Escalation in recent Saudi crisis drives oil prices up

US President Donald Trump has accused Iran of Saturday’s attacks on Saudi Arabia’s Abqaiq oil facility, which have disrupted production of 5.7 mn barrels of oil a day, or roughly 5% of global supply. Accusing Iran of lying in a tweet, he reiterated his support for Saudi Arabia, and hinted that he is ready to escalate a conflict if evidence emerges to verify that Iran was behind the attack — an accusation first directly leveled by Secretary of State Mike Pompeo.

Saudi Aramco officials, meanwhile, are less optimistic about the rapid resumption of full oil production than they were on Sunday. Having initially said operations would resume within days, current estimates suggest it may be weeks or even months before the plant is operating at full production capacity again. While Aramco is using offshore oil fields to replace some of its lost production, and supplying customers using stockpiles, analysts are highlighting the infrastructure’s vulnerability to attack, driving market jitters.

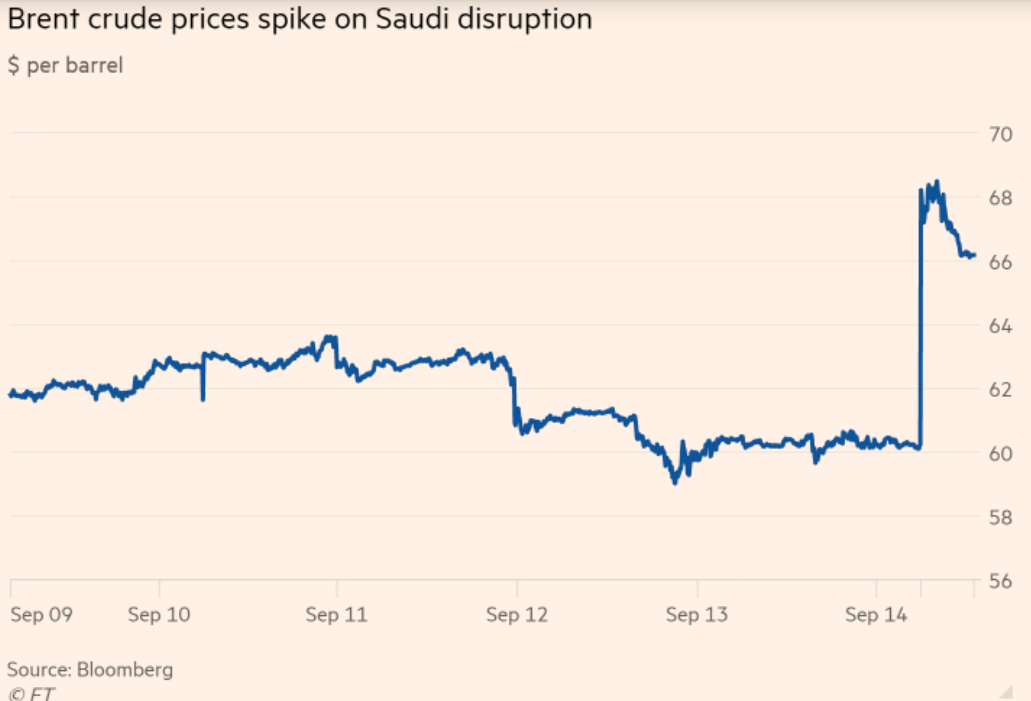

In response to the turmoil, crude oil prices made their biggest jump on record, initially soaring by as much as 20% to almost USD 72/bbl when the market opened on Monday, the Financial Times reports. While they later decreased to around USD 66/bbl, this is still a gain of almost 11% on the day, which puts them on track for their biggest one-day percentage gains since 2016. “We have never seen a supply disruption and price response like this in the oil market,” says a Credit Suisse energy analyst. “Political-risk premiums are now back on the oil-market agenda.”

This isn’t good for us, as Egypt has budgeted a benchmark price of USD 68/bbl. Even the fuel hedging contracts the government has already signed with international banks have reportedly been set at USD 64-68 per bbl. A Bloomberg analysis last year showed that every USD 1 increase above a benchmark price used by the state in annual budgeting added EGP 4 bn (USD 222 mn) to annual spending.

Nonetheless, Saudi Aramco is moving forward with plans for its IPO,and has given no indication that it will delay its timeline, Bloomberg reports. However, bankers and analysts are reportedly casting doubt on the odds of the IPO happening on schedule, with some citing the climate of heightened risk as a reason for investor caution, others saying the attack is likely to reduce Aramco’s valuation — which Crown Prince Mohammed bin Salman has put at over USD 2 tn — and still others raising the specter of other potential attacks, which they say would make it virtually impossible for the IPO to proceed. The rate at which Aramco can resume full production is the crucial determinant for whether the IPO will move forward on schedule, experts say.

Lack of confidence is the prevailing sentiment in the foreign press, with an FT opinion piece that decries Saudi Arabia as “ill-equipped” to handle the disruption, having just dismissed Khalid Al Faleh as energy minister and Saudi Aramco chairman, seeming to capture the overall mood.