Global FDI jumps 24% in 1H2019, and Egypt remains Africa’s top destination

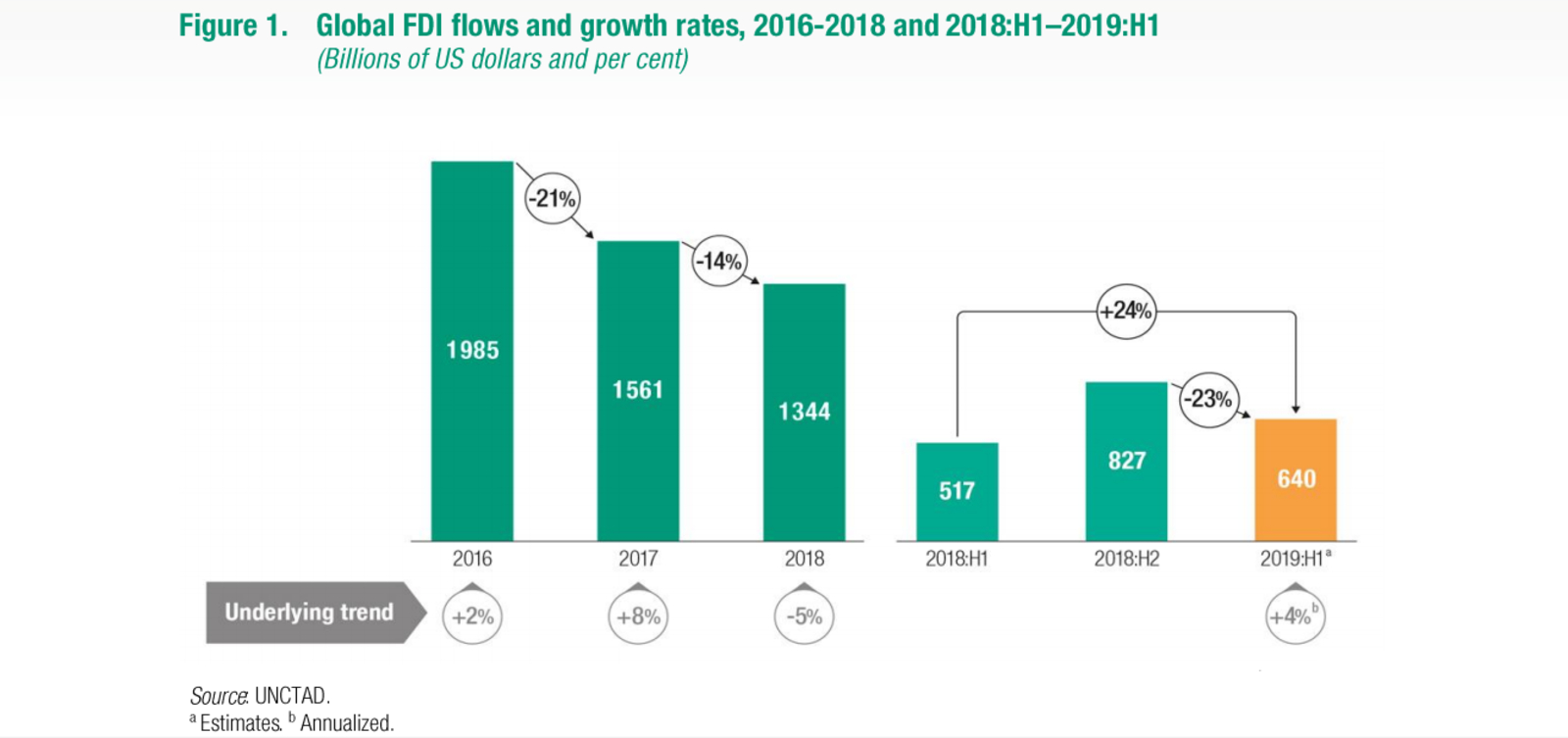

Egypt is still Africa’s top FDI destination as global flows pick up in 1H2019 -UNCTAD: Global foreign direct investment (FDI) grew 24% y-o-y in 1H2019 to USD 640, mostly thanks to a favorable base effect as a result of unusually low FDI levels during the same period last year, according to UNCTAD’s latest investment trends monitor report (pdf). Without the effects of one-off transactions and intra-firm financial flows, global FDI only picked up 4% during the first six months of the year.

Inflows increased in developed economies, while developing countries saw a minor dip: Developed countries saw FDI almost double from 1H2018 in North America, while flows to Europe “rebounded sharply” with an almost five-fold increase. In developing economies, FDI remained relatively stable, slipping 2% y-o-y to USD 342 bn.

FDI to Africa also fell 2%, mainly due to trade tensions and political instability in some countries. The report notes that Nigeria’s recent reforms attracted investments in the oil and gas sector, while South Africa lost almost two thirds of its FDI. Egypt remains the most attractive destination on the continent, accounting for USD 3.6 bn of the USD 23 bn funneled into the entire continent, despite non-oil FDI falling to USD 400 mn in 1Q2019, its lowest level since 2014. High interest rates, low consumer demand, and the slow rate of privatization have all been cited as key culprits behind Egypt’s lagging ability to attract more FDI.

The list of the top 10 host economies in 1H2019 was split between developed and developing economies, with the US topping the charts, followed by China. The UK and the Netherlands both fell out of the top 10 FDI destinations, while Singapore climbed to the third spot and France became the fourth largest recipient of FDI.

Global headwinds aside, investments are expected to continue recovering for the remainder of 2019. The report notes that geopolitical risks, trade tensions, and concerns about the emergence of protectionist policies threaten forecasts.