S&P gives its two cents on Egypt’s post-IMF landscape during Q&A

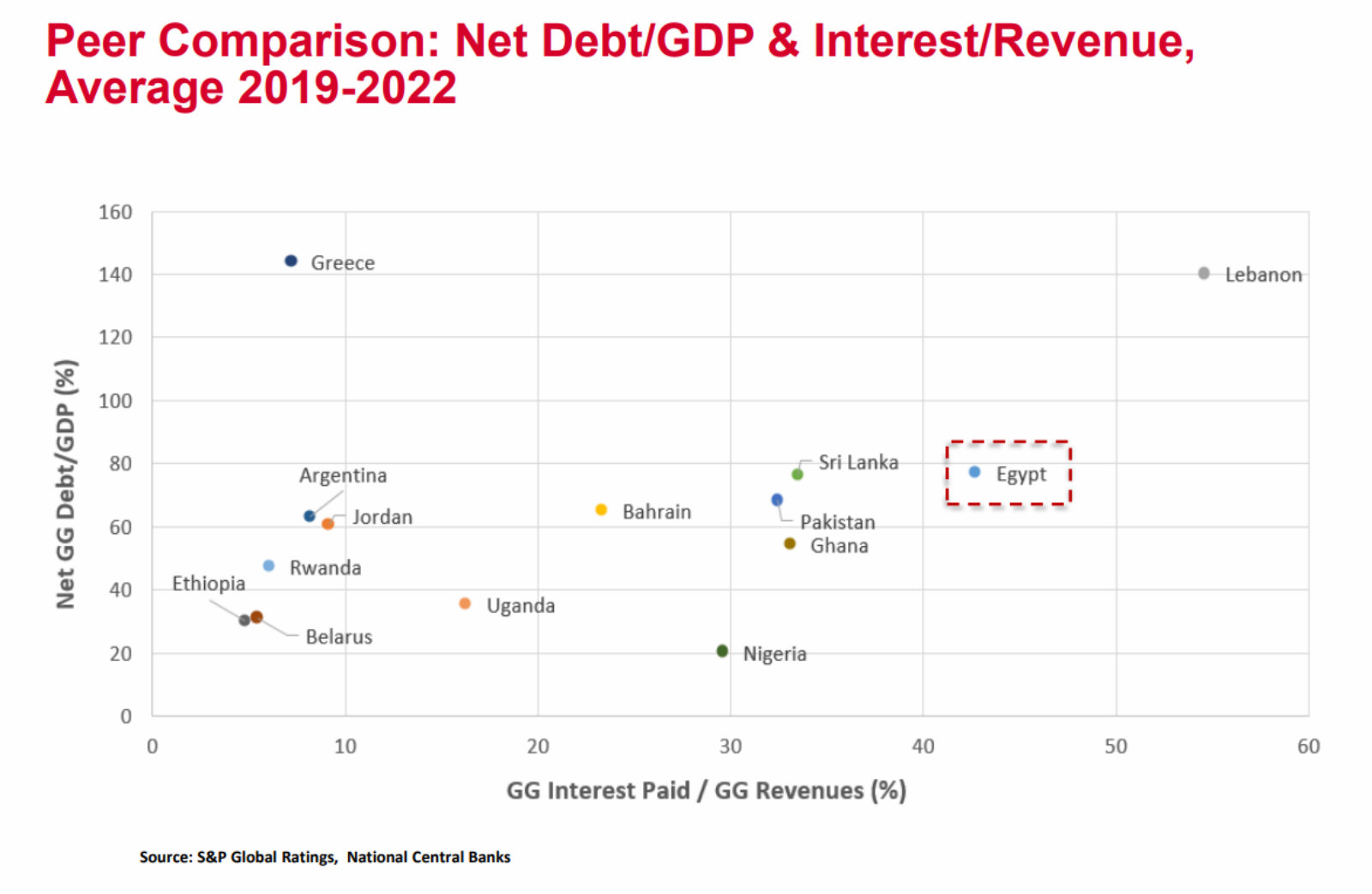

EXCLUSIVE- S&P’s two cents on Egypt’s post-IMF landscape: Egypt has begun to see the “small green shoots of recovery” but serious risks remain to the government’s fiscal stability, Zahabia Gupta, S&P Global’s associate director of sovereign ratings, said during a Q&A with investors this week. The situation in Egypt is “gradually improving” as it approaches the end of its IMF program, she said, citing the government’s falling current account deficit, rising gas production, a recovery in tourism, and stabilizing remittances. But the country’s fiscal position remains “very weak” and substantial debt service costs present challenges. Key takeaways from the Q&A:

Egypt is unlikely to receive more funding from the IMF because they would struggle to meet the tighter conditions on debt sustainability. Having said that, S&P does not see the need for Egypt to return to the fund for post-program funding given its improved liquidity position. Further IMF assistance is more likely to take the form of a policy coordination instrument — a non-financing tool designed to improve the government’s credibility in its commitment to reform. The IMF will also monitor the government’s progress twice a year after the end of the program.

“Real interest rates remain a risk to Egypt’s debt sustainability,” Gupta said, highlighting the fact that under the central bank’s current easing strategy, the interest cost will remain high for a significant period. Strong market demand for the country’s foreign currency-denominated debt helps it manage nominal interest, while at the same time raising its exposure to fluctuations in the exchange rate.

S&P believes Egypt’s current FX levels provide sufficient liquidity to cover around five and a half months of current account payments for the next two years. There remain risks that portfolio flows could rapidly leave the country, but the CBE’s ring-fenced foreign assets could mitigate some of the impact on the country’s reserves and exchange rate. The ratings agency expects reserves to dip only slightly over the coming three years.

Foreign direct investment into productive areas of the economy has “disappointed” despite the competitive exchange rate, Gupta said. FDI has over the past few years gone primarily into the energy sector, which creates few jobs for Egypt’s increasing population. The government is responding to the problem by increasing subsidies for exporters.

Remittances don’t pose a significant risk to Egypt’s balance of payments: Although some inflows may exit the country as interest rates slowly decline, the bulk of remittances come from Egyptians living abroad and will likely remain stable over the coming years.

What are the chances of a credit upgrade? Slim, in the near term. “We do not see the possibility of an upgrade in the near future,” Gupta said, citing the government’s weak fiscal position and the lengthy time period it takes to complete its structural overhaul of the public sector.