan alongside Chinese scientists, according to the Wall Street Journal. The move comes a week after WHO Director-General Tedros Adhanom Ghebreyesus rebuked China for not allowing the UN agency’s investigators to enter the country after over a year of negotiations.

M&A WATCH

Healthcare mega-merger, dissected

What to expect from the health industry’s mega-merger: In a conference call with investors yesterday, Cleopatra Hospitals Group (CHG) CEO Ahmed Ezzeldin and Chairman Ahmed Badreldin broke down the healthcare provider’s planned acquisition of Alameda Healthcare Group’s Egypt assets. The merger, which was announced last month, is still pending regulatory approvals but is expected to close before the end of June. Key takeaways from the call:

The basics: The combined group is expected to hold around 15% of Greater Cairo’s commercial bed capacity, with CHG currently holding 8% and Alameda bringing 7% to the new entity. In terms of facilities, CHG has six facilities, while Alameda has three facilities up and running and a fourth that it expects to inaugurate in 1H2021.

The merger comes at a time when the private healthcare industry is ripe for investments — and consolidation. With a growing population and longer life expectancies, combined with an increased prevalence of chronic diseases, there’s “a huge market that’s growing every year,” said Ezzeldin. The vast majority of hospital beds — of which Egypt has 1.3 per 1,000 citizens — are owned by the health and defense ministries and university hospitals, while the private market that holds the rest of the country’s patient capacity is “totally fragmented.”

It also coincides with the ongoing roll-out of the government’s universal healthcare scheme, in which the combined company “expects to be a key partner,” said Badreldin. “With the combined scale, we expect to be able to expand our capacity in other governorates following the healthcare scheme,” he said.

What about the competition authority? The call ended without officials addressing a question from Enterprise about regulatory approval of the transaction. The Egyptian Competition Authority has expressed opposition to the merger.

Both CHG and Alameda are going into the merger on solid financial footing: CHG closed out 2020 with revenues north of EGP 2 bn, following record performance during the fourth quarter of the year, said Ezzeldin. The company is expected to release its full-year earnings in around six weeks or less, he noted. Alameda’s 9M2020 revenues come in at around EGP 1.49 bn, growing 4% y-o-y despite the pandemic.

…and they expect a bump from the merger: Overall, Cleopatra runs its facilities at 65-75% utilization, and Alameda has a utilization rate of around 50% across its hospitals, said Badreldin. CHG expects Alameda to “exhibit strong EBITDA and cashflow generation,” given the group has invested north of EGP 3.5 bn in capex over the last four years, said Badreldin. The merger is expected to accelerate the overall growth trajectory for CHG, which has been investing in the Egyptian market since 2015. Alameda’s hospitals already enjoy a strong reputation, but operate “at somewhat lower margins'' than CHG. “There is, in our view, room for EBITDA margin improvement for the Alameda assets to bring them to the same level” as CHG’s, whose flagship hospital runs at north of 30% EBITDA margins.

The merger will also improve service quality and employment prospects: Both CHG and Alameda are expected to benefit from clinical standardizations and the transfer of knowledge, allowing for enhanced patient safety and an improvement in the quality of outcomes, said Badreldin. The combination of the two healthcare players will also benefit the healthcare industry at large by creating at least 2,000 new jobs, Ezzeldin said.

PRIVATIZATION WATCH

Privatization program coming back to life?

EXCLUSIVE- The state privatization program appears to be on track to shake off its cobwebs as the government committee in charge of it is set to meet later this month, Public Enterprises Minister Hisham Tawfik told Enterprise. The committee could shuffle the planned order of stake sales, Tawfik said, but stressed that all options are on the table and will ultimately be in the committee’s hands to decide.

Is there appetite for the program? Yes, says Tawfik, pointing to turnover on the EGX tripling since the committee’s decision to shelve the program as a key signal that it’s a good time for fresh listings. While the committee has been holding its monthly meetings as normal throughout the pandemic, the improved conditions have created a window to revive the program, the minister said. Tawfik had also said last month that the government is revisiting the program amid an increase in foreign appetite for Egyptian equities.

The only question: How global markets impact sentiment on the EGX.

The program could also see some new entrants, with the Public Enterprises Ministry tapping four new companies — including El Nasr Mining Company — to join the roster, Tawfik told Hapi Journal earlier this week. That doesn’t necessarily mean the companies will be included, but the ministry sees solid potential in offering them up for IPOs or secondary stake sales and will leave it to the committee to decide, Tawfik tells us. The minister declined to disclose any further details.

REFRESHER ON THE PROGRAM: The program, which was first announced in 2018, has been subject to repeated delays, only seeing a single secondary offering when Eastern Tobacco sold a 4.5% stake in March 2019. Alexandria Containers, Abu Qir Fertilizers, and Sidi Kerir Petrochemicals are slated for secondary stake sales. Meanwhile, Banque du Caire and e-payments firm E-Finance are expected to IPO in separately managed processes.

MARKET WATCH

Egyptian Modern Education Systems wants to follow in Speed Medical’s footsteps

Egyptian Modern Education Systems is still working on its plan to jump from the small-cap Nilex to the EGX. The company is set to up its capital to EGP 110 mn from EGP 86.66 mn and fulfil a number of other requirements for inclusion in the index, the local press reports, citing unnamed company officials. The company said in 2019 that it would invest EGP 65 mn to establish an American school in an effort to upgrade its listing to the EGX. Speed Medical was the first company to make the transition from the Nilex to the EGX in December last year.

ECONOMY

Credit Suisse, Fitch bullish on Egypt

Egypt’s economic growth will move back towards 5% by the end of the 2021 calendar year, helped by the upcoming vaccine rollout and continued public investment, Fitch Solutions said yesterday. In its latest MENA macroeconomic update, the research house forecasts FY2020-2021 GDP growth to come in at 3%, slightly below the 3.3% it predicted in November.

The country will do “reasonably well over the coming quarters” after experiencing a “relatively shallow” contraction during the covid-19 lockdown in 2Q2020, said Andrine Skjelland, head of MENA country risk at Fitch Solutions, during a webinar yesterday. This will be supported by what Fitch expects to be a “relatively fast vaccine rollout,” sizable government investment in the transport, IT and construction sectors, and growing demand for exports from the EU.

From the region: Fitch expects economic growth to rebound to 3.3% this year after having contracted by an estimated 5.1% in 2020. There will be noticeable divergences as countries access and distribute the vaccine at different speeds and OPEC production cuts hurt oil exporters in the Gulf.

Credit Suisse is sending the hot money our way

A “significant and attractive risk-reward payoff” from Egypt’s t-bill carry trade is keeping Credit Suisse bullish on the Egypt story, head of MENA research Fahd Iqbal said on Bloomberg Daybreak yesterday (watch, runtime: 6:51). Egypt still has one of the highest real rates among emerging markets despite having made the biggest rate cuts among EMs since the outset of the pandemic.

Look for the Central Bank of Egypt to resume its monetary easing cycle at its February or March meetings, as it has “considerable room for continued cuts,” Iqbal said. If the central bank doesn’t cut rates at its next meeting on 4 February, that would make it all the more probable we’ll see lower rates at the following meeting on 18 March.

Less hot: Egyptian equities, whose performance is being held back as a result of liquidity headwinds, despite strong fundamentals, Iqbal said. “If you look at how growth has been developing, valuations, the quality of companies, the structural growth trend in Egypt — all of it adds up to a very, very compelling story. But it simply doesn’t follow through in actual performance,” he said. Without decent liquidity for equities, t-bills remain the “preferred way” to play the Egypt trade thanks to their attractive payoff, he said.

M&A WATCH

Nassef goes long on private jets

Nassef Sawiris’ investment firm NNS Holding has upped its stake Signature Aviation amid a takeover battle for the private jet operator, according to a disclosure to the London Stock Exchange. The bn’aire invested almost USD 11.7 mn in the company after purchasing more than 2.14 mn shares at USD 5.47 apiece, raising his stake to 7.41% from 7.16%, according to the filing.

This came on the same day that Signature accepted investment fund Global Infrastructure Partners’ offer to purchase the company at USD 5.50 / share, valuing it at USD 4.63 bn.

The company is continuing to welcome rival bids though: PE giants Carlyle Group and Blackstone (in an alliance Bill Gates) have also expressed interest in the company. Blackstone, which last week said it was considering a USD 5.17/share offer, would now have to up its bid considerably, though as Bloomberg points out, Gates’ 19% ownership of Signature will make a rival takeover more difficult.

DEBT WATCH

External debt up 15% in 1Q FY2020-2021

Egypt’s total external debt rose 15% y-o-y in 1Q FY2020-2021 to more than USD 125 bn, up from almost USD 110 bn last year, new central bank figures showed yesterday. On a quarterly basis, debt increased 1.4% from USD 123.5 bn in 4Q2019-2020. Government external debt surged almost 25% y-o-y to USD 73.1 bn from USD 58.9 bn last year, accounting for 58.3% of the country’s total external debt.

WHO’S IN THE MARKET FOR DEBT-

- Eight banks signed off on a EGP 3.2 bn syndicated loan for Al Marasem Development to develop its Fifth Square project in New Cairo.

PUBLIC SECTOR

Electricity company demerger pushed to 2025

The Egyptian Electricity Transmission Company’s (EETC) planned split from the Egyptian Electricity Holding Company (EEHC) has been pushed until 2025, Al Mal reports, citing Electricity Ministry sources. The delay comes as a result of the government extending its timeline to withdraw electricity subsidies from 2022 until 2025, leaving electricity prices over that period uncertain, and making it impossible for the company to accurately take stock of its capital and financial resources before the split, the sources said. Financial disputes with the Egyptian Transport Company as well as the National Investment Bank also contributed to the delay, the sources added.

The split is part of a push to reform the electricity sector under the 2016 Electricity Act, that would see the EETC regulate and manage the national grid independently of the EEHC, which is responsible for much of the country’s electricity production and distribution. Though the demerger is technically underway, procedures to complete the process have been ongoing for years. The Electricity Ministry had contracted ESB International to advise on the split.

ALSO FROM THE PUBLIC SECTOR-

Egyptian Iron and Steel is officially spinning off its mining operations and liquidating its steel plant in Helwan, Masrawy reports. The process will only be completed after the company’s workers are compensated, Public Enterprises Minister Hisham Tawfik said yesterday. Tawfik had said last year that the troubled company would spin off its most valuable business into a separate company ahead of a potential listing on the EGX. This comes as the ministry attempts to streamline a number of state-owned enterprises and make the public sector more competitive.

RETAIL

Omar Effendi and MAF get cozier

Omar Effendi has tapped Majid Al Futtaim (MAF) to manage 14 of its branches, Al Mal reports, citing an unnamed source at the state-owned retailer. Under the partnership, MAF will develop and maintain the branches as well as train employees to prepare them for a planned introduction of e-payments and an automated system. Last week Omar Effendi and MAF signed a cooperation protocol to see MAF-owned supermarket chain Carrefour open in 14 of Omar Effendi’s locations. The details of the agreements will be announced “soon,” the source said.

Omar Effendi has big plans for this fiscal year, targeting a bottom line of EGP 30 mn in FY2020-21 compared to EGP 7 mn in FY2019-20, the source added.

STARTUP WATCH

Docspert Health raises USD six figure seed round from Flat6Labs, angel investors

Telehealth startup Docspert Health has closed a six-figure USD seed round from Flat6Labs and a group of UK and US angel investors less than a year after its founding, according to a press release (pdf). The startup, headquartered in the UK and Egypt, plans to use the financing to expand further into Egypt and into the Gulf. Docspert offers an online platform that connects patients in the Middle East and Africa with medical specialists from the UK, USA, and Europe. The startup is part of Flat6Labs Cairo’s current cycle cohort.

MOVES

Pachin appoints managing director and non-executive chairman

Amr Mahmoud Ismail has been appointed managing director of paint and coatings maker Pachin, while Mohamed Salah El Din has been appointed non-executive chairman of the board of directors, the company announced in an EGX filing (pdf).

EGYPT IN THE NEWS

All is quiet in the pages of the foreign press this morning. Be thankful and move on.

ALSO ON OUR RADAR

Other things we’re keeping an eye on this morning:

PLANET FINANCE

Is the crypto bubble about to burst? Bitcoin lost nearly 26% of its value on Sunday and Monday, its biggest two-day slump since March, amid a fierce selloff, reports Bloomberg. The currency fell as low as USD 33.1k yesterday after having reached an all time high of nearly USD 42k on 8 January. “It’s to be determined whether this is the start of a larger correction,” Vijay Ayyar, business development head at Singapore’s crypto exchange Luno said.

China is on track to challenge Wall Street and London to become the world’s most important financial center, according to bn’aire hedge fund manager Ray Dalio, who told the Financial Times that 2020 was a watershed year for what he sees as the world’s next preeminent financial power. “China already has the world’s second largest capital markets, and I think they will eventually vie for having the world’s financial center,” the Bridgewater founder said, comparing Beijing’s rise to the transition from the British to the American empire.

Saudi Arabia is looking to raise upwards of USD 5 bn in a bond-market comeback designed to bolster its state coffers, which have been battered by low oil prices, Bloomberg reports. Although Brent has recovered to more than USD 55 per barrel, this is still far below the USD 80 price the kingdom needs to balance its budget.

Twitter’s shares fell 7% on Monday following the suspension of Agent Orange’s account as investors worried the move might shift interest away from the platform, reports Reuters.

Hyundai and Apple plan to begin joint production of autonomous electric cars in the US in 2024 under the terms of a partnership agreement to be signed in March, Reuters reports, citing a Korean news outlet.

| EGX30 | 11,279 | +0.6% (YTD: +4.0%) | |

| USD (CBE) | Buy 15.59 | Sell 15.69 | |

| USD at CIB | Buy 15.60 | Sell 15.70 | |

| Interest rates CBE | 8.25% deposit | 9.25% lending | |

| Tadawul | 8,869 | +0.6% (YTD: +2.1%) | |

| ADX | 5,237 | +1.2% (YTD: +3.8%) | |

| DFM | 2,698 | +0.9% (YTD: +8.3%) | |

| S&P 500 | 3,799 | -0.7% (YTD: +1.2%) | |

| FTSE 100 | 6,798 | -1.1% (YTD: +5.2%) | |

| Brent crude | USD 55.62 | -0.7% | |

| Natural gas (Nymex) | USD 2.75 | +1.7% | |

| Gold | USD 1,850 | +0.8% | |

| BTC | USD 34,800 | -9.7% |

The EGX30 rose 0.6% yesterday on turnover of EGP 1.5 bn (11.5% above the 90-day average). Regional investors were net sellers. The index is up 4.0% YTD.

In the green: Cleopatra Hospital (+3.3%), Orascom Development Egypt (+2.3%) and Sidi Kerir Petrochemicals (+2.3%).

In the red: SODIC (-2.9%), Dice (-1.5%) and Ibnsina Pharma (-1.4%).

Most Asian markets are up in early trading this morning and futures suggest European markets will open in the red later today.

AROUND THE WORLD

Oman is embarking on a radical shakeup of its constitution: Sultan Haitham bin Tareq announced yesterday that a crown prince will be appointed for the first time ever and a new committee will be formed to evaluate the performance of government officials, reports the Oman News Agency.

The US State Department is expected to declare Yemen’s Houthis a terrorist organization in a symbolic attempt to boost its support for Saudi Arabia, which has backed the Yemeni government opposed by the Houthis for the past six years, the New York Times reports, citing unnamed sources.

Saudi Arabia plans to build a carless, roadless city called “The Line” by 2030 as part of its USD 500 bn Neom project, Crown Prince Mohammed bin Salman said Sunday, Bloomberg reports.

IN DIPLOMACY: Egypt, France, Germany, and Jordan agreed to push for a revival of Israel-Palestine talks over a two-state solution in a meeting of the four countries’ foreign ministers in Cairo yesterday, according to a statement from Egypt’s Foreign Ministry. The ministers agreed to communicate their recommendations to Palestinian and Israeli parties, and decided to hold their next meeting in France. The Associated Press also had the story.

President Abdel Fattah El Sisi discussed the reconciliation drive in talks with the three ministers in Ittihadiya yesterday, according to a statement. El Sisi also separately met with French Foreigh Minister Jean-Yves Le Drian, to talk across-the-board cooperation, and Foreign Minister Sameh Shoukry had a one-on-one with his German counterpart, Heiko Maas, on regional affairs.

CALENDAR

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship in four venues in Alexandria, Cairo, Giza and the New Capital.

25 January (Monday): 25 January revolution anniversary / Police Day.

25-29 January (Monday-Friday): The World Economic Forum’s “Davos Dialogues” (virtual)

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic)

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day.

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labour Day (national holiday)

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

18-21 May (Tuesday-Friday): The World Economic Forum’s annual meeting “The Great Reset”

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo.

30 May-15 June (Wednesday-Thursday): Cairo International Book Fair.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June (Wednesday): June 30 Revolution Day

1 July: (Thursday): National holiday in observance of 30 June Revolution

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday)

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday)

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October (Friday): Expo 2020 Dubai opens

6 October (Wednesday): Armed Forces Day

7 October (Thursday): National holiday in observance of Armed Forces Day

18 October (Monday): Prophet’s Birthday

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.