- EXCLUSIVE- Cabinet mounts push for state-owned companies start paying overdue energy bills; will channel funds to energy companies. (Speed Round)

- Fuel prices could rise by as much 60% next fiscal year. (Speed Round)

- Gov’t to announce EGP 15 bn social protection package in July to offset rising prices. (Speed Round)

- The Emerging Markets Zombie Apocalypse continues, and Mark Mobius sees buying opportunities. (What We’re Tracking Today)

- Egypt and Russia finally sign contracts for USD 7 bn Russian industrial zone. (Speed Round)

- Emaar Misr, El Nasr reach settlement agreement in Uptown Cairo land dispute. (Speed Round)

- Officials broke ground yesterday on the third phase of Cairo Metro Line 3. (Speed Round)

- New European regulation in effect from tomorrow could impact every Egyptian business with a website. (Spotlight)

- We may next eat at … 6:47pm CLT.

- The Market Yesterday

Thursday, 24 May 2018

Gov’t girds for summer of energy price hikes

TL;DR

What We’re Tracking Today

We hope you, like us, have had a wonderful week and are looking forward to the second weekend of Ramadan. We are forever grateful for the privilege of writing all of you each morning.

Our top three stories this morning are at the intersection of energy and social stability. Sources close to Cabinet tell us that ministers are pushing state-owned companies to start making good on arrears owed to energy companies. The energy companies have already been given new incentives — by rising oil prices (for IOCs) and a mix of state contracts and deregulation (electricity producers and contractors) — to play ball. That incentive is about to get sweeter (directly and indirectly) for some of them: Capital Economics suggests that rising oil prices could force the state to raise fuel prices by as much as 60% in the new fiscal year starting in July, and we’ve already reported this week that electricity prices could rise by as much as 55% this summer. Capital economics thinks the impact on inflation of the subsidy phase-out will be limited and transient. Either way, cushioning low income earners from the impact of subsidy reform this summer is high on Cabinet’s agenda: Ministers are reportedly preparing to sign off on an EGP 15 bn package of new spending to strengthen the social safety net.

We have chapter and verse in today’s Speed Round.

With our random sappiness out of the way, may we just say while it could be the lack of coffee speaking, but: We’re getting a little bit tired of the wall-to-wall coverage of the Emerging Markets Zombie Apocalypse?

Nobel Prize-winning economist and columnist Paul Krugman got in on the party yesterday suggested we could be looking at a 1990s Asian financial crisis-style meltdown, which Bloomberg helpfully notes saw “developing-nation stocks [slide] 59 percent and governments [raise] interest rates to exceptionally high levels.” Krugman wrote on Twitter: “It’s become at least possible to envision a classic 1997-8 style self-reinforcing crisis: emerging market currency falls, causing corporate debt to blow up, causing stress on the economy, causing further fall in the currency. … Are we seeing the start of another global financial crisis? Probably not — but I’ve been saying that there was no hint of such a crisis on the horizon, and I can’t say that anymore. Something slightly scary this way comes.”

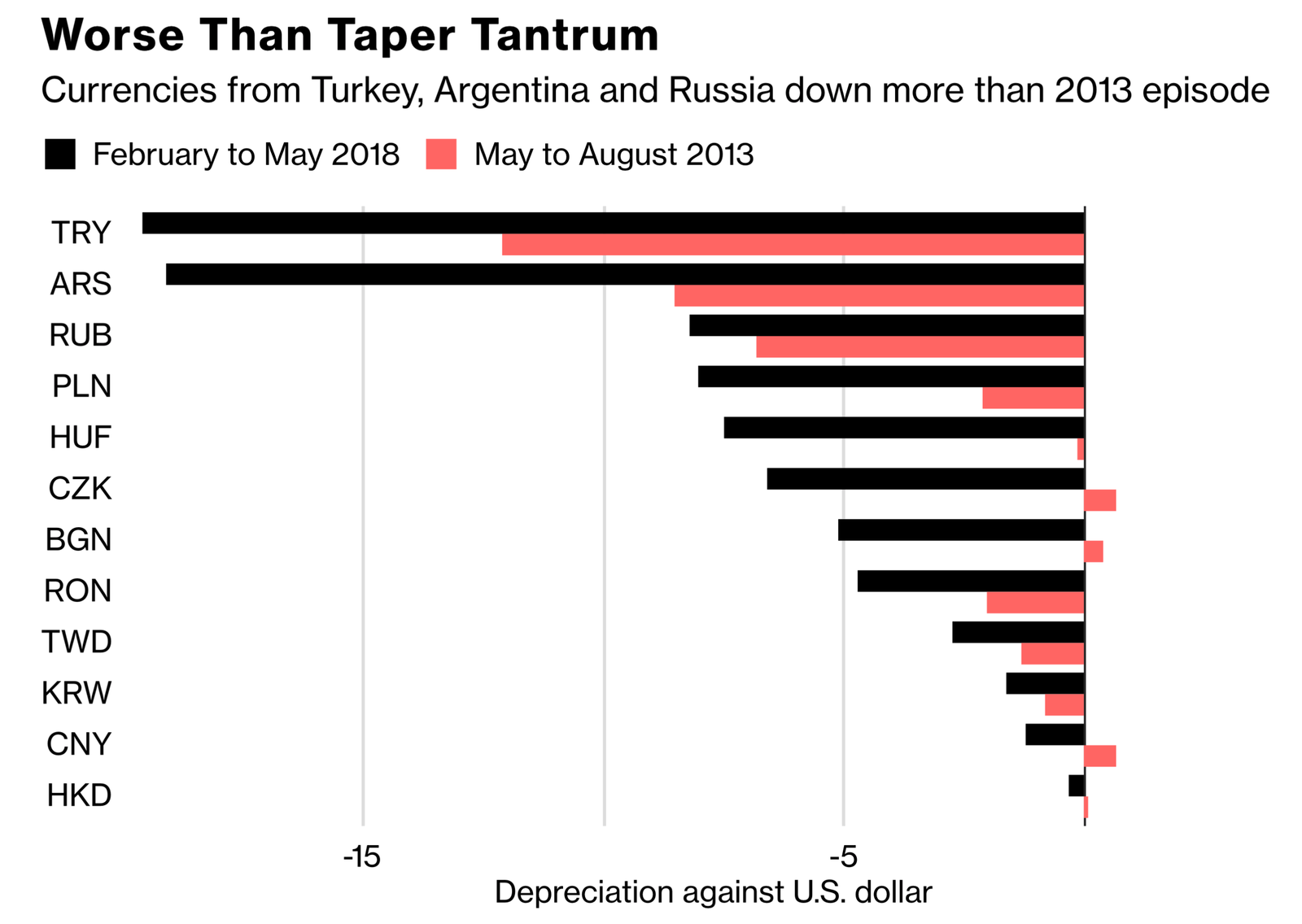

As of now, Bloomberg adds, a dozen EM currencies have tumbled more since February than they did during the 2013 taper tantrum, such saw its five-year anniversary on Tuesday.

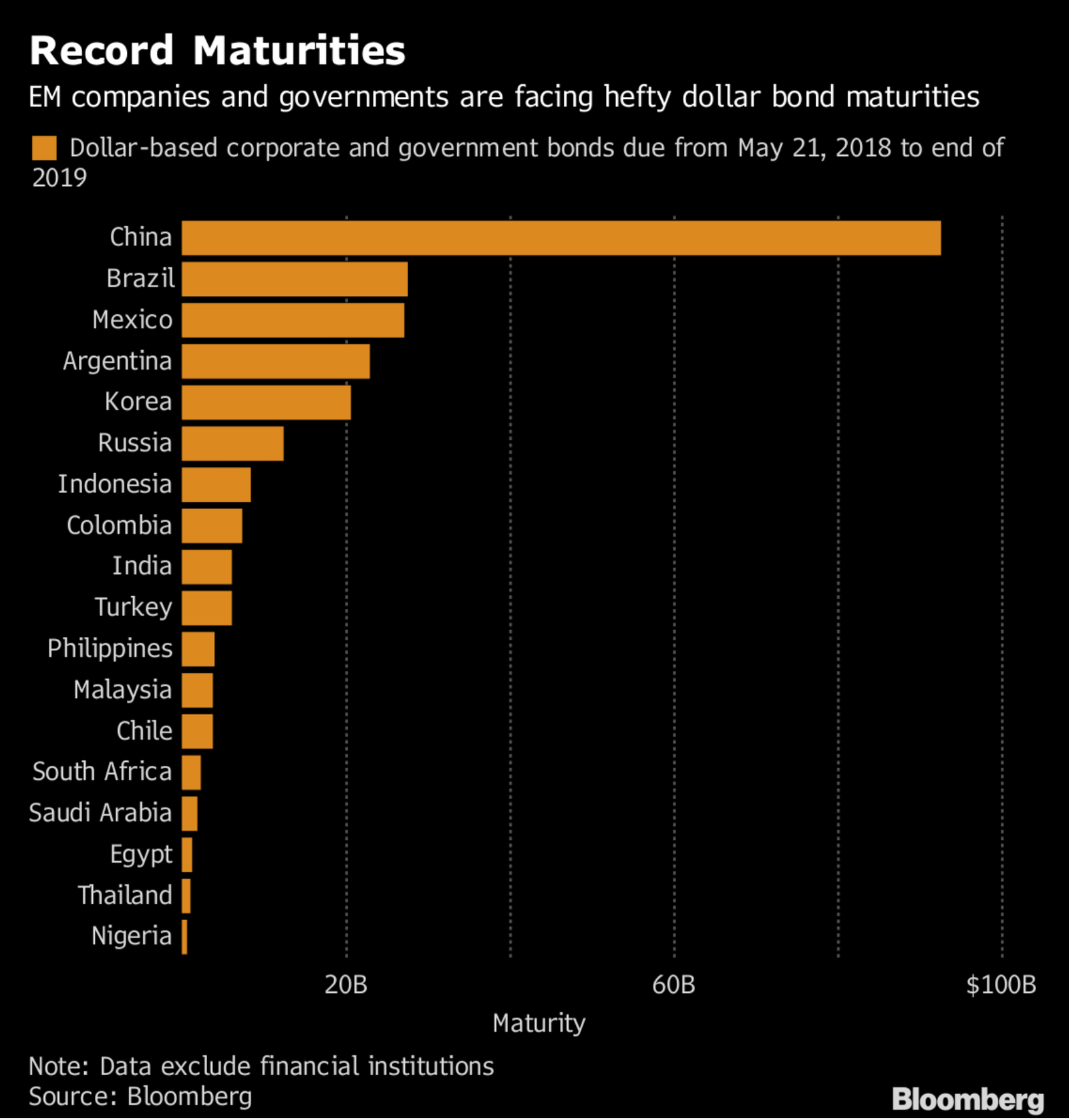

Will the stress get worse when EM run into a “looming” debt wall? Are we really facing a “contagion”? Bloomberg has compiled data suggesting that EM companies and governments are “straining to deal with the rising cost of borrowing in USD” and have some USD 249 bn that will need to be repaid or refinanced through next year. “That’s a legacy of a decade-long debt binge during which emerging markets have more than doubled their borrowing costs in USD, ignoring the many lessons of history from the 1980s Latin American debt crisis, the 1990s Asian financial crisis and the 2000s Argentine default.” Egypt is near the bottom of the list of 18 countries that Bloomberg says are potential “points of stress” and doesn’t make its list of the 16 most fragile EM as measured by the ratio of foreign debt exposure to GDP.

Into the fray rides the Financial Times, which writes that the last time sub-Saharan African countries had this much debt was just “before the debt forgiveness programme of the early 2000s,” citing a report by credit rating agency S&P.

As usual, Mark Mobius is the voice of reason. The iconic, 81-year-old EM investor, who left Franklin Templeton earlier this year to set top Mobius capital Partners, told Bloomberg yesterday that, “We still could have some downside in the emerging markets, but selectively, you have some good opportunities. Now would be a stock picker’s market.” Mobius singled out Indian financial and tech stocks and said that if the correction deepens, Chinese tech shares could start to look interesting. Also looking good: South Africa, Russia, Malaysia and South Korea.

Other stuff that’s on our radar this morning:

- Standard Chartered and Barclays kicking the tires on a potential merger, the FT reported yesterday in an exclusive.

- Deutsche Bank plans to cut as many as 10k jobs (or about 10% of its workforce), with the deepest cuts hitting the investment banking division in the US and the UK. (Wall Street Journal | Reuters | Financial Times)

- The Fed’s worries that trade tensions may dampen business sentiment in the US saw the biggest fall in the two-year treasury bill yield fall so far this year. (Financial Times)

- The UAE’s proposal to allow 100% foreign ownership of companies in the Emirates could be limited to specific industries. (Bloomberg)

Your Ramadan rundown for today:

Bank hours run 09:30 am to 01:30 pm for customers and from 09:00 am to 02:00 pm for employees, CBE announced.

The EGX is running shorter trading hours. The trading session kicks off at 10:00 am, but closes at 1:30 pm. Tap or click here for the full schedule.

It’s going to be hot through the weekend: The ongoing heatwave is continuing today, but temperatures will finally drop below 40°C with forecasts for a daytime high of 38°C, according to the Meteorological Authority. Respite comes on Sunday (yeah, Sunday, not Saturday, according to the updated forecast), when you can expect a string of days at 33°C running through the end of next week. Northern coastal cities can expect to see some rainfall today.

So, when do we eat? For those of us, Maghrib is at 6:47 pm CLT today. You’ll have until 3:15 am tomorrow to finish your sohour.

On The Horizon

Our friends at AmCham are holding their annual general meeting and iftar next Tuesday, 29 May. Their guest speaker will be Education Minister Tarek Shawki, who will speak about the government’s “national strategy for education transformation in Egypt.” If our own little company’s iftar wasn’t scheduled for the same night, we’d attend: We don’t know Tarek Shawki, but the man is brave to push for sweeping education reform, and none of us in the business community (ourselves included) are doing enough to support him. Hats off to AmCham for inviting him to speak. Members and their guests and register here to attend the iftar and AGM.

Enterprise+: Last Night’s Talk Shows

The nation’s talking heads are on hiatus, stuffing themselves with konafa while we toil through the Holy Month.

Speed Round

EXCLUSIVE- Cabinet is pushing state-owned companies start paying overdue energy bills; will channel funds to energy companies: The Ismail Cabinet is pushing state companies falling under the umbrella of the Public Enterprise Ministry start paying overdue gas and electricity bills so that the government can accelerate payments to foreign energy companies and other contractors, sources close to Cabinet tell us. In addition to payments owed by the Oil Ministry to international oil companies, Siemens and GE still have receivables on their books owed by the Electricity Ministry, sources said, adding that the arrears were a subject of discussion at this week’s cabinet meeting. CBE Governor Tarek Amer had said earlier this month that Egypt plans to pay IOCs USD 850 mn without noting the timeline for the disbursement.

Oil Ministry sources had previously said that Egypt will pay IOCs USD 200 mn in June. The Oil Ministry’s arrears had dropped to USD 2.4 bn as of June 2017, but the ministry has been preferentially making payments to the global oil majors while starving local producers, industry sources tell us.

In related news, CIB, Banque Misr, NBE, and Banque Du Caire are reportedly arranging a USD 550 mn syndicated loan to the Oil Ministry to help it pay down its arrears. Banque Misr Vice Chairman Akef El Maghraby said his bank has successfully placed USD 100 mn of the facility with eight local banks.

The government is going so far as to have four state holding companies starved for liquidity sell off assets to the private sector. Among them is the Cotton & Textile Industries Holding Company, whose CEO Ahmed Moustafa tells us that they are holding meetings with Public Enterprise Minister Khaled Badawi to determine which assets of its 22 companies to sell and how to proceed. He added that the company owes a total of EGP 2 bn in overdue bills. It plans to make an initial payment of EGP 350 mn and will sell assets worth EGP 1.7 bn to pay off the remainder.

Gov’t sorts out overdue bills: The Ismail Cabinet had set on Tuesday a timetable for when these companies need to start paying their overdue bills. State companies must make a 25% upfront payment of the bills, with the remaining 75% to be paid in 36 months. State companies must commit to paying their monthly bills on time, according to a cabinet statement.

Fuel prices could rise by as much 60% next fiscal year: Research firm Capital Economics expects the government to raise fuel prices by as much 60% in FY2018-19 to meet IMF fiscal targets. It sees rising global oil prices as the cause for this increase. “The government will now be forced to increase administered prices by more than it otherwise would have done in order to meet IMF-mandated fiscal targets,” Capital Economics said its Egypt Macroeconomic Update (pdf). The government is planning on cutting fuel subsidies 19.1% to EGP 89.08 bn in the FY2018-19 budget, which it drafted before oil prices shot up to USD 80/bbl. This comes as the House of Representatives Budget Committee is debating whether to set aside more funds in case the government overshoots its 2018-19 budget deficit target as a result of higher oil prices.

No date has been set for the next fuel price hike, Oil Ministry spokesperson Hamdy Abdel Aziz said yesterday, Al Shorouk reports. He advised citizens to ignore news reports and rumors and wait for an official announcement from the government.

As for electricity, Capital Economics’ outlook is in line with reports on Tuesday suggesting July’s power price hikes could be as steep as 55% for top tier consumers. Other reports suggested that the minimum price increase would be 15% or 33%. Government sources have consistently said that the increases will be applied across all consumption tiers, but it remains to be seen whether the Ismail Cabinet will decide at the last minute to shield the poor and low-income consumers from the hikes.

Capital Economics sees limited, transient impact on inflation: “This may result in a slight bump in inflation in July, but we still think that the trend will be towards weaker price pressures over the coming years,” the report says. The rising inflation will be mitigated by higher interest rates, and “the adoption of inflation targeting will anchor inflation and inflation expectations.” Lower inflation will ease household spending pressures and allow the CBE to proceed with the monetary easing. As the government has made good progress on reining the budget deficit, this shall give room for the government it to ease austerity measures, the firm said.

Gov’t to announce EGP 15 bn social protection package in July: The government is planning to further reinforce the social safety net at the beginning of July to offset the impact of the planned electricity and fuel hikes, unnamed government sources tell Al Mal. Prime Minister Sherif Ismail had previously announced the package would be rolled out in Ramadan. The measures will include a “marginal” increase in the monthly allowance ration card holders use to purchase subsidized commodities, in addition to an across-the-board “exceptional” wage increase for civil servants. The sources did not disclose further details on the size of either increase. Overall spending on commodity subsidies is expected to rise 36.6% next year to EGP 86.18 bn. The Planning Ministry had also reportedly amended the Civil Service Act’s executive regulations to pave the way for public sector employees to get bigger annual raises.

The measures will be less extensive than those in the EGP 85 bn package the government rolled out last year before raising fuel prices 55% at the beginning of the 2017-18 fiscal year, the government source notes. These included increasing state pensions, monthly allowances under the Takaful and Karama cash subsidy programs, and implementing a 7% annual raise and 7% hardship raise for state bureaucrats, among others.

Egypt and Russia finally sign contracts for USD 7 bn RIZ: Trade and Industry Minister Tarek Kabil signed the contracts to establish the USD 7 bn Russian Industrial Zone (RIZ) on Wednesday, according to a ministry statement. The long-awaited 50-year agreement will give Russian companies rights to develop a 5.25 mn sqm stretch of land in the Suez Canal Economic Zone, giving them a jumping off point to export to the rest of the region, the ministry said. First phase construction of the RIZ is expected to cost around USD 190 mn, according to Reuters. The signing took place on the sidelines of the Egyptian-Russian Economic Committee meetings.

Also from the meetings: Egypt will start trade talks in September with the Russia-led Eurasian Economic Union, Kabil said yesterday, Al Masry Al Youm reports. Kabil agreed with the union’s Trade Minister, Veronika Nikishina, to create a specific roadmap and timeline for the negotiations to speed up the process. The agreement between Egypt and the union — which includes Russia, Armenia, Belarus, Kazakhstan, and Kyrgyzstan — was in the final stages of drafting last August.

El Nasr Housing and Reconstruction appears to have accepted Emaar Misr’s offer to settle their dispute over land for Uptown Cairo, Public Enterprises Minister Khaled Badawy told the press yesterday, Al Mal reports. Badawy said state-owned El Nasr would have lost the international arbitration case it filed against Emaar last July. It’s claims are baseless, he suggested, as the property developer was not issued a full set of licenses to begin working on the project. El Nasr had claimed that Emaar failed to develop 3 mn sqm of land allotted to it back in 2005 and that there are 215k sqm of Uptown that are technically outside the project’s borders.

Reports emerged earlier this week claiming that El Nasr plans to proceed with the arbitration against Emaar, despite an earlier statement by a board member saying that El Nasr’s general assembly voted to accept Emaar’s EGP 100 mn settlement offer. Badawy said he pushed both sides to come to an out-of-court settlement. We suspect the case also came up during an Ismail Cabinet meeting on Tuesday that dove into lingering high-profile disputes between the state and investors.

Officials broke ground yesterday on the third phase of Cairo Metro Line 3, a Cabinet statement says. Our friends at Orascom Construction began their tunneling work on the line right after Prime Minister Sherif Ismail gave the signal at a ceremony, according to an emailed statement (pdf), which explains that the project is being executed by “an Egyptian-French joint venture comprised of VINCI, Bouygues and Arab Contractors” and that the third phase of Line III will stretch across 18 km of tunneling and viaduct works, including 15 elevated, grade and underground stations,” according to Orascom.

Background: Orascom and Eurovia subsidiary ETF had signed back in 2016 the EGP 180 mn + EUR 60 mn agreement to execute the civil and track work for the line with the Transport Ministry. A EUR 300 mn loan from the French Development Agency and a EUR 600 mn loan from the European Investment Bank are covering 60% of the project’s cost, while the Egyptian government will cover the remainder. The total price tag stands at EUR 1.53 bn and EGP 10.5 bn, according to National Authority for Tunnels (NAT) head Tarek Gamal El Din.

This phase is expected to be complete and operational in around six years, Gamal El Din said, Al Masry Al Youm reports. Once it opens its doors to commuters, it will save state coffers c. EGP 2 bn per annum from lower fuel consumption and broad environmental benefits, according to Transport Minister Hisham Arafat.

NAT and French public transport operator RATP had been in talks to establish a JV to operate the new line. Suggestions of the JV entails an 80/20 split ownership, with NAT holding the largest piece of cake. Since April, NAT has been waiting on amendments to the law regulating the authority’s operations to finalize the agreements for the new company, according to NAT spokesman Hassan Tawfik. Zaki Hashem & Partners are reportedly acting as legal advisors to RATP.

Tourism revenues reportedly up 83.3% y-o-y to USD 2.2 bn in 1Q2018, an unnamed government official told Reuters. Tourist arrivals also grew 37.1% y-o-y to 2.38 mn visitors. Tourism in Egypt has been slowly recovering from the political upheaval and security concerns that had caused a downturn in the sector over the last several years since the 2011 uprising. Holiday bookings giant Thomas Cook had said last month that demand for Egypt is on the rise as conditions in the country begin to stabilize.

This comes as we hear that bookings to Croatia are suffering as a result of a revival in Egypt, Turkey, and Tunisia, Total Croatia News reports. British and German holidaymakers are shifting their focus away from Croatia towards more affordable destinations in the Mediterranean Sea, especially as Croatian hotels continue to raise prices, seemingly oblivious to the “dip” in bookings. We noted yesterday that Egypt Tunisia, and Turkey are also luring British tourists away from Spanish coastal city Benidorm.

The Macro Picture

How correct is the notion that a weaker currency means higher exports? Conventional wisdom says the bigger the fall in a country’s currency, the greater the rise in its export volumes. It was, you’ll remember, touted as one of the secondary benefits of the late 2016 float of the EGP. However, according to current and past data compiled and analyzed by the Financial Times, this does not seem to be the case. In the most recent emerging market sell-off, Argentina, Brazil, Russia, South Africa and others have failed to see a rise in their exports despite seeing their currencies plunge in value against major global currencies. The notable exception was Turkey. A working paper published earlier this year by the Bank for International Settlements explains this by suggesting that a strengthening USD has a detrimental impact on exports from EM because it makes finance more expensive and that this financial channel outweighs any competitive edge gained by exporters from weakness in their own currencies.

The conventional wisdom holds true apparently for imports, as the FT’s data shows that the more a currency depreciates the lower import volumes are.

Spotlight

How the European Union’s new data protection regulation affects your business here in Egypt

A new regulation that goes into effect in the European Union tomorrow could have an impact on every Egyptian business with a website. We asked our friends at Sharkawy & Sarhan Law Firm for a primer on what it means to all of us and how to be prepared for it:

Here’s how the European General Data Protection Regulation (GDPR) affects companies in Egypt, starting from tomorrow when it goes into effect. It set out the rules for collecting personal information from individuals. The GDPR applies to all companies outside the EU, as long as they collect personal data in the context of offering goods or services to people located in the EU, or if the collected data is about the behavior of individuals located in the EU. We note that the GDPR refers to persons “in” the EU, regardless their nationality or the place where they usually live.

This means that any personal information you may have collected for future marketing purposes may be subject to the GDPR if the marketing happens when that person was located in the EU. Likewise, if your company has a website with cookies (files that allow you to collect personal information relating to the users of your website), then you must watch out as you never know where the user may be based.

In brief, what the GDPR regulates is mainly the collection, storage, transfer and usage of any information relating to natural persons. This includes the name, location data, online identifier or cultural traits of that natural person, as long as such information may lead to identifying the concerned person.

Fines are massive and can find their way to Egypt. In certain cases, fines can reach up to EUR 20 million or 4% of the company’s total worldwide annual turnover of the preceding financial year, whichever is higher. Administrative fines are imposed by the competent European supervisory authority. Claims for compensation may be also lodged before EU courts. The GDPR additionally requires all EU States to enforce their international cooperation mechanism to ensure cross-border enforcement where necessary — these mechanisms are already in place between Egypt and a number of EU countries.

But you’re not in the crosshairs — not yet, at least. The EU might not apply the extra-territorial effect of the GDPR aggressively on small and medium sized non-EU companies, at least at the early stages. Instead, we expect it to start by targeting large global companies, such as Facebook and Google. It might also focus on substantial leakages of personal data that result in actual damages. So if this is the first time you hear about the GDPR, don’t panic — but don’t ignore it, either. You still need to comply.

What you can do now? If your company collects personal information about people outside Egypt, make sure that the concerned persons know who you are, the type of information that you are collecting, and why. For instance:

- If your company sends out newsletters, send an email to your list of addressees to seek their consent, with a link directing them to more details on your privacy policy. Remove from your list those who do not agree to receive the newsletters;

- If your website uses cookies, install a pop-up on your website that notifies the user that these cookies exist;

- If someone requests to correct or delete their data, make sure you comply;

- If you do not have a privacy policy, set up one that is clear and easy to understand;

- If you outsource service providers who collect personal data on your behalf, discuss GDPR compliance with them;

- Also, depending on the nature and amount of personal data that you collect, you may need to designate a representative in the EU.

For your background, Egypt does not have a generic data protection law, although various regulations include privacy and secrecy regulations that apply in specific situations. The Egyptian Constitution of 2014 sanctifies private life. It also provides for the secrecy of emails, phone calls and other means of communication and prohibits their monitoring and confiscation without a prior court order and for a limited period. However, it remains to be seen how and whether Egypt will be taking effective steps towards further protection of data protection, especially in light of the new draft law against crimes using technical means, which is currently being drafted.

Want more? Visit these links (here and here, both pdfs) for more practical insights on the GDPR.

Egypt in the News

Egypt’s human rights record is black in the spotlight for the foreign press after the arrest yesterday of blogger and activist Wael Abbas. Rights groups are saying that move is part of a campaign to silence government critics, Reuters reports. “The roundup appeared to be one of the most far-reaching since the government clampdown that took place in 2013 … The current crackdown reflects the government’s concern about political instability as a painful economic overhaul is rolled out and voices critical of the state are suppressed,” the Wall Street Journal writes. “Egyptians who hoped that President Abdel Fattah El Sisi’s thumping victory in the March presidential election … would encourage the authoritarian government to soften its crackdown on dissent have been disappointed,” adds the New York Times.

Meanwhile, the Armed Forces condemned yesterday a Human Rights Watch report accusing Egyptian forces of destroying homes in North Sinai as they move against terrorist groups and operatives in the area, Asharq Al-Awsat reports. Military spokesperson Tamer Refai said the report was based on “undocumented” evidence and stressed that the military has been taking every precaution protect civilians and civilian infrastructure in North Sinai during the anti-terror campaign.

Drivers working for ride-hailing services are worried about new fees set out by the Ride-Hailing Apps Act despite the support for the bill shown by Uber and Careem, notes the Saudi Gazette. “It is too much for an Egyptian,” says one drivers. “As soon as the law is implemented, I will leave Uber,” says another. The laws will require drivers to pay EGP 3,000 for a special license, which is more than many can pay, the newspaper says.

Other headlines worth noting in brief this morning:

- Daesh offshoots in Egypt, Yemen,and Afghanistan are vital to the group’s continued existence as they provide it with “propaganda presence to maintain its transitional brand after its losses in Syria and Iraq,” says the National.

- Hundreds of Palestinians rushed to the Rafah border crossing as soon as Egypt opened it last week, hoping to use the rare occasion to exit the besieged enclave, the Wall Street Journal reports.

- Egyptian sports academy Children Without Shelter hopes to improve the lives of orphans and street children through football, Reuters reports.

Worth Reading

How exactly does plastic factor into our planet’s health? The global plastic waste crisis is very much real and National Geographic has the numbers and infographs to prove it. According to the magazine, 18 bn pounds of plastic waste ends up in the planet’s oceans every year — a number that could likely be reduced if we cut back on plastic packaging, which is used once and not recycled despite accounting for 40% of plastic produced. It may seem difficult, but the human race has only really become this dependent on plastic in the past two decades: Almost half of all the plastic ever produced has been made since 2000. Check out the magazine’s years-long series, Planet or Plastic, for a world of material on how and why plastic is the “scourge of the Earth.”

Worth Watching

A video released by the British Pathé news archive shows how cotton was grown in Egypt, during the haydays of the 1940s (watch, runtime: 08:32). The silent footage demonstrates the steps of cotton cultivation, from preparing the land and irrigation to sowing the cotton seed and harvesting the crops. Film nerds with a thing for documentaries in the silent era would find it worth it. For more old footage of Egypt, you can check the British Pathé video library.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met with Jordan’s King Abdullah in Cairo yesterday, according to an Ittihadiya statement. The two leaders discussed regional issues, particularly the latest developments on the Gaza crisis. They reiterated the need to resume direct Palestinian-Israeli negotiations for a two-state solution.

Egypt gets EGP 3.2 mn grant from Spain for National Judicial Studies Center: Investment and International Cooperation Minister Sahar Nasr signed yesterday a EGP 3.2 mn grant agreement with the Spanish government for the Justice Ministry-affiliated National Center for Judicial Studies, according to an emailed statement (pdf). The grant will help cooperation with Spain in several legal areas, including combating corruption, money laundering, and cyber crimes.

Energy

Tharwa Petroleum readies to drill in North Sinai’s Noor concession

Tharwa Petroleum is waiting for final gas exploration approvals to begin drilling in the Noor concession in North Sinai, a company source says. The number of wells to be drilled will be determined once the contracts are signed, they added. The Cabinet had approved earlier this month a USD 105 mn exploration agreement with Eni and Tharwa to search for oil and gas in the Mediterranean off the coast of North Sinai. Parliament had signed off on the agreement earlier in the week.

Oil Ministry wants Haliburton to advise on maturing fields

Oil Minister Tarek El Molla met with Halliburton’s Executive Vice President of Global Business, Eric Carre, on Wednesday to discuss the possibility of the company advising the ministry on strategies on further development on maturing fields, according to an Oil Ministry statement. They also discussed progress on the seismic database currently being developed to market Egypt’s reserves.

Infrastructure

Gov’t to turn Minufiya landfill into EGP 40 mn recycling plant

The government is planning to launch development on a EGP 40 mn recycling plant today on the site of what was once an informal landfill in Minufiya, according to a statement from the Ismail Cabinet. The Abu Kharita landfill, the largest of its kind in Egypt, was recently cleared from nearly 280k tonnes of garbage as part of a wider government plan to eliminate informal landfills across the country, including 12 around Cairo.

Basic Materials + Commodities

Gov’t could tap int’l wheat market early after Dubai’s AOS failed to deliver on contracted shipments

Dubai-based trader AOS has failed to deliver two of its wheat cargoes to Egypt, which may force the government to tap international wheat markets sooner than expected to maintain wheat reserves, Reuters reports. Supply Minister Ali El Moselhy tells the newswire that the company was given two extensions for delivering the wheat but had failed to meet both deadlines. The ministry’s wheat buyer GASC through the international wheat market off last week by holding an international tender, despite the ongoing domestic harvest season, which has been proving bountiful and where wheat imports usually halt. The Supply Ministry said on Tuesday that it had purchased a total of 3 mn tonnes of wheat from local farmers so far this year at a cost of EGP 11.8 bn, according to Reuters.

116k feddans of the 1.5 mn feddans project was cultivated

Almost 116k feddans of the 1.5 mn feddans project was cultivated in FY2017-18, according to a CAPMAS release. Minya topped the list with 70,000 feddans (accounting for 60.5% of the total cultivated area), followed by Matrouh with 35,000 feddans (30.3%) and El Wadi El Gedid with 10,000 (8.6%). The Egyptian Countryside Development Company announced last month that it was planning to tender 800k feddans of the project this year.

Manufacturing

Military Production Ministry eyes cooperation with Portugal to manufacture tablets, laptops

Military Production Minister Mohamed El Assar met yesterday with the CEO of Portuguese electronic product design company JP Sá Couto to discuss potentially cooperating in manufacturing electronic tablets and laptops, according to state news agency MENA.

Real Estate + Housing

Misr Italia buys 110 feddans for EGP 9 bn project in new capital

Real estate developer Misr Italia Properties has purchased a 110 feddan plot in the new capital to build an EGP 9 bn project, Al Mal reports. The company is currently in talks with global consultants and architects to join the project.

Telecoms + ICT

TE to settle with Etisalat, Orange for EGP 1.2 bn

Telecom Egypt (TE) will pay EGP 1.2 bn to Etisalat Misr and Orange Egypt to settle past and long-standing disputes which had gone through arbitration proceedings, the company said in its general assembly minutes (pdf). TE will pay Etisalat the lion’s share of EGP 924 mn over TE withholding payments for using Etisalat’s network to run international calls. TE will pay Orange EGP 250 mn over a dispute over utilization fees.

Banking + Finance

CBE instructs banks to verify licensing of charities before accepting donations

The CBE has instructed banks to make sure NGOs and charities have the required licenses from the Social Solidarity Ministry as per the 2017 NGOs law before opening accounts for them to receive clients’ donations.

Egypt Politics + Economics

Egypt holds first workers union elections after Labor Unions Act’s passage

Egypt held the first workers union elections in 12 years yesterday, Gulf News reports. The vote comes six months after the contentious Labor Unions Act, which regulates the formation and activities of workers unions, passed the House of Representatives. The legislation earned the ire of many as it made its way through Parliament, including the International Labor Organization, the World Federation of Trade Unions, and the Egyptian Federation of Trade Unions for being too restrictive to union activity and freedom. The law does not allow for the formation of independent unions. Some unionists speaking to Gulf News also say the process was “rushed” to get Egypt removed from the ILO’s “blacklist” for allegedly violating workers’ rights.

Nation’s Future becomes the largest party in the House

The Nation’s Future Party now has the largest number of seats in the House of Representatives with nearly 350 MPs, Deputy Chairman Alaa Abed tells Al Shorouk. The rapidly growing party is quickly rising to the top with dozens of MPs defecting from other parties to join. Over 50 members of the Free Egyptians Party and Al Wafd’s former Deputy Chairman Houssam El Khouly have signed on to join the Nation’s Future.

Gov’t working on national strategy for economic development of lakes

The government is studying ways to develop the country’s lakes and develop a national strategy to make use of them commercially, according to a statement from the Ismail Cabinet. The national strategy to develop lakes aims to address issues including pollution, climate change, and overfishing, as well as to facilitate investment in sustainable fish farming.

Egypt top prosecutor refers 40 to trial on human trafficking

Prosecutor General Nabil Sadek referred 40 suspects to trial yesterday on a host of charges including human trafficking, migrant smuggling, bribery, and forging official documents, the Associated Press reports. If convicted, the suspects could face prison sentences of up to 15 years. The prosecution is yet to set a date for the trial.

On Your Way Out

Greco-Roman bath discovered in Gharbiya: Egyptian archaeologists have unearthed parts of a “massive” red brick structure that could be a Greco-Roman bath at Sen El Hagar archaeological site in Gharbiya, according to the Antiquities Ministry.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.96

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.77 | Sell 17.87

EGX30 (Wednesday): 16,663 (Almost Flat)

Turnover: EGP 684 mn (41% BELOW the 90-day average)

EGX 30 year-to-date: +10.9%

THE MARKET ON THURSDAY: The EGX30 ended Wednesday’s session almost flat. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were Amer Group up 3.1%, Egyptian Iron & Steel up 2.9% and TMG Holding 2.2%. Yesterday’s worst performing stocks were Abu Dhabi Islamic Bank down 2.5%, Eastern Co down 1.6%, and Qalaa Holdings down 1.6%. The market turnover was EGP 684 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -9.2 mn

Regional: Net Long | EGP +20.8 mn

Domestic: Net Short | EGP -11.6 mn

Retail: 63.2% of total trades | 65.4% of buyers | 61.0% of sellers

Institutions: 36.8% of total trades | 34.6% of buyers | 39.0% of sellers

Foreign: 23.7% of total | 23.0% of buyers | 24.3% of sellers

Regional: 8.4% of total | 10.0% of buyers | 6.9% of sellers

Domestic: 67.9% of total | 67.0% of buyers | 68.7% of sellers

WTI: USD 71.83 (-0.01%)

Brent: USD 79.80 (+0.29%)

Natural Gas (Nymex, futures prices) USD 2.92 MMBtu, (+0.21%, June 2018 contract)

Gold: USD 1,298.90 / troy ounce (+0.32%)

TASI: 8,039.05 (-0.07%) (YTD: +11.25%)

ADX: 4,585.57 (+1.30%) (YTD: +4.25%)

DFM: 2,946.67 (-0.89%) (YTD: -12.56%)

KSE Premier Market: 4,718.45 (-0.72%)

QE: 8,999.92 (+0.07%) (YTD: +5.59%)

MSM: 4,556.70 (-0.49%) (YTD: -10.64%)

BB: 1,267.04 (+0.12%) (YTD: -4.86%)

Calendar

14 June (Thursday): 2018 World Cup kickoff match between Russia and Saudi Arabia, Moscow, Russia.

15 June (Friday): Egypt’s first 2018 World Cup match against Uruguay, Yekaterinburg, Russia.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

19 June (Tuesday): Egypt plays against Russia at 2018 World Cup, St. Petersburg, Russia.

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.