Are we facing EM “contagion” from “looming debt wall”?

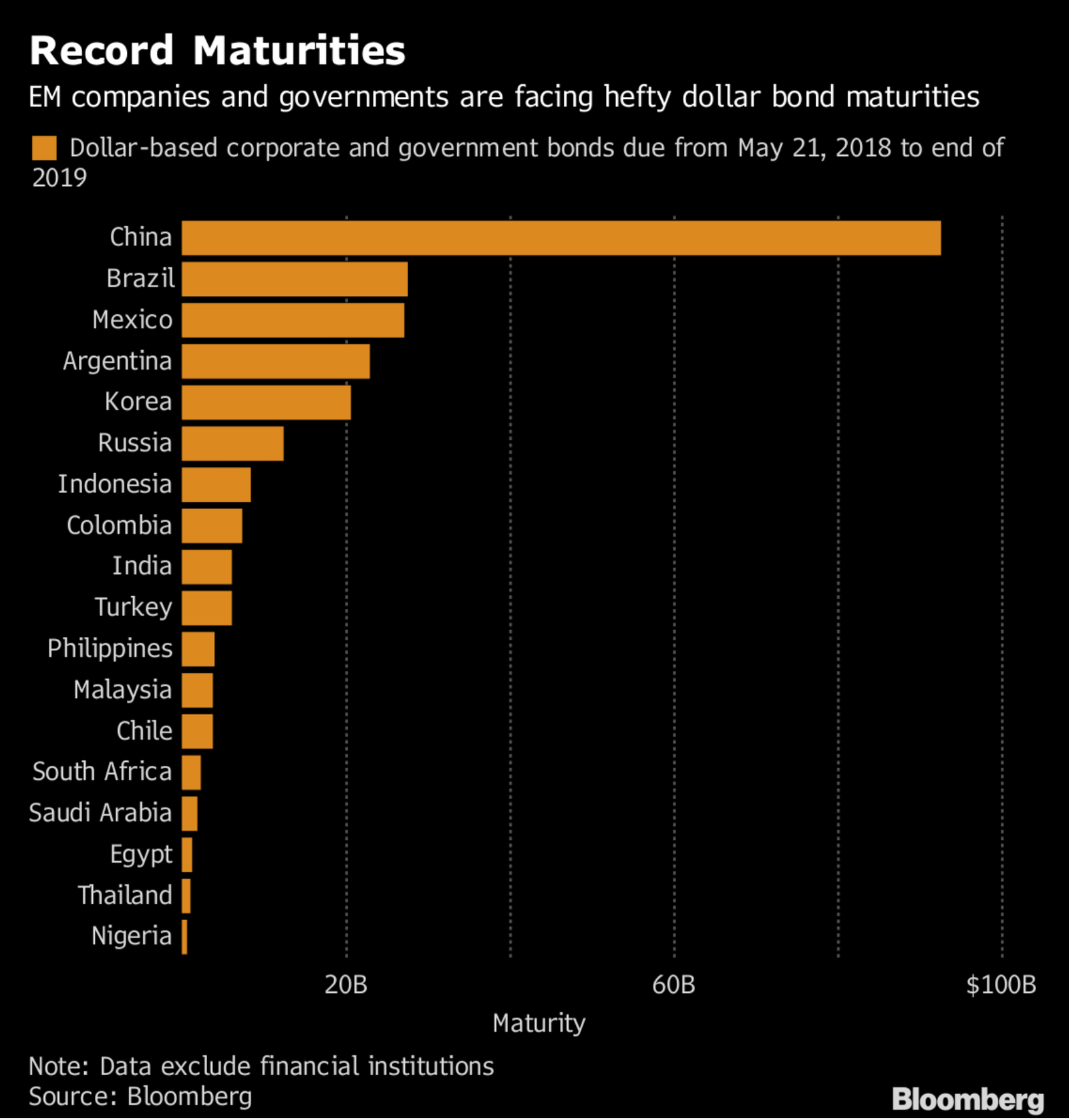

Will the stress get worse when EM run into a “looming” debt wall? Are we really facing a “contagion”? Bloomberg has compiled data suggesting that EM companies and governments are “straining to deal with the rising cost of borrowing in USD” and have some USD 249 bn that will need to be repaid or refinanced through next year. “That’s a legacy of a decade-long debt binge during which emerging markets have more than doubled their borrowing costs in USD, ignoring the many lessons of history from the 1980s Latin American debt crisis, the 1990s Asian financial crisis and the 2000s Argentine default.” Egypt is near the bottom of the list of 18 countries that Bloomberg says are potential “points of stress” and doesn’t make its list of the 16 most fragile EM as measured by the ratio of foreign debt exposure to GDP.

Into the fray rides the Financial Times, which writes that the last time sub-Saharan African countries had this much debt was just “before the debt forgiveness programme of the early 2000s,” citing a report by credit rating agency S&P.