Are African countries overstraining themselves with foreign debt issuances?

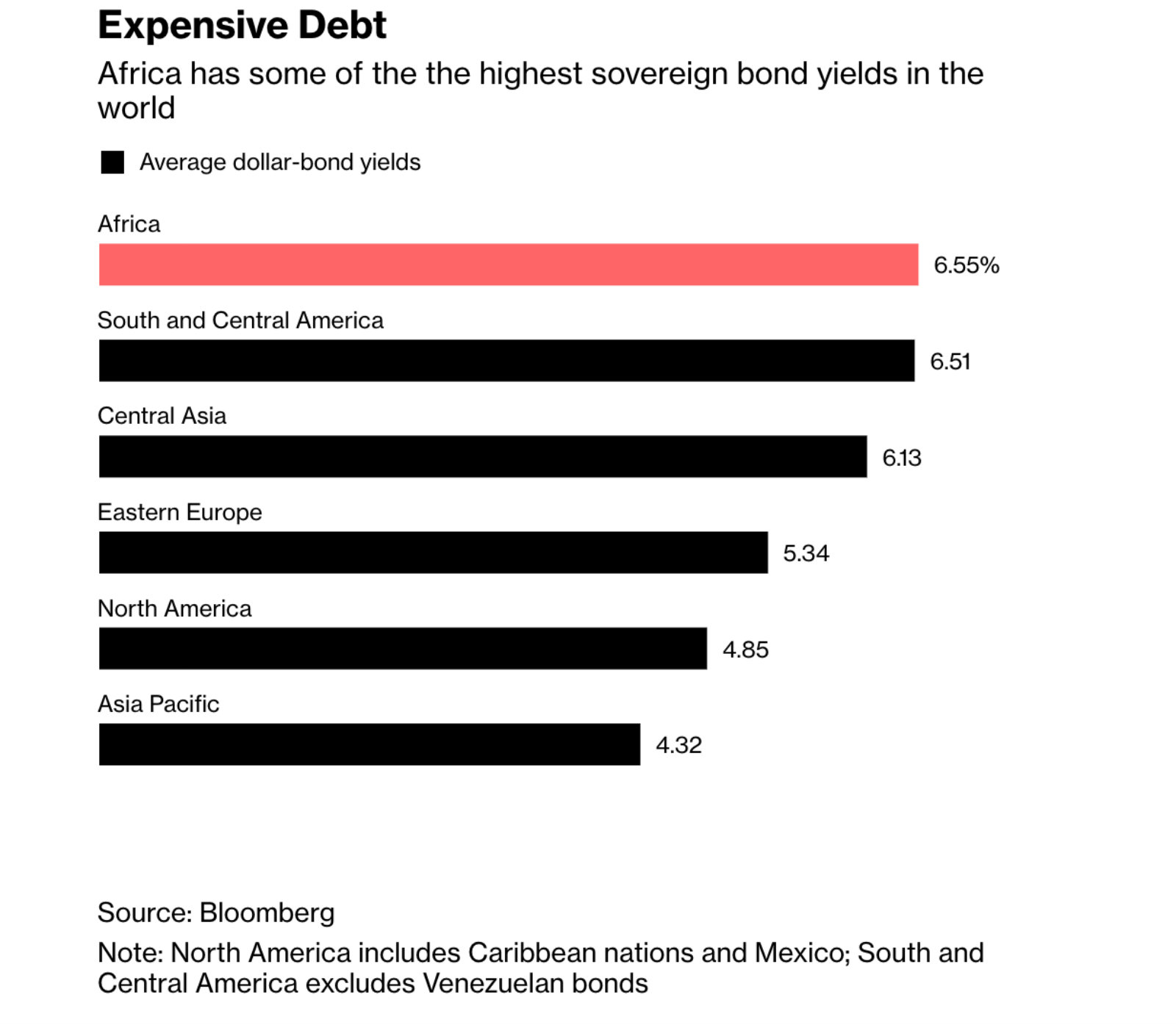

Are African countries overstraining themselves with foreign debt issuances? With African countries offering some of the world’s highest bond yields, there have been growing concerns about debt-service costs, particularly as their currencies fall against the USD, African Development Bank (AfDB) President Akinwumi Adesina tells Bloomberg in an interview. While high interest rates are attractive for outside investors, several African countries are failing to take into consideration the “extent” of their debt load.

African issuers are paying a premium compared with other EM: “USD bonds sold by African governments now yield 6.91% on average, compared with 5.66% in early January” according to Standard Bank Group data. “That compares with 6% for emerging markets generally.” African countries, including Egypt, Kenya, Nigeria, and Senegal, have already sold USD 18.3 bn-worth of EUR and USD denominated bonds this year, “already beating full-year records.” Adesina suggests that to raise funds, some African nations should consider more local currency issuances to bypass the problems presented by a weak exchange rate when repaying the debt.