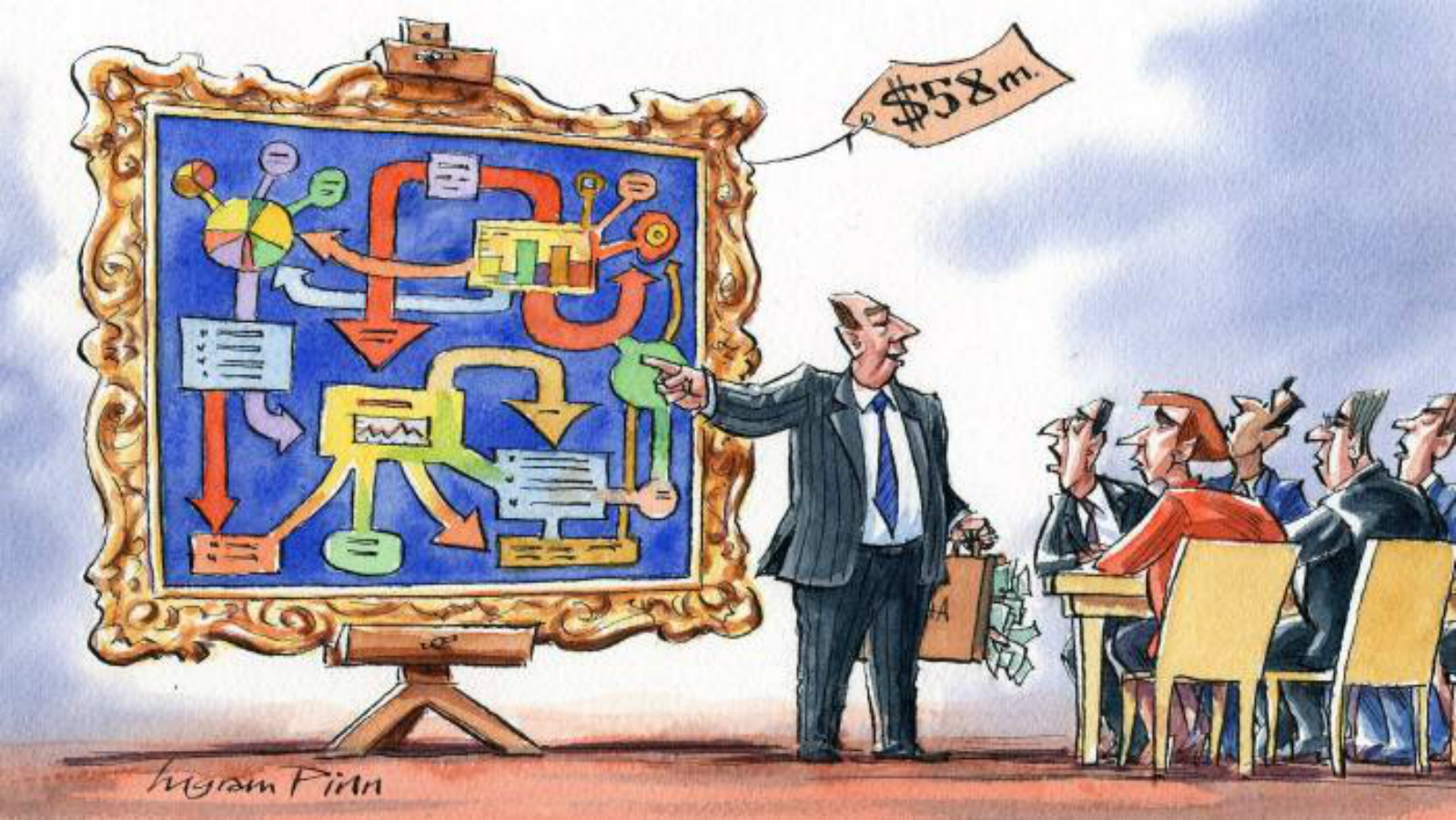

Investment bankers are grossly overpaid — partially because they obfuscate what unique service they provide

Investment bankers are grossly overpaid for their services, partially because they obfuscate just what unique service they really provide, John Gapper writes for the Financial Times. “The secret to a bulging ‘success fee’ is less to obtain the best possible [outcome] than to make the chief executive and the board believe they got it. That is not the same thing, particularly in the long term.” In many ways, an investment banker is valuable — they come bearing significant technical knowledge and skills and are tasked with guiding a company through a series of potential pitfalls in the process. All things considered, bankers’ fees are actually a small portion of the size of any transaction. However, their long-term value is much less obvious and many M&As are ordered undone when a company’s leadership changes. “The success fees of advisers should be more closely tied to whether the deal succeeds long after it has closed and they have moved on to the next one,” Gapper argues.