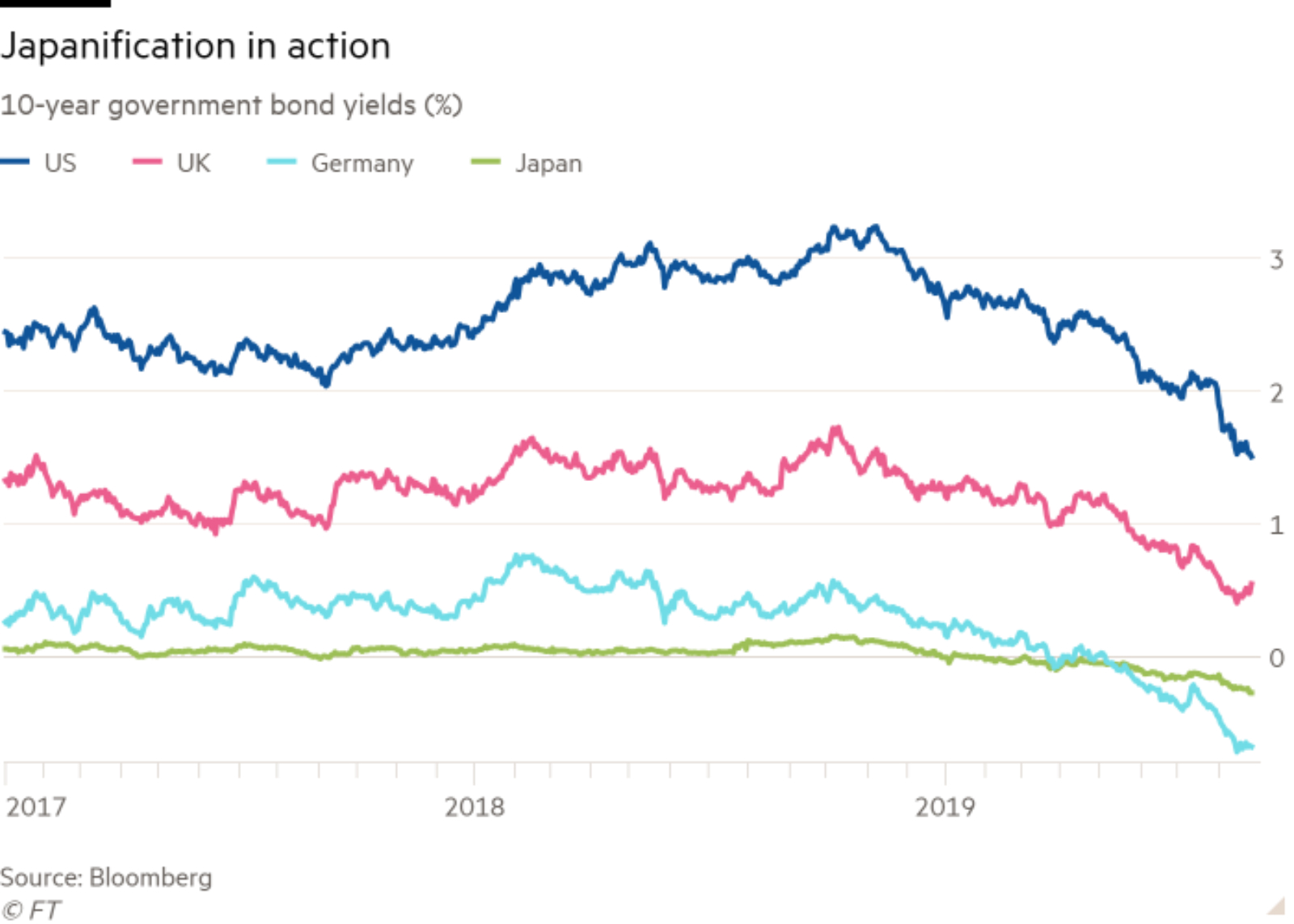

Is ‘Japanification’ going global?

Is ‘Japanification’ going global? Economists are becoming increasingly concerned that the hallmarks of so-called ‘Japanification’ are spreading around the world, Robin Wigglesworth writes in the FT. Japanification refers to problems that have plagued the Japanese economy for the past three decades — negative interest rates, low inflation and weak growth — for which monetary policymakers are yet to find a solution. Now, other parts of the developed world are showing signs of undergoing a similar, perhaps irreversible transformation. Lisa Shalett, CIO of Morgan Stanley Wealth Management, frames the problem in terms of addiction. “You can get addicted to low or negative rates,” she said. “It’s very scary. Japan still hasn’t gotten away from it… The world is in a very precarious spot.”

Europe is increasingly resembling Japan. Negative yielding debt has soared in recent months, helped by the European Central Bank’s (ECB) deposit rate, which has been in sub-zero territory since 2014. The entire German and Dutch sovereign bond markets carry negative yields, while large parts of Spanish, Portuguese and Irish markets — countries, lest we forget, were embroiled in sovereign debt crises just a few years ago — are negative yielding. Inflation has remained stubbornly below the ECB’s target rate of just under 2% over much of the past six years, and fell to 1% for the first time since 2016 in July. And none of the central bank’s stimulus measures have made much of an impact either on inflation or GDP, which has continued to languish below 1% since the 2008 financial crisis.

Will “black-hole economics” cross the Pacific? Although the US has shown less symptoms of Japanification than the Eurozone — GDP has remained robust over the past two years, and sovereign yields are still above 1% across the market — there are signs that this may be beginning to change. Inflation is low, and the Federal Reserve may be about to embark on an extended easing cycle with the Federal Funds rate at only 2.25%. The threat of what former Treasury Secretary Larry Summers calls “black-hole monetary economics” in the US is now real. “Black-hole monetary economics is now the confident market expectation in Europe and Japan, with essentially zero or negative yields over a generation,” he said last weekend. “The United States is only one recession away from joining them.”