What we’re tracking on 10 December 2019

It’s another day in which the House dominates the nation’s news agenda, but there’s still no sign of the much-awaited cabinet shuffle. Pundits in the nation’s capital now say it’s today or after the World Youth Forum, which gets underway this weekend and ends a week from today.

A Lebanese business delegation is in Egypt to talk public-private sector cooperation as part of regular meetings organized by the Egyptian Lebanese Businessmen Association, according to Al Shorouk.

Rameda Pharma shares make their EGX debut tomorrow, trading under the ticker RMDA.

Also making its trading debut tomorrow: Saudi Aramco, where Bloomberg argues that policymakers have gone to great lengths to ensure the shares have a strong debut. Look for “a lot” of the proceeds from the transaction to be deployed locally, the business information service suggests.

The US Federal Reserve will tomorrow wrap up its final meeting of 2019. Given Fed chair Jay Powell’s statements last month, it’s pretty much a dead cert that interest rates will remain unchanged at 1.5%-1.75% heading into 2020.

Speaking of the Fed:

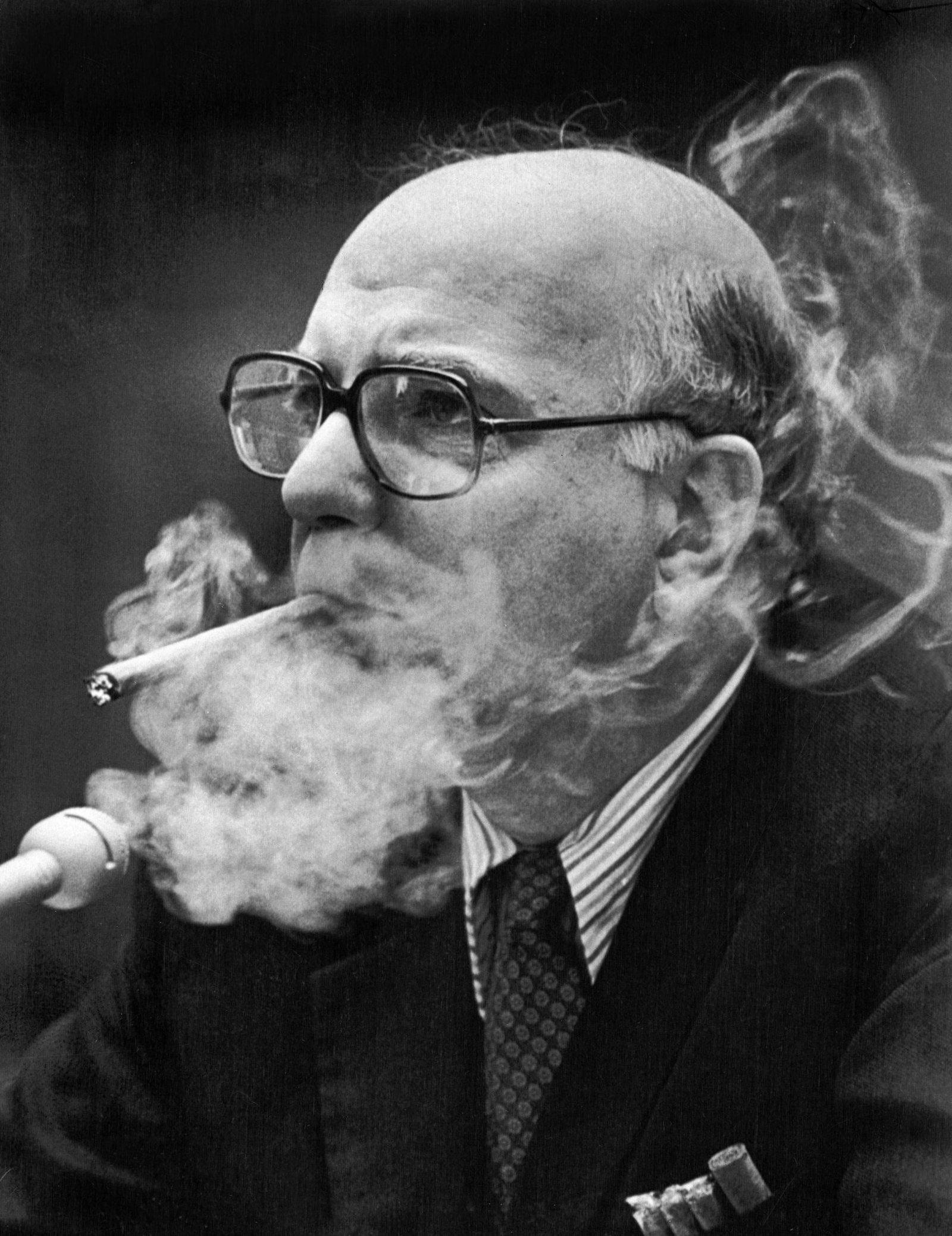

The story of the morning in the global business press: The man who in many ways invented the modern role of the central bank governor has died. Paul Volcker, who led the US Fed in the ‘70s and ‘80s, was 92. Volcker’s time at the helm of the US central bank is most widely known for successfully addressing runaway inflation that coincided with a period of economic stagnation. Perhaps most importantly, Volcker, who “personified the idea of doing something politically unpopular but economically necessary” helped cement the notion of a politically independent central bank in modern times, the New York Times says. “He became one of the most unpopular Fed chairmen in history for pushing interest rates as high as 20% to break the soaring inflation that consumed the US economy in the 1970s. But his actions succeeded in bringing [down] inflation, making Mr. Volcker one of the most successful central bankers in history,” the Wall Street Journal says in an obit.

Volker, a fly-fishing enthusiast, had a long career as a public servant, most recently coming out of retirement in his 80s to advise then-US president Barack Obama. But he made more in one day in the 1990s than he did in 30 earlier years of service when the investment bank he had helmed was bought out. Check out additional obits in the Financial Times and Bloomberg.

Is Trump about to curb stomp the WTO? The press is all but signing the death warrant for the World Trade Organization this morning as the US looks set to veto the appointment of judges to its dispute settlement body. The move would effectively cripple the appeals body, which is responsible for adjudicating country-to-country disputes. The Financial Times warns of “serious damage” to the global trading system, the Wall Street Journal says the US is “threatening the global body’s survival,” while a headline in the Nation literally reads “RIP, World Trade Organization?”

Assets held by ETFs may be surging, but investors are pulling out record amounts of cash: Outflows from US-equity focused mutuals and exchange-traded funds have reached a record USD 135.5 bn this year, the Wall Street Journal reports, citing Refinitiv data. Analysts say that the deterioration of US-China trade relations and concerns over a possible US recession has driven investors to exit equity funds and move into bonds and money-market funds.

The robots are coming for the millenials: The impact of workplace automation needs to be spread more evenly among generations, or younger members of the workforce who don’t have employment protections risk becoming alienated, argues Ferdinando Giugliano in Bloomberg. Read that alongside this piece from the Wall Street Journal out overnight, which argues that US factories are now demanding white-collar education for blue-collar work, suggesting that within three years, more US manufacturing workers will have college degrees than not.

Bloomberg is out with a profile of Khaldoon Al Mubarak: Mubadala CEO, Manchester City chairman, and special envoy to China.

Predictions for 2020 are rolling in:

- The optimists: UBS Global Wealth Management sees the global economy finally recovering from the slowdown in 2H2020. UBS is hanging its prediction on the notion that a) the US and China will; put aside their differences and reaching a meaningful trade accord, and b) that this year’s swell of monetary stimulus will be successful in supporting growth. (CNBC)

- The pessimists: Saxo Bank’s chief economist Steen Jakobsen says that monetary easing will increase inequality across “society as a whole” over the coming 12 months, and suggests that oil and gas companies will continue to account for the bulk of energy investment given the comparatively low returns offered by renewables. (CNBC)

International news worth knowing:

India plans to make it nearly impossible for Muslims to become citizens, the New York Times reports, and the move comes at the same time as business leaders are showing signs of breaking ranks with the government amid economic strains, according to the Financial Times.

Officials from the US, Canada and Mexico will meet in Mexico City today to hammer out final changes to a “languishing” North American trade pact, Reuters notes.

The world’s youngest serving prime minister is now from Finland. Sanna Marin, 34, was previously her coalition government’s transportation minister. (CBC)

Setback in the race to find a Lebanese PM: Lebanon’s main candidate to replace Saad Hariri as prime minister, Samir Khatib, has said he is dropping his bid after facing opposition from the Sunni community, the Associated Press reports.

*** Entertainment for your morning commute: The trailer for the next Ghostbusters movie (coming summer 2020), which the resident 12-year-old declares looks “awesome” (watch, runtime: 2:34). The flick stars Paul Rudd and one of the kids from Stranger Things.

Help choosing your next binge: The full list of Golden Globe nominees is out now, and streaming services from Apple TV+ (The Morning Show) to Netflix (The Irishman) dominated.