What we’re tracking on 29 March 2020

Wait, you mean the sell-off is over? US markets entered and exited bear market territory (defined as 20% off a recent peak) in record time. Insider buying and buybacks suggest there are at least a few people out there (including here in Egypt) who thing the sell-off is done, but this warning in the Globe & Mail rings true to us: “The magnitude of the decline merely matches the average bear-market since 1980, and pales next to the 52 per cent decline during the 2008-09 financial crisis.” In the global financial crisis, too, markets stabilized for a brief period before plunging again. Volatility will remain the order of the day, particularly as we’ve yet to see how the current circumstances have hit corporate earnings globally.

We have more on markets below in this section.

Now is a great time to what? We don’t know the playwright and writer R. Eric Thomas, but his voice is in our head every time someone on Youtube / Instagram suggests that now is the best time ever to learn a new instrument / learn a foreign language / invest time in your hobby / write a screenplay:

“It’s been two weeks, can we all agree to drop the pretense that “we all” have “so much free time” now? Everyone I know is stretched to the limits of their emotional capacity and/or is dealing with an increased workload, professionally and/or domestically. What is this free time?”

Oh, and you think we (collectively) are experts in shiteema? You haven’t met Italian mayors (watch, runtime 1:46) — or this mayor in the US, who seems like the reincarnation of Gen. George S. Patton.

COVID-19 IN EGYPT-

Egypt has now reported a total of 576 cases of covid-19, 120 more than since we last wrote you on Thursday, while 15 people have died of the disease in the same period. The Health Ministry announced 40 new cases last night and said the six deaths were all of people aged 57-78. Some 121 people have made full recoveries and another 161 people who have sought treatment have since tested negative, suggesting they’re on the path to recovery.

*** PSA- The Health Ministry is holding a webinar for medical doctors at 11am CLT today to share information and best practices on covid-19. The 1.5-hour webinar will the disease, the Egyptian covid-19 management protocol, case discussions and a Q&A. Find out more here.

The World Health Organization is giving Egypt some love: The World Health Organization (WHO) has said that Egypt is making “substantial efforts” to contain the covid-19 outbreak and that its disease surveillance system “has proven effective” in preventing clusters of cases from spreading. “After several days of intensive meetings and field visits both inside and outside Cairo, we see that Egypt is making substantial efforts to control the covid-19 outbreak. Significant work is being done, especially in the areas of early detection, laboratory testing, isolation, contact tracing and referral of patients,” said Dr. Yvan Hutin, director for communicable diseases at WHO’s regional office.

“But more needs to be done” to control the outbreak, Hutin said. “We have agreed on several areas that can be scaled up, taking a whole-of-government and whole-of-society approach,” he said without elaborating.

We’re going to go a step further and suggest that from how the Health Ministry has managed things to the imposition of curfew and announcement of stimulus measures, the Madbouly government’s collective response to covid-19 has so far been on point. Would that our fellow citizens were taking things as seriously. A case in point:

All beaches are being closed nationwide following an order from the Ministry of Local Development. The announcement comes after photos made the rounds of people flocking to beaches over the weekend in Alexandria and Ain Sokhna.

The nation’s administrative and supreme administrative courts are now closed until 15 April on the order of the Council of State (Maglis El Dawla), according to state news agency MENA. Exceptions will be made for urgent matters and a handful of other circumstances, and courts will still be open to receive filings and to handle office duties.

Factory workers will be permitted to travel during curfew hours provided their employer obtains a permit from the governorate in which they’re based, the local press reports, citing the head the operations room at the Council of Ministers. Pick-up trucks will also be exempt from the 7pm-6am curfew if they’re removing goods from ports to warehouses.

Egyptian embassies around the world are working to bring back citizens who want to return home, according to a Foreign Ministry statement. Four flights today will bring folks back from the UK, and an EgyptAir flight is scheduled to fly from London Heathrow on Tuesday. Arrangements are also being made for an exceptional flight on Tuesday to return citizens still stranded in France, while others are in place for nationals who are presently in Saudi Arabia, UAE, Oman, Lebanon, and Jordan to follow soon.

If you’re coming back on one of those flights, you’ll need to self-quarantine for 28 days, according to a new directive from the Health Ministry. Anyone entering Egypt was previously required to self-isolate for 14 days.

EgyptAir and the US embassy in Cairo have arranged flights to Washington, DC, from Cairo. The flights are scheduled for Wednesday, 1 April and Friday, 3 April, and are for US citizens with “some allowances for legal permanent residents accompanying them.” The flights can be booked on EgyptAir’s website. See the embassy’s announcement here for more information.

Air Canada is operating a commercial flight from Cairo to Paris’ Charles de Gaulle airport on 31 March. You can get more information here or by Calling Air Cairo on 02 2266 3155 / 02 2268 9892 / 02 2269 5550. The flight is for Canadian visitors to Egypt who normally reside in Canada and want to return home.

All normal commercial flights into and out of Egypt remain suspended until at least mid-April. Cargo flights are not subject to the ban.

Jordan has shut down the traffic of goods coming by land from Egypt, Al Mal reports. The ferry line had stopped carrying passengers on 11 March but continued to carry cargo. Goods bound for Jordan will be held by Egypt’s authorities until further notice.

Cairo Metro’s three lines are getting five extra trains during rush hour in a bid to ease overcrowding, according to Al Mal. The metro is now on an amended schedule after the government imposed a nationwide 11-hour curfew last week.

The Social Solidarity Ministry will be adding 80-100k families to its Takaful and Karama benefit programs at a cost of about EGP 800 mn, Al Mal reports. The ministry had said earlier last week that it would be adding some 60k families to its program.

TOLL ON BUSINESS- Mediterranean gas group Energean might cut its budget for Egypt by USD 140 mn as oil and gas companies cut back on spending amid the covid-19 pandemic and a simultaneous oil price war. Energean has already cut its planned outlay in Greece and Israel by USD 155 mn. Reuters has a company-by-company rundown here.

Some businesses are advocating for the state’s EGP 100 bn bailout package to cover wage subsidy to make it easier for them to pay workers’ salaries in the event factories are shut down or running fewer shifts, the local press reports.

A PROPOSAL WORTH DEBATING- Suspend remission of income tax and social insurance and give businesses a tax break by cutting wage taxes in half, suggests Maged El Menzelawi, chairman of the industry committee at the Egyptian Businessmen’s Association.

Egypt’s pharmaceutical companies generally have raw materials on hand sufficient for four months of production, Al Mal reports. Aly Ouf, head of the medicines Division in the Federation of Egyptian Chambers of Commerce. He noted that Egypt imports from China some 40% of the raw materials domestic producers need.

The silver lining for Egypt: Chinese factories are now ramping up, but they’re finding export markets in Europe and the US are in disarray, reports Bloomberg.

The Consumer Protection Agency boss Rady Abdel Moaty is warning retailers against price gouging, according to state news agency MENA.

The Customs Authority is giving importers a break to expedite the clearance of shipments from ports, allowing them to present contracts and transaction receipts in the place of standard documentation, Al Mal reports.

Authorities are cracking down on producers of counterfeit protective gear, Arab News reports.

Leading private sector education outfit CIRA has moved all classrooms at its schools and Badr University online with its distance learning protocol, with all of its non-essential staff working from home to curb the spread of covid-19, according to a statement (pdf). Of the company’s campuses that are still under construction, Regent British School in Mansoura is the only one expected to see delays after the company slowed down construction services.

School children are getting a break: End-of-year public school assessments will be based on lessons delivered until 15 March, rather than the full year’s curriculum, Education Minister Tarek Shawky said in a statement. The remaining parts of the curriculum will be covered next academic year. Assessments will take the form end-of-year projects (for grades 3-8) or electronic and seated exams (grades 9-12), we noted in last week’s edition of Blackboard. Technical and vocational education, meanwhile, will continue online until mid-to-late April, with students required to hand in an assessed report by 15 June.

ON THE GLOBAL FRONT-

The US has enacted a USD 2.2 tn stimulus package as The Donald signed it into law shortly after it was approved by the House of Representatives late last week. The bill is the largest relief package in US history, designed to support citizens struggling in the face of the covid-19 pandemic by offering direct payments and expanded unemployment insurance, the Wall Street Journal reports.

What’s in it? It includes roughly USD 290 bn in direct payments to US citizens, enhanced employment aid of USD 260 bn, loans and grants of USD 377 bn to small businesses, USD 504 bn to bail out airlines and large businesses, USD 100 bn for hospitals and other health providers, USD 16 bn for ventilators and other medical supplies, USD 30 bn for education, and a raft of tax cuts. Reuters has a longer run-down.

The story is being widely covered: Reuters ⎸New York Times ⎸Financial Times.

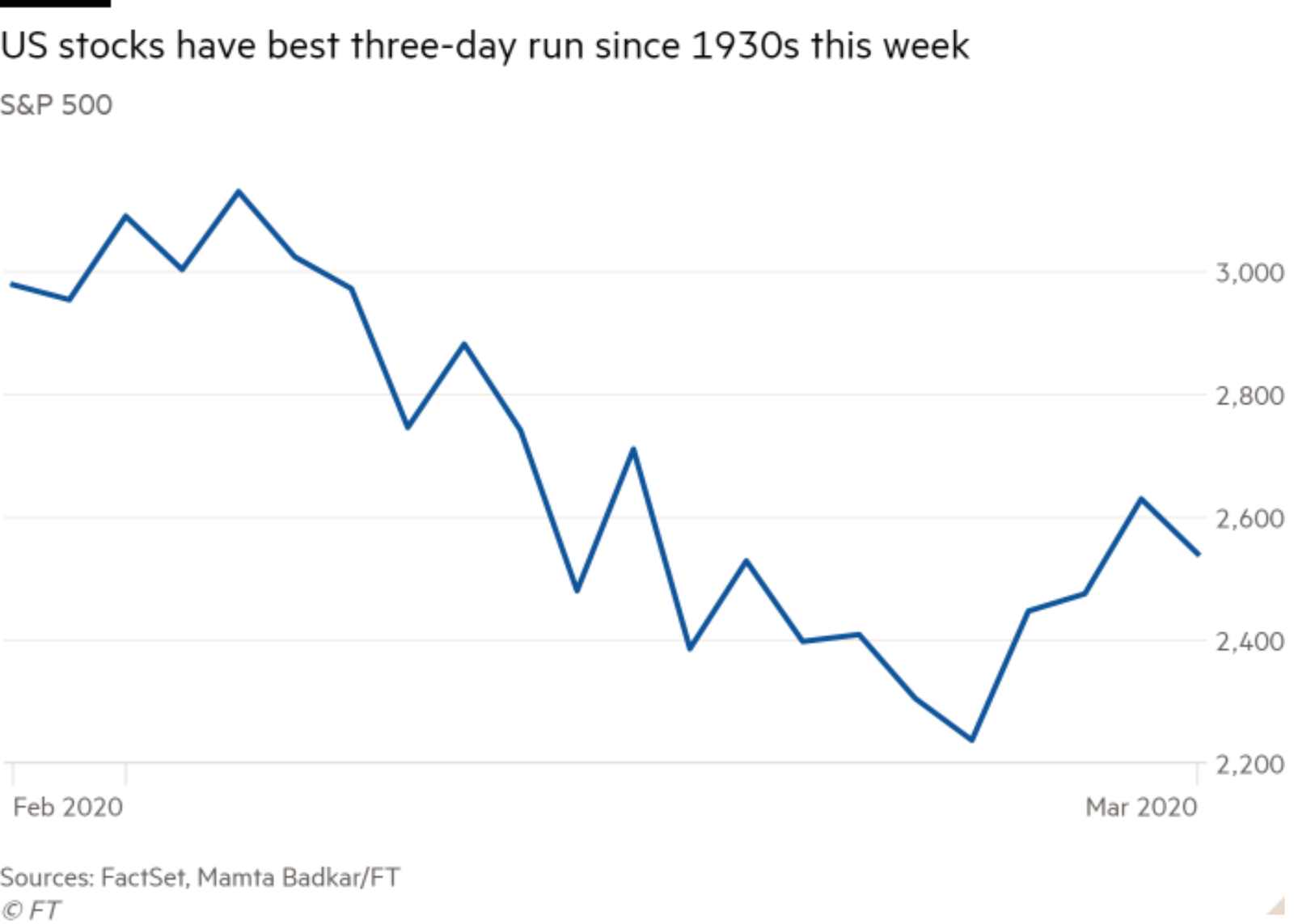

Last week’s rally in equity markets might go down as one of the biggest dead cat bounces ever: The sell-off in the global markets resumed on Friday even as Trump was preparing to sign off on the emergency stimulus package. Stocks launched a fierce three-day recovery last week after the Federal Reserve announced a flood of monetary stimulus and hopes grew for large-scale fiscal stimulus from countries around the world. The Dow Jones had its best week since 1938 and the S&P 500 rose 10%, its biggest gain since March 2009.

US and European stocks finished deep in the red on Friday: All three major US indices were down more than 3%, with the S&P 500 losing 3.4% and the Dow down more than 4%. It was slightly messier in Europe as markets all fell between 3-5%, with Germany’s DAX being the best performer (down 3.7%) and the FTSE 100 being the hardest hit (down 5.2%).

World already in recession -Georgieva: The covid-19 outbreak has already pushed the world into recession and policymakers must react with “very massive” spending to avoid widespread bankruptcies and emerging market bond defaults, IMF head Kristalina Georgieva said on Friday, Reuters reports. “It is now clear that we have entered a recession as bad or worse than in 2009,” she said at a news conference, adding that there is a good chance for a “sizeable rebound” next year if the virus is successfully contained and countries provide enough fiscal support to businesses.

EM countries need at least USD 2.5 tn in emergency funding to survive the crisis, Georgieva said. Eighty-one countries have so far approached the IMF to ask about emergency funding, including 50 low-income and 31 middle-income countries.

S&P has lowered its crude price forecasts by USD 10/bbl for 2020 as the price war between Saudi Arabia and Russia continues to bring down prices and covid-19 hits global demand, according to a research note (paywall). The ratings agency now sees Brent averaging USD 30/bbl this year and US crude trading at USD 25/bbl until the end of the year.

Riyadh isn’t signalling that it’s ready to kiss and make up: Saudi Arabia said on Friday that no communication has taken place with Russia to balance oil markets despite the US ramping up pressure on Riyadh to end the price war, according to Reuters.

Covid-19’s pressure on corporate earnings could push global FDI down 35% in 2020-2021 -UNCTAD: Earnings revisions in multinational enterprises (MNEs) since the spread of the covid-19 virus suggest that the effect of the outbreak will extend beyond supply chain disruptions and will create downward pressure of around 35% on global FDI, UNCTAD said in a revised investment trends monitor (pdf). “On average, the top 5000 MNEs, which account for a significant share of global FDI, have now seen downward revisions of 2020 earnings estimates of 30% due to Covid-19, and the trend is likely to continue,” UNCTAD says.

Cross-border M&A, which count as a portion of FDI, could also decline 50-70% for part of 2020, and M&A transactions that have already been completed are now facing delays that could turn into cancellations, according to the report. The full scale of decline in global FDI depends how long the pandemic lasts, its level of severity, and “the scope of containment measures” being enacted by governments to mitigate the virus’ spread.