Timing is key to IPO success, says Box CEO

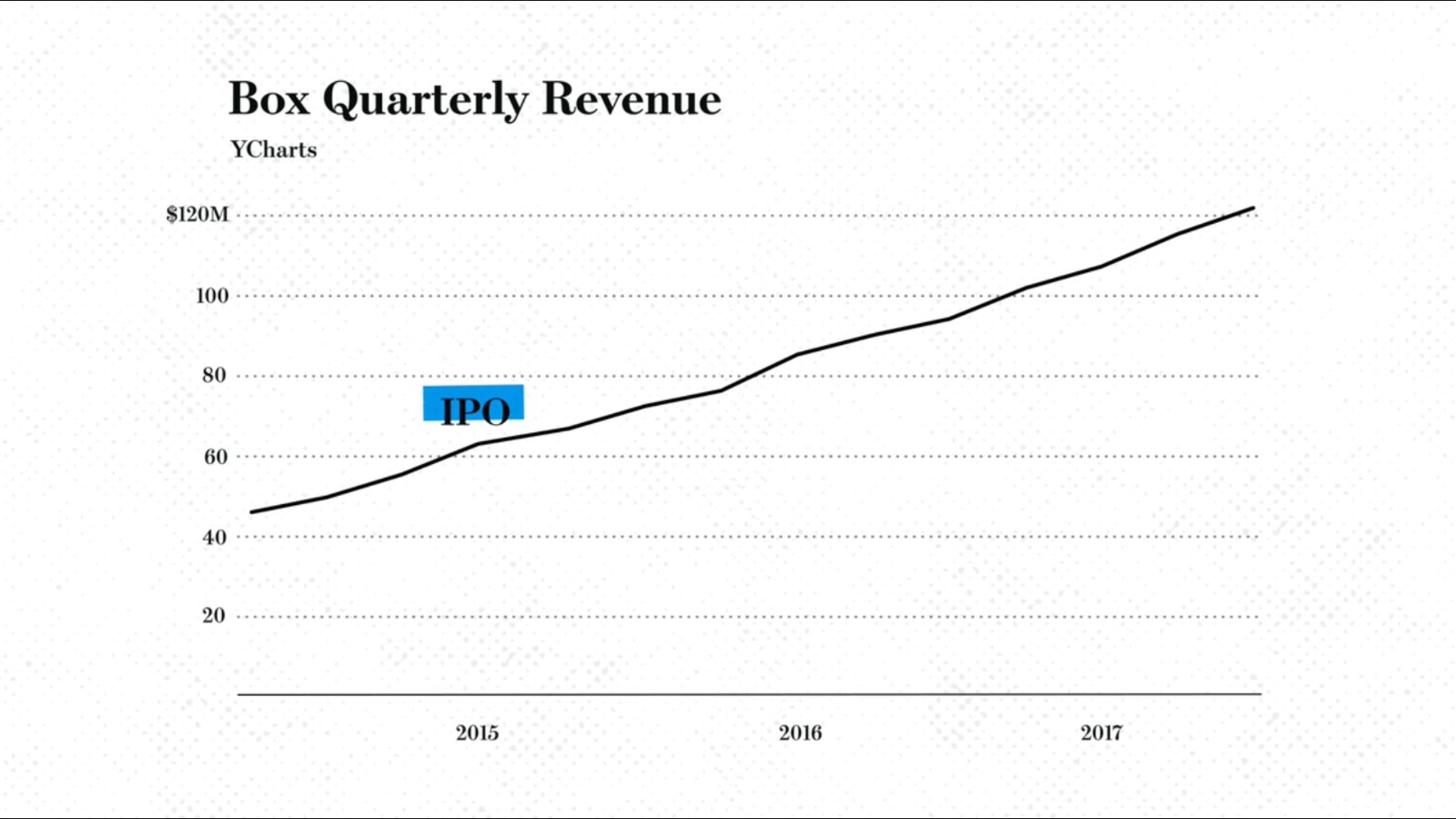

The challenges inherent in launching an IPO can make or break a company, says Box co-founder and CEO Aaron Levie in a conversation with the Wall Street Journal (watch, runtime: 02:41). Timing is one key determinant of future success: IPO too early and your business model might not be established, but leave it too late and you might find your growth ceiling has already been reached. Box struck a good balance, Levie believes, by launching an IPO once it had reached over USD 100 mn in revenue, having proven its model and operations, and shown that it could replicate scaling and customer outreach. This meant making some tough decisions, however, including pushing the initial date of the IPO to get the business into a better financial position, and turning down a lucrative early acquisition offer that would have limited its growth. Going public changes a business, and the shift from having a handful of investors to having thousands (or even hundreds of thousands) does not come naturally to any organization. And as a company grows, it will face decisions that test the vision and conviction of its team members.