- The Finance Ministry and the Egypt’s banks reach agreement on cost-to-income ratio in new tax treatment. (Speed round)

- Theresa May to Egypt: Don’t hold your breath on direct flights to Sharm. (Speed round)

- Financial Regulatory Authority fires starting gun on short selling. (Speed round)

- Trade and Industry Ministry agrees to pay export subsidies worth EGP 7.8 bn. (Speed round)

- Qalaa Holding’s USD 4.3 bn ERC refinery will be up and running in 3Q2019. (Speed round)

- Nationwide campaign in support of constitutional amendments kicks off. (On the Front Pages)

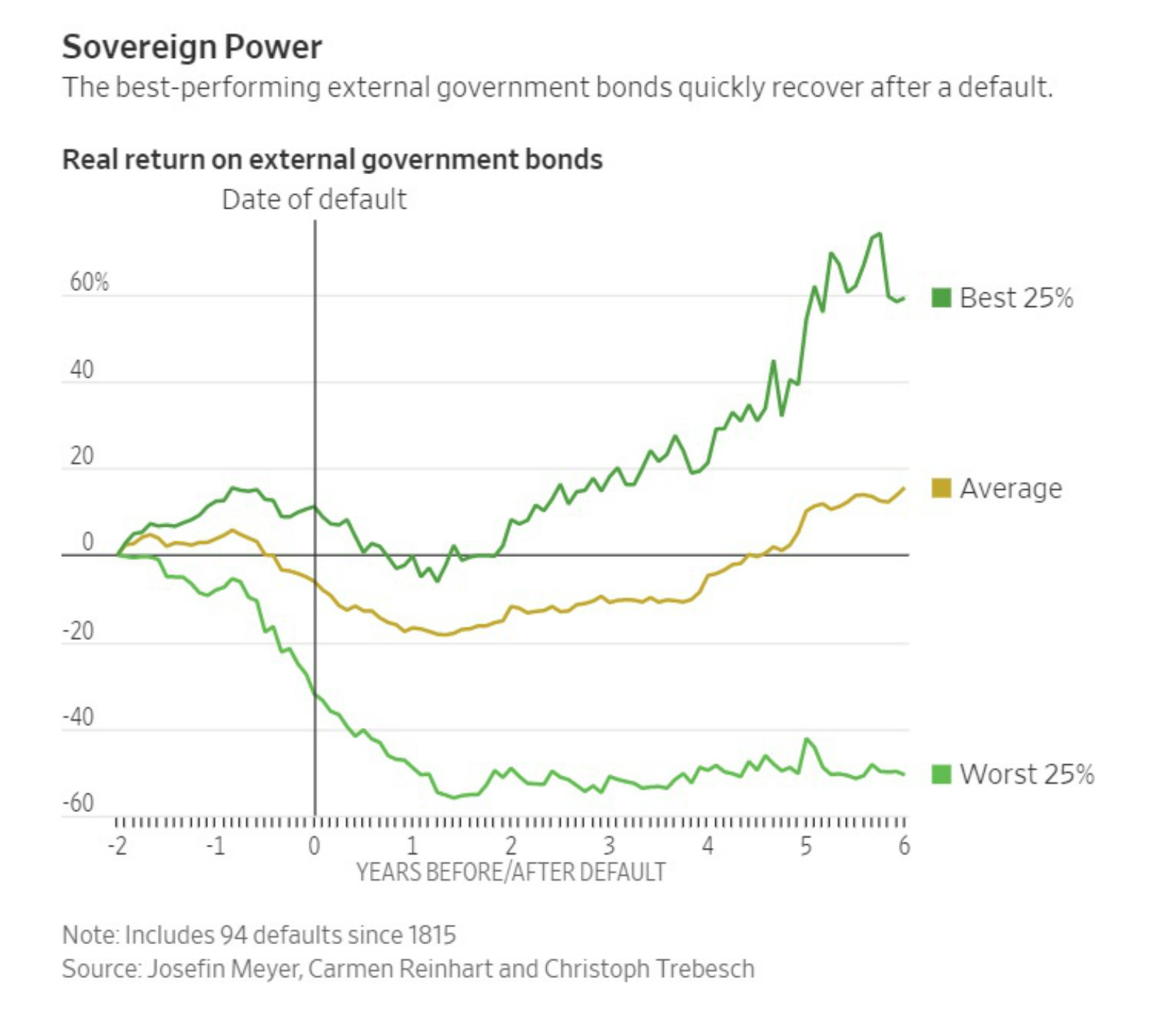

- Risky EM debt pays in the long term — if you can brave the prospect of default. (Macro picture)

- Amr Adib had a tarot card reader predict what the economy will look like this year. (Worth Watching)

- The Market Yesterday

Wednesday, 27 February 2019

New banking tax regs out soon

TL;DR

What We’re Tracking Today

The slow news week continues, at home and abroad. It’s not a seasonal thing, just a quirk of the news cycle: A year ago, we were busily discussing a USD 15 bn agreement to import gas from Israel and a veritable ton of M&A and investment news here at home, while internationally the news was about then-new US Federal Reserve chairman Jay Powell and China abolishing term limits.

This year’s edition of the International Conference on Petroleum Mineral Resources and Development kicked off yesterday at the Egyptian Petroleum Research Institute in Nasr City. With opening speeches from the oil and higher education ministers, the event is essentially a three-day expert discussion on oil and gas, renewables and resource management.

Egypt’s bid to steady its economy and restore political stability is allowing it to return to its traditional role as a regional player, according to analysis from once-high-flying intel outfit Stratfor. The geopolitical intelligence firm says that the economic benefits of the IMF-backed reform program and the newly-discovered Mediterranean gas fields, combined with President Abdel Fattah El-Sisi’s consolidation of power, is allowing Egypt to strengthen its regional influence and balance its alliances with the US, Russia and China. As a result, Stratfor predicts that the country is likely to become increasingly assertive with other states looking to control the Nile and the Eastern Mediterranean.

Bonus: An Egypt population density map, which reminds us just how concentrated along the Nile we all are.

Muhammadu Buhari has reportedly won re-election as president of Nigeria according to the latest results from Saturday’s general election, the BBC reports. The party of challenger Atiku Abubakar has apparently “rejected the result.” Look for the results of the poll, which saw less than 35% of registered voters turn out, to be made official today.

The Donald and that chap who runs North Korea kick off a two-day summit today in Vietnam. Among the more interesting of the many, many takes on the story now circulating is Hannah Beech’s piece for the New York Times, wherein Vietnamese communists make the case that North Korea has a once-in-a-generation opportunity to transform “from a closed society strangled by central planners to a bustling nation full of capitalist enterprise.” Read: Cozy up to US, Vietnam tells North Korea. Look what it did for us.

And speaking of Jay Powell: The Fed chairman has a warning for us all. “Slowing growth in Europe and China and ‘elevated’ uncertainty over Brexit and trade are continuing to weigh on the Federal Reserve’s policy outlook, chairman Jay Powell said, even as he gave a broadly favourable health check to the US economy,” the Financial Times reports. CNBC and the WSJ have also taken note of his remarks, as has Bloomberg Opinion.

Is the future of the mobile phone foldable? That notion has captured the imagination of the world’s business and technology writers after Huawei and Samsung each debuted folding smartphones at the annual Mobile World Congress in Barcelona this week. The Verge’s Vlad Savov called it, as he so often does, having predicted last weekend that when the iPhone doesn’t change, Android phones get weird. Now, the Financial Times is asking whether “foldable phones are more than just a gimmick?” and Business Insider is noting that smartphones “getting weird again … could be a sign that the industry is on the brink of another huge change.” And the Woz, naturally, wants a folding iPhone.

And while we’re at it: Don’t believe the 5G hype. At least not yet, AFP warns in a well-timed piece. 5G will make make near-instant movie downloads possible and enable new technologies including self-driving cars, but the reality is that even in developed markets, a high-speed, zero-latency internet “will only be a reality in 2023-25.” To get there, network operators need to invest bns in infrastructure and device makers need to roll out 5G handsets people will actually want to buy. Read the AFP piece or check out the list of 5G handsets announced at MWC.

In miscellany worth your attention this morning:

- Toronto Tech: Why Canada is attracting the ‘best’ people. (Financial Times)

- Is maple syrup the new aioli? Meet “the season’s secret ingredient.” (Wall Street Journal)

- Why Alien still has a hold on us after 40 years. (Are we alone in having a small preference for Aliens, not Alien?) (Financial Times)

- Sorry, fanboys: Apple Music isn’t coming to Google Home after all. (Bloomberg)

PSA #1- Keep your dog on a leash — and don’t linger outdoors for the next little while. Officials in multiple districts of Cairo, including Maadi, have launched a crackdown on unleashed pets after high-profile talk show host Amr Adib picked up on a case in which two privately owned dogs brutally attacked a child in the suburbs.

PSA #2- Thursday and Friday could see lower temps and some rain, according to an Egypt Today report channelling the national weather service. Our favourite weather app is guiding for daytime highs of 17°C both days and a chance of rain on Thursday as well as next Monday.

Enterprise+: Last Night’s Talk Shows

Due to technical difficulties resulting from Doc Brown’s manipulation of the space-time continuum, our talk shows roundup is on hiatus today. We will resume tomorrow with our regular coverage of the lowlights on the nation’s airwaves.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- FinMin, FEB reportedly reach agreement on cost-to-income ratio in new tax treatment: The Finance Ministry and the Federation of Egyptian Banks (FEB) have reached an agreement on a key aspect of newly ratified amendments to the Income Tax Act that change how banks and corporations account for income from investments in government debt. The agreement will see the cost-to-income ratio on income from holdings of treasuries capped at 50%, a senior government source tells us, and allow these expenses to be counted as deductibles against pre-tax income on the income statement. This provision, as well as rules on the recognition and calculation of allowable costs, are expected to be in the executive regulations, which could be out “in a matter of days,” the source tells us. The Finance Ministry had previously agreed to mark the cost of investment in treasuries as deductible in the new tax treatment.

Are banks to account separately for FX-denominated treasuries? The executive regs will outline how banks and companies will be required to account for FX-denominated government treasuries, the source told us, but did not elaborate. The source did hint that a formula might be in the works that could see them accounted for separately.

Will the law apply retroactively? The new tax treatment will not apply to any government debt bought at auction prior to the issuance of the executive regulations, unless those treasuries are later traded to another institution or sold on the secondary market (once that secondary market starts trading), the source said.

May to Egypt: Don’t hold your breath on direct flights to Sharm. UK Prime Minister Theresa May told President Abdel Fattah El Sisi at the EU-Arab League summit in Sharm that although ties between the two countries remain strong, a ban on direct flights to Sharm El Sheikh is still “under review,” the Sun reports. “We are working together to address the shared challenges of terrorism. On the position of flights, our position is clear. The security of British nationals is our top priority. Of course we understand the importance of the issue for Egypt, and while we haven’t yet concluded that it’s right to lift the restriction on flights, we continue to keep that under review,” May said. While the tabloid appears to be the only newspaper to have picked up the remarks, they are in line with UK policy.

Still, isn’t it almost a relief? The inherent condescension aside (“of course we understand the importance of the issue for Egypt…”), it is almost refreshing that May came out and said it rather than leave us to suffer through another year’s worth of platitudes and vague nonsense from Her Majesty’s diplomatic corps. UK flights to Egyptian resorts have been banned since 2015.

Do the Russians, at least, know what’s up? Direct flights from Russia to the Red Sea tourist destinations “fully” resume in the near future, but there’s still no official deadline, Russian Federation Council Foreign Affairs Committee Chairman Konstantin Kosachev told Egypt’s ambassador to Russia Ihab Nasr, according to TASS. “We are close to resuming these routes in full in accordance with the sides’ interests,” Kosachev added. Nasr previously said he is hoping to see the issue resolve by the end of 2019. Russian officials have repeatedly stopped short of saying when they see flights resuming.

The latest: A Russian security delegation was said to have been preparing a final security sweep of Sharm El Sheikh and Hurghada airports in the second half of this month, but we haven’t heard of updates since then. Flights between Cairo and Moscow resumed last April after being banned following the downing of a Metrojet flight in 2015. President Abdel Fattah El Sisi’s October 2018 visit to Russia was expected to deliver an agreement on the resumption of flights, but no word on the ban emerged from his sit down with President Vladimir Putin.

Habemus short selling: The Financial Regulatory Authority (FRA) took a giant leap forward in the drive to bring short selling to the Egyptian Exchange when it issued regulations yesterday that allow brokerage firms to act as market makers by finding lenders and borrowers of stocks, the market regulator said in a statement. Under the regulations, you can only short 20% of a company’s freefloat shares while any one shareholder won’t be able to lend more than 5% of a company’s shares. The regulations will also cap the total percentage of any company’s shares that can be used to create a short position. Folks looking to open a short position will need to put down 50% of the value of the securities borrowed, and brokerages will be required to park that sum in fixed-income assets while the position is open.

So, what’s next? The FRA has said the EGX needs now to finalize the technical systems to support short selling and then let the FRA know when it is ready to launch the product. You can learn more about how the EGX views shorts in our sit-down with EGX Chairman Mohamed Farid.

Trade Ministry reportedly agrees to pay export subsidies worth EGP 7.8 bn: The Trade and Industry Ministry will pay EGP 7.8 bn worth of overdue export subsidies to exporters, ministerial adviser Hossam Farid was quoted as saying by Hapi. His statement came during a meeting between ministry officials and the Egyptian Businessmen’s Association (EBA) to discuss the new export incentives program that on which the ministry has been working. The new program will focus on incentives to grow value-added exports as well as to push industry to Upper Egypt and to develop shipping and logistics operations. The strategy should be in final form for cabinet review soon.

Background: Exporters have ratcheted up the pressure to get the government to pay out what they say are bn’s in overdue subsidies. The government, which is trying to boost exports and reduce imports to plug its trade deficit and save foreign currency, said it will decide on its next payment in March and has hinted that the new incentive program might be a non-cash one.

Qalaa’s ERC goes online in 3Q2019: Egyptian Refining Company (ERC)’s USD 4.3 bn facility will be up and running in the third quarter of the year, Qalaa Holdings, the company leading the project, said in an EGX disclosure (pdf). The facility is now 99.28% complete, and is running trial operations until the second quarter, the statement adds. Qalaa Chairman Ahmed Heikal has previously said the new plant will satisfy about 14 percent of Egypt’s annual need for liquid oil products.

Aramco to pump crude to Egypt’s refineries through June: Saudi Aramco will be supplying Egypt with 500k barrels of crude through June, Oil Minister Tarek El Molla said, according to Reuters’ Arabic service. The Saudi giant had been supplying Egyptian refineries with the monthly amount of crude, initially to the Middle East Oil Refinery (Midor), since January 2018, Oil Minister Tarek El Molla previously said. Egypt is also receiving 700k tons of petroleum products per month from Aramco under an existing five-year fuel supply agreement.

M&A WATCH- NBK Capital Partners’ Kaumeya Language School acquires KIAS: NBK Capital Partners’ Kaumeya Language School has acquired King Integrated American School (KIAS) in Alexandria amid growing interest in Egypt’s education market, the firm said in press release (pdf). Rebranded as KLS King Mariut, the school will roll out a British curriculum starting the next academic year. The transaction marks NBK Capital Partners’ ninth in the region’s education market. Matouk Bassiouny was legal advisor to NBK Capital Partners and the founders.

EARNINGS WATCH- Sarwa Capital’s 4Q profit unchanged, volatility seen in the short term: Structured- and consumer-finance firm Sarwa Capital’s 4Q2018 net income was unchanged compared to a year earlier at EGP 34.6 mn, impacted by one off items such as IPO fees and provision for the health insurance tax, the company said in a statement (pdf). Revenues for FY2018 grew 51.4% y-o-y to EGP 52.2 mn. The company expects volatility in the short term but sees market dynamics offering chances for expansions as demand picks up. “Going forward, we expect continued strength across our business, while closely monitoring developments and shifts in our underlying asset markets and consumer dynamics as a result of macroeconomic and monetary policy developments,” Sarwa said in the statement. It plans to make “substantial investment” in technology to widen its reach.

Shoukry criticizes use of UN Human Rights Council for political ends: Foreign Minister Sameh Shoukry was in Geneva yesterday for a meeting of the UN Human Rights Council, where he said that some have begun to use the council to settle political scores, according to a statement from the Foreign Ministry. Shoukry also attended yesterday the Geneva Arms Conference, where he said that the efforts of the convention have been stagnating, the ministry said.

Shoukry sat down with CNBC yesterday, giving his two cents on Egypt’s economic reforms and proposed amendments to the constitution that could see President Abdel Fattah El Sisi serve a longer term in office (watch, runtime: 1:40). “The president has been very effective over the first and second terms, creating stability and security,” Shoukry said, responding to a question about the proposals to extend President Abdel Fattah El Sisi’s term limit.

Shoukry also commented on the ongoing protests in Sudan, telling Reuters that Egypt is willing to give the government support if necessary. “We believe that the Sudanese and Egyptian peoples have a common history and a common future,” he said. “Definitely anything that disrupts the security, stability and prosperity of the Sudanese people is of utmost concern to us.” Sudanese President Omar Al Bashir yesterday ordered the establishment of emergency courts across the country to clamp down on the continuing demonstrations against his rule.

In other political news, Turkey continues its whining: President Recep Tayyip Erdogan is still throwing his toys out of the pram over the EU-Arab League summit, accusing the EU of hypocrisy for attending an event hosted by President Abdel Fattah El Sisi, the New York Times said.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

The Egypt Investment Forum kicks off on Saturday at Al Masa Hotel Nasr City, and continues on Sunday at the Nile Ritz Carlton. Discussion will focus on Africa, with an emphasis on trilateral cooperation between Egyptian companies, GCC-based investors and suppliers based in developed economies. Also look for public-private partnership strategies for infrastructure and urban development to get air time. You can click here for the agenda.

A consortium of Russian companies is expected to visit Egypt next month to explore investment and operational logistics in the Russian Industrial Zone area of the Suez Canal Economic Zone, reports the local press.

The gov’t will begin rolling out its debt control strategy next month. The four-year strategy aims to bring down Egypt’s public debt to 80-85% of GDP by the end of FY2021-22.

An Egyptian ministerial delegation will visit France in March to discuss boosting bilateral trade, local press reported.

Egypt-Sudan electricity grid connection project is on track, and is set to begin its first-phase trials next month, according to The North Africa Post.

The Macro Picture

Risky EM debt pays over the long term — if you can brave the prospect of default: Bondholders expose themselves to greater risk of default by investing in emerging market debt, but defaults aren’t necessarily a bad thing if you’re a long-term investor, James Mackintosh writes in the WSJ. New research examining bond issuances since 1815 finds that average returns on bonds issued by governments in GBP or USD rival those of US stocks and are less volatile. The higher yields attached to junk bonds deliver even greater returns, even if the country defaults and investors are forced to take losses. Many bonds stage a speedy recovery following default, paying returns that more than compensate for the haircut.

Argentina is a case in point. The study finds that bonds issued by Argentina (which has spent around a third of its 124-year-old history in default) actually paid 5.6% higher returns on average than low-yielding Gilts and US Treasuries, despite the losses suffered by investors after default.

Long-term investors can ride out the storm: “Truly long-term investors who can lend for decades without worrying should make a decent return, punctuated by awful periods of loss,” Macintosh writes. And for the rest of us who aren’t in it for the long haul? “Everyone else has to worry about the boom-bust cycle.”

Image of the Day

If you have ever looked around greater Cairo and wondered how things became so drab, this piece from Masrawy has you covered. Reminiscing about the lush greenery and towering palm trees that used to define the Nile Delta region, this stunning photo gallery laments the urban sprawl that has slowly made redbrick buildings the dominant feature of Cairo’s surroundings.

Egypt in the News

The international press has human rights on the brain once again. Foreign Minister Sameh Shoukry’s trip to Geneva for the UN Human Rights Council Meeting topped coverage of Egypt in the foreign press this morning. And on related notes: Egypt’s human rights problems “expanded” during 2018, Amnesty International said in its annual MENA report. Another report published by US NGO Human Rights First is saying that Egypt’s prisons are fertile recruiting grounds for the Daeshbags and other terrorist groups. Meanwhile, a UK-based NGO is calling for an investigation into allegations that nine Egyptian men were tortured before their execution decision last week, Turkey’s Anadolu Agency reports.

Other news worth noting in brief:

- Egypt is included in a list of affordable must-travel holiday destinations, published by the NYT.

- Egypt’s concern at Ethiopia’s Grand Renaissance Dam is in part because it “represents a push back against Egypt’s view of itself as the region’s water powerhouse and ‘guardian’ of the Nile River,” Shimelis Dessu writes for Quartz Africa.

- National Geographic is set to broadcast “Fiennes Return to the Nile”, a 3-part documentary on the adventures of legendary British explorer Ranulph Fiennes in Egypt featuring his much younger cousin Joseph Fiennes,according to Reuters.

- An ancient workshop has been found in Aswan, the Ministry of Antiquities revealed in a statement on Tuesday. The discovery probably dates back to the period 1391 B.C. to 1353 B.C., reports Xinhua News.

- Egyptian authorities foiled an attempt to smuggle six mummified limbs in a hollowed-out speaker though none of the perpetrators were identified, reports the NYT.

On The Front Pages

Nationwide campaign to promote constitutional amendments commences: The front pages of the three largest state-owned newspapers are a mixed bag this morning now that the EU-Arab League summit is over and done with. Topping coverage in Al Ahram is the launch of a nationwide campaign by “55,000 civil society organizations” and some NGOs to “promote awareness” on the necessity of the constitutional amendments that would extend presidential terms in office. The newspaper is framing the story as part of a “national dialogue” on the amendments. The amendments are currently with the House of Representatives Legislative Committee, which will formally draft the proposed amendments, which will then go through reading and debate ahead of a vote in the general assembly, where they must be approved by at least two-thirds of the House. Once parliament signs off, the president would be required to call a referendum.

“Egypt warns against the use of human rights to score political points,” was the leading headline in the front page of Al Akhbar, which was a veritable cornucopia of stories that covered defense, Rami Malek’s Egyptian identity, and a random piece on African students praising Egypt. Al Gomhuria focused on a talk with Defense Minister Mohamed Zaki on operations in Sinai.

Worth Watching

Egypt’s economy will be both better but also the same in 2019, according to expert tarot card reader: Wondering how Egypt’s economy will perform in 2019? Look no further than this “expert” tarot card reading featured on Amr Adib’s El Hekaya (watch, runtime: 2:27), who suggests things will both improve and stay the same, but will definitely not get worse. It was apparently “significant” that a money card was drawn, meaning that we will see improvement for some period of the year, but it will also depend on how secretive the moon is to you. With volume of macro research reports we read every day, we sometimes feel we’re reading reports written by tarot card readers with Masters degrees.

Worth Reading

Currency reforms being undertaken by Zimbabwe’s central bank have been labeled “voodoo economics” by the country’s former finance minister, according to the FT. The central bank on Monday unpegged the RTGS (a newly-created currency made up of bond notes and electronic ZWD) from the USD, allowing banks to trade it at market rates instead of USD-parity. But former Finance Minister Tendai Biti predicted that the currency floatation is doomed to fail. “It is disaster, it is grand theft, it is voodoo economics,” he told the FT. “There is no market confidence and there are no reserves.”

Fiscal reforms are also needed: The central bank hopes that removing the peg will address the severe cash shortage the country has faced since President Emmerson Mnangagwa’s 2017 coup against Robert Mugabe. But Biti insists that without fiscal reforms trust in the currency cannot be restored. “The fundamentals are not there,” he said.

But not everyone is calling voodoo: Despite Biti’s gloomy prognosis the floatation has its supporters, who believe that it is the first step for the country to regain a stable currency. “We have a long way to go, but I believe this is a good start,” Zimbabwean economist John Robertson said. “Prices should gradually stabilize and allow businesses to start planning more effectively.”

Diplomacy + Foreign Trade

South Korean companies explore raising investments in Egypt: South Korea is looking to boost economic ties with Egypt, Prime Minister Lee Nak-yeon said yesterday during meetings in Seoul with an Egyptian delegation which included Investment Minister Sahar Nasr, Finance Minister Mohamed Maait and Suez Canal Authority (SCA) Chairman Mohab Mamish, the Investment Ministry said in a statement. Nak-yeon said his country is looking to increase investments in Egypt and cooperate with Cairo in the field of shipbuilding in the Suez Canal Economic Zone, according to the statement. Hyundai Heavy Industries, Daelim Industrial, Dohwa, GS E&C, Samsung Heavy Industries and Hyundai Engineering & Contracting were among companies that expressed interest in increasing investments in Egypt, according to a separate ministry statement. Nak-yeon is planning to visit Egypt in the coming months, MENA reported.

Infrastructure

Polaris, ARDIC, SIAC to develop infrastructure for 1 mn sqm in SCZone

A consortium of Polaris Al Zamil, ARDIC for Real Estate and Developments and SIAC Holding has begun developing infrastructure for 1 mn sqm in the Suez Canal Economic Zone (SCZone), Polaris Deputy General Manager Bassel Shuaira said. The project was part of an MoU signed between the consortium and the SC Authority in 2017 to develop 5.5 mn sqm in the zone. The project aims to attract USD 3.5 bn in investments to the area over 15 years. The land was allocated on a right-to-use basis for 50 years.

Health + Education

USAID to invest USD 90 mn in Egypt-US university partnerships

The US Agency for International Development (USAID) will invest USD 90 mn to establish energy, water and agriculture research centers to be joint-managed by leading Egyptian and American universities, according to a press release from the US embassy. Egyptian researchers from Ain Shams University will work with the Massachusetts Institute of Technology (MIT) to launch an energy center, while Cairo University and Cornell University will establish an agriculture center. Alexandria University will partner with the American University in Cairo (AUC) to create a water center.

Real Estate + Housing

ARDIC to invest EGP 1 bn in Zizinia Al Mostakbal prooject

ARDIC for Real Estate Development and Investments is investing EGP 1 bn in its Zizinia Al Mostakbal project, the company said in a press release. “The positive response to our efforts encourages us to continue developing and investing in the Egyptian market,” said CEO Ashraf Dowidar. The real estate company began construction on the EGP 2 bn project in New Cairo in 2016.

Telecoms + ICT

Canon eyeing business avenues in Egypt

Japan’sCanon is looking at business avenues in the field of imaging innovations and technologies in Egypt said EMEA CEO Yuichi Ishizuka, according to African Review. There are several avenues for growth “for Canon in Africa and Egypt in particular, as we see it as a gateway to the African continent. The country is on an upward trajectory and witnessing positive transformations that will establish it as a regional business hub,” said Ishizuka on the sidelines of a GUC visi to tour the Canon Printing Park.

ICT Ministry seeks to grow tablet production in collaboration with LG

ICT Minister Amr Talaat met yesterday with several electronics business leaders including Morris Lee, president of LG Electronics Mobile USA and head of North America Mobile Business,on the sidelines of the Mobile world congress in Barcelona. The pair discussed to discuss LG increasing investment in the country, particularly in increasing local tablet production capabilities, reports Youm7.

Other Business News of Note

Government to offer 75 sports facilities project through PPP system

The government agreed to tender 75 sports facilities and other projects to the private sector through a public-private partnership (PPP) framework , local press reported. Companies taking part will be given building and management rights under the PPP framework for periods of 5 to 25 years. The projects that will be offered by both government entities and 32 sports clubs and associations include building hotels, hospitals and commercial units around stadiums and indoor halls to maximize income and building sports facilities across governorates.

Egypt Politics + Economics

1954 decree dissolving Muslim Brotherhood upheld by Cairo Administrative Court

A Cairo Administrative Court upheld on Tuesday a 1954 decree dissolving the Muslim Brotherhood, Masrawy reports. A ban on the group’s activities and confiscation of its property was issued in 2013, the same year in which it was designated a terrorist organization by Egypt and, shortly afterwards, Saudi Arabia.

National Security

Foreign Ministry denies signing EU agreement on citizen information exchange

The Foreign Ministry has issued a staunch denial of what it calls rumors alleging that it signed an agreement with the EU to exchange sensitive personal information about citizens, including name, race, political ideology, religious views, syndicate membership and health status, according to Al Shorouk. The rumor started circulating on social media at the very end of the Sharm summit. The cabinet media center has reported the ministry as stating that it “respects the privacy of Egyptian citizens and that the country respects its people and their privacy.”

Sports

All Egypt cup matches postponed until further notice for security reasons

The Egyptian Football Association (EFA) announced the indefinite postponement of all Egypt cup matches for security reasons, according to statements from EFA head Amer Hussein cited by Ahram Online. The decision came after tensions arose following the EFA’s decision to change an Al Ahly vs Pyramids FC fixture from a league match to a cup one, sparking concerns over a possible riot.

On Your Way Out

Tesla’s model 3 dominates the global electric car market: Despite production challenges and Elon Musk’s legal hiccups with the Securities Exchange Commission, Tesla’s model 3 dominated electric vehicle (EV) sales in 2018, putting 138,000 units on the road and beating the nearest competitor by about 50%, reports Bloomberg. The nearest competitor—flagship EV of state-owned Chinese automaker BAIC—sold 92,000 units. The news comes as Tesla attempts to increase model 3 sales by an additional 100,000 units this year by breaking into the Chinese market, according to The Verge. Tesla had announced earlier this year that it was making ground on establishing a ‘gigafactory’ for battery production in Shanghai to service its expansion, the first such factory for the company outside the US.

The Market Yesterday

EGP / USD CBE market average: Buy 17.47 | Sell 17.57

EGP / USD at CIB: Buy 17.47 | Sell 17.57

EGP / USD at NBE: Buy 17.46 | Sell 17.56

EGX30 (Tuesday): 14,886.85 (-0.40%)

Turnover: EGP 842 mn (7% below the 90-day average)

EGX 30 year-to-date: +14.20%

WTI: USD 56.02 (+0.94%)

Brent: USD 65.21 (+0.69%)

Natural Gas (Nymex, futures prices) USD 2.86 MMBtu, (+0.67%, Apr 2019)

Gold: USD 1,331.30 / troy ounce (+0.21%)

TASI: 8,456.22 (+0.27%) (YTD: +8.04%)

ADX: 5,139.80 (+0.47%) (YTD: +4.57%)

DFM: 2,683.74 (+0.85%) (YTD: +6.09%)

KSE Premier Market: 5,502.33 (+0.39%)

QE: 10,255.97 (+0.29%) (YTD: -0.42%)

MSM: 4,089.06 (+0.53%) (YTD: -5.43%)

BB: 1,414.64 (+0.46%) (YTD: +5.79%)

Calendar

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

28 February (Thursday): Scaling-up MENA SME’s Report Launch by Endeavor Egypt, AUC Tahrir, Cairo.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

8 March (Friday): SHE CAN women’s entrepreneurship event, Greek Campus, Cairo.

10 March (Sunday): CIB to hold EGM meeting to look into planned capital increase.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

April: The EUR 250k first phase of Egypt’s national waste management program kicks off.

2-5 April: APPO Cape VII petroleum and energy conference, in Malabo, Equatorial Guinea.

4-6 April: LafargeHolcim Forum for sustainable Construction

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg).

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Cairo, Egypt.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.