What we’re tracking on 1 September 2019

Good morning, ladies and gents — and welcome to September. The end of Sahel season as we know it means the promise of slightly better weather to brave the uptick in traffic from the new school year. Across the pond, your colleagues in North America are ringing in the new month with a three-day weekend (unlike us) in observance of Labor Day.

President Abdel Fattah El Sisi landed in Kuwait yesterday for a two-day visit, during which he is set to meet Kuwaiti Emir Sheikh Sabah Al Ahmad Al Sabah and several high-level government officials, according to MENA. Egypt and Kuwait are set to sign a number of agreements during the visit, including a cooperation protocol between the two countries’ prosecutor generals on exchanging information, Al Shorouk reports.

Key news triggers in the coming days:

- PMI: The purchasing managers’ index for Egypt, the UAE and Saudi Arabia will be released on Tuesday, 3 September at 06:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release Egypt’s net foreign reserves figures for August this week.

- Inflation: Monthly inflation figures for August at due out next week. Inflation fell unexpectedly to a four-year low of 8.7% in July.

Across the pond, the start of September means fresh tariffs on Chinese imports come into effect today. US President Donald Trump told reporters on Friday that he doesn’t plan on pulling the brakes on the tariff hikes, but that talks with China are scheduled for this month, according to Reuters. A reprieve in the trade war could not come a minute too soon for American consumers and retailers, who are caught in a metaphorical tennis match of who will bear the brunt of increased costs from the tariffs, the Associated Press says. Businesses that hiked prices on affected products were faced with consumers who all but refused to buy, while those who opt to absorb the higher costs say their margins are being eaten away and will eventually have to raise their prices.

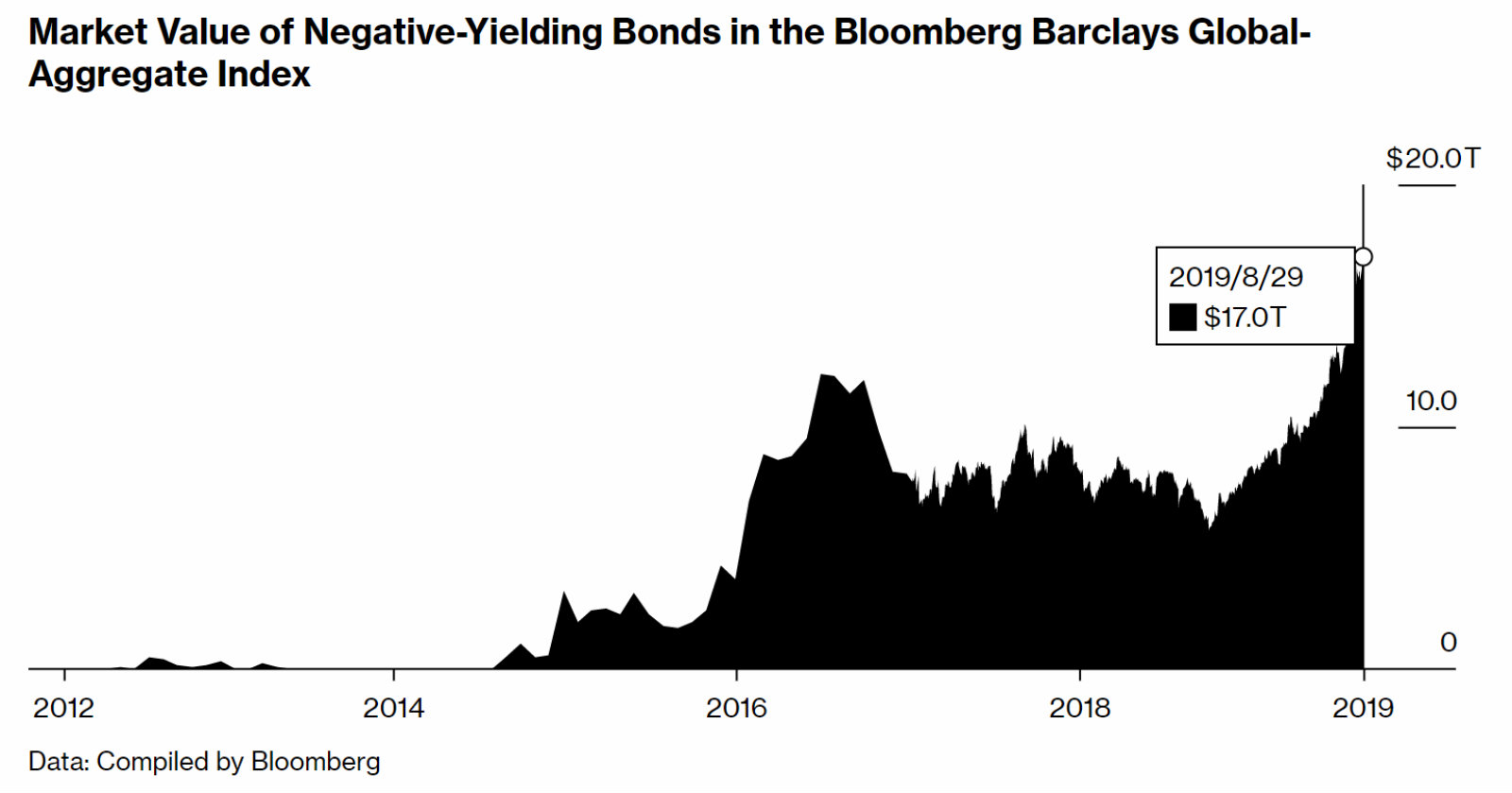

The surge in negative yielding debt shows no signs of letting up: The amount of global negative-yielding debt has risen above USD 17 tn as investors continue piling into bonds, Bloomberg reports. Sustained market volatility pushed yields on USD 2 tn-worth of bonds into negative territory in just the last three weeks of August. Almost a third of all investment-grade bonds are now below zero.

Well, that didn’t go as intended: Investors pulled record amounts of money from the biggest Saudi-focused ETF in the US on Thursday, the same day as the second batch of Saudi shares were added to the MSCI EM Equity Index, Bloomberg reported. iShares MSCI Saudi Arabia outflows recorded USD 119 mn, the most for any day since the ETF’s inception in 2015. MSCI finished the second phase of including Saudi stocks in its EM index last Tuesday which prompted some investors to sell shares, taking advantage of increased liquidity on the securities. The Tadawul stock exchange also fell on Wednesday and Thursday.

A Sudanese court officially charged yesterday ousted president Omar Al Bashir with corruption and “possessing illicit foreign currency,” Reuters reports. The court will determine the length of the former strongman’s sentence separately on Saturday, 7 September. The charges leveled against Al Bashir are punishable by up to 10 years in prison.