Egypt picks banks, legal advisors for international bond issuances

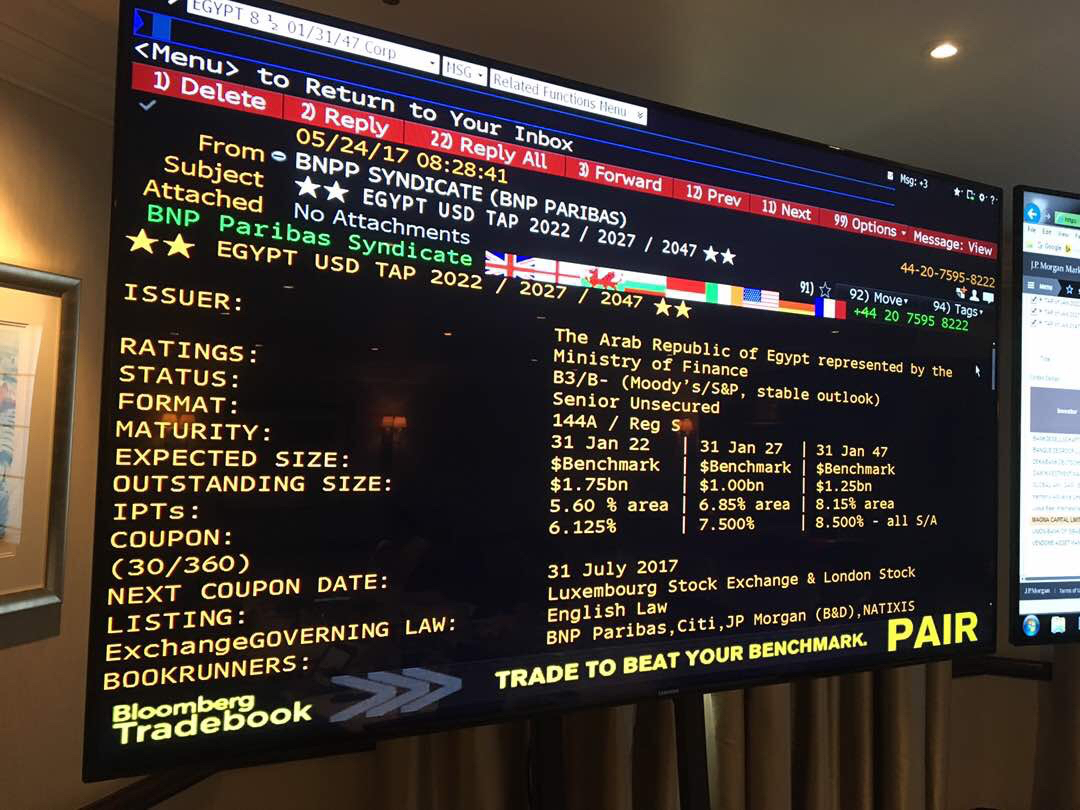

Egypt picks banks, legal advisors for int’l bond issuances: The Finance Ministry has selected the investment banks that will advise on a both USD- and EUR- denominated eurobond issuances that will go to market before the current fiscal year ends in June, the ministry said in a statement. JP Morgan, HSBC, Goldman Sachs and Citibank will advise on the USD-denominated eurobond issuance, while BNP Paribas, Natixis, Bank of Alexandria, and Standard Chartered were tapped to manage the EUR-denominated portion of the issuance. The National Bank of Egypt and Banque Misr will be “assisting with the offerings,” according to the statement. The ministry also picked Al Tamimi & Co. as domestic legal counsel and Dechert LLP as international legal counsel for all the offerings.

More FX-denominated bonds in the offing this year: The Finance Ministry is still planning to move ahead with a bond issuance in an Asian currency for the first time this year, the statement noted. The ministry had previously said that it will move ahead with samurai and panda bonds. The ministry also plans to issue green bonds for the first time this year.

Background: Egypt could issue USD 3-7 bn worth of FX-denominated bonds, pending approval from the Madbouly Cabinet, Finance Minister Mohamed Maait said earlier this month. Cabinet had signed off last week on the Finance Ministry’s debt control strategy, which caps Egypt’s eurobond issuances at USD 22 bn until the end of FY2021-22.