Central bank leaves interest rates unchanged

The Central Bank of Egypt left key interest rates unchanged at its Thursday, 16 August meeting. The widely expected move saw the bank leave its overnight deposit and lending rates on hold at 16.75% and 17.75%, respectively, with the main operation and discount rates also stable at 17.25%, the CBE said in a statement. Global financial conditions — including rising international oil prices and increased pressure on emerging market economies — coupled with subsidy cuts pose a downside risk to inflation levels, the CBE notes.

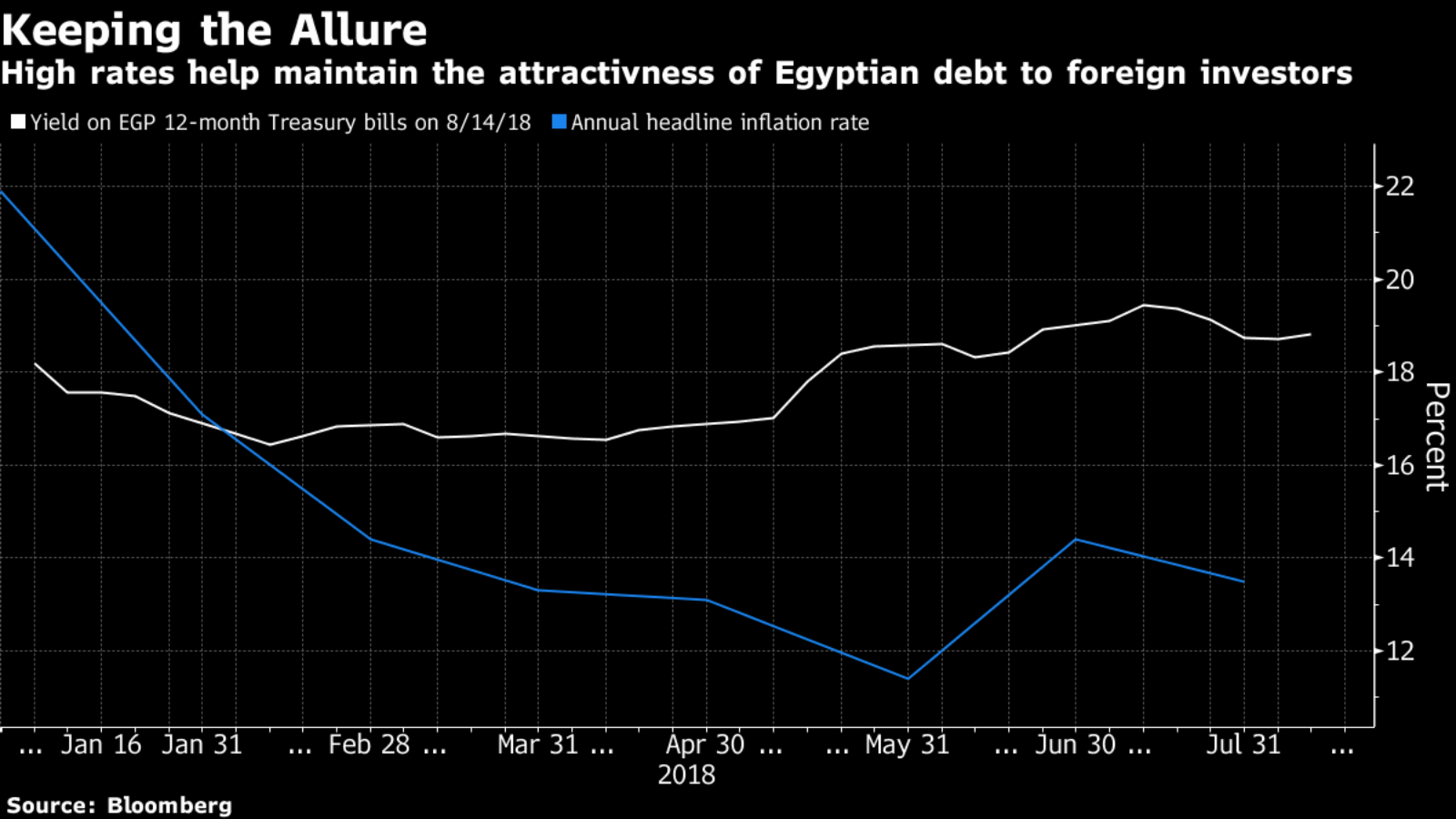

MPC still sees inflation falling to single digits next year: The MPC maintained its outlook on headline inflation, which it expects to hit c.13% in 4Q2018 before dropping to the single digits “after the temporary effect of fiscal supply shock dissipates.” Keeping rates on hold “remains consistent with achieving this inflation outlook and target path,” according to the statement. Annual headline inflation in July cooled to 13.5%, while monthly headline inflation reached 2.5%.

The move “might shore up the attractiveness of local bonds amid a selloff in emerging-market assets,” but also suggests the easing cycle is unlikely to resume this year, Tarek El Tablawy and Ahmed Feteha write for Bloomberg. Asset managers have singled out Egypt as the best option for debt investors as emerging market equities enter bear territory thanks to stabilization measures that have maintained a “relatively high yield and relatively stable currency.”