EGX sell-off slows following CBE’s surprise rate cut

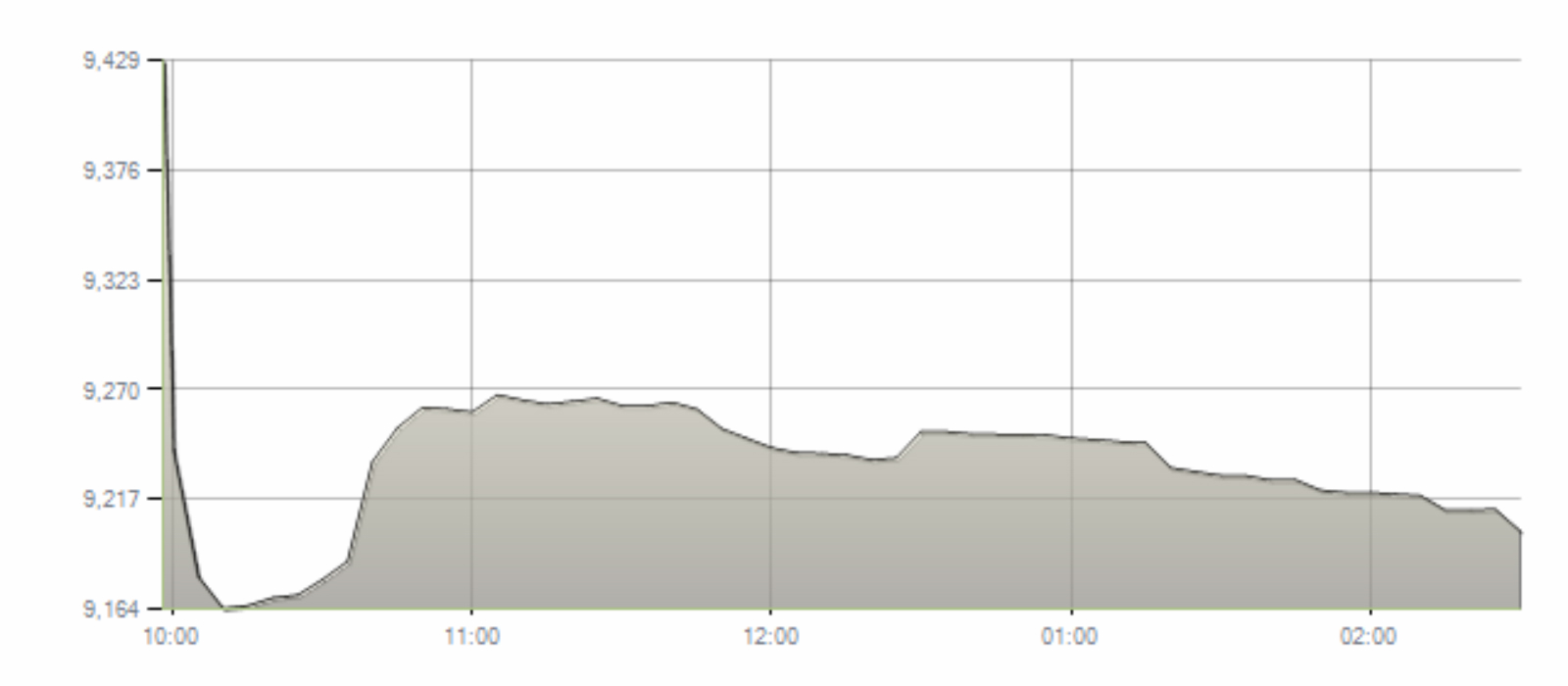

EGX sell-off slows following CBE’s surprise rate cut: The benchmark EGX30 index dipped again yesterday, but at a slower pace Sunday and Monday as concern over the covid-19 outbreak continued to rattle the markets. The EGX30 fell 2.64% in the first minutes of the trading session and went on to close down 2.41%. The EGX30 has shaved off 17% this week and is down 34% from its peak in early February. Yesterday’s session came after the Central Bank of Egypt announced an emergency 300 bps rate cut late on Monday.

On the EGX30, index heavyweight CIB and Eastern Company were the best performers, closing up 0.9%, while Egyptian Resorts Company and EFG Hermes were each down 10%.

Yesterday was the first session this week that the index’s circuit breakers were left untriggered, but 40 companies saw their shares suspended after falling more than 5%. Ezz Steel (down 8.4%) and Madinet Nasr for Housing and Development (down 9.6%) were among the companies that saw trading on their shares halted for 10 minutes.

Buybacks continue to help falling shares: Egypt Kuwait Holding bought some 433k treasury stocks, Arabia Investments Holding bought back 1.4 mn stocks, and Odin Investments approved the purchase of close to 10 mn shares, according to regulatory filings (here, here, and here — pdfs). A growing number of listed companies have been buying back stock after the Financial Regulatory Authority eased rules to allow companies to complete same-day buybacks in a bid to prop up share prices.