The future of SWFs is at risk as covid-19 turns the industry on its head

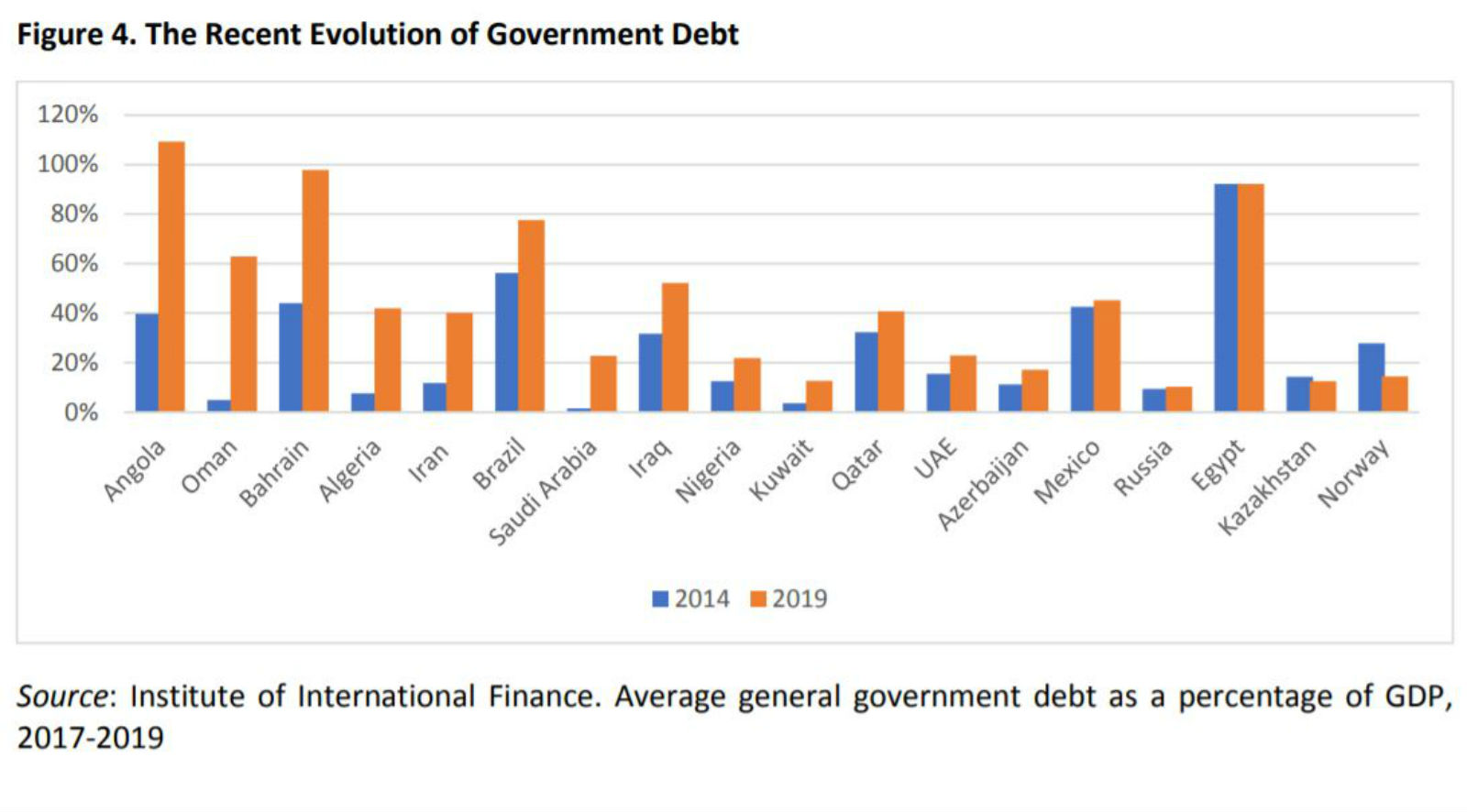

The future of SWFs is at risk as covid-19 turns the industry on its head: Sovereign wealth funds (SWFs) around the world may undergo “profound changes” as cash-strapped governments turn to them to help them plug revenue shortfalls and support local economies, academics from Bocconi University, New York University and the London School of Economics said in a report (pdf). Funds in oil-dependent economies in particular are facing “the most severe adverse shock of their history” as one of the deepest demand slumps in living memory wreaks havoc on state revenues, while at the same time a pandemic forces them to ramp up fiscal stimulus. In response, JPMorgan sees MENA SWFs offloading almost USD 225 bn of their equity assets, while the Institute of International Finance is forecasting Gulf funds to draw down around USD 80 bn.

Lots of money out: SWFs in Norway, Iran, Kuwait and Nigeria have seen withdrawals to fund government spending while Singapore, Malaysia and Turkey have used them for corporate bailouts. And Diego Lopez, managing director of Global SWF — a firm that follows SWFs — expects there to be several more withdrawals coming, particularly among Gulf states.

SWFs are becoming more leveraged and less focused on profitability post-pandemic: Instead of investing globally, the covid-19 pandemic could create “more leveraged” SWFs, and ones that turn to domestic investments, rather than looking abroad for returns, the report suggests. What this would mean is that SWFs who together have over USD 6 tn in assets stand to lose on financial returns as they “focus on [the] broader economic and social impact,” the report adds, estimating “paper losses” of USD 800 bn. SWFs have already been seeing a fall in direct investments, even before the covid-19 pandemic hit, CNBC recently reported.

Is the “golden age” of SWFs actually over? The short answer is yes, according to the report, which says that falling oil prices, increasing protectionism and new barriers to cross-border flows have stymied SWFs over the past two decades. While some will remain powerful players in international finance, the pandemic and the economic downturn pose a “quintessential challenge” to the industry. “The disruptive potential of the crises is such that no country, nor SWF, will be spared. Sovereign investors of all stripes will be called to reassess their investment strategies, as new public-sector liabilities will have to be accounted for,” the academics write.