What we’re tracking on 30 September 2019

We’re one trading session into the week, and so far so good. The EGX gained another 3.3% yesterday, continuing last week’s late rally to claw back losses in a torrid Sunday-Tuesday sell-off. The EGP also strengthened against the USD on the back of Thursday’s interest rate cut and improving sentiment among investors about the country’s political climate. We have more details in this morning’s Speed Round, below.

Our elected representatives will trudge back to the House of Representatives tomorrow fresh for the start of the final legislative session of the current parliament. We have a full round-up of key legislation we expect to be on the government’s agenda for the coming months in our Spotlight section, below.

Indicators we’re keeping our eye on as we head into October:

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Thursday, 3 October at 6:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release net foreign reserves figures for August this week or next.

- Monthly inflation figures for September are due at the end of next week. Inflation cooled for the second consecutive month in August to 7.5%, marking the lowest reading in six-and-a-half years.

Among the conferences taking place in the coming days:

- The launch of the Mediterranean Business Angels Network is taking place at the three-day Techne Summit 2019, which wraps up today at Bibliotheca Alexandrina.

- The three-day China Trade Fair Egypt finishes today, bringing more than 195 Chinese manufacturers to the Cairo International Convention Center to meet with Egyptian businessmen.

- Beltone is running an investor conference in Dubai this week.

Waste collection mobile app Dawar launches today: Environ-Adapt and the Environment Ministry are launching their Dawar mobile app today. The app allows users to report garbage on Cairo’s streets and direct authorities to clean it up, Al Mal reports. It links to the Waste Management Authority, the relevant district office (hayy), Cairo Governorate, and the Environment Ministry, which will jointly coordinate pickups. The app has been in beta testing in Maadi and Tora for the better part of a year.

It looks like our friend Lamees Al Hadidi is returning to the small screen on 20 October with a new show called Cairo Now (El Qahera Al Aan) on Al Arabiya Al Hadath channel, Al Shorouk reports. The show, which will cover local and regional affairs, will air on Sundays and Mondays from 21:00 to 23:00 pm. We’ll be adding business-relevant segments of Lamees’ new show to our Last Night’s Talk Shows roundup.

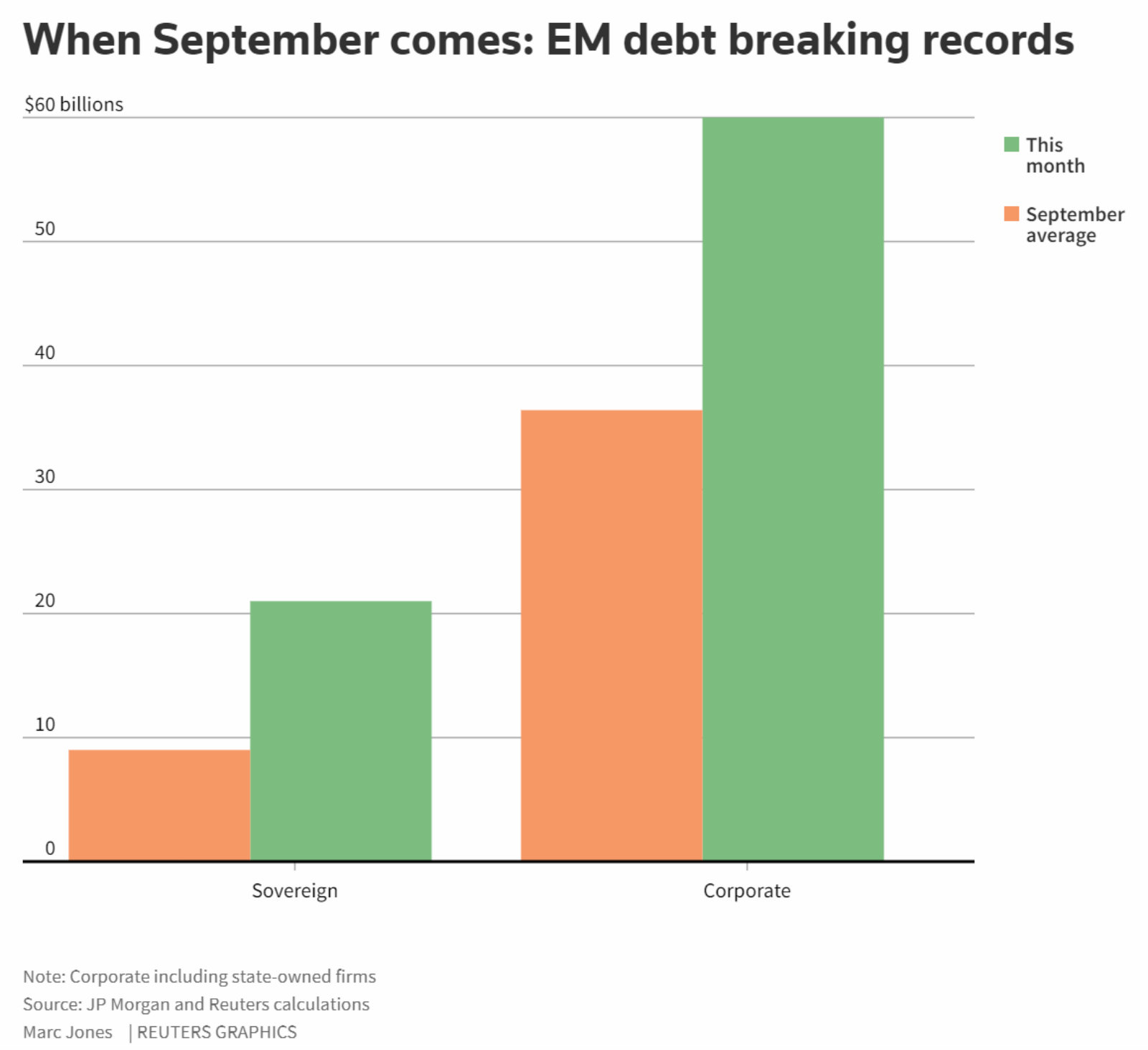

EM debt issuance breaks records in September: Corporate bond issuances in emerging markets broke September records last week as companies and governments took advantage of record low borrowing costs, Reuters reports, citing JPMorgan data. Corporate issuances reached USD 60 bn on Thursday, surpassing the previous record of USD 53.9 bn set in 2017. The average amount raised in September in recent years has been USD 36.4 bn. Meanwhile, sovereigns sold more than USD 21 bn in bonds during the month, more than double the USD 9 bn issued during the previous six Septembers. “It has been an exceptionally heavy week for issuance,” Koon Chow, EM macro and FX strategist at UBP, said. “I think people are having a bit of trouble digesting it all.”

Nasdaq gets tough on Chinese IPOs: Nasdaq is limiting new offerings by Chinese companies due to a small number of Chinese investors crowding out US market players, Reuters reports. Listed Chinese companies tend to have a low trading volume due to the fact they raise the bulk of their capital from Chinese investors who hang onto their shares. Nasdaq is worried that a more illiquid stocks will drive away the large institutional investors it is trying to attract. The rule change comes as the US-China trade war continues to simmer.

WTO’s Airbus ruling this week could escalate US-EU trade spat: The World Trade Organization is this week expected to allow the US to impose tariffs on USD 7.5 bn of European goods in retaliation for bns of USD in illegal subsidies allegedly given to Airbus by the EU, Reuters reports. The EU will not be able to respond until next year when the WTO rules whether the EU can slap the Americans for playing the same type of subsidy game with rival aerospace firm Boeing. The Donald has already slapped tariffs on European steel and aluminium and has threatened to expand them to include cars and car parts.

Support for impeaching The Donald increases bigly: US public opinion is shifting in favor of an impeachment investigation into Donald Trump’s alleged attempt to convince Ukraine’s prime minister to investigate political rival Joe Biden. (Axios)

Don’t know your fusion from your fission? Bloomberg has you covered in this long-form article that delves into the history, the science and the possible future of a technology that could one day be the solution to our growing climate crisis.

April 2020 is D-Day for companies in the streaming war: HBO, NBC and Jeffrey Katzenberg’s video app Quibi will all launch next April in what Axios suggests will be a “decisive moment for the future of television.”