- Egypt treasuries are once again competitive to carry traders. (Speed Round)

- We could see inflation at 8% this year — and that’s good news for the EGP:USD exchange rate -RenCap. (Speed Round)

- FDI figures aren’t as bad as we all think — and are basically in line with global trends -Shuaa. (Speed Round)

- Look to real estate, education and consumer stocks in 2019, EFG says. (Speed Round)

- Challenger banks are coming to town. Here’s what that means. (Speed Round)

- Ittihadiya now has to green-light travel by top state officials. (Last Night’s Talk Shows + Speed Round)

- Egypt and Israel are in early talks to set up a new underwater natural gas pipeline. (Speed Round)

- You can now email your financials to the FRA + the healthcare levy really is 0.25% of your top line. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 16 January 2019

Lots of macro love for Egypt this morning

TL;DR

What We’re Tracking Today

You can now email your financial statements to the FRA: The Financial Regulatory Authority (FRA) now requires emailed copies of quarterly and annual financials for companies that have issued (or are in the process of issuing) securities to the public, the regulator said yesterday (pdf). Companies are to send their financials to financial.statements@fra.gov.eg.

Finance Minister hits G20 meeting in Tokyo: Finance Minister Mohamed Maait is in Tokyo for a meeting of G20 finance ministers that will lay the groundwork for a G20 summit in June, the Finance Ministry said in a statement. Maait is currently in Asia on a roadshow ahead of a series of global bond issuances and attended yesterday a workshop on cross-border information sharing at the Organization for Economic Cooperation and Development (OECD).

You can expect public consultations on new tax procedures and e-billing system over the coming two weeks: Maait said his ministry will put proposed legislation on new unified tax procedures and an electronic tax filing system up for public discussion in two weeks’ time, Al Mal reports. We remind readers that however this may be positioned by some domestic press outlets, the changes do not presage a change in tax rates, which the government has repeatedly said will not change anytime soon. (Maait’s most recent assurance on that front came on Sunday in Cairo.) Rather these are simplified procedures that allow for unified filing of income taxes and VAT, as well as implementing a new electronic billing system that would help the ministry keep tabs on the books.

Speaking of taxes — the national healthcare tax is 0.25%: A number of readers have reached out to us to suggest that the national tax on revenues to fund the new healthcare system under the Universal Healthcare Act is 0.0025% as that was the tax rate that ran in the Official Gazette. That’s unfortunately incorrect: We checked months ago with the Finance Ministry (and did so again this week). They, like other friends of Enterprise, confirmed to us that the levy is in fact 0.25% — the taxman will take EGP 2.5 out of every EGP 1,000 in sales revenues. The ministry has issued a correction on the Official Gazette. Also remember that the 0.25% levy doesn’t count as an expense that would reduce your taxable income.

The head of the US development finance agency is in the running to become president of the World Bank. Ray Washburne heads the US Overseas Private Investment Corporation, a government agency that has been a stalwart investor in Egypt. Washburne also been the advocate of a plan to recast OPIC as the International Development Finance Corporation with a higher lending ceiling to counter Chinese “economic warfare,” as we’ve previously noted. OPIC has previously backed or proposed backing companies in Egypt including Apache, CIB, Carbon Holdings and Qalaa Holdings as well as microfinance players, among others.

The UK Parliament nixed Prime Minister Theresa May’s Brexit plan in a vote yesterday in the “largest defeat for a sitting government in history,” BBC reports. A victory would have led the UK to proceed with plans to exit the EU on 29 March. The Brexit plan failed in parliament 432-202, prompting opposition leader Jeremy Corbyn to call a confidence vote on May’s government for this evening. The Financial Times expects May will win the vote, which is scheduled for this evening, setting the UK up for a “hard” Brexit.

Want to trade UAE futures? Nasdaq Dubai has got you covered. The exchange launched trading of futures on the MSCI United Arab Emirates (UAE) equity index, it said in emailed statement (pdf). Trading of MSCI UAE futures comes a week after Nasdaq Dubai began offering single-stock futures trading on 12 Saudi companies. The MSCI UAE index is made up of 11 of the largest and most liquid companies in the Emirates including DP World, Emaar Properties, and First Abu Dhabi Bank. Look for “more regional MSCI index products” in the period ahead, Nasdaq Dubai CEO Hamed Ali said.

OECD sees mixed growth prospects for emerging markets: There’s no single theme underpinning the prospects of emerging-markets members of the OECD, a report from the organization out on Monday (pdf) suggests. While growth in China is projected to be stable (we’re not so sure on that front, frankly), along with India and Indonesia, the picture is a little less pretty for Russia, Brazil and South Africa, whose economies will continue to slow in the coming months. Turkey, meanwhile, could see some easing of pressure.

China continued to dominate global econ news after it raised the prospect of renewed economic stimulus yesterday, Reuters reported. Weak export data released on Monday showed that the country experienced its worst month in two years in December, as the US-China trade war continues to weigh on the country’s economy.

In miscellany this morning:

Cracks are starting to show for UAE banks as bad loans look set to rise, Bloomberg suggests, citing analyst reports that provisions could rise by as much as 20 bps thanks to struggling real estate and SME players.

Lessons for us from Vietnam: Red tape is holding back frontier market power Vietnam’s transition into a cashless society, the FT reports: 46% of Vietnamese use only cash to settle payments, compared to 34% of those surveyed in the Philippines and 18% in Malaysia.

So much for rapprochement: Qatar Airways’ boss says he won’t buy Jet Airways because it is backed by an “enemy” state, the WSJ writes.

It’s day 25 for the US government shutdown. Reuters has a look at how US agencies are faring.

How tell your boss s/he is clueless, via the Financial Times. Bonus: It’s from the author of How to be successful without hurting men’s feelings.

And speaking of the patriarchy, may we rather recommend reading this morning Advice from one woman portfolio manager to others, also in the FT, regardless of whether you identify as a boy, a girl or neither?

PSA- Expect strong winds to continue today with gusts as high as 65 km/h, carrying with it the chance of a sand storm and a small possibility of raindrops mid-to-late afternoon in the capital city. We’re looking at a daytime high of 15°C (it will feel like 11°C) and an overnight low of 8°C.

Enterprise+: Last Night’s Talk Shows

A presidential decree that requires senior officials to obtain Ittihadiya approval for overseas travels and business trips has sparked public debate, Al Hayah Al Youm’s Lobna Assal said (watch, runtime: 05:15). Assal defended the decree, which applies to the PM and his deputies as well as other senior cabinet officials, explaining it’s not meant to restrict movement, but instead ensure officials are available when needed. Khaled Abu Bakr meanwhile slammed RT’s coverage of the decision, describing it as misleading and demanding an apology from the news outlet (watch, runtime: 04:31).

Abu Bakr also pointed to a Cabinet report that denied rumors that the government was planning to lift food subsidies and shut down churches in Minya (watch, runtime: 02:16). The host praised the Cabinet’s press center for its efforts to contain false rumors, which he said could threaten stability and national security.

51k civil servants will have moved to the new capital by 2020, Spokesman Khalid El Hosseini told Yahduth fi Masr’s Sherif Amer (watch, runtime: 03:53).

National Population Council Rapporteur Amr Hassan phoned Hona Al Asema to discuss the country’s new strategy to contain the rapid population growth (watch, runtime: 07:00).

A meeting between the PM and British Ambassador Sir Geoffrey Adams got some attention on Al Hayah Al Youm with guest commentator Kamal Ryan, a journalist, pointing out that Britain is Egypt’s largest trading partner (watch, runtime: 03:48)

A heated debate broke out between a Thanaweya Amma student’s mother and Education Ministry Spokeswoman Omnia Khairy over the continued leaking of exams (watch, runtime: 08:10). The student’s parent complained that the leak of exams demotivates hard-working students; Khairy reassured her that these particular exams were only for practice.

In an interview with Masaa DMC ‘s Osama Kamal, Arab League Secretary General Ahmed Aboul Gheit said the Arab Spring has led to destruction across the region that has made the organization’s work challenging (watch, runtime: 05:50).

Speed Round

Treasury bond yields have fallen to their lowest levels in six months: Average yields on 5- and 10-year treasury bonds auctioned by the central bank on Monday fell to their lowest since August and July, respectively, according to CBE data. Average yields for the 5- and 10-year notes were 18.030%, down from 18.292% and 18.152% at the last auction two weeks ago.

Still, yields have risen to the point where Egypt’s treasuries are once again competitive, some analysts say. Subscription rates in government debt auctions suggest investors’ appetite has increased significantly and it seems likely that foreign investors are net buyers of T-bills for the first time since the parallel Central Bank of Egypt repatriation system was terminated, Naeem Holdings said in a research note yesterday. On average, yields on T-bills dropped by 0.88bps since late December and subscription ratios rose 2.3x month-on-month in January, according to Naeem.

The new bank treatment at play here? Banks are also rushing in before the implementation of a new tax treatment that would separately tax all income from investment in government debt, Pharos’ Radwa El-Swaify tells us. Finance Ministry officials have previously said the tax treatment will only apply to treasuries bought after the measure goes into effect.

Could we see 8% inflation this year? Renaissance Capital thinks so. Following the “stunning” December inflation figures posted last week, where annual headline inflation dropped to 12.0%, some analysts see the trend continuing. Among them is star analyst Charlie Robertson at Renaissance Capital, who predicts that headline inflation will continue to fall over the coming 10 months to 8% in October 2019 — a low not seen since August 2015. Among the primary drivers: base effects of food prices, he added in a research note. Inflation will then move back into double-digits (11-13%) until June 2020 before falling back again after the effects of subsidy removal dissipate.

Good news for consumers and FI investors alike: December’s inflation figure is “great news for Egypt,” Robertson writes, adding that it will provide additional incentive for fixed income investors to invest in the country.

And he’s not the only one — Beltone’s Alia Mamdouh expects inflation to remain subdued in 1H2019 despite fuel prices increases. She doesn’t see triggers for inflationary shocks, at least over 1Q2019, she said in a note. She expects a 20.6% increase in the average price of petroleum products as Egypt starts indexing prices at the pump to global fuel prices toward the end of 2Q2019, pushing headline inflation by an extra 2.5 to 3.5 percentage points. In 2H2019, she says, inflationary pressure should be lower than expected, remaining in the range of 14%-15% thanks to low figures reported in December.

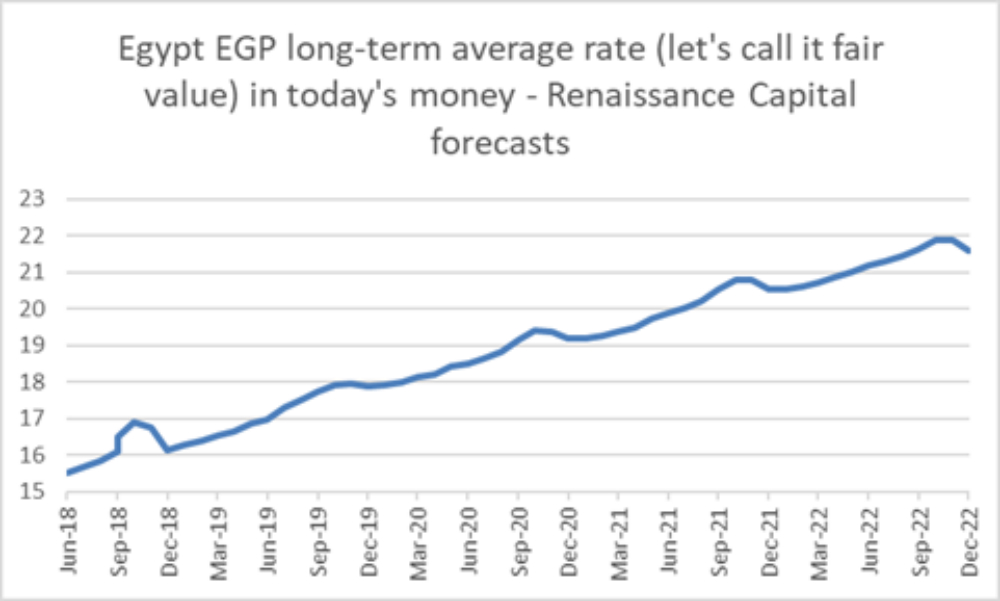

Slowing inflation is great if you’re hoping the EGP doesn’t slide against the greenback: Robertson reckons that cooling inflation will significantly slow devaluation of the EGP. Current estimates show the EGP hitting 18 to the USD in February 2020 and EGP 20 to the USD in July 2021, “giving a very attractive return to investors in local debt.” This is a slowdown from the bank’s previous estimate, which forecast EGP 17.90 for the USD as early as 2Q2019.

What this means for interest rates is unclear: Food and oil price volatility following the final round of subsidy cuts later this year lead Renaissance Capital to predict no moves on interest rates in the near term. They note, however, that others believe the CBE could push ahead with a rate cut as early as February 2019.

Beltone also reiterated their view that interest rates will be stable for the rest of the fiscal year, with a possible cut at the end of 2019, according to the note. However, a cut might take place earlier if inflation to ease, if foreign outflows from fixed income slow down, and if pressure subsides on the foreign assets held by the nation’s banks.

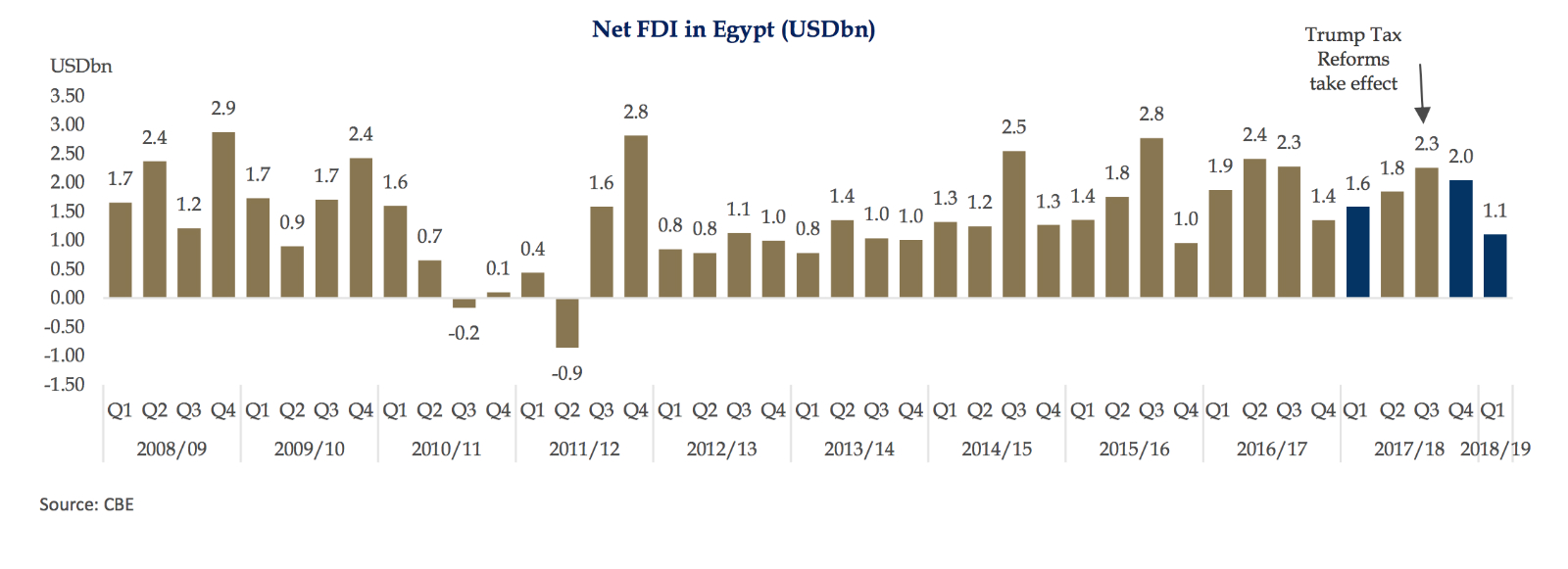

Egypt’s FDI figures aren’t as bad as we all think — and are basically in line with global trends –Shuaa. Shuaa Securities Egypt analyst Esraa Ahmed politely suggests we’re all a little off-base when we get down in the dumps over the drop in net FDI into Egypt in the first quarter of the government’s current fiscal year.

What we’re really seeing here is rising outflows — because inflows are stable. FDI inflows were “largely stable” on both a yearly and quarterly basis, but the net figure was dragged down as a result of a spike in FDI outflows to USD 1.8 bn, up from USD 1.2 bn during the comparable period in FY17-18, Shuaa notes. The rise in outflows was largely triggered by the Trump administration’s tax reforms, which “encouraged more companies to rebase their businesses and repatriate capital to the United States, the largest FDI origin country in the world.”

The real culprit is the global slump in FDI: Net foreign direct investment into Egypt was down 30% y-o-y in 1Q18-19, but this isn’t about “inherited structural problems” in Egypt, Ahmed suggests in a recent research note (pdf). They’re a factor in drop in net FDI, sure (and we’re also losing “key competitive advantages, such as [inexpensive] energy” as a result of subsidy cuts). But the real villain is a global slump in FDI on fears the US-China trade war.

And while we’re basking in this glow of macro positivity, here’s one more: NBK expects Egypt growth to maintain strong momentum. Public investment spending, rebounding tourism and increasing natural gas output will help the Egyptian economy maintain its strong growth momentum in 2019, according to a research note by the National Bank of Kuwait. Tourism and exports have partially rebounded thanks to the flotation of the currency, the lender noted. GCC economies are expected to grow 2.3% in 2019 and 2.6% in 2020.

So, which stocks should you pick? Look at real estate stocks this year, says EFG Hermes: 2019 will be a better year for real estate stocks after last year’s squeeze, EFG Hermes Head of MENA Strategy Mohamed Al Hajj told Bloomberg TV (watch, runtime: 2:21). “If we see continued falling inflation and interest rates, we should see some pick up in the sector, which was the worst-performing sector in Egypt last year,” he said.

Real estate, consumer and education stocks leading the way in 2019: Consumer and education stocks, along with real estate, are the current stock market picks for EFG Hermes, as the banking sector takes a backseat. “Banks continue to post decent earnings growth but banks wouldn’t be our top sector in Egypt this year,” Al Hajj said. “Consumers, real estate and education are probably the three sectors we’ll be focusing on.”

Egypt and Israel are in early talks to build a new underwater natural gas pipeline, on which construction could begin as early as next year, Israeli Energy Minister Yuval Steinitz tells Bloomberg. The line would allow Israel to export more natgas into Egypt from its Leviathan and Tamar fields — “much more” than the maximum 7 bn cubic meters (bcm) per year through the existing East Mediterranean Gas (EMG) pipeline. Egypt will begin importing Israeli gas in a few months’ time as part of a USD 15 bn agreement signed last year for 7 bcm per year over 10 years. The agreement will see Tamar and Leviathan operators Delek Group and Noble Energy supply natgas to Alaa Arafa’s Dolphinus Holdings, most of which will be re-exported as liquefied natgas.

Why is another pipeline necessary? EMG’s capacity is sufficient to carry the contracted amount into Egypt. But Israel’s domestic pipeline network will need to be widened or supplemented by a second, parallel pipeline or an undersea link, earlier reports had suggested. While few details were provided, the new pipeline could be part of the solution. It could also be paving the way for future deliveries of Israeli natgas to Egypt when Leviathan is operating at full capacity.

Steinitz’s remarks were made on the sidelines of the East Med Gas Forum, which took place in Cairo on Monday with attendees from Israel, Cyprus, Greece, Italy, Jordan, Palestine and Egypt. The participants agreed to establish a regional gas market, with Cairo serving as the new organization’s headquarters. The next gathering is scheduled for April.

High-ranking officials need presidential sign-off on diplomatic missions: President Abdel Fattah El Sisi announced yesterday that senior officials embarking on diplomatic missions will be required to obtain presidential approval, according to a decree published in the official Gazette (pdf). The requirement applies to the prime minister and his deputies, the ministers of defense, interior, justice and foreign affairs, as well as independent watchdog and security agencies heads. All other high-ranking officials will need prior approval to travel from the prime minister’s office.

MOVES- Magdy Ghazi was appointed the acting head of the Industrial Development Authority (IDA) by decree of the Madbouly Cabinet, according to Youm7. Ghazi, who had served as the former deputy head of the IDA, subsequently spoke of the IDA’s plan to expand access to industrial land to manufacturers, local sources report. The agency plans to accelerate the process to meet its targets of freeing up 60 mn sqm by 2020, in addition to expanding existing industrial zones.

EARNINGS WATCH- QNB Al Ahli reported a net profit of EGP 7.20 bn in FY2018, up 30% y-o-y from EGP 5.52 bn in FY2017, according to QNB's financial statement (pdf).

CORRECTION- We had noted a piece from Al Borsa yesterday that claimed the Investment Ministry had selected McKinsey & Company to advise on its global investment promotions strategy. Ministry sources tell us now that no decision has yet been reached on the advisor. The piece has been removed from our website and the original Al Borsa article has been corrected.

Egypt in the News

On a slow morning in the foreign press, a handful of headlines worth noting in brief:

- The newly-established regional natgas alliance “formalizes growing energy ties among recent rivals,” Foreign Policy says.

- Few sites around the world rival the Giza Pyramids, Business Insider correspondent Harrison Jacobs says after paying a visit.

- An archaeological team has discovered two Roman-era tombs in the Western Desert, according to the AP.

- An Egyptian who was denied entry into Italy jumped from a parked airplane at Milan’s Malpensa Airport, causing the airport to temporarily close, the AP reports.

- Egypt will break ground soon on what will be the “tallest building in Africa,” the 390-m tower in the new capital’s business district, according to a statement cited by the National.

- Upper Egyptian artist Hassan El Sharq’s tradition-inspired, slightly surreal recreations of village life received due global recognition for their “intricate outlines of people and forms,” says Reuters. The Express Tribune has images of his work.

- Al-Azhar University’s decision to reverse the expulsion of the woman filmed hugging her fiancé was picked up by a number of outlets, including the Times of Israel.

Worth a Listen

Genome editing: A scientific miracle? After the highly controversial revelation in November last year from Chinese scientist He Jiankui that he had created the world’s first genetically edited twin babies, the ethics of genome editing have moved from classroom theory to real-world problem. Throwing ethical questions and a lifetime of Michael Crichton novels aside, developmental biologist Robin Lovell-Badge speaks with the FT in a podcast interview on the nitty-gritty of the science the revolutionary technology is (listen, runtime: 14:46).

Diplomacy + Foreign Trade

UN supports us getting aid for refugees: UN High Commissioner for Refugees Filippo Grandi pledged to campaign for Cairo to receive more bilateral development aid to support its efforts in hosting refugees at a press conference on Monday, following his meeting with President Abdel Fattah El Sisi, at the end of his two-day visit to Egypt, reports the Guardian. Egypt currently hosts a reported 242,000 refugees, and the value of UNHCR programs in the country in 2017 ranged from USD 40-50 mn, a figure described by Grandi as “insufficient.” Saying that he, like so many refugees, would do “anything” to escape a holding camp of the kind set up in Libya, Grandi praised Egypt for its determination not to set up such camps and urged the world’s wealthiest nations to offer sufficient funding to support the efforts of host countries.

Background: For past two years, Egypt and the EU have been dancing around an agreement which would see the latter increase aid and support in exchange for holding more refugees and migrants attempting to move to Europe. The agreements appears more tangible by the day, the policy appears to gain favor among EU countries, who have begun holding talks to ink such an agreement.

Bashir thanks Egypt: Sudanese President Al Bashir made a point of thanking Egypt, along with Ethiopia and Chad, for what was termed in Ahram Online “their support for his country’s security and stability.” In a speech given in South Darfur on Monday, Al Bashir said that the three countries had sent high-level delegations to back Sudan, which is in its fourth week of protests over an economic crisis that mark what the Wall Street Journal has called “the stiffest challenge to [Al-Bashir’s] three-decade rule.” Bashir’s expression of gratitude to Egypt is quite the departure from the tension that has marked the past several months between Cairo and Khartoum.

Salva Kiir in town to hold talks with El Sisi: Meanwhile, South Sudanese President Salva Kiir is in town to hold talks with President Abdel Fattah El Sisi, South Sudan’s ambassador to Egypt Joseph Majak said, according to Ahram. Kiir’s three-day visit, which started yesterday, will see discussions on the latest developments since he signed the South Sudan inter-state peace agreement, which ended a five-year civil war.

Energy

SDX announces Gulf of Suez oil find

SDX Energy has discovered an oil pay in the South Ramadan concession located in the Gulf of Suez, the company said in a press statement (pdf). Field operator Pico reported that the SRM-3 well encountered a total 120 feet of net conventional oil pay. It isn’t yet clear whether the discovery will be commercially viable.

Utilities of Dabaa nuclear plant completed

Utilities and infrastructure of the Dabaa nuclear power plant have been completed and the Nuclear Power Plants Authority (NPPA) was handed over the site to complete preparations for the construction, local press reported. Infrastructure works were carried out by state and private sector companies and were financed locally through the Finance Ministry.

Basic Materials + Commodities

Centamin Egypt spent USD 100 mn in new investments on Sukari mine in 2018

Centamin Egypt spent USD 100 mn developing the Sukari gold mine in 2018, company exec Shady Al Rajahi told Al Mal, bringing the total spent on the mine since 2010 to USD 1.3 bn. This comes after Centamin announced a 13% y-o-y decrease in production, citing operational difficulties in 1H2018.

Egypt to begin producing black sand minerals soon

The Nuclear Materials Authority and the Egyptian Black Sand Company have signed a cooperation protocol to enhance efforts to benefit from black sand minerals and make available the necessary facilities to treat them, according to a Cabinet statement. Under the agreement, the two sides will use an experimental factory unit in Rashid to treat black sand and begin production in coming days. No details were provided on production targets.

Telecoms + ICT

Egypt’s Raya to launch in Saudi Arabia in 2H2019

Raya Contact Center (RCC) is planning to launch services in Saudi Arabia in 2H2019, CEO Reem Asaad said, according to Al Mal. The company is looking to spend EGP 7 mn to get the operation up and running and plans to initially hire 100-150 new staff members there, she added. The outsourcing firm is also planning to expand into the UAE and Poland next. The company is targeting growing its client base to 10,000 clients by 2020, from a current 6,500.

Automotive + Transportation

House passes Chinese loan for high-speed electric railway to Egypt’s new capital

The House of Representatives has approved a c.USD 680 mn loan from China to develop a high-speed electric railway line linking 10 Ramadan to the new capital, Al Mal reported. The two countries had signed the agreement in September last year during President Abdel Fattah El Sisi’s visit to Beijing.

Egypt’s House approves bill to establish authority to regulate land transport

The House of Representatives approved yesterday a bill that will establish an authority to regulate land transport and freight after scrapping one article, according to a report seen by Al Mal. The authority, which will set policies to better organize domestic and international transport, as well as license and certify service providers, will report to the Transport Ministry.

Banking + Finance

NBE, QNB, BM consortium to arrange loan for Egypt’s Abu Qir Fertilizers

A banking consortium comprised of the National Bank of Egypt, QNB Al Ahli, and Banque Misr has pledged to arrange financing for state-owned Abou Qir Fertilizers’ c. EUR 80 mn project to upgrade its mixed fertilizers facility, the company said in an EGX disclosure (pdf).

Central Bank of Egypt excludes retailers from EGP 200 bn SME financing initiative

The Central Bank of Egypt (CBE) has excluded retail-focused SMEs from its facilitated financing initiative in a bid to reroute funding to the service, agriculture, and manufacturing sectors, banking sources told Mubasher. Retailing SMEs currently account for the lion’s share of the initiative’s borrowers. The CBE’s initiative, launched in 2016, aims to extend as much as EGP 200 bn in SME loans by 2020 through making it mandatory for commercial banks to allocate 20% of their loan portfolios to SMEs at 5% interest.

Egypt Politics + Economics

Woman detained for BBC interview on Egypt’s disappearances released

A criminal court has ordered the release of a woman who was detained last year over a BBC report in which she claimed authorities tortured and disappeared her daughter, Ahram Online reported. Mona Mahmoud, who was charged with publishing false news, was released on Tuesday under the condition she’d report to a police station twice per week. After the BBC interview was published, the woman’s daughter, Zubaida, denied she had been abducted or tortured.

National Security

Egypt imposes curfew on parts near North Sinai’s Arish, Rafah

The government has imposed a curfew on areas around Arish and Rafah in Northern Sinai, excluding the international highway and Arish’s inner city as of yesterday, according to a ministerial decree published in the Official Gazette (pdf). The curfew will run from 7 pm to 6 am.

Sports

Egypt scrapes narrow victory over Argentina in World Handball Championship

Hope springs eternal for Egypt in this year’s Handball World Championship, after scraping a narrow 22-20 victory over Argentina on Monday, reports Ahram Online. Having lost their first two games against Sweden and Qatar, respectively, the Pharaohs must now win against their forthcoming opponents, Hungary and Angola, if they are to avoid crashing out of the tournament.

On Your Way Out

The Antiquities Ministry is turning the entrance of Qena’s Dendera Temple into an open-air museum, according to a statement. Artifacts at the entrance include engraved blocks, stone slabs and statues — all discovered in the surrounding areas. Some of the statues are those of ancient Egyptian goddess Hathor, god Bes and the falcon god Nekhbet Waawet.

The Market Yesterday

EGP / USD CBE market average: Buy 17.87 | Sell 17.96

EGP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.79 | Sell 17.89

EGX30 (Tuesday): 13,447 (+0.8%)

Turnover: EGP 600 mn (xx% BELOW / ABOVE the 90-day average)

EGX 30 year-to-date: +3.2%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.8%. CIB, the index heaviest constituent ended up 1.7%. EGX30’s top performing constituents were Egyptian Resorts up 6.7%, Telecom Egypt up 2.6%, and Egypt Kuwait Holding up 2.1%. Yesterday’s worst performing stocks were SODIC down 1.1%, Egypt Aluminum down 1.0% and Sidi Kerir Petrochemicals down 0.8%. The market turnover was EGP 600 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -32.7 mn

Regional: Net Short | EGP -17.0 mn

Domestic: Net Long | EGP +49.7 mn

Retail: 66.9% of total trades | 68.6% of buyers | 65.3% of sellers

Institutions: 33.1% of total trades | 31.4% of buyers | 34.7% of sellers

WTI: USD 51.72 (+2.40%)

Brent: USD 59.98 (+1.68%)

Natural Gas (Nymex, futures prices) USD 3.46 MMBtu, (-3.68%, Feb 2019 contract)

Gold: USD 1,288.20 / troy ounce (-0.24%)

TASI: 8,347.25 (+0.93%) (YTD: +6.65%)

ADX: 4,983.42 (-0.32%) (YTD: +1.39%)

DFM: 2,490.55 (-1.45%) (YTD: -1.55%)

KSE Premier Market: 5,473.63 (+0.04%)

QE: 10,762.99 (+0.86%) (YTD: +4.51%)

MSM: 4,279.87 (-0.67%) (YTD: -1.01%)

BB: 1,340.12 (-0.27%) (YTD: +0.21%)

Calendar

13-16 January (Sunday-Wednesday): CI Capital’s third annual MENA Investor Conference, Four Seasons Nile Plaza, Cairo, Egypt.

17 January (Thursday): Talent in the Digital Era, Galleria40, Cairo, Egypt.

19 January (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January (Sunday): Cairo Court of Urgent Matters to hear an amendment to the constitutional to extend the presidential term limits.

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-23 January (Tuesday-Wednesday): CI Capital’s third annual MENA Investor Conference, The Plaza, New York City, USA.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

03 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

05 February (Tuesday): Egypt’s Emirates NBD PMI for January released.

07 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

23 July (Tuesday): 23 July revolution, national holiday.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.