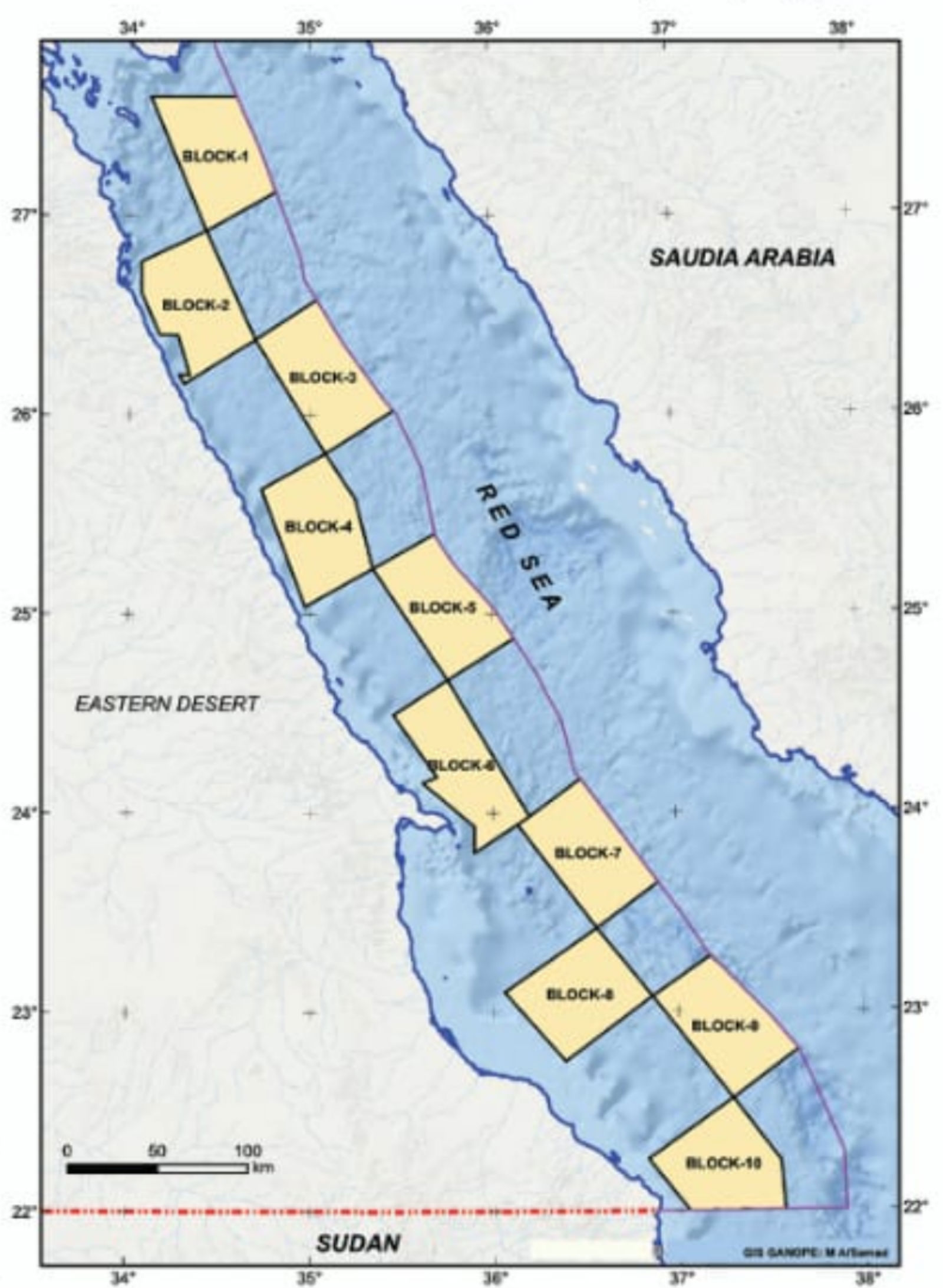

Egypt announces Red Sea oil and gas bid rounds for 10 offshore blocks

The scramble to drill for oil and gas in the Red Sea just got underway: The South Valley Egyptian Petroleum Holding Company (Ganope) has launched a tender for 10 oil and gas exploration blocks off the Red Sea coast under a new production sharing contract, according to a company statement (pdf). There is detailed information (pdf) on the bid round available on Ganope’s website. The launch of the tender came following the completion of seismic scans in the area by Schlumberger, Norway’s TGS and three other oil companies. Schlumberger’s data suggests there is a high probability of natural gas discoveries, noting that the seafloor resembles the gas-rich terrain of neighboring Saudi Arabia.

Just in time: The tender was expected back in December but was delayed just long enough to take place under new production sharing contracts, which took effect this quarter. The new friendlier terms would see companies bear the cost of exploration and production in return for a share of the output, which will vary from one concession to another based on the cost of investment. They also allow companies to sell their share of production to any entity of their choosing, as opposed to the current system, which gives them only one-third of output and allows the government to buy the producer’s entire share at predetermined prices.

This is clearly not the time for a company to pursue LNG imports: On the natural gas front,private sector companies seeking to import LNG for the local market have put their plans on hold now that Egypt is exporting surplus gas, according to a domestic press report citing an oil ministry official. The Natural Gas Regulatory Authority, which issued 18 licenses for gas import and distribution last week, has not handed a single import license to a private sector company. The ministry has signalled it is willing to extend preliminary import approvals for companies including BB Energy, Fleet Energy, and Qalaa Holdings’ TAQA Arabia.