Egypt’s incorporation of the informal economy hinges on its investment in digitalization and financial inclusion

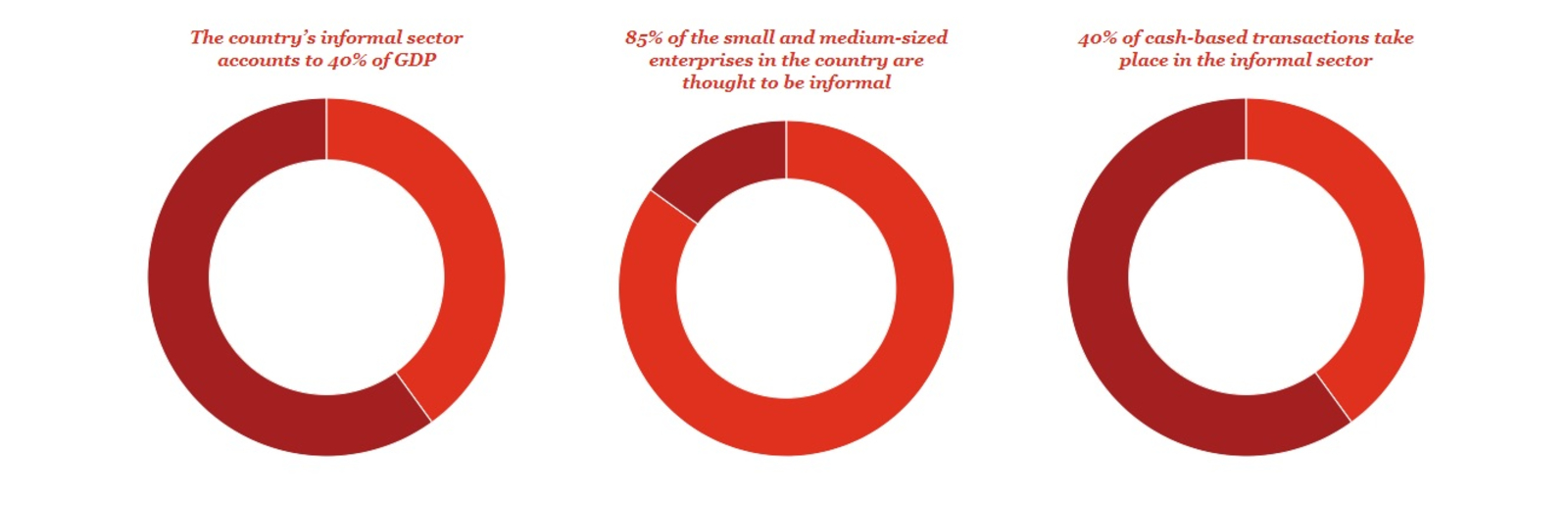

Egypt’s drive to make the informal economy go legit hinges on its investment in digitalization and financial inclusion, our friend Maged EzzEldeen, country senior partner at PricewaterhouseCoopers, argues in a report on the shadow economy. The government, Ezzeldeen says, is cognizant of the importance of incorporating the informal economy and the issues that come with an informal economy as large as Egypt’s: “Its very size distorts GDP and therefore policy making for the whole economy. Unregulated goods and services rarely comply with health and safety codes and legal redress for faulty goods or poor service is impossible to obtain.” There are also key policies being put in place that reflect state-led efforts to go digital as part of the push to incorporate the informal economy, including the availability of electronic tax return filing and the draft SME taxation framework.

That said, the prevalence of cash payments and cultural issues such as the institutionalization of corruption threaten to undermine the government’s digitalization drive, Ezzeldeen argues. As it currently stands, there are no legal limits on the size of cash transactions (except for the EGP 500 limit the Finance Ministry plans to apply on the cash payment of government fees as of May). The lack of an upper limit on cash transactions feeds into the growth of tax evasion and other illicit activities. This “limits the development of financial services and reinforces the financial exclusion of the most vulnerable sectors of the population.”