Egypt is susceptible to EM crisis contagion, says IIF

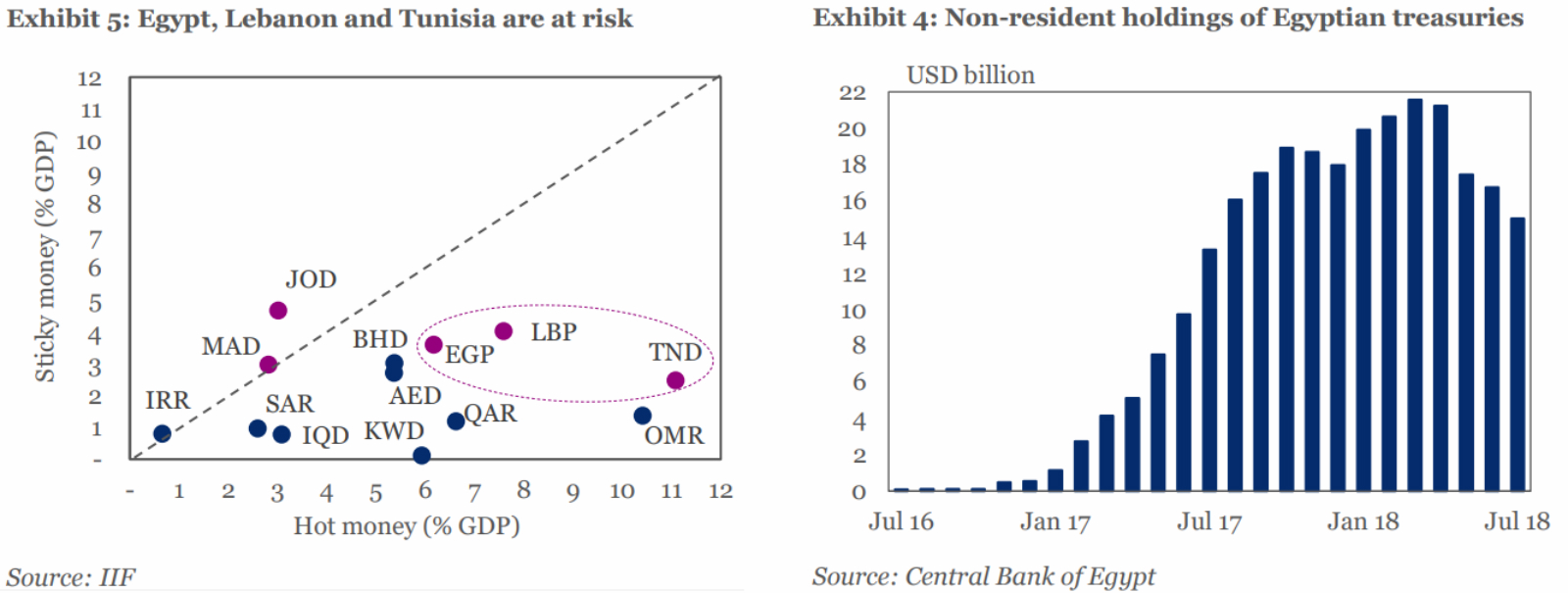

**#2 Egypt is among three net-importers in the Mideast that are susceptible to EM crisis contagion, says IIF: Egypt, Tunisia and Lebanon are the three Middle East countries most at risk of contagion from the unfolding emerging markets selloff, according to a report from the Institute of International Finance (IIF) (pdf). Data suggests that the three net-importers of oil and gas have been among the hardest hit regionally. “Non-resident capital inflows to MENA oil importers are expected to decline to USD 54 bn this year, from USD 67 bn in 2017, as global monetary tightening, higher oil prices and external imbalances put MENA oil importers at risk,” says the report. Higher oil prices, USD pegs, and large public foreign assets will largely shield oil exporters from EM contagion.

For Egypt, inflows by the end of FY2017-18 declined to USD 35 bn from USD 43.6 bn in FY2016-17. Egypt’s sovereign debt market saw USD 6.2 bn in outflows between April and July, the report notes. Furthermore, “a jump in yields on EGP-denominated treasury bills is pushing borrowing costs higher.” The report also notes that Egypt has recently called off three treasury bond auctions.

By that logic, shouldn’t Zohr save us? While the report sees a correlation between being a net-importer of oil and EM contagion, there is very little analysis on how this will play out once full production on Zohr and other concessions commences by late this year or early next year. Egypt is gearing to become a net-exporter of gas in 2019 and primary export hub of the East Mediterranean basin to Europe.

Overall, The IIF sees foreign capital inflows to MENA rising to USD 182 bn in 2018, equivalent to 6% of the region’s GDP. This downward revision from its March report primarily came on the back of the Aramco IPO not coming through. The report also concludes that the direct spillover effect from Turkey has been limited due to relatively low trade and financial connections to the region.