Risky EM debt pays over the long term — if you can brave the prospect of default

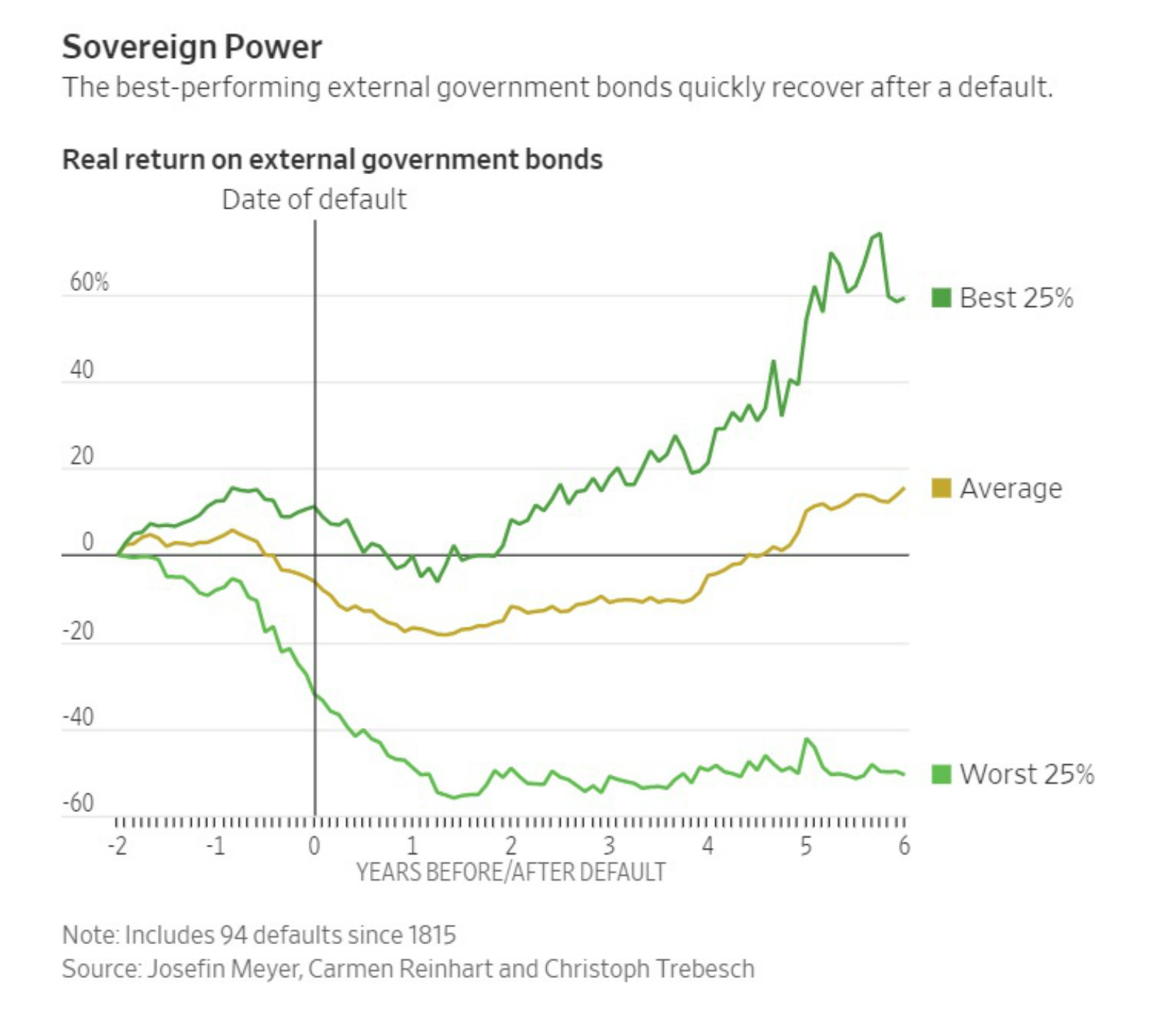

Risky EM debt pays over the long term — if you can brave the prospect of default: Bondholders expose themselves to greater risk of default by investing in emerging market debt, but defaults aren’t necessarily a bad thing if you’re a long-term investor, James Mackintosh writes in the WSJ. New research examining bond issuances since 1815 finds that average returns on bonds issued by governments in GBP or USD rival those of US stocks and are less volatile. The higher yields attached to junk bonds deliver even greater returns, even if the country defaults and investors are forced to take losses. Many bonds stage a speedy recovery following default, paying returns that more than compensate for the haircut.

Argentina is a case in point. The study finds that bonds issued by Argentina (which has spent around a third of its 124-year-old history in default) actually paid 5.6% higher returns on average than low-yielding Gilts and US Treasuries, despite the losses suffered by investors after default.

Long-term investors can ride out the storm: “Truly long-term investors who can lend for decades without worrying should make a decent return, punctuated by awful periods of loss,” Macintosh writes. And for the rest of us who aren’t in it for the long haul? “Everyone else has to worry about the boom-bust cycle.”