- Picking up where we all left off: The five things everyone was talking about before the holiday. (What We’re Tracking Today)

- Central bank leaves interest rates unchanged. (Speed Round)

- FinMin seeks access to corporate bank data under proposed amendments to the Income Tax Act. (Speed Round)

- Apache plans to raise Egypt investments to USD 1 bn a year. (Speed Round)

- El Sisi ratifies cybersecurity, leasing and factoring and SWF acts. (Speed Round)

- Governors told to get tally of tuktuks ahead of licensing drive. (Last Night’s Talk Shows)

- Netflix movie The Angel tells the story of alleged double-agent Ashraf Marwan, debuts next month. (Worth Watching)

- Ex-diplomat, six others face possible terror charges after calling for referendum on President Abdel Fattah El Sisi. (Last Night’s Talk Shows)

- The Market Yesterday

Sunday, 26 August 2018

Refresh your memory: 5 things we were all talking about before the holiday

TL;DR

What We’re Tracking Today

Welcome back, ladies and gentlemen — and welcome to the last real week of summer. A metric s*ton of news has unfolded in the week we’ve been on vacation, most of it either (a) in international news or (b) foreign media coverage of Egypt. We’ve boiled it all down to its essence for you this morning to help you get back into the swing of things.

Our advice for today: (a) Quickly take stock of the five things that were most important to your work life before you went on vacation. Then think through (b) what five things are most important this week and (c) what five things will define your priorities as we slip into fall.

Five things we were all talking about in the week before the Eid holiday:

1. Will the fall window for Egyptian equity offerings slam shut in the face of the Emerging Markets Zombie Apocalypse? EGX boss Mohamed Farid expects 4-5 IPOs over the coming eight months (about right, if you ask us, provided the stars remain aligned). And the government looks set to push forward with stake sales at already-listed state-owned companies. But emerging market equities had “slumped into a bear market” territory, falling to a six-month low on the back of weak Chinese economic data and EM currencies taking a hit. Our explainer on what was (and is) going on is here.

2. Macro and confidence indicators were looking good across the board: Corporate earnings in 2Q looked reasonably good. Unemployment was down in 2Q2018. Hotel occupancy was on the rise (at last before the death of two British tourists in Hurghada). The purchasing managers’ index for July points to an ongoing private-sector recovery (and yes, it was out later than usual). And inflation cooled in July, falling to 13.5% after a surge in June.

3. It’s going to be a long winter for FDI — unless interest rates start trending down: Bloomberg’s declaration that traders looking for refuge from volatility will find it in Egypt was getting plenty of attention, as was DPI’s high-profile investment in a GB Auto financing company and Lightsource BP’s joint venture with Hassan Allam. On the other side of the coin, we think it fair to say there is now consensus that major foreign direct investment will be limited until Egyptian companies start to invest in themselves as interest rates (eventually) decline. Recent FDI announcements track largely to Saudi and Chinese companies. The CBE next meets to discuss interest rates at the end of September.

4. Everyone was up in arms about the real estate tax. Well, maybe not everyone. Maybe all the folks who sunk their savings into real estate prior to the float of the EGP, at which time second (and third and fourth and fifth) houses were the investment of choice for many. (Remember, that was a time when receipts for the future delivery of automobiles had effectively become tradable securities.)

5. Our dream of becoming an energy hub becomes real in January when Egypt is expected to make its first foreign sales of natural gas since before 25 January 2011. Israel looks like its backing natgas exports to Egypt, and there’s lots more exploration taking place.

What happened outside Egypt in the last week that’s of relevance to us?

- We need to pay a lot more attention to Arctic politics: Maersk launched a container ship on the Arctic Northern Sea route that could threaten the Suez Canal’s share of Asia-European trade.

- US stocks are now officially in their longest-ever bull market at more than 3,453 days. CNBC looks at what has (and hasn’t) changed since the run began.

- Saudi Aramco’s IPO is officially on ice, throwing into question “the core funding for the diversification that is needed to generate much-needed jobs and over time enable Saudi Arabia to eliminate its dependence on oil.” More in the Financial Times and Bloomberg.

- The Emerging Markets Zombie Apocalypse continues unabated, spurring outflows from South African bonds and hitting global miners and eurozone financials. Actively managed EM equity funds saw outflows of USD 2.9 bn in the first three weeks of August, Renaissance Capital suggests in a recent note, while EM bond funds have seen month-to-date outflows of USD 2.5 bn. Global emerging market funds have increased their exposure to China, Brazil and Indonesia and axed holdings from South Africa, Russia and Turkey.

- The USD came under a bit of pressure after Federal Reserve boss Jay Powell signaled last week that interest rate rises will be gradual.

- Elon Musk isn’t taking Tesla private after all, he said on Friday, “abandoning an idea that stunned investors and drew regulatory scrutiny.”

- Oh, and it was an insane week in US politics as associates of The Donald were convicted of wrongdoing and / or appeared to ‘flip’ and line up to testify in cases that could see him face impeachment proceedings. The New York Times has got your back if you need to catch up.

We’re heading into the 10-year anniversary of the global financial crisis, which most folks generally observe 15 September, the day Lehman Bros collapsed. Plans by some ex-Lehman bankers to hold a party in London to mark the occasion are already getting negative press. You can expect the torrent of “10 years later, we’re on the verge of another collapse” stories to begin flowing any day now.

Meanwhile:

Keep an eye on diplomacy this week: Investment Minister Sahar Nasr will be signing an unspecified agreement today with Korean Ambassador to Egypt Yoon Yeocheol and Transport Minister Hisham Arafat, according to an emailed press release. And the president of Vietnam is in town tomorrow for meetings including a sit-down with President Abdel Fattah El Sisi.

Egypt is getting a toonie: The Finance Ministry is looking at the possible issuance of an EGP 2 coin in a bid to solve Egypt’s chronic shortage of change, according to a statement picked up by Al Masry Al Youm. The statement gave no timeline for the prospective issuance.

US Senator John McCain died overnight after a battle with cancer. The long-serving politician and war hero was a loud voice for an active US foreign policy, an outspoken critic of Egypt and a pure maverick, general in the best sense of the word. Read the New York Times obituary to get started.

Enterprise+: Last Night’s Talk Shows

The airwaves offered up a mixed bag of nuts on the final night of the long Eid break, with topics ranging from the arrest of a former diplomat, clashes with militants in the Sinai, and tuk-tuk regulation.

Prosecutors on Friday ordered the 15-day detention of ex-diplomat Masoum Marzouk and six others on terror charges relating to their call for a referendum on (and the potential ouster of) President Abdel Fattah El Sisi. MP Tamer El Shahawy told Al Hayah fi Misr that security forces received a tip confirming that Marzouk and others — including academics Yahya Kazaz and Raed Salama — were being funded by a terrorist organization whose main aim was to wreak havoc in Egypt. Reuters suggested, however, that the arrests were made after Marzouk ”called for a referendum on [President Abdel Fattah El Sisi’s] rule, in rare public criticism of the former general.” El Shahawy dismissed the claims, adding that Ikhwan-backed media has been trying to sell that narrative (watch, runtime: 9:16). The Financial Times also has the story.

Others agreed with the chaos theory. Sout Al Omma’s Editor-in-chief Youssef Ayoub said Marzouk’s attempt was part of a wider scheme to upset order in the region, claiming as well that the former diplomat is an Ikhwan operative (watch, runtime: 2:47). Journalist Ali Al Sayed said Marzouk’s proposal was, in any case, unconstitutional (watch, runtime: 9:39).

An unsuccessful attack on a police checkpoint in North Sinai’s Al Arish yesterday is an indication of terrorist group’s weakness in light of the military’s anti-terror campaign in the area, Supreme Counterterrorism Council member Khaled Okasha told Hona Al Asema (watch, runtime: 5:18). The attack, which left at least four people dead, also received air time on Al Hayah fi Misr (watch, runtime: 1:17) and Masaa DMC (watch, runtime: 0:41). We have more in Egypt in the News, below.

The Local Development Ministry is looking to get a tally of tuk-tuks as a first step to rounding them up for licensing, according to Hona Al Asema’s Reham Ibrahim. The ministry has asked governors to come up with an accurate count. Gharbiya governor Ahmed Sakr said that his governorate has licensed 22,000 tuk-tuks in the past two years (watch, runtime: 4:08), a move made possible by amendments to traffic laws issued in 2008 (watch, runtime: 5:17). Beheira Governor Nadia Abdou said, however, that tuk-tuk drivers avoid getting permits to avoid paying fees and insurance (watch, runtime: 50:01).

Some 12-15 governors are expected to be replaced in an upcoming reshuffle set to happen next week, according to Masaa DMC’s Eman El Hossary, who discussed the issue with MP Mohamed Attia El Fayoumi, Al Shorouk Editor Emad El Din Hussein, and municipalities’ expert Shady Abdel Latif (watch, runtime: 3:51).

El Hosary was also occupied with covering news of the death of two children in Dakahlia who had been missing (watch, runtime: 4:43).

Speed Round

The Central Bank of Egypt left key interest rates unchanged at its Thursday, 16 August meeting. The widely expected move saw the bank leave its overnight deposit and lending rates on hold at 16.75% and 17.75%, respectively, with the main operation and discount rates also stable at 17.25%, the CBE said in a statement. Global financial conditions — including rising international oil prices and increased pressure on emerging market economies — coupled with subsidy cuts pose a downside risk to inflation levels, the CBE notes.

MPC still sees inflation falling to single digits next year: The MPC maintained its outlook on headline inflation, which it expects to hit c.13% in 4Q2018 before dropping to the single digits “after the temporary effect of fiscal supply shock dissipates.” Keeping rates on hold “remains consistent with achieving this inflation outlook and target path,” according to the statement. Annual headline inflation in July cooled to 13.5%, while monthly headline inflation reached 2.5%.

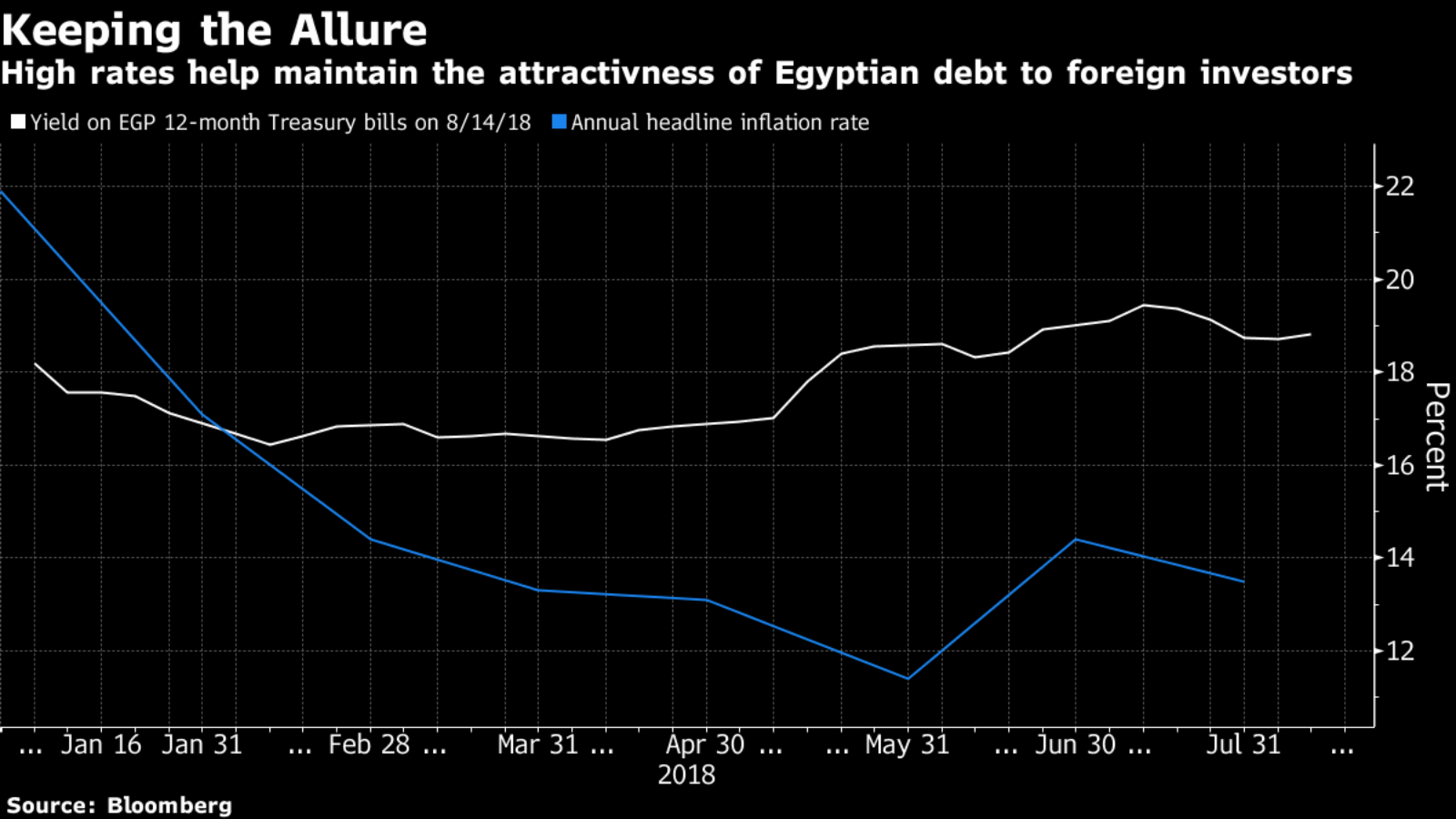

The move “might shore up the attractiveness of local bonds amid a selloff in emerging-market assets,” but also suggests the easing cycle is unlikely to resume this year, Tarek El Tablawy and Ahmed Feteha write for Bloomberg. Asset managers have singled out Egypt as the best option for debt investors as emerging market equities enter bear territory thanks to stabilization measures that have maintained a “relatively high yield and relatively stable currency.”

EXCLUSIVE- FinMin seeks access to corporate bank data under proposed amendments to the Income Tax Act: Forthcoming amendments to the Income Tax Act would allow the Finance Ministry to check up on company accounts to make sure they’re paying their income taxes, Tax Authority boss Emad Samy told Enterprise. The amendment will require discussion with the central bank to ensure the language conforms to the Central Bank Act, Samy noted, explaining that under the proposed measure — which is a part of the authority’s drive to clamp down on tax evasion — the ministry would have to make a formal request to the CBE to be allowed to view bank data or investigate suspicious activity.

Background: We had reported in July that the Finance Ministry was drafting a new Income Tax Act that’s more in-keeping with the times and that would cover everything from income tax rates to exemptions and tax breaks, in addition to factoring in e-commerce. Finance Minister Mohamed Maait had previously told us that amendments coming to the act would streamline tax procedures and cut red tape.

The news comes as the Finance Ministry announced that it’s ready to begin receiving tax returns electronically, according to Al Masry Al Youm. The House of Representatives had signed off on amendments to the Accounting Act, which make it mandatory for all government transactions — including collecting taxes and disbursing civil servants’ wages — to be electronic, banning the use of paper cheques. Under the same cashless / paperless economy bid, the ministry launched a digital platform earlier this month that allows all state ministers and governors to keep track of their respective budgets and expenditures.

INVESTMENT WATCH- Apache plans to boost its investment in Egypt to an annual USD 1 bn, CEO John Christmann is reported to have said last week at a meeting with Oil Minister Tarek El Molla, according to a ministry statement carried by Al Mal. Apache is already eyeing new opportunities in Egypt under its current five-year strategy, the paper quotes Christmann as saying. Apache and the EGPC had signed in July a USD 9 mn exploration agreement for blocks in the Western Desert and the company had said it plans to begin drilling this year.

Also last week, El Molla sat down with our friend Tom Maher, president and COO at Apex International Energy, and a delegation from partners Blue Water Energy to discuss their plans to begin drilling at Apex’s Western Desert concessions. Apex had previously said it was planning to begin exploration at the West Badr El Din and South East Meleiha concessions in in 4Q2018. The Oil Ministry is stepping up the pace at which it brings out tenders for new exploration blocks as part of its drive to position Egypt as the premier regional energy hub.

Natural gas from Cyprus’ Aphrodite field could begin flowing into Egypt by 2022, according to comments attributed to Cypriot Energy Minister Giorgos Lakkotrypis last week by the Cyprus Mail. The plan, however, is contingent on talks between the Cypriot government and a consortium made up of Noble Energy, Israel’s Delek, and Royal Dutch Shell, who are looking to renegotiate the financial terms of their contract for the field, according to Lakkotrypis. “The consortium wants to renegotiate because current, lower global oil prices don’t make viable a preliminary [agreement] to sell Aphrodite gas to a Shell-operated processing plant in Egypt,” the minister said, according to the Associated Press.

Background: Egypt and Cyprus had reached a preliminary agreement earlier this month to connect the Aphrodite field with liquefaction plants in Egypt via an underwater pipeline worth up to USD 1 bn. The move is part of Egypt’s strategy to become the natural gas export hub for the Eastern Mediterranean as it plans to re-export a portion of the LNG to Europe after satisfying local demand. Oil Minister Tarek El Molla had previously said that Egypt would reach natural gas self-sufficiency by January 2019 as it ramps up production from the Zohr gas field and other projects.

On a related note: Yale Global says that Egypt is “the most logical” gas export hub for the region despite some “pending issues.” Several factors play out in our favor, including existing refining and export infrastructure, location, and access to suppliers and buyers in the region. “Some of Egypt’s plans, however, may be too optimistic — from the quality of the gas in Zohr to the Mediterranean underground pipelines — and the nation is an immense market itself, compelling the government to fulfill local needs before considering exports.” The security situation in the Sinai Peninsula and Egypt’s local consumption needs also remain points of concern, and bringing our hub plans to fruition remains contingent on careful policy and more transparent local communication.

In other energy news: The Electricity Ministry plans to begin work on a power interconnection project with Nicosia in December, sources tell Al Mal. The project, which could see the two countries exchange up to 2 GW of power, is also expected to extend into Greece and will take about 36 months to complete, according to the sources. President Abdel Fattah El Sisi had met in June with executives from EuroAfrica Interconnector to discuss the USD 4 bn project after EuroAfrica finished feasibility studies. The interconnection project with Cyprus and Greece is part of a larger plan to link to power grids in Africa and Europe.

Egypt is aims to attract as much as USD 11 bn in foreign direct investments in FY2018-19, up from USD 7.9 bn in the previous year, Planning Minister Hala El Saeed said last week, according to Reuters. FDI is expected to reach USD 20 bn by the end of the government’s development plan in 2022, driven by ongoing economic reforms, El Saeed said. The government is also hoping to create 750k jobs by the end of the fiscal year under its medium-term development plan for 2022, the minister said.

Putting this in context: Prime Minister Mostafa Madbouly had unveiled a four-year strategy after he was sworn into office, which sees GDP growing and unemployment falling to 8% by 2022. The medium-term plan also sees a lower budget deficit of 6% of GDP and a primary surplus of 2%. The government is also hoping to boost non-oil exports by 13% to USD 35 bn by 2022 and increase average savings to 23%, from a current 11%, according to El Saeed. FDI had reached USD 6.0 bn in 9M2017-18, driven by some USD 3.4 bn in new oil sector investments. Carnegie Endowment had noted in a June report that FDI fell short of its USD 10 bn target last year, suggesting the government wasn’t doing enough to attract foreign investors.

Our friends at Sarwa Capital announced yesterday they had completed a EGP 1.75 bn securitized bond issuance “backed by the portfolios of Contact Auto Credit and its affiliate companies,” according to a company press release (pdf). Sarwa Promoting & Underwriting was the transaction’s lead manager and financial advisor, while Arab African International Bank acted as underwriter, with Attijariwafa and Ahly United Bank as co-underwriters. Arab Legal Consultants were legal counsel. “We are excited to announce the closure of another milestone transaction immediately following the recent EGP 2 bn issue during the second quarter,” said Sarwa Promoting & Underwriting CEO Ayman El Sawy. “As before the bonds have attracted the highest ratings on the back of our unique structuring know-how and the sustained credit quality of Contact’s portfolios.” We had reported last month Sarwa plans to offer for sale up to 40% of the company’s shares on the EGX in September.

El Sisi ratifies cyber crimes, leasing and factoring acts: President Abdel Fattah El Sisi ratified last week the controversial Cyber Crimes Act, Ahram Online reported. The law stipulates that internet service providers hold user data and records of web activity — including voice calls and browsing history — for a period of 180 days, among other stipulations.

The law’s ratification opened up the floodgates of criticism in the foreign press. Rights groups view the law as part of a “series of measures … aimed at curbing freedom of expression online, with the internet one of the last forums for public debate over Sisi’s rule,” AFP said. Authorities maintain that the law is necessary for counterterrorism operations, the Times of Israel noted. Islamist mouthpiece Middle East Eye also took note.

Also over the Eid break, El Sisi ratified the Leasing and Factoring Act (which regulates leasing and factoring as non-banking financial tools that are subject to oversight by the Financial Regulatory Authority), the Sovereign Wealth Fund Act, and the renewal of the Tax Dispute Resolution Act.

Speaking of the sovereign wealth fund, the government has tasked a committee of legal and economic experts to advise on the act’s executive regulations. The committee, which will set the framework for the EGP 200 bn fund, will lay the ground rules and set the criteria that will determine how staff will be hired, Planning Minister Hala El Saeed said on Thursday, Al Mal reports. The government intends to put out a job posting for an executive director soon, before the final formation of the board is announced, she said. We had been expecting Prime Minister Mostafa Madbouly to announce the details of the board before the holiday, as the fund is set to launch before year’s end.

Who’s got oversight of the EGP 200 bn SWF? The board will be headed by the Planning Minister and include representatives from the ministries of finance and investment, alongside five other members who are yet to be selected. The regulations should be issued within 60 days and studies are ongoing to decide on a location to set up the fund’s main headquarters.

Background: The House of Representatives had signed off on the law establishing the sovereign wealth fund last month.We had also reported in July that a consortium of law firms — including Sarie-Eldin, PricewaterhouseCoopers, and Baker Mckenzie — had entered into an agreement with the government to advise on the establishment of the fund’s framework and governing structure.

LEGISLATION WATCH- Parliament’s Housing Committee drafts a new real estate tax law: The House of Representatives’ Housing Committee has drafted new legislation on taxing real estate to replace the existing law under an alias: The Returns Act. The legislation would impose taxes on real estate based on size and location and would be applicable to commercial and residential properties alike, Al Masry Al Youm reports. The annual tax would be added to electricity bills once a year, and is expected to reel in around EGP 17 bn per annum, committee head Moataz Mohamed tells the newspaper. The committee has submitted the draft law to Finance Minister Mohamed Maait for review ahead of discussion at the House of Representatives when MPs return in October for the new legislative season.

Background: The Finance Ministry’s intention to reform the real estate tax has drawn the ire of the business community and private citizens alike, in no small part due to the lack of clarity on the specifics of these amendments. Sources had also told us that the Madbouly Cabinet is devising a new real estate tax formula as part of a major real estate tax overhaul that would impact both business and private landholdings, while the Finance Ministry is reportedly looking to impose real estate taxes on the oil and gas industry.

MOVES- High-profile UK Ambassador to Cairo John Casson is saying goodbye to Egypt after completing his term, according to Al Shorouk. No successor has yet been named, so far as we can tell.

Up Next

As many as 16 of the nation’s 27 governors will be replaced in a shuffle expected to take place this week, unnamed sources tell Egypt Today. The announcement of the shuffle has been postponed multiple times since since June.

We love Vietnam, part I: Vietnamese President Tran Dai Quang will be in town tomorrow as part of a visit to the region that will also take him to Ethiopia. On the schedule: A meeting with President Abdel Fattah El Sisi as well as Prime Minister Mostafa Madbouly and Parliament speaker Ali Abdel Aal, according to the Voice of Vietnam. The Vietnamese leader is due in Addis Ababa later this week.

We love Vietnam, part II: Vietnam’s Planning and Investment Minister Nguyen Chi Dung is visiting Egypt within the week to discuss opportunities in the Suez Canal Economic Zone, according to Al Masry Al Youm.

El Sisi in China next month: The president is expected to visit Beijing next month, at which time he will sign cooperation agreements in the energy, education, transport, and housing sectors, according to a Cabinet statement.

The House of Representatives is in recess until October.

Image of the Day

Camel traders at the Birqash camel market on the outskirts of Cairo are under fire for animal abuse, according to VOA News, citing the animals’ “arduous journey” on foot from as far away as Sudan

Egypt in the News

Topping coverage of Egypt in the foreign press this morning: The death of two British tourists in Hurghada. Egypt’s top prosecutor dismissed yesterday speculation that a “toxic gas leak” was behind the death on Tuesday of a British couple at the Steigenberger Aqua Magic Hotel in Hurghada, according to the Associated Press. “All devices in the room were functioning efficiently without any defects,” Reuters quotes an investigator as saying. While the hotel attributed the deaths to “natural causes,” prosecutors are still waiting on forensics. The deaths prompted tour operator Thomas Cook to evacuate just over 300 customers from the hotel (with many leaving Egypt and others being relocated to other properties on the Red Sea) after allegedly reporting “a raised level of illness among guests.”

Also making headlines this morning are the weekend deaths of four policemen and four terrorists in clashes in Arish, according to unnamed security officials, the Associated Press reports. Last week, one security officer was killed and four other conscripts were injured in a car bomb south of Arish.

High demand for affordable housing has propelled an illegal and unsafe building boom, Hamada Elrasam says in a photo essay for VOA News. The explosion of illegal housing is a product of “unmanaged growth and often nonexistent planning,” which has led to the destruction of fertile farmlands along the Nile. “Urban sprawl in Egypt is threatening not only agricultural land but also the country’s cultural heritage. And yet, government figures show the majority of Egypt’s population lives in 6 percent of the land,” Elrasam says.

Other headlines from the past week:

- Eid, Redux: Some Egyptians prefer to sacrifice camels, rather than sheep and cows for Eid Al Adha, despite the camels’ steeper price tags, says Reuters. The livestock market struggled ahead of Eid as prices spiraled, according to Antara News.

- Mmm, cheese: 3,200-year-old cheese and a mummification process that predates the pharaohs made headlines.

- Prosecutors extended the detention of four journalists held as part of mass trial, according to the Committee to Protect Journalists.

- A group of UK academics condemned their government for working with Egypt against a backdrop that includes the torture and murder of Italian student Giulio Regeni, according to The Guardian.

- An Islamist teacher facing a death sentence in Egypt was granted asylum in the US despite facing a removal order from the US Immigration and Customs Enforcement agency, according to the New York Post.

- Actress Hala Shiha stirred controversy among Islamists by returning to the silver screen sans hijab, according to the Associated Press.

- The government’s digitization drive is an “effective” reform measure, but the success of the electronic payment system is contingent on its strict implementation, Muhammed Magdy writes for Al-Monitor.

- The military’s economic activities are a threat to Egypt’s stability and undermine other investors, Chloe Teevan writes for Middle East Eye.

Worth Watching

The Angel, an English-language Netflix film depicting the alleged Egyptian double-agent Ashraf Marwan, will be released on 14 September. The movie revolves around the period leading up to the 1973 Arab-Israeli war, during which time Marwan worked as a double-agent, feeding Egypt information but also passing sensitive information on to the Mossad, allegedly as a way of saving lives. Watch the trailer here (runtime: 2:04).

Diplomacy + Foreign Trade

Egypt in talks with World Bank for grants to finance environment projects: Investment Minister Sahar Nasr and Environment Minister Yasmine Fouad met last week with the World Bank’s Chief Environment Specialist Craig Messner to discuss potential grants to finance pollution management projects, according to an Investment Ministry statement (pdf).

Cairo and Moscow agreed to work on strengthening military ties last week, during meetings between Defense Minister Mohamed Zaki and his Russian counterpart Sergei Ivanov, according to an Armed Forces statement. Zaki returned from Moscow after a two-day visit, where he also met with UAE Defense Minister Ahmed Al Bowardi, as well as the head of Belarusia’s head of military industries to discuss a number of issues of mutual interest. No further details were divulged. The AP also has the story.

Energy

Electricity Ministry to tender EGP 6 bn hydro power plants next year

The Electricity Ministry is expected to issue a tender next year to develop micro hydro power plants with a combined generation capacity of 150-200 MW and an estimated total cost north of EGP 6 bn, reported Al Mal.

Infrastructure

Transport Ministry to launch tender for USD 100 mn Six October dry port next month

The Finance Ministry is planning to launch a tender for the construction of the USD 100 mn Six October dry port project next month, according to a ministry statement. The contract for the project, which will be developed under a PPP framework, is expected to be signed by 4Q2018. The Transport Ministry announced in June the list of qualifying consortias, which include Elsewedy Group, Germany’s Schenker, and Cairo 3A. A Groupe PSA-Hassan Allam Construction-Concorde Engineering and Contracting consortium is also bidding on the project, as is a consortium made up of the Holding Company for Maritime and Land Transport, the Suez Canal Economic Zone, and DP World.

Basic Materials + Commodities

Gov’t reimposes export tariff on fish for one year

Trade Minister Amr Nassar reimposed a EGP 12,000 tariff on every tonne of fresh and frozen fish exported from Egypt, Al Masry Al Youm reports. The decision, which came into effect yesterday, aims to curb increases to the prices of fish sold locally. The initial tariff was imposed back in April last year and had led to a 30-40% drop in prices.

Tourism

White Desert National Park added to UNESCO’s World Heritage List

The Western Desert’s White Desert National Park will become the first Egyptian geopark on the UNESCO World Heritage List, Al Masry Al Youm reported. The site is distinguished by its rock formations, and famous for expansive sand dunes and endangered animals.

Swiss Inn set to operate three new hotels in Red Sea

Swiss Inn Hotels and Resorts will manage three new hotels by the Red Sea within a year, according to Hotel Management. The hotel management company will take over a new hotel in Sharm El Sheikh in the next four months and two new hotels in Marsa Alam and South Hurghada within the year.

Turkish Airlines to begin regular trips to Luxor

Turkish Airlines announced that it will begin operating flights from Turkish airports to Luxor, with the continuity of this new route dependent on demand, Reuters says.

Automotive + Transportation

Transport Ministry to sign contracts with Russia’s Transmashholding for 1,300 railway cars “within days”

The Transport Ministry is reportedly days away from signing an agreement with Russia’s Transmashholding to purchase 1,300 new railway cars, Al Mal reports, citing a cabinet statement. A Russian-Hungarian banking consortium had offered to provide the Egyptian National Railways (ENR) with a loan to finance the purchase of the railway cars from Transmashholding, which would carry an interest rate of 1.8%. Egypt will pay around EGP 17 bn to buy the cars, with delivery expected to take place within six months to a year.

Banking + Finance

Pharos Holding increases AUM to EGP 4.55 bn in 1H2018

Pharos Holding raised its assets under management (AUM) to EGP 4.55 bn by the end of 1H2018, Chairman and CEO Elwy Taymour told Amwal Al Ghad. Pharos plans to increase its AUM through the remainder of the year largely by working to diversify its portfolio.

Egypt Politics + Economics

Former monks accused of bishop’s murder referred to trial

Prosecutor General Nabil Sadek referred former monks Wael Saad and Ramon Mansour to trial on Sunday for their alleged involvement in Bishop Epiphanius’ murder, according to Reuters’ Arabic service. Saad and Mansour confessed to the premeditated crime, the newswire says.

Sisi pardons over 2,300 prisoners

President Abdel Fattah El Sisi issued a presidential pardon last week for 2,376 inmates on the occasion of Eid Al Adha, according to an Interior Ministry statement.

National Security

Egyptian navy holds military exercises with Italian, Greek, South Korean counterparts

Egypt’s naval forces held joint military exercises with their Italian, Greek and South Korean counterparts off the Mediterranean and the Red Sea coasts last Monday, according to an Armed Forces statement.

Sports

Egyptian national football team FIFA ranking drops to 65th

Egypt’s national football team took a plunge in the latest FIFA World Ranking, dropping to the 65th spot from 31 previously. The drop also pushed us out of our position among the top 10 African teams. World Cup champions France sit at the top of the ranking, while Germany — whose performance at this year’s championship was unexpectedly less-than-stellar — nosedived to 15.

Mo Salah shortlisted for UEFA best player and UCL best forward

Egyptian footballer Mohamed Salah is among the shortlisted nominees for the Union of European Football Associations (UEFA) Player of the Year and the UEFA Champions League (UCL) Forward of the Year. Both awards will be presented during the 2018/19 UCL group stage draw in Monaco on 30 August. Salah is up against Cristiano Ronaldo and Luka Modric for best player, and Ronaldo and Lionel Messi for best forward.

Javier Aguirre calls up 13 foreign-based players for Egypt

National football team coach Javier Aguirre will announce on 31 August the full roster of overseas-based players set to join the team for the 2019 Africa Cup of Nations qualifier against Niger next month, according to BBC. Mo Salah is naturally on the preliminary list with the likes of, El Neny, Ramadan Sobhi, and Mahmoud Hassan Trezeguet. Vancouver Whitecaps’ Ali Ghazal will reportedly be joining the squad after a four-year absence.

On Your Way Out

Cyprus extradites lovejacker (remember him?) to Egypt for trial: Seif Eddin Mustafa, the man who hijacked a domestic EgyptAir plane and diverted it to Cyprus, has been extradited to Egypt to be tried for the 2016 incident, according to Reuters. The extradition came after “Cairo provided assurances that he would faced legal proceedings that conform to international standards.” Mustafa has been in Cyprus since the hijacking, which he claimed he committed to seek asylum in Italy. The European Court of Human Rights had blocked Cypriot authorities from extraditing Mustafa last year.

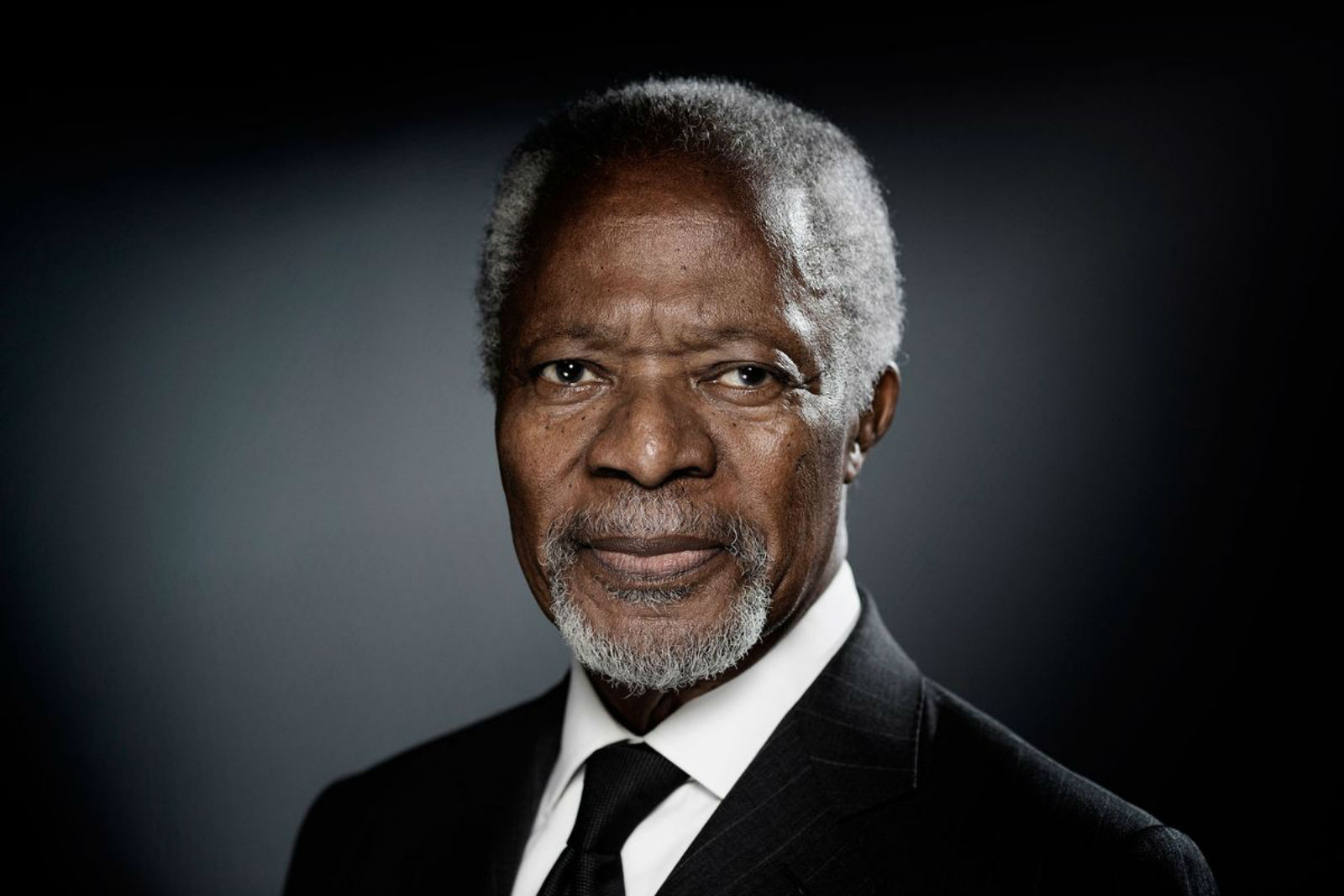

Former UN secretary general Kofi Annan died last Saturday at the age of 80 after a “short unspecified illness” at a hospital in Switzerland, according to Bloomberg. The first black African to head the body, Anan served two terms between 1997 and 2006. He was awarded the Nobel peace prize for his humanitarian work with the UN in 2001.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.82 | Sell 17.92

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 15,273 (-0.2%)

Turnover: EGP 249 mn (71% BELOW the 90-day average)

EGX 30 year-to-date: +1.7%

THE MARKET ON SUNDAY: The EGX30 ended last Sunday’s session down 0.2%. CIB, the index’s heaviest constituent, closed the session off 0.6%. The EGX30’s top performing constituents were Orascom Construction (up 1.8%), TMG Holding (+1.6%), and Ezz Steel (+1.4%). Egyptian Iron and Steel (down 7.4%), Pioneers Holding (-1.6%) and Orascom Investment Holding (-1.5%) were the day’s worst performers. Market turnover was an abysmal EGP 249 mn as everyone was on vacation, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -2.4 mn

Regional: Net Long| EGP +2.8 mn

Domestic: Net Short | EGP -0.5 mn

Retail: 81.3% of total trades | 80.2% of buyers | 82.4% of sellers

Institutions: 18.7% of total trades | 19.8% of buyers | 17.6% of sellers

Foreign: 7.8% of total | 7.4% of buyers | 8.3% of sellers

Regional: 4.8% of total | 5.4% of buyers | 4.2% of sellers

Domestic: 87.4% of total | 87.2% of buyers | 87.5% of sellers

WTI: USD 68.72 (+1.31%)

Brent: USD 75.82 (+1.46%)

Natural Gas (Nymex, futures prices) USD 2.92 MMBtu, (-1.59%, September 2018 contract)

Gold: USD 1,213.30 / troy ounce (+1.62%)

TASI: 7,867.16 (+0.02%) (YTD: +8.87%)

ADX: 4,884.92 (-0.45%) (YTD: +11.06%)

DFM: 2,815.79 (+0.44%) (YTD: -16.45%)

KSE Premier Market: 5,381.57 (+0.18%)

QE: 9,447.88 (-1.50%) (YTD: +10.85%)

MSM: 4,390.45 (+0.02%) (YTD: -13.94%)

BB: 1,347.98 (+0.04%) (YTD: +1.12%)

Calendar

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

06 October (Saturday): Armed Forces Day, national holiday.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.