Egypt’s FDI figures aren’t as bad as we all think — and are basically in line with global trends

Egypt’s FDI figures aren’t as bad as we all think — and are basically in line with global trends –Shuaa. Shuaa Securities Egypt analyst Esraa Ahmed politely suggests we’re all a little off-base when we get down in the dumps over the drop in net FDI into Egypt in the first quarter of the government’s current fiscal year.

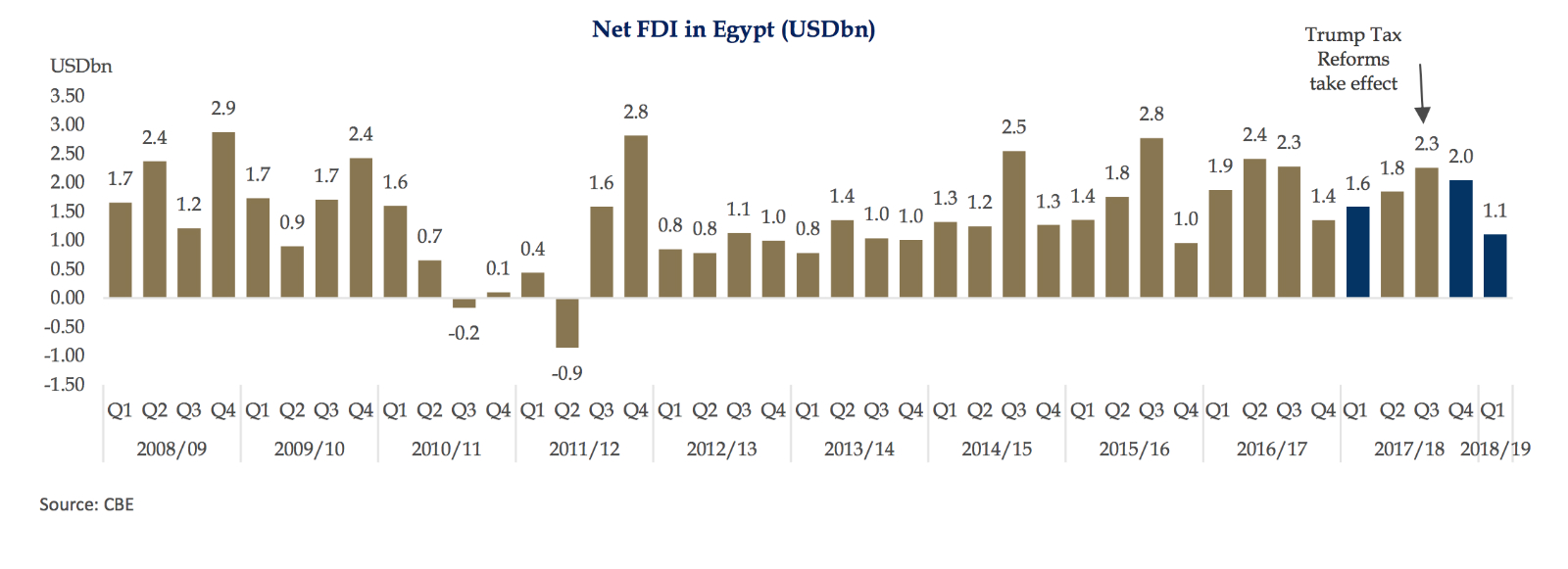

What we’re really seeing here is rising outflows — because inflows are stable. FDI inflows were “largely stable” on both a yearly and quarterly basis, but the net figure was dragged down as a result of a spike in FDI outflows to USD 1.8 bn, up from USD 1.2 bn during the comparable period in FY17-18, Shuaa notes. The rise in outflows was largely triggered by the Trump administration’s tax reforms, which “encouraged more companies to rebase their businesses and repatriate capital to the United States, the largest FDI origin country in the world.”

The real culprit is the global slump in FDI: Net foreign direct investment into Egypt was down 30% y-o-y in 1Q18-19, but this isn’t about “inherited structural problems” in Egypt, Ahmed suggests in a recent research note (pdf). They’re a factor in drop in net FDI, sure (and we’re also losing “key competitive advantages, such as [inexpensive] energy” as a result of subsidy cuts). But the real villain is a global slump in FDI on fears the US-China trade war.