Paul Krugman jumps on EM Zombie Apocalypse bandwagon

With our random sappiness out of the way, may we just say while it could be the lack of coffee speaking, but: We’re getting a little bit tired of the wall-to-wall coverage of the Emerging Markets Zombie Apocalypse?

Nobel Prize-winning economist and columnist Paul Krugman got in on the party yesterday suggested we could be looking at a 1990s Asian financial crisis-style meltdown, which Bloomberg helpfully notes saw “developing-nation stocks [slide] 59 percent and governments [raise] interest rates to exceptionally high levels.” Krugman wrote on Twitter: “It’s become at least possible to envision a classic 1997-8 style self-reinforcing crisis: emerging market currency falls, causing corporate debt to blow up, causing stress on the economy, causing further fall in the currency. … Are we seeing the start of another global financial crisis? Probably not — but I’ve been saying that there was no hint of such a crisis on the horizon, and I can’t say that anymore. Something slightly scary this way comes.”

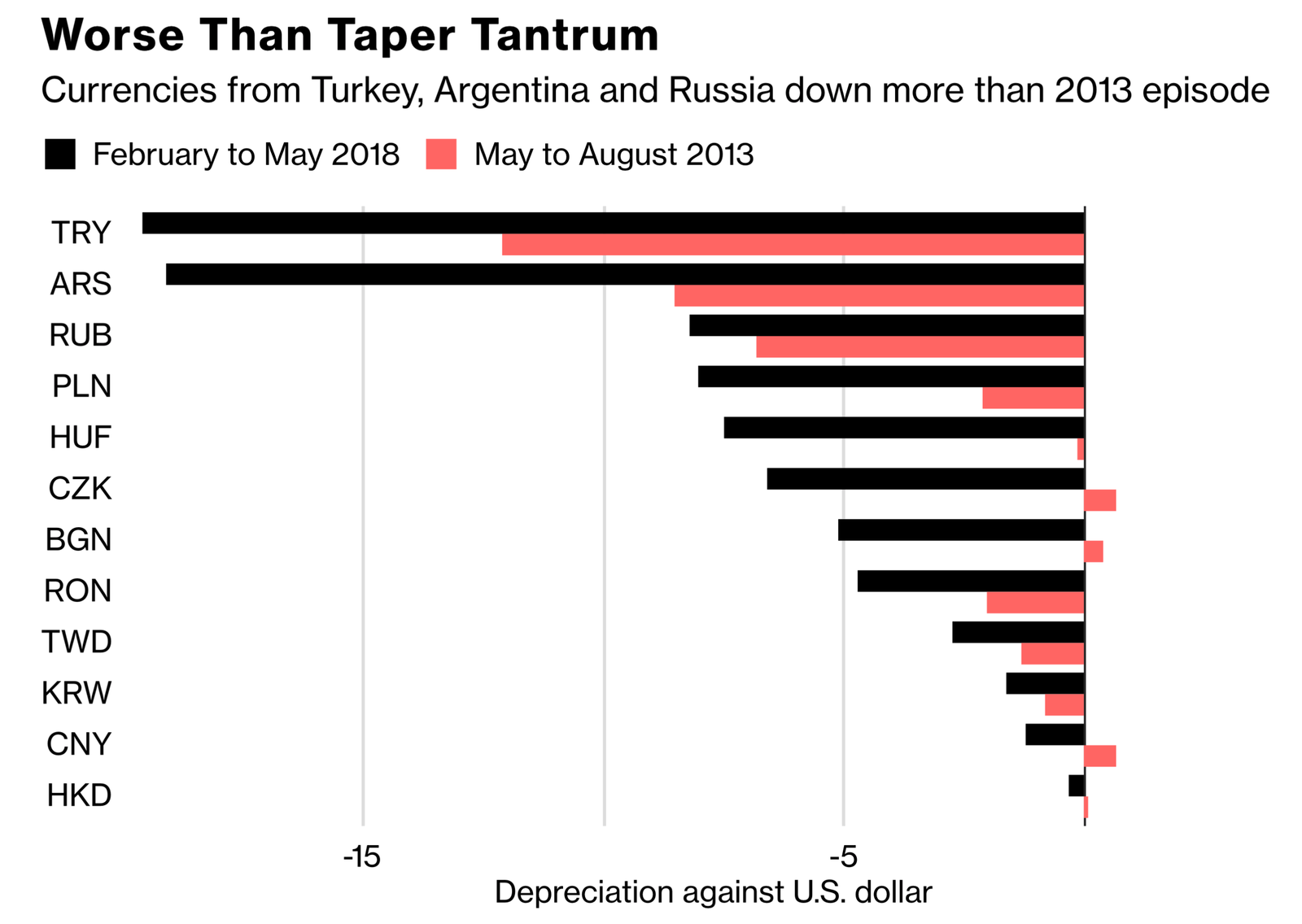

As of now, Bloomberg adds, a dozen EM currencies have tumbled more since February than they did during the 2013 taper tantrum, such saw its five-year anniversary on Tuesday.