What we’re tracking on 08 April 2019

El Sisi heads to DC today: President Abdel Fattah El Sisi is heading today to Washington, DC, for a three-day visit to America, the highlight of which will be a meeting with US President Donald Trump. The president’s visit comes as the IMF and World Bank gear-up for their spring meetings, which will feature a meeting of G-20 finance ministers on the sidelines.

Presidential diplomacy will get plenty of headlines heading into Ramadan: El Sisi was in Guinea yesterday for talks with President Alpha Conde — the first time an Egyptian president has visited the country since 1965. Also in the cards for the president are visits to Senegal and Cote d’Ivoire, according to a presidential statement. El Sisi is also due in Beijing later this month to attend China’s Belt and Road Forum for International Cooperation, according to Xinhua.

The mood for the global economy this week is going to be set in Washington and in New York. Specifically:

The IMF looks set to downgrade this week its global growth forecasts for 2019 and 2020 just in time for the aforementioned spring meetings of the IMF and World Bank. IMF boss Christine Lagarde reportedly still expects an “an anaemic pick-up later this year” but “believes that a major fiscal easing may be needed to reverse the downward trend in the longer term,” according to the Financial Times. Lagard had said last week that the outlook is “precarious” for an “unsettled” global economy that is particularly vulnerable to trade wars, Brexit and financial markets shocks (including, say, a sell-off sparked by a run of poor earnings reports).

That comes as the global economy is entering a “synchronised slowdown,” according to an index compiled by the Financial Times and US think tank Brookings that looks at “sentiment indicators and economic data” across advanced and emerging economies.” The Brookings-Financial Times TIGER (Tracking Indexes for the Global Economic Recovery) index shows that investment is easing across the world due to falling business and consumer confidence as well as geopolitical tensions, Brookings writes. At the same time, record public debt levels mean that advanced economies are running low on ammunition to prevent a possible recession. The salmon-colored paper has coverage here.

So will poor 1Q earnings in Europe and the US be one of the triggers of Doomsday? Maybe, the Wall Street Journal suggests, noting that “dozens of companies have slashed their profit forecasts for the first quarter,” from Walgreen Boots to FedEx, Apple and 3M. CNBC is less certain, acknowledging that (expected) poor first-quarter earnings could hit market sentiment, but fretting more about what could happen on Wednesday. That’s when the US Federal Reserve releases the minutes of its last meeting — and when the EU meets to talk about Brexit.

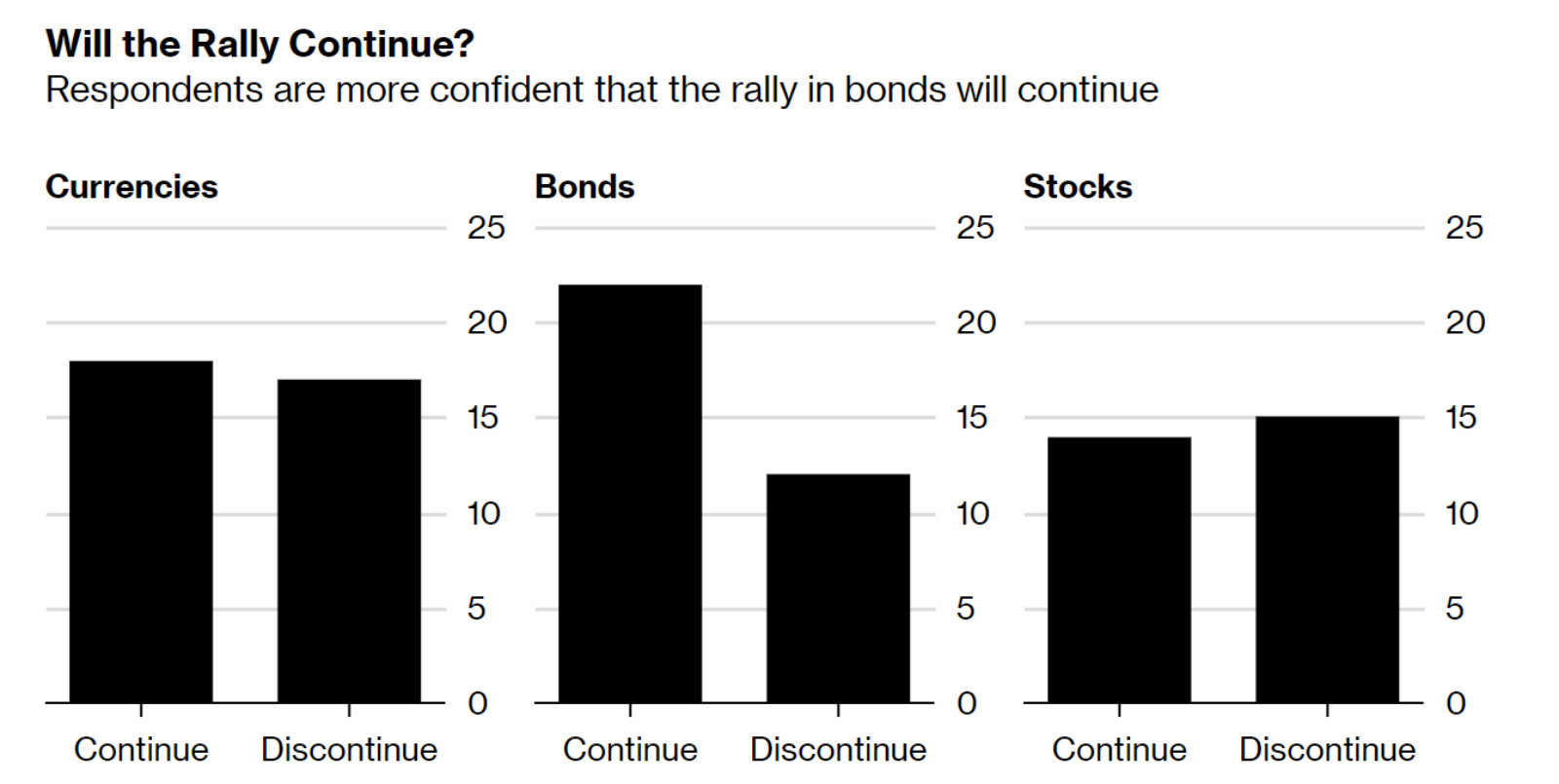

A ray of sunshine? Emerging market debt will continue to rally in the coming months despite the fading recovery in developing economies, according to Bloomberg’s monthly EM survey. “With the [US Federal Reserve’s] dovish turn and risks of economic slowdown globally, central banks in emerging markets won’t have to raise rates, which is a good environment for bond,” FPG Securities CEO Koji Fukaya said.

In regional goings-on:

- Saudi Aramco’s upcoming USD 10 bn bond issuance is already 3x oversubscribed as investors shrug off concerns related to the murder of journalist Jamal Khashoggi last year, the FT reports.

- The US is pulling troops from Libya as fighting between the east Libyan forces of Egypt-backed Gen. Khalifa Haftar and the UN-backed government of Fayez Al Serraj left 21 dead yesterday, according to the BBC. The clashes are “elevating the risk of new oil supply outages from the OPEC member,” says Bloomberg.

- Thousands of Sudanese protesters are holding a sit-in outside President Omar Al Bashir’s compound in Khartoum, Reuters reports.

- Israeli Prime Minister Benjamin Netanyahu vowed to annex Jewish settlements in the West Bank as he looks to secure rightwing support ahead of elections tomorrow that would determine whether or not he lands a fifth term in office, the FT notes.

Also happening in the next couple of days:

- Renaissance Capital’s annual Egypt Investors Conference takes place in Cape Town Tuesday and Wednesday. EGX Chairman Mohamed Farid will deliver the keynote address on expanding the role of capital markets in Egypt’s economy. Tap or click here to view the preliminary agenda for the event (pdf).

- Monthly inflation figures are due out on Wednesday. Annual headline inflation accelerated to 14.4% in February, up from 12.7% the previous month. In a report earlier this week, the IMF urged Egypt to take it easy with the monetary policy easing to avoid another surge in inflation, Bloomberg noted.

- AmCham is holding its annual HR Day at the Cairo Marriott Hotel on 10 April. You can register here.

- The House of Representatives will vote on the proposed constitutional amendments on Sunday, 14 April.

The New York Times would like to scare the hell out of you with what is shaping up to be a scary and insightful investigative series on superbugs. It’s not just a rich-country problem, and fungi are getting in on the act, too. Read:

- In a poor Kenyan community, cheap antibiotics fuel deadly drug-resistant infections

- A mysterious infection, spanning the globe in a climate of secrecy

QUESTION OF THE MORNING: Does anyone out there know of homegrown Egyptian businesses that have successfully scaled up and expanded beyond our borders (not necessarily just to shiny Dubai)? We’re looking at great growth stories to feature in a new product we’re developing. Know someone? Drop us a line at editorial@enterprise.press.