- Could the emerging markets sell-off close the fall IPO window earlier than expected? (Speed Round)

- Egypt is susceptible to EM crisis contagion, says IIF. (Speed Round)

- Saudi Arabia’s economic reform program is bad news for Egypt? (Speed Round)

- Egypt, Cyprus to sign gas pipeline agreement this morning. (What We’re Tracking Today)

- ECA probing transportation industry, seeks expanded powers. (Speed Round)

- Vodafone Egypt (sort of) says it won’t lay-off call center operators in favour of robots. (Speed Round)

- Egypt software piracy rate is now lower than Vietnam, Mococo, Philippines. (Telecoms + CIT)

- Is the CBE building a central database to house KYC data? (Banking + Finance)

- Egypt Oscar entry Yomeddine gets North American distribution agreement. (Speed Round)

- The Market Yesterday

Wednesday, 19 September 2018

Is the fall IPO window closing thanks to EM Zombie Apocalypse?

TL;DR

What We’re Tracking Today

**#4 Egypt, Cyprus to sign gas pipeline agreement this morning: Oil Minister Tarek El Molla and Cyprus Energy Minister Yiorgos Lakkotrypis will sign this morning an agreement to build a USD 1 bn pipeline connecting the Aphrodite gas field to liquefaction plants in Egypt, Oil Ministry spokesperson Hamdy Abdel Aziz tells AMAY. Lakkotrypis and El Molla met yesterday in Nicosia with Cyprus President Nicos Anastasiades, according to Cyprus Mail. El Molla said that some of the gas imported from the Aphrodite gas field will be used for domestic consumption, adding that the agreement would be a win-win for Egypt, Cyprus and the EU, according to the AP. Lakkotrypis called the agreement a first of its kind for the region, saying it would bolster Europe’s energy security. The pipeline is a crucial stepping stone towards Egypt’s bid to become the Eastern Med’s premier energy hub.

New Brit ambassador arrives in town: Newly-appointed British ambassador Sir Geoffrey Adams arrived in Cairo yesterday, Ahram Online reports, citing a report by state news agency MENA. Adams, who replaces outgoing ambassador John Casson, was the number two at the UK’s mission to Cairo from 1998-2001. Unlike his predecessor, Adams doesn’t tweet very often. He was previously the UK’s ambassador to the Netherlands and to Iran. Adams’ very brief FCO biography is here; the UK embassy’s website still shows Casson as ambassador as of dispatch time this morning.

Drilling for oil? You’ll be happy to know that Saudi Arabia is “now comfortable with Brent oil prices rising above USD 80 a barrel, at least in the short term, as the global market adjusts to the loss of Iranian supply from U.S. sanctions, according to people familiar with the kingdom’s view.”

China hit back yesterday at USD 200 bn in tariffs imposed by The Donald, saying it would slap import duties on about USD 60 bn worth of US goods, the Wall Street Journal reports. That means China has now imposed new duties on just about everything it imports from the United States — suggesting, in turn, that Beijing is increasingly out of options in this tit-for-tat war, the New York Times argues.

The African Development Bank has offloaded risk from some USD 1 bn in loans to a New York hedge fund in what is being described as a “pioneering [agreement] which illustrates the growing financial sophistication of supranational institutions. … The AfDB has bought insurance on a USD 1 bn portfolio of loans from a group of investors led by Mariner Investment Group through a so-called synthetic securitisation, in which the hedge fund does not acquire the assets but will take on USD 152 mn of default risk in exchange for returns in the low double digits.” (Financial Times)

In miscellany this morning:

- Tesla faces investigation over take-public tweets: The US Justice Department is investigating electric car maker Tesla over CEO Elon Musk’s claim last month that he had lined up funding to take his company private. IROs: Do you follow your CEO on Twitter or El Face? (Reuters)

- In other news from Planet Elon: A Japanese bn’aire is going to be the first space tourist as he flies around the moon on Elon Musk’s SpaceX. (CNBC)

- High times: With Canada about to end prohibition on pot, Coca-Cola is debating whether to get into the cannabis drink business. (Financial Times)

FINANCIAL CRISIS ANNIVERSARY- Even casual readers will want to read the Financial Times’ series on the financial crisis a decade later. Skip today’s installment from the chairman of UBS (it’s an insipid take that argues we need to take steps now to be ready for the next crisis). But the series as a whole is solid — and is due to end with what will likely be a must-read headlined What are the new risks? Bookmark the series landing page and have a look on Friday.

Particularly awesome: FT columnist John Authers latest piece is a roundup of the best reporting on the 10-year anniversary as written by the salmon-colored paper’s global competitors.

The new iPhones are getting great reviews, with even tech critics who had previously disdained ‘phablet’ devices saying they love the iPhone XS Max (cf: NYT). But you may want to hold back until October even though these are “fabulous phones” (WSJ): That’s when we’ll see what the iPhone XR offers. It could be the best value-for-money play in the three-phone lineup. Want to drill into the details? 9to5Mac and Macworld have roundups of reviews from all of the major outlets, from CNET to Tom’s Guide and the Verge and plenty more.

But when is it coming to Egypt? Apple’s Egyptian website doesn’t show a release date for the XS or XR as yet — it’s still plugging last year’s iPhone X, as are the sites of its local authorized resellers.

Enterprise+: Last Night’s Talk Shows

A variety of econ-related subjects made it to the airwaves last night, which was otherwise unremarkable. (Also: Still no Lamees El Hadidy.)

Trade and Industry Minister Amr Nassar raised export duties on fertilizers yesterday to EGP 500 per tonne, from EGP 125 currently, according to a ministry statement. The move means to ensure that the local market’s needs of fertilizer are covered and force producers to meet their monthly delivery commitments to the government. We had heard in July that the Agriculture Ministry was considering imposing sanctions on suppliers of subsidized fertilizers who have fallen behind on their monthly deliveries, creating a shortage in the market. Manufacturers had said, however, that they lose as much as EGP 250 per tonne on government contract, which has led them to focus more on exports lately. Manufacturers are required to sell 55% of their production to the government.

Agriculture Ministry spokesperson Hamed Abdel Dayem defended the decision, saying that manufacturers had not been meeting their quotas. He added that this had driven up market prices of produce as farmers turned to the black market for fertilizers. The Agriculture Ministry is developing estimates on governorate-level demand for fertilizers to set up a quota system, he told Hona Al Asema (watch, runtime: 6:36). The Federation of Egyptian Industries sees that the move would have the desired effect, the head of its chemicals division Sherif El Gabaly phoned-in to say. He called on farmers and producers to get together to more accurately gauge demand and come to a consensus on the quantities they should be given and at what prices (watch, runtime: 7:15).

On to housing, where the New Urban Communities Authority (NUCA) approved a one year penalty-free extension for developers on new cities who have finished 95% of a project, but need more time to reach the finish line, NUCA deputy head Tarek Al Sebaay told Hona Al Asema. The decision will made a matter of record in the Official Gazette in a little over a week, he says (watch, runtime: 9:59).

Pharma shortages scares are back on the airwaves, with the head of pharma division of the Federation of Egyptian Chambers of Commerce, Ali Aouf, telling Yahduth fi Masr that some 150 meds, including insulin, are in short supply. In a bid to push for more local manufacturing, Aouf blamed the problem on a lack of a generic alternatives to brand-name products (watch, runtime: 3:58). Health Ministry official Rasha Zeyada denied there is an insulin shortage, saying that most pharmacies are well stocked (watch, runtime: 8:33).

The Environment Ministry’s delusions that air pollution is under control is actually quite disturbing. The Environment Ministry’s September study on levels of air pollution in Cairo and Delta region are “positive” and indicate that the ministry’s policies have been working, Masaa DMC’s Osama Kamal said (watch, runtime: 2:04). These “positive results” were a direct result of the agriculture and environment ministry’s efforts to reduce the area of rice cultivation, clamp down on the burning of rice straw, and using rice straw as an alternative fuel in cement plants, Environment Ministry official Mostafa Mourad told Kamal (watch, runtime: 2:42). We suppose that by sidestepping mention of soot, smog, car pollution, factory pollution, waste disposal, construction, or any other of the myriad of things that cause air pollution, things are indeed quite positive.

Kamal also discussed the last round of water prices hikes with Water Holding Company chairman Mamdouh Raslan, who urged water rationing (watch, runtime: 4:40).

The K-6 component of the Education Ministry’s curriculum reforms were looked at by Hona Al Asema’s Dina Zahraa (watch, runtime: 30:31).

Speed Round

**#1 IPO WATCH- Could the EM Zombie Apocalypse close the fall IPO window earlier than expected? As we first suggested two weeks ago, analysts are concerned that negative sentiment on global emerging markets could drive investors away from a wave of share sales expected on the Egyptian Exchange in the coming months, Reuters reports. “A realistic good scenario is that you stick to your timeline and you’re able to sell your entire pipeline of offerings at very compelling valuations,” says our friend Wael Ziada, founder of Zilla Capital and former head of research at EFG Hermes. “A bad scenario is that if there is a deep, deep crisis in emerging markets, you may have to pull some of these offerings.”

Who is in the queue? Private sector players including education outfit CIRA, consumer and structured finance provider Sarwa Capital, and Rameda Pharma are all exploring fall IPOs, and as many as five state-owned companies are expected to tap the EGX before the end of the year.

Appetite for the share sales will shed light on the odds Egypt can withstand the EM crisis if it gets any deeper. Some analysts believe that the government “was stretching the ability of banks managing the offerings and the appetites of investors” with its targets for the privatization program, from which it hopes to raise EGP 10 bn by the end of FY2018-19. Private sector offerings could surpass that, says Beltone’s Mohamed Elakhdar, who believes that “people are viewing Egypt differently than the rest of emerging markets.” CI Capital’s Hany Farahat agreed that the appetite exists, but that “the key challenge is related to the process, how these transactions have to be structured and marketed to investors. This is what could make them a big success or failure.” Both firms are advising on IPOs due to tap the market this fall.

All of this comes as sentiment on global growth is at its worst level since December 2011. Investor sentiment on global economic growth has “worsened significantly,” according to a Bank of America Merrill Lynch report, which found that investors have been trimming exposure to EM in favour of cash holdings. Some 24% of those surveyed in the report, which was picked up by Reuters and the Financial Times, believe that global growth will slow down in the coming year, with a looming trade war between the US and China being the main risk factor. Other factors driving the negative outlook include the persistence of the emerging market sell-off and the uncertainty European markets face after Brexit.

Wait — it gets worse: The boss of Emirates airlines thinks we’re looking at a mini-financial crisis within 2-3 years as “there is going to be a major reset.” Celebrity hedge fund boss Ray Dalio agrees, saying it feels a lot like 1937 at the moment and that a downturn is coming in the next two years.

The silver lining? The EM Zombie Apocalypse is overdone, Goldman Sachs Asset Management has signalled by taking positions in Turkey and Argentina.

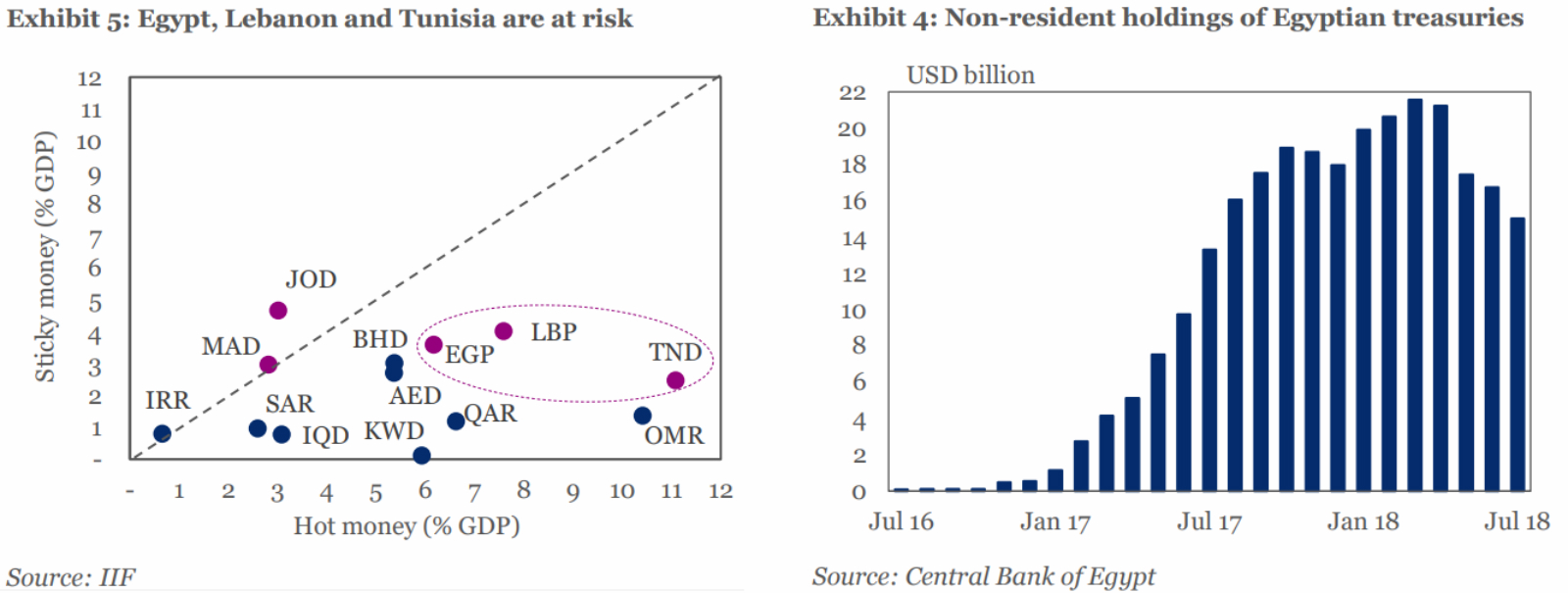

**#2 Egypt is among three net-importers in the Mideast that are susceptible to EM crisis contagion, says IIF: Egypt, Tunisia and Lebanon are the three Middle East countries most at risk of contagion from the unfolding emerging markets selloff, according to a report from the Institute of International Finance (IIF) (pdf). Data suggests that the three net-importers of oil and gas have been among the hardest hit regionally. “Non-resident capital inflows to MENA oil importers are expected to decline to USD 54 bn this year, from USD 67 bn in 2017, as global monetary tightening, higher oil prices and external imbalances put MENA oil importers at risk,” says the report. Higher oil prices, USD pegs, and large public foreign assets will largely shield oil exporters from EM contagion.

For Egypt, inflows by the end of FY2017-18 declined to USD 35 bn from USD 43.6 bn in FY2016-17. Egypt’s sovereign debt market saw USD 6.2 bn in outflows between April and July, the report notes. Furthermore, “a jump in yields on EGP-denominated treasury bills is pushing borrowing costs higher.” The report also notes that Egypt has recently called off three treasury bond auctions.

By that logic, shouldn’t Zohr save us? While the report sees a correlation between being a net-importer of oil and EM contagion, there is very little analysis on how this will play out once full production on Zohr and other concessions commences by late this year or early next year. Egypt is gearing to become a net-exporter of gas in 2019 and primary export hub of the East Mediterranean basin to Europe.

Overall, The IIF sees foreign capital inflows to MENA rising to USD 182 bn in 2018, equivalent to 6% of the region’s GDP. This downward revision from its March report primarily came on the back of the Aramco IPO not coming through. The report also concludes that the direct spillover effect from Turkey has been limited due to relatively low trade and financial connections to the region.

**#3 Saudi Arabia’s economic reform program is bad news for Egypt, and we need to act now by upping our own reform game, the American Enterprise Institute’s Karen E. Young writes for Bloomberg Opinion. Recent months have seen a “steady exodus” of expats from the kingdom as authorities there take steps to boost national employment levels at the expense of the foreign workforce. “There is no breakdown of the nationality of foreigners who’ve been forced out of jobs, but it’s fair to guess that Egyptians make up a high proportion,” according to Young, who says that some estimates place the number of Egyptian expats in Saudi at 2.9 mn. This could mean a slowdown in remittances a top source of foreign currency for Egypt (40% of total remittances to Egypt are from workers in KSA) — and rising unemployment as laid-off expats in Saudi return home.

Saudi may also also choose to cut back on aid to Egypt if it takes its reform program further. “Already, many of the grand plans by Saudi Arabia and the UAE to invest in new cities, infrastructure, and housing development in Egypt are being scaled down,” especially with Saudi planning to develop its portion of the Red Sea coast, which may pose a threat to Egypt’s tourism industry.

So what’s the solution? “The goal should be to remove the necessity for so many to leave Egypt at all.” That would entail less reliance on external borrowing and more government support for sustainable private sector growth, which can create jobs and boost the country’s overall economic performance. Reducing the military’s role in the economy would also help boost market competitiveness, she suggests.

**#5 EXCLUSIVE- ECA looking into Ocean Alliance: The Egyptian Competition Authority (ECA) is looking into international shipping consortium Ocean Alliance and its decision to leave East Port Said, an ECA official told Enterprise. The group — which includes CMA CGM Group, APL, Evergreen, and China’s COSCO Shipping — left the port last month over high fees. The “ECA sees signs of unlawful collusion” between the various shipping concerns, which could warrant antitrust action, the source added.

ECA actively working to scupper Uber, Careem merger talks? It appears that the ECA is in talks with a number of other antitrust regulators in a bid to end a merger that could come from the ongoing talks between ride-hailing rivals Uber and Careem, ECA Chairman Emir Nabil suggested. Nabil refused to comment further.

Our ECA source told us yesterday that both Uber and Careem denied they were in merger talks. The ECA has made it no secret that it does not want a merger to take place, issuing two warnings against such a move. Nabil’s statement came after Bloomberg revealed that were ongoing on a potential USD 2.5 bn sale of Careem to Uber, with active encouragement from Careem’s board.

Expect ECA to zero in on transportation in the months ahead: Both investigations come as part of the ECA’s agenda to focus heavily in the coming period on the transportation sector, our source told us.

The competition authority also wants new powers under an amended Antitrust Act. The expanded powers would give it teeth and scope comparable to antitrust agencies abroad, the source told us, without revealing any details. This is likely a revival of a push last year by former ECA Mona El Garf, which would give the authority the right to block M&As. El Garf had said at the time that the ECA would likely have sign-off on transactions worth more than EGP 100 mn.

**#6 The spin doctors speak: Vodafone Egypt (sort of) says it won’t lay-off call center operators in favour of robots. The mobile network operator told Al Mal yesterday that it won’t actively lay off call-center staff, but suggested technological “progress” will gradually make some jobs obsolete. That will see VFE stop hiring new operators as old ones “willingly leave their jobs,” which happens quite regularly in the customer service field, which has sharp turnover rates. The comments were prompted by a Financial Times interview with Vodafone Group’s income CEO, Nick Read, in which he said that robots will replace some 1,700 “shared service center” operators in Egypt, India and Romania this year.

REGULATION WATCH- FRA lowers annual service fees for listed companies by half: The Financial Regulatory Authority has slashed annual service fees for listed companies by 50%, FRA boss Mohamed Omran said in a statement yesterday. Companies on the EGX will have to pay an annual fee equivalent to 0.05% of their issued capital, down from 0.1% previously. The minimum fee threshold has also been reduced to EGP 5,000 from EGP 10,000, with the ceiling set at EGP 25,000. Fees for companies listed on the Nilex have also been reduced by 50%.

Background: The move is the latest in a series of changes to listing and trading regulations, which the FRA adopted recently to boost EGX liquidity and improve stock market performance, as well as encourage new companies to join the capital market. The coming period is expected to see the FRA issue more regulatory and policy changes, as well as introduce new instruments to the market, short-selling, futures and commodities exchanges, as well sukuk and green bonds.

Egypt moves to the forefront of the EU immigration debate: European Union Council President Donald Tusk and Austrian chancellor Sebastian Kurz have put put Egypt on this Wednesday’s agenda at the informal gathering of all 28 EU heads of state and government in Salzburg, the EU Observer reports, citing EU sources. The EU has been increasingly seeing Egypt as a success story in Europe’s bid to stem the flow of illegal migrants and human trafficking, the source added. "It is worth recalling that the Egyptian authorities have made the fight against smuggling and trafficking their priority. As a result there have been no irregular departures from Egypt to Europe this year," Tusk said. Migration policy is set to be among the key agenda items at the gathering.

EBRD aims to raise investment in Arab world to EUR 2.8 bn by year’s end: The European Bank for Reconstruction and Development (EBRD) plans to bring its total investment in the Arab world to EUR 2.5 bn by the end of 2018, up from EUR 2.2 bn at the end of last year, Southern and East Med Managing Director Janet Heckman said yesterday, Reuters reports. The bank invested EUR 2.2 bn last year in projects in Egypt, Tunisia, Morocco, and Jordan and has since added Lebanon and Palestine to its “areas of operation.” An EBRD delegation was in town earlier this month to discuss its Egypt plan for the rest of the year.

**#9 Egypt Oscar entry Yomeddine gets North American distribution agreement: Egypt’s entry for best foreign-language film at the upcoming Academy Awards is heading to cinemas in the US and Canada, according to an exclusive from Variety, which writes, “Strand Releasing has acquired all North American rights for A.B. Shawky’s road comedy ‘Yomeddine’ from CAA and Wild Bunch.” The film vied for the Palme d’Or at the 2018 Cannes Film Festival, where it won the François Chalais Prize. Directed by first-time Egyptian-Austrian filmmaker Abu Bakr Shawky, Yomeddine follows the story of a leper who goes on a quest to find his family, which had left him in a leper colony as a child with unfulfilled promises to return. Yomeddine is meant to “tell the story of the underdog, the outsider, the labeled ‘nobody’ who grows to understand the workings of a world that refuses to accept him,” first-time Egyptian-Austrian filmmaker Abu Bakr hawky said of his work (pdf). You can catch the trailer here (watch, runtime: 5:04).

Up Next

The E-Commerce Summit in Egypt takes place on Wednesday, 26 September.

The Egyptian-Sudanese ministerial committee will meet at the end of this month ahead of a presidential summit set to be held in Khartoum in October.

The Egypt-Romania business council will meet in Bucharest from 7-11 October, according to Al Mal.

Egypt in the News

Topping coverage for Egypt in foreign press: Archaeologists discovered a ptolemaic-era sphinx at the Kom Ombo temple in Upper Egypt. CNN, Reuters and the BBC all have the story on a morning that is otherwise pleasantly quiet for Egypt in the international media.

Other headlines worth noting in brief:

- Pompeo, Trump see eye-to-eye on Egypt: Unlike former US Secretary of State Rex Tillerson, Mike Pompeo and Donald Trump are in sync on Egypt’s government and President Abdel Fattah El Sisi, writes former State Department analyst and adjunct professor Gregory Aftandilian for the Arab Weekly.

- Nigerian human traffickers: Egypt, KSA, the UAE and Oman are the new destinations of choice for Nigerian human traffickers, Reuters reports.

- Latest Amnesty campaign: Amnesty International called for the “unconditional release” of Egyptians jailed for activism, launching a campaign to express its solidarity.

On Deadline

In’l arbitration is Ziad Bahaa El Din’s cause du jour: Fresh off what felt a bit like a coordinated attack by opinion writers over the past few weeks on Egypt losing out in international arbitration cases, Ziad Bahaa El Din is at it again — and gets it wrong again. In a column for Al Shorouk, the noted lawyer and economic thinker again blames bad negotiations and poor contract terms for Egypt losing arbitration cases. He suggests that these “badly negotiated terms” come from a culture that is pushing hard towards economic liberalization.

Diplomacy + Foreign Trade

Egypt is actively working to resolve regional conflicts, Foreign Minister Sameh Shoukry told Bloomberg TV in an interview aired yesterday. Although rising tensions in countries across the Middle East have a “direct impact” on Egypt, they also pose challenges to greater security issues, such as border control, curbing illegal migration, and combating terrorism. Middle Eastern states are also quite interdependent on one and other, Shoukry also points out, noting that the resolution of conflict is key to achieving regional stability.

Topping Egypt’s regional agenda is reconciliation between Palestine’s rival factions Fatah and Hamas, which Shoukry says is a prerequisite to Arab-Israeli peace. Shoukry reaffirmed Egypt’s commitment to the Arab peace initiative and stance on the Trump administration’s “unilateral” decision to officially recognize Jerusalem as a capital of Israel. He also stressed that a diplomatic solution was the only way forward, for the conflict with Israel, as well as the situation in Syria (watch here, runtime: 17:38).

Egypt will receive a USD 31.5 mn grant from the Green Climate Fund and UNDP for climate change support initiatives, Irrigation Minister Mohamed Abdel Aty said, Youm7 reports. The funds will be used to protect areas that are most at risk from rising sea levels through a project that will span seven years. The agreement should be signed at the end of this month, Abdel Aty added.

Energy

Empower signs contract with El Beheira Electricity Distribution Company to sell electricity from waste

Energy group Empower signed a contract with El Beheira Electricity Distribution Company to produce and sell electricity from two waste-to-energy (WtE) plants that Empower will establish, CEO Hatem El Gamal tells Al Mal. The EGP 160 mn plants will be partially financed through a loan from unnamed local bank, with the rest sourced from the company’s own resources. Empower will sell electricity to the government-run company at EGP 1.30 per kWh for 20 years. Work on the projects is set to begin in October and be completed by mid-2019. We had earlier noted that Empower won a contract to produce and sell electricity from its 24 MW waste-to-energy (WtE) plant in Beheira under an independent power producer (IPP) framework.

Onera Systems signs agreement with Global Lease to finance solar power projects

Onera Systems signed an agreement with Global Lease to finance the establishment of 25 MW’s worth of solar power projects over the next five years for businesses in industry, tourism, and agriculture, Onera CEO Khaled El Nashar tells Al Mal. SMEs would receive special rates and discounts, he added. The move is part of Onera’s expansion plans, which should also see it work with more factories in the coming period to help them set up solar power installations.

Infrastructure

OC contracted to build infrastructure for New Cairo’s southern expansions

The New Cairo City Authority contracted Orascom Construction to build EGP 650 mn in new road, utility and infrastructure developments in New Cairo, city authority head Adel El Naggar told the local press. The new projects will cater for planned housing projects and the southern expansions in New Cairo.

Basic Materials + Commodities

Fruit producer Jana Fresh plans to set up a new packaging station by 2021

Fruit producer Jana Fresh is working on acquiring licenses to set up a new export-focused packaging terminal on the Cairo-Alexandria desert road, export manager Abdel Rahman Mahrous said. The project’s investment value was not disclosed, but Mahrous mentioned it will be financed through the company and its partners. The new facility, which will open in 2021, will start off with packaging stations for grapes, with mango and pomegranate stations to be added later, as the company targets a 20-25% growth in exports.

IDA to issue iron plant licenses only to those moving up the value chain

The Industrial Development Authority (IDA) will issue new licenses for iron plants only if they can go up the value chain, Trade and Industry Ministry adviser Hussein El Garhy said. This would involve the production of more refined iron, such as sponge iron. He noted that the IDA has received around five requests for iron plant licenses in 1H2018.

Manufacturing

Abu Qir studies new methanol production facility

Abu Qir Fertilizers is considering establishing a new methanol production facility and is currently preparing to launch a tender to select a company to conduct feasibility studies, the company announced in a bourse filing yesterday. The project’s investment value was not brought up, but Oil Minister Tarek El Molla had reportedly said in March that a new methanol production facility in Damietta would be established for total investments of nearly USD 50 mn. El Molla had then met with the heads of PowerChina and Methanex to discuss investment opportunities in Egypt. Abu Qir is one of five state-owned companies set to sell stake on the EGX this year under the government’s privatization program.

Banking + Finance

Is the CBE building a central database to house know-your-customer information?

**#8 The CBE has launched a client’s database for the banking sector, ostensibly to monitor progress on financial inclusion, the CBE said in a statement. The CBE instructed banks to provide it with client datasheets by 21 October. The statement did not specify how extensive the client data should be or if they will include all know-your-customer data. The CBE noted that banks are required to ensure that their client data must be updated every month.

Real Estate + Housing

NUCA announced housing projects on El Warraq and Sphinx City

The New Urban Communities Authority (NUCA) board of directors agreed to establish two new housing projects, one on El Warraq island — the site of major eviction clashes last year — and the other on a patch of land on the Cairo-Alexandria desert road which become the new Sphinx City, Prime Minister Mostafa Madbouly told the local press, according to Al Shorouk. Development authorities for both cities were also established.

Tourism

Sharm and Hurghada to top MENA destinations in 3Q2018 -Colliers

Sharm El Sheikh and Hurghada are expected to remain two of the top tourist hotspots in the MENA region in 3Q2018, with revenue per room expected to rise 18% and 13%, respectively during the quarter, according to Colliers International latest forecast. The top five hotels on the list were all in the UAE, with four in Dubai and one in Abu Dhabi. Tap or click here for the report (pdf).

Antiquities Ministry to raise ticket prices further

The Antiquities Ministry will raise ticket prices more on Egypt’s museums and archaeological sites as it looks to offset increased spending and running costs incurred over the past year, Antiquities Minister Khaled El Anani said, according to Al Masry Al Youm.

Telecoms + ICT

Egypt software piracy rate is now lower than Vietnam, Mococo, Philippines

**#7 Software piracy in Egypt is down for the second consecutive year, thanks in part to the Cybercrime Act passed in July, the Business Software Alliance said. The study reveals that the global commercial value of unlicensed software witnessed a significant decline to USD 64 mn in 2017 from USD 157 mn in 2015, giving Egypt lower piracy rates than Morocco, Sri Lanka, Vietnam, and the Philippines.

Raya Contact Center moving into mega facility in West Cairo Smart Village

Raya Contact Center is now leasing a 8,400 sqm facility in West-Cairo’s Smart Village business park. This new mega facility is expected to host state-of-the-art 1,500 seater workstation, the company said in a press release today (pdf).

Automotive + Transportation

Russia’s Transmashholding to deliver first batch of railway cars in October

Egypt will be receiving in October the first 500 batch of 1,300 railway cars from Russia’s Transmashholding, Egyptian National Railways (ENR) head Ashraf Raslan said, Al Shorouk reports. The cars will be used in lines servicing the Upper Egypt area, he said. Egypt’s Cabinet approved in August ENR’s agreement with Transmashholding to supply the railway cars financed through a loan by a Russian-Hungarian banking consortium. Egypt will pay around EGP 17 bn to buy the cars, with final delivery rolling out within a year. On a related note, the ENR signed an MoU yesterday with Progress Rail Locomotive to purchase 50 new locomotives, repair 91 old ones, and service 141 others under a 15-year contract. The value of the agreement was not disclosed.

Other Business News of Note

Public Enterprises Ministry to shut down National Cement Company

The Public Enterprises Ministry has decided to shut down the National Cement Company after a feasibility study concluded that it would be able to make a turnaround, Chemicals Holding Company head Emad El Din Moustafa said, according to Masrawy.

Bertelsmann’s customer service venture to enter Egypt through JV with Morocco’s Saham

German publisher Bertelsmann create a 50-50 joint venture with Moroccan partner Saham that will extend its customer service business to Egypt, Saudi Arabia and Qatar, the company said yesterday, according to Reuters. The EUR 17 bn company will merge its customer service business, Arvato CRM, with that of Saham’s to create a EUR 1.2 bn business with reach across 25 countries.

National Security

US approves USD 99 mn in military sales to Egypt

The US State Department approved the potential sale of USD 99 mn-worth of ammunition to Egypt, the US Defense Security Cooperation Agency said in a statement yesterday. The Egyptian government had made a request for the purchase of 60,500 rounds of different types of ammo. “The proposed sale will improve Egypt’s capability to meet current and future threats and provide greater security for its critical infrastructure,” as forces face off against Daesh in the Sinai. General Dynamics Ordnance and Tactical Systems will be the prime contractors for the sale. US State Secretary Mike Pompeo had signed off on the release of a USD 1.2 bn military aid package to Egypt last week. The US had also released another USD 195 mn in military financing to Egypt in July, which had been frozen over human rights concerns.

On Your Way Out

GoT takes the best drama Emmy (NOW HURRY UP WITH SEASON 8): HBO’s Game of Thrones snagged the award for best drama series at the 70th annual Primetime Emmy Awards, beating out Hulu’s Handmaid’s Tale and Netflix’s Stranger Things. FX’s Atlanta season 2 continued its critical acclaim, winning best comedy. The Americans’ Matthew Rhys and The Crown’s Claire Foy claimed awards for best drama lead actor and actress; and best comedy leads were Barry’s Bill Hader and The Marvelous Mrs. Maisel’s Rachel Brosnahan. Netflix failed to topple reigning king HBO, but secured a tie with 23 awards each. TV shows The Marvelous Mrs. Maisel and Saturday Night Live each snatched up eight awards, trailing closely behind Game of Thrones’ nine Emmys. You can catch a recap courtesy of Rotten Tomatoes and the full list of the winners.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 14654 (0.00%)

Turnover: EGP 706 mn (9% below the 90-day average)

EGX 30 year-to-date: -2.4%

THE MARKET ON TUESDAY: The EGX30 index ended Tuesday’s session flat. CIB, the index heaviest constituent ended flat. EGX30’s top performing constituents were Eastern Co up 3.9%, Qalaa Holdings up 2.3%, and AMOC up 1.4%. Yesterday’s worst performing stocks were Telecom Egypt down 4.6%, Sidi Kerir Petrochemicals down 3.9%, and Heliopolis Housing down 3.8%. The market turnover was EGP 706 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -42.6 mn

Regional: Net Long | EGP +4.7 mn

Domestic: Net Long | EGP +37.9 mn

Retail: 60.8% of total trades | 59.0% of buyers | 62.5% of sellers

Institutions: 39.2% of total trades | 41.0% of buyers | 37.5% of sellers

Foreign: 22.8% of total | 19.8% of buyers | 25.8% of sellers

Regional: 5.7% of total | 6.1% of buyers | 5.4% of sellers

Domestic: 71.5% of total | 74.2% of buyers | 68.8% of sellers

WTI: USD 69.85 (+1.36%)

Brent: USD 78.98 (+1.19%)

Natural Gas (Nymex, futures prices) USD 2.92 MMBtu, (+3.80%, Oct 2018 contract)

Gold: USD 1,203.00 / troy ounce (-0.23%)

TASI: 7,643.40 (+0.44%) (YTD: +5.77%)

ADX: 4,876.38 (-0.13%) (YTD: +10.87%)

DFM: 2,742.98 (-0.33%) (YTD: -18.61%)

KSE Premier Market: 5,339.18 (-0.13%)

QE: 9,823.53 (-0.09%) (YTD: +15.25%)

MSM: 4,495.69 (-0.45%) (YTD: -11.84%)

BB: 1,340.06 (+0.08%) (YTD: +0.63%)

Calendar

17-19 September (Monday-Wednesday): INTERCEM Cairo to Cape Town cement industry conference, Dusit-Thani LakeView, Cairo.

18-21 September (Tuesday-Friday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Cairo, Egypt.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

23-24 September (Sunday-Monday): Arab Security Conference on cyber security, Nile-Ritz Carlton, Cairo.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

06 October (Saturday): Armed Forces Day, national holiday.

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday- Wednesday) World Travel Market London exhibition, London, England, UK.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.