- Big Tobacco, unhappy with new sin tax, could stall planned investment. (Speed Round)

- Actis is in early talks to acquire Abraaj’s 95% stake in Nahda University, as Naqvi gets temporary reprieve. (Speed Round)

- Yields come back down as auctions become cat and mouse game with carry traders in zombie survival mode. (Speed Round)

- FRA is drafting a bill that would make travel insurance mandatory. (Speed Round)

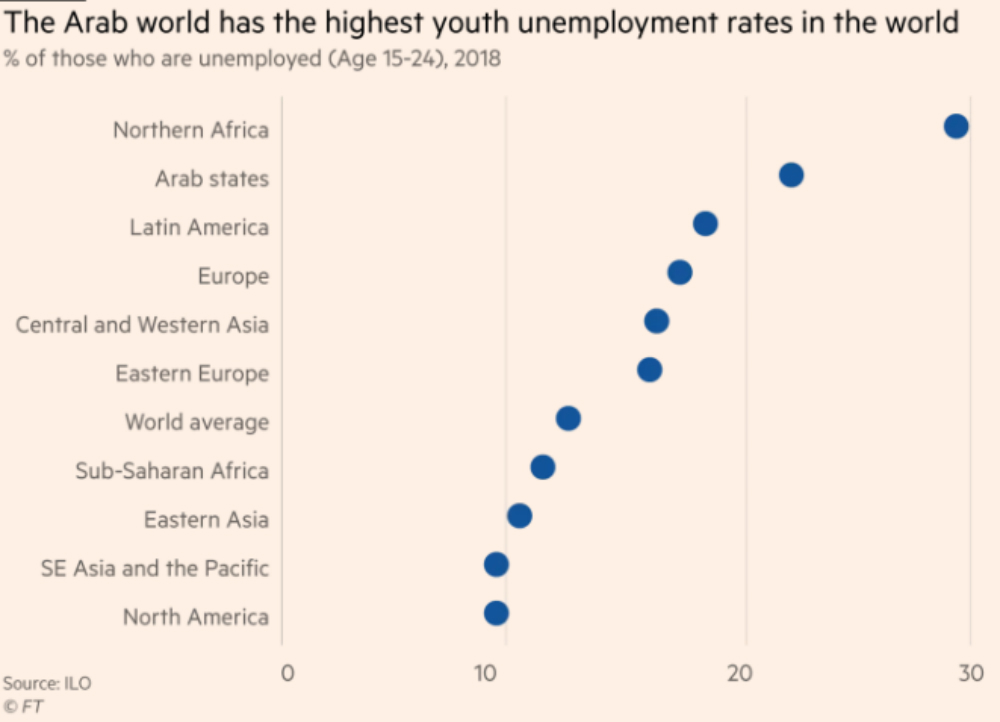

- One in four youth in the Arab world is unemployed, and our failure to include women in the workforce is to blame (Macro Picture)

- From Smiley Face to Stickers: How the Consumer Protection Agency went full Maoist (Speed Round)

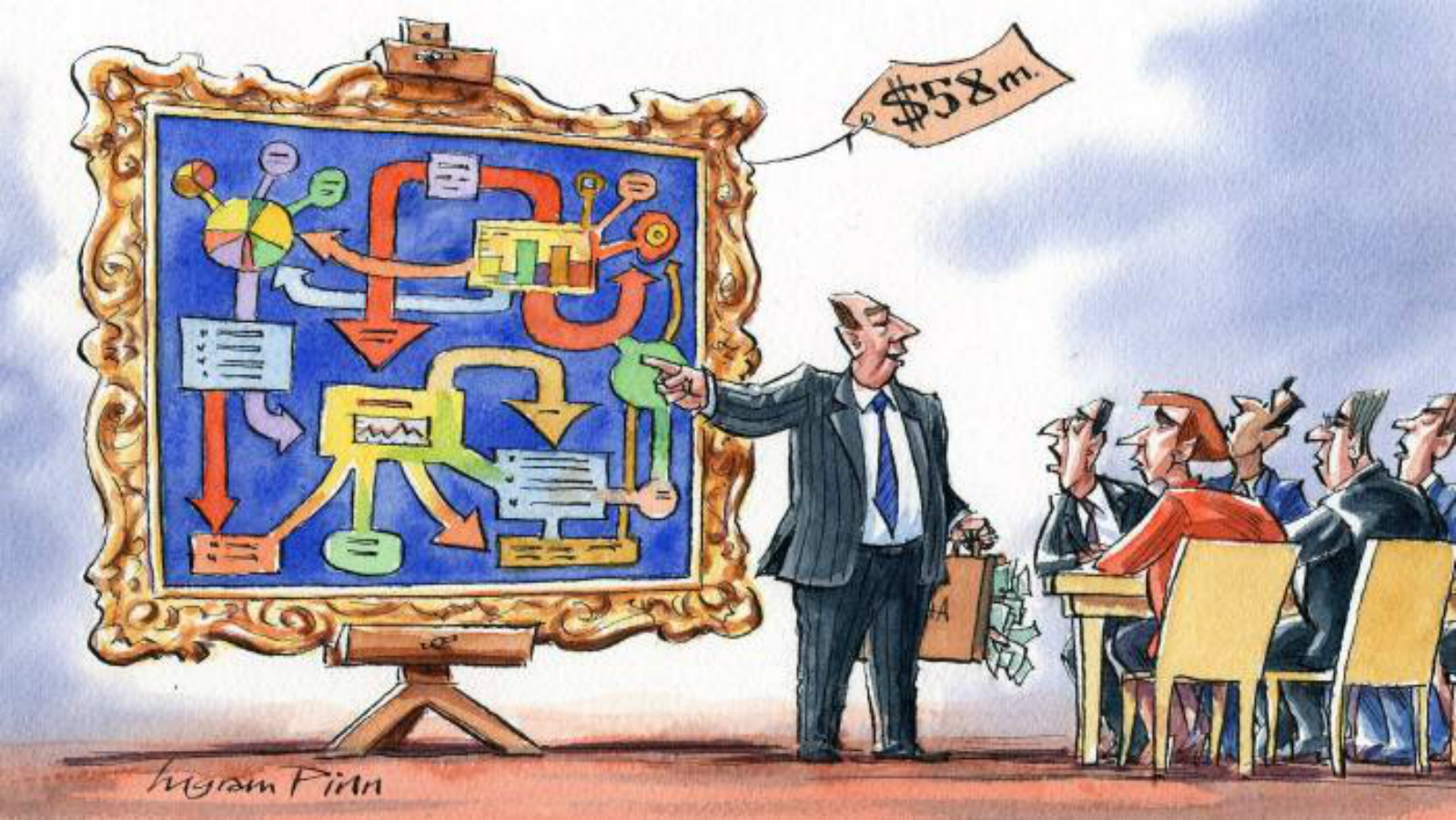

- Investment bankers are grossly overpaid — partially because they obfuscate what unique service they provide. (Worth Reading)

- France wins its second World Cup title with 4-2 victory over Croatia. (Speed Round)

- The Market Yesterday —

Monday, 16 July 2018

Big tobacco stalling investment over sin tax?

TL;DR

What We’re Tracking Today

It’s a relatively slow news morning in Cairo between the combination of the World Cup final and the lure of summer vacation season in Sahel and abroad.

MPs may not get much of a summer break: The House of Representatives’ legislative season, originally set to wrap before the end of July, could extend into August, according to chatter in the nation’s capital. On the agenda is a vote of confidence in the Madbouly cabinet on Tuesday (the House kicked off debate on the government’s policy program yesterday) and laws on both public contracts and Egypt’s sovereign wealth fund. House Speaker Ali Abdel Aal has warned MPs they will have to work into next month if they’re unable to get through their full agenda by the end of next week, according to Amwal Al Ghad.

Ibn Sina ruling today: The Cairo Court of Appeals is expected to rule today on Ibnsina Pharma’s appeal of bns worth of antitrust sanctions imposed in a case brought by the Egyptian Competition Authority.

Further afield: The Donald will meet Vladimir Putin in Helsinki today for their first-ever summit in what Reuters is describing as a “political minefield for the US president but a geopolitical win for his Russian counterpart.” The New York Times takes it even further in a solid analysis headlined Just sitting down with Trump, Putin comes out ahead. Trump arrives in Finland having thrown (metaphorical) bombs at his NATO allies, undercut UK PM Theresa May while in Britain, and called the European Union a trade “foe.” The two men will meet face-to-face with only interpreters in the room, a prospect that has spooked some in the US.

The USD is holding steady near its six-month high against major currencies ahead of “big economic indicators” due to be released today as traders await second quarter GDP data from China and June retail sales figures from the United States.

Is the inverted yield curve the new EM Zombie Apocalypse? We’re still not certain it augurs disaster, but the yield curve for US debt has now flattened to its lowest level since August 2007, the Financial Times notes, pointing out that “the difference between two-year and 10-year Treasury yields dropped further this week … the measure is an important signal for investors of when the Federal Reserve may curtail its policy tightening and is also seen as warning of a coming recession if it turns negative, which last happened in 2006.” CNBC also has the story.

The catch: While recessions in the US are almost always preceded by an inverted yield curve, the time between inversion and recession is highly variable. What’s more, an inverted curve is only a predictor of recession, not a cause — and (almost) only in the United States.

In our TBR pile ahead of a flight tonight that will see us spending 26 or so hours in transit from door to door:

- Forget a fast car. Creativity is the new midlife crisis cure. (New York Times)

- Smartphones killed handwriting. Let’s bring it back. (Wall Street Journal)

- One of the following: The Financial Times: A centenary history (out of print, not on Kindle) or The Wall Street Journal: The story of Dow Jones and the nation’s business newspaper (also out of print, not on kindle)

- The Smartest Guys in the Room: The amazing rise and scandalous fall of Enron

Oh, and did we mention that Hotel Transylvania 3 is out and that we’re oddly looking forward to being dragged to the theater?

Need a video pick-me-up right now? We can think of nothing more apropos this morning than Saturday Night Live’s “parole board” sketch, which had us in stitches (watch, runtime: 3:55). H/t one of the smartest (and funniest) guys we know.

Enterprise+: Last Night’s Talk Shows

An eventful day at the House of Representatives made for a legislation-heavy night on the airwaves, with part two of the Press and Media Act garnering the most attention.

Among the few exceptions to the rule was IMF Mission Chief for Egypt Subir Lall’s praise of Egypt’s economic reforms on Yahduth fi Masr. Lall repeated much of what was said in the IMF’s policy review, which was released on Thursday, including a hat tip to the central bank for its monetary policy. He drove home the point that the path ahead is reason for optimism as long as Egypt remains committed to the balance of the program (watch, runtime: 5:37).

The House of Representatives signed off in principle yesterday on the three articles that comprise part two of the Press and Media Act, but postponed its final vote due to lack of quorum, Ahram Online reports. The assembly approved amendments to the bills made after the Council of State (Maglis Al Dawla) suggested several of them were unconstitutional and an infringed freedom of the press. The amended version of the act appears to eliminate a clause that would have required reporters to acquire permits for every event or incident they cover, according to Al Mal.

Members of the Press Syndicate are still opposed to the final draft of the legislation, saying in a statement put out yesterday that the House ignored the vast majority of comments made by the syndicate and Maglis El Dawla, Al Shorouk reports.

Syndicate head Abdel Mohsen Salama, by contrast, seemed satisfied with the amended bill, including an amendment that only allows journalists to be held in pre-trial detention in cases related to discrimination, inciting violence, and tarnishing someone’s honor (which governorate is being represented by Don Quixote?). The amended version of the act also tweaked a clause that would have required reporters to acquire permits for every event they cover, and now only stipulates that these permits be obtained to access restricted areas, according to Salama (watch, runtime: 4:40). He also had a similar chat with Hona Al Asema’s Reham Ibrahim (watch, runtime: 6:32).

Take Salama’s boosterism with a grain of salt: It probably doesn’t represent the views of most mainstream journalists. The syndicate boss recently outraged many in the rank and file by appearing just a bit too close to his industry’s regulator. When Supreme Media Council boss Makram Mohamed Ahmed was recently summoned to account for a gag order imposed on the media, Salama not only defended the gag, but said he would accompany Ahmed to the meeting with prosecutors.

Rep. Osama Heikal seemed disgruntled that the article on pre-trial detentions was amended at all, telling Hona Al Asema that he was fond of its original form. Heikal said that the House “generally” took the Council of State and Press Syndicate’s recommendations and requests when amending the act. Deputy House Speaker Soliman Wahdan also tried to frame the bill as an indication of House representatives’ “appreciation” for the journalistic profession (watch, runtime: 10:14).

Lack of quorum behind postponement of vote on Madbouly gov’t program? On a separate note, It appears that a lack of a quorum was behind parliament’s delay in voting on the Madbouly government’s policy program to tomorrow. Absentee reps also resulted in the postponement of deliberations over other pieces of legislation (watch, runtime: 4:26). Parliament Speaker Ali Abdel Aal said he hopes parliament will make it through its discussion of the policy program by the beginning of next week, Al Hayah fi Masr’s Kamal Mady said (watch, runtime: 2:05).

A path to citizenship for foreigners? Not gonna happen, we say: Rep. Kamal Amer took to the airwaves to defend a proposed law that would grant foreign residents Egyptian citizenship in exchange for an EGP 7 mn deposit (or its foreign currency equivalent). The final vote on the law was postponed due to lack of quorum yesterday, Youm7 reports. Amer slammed the suggestion that Egypt is selling citizenship, saying that foreigners would be required to meet several other requirements (watch, runtime: 8:09). Passing the bill, he said, would also help spur foreign investment (watch, runtime: 5:48).

Health Minister Hala Zayed finally washed her hands of the national anthem gaffe during a meeting with the House Health Committee yesterday, Rep. Shadia Thabet told Masaa DMC’s Eman El Hosary. Zayed denied she had issued a binding ministerial decision to play the national anthem and Hippocratic oath in hospitals, saying that it was nothing more than a suggestion to “spread positive energy” (watch, runtime: 4:51).

Speed Round

EXCLUSIVE- Is Big Tobacco mounting a power play after imposition of new sin tax? Tobacco companies are not happy with new sin tax, and execs at three of them are suggesting a new EGP 0.75 per pack sin tax to fund the universal healthcare system could prompt them to hold off fresh investment in Egypt. A source at one international label, who who spoke on condition of anonymity, told us that the company was putting on hold some GBP 30 mn in new investment this year. The company had been looking to bring to market a “low cost” foreign brand to compete with the likes of Cleopatra. The new sin tax, the exec said, would make it impossible for their challenger brand to compete with local low-cost brands.

At the heart of the issue: They want a new tax framework: Tobacco companies held meetings with the Finance Ministry before the sin tax came into effect to push for a new tax framework. The ministry had imposed a sin tax hike of EGP 0.75-1.25 back in 2017. The meetings have not gone well, the sources tell us.

A state monopoly at play here? Meanwhile, Eastern Tobacco has reduced the price of Cleopatra ‘King Size’ cigarettes — the country’s cheapest cigarette brand — by EGP 0.50 to EGP 15.50 per pack, Ahram Online reports. The company had raised the price by EGP 2 last Thursday as part of the 10-15% markup in its prices.

M&A WATCH- Global private equity firm Actis is reportedly in early talks to acquire Abraaj Group’s 95% stake in Nahda University, sources close to the matter tell Al Mal. The transaction would not be finalized until after Abraaj completes its court ordered restructuring and liquidation, as decision-making at the UAE-headquartered firm is on hold until then, according to the newspaper. Its sources add that Matouk Bassiouny has been tapped as sellside advisor, while Zaki Hashem is advising Actis.

Emirati court dismisses charges against Abraaj founder: Meanwhile, a UAE court dismissed criminal charges against Abraaj founder Arif Naqvi and firm executive Muhammad Rafique Lakhani for bouncing checks, Reuters reports. The dismissal comes after the claimant dropped the charges, the judge said. The dismissal offers some relief to the beleaguered PE outfit, which is trying to sell its investment management business after filing for provisional liquidation last month. It is estimated that the firm owes more than USD 1 bn.

On that front, PwC highlights Abraaj’s “unstable” business model and bad accounting: PricewaterhouseCoopers — which along with Deloitte was hired to act as provisional liquidators — called out Abraaj’s “unusual” business model reliant on short-term borrowing and missing key financial statements in a report seen by Bloomberg. The confidential report noted “multiple layers of leverage” as the company borrowed to offset a “long-running liquidity shortfall between the investment management fees and operating expenses.” In simple terms: Abraaj was living beyond its means.

Where was the board of directors? PwC also reportedly said it has “been unable to obtain standalone annual financial statements or management accounts for the company. … This lack of financial record-keeping raised the question of how the company’s directors were able to ensure that the company was solvent and being effectively managed.”

Playing cat and mouse with the carry traders: Yields on three- and nine-month T-bills fell at an auction on Sunday after a month-long advance, Reuters reports. the yield on three-month treasuries fell to 19.364% from 19.69% a the last auction, while the yield on nine-month bills dropped to 19.422% from 19.68%. Rates had peaked last week, a sign some have suggested is suggests waning interest amid the still unfolding Emerging Markets Zombie Apocalypse. Banking sources told Reuters over the weekend that Egypt saw up to USD 5 bn in outflows from its debt market as a result of the broader emerging market selloff. The CBE’s data bulletin for April indicated that the foreign holdings of Egyptian debt fell 1.25% m-o-m to EGP 375.5 bn — the first drop in foreign portfolio investments in 2018. “The average coverage ratio for treasuries, a measure of participation in debt auctions, dropped to its second lowest level in June since EGP was floated in late 2016,” our friends at Pharos said in a note on Sunday. “The auction saw higher participation than in recent weeks but there was no breakdown available between local and foreign buyers,” Reuters adds. Take it as additional impetus for the central bank to leave interest rates unchanged.

These external factors are driving the government to reduce its reliance on short-term borrowing and look to long-term facilities, Finance Minister Mohamed Maait told us in an exclusive chat over the weekend. The Finance Ministry, which cancelled a bond sale last Tuesday because prices were too expensive, is now in talks with multiple international funders to plug Egypt’s funding gap, through loans of up to 30 years in duration.

INVESTMENT WATCH- Energy group Empower is planning to invest EGP 420 mn this year in waste-to-energy (WtE) projects, CEO Hatem El Gamal tells Al Shorouk. Empower had reportedly won a contract last month to produce and sell electricity from its 24 MW WtE plant in Beheira under an independent power producer (IPP) framework. The plant is currently selling electricity at a feed-in tariff rate of EGP 1.03/kWh until the government announces an official tariff structure, El Gamal said. Sources had said that the Egyptian Electric Utility and Consumer Protection Agency has already approved setting the feed-in tariff for WtE projects at EGP 1.03 per kWh.We had heard before, however, that Cabinet would set the rate of EGP 1.40 per kWh.

LEGISLATION WATCH- Egypt’s sovereign wealth fund will be exempt from paying taxes on transactions with any of its subsidiary funds. The House of Representatives’ Budget Committee reached an agreement yesterday with Finance Minister Mohamed Maait to tax only transactions with non-affiliates, Youm7 reports. We reported on Sunday that amendments had been introduced to the bill — which will outline the functions and structure of Egypt’s EGP 200 bn sovereign wealth fund — to exempt the fund from taxes for a renewable periods of four-years, right before the Planning Ministry and Budget Committee reached consensus on the final draft. The bill could go be up for a plenary session discussion any day now, but officials have given clarity on the timeline beyond Planning Minister Hala El Said saying the law would be issued by year’s end.

The House also made it tougher to dodge a 2.5% tithe on real estate sales, Al Shorouk reports. MPs voted in favor of amendments to the tax code that bar property owners from basic services such as power and water until they are able to present proof that they have paid the tax.

Public transportation, traffic laws in play: The House is also waiting on the government to send back its draft law on public transportation, House Transport Committee deputy chair Rep. Mohamed Zeineldin tells Al Mal. The legislation would be a prelude to installing so-called “intelligent transportation systems” to manage and monitor transportation networks around the country. The law should also be passed before the new Traffic Act, which is also on the agenda for the National Security Committee.

Parliament also gave a preliminary nod to the Foreign Campuses Act, which sets the rules for foreign universities opening campuses in Egypt, Ahram Gate reports.

Elsewhere, Health Minister Hala Zayed is expected to make an appearance this week to present her ministry’s program to the House Health Committee.

Mandatory insurance for arriving tourists in the works? The Financial Regulatory Authority is drafting a bill that would force tourists to pay a nominal personal insurance fee, deputy head Reda Abdel Moty said yesterday, Al Mal reports. The preliminary draft extends coverage to life as well as healthcare, he said, adding that talks are ongoing with the Tourism Ministry to conduct a study that will be used to price the policy and determine the method of collection, which is likely to be through a network insurance companies that join the program.

MIDOR looks to Afreximbank, ADIB for USD 200 mn loan to finance refinery expansions: The state-owned MIDOR is reportedly in talks with the African Export-Import Bank (Afreximbank) and Abu Dhabi Islamic Bank (ADIB) for a USD 200 mn loan to help finance expansion plans at the company’s refinery, banking sources tell Al Shorouk. MIDOR, which we think is in line to sell additional equity in the first phase of the government’s privatization program, had secured a USD 1.2 bn loan from France’s Crédit Agricole, BNP Paribas, and Italy’s CDP in 2016 to finance the USD 2.2 bn project, which will expand its refining capacity to 175k barrels of crude per day from a current 115k barrels. The project is being developed by Italy’s Technip, which signed had signed a USD 1.7 bn agreement with MIDOR in June. Afreximbank had said last week that it pledged USD 3 bn in new financing to Egyptian companies.

On a related note, Afreximbank has been tapped to conduct studies on Egypt’s joint investment fund with Sudan and Ethiopia, Executive Vice President Amr Kamel tells Al Mal. We had been expecting the fund, which is meant to finance infrastructure projects, earlier this month. The idea for the fund came into existence back in January when officials from the three countries agreed to begin resolving a gridlock they had reached last year when Ethiopia and Sudan refused to ratify the results of an environmental impact study concluding that the Grand Ethiopian Renaissance Dam would be detrimental for Egypt’s Nile water supply.

Private sector could get a piece of Cairo Metro Line 3 opeations: The Transport Ministry is looking to launch a new company to manage the Cairo Metro Line 3 once construction work on it is complete, sources with knowledge of the matter tell Al Shorouk. The private sector will be allowed to participate in the new company, which would operate in a manner similar to the Egyptian Co. For Metro Management & Operation. The ministry should settle on a final corporate structure by the end of September. Orascom Construction and a JV comprised of VINCI, Bouygues, and Arab Contractors broke ground on Line 3 in May, with some EUR 300 mn in funding from the French Development Agency (AFD).

On a related note, Sestra has been tapped to consult on the overhaul of Metro Line 1, which the ministry is currently trying to secure funding for ahead of the planned commencement of work in 2019.

Ships passing through the Suez Canal will now have to pay their fees in advance, Suez Canal Authority (SCA) head Mohab Mamish said yesterday, Al Shorouk reports. Fees, which are collected in USD, will now have to be wired from a ship’s country of origin rather than transferred locally through the Central Bank of Egypt. Mamish said that this new digital payment system has been implemented at six other ports under the SCA’s domain — including Adabiya, Ain Sokhna, East Port Said, and Arish — and means to expedite the passage of ships through the canal and enhance transparency, he said.

Oh, Smiley Face, wherefore art thou? While former Consumer Protection Agency (CPA) head Atef “Smiley Face” Yakoub may be out, he’s definitely still with the CPA in spirit. Current head Rady Abdel Moaty appears to be recycling Smiley Face’s idea to reward “consumer friendly” business with a smiley face. Abdel Moaty’s idea? A certificate declaring the business “consumer friendly,” Al Mal reports. You would think they’d get more original. A wreath handed out by a hula girl? A lifetime’s supply of muffin tops (hello, Seinfeld)? A Hello Kitty sticker / coloring book? We’re not expecting Oprah, but they can certainly do better than that school in Suez that awarded its top performing middle schooler a … towel.

And for you, naughty business kids, a good, old-fashioned Maoist public denouncement. That’s right, Abdel Moaty took a step back for a good two seconds before realizing the certificates wouldn’t work. Not one to be deterred by a bad idea, he doubled down and wants to “publicly shame” business leaders the CPA considers not “consumer friendly” (because, you know, the free market took an extended nap). The scariest part? Abdel Moaty (who will henceforth be affectionately referred to as “Stickers”) appears to be serious. Mandatory education in the finer arts of Maoist self-criticism will surely be next.

France wins its second World Cup title with 4-2 victory over Croatia: France lifted the World Cup last night after a classic match that saw in Les Bleus beat underdog Croatia 4-2. Croatia started off strong but was dealt a painful blow when Mario Mandzukic accidentally scored an own goal in the 18th minute. France also scored on a controversial penalty shot towards the end of the first half. Croatia was dogged until the very last minute. Reuters has a solid play-by-play breakdown, the Guardian looks at how players from each team fared, while USA Today dissects why so many of us were keen to dismiss France’s excellence throughout the championship. Our favourite take on the match is from Cathal Kelly at Toronto’s Globe & Mail, and the WSJ has a sweet drill-down into Croatia and its fan. The on-field class of Croatian President Kolinda Grabar-Kitarović after the match (and insistence she travel coach with Croatian fans) won hearts worldwide.

Up Next

Long weekend coming up, if you want to bridge: Monday, 23 July is a national holiday in observance of Revolution Day. Expect half the nation’s workforce to try to cadge a four-day weekend.

President Abdel Fattah El Sisi will reportedly unveil a new education program this month. It is unclear whether the program is K-12 or post-secondary.

The deadline for companies bidding to open stores at the Grand Egyptian Museum (GEM) has been extended to 21 August, according to GEM supervisor Tarek Tawfik.

The Macro Picture

One in four youth in the Arab world is unemployed, and our failure to include women in the workforce is to blame: As youth unemployment reaches 25% in the Arab world, the IMF is urging further action on inclusive growth: “The Arab region has the highest level of youth unemployment in the world, averaging 25%, and more than 27 mn young people will enter the labor market in the region over the next five years,” IMF Middle East and Central Asia Director Jihad Azour said in a speech in Lebanon last week.

An IMF report out on Thursday doesn’t mince words on what it sees as one of the primary cause: gender inequality. If the gender gap in employment was narrowed “from triple to double the average for other emerging markets and developing economies,” the region’s economic growth could have doubled in the past decade, gaining USD 1 tn in cumulative output, said the report. “Women in the region are three times less likely than men to be in the labour force, while the level of joblessness among young women is nearly 36%, rising to 62% in Saudi Arabia,” the IMF said, according to the FT.

Financial inclusion, education are key to inclusive growth, says Azour: “Financial inclusion, including the use of FinTech, is an important tool for enabling people, as approximately 70% of the adults in the region do not have bank accounts, he said in his speech. Improving fiscal spending on education, “which today amounts to only 11% of GDP in the Middle East, compared to 19% in the developing countries of Europe,” would also help bridge the gender employment gap, he added. His other recommended policies for improving employment for women are your standard IMF-prescribed policies of subsidy cuts, improving the business climate, and a social safety net.

Image of the Day

Man, UK protestors are vicious: While it seems highly unlikely that US President Donald Trump saw this unflattering (yet accurate) balloon having tea with the queen on his first state visit to the UK, we really hope he did. By far one of the funniest effigies we’ve seen in a while (watch; runtime: 1:21).

Egypt in the News

Topping coverage of Egypt in the foreign press on this very slow news morning is a Human Rights Watch report critical of the government. Egyptian authorities are using counterterrorism and state-of-emergency laws and courts “to unjustly prosecute journalists, activists, and critics for their peaceful criticism,” says the report.

On Deadline

You likely don’t need the reminder, but still: It’s not just the state that’s suspicious of the private sector’s role in the economy. The government should set parameters for private sector participation in the development of Egypt’s railways to ensure the service remains accessible and affordable, says Heba Raslan. While opening up the country’s railway development to the private sector is an appealing window for investment, it remains to be seen how the government and private players will find a middle ground between quality and affordability, which is often the biggest concern surrounding privatization, Raslan says.

Worth Reading

Investment bankers are grossly overpaid for their services, partially because they obfuscate just what unique service they really provide, John Gapper writes for the Financial Times. “The secret to a bulging ‘success fee’ is less to obtain the best possible [outcome] than to make the chief executive and the board believe they got it. That is not the same thing, particularly in the long term.” In many ways, an investment banker is valuable — they come bearing significant technical knowledge and skills and are tasked with guiding a company through a series of potential pitfalls in the process. All things considered, bankers’ fees are actually a small portion of the size of any transaction. However, their long-term value is much less obvious and many M&As are ordered undone when a company’s leadership changes. “The success fees of advisers should be more closely tied to whether the deal succeeds long after it has closed and they have moved on to the next one,” Gapper argues.

Diplomacy + Foreign Trade

Cairo wants to begin exporting mangoes to Johannesburg, according to Al Mal. A delegation of South African agriculture and quarantine officials are expected to visit in September to meet with their Egyptian counterparts to set the framework for an agreement and inspect mango fields in Ismailia and Wadi El Natrun. Egyptian officials are also in talks with Vietnamese authorities to begin exporting grapes there.

Infrastructure

Maritime and Land Transport Co. to develop second container terminal at East Port Said

It looks like Maritime and Land Transport Company, a subsidiary of the Port Said Container and Cargo Handling Company, will be taking on the contracts for the construction and management of another zombie project, the second container terminal at the port in East Port Said, holding company boss, Mohamed Youssef, tells Al Shorouk. This comes not too long after we heard that talks were back on with both Singapore’s PSA International and France’s CMA CGM for the construction and management of the platform. The statements confirm reports in March that talks with both companies for the USD 300-400 mn project had fallen through and had been awarded to the Port Said Container and Cargo Handling Company.

Damietta Port Authority to sign loan agreement with EIB to finance second container terminal

The Damietta Port Authority is set to sign a loan agreement with the European Investment Bank (EIB) to finance the establishment of a second container terminal, Authority head Ayman Saleh tells Al Shorouk. Saleh doesn’t provide any clarity on the timeline for the agreement. We had reported in February that the Damietta Port Authority was in talks with a number of international lenders to secure a USD 305 mn loan to fund the container terminal project. PricewaterhouseCoopers had been tapped last year to conduct feasibility studies.

Basic Materials + Commodities

Agriculture Ministry could take measures against subsidized fertilizer suppliers for missing monthly deliveries

The Agriculture Ministry is reportedly considering imposing sanctions on suppliers of subsidized fertilizers who have fallen behind on their monthly deliveries, creating a shortage in the market, ministry sources said yesterday. Manufacturers say they lose as much as EGP 250 per tonne on government contracts, which has led them to direct most of their output lately towards exports, they added.

Manufacturing

OUD to tender Gulf of Suez industrial complex in 3 months

Oriental Weavers subsidiary Orientals for Urban Development (OUD) is planning to tender its Gulf of Suez industrial complex to investors in three months’ time, founder Mohamed Khamis said in statements carried by Al Shorouk The complex is set to house different manufacturers from across industries, including food, petrochemicals, and furniture.

Telecoms + ICT

ICT Ministry plans to launch government based blockchain project in 4Q2018

The ICT Ministry is planning to launch a government based blockchain project in 4Q2018, in cooperation with an unnamed technology company, an unnamed source tells Amwal Al Ghad. The blockchain platform is expected to be used by government institutions at a later stage, the source adds. The National Bank of Egypt (NBE) has already been exploring different commercial application of blockchain technology.

SICO to invest EGP 200 mn on new production lines at its Assiut factory

Egyptian electronics manufacturer SICO plans to invest EGP 200 mn to add new production lines to its Assiut factory this year, CEO Mahmoud Salem said, Amwal Al Ghad reports. Salem had previously said the company plans to raise its CAPEX to EGP 1 bn over the coming three years, from a current EGP 422 mn.

Automotive + Transportation

China’s CRR front runner to supply 1,300 railway cars

CRRC Corporation Limited (CRRC) is now the front runner in a tender to supply the Egyptian National Railways with 1,300 railway cars, offering EGP 19-20 bn for the project, sources close to the matter tell Al Mal. Under the 15-year supply and maintenance contract, Egypt will pay for the project through a loan with a four-year grace period for repayment. The government is trying to extend that period, sources added. Last week, the ministry was negotiating to lower the price offered by the Russian-Hungarian consortium from EUR 1 bn to EUR 950 mn.

NRA gearing up to launch tenders to conduct feasibility studies on three rail projects

The National Railways Authority (NRA) is gearing up to launch tenders to conduct feasibility studies on three rail projects, an unnamed government source tells Al Mal. The NRA is currently working with the European Bank for Reconstruction and Development (EBRD) to prepare the terms and conditions for the project, according to the source. The projects include setting up rail lines connecting Giza and the 6 October industrial zone, one in the Rubiky leather city, and a third in 10th Ramadan City. The source did not disclose when the tenders will be launched.

Banking + Finance

CI Capital funds top EIMA’s 1H2018 rankings

CI Capital said yesterday it topped all classes in the Egyptian Investment Management Association (EIMA) Funds’ 1H2018 report. CIB’s Istethmar was the best-performing equity fund, with returns of 22.1% compared to an average return of 10.2% for peers. Aman was the top sharia-compliant fund, while Takamol ranked first in the balanced funds category. Tap or click here for the full rundown (pdf)

BdC studies participation in EGP 2.3 bn loan to Al Ghurair Group’s Al Canal Sugar

Banque du Caire (BdC) is considering joining a consortium of local banks in providing Al Ghurair Group’s Al Canal Sugar with a EGP 2.3 bn short-term bridge loan that will be used to fund its USD 1 bn sugar refinery, Al Shorouk reports. Qatar National Bank Ahli, AlexBank, National Bank of Egypt, and NBK Egypt were said to be among the banks contributing to the facility, whose lead arranger is the National Bank of Egypt.

MBE to offer EUR 100 mn to Egypt’s export companies as credit facilities

Misr Bank-Europe is planning to provide Egyptian exporters with as much as EUR 100 mn in credit facilities “in the coming period,” CEO Gerald Bumharter tells Al Mal. MBE plans to allocate between EGP 25-30 mn per company and is in talks with Deutsche Bundesbank to arrange the loan to finance the export of various products, — including textiles and fruits and vegetable — to Europe.

Other Business News of Note

India’s SPP Pumps to invest EGP 100 mn in Egypt by 2020

India’s SPP Pumps is planning on investing EGP 100 mn in Egypt by 2020, Chairman Mohammed Hassan said on Saturday, Al Masry Al Youm reports. The company has already invested a total of EGP 55 mn in Egypt, and recently won a contract to supply pumps for the construction of the government district in the new administrative capital.

Law

Alex Port Authority taps Sarie Eldin to advise on multipurpose platform project

The Alex Port Authority has tapped Sarie Eldin & Partners as legal advisor for the USD 450 mn multipurpose platform project at the Alex Port, an unidentified source tells Al Mal. The port authority had signed an agreement with the Suez Canal Authority and the Land Maritime Transport Holding Company to establish a EGP 500 mn holding company to construct, manage, and operate the platform. The facility was originally meant to be constructed by China Harbour until talks reached an impasse due to pricing.

On Your Way Out

The Associated Press cast a spotlight on Egypt’s Nubian community yesterday in a series of articles meant to highlight their struggle and attempts, through the years, to revive the dream of their once cherished homeland. While the older generation appears to have largely accepted the “trauma” of mass displacements, younger activists say they are more determined, with a “new spirit,” to push for their rights, says the newswire.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.93

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 15,842 (-0.2%)

Turnover: EGP 446 mn (54% below the 90-day average)

EGX 30 year-to-date: +5.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.2%. CIB, the index heaviest constituent ended up 0.4%. EGX30’s top performing constituents were Egyptian Iron & Steel up 2.2%, Abu Dhabi Islamic Bank up 1.3%, and Pioneers Holding up 1.2%. Yesterday’s worst performing stocks were Amer Group down 3.3%, Arab Cotton Ginning down 2.8%, and Global Telecom down 2.6%. The market turnover was EGP 446 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +2.9 mn

Regional: Net Short | EGP -16.5 mn

Domestic: Net Long | EGP +13.5 mn

Retail: 79.3% of total trades | 79.5% of buyers | 79.1% of sellers

Institutions: 20.7% of total trades | 20.5% of buyers | 20.9% of sellers

Foreign: 8.2% of total | 8.5% of buyers | 7.9% of sellers

Regional: 8.4% of total | 6.6% of buyers | 10.2% of sellers

Domestic: 83.4% of total | 84.9% of buyers | 81.9% of sellers

WTI: USD 70.72 (-0.41%)

Brent: USD 75.03 (-0.40%)

Natural Gas (Nymex, futures prices) USD 2.77 MMBtu, (+0.55%, August 2018 contract)

Gold: USD 1,242.00 / troy ounce (+0.06%)

TASI: 8,405.09 (+0.51%) (YTD: +16.31%)

ADX: 4,696.20 (+0.20%) (YTD: +6.77%)

DFM: 2,900.16 (+0.55%) (YTD: -13.94%)

KSE Premier Market: 5,336.40 (-0.15%)

QE: 9,340.69 (+0.24%) (YTD: +9.59%)

MSM: 4,456.76 (+0.36%) (YTD: -12.60%)

BB: 1,343.84 (+0.10%) (YTD: +0.91%)

Calendar

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

26-28 July (Thursday-Saturday): Green Banking: The Road to Sustainable Development, Baron Palace, Sahl Hasheesh, Hurghada.

05 August (Sunday): Egypt’s PMI reading for July released.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.