- EGX30 has nearly erased its gains for 2019; gov’t signals it’s talking a long-term view on stake sale program. (Speed Round)

- Schneider Electric mulling acquisition of Egyptian technology outfits. (Speed Round)

- OPIC commits USD 10 mn to LimeVest for investment in healthcare opportunities. (Speed Round)

- El Sisi calls for global community to take “constructive” role in resolving GERD deadlock, says Sudan should be removed from terrorism blacklist. (Speed Round)

- Media, human rights and the Egypt-US relationship are together leading the conversation on Egypt in the foreign press. (Egypt in the News)

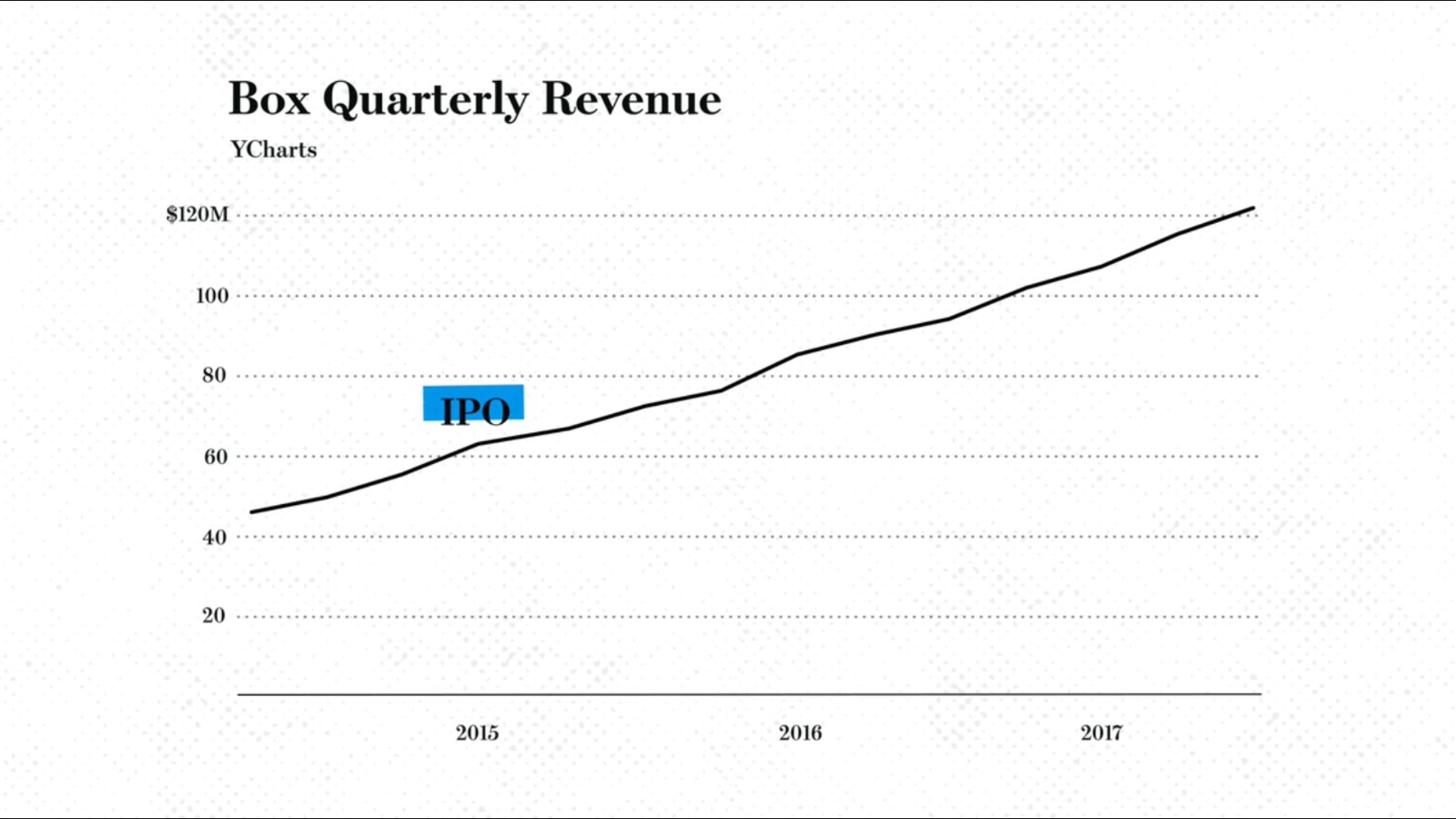

- The challenge of managing an IPO can make or break a company. (Worth Watching)

- Adib reveals assassination plot against El Sisi at Maamoura presidential residence. (Last Night’s Talk Shows)

- The Market Yesterday

Wednesday, 25 September 2019

The EGX30 has nearly erased its gains for the year after closing again in the red

TL;DR

What We’re Tracking Today

Aside from the fact that the EGX has, in just three days, largely erased its gains of this year (more on that in Speed Round, below), the big news of the day is taking place outside Egypt as world leaders grapple with political headaches.

It could be shaping up to be a spectacularly bad day for The Donald, who could (finally) be looking down the barrel of a formal impeachment inquiry over “allegedly betraying his oath of office and the nation’s security by seeking to enlist a foreign power to tarnish a rival for his own political gain.” House Speaker Nancy Pelosi announced overnight she would launch the inquiry after the US president allegedly pushed the president of Ukraine to investigate presidential hopeful Joe Biden and his son over potential corruption, according to the New York Times.

Like a schoolboy recalled from summer break to start class early, Boris Johnson is trudging back into parliament today. He’ll be listening to calls from opposition parties for his resignation after the Supreme Court ruled yesterday that he had acted illegally in suspending parliament earlier this month, the BBC reports. Boris was due to fly back to London from New York overnight.

The big news of the week here in Egypt is due tomorrow. That’s when the central bank’s Monetary Policy Committee meets to review key interest rates. Eight of nine economists we surveyed expect the CBE to cut interest rates by 50-150 bps for the second consecutive month on the back of unexpectedly low inflation figures in August. Meanwhile, all 11 economists polled by Reuters also predict a cut: Five forecast a 100 bps cut, three predicted 150 bps, and three see a 50 bps coming.

All eyes then cast toward the weekend as the business community waits to see if there is a repeat of the events of last Friday and Saturday.

Also happening this week:

- It’s the final day of the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) today, which is taking place at the Kempinski Royal Maxim.

- The launch of the Mediterranean Business Angels Network will take place at Techne Summit 2019, which runs 28-30 September at Bibliotheca Alexandrina in Alexandria.

Looking ahead: Beltone Financial Holding will hold its Beltone Access conference in Dubai next week. Funds with a combined USD 1 tn in assets under management as well as representatives from more than a dozen sovereign wealth funds will attend the event, which will highlight the economic successes brought about by the government’s reform program.

EM easing causes “yield mania” with investors: Monetary easing is encouraging emerging market governments to step up their bond issuances — and investors are lapping them up, according to Bloomberg. EM bond funds have seen USD 900 mn in inflows over the past week in what the Bank of America refers to as a “yield mania.”

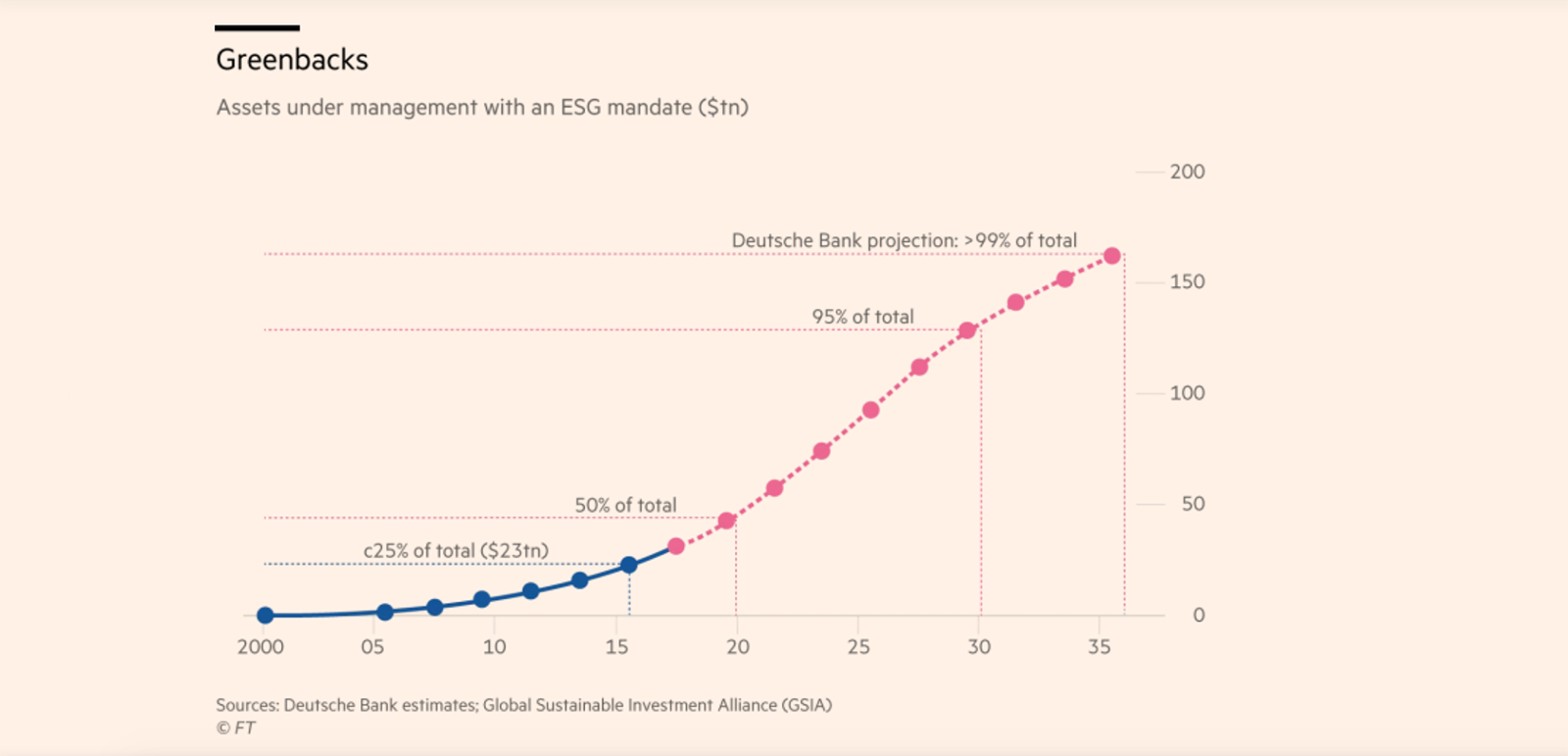

EMs should pay attention to ESG scores or be ready to fall out of favour. Emerging markets stand to lose if ESG or “ethical” investors, who are “on the verge of taking over,” expand their mandates to emerging market debt, says this piece by the FT. ESG — short for environmental, social, and governance — principles are about to factor into 50% (some USD 40 tn) of all assets under management, but the love of ESG principles among equity investors has yet to carry over to sovereign debt. EMs tend to have lower ESG scores and would therefore be more susceptible to capital flight should debt investors follow the lead of equity investors and start giving more weight in their portfolios to ESG ratings. Paradoxically enough, the very investor who adopts this ethical approach “threatens to starve poorest countries of much-needed cash.”

Aramco IPO may not materialize this year: Saudi Aramco looks unlikely to move ahead with its blockbuster IPO this year after investor confidence was shaken from this month’s attack on two of its facilities, two sources in the know told Reuters. “The attacks have spooked investors by exposing how ill-prepared Saudi Arabia is to defend itself despite repeated attacks on vital assets during the more than four years it has been embroiled in a conflict in neighboring Yemen.” In addition to restoring investor sentiment, the Saudi company also still needs time to bring its output levels back to normal, after they were down by half as a result of the attacks.

Investment banks have a hand in the WeWork fiasco: WeWork’s swelling losses and lurching valuations — which have alienated potential investors, caused We Company CEO Adam Neumann to push its planned IPO, and in turn spurred calls for his removal from one of its biggest investors, Softbank — are the partial result of advisory oversights by banks, including JPMorgan and Goldman Sachs, the Financial Times says. By enabling a business model and corporate governance behavior that has inspired little confidence in stock market investors, these and other advisers helped to precipitate WeWork’s current crisis, in turn calling their own reputations into question, the piece says.

Big Oil attends climate week in NY: The heads of some of the world’s biggest oil and gas companies gathered in New York this week for the “Oil and Gas Climate Initiative” — a project that aims to reduce emissions and gas flaring in the energy sector. Bloomberg has the key quotes from the Shell, BP and Total CEOs, among others.

Enterprise+: Last Night’s Talk Shows

As we suspected, President Abdel Fattah El Sisi’s activities at the UN General Assembly remain at the forefront of the talking heads’ agendas. Al Hayah Al Youm’s Lobna Assal received the daily update from Khaled Abu Bakr, who’s in New York to cover the UN meetings (watch, runtime: 12:04). We have a full recap in this morning’s Speed Round, below.

Adib reveals assassination plot against El Sisi at Maamoura presidential residence: While the president is in New York, El Hekaya’s Amr Adib unveiled the details of an alleged plot by members of terrorist group Lewaa Al Thawra to assassinate El Sisi during one of his stays at the presidential residence in Alexandria’s Maamoura (watch, runtime: 37:04). Adib detailed previous administrations’ efforts to upgrade and increase security at the residence — which were reportedly halted following the 2011 uprising and resumed under El Sisi — and pointed to the attempted assassination as evidence that these renovations were important “no matter their cost.”

Five- and 10-year treasury T-bond issuance was more than 3x oversubscribed: The central bank received orders for EGP 9 bn-worth of five- and 10-year treasury bonds at a sale worth a combined EGP 2.5 bn, Al Hayah Al Youm’s Lobna Assal reported, citing a Finance Ministry statement (watch, runtime: 1:04). Of the EGP 9 bn, the ministry accepted EGP 5.8 bn-worth of offers.

Mohamed Salah changes Twitter bio, 100 mn go crazy on social media: Fifa announced yesterday the results of its Best Fifa Men’s Player Award, which showed that Mo Salah trailed behind Lionel Messi, teammate Virgil van Dijk, and Juventus’ Cristiano Ronaldo. The award is handed out based on votes, and the announcement of the results did not include the names of Egyptian national coaches and team captains, suggesting their votes were not cast in Salah’s favor. Salah promptly edited his Twitter bio to “Footballer for Liverpool FC,” removing “and the Egyptian national team.” Salah’s reaction triggered a debate on social media, according to Hona Al Asema’s Reham Ibrahim (watch, runtime: 6:16).

Speed Round

Speed Round is presented in association with

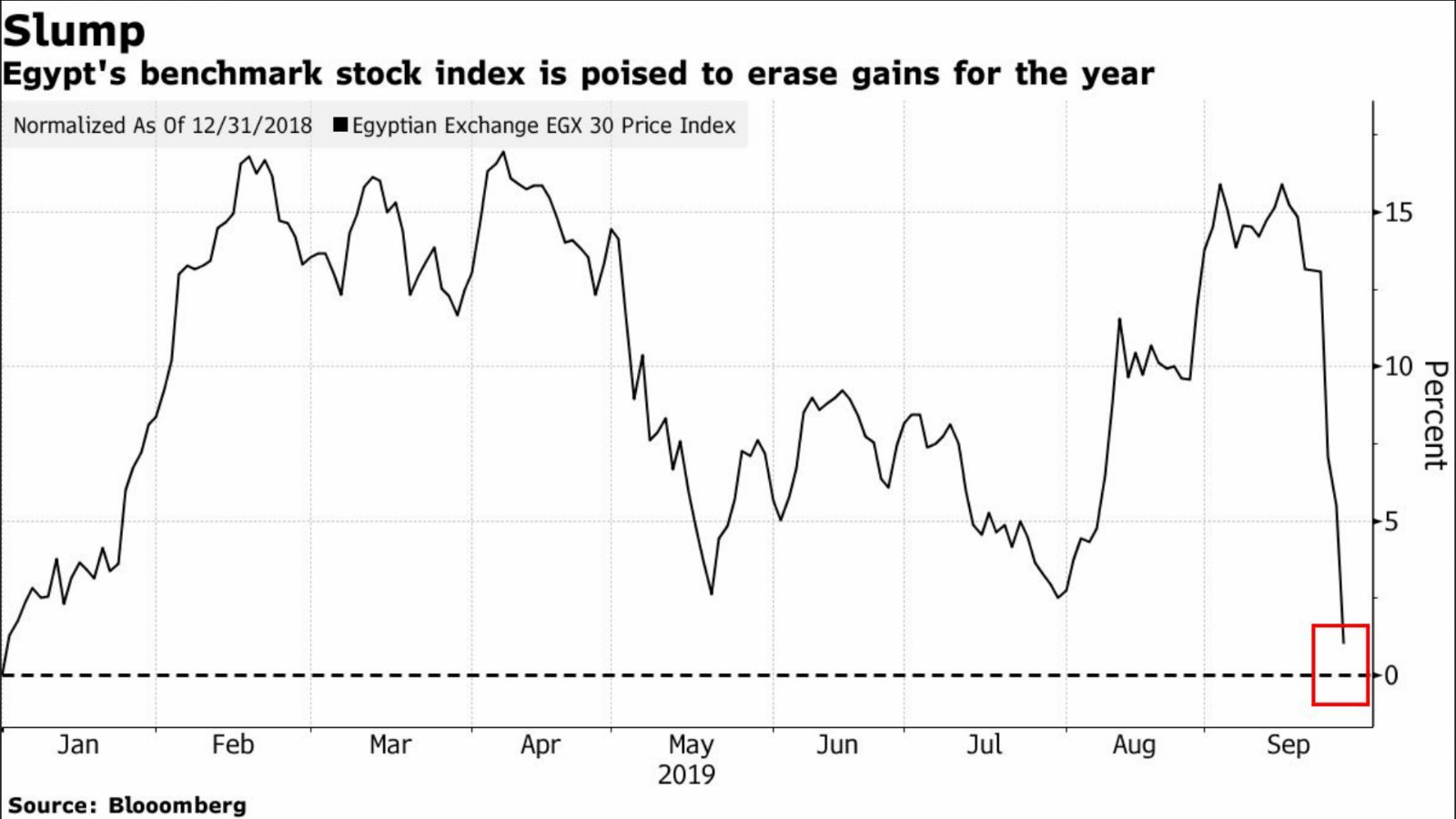

EGX share slide continues, nearly wiping out 2019 gains: The sell-off on the EGX accelerated yesterday, as investor concern about the impact of protests last weekend almost wiped out the index’s 2019 gains. The benchmark EGX30 index fell 4.2% in a third successive day of losses after dropping 5.3% on Sunday and 1.5% on Monday. This week has seen the index post its longest losing streak in four years; it would need to fall again today and tomorrow to match its worst streak in 2011, Bloomberg noted.

The EGX30 is now up just 1% since the start of the year.

Index heavyweight CIB shed 5.2% yesterday, while tobacco maker Eastern Company was down 7%. Chemical, real estate, and basic material shares also closed in the red, with Egyptian Iron & Steel down a further 6.7%, Ezz Steel dropping another 6.7%, and Kima falling 5.9%. Qalaa Holdings suffered the steepest fall yesterday, declining 7.4%.

Foreigners are leading the sell-off: “Today, the sell-off was again led by foreigners who were net sellers. They accounted for 27% of the total turnover,” said Allen Sandeep, head of research at Naeem Brokerage. With calls for further protests on Friday, the prospect of escalation is a concern for investors. “What happened over the weekend was very minimal, but with what happened over previous experience, everyone is being very cautious. That’s why everyone’s cutting risk,” said Ashraf Akhnoukh, director at Arqaam Capital.

The government made clear yesterday it’s staking the long view on stake sales and IPOs of state-owned companies. Prime Minister Moustafa Madbouly said yesterday his government plans to sell stakes in five or six major companies on the EGX before the end of the fiscal year next June, according to a statement from the prime minister’s office in which the PM also called on the private sector to ramp up its investment in the domestic economy. The release came after the trading session closed and followed several news and TV reports that the government has finalized procedures for state companies due to hit the EGX with additional stakes before the end of the year.

Meanwhile, government-issued USD bonds came under pressure in the secondary market for a second day, with longer-dated issues all falling more than USD 0.01 to their lowest point in around a month, Refinitiv data cited by Reuters shows.

The EGP also continued to soften against the USD: 12-month non-deliverable forwards on the EGP ticking to 18.51 to the USD compared with 18.38 the day before, while greenbacks were changing hands for EGP 16.32 at the banks compared to EGP 16.29 the day before.

M&A WATCH- Schneider Electric is mulling the acquisition of a number of Egyptian tech companies,Middle East and Africa President Caspar Herzberg told Al Mal without elaborating further. Schneider also aims to turn Egypt into an export hub for the region and beyond, targeting 70 countries in the Middle East, Africa, Central Asia and Turkey, he said. This could be related to the company’s ongoing work with the government to set up 14 data centers in new cities.

This announcement came shortly after Schneider inked an agreement with authorities that would see the company receive overdue export subsidies from the Export Subsidy Fund by the end of the year. The government started implementing a new EGP 6 bn export subsidy framework last week, and said it is taking steps to settle overdue payments promised under an old program. Walid Sheta, the company’s president for North East Africa and the Levant, had said the agreement would contribute to increasing the company's exports next year. Schneider is also considering establishing a new factory in the Suez Canal area within the next 2-3 years.

INVESTMENT WATCH- OPIC commits USD 10 mn to LimeVest: The Overseas Private Investment Corporation (OPIC), the US government’s development finance institution, has committed USD 10 mn to Sharif El Akhdar’s LimeVest, which will deploy the funds in healthcare investments that have a special focus on women and children, it said in a statement (pdf).

It’s the first publicly announced fundraising for LimeVest, which focuses on providing long-term capital and expertise to middle-market and lower-middle market businesses in Egypt. OPIC financing will allow LimeVest to invest in healthcare businesses to enhance their competitiveness, create jobs, promote the role of women in the workplace, and ultimately expand access to basic healthcare services, the statement said.

Underserved healthcare market needs value-added investing, LimeVest says: LimeVest views Egypt’s healthcare system as underserved, with low spending and inefficiency creating a gap in the market that can be filled by value-added investing. Total spending on healthcare in Egypt rang in at USD 7.5 bn in 2017, making up less than 4% of GDP, and the number of hospital beds stood at just 1.3 per 1000 citizens.

El Sisi’s General Assembly address calls on int’l community to take “constructive” role in resolving GERD gridlock: President Abdel Fattah El Sisi’s speech to the UN General Assembly yesterday in New York called on the international community to help Egypt, Sudan, and Ethiopia reach a resolution on the Grand Ethiopian Renaissance Dam, the negotiations over which have repeatedly stalled. The president also focused discussed regional conflicts, including in Libya, Syria, and Iraq, as well as the Israeli-Palestinian conflict. Terrorism also featured in the address as El Sisi, who went on to again call for the removal of Sudan from the list of terror-sponsoring states, considering the “positive political developments in the country.”

El Sisi meets Boris Johnson, Macron at UNGA: El Sisi also met yesterday with British Prime Minister Boris Johnson on the sidelines of the UNGA to discuss cooperation in the fight against terrorism and how to bolster economic ties, according to an Ittihadiya statement. El Sisi had a similar chat with French President Emmanuel Macron. The president also had sit-downs with Irish Prime Minister Leo Varadkar, Lebanese President Michel Aoun, Pakistan’s Prime Minister Imran Khan, Hungarian President János Áder, and Spanish Prime Minister Pedro Sánchez.

The president met with a number of US corporations, private equity funds, and asset and portfolio management companies at a working meeting organized by the Business Council for International Understanding. El Sisi promoted potential investments in Egypt, including in the Suez Canal Economic Zone.

EARNINGS WATCH- Orascom Investment Holding (OIH) recorded net losses of EGP 153.3 mn in 1H2019, compared to losses of EGP 141.2 mn during the same period last year, the company said in an EGX disclosure (pdf). Revenues fell to EGP 792.4 mn in 1H2019 compared to EGP 823.5 mn a year earlier.

Image of the Day

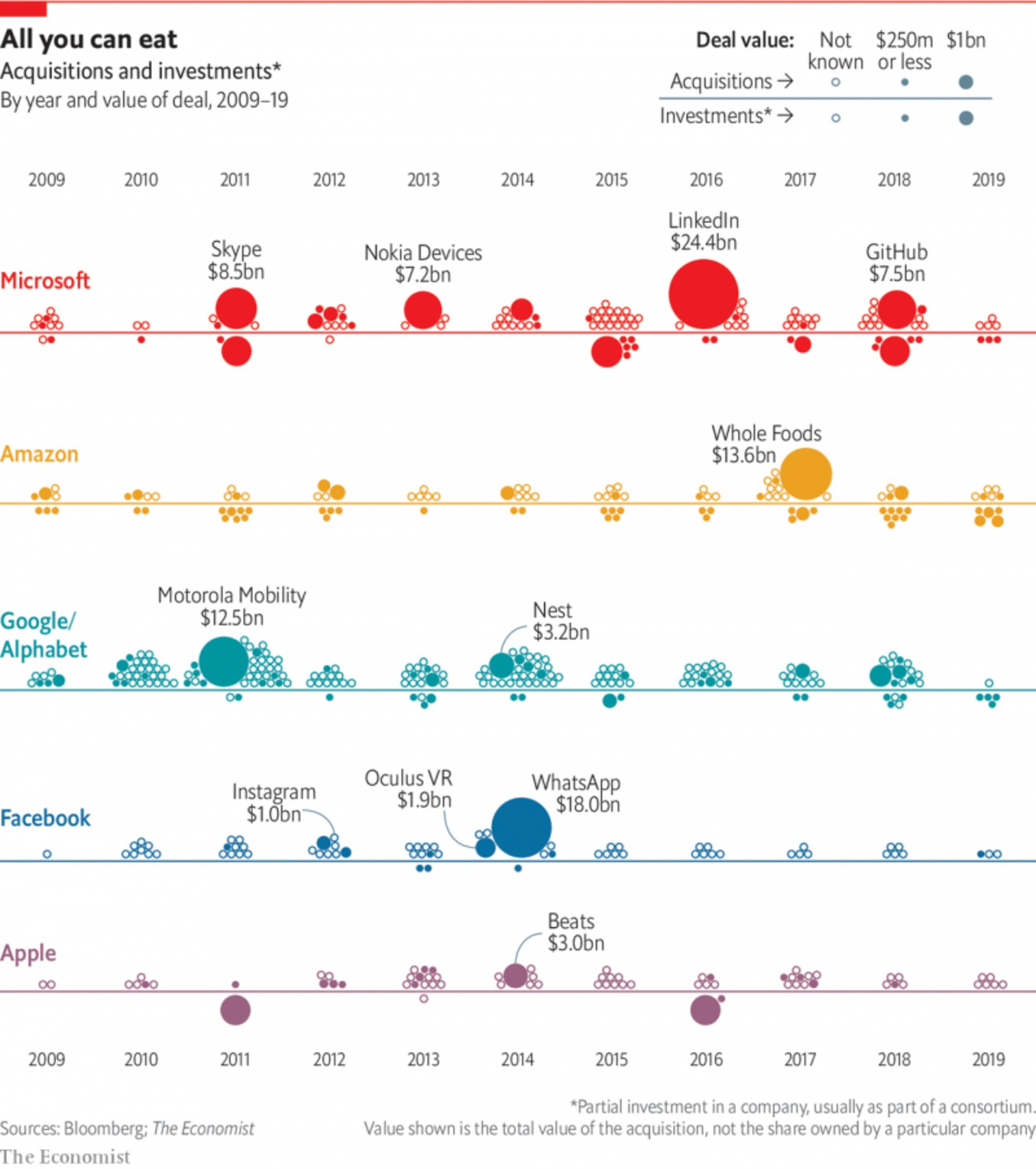

Hungry Hungry Tech: As large tech companies continue to come under the spotlight for possible anti-competitive practices, the question of just how big is too big continues to be asked. This nifty infographic, compiled using data from the Economist and Bloomberg, shows exactly why. The big five — Amazon, Apple, Alphabet, Facebook and Microsoft — are shown gobbling up a host of smaller companies over a 10 year period. Visualized this way, Facebook’s USD 1 bn acquisition of Instagram in 2012 looks positively miniscule, especially beside Microsoft’s USD 24 bn acquisition of LinkedIn in 2016. But all pale in comparison to the cumulative value of these five giants: a whopping USD 4.2 tn, which represents one-seventh of the total stock market value of the US.

Egypt in the News

Media, human rights and the Egypt-US relationship are together leading the conversation on Egypt in the foreign press. A rare op-ed by New York Times publisher A.G. Sulzberger calls into question whether the administration of US President Donald Trump would have provided assistance to the paper’s Cairo bureau chief, Declan Walsh, who was reportedly set to be detained two years ago. The Trump Administration is said to have known of the threat of arrest and sat on the information. The story is being widely picked up: Financial Times | Washington Post | Independent | RTE | NBC.

Meanwhile, the Committee to Protect Journalists is calling on authorities to release Egyptian journalists said to have been detained while covering protests last weekend, and not to restrict access to news and social media sites. Amnesty International also issued a statement calling on world leaders to bring up the matter with President Abdel Fattah El Sisi during the ongoing UN General Assembly meetings.

The foreign press also still has Mohamed Ali on the brain: Egyptian businessman Mohamed Ali’s stirring of the Egyptian people is being poked and prodded by an article by BBC, after protestors took to the streets inspired by Ali’s viral claims of government corruption.

Also getting attention in the international press:

- The Egyptian startup scene: Egypt’s startup ecosystem is thriving, with incubators on the rise, tech innovation increasing, and several of our startups on the brink of unicorn status, Entrepreneur’s Aparajita Saxena writes, in a piece that reads like a who’s who of Egypt’s startup community.

- Egypt is one of 18 countries that stood with the US in calling for the UN to remove “ambiguous” terms and expressions in UN documents on the grounds that such language could promote abortion, CNN reports.

Worth Watching

The challenges inherent in launching an IPO can make or break a company, says Box co-founder and CEO Aaron Levie in a conversation with the Wall Street Journal (watch, runtime: 02:41). Timing is one key determinant of future success: IPO too early and your business model might not be established, but leave it too late and you might find your growth ceiling has already been reached. Box struck a good balance, Levie believes, by launching an IPO once it had reached over USD 100 mn in revenue, having proven its model and operations, and shown that it could replicate scaling and customer outreach. This meant making some tough decisions, however, including pushing the initial date of the IPO to get the business into a better financial position, and turning down a lucrative early acquisition offer that would have limited its growth. Going public changes a business, and the shift from having a handful of investors to having thousands (or even hundreds of thousands) does not come naturally to any organization. And as a company grows, it will face decisions that test the vision and conviction of its team members.

Worth Reading

How mobility apps capitalize on the need for resilient, flexible transport solutions in rapidly growing EMs: Low-tech transport apps that cater to “the realities” of infrastructural challenges in emerging markets are a key solution for EMs that need to rely more on resilience than smart city grids, Swvl co-founder and CEO Mostafa Kandil writes for the National. “Cities in emerging markets do not need to become ‘smart’ cities, relying on the latest state-of-the-art technologies. Rather, they must become resilient cities and be built on three pillars of frugality, flexibility and inclusiveness.” EMs have highly unique infrastructural challenges (many in Cote d’Ivoire, for example, don’t have formal street addresses), and the flexibility of tech-driven local transport companies makes them able to adapt to the specifics of each market they operate in.

These transport apps have a huge window for growth in offering intermodal transport options for commuters in emerging markets, where a lack of central urban planning and a highly fragmented transport network means commuters often have to switch between different modes of transport for a single trip. This reliance on intermodal transport is only expected to increase as urban growth in emerging market cities — much of which is occurring at breakneck speeds — continues to spur decentralization. And this growth is also happening in tandem with a significant rise in smartphone penetration, which has reached 47% in emerging markets, meaning mobility apps have a chance to tap into an ever-growing consumer base.

Energy

AfDB looks to increase funding to Egypt for solar projects

The African Development Bank (AfDB) could increase funding to Egypt for solar projects as part of an initiative to develop the Sahara’s solar generation capacity, the local press reported. Bank VP Wale Shonibare said that Egypt had an important role to play in the project, which aims to see the construction of 10 GW-worth of solar plants in the Sahara, capable of providing electricity to 250 mn people.

NREA aims to build 2 GW solar power plants

The National Renewable Energy Authority (NREA) aims to build solar power plants with a combined capacity of 2 GW, authority head Mohamed El Khayat said without specifying a timeframe or elaborating further. NREA has received 10 requests from companies looking to build projects with a capacity of 10 GW since Egypt announced its feed-in-tariff program, he said. A number of Arab and multinational companies have made offers to build renewable energy plants with a capacity up to 4 GW, Electricity Minister Mohamed Shaker told the local press.

Manufacturing

Higher prices after Aramco attacks see plastic sales fall in Egypt

Plastic producers in Egypt say their sales have been affected amid an increase in the prices of polypropylene and polyethylene after last week’s attacks on Saudi Aramco facilities, Youm7 reported. Amr Abdel Aziz, an Alexandria-based trader, said large companies have turned to hoarding amid uncertainty over supply, which has exacerbated the situation.

Health + Education

Egypt’s Education Ministry open to discuss foreign ownership limit with schools

The Education Ministry’s recent decision to implement a 20% cap on foreign investor ownership in international schools will not be applied retroactively, according to a ministry official. The ministry is also open to discussing the decision and its implications of the decision with school management bodies, the official said, while maintaining the move is “in line with national security considerations.” This comes as a number of school owners said they are gearing up to meet with the minister to lobby against the decision.

Automotive + Transportation

AOI in talks with France’s Thales to upgrade Egypt’s train networks

The Arab Organization for Industrialization (AOI) is in talks with France-based transportation and defense giant Thales Group to upgrade the signaling system for Egypt’s railway and metro, as well as trains’ communication networks, the AOI said in a statement seen by Al Shorouk.

Banking + Finance

Orascom Construction to build EGP 636 mn HDB HQ in new capital

Orascom Construction signed an agreement with the Housing & Development Bank (HDB) on Sunday to construct the bank’s headquarters in the new administrative capital, the local press reports. The building is estimated to cost EGP 636 mn, and will be financed by the bank’s equity, which exceeds EGP 5 bn. The new building is due to be completed within 18 months.

Egypt Politics + Economics

Lawyer files request to strip Mohamed Ali of Egyptian citizenship

Egyptian lawyer Leila Maklad has filed a request to the Egyptian Prosecutor General to withdraw Mohamed Ali’s Egyptian citizenship on the grounds that his viral videos “spread rumors” and “broadcast obscenity” about President Abdel Fattah El Sisi and the Egyptian army, according to RT Arabic. Maklad also accused Ali of threatening national security after calling for anti-government protests.

On Your Way Out

Court condemns lovejacker for life: The Alexandria Criminal Court handed yesterday Seif El Din Moustafa, the man who hijacked and diverted a domestic EgyptAir plane to Cyprus in 2016, a life sentence for charges including “intimidation and threats to seize a plane and abduct its passengers for a terrorist purpose,” reports Reuters. Moustafa has a right to appeal the sentence within 60 days. He was extradited to Egypt last year after having been held in custody in Cyprus for over two years. His story made headlines in March 2016, when he used a fake explosives belt to abduct an Alexandria-Cairo flight with 55 passengers on board. He claimed at the time he wanted to send a message to his former Cypriot wife, and also called for the release of female detained in Egyptian prisons.

Egyptian artisans featured in Harper’s Bazaar Arabia: Egyptian handmade home accessories online store Decobate was featured in fashion and lifestyle magazine Harper's Bazaar Arabia. Decobate is a blended word combining the first half of “decorate” and “bate,” an alternative spelling for the Arabic word meaning house. The store, founded in 2018, ships its products to 50 countries worldwide.

The Market Yesterday

EGP / USD CBE market average: Buy 16.24 | Sell 16.37

EGP / USD at CIB: Buy 16.24 | Sell 16.34

EGP / USD at NBE: Buy 16.24 | Sell 16.34

EGX30 (Tuesday): 13,170 (-4.2%)

Turnover: EGP 1.1 bn (65% above the 90-day average)

EGX 30 year-to-date: +1.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 4.2%. CIB, the index’s heaviest constituent, ended down 5.2%. EGX30’s top performing constituent was Orascom Construction up 1.2%. Yesterday’s worst performing stocks were Qalaa Holdings down 7.4%, Eastern Co down 7.1% and Ezz Steel down 6.7%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -273.9 mn

Regional: Net Long | EGP +29.5 mn

Domestic: Net Long | EGP +244.5 mn

Retail: 51.3% of total trades | 53.7% of buyers | 48.9% of sellers

Institutions: 48.7% of total trades | 46.3% of buyers | 51.1% of sellers

WTI: USD 56.89 (-0.70%)

Brent: USD 63.10 (-2.58%)

Natural Gas (Nymex, futures prices) USD 2.50 MMBtu, (0.00%, Oct 2019 contract)

Gold: USD 1,538.50 / troy ounce (-0.11%)

TASI: 8,069.55 (+1.45%) (YTD: +3.10%)

ADX: 5,076.48 (+0.02%) (YTD: +3.28%)

DFM: 2,803.34 (-1.13%) (YTD: +10.81%)

KSE Premier Market: 6,263.29 (+0.15%)

QE: 10,318.52 (-0.43%) (YTD: +0.19%)

MSM: 4,017.71 (+0.27%) (YTD: -7.08%)

BB: 1,520.13 (+0.05%) (YTD: +13.68%)

Calendar

23-25 September (Monday-Wednesday): Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS), Kempinski Royal Maxim, Cairo

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

27 September (Friday): The Justice Ministry’s dispute resolution committee will hear a case filed by Raya Holding against the Financial Regulatory Authority (FRA).

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

28 September (Saturday): Smart Vision Egyptian Women’s Forum, venue TBA.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

8-10 October (Tuesday-Thursday): A delegation of 20 Korean companies visits Egypt.

10-13 October (Thursday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, to be announced and Pitch by the Pyramids, Giza Pyramids

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.