- Is the government really caving to public pressure on its education reform drive? It should stay the course. (Last Night’s Talk Shows)

- Uber welcomes passage of ride sharing act, Egypt GM tells us. (Speed Round)

- Qalaa considering increasing stake in ERC. (Speed Round)

- CIB posts record first quarter earnings. (Speed Round)

- London based PE firm Alta Semper Capital opens regional office in Cairo. (Speed Round)

- Competition authority, customs offices get new bosses. (Speed Round)

- Are African countries overstraining themselves with foreign debt issuances? (The Macro Picture)

- Egyptian indie film Yomeddine premieres at Cannes film festival today (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 9 May 2018

Gov’t must hold the line on education reform

TL;DR

What We’re Tracking Today

The biggest story of this morning: US President Donald Trump announced overnight that the US is withdrawing from the 2015 multi-country nuclear pact with Iran, calling it “one of the worst and most one-sided transactions the United States has ever entered into.” Washington will move to reinstate “the highest level” of economic sanctions against Tehran, he said. Members of the European Union are losing it, Saudi and the UAE are crowing, and Egypt is tending its knitting. We have chapter and verse in Speed Round, below.

Okay, but what does it mean for oil prices? The consensus is that prices are likely to rise. Iran raised its oil output by c. 1 mn barrels per day when sanctions were lifted in 2016, and “at least some of that” will be pulled now at the same time as oil is already north of USD 70 thanks to production cuts from OPEC and Russia, CNN notes. Reuters, meanwhile, thinks Iranian exports to Europe and Asia are at risk. Iran currently exports about 2.5 mn barrels of its 3.8 mn BOPD of production, with China, India and other Asian countries its top markets. Brent crude was up 1.9% after the announcement to USD 76.27 while WTI rose 1.6%, the Financial Times notes, quoting an analyst report that says the sanctions announcement “puts into place a scenario that could see the crude oil market tighten significantly in H2 2018 and into next year.” Bloomberg also has a decent rexplainer.

On the whole, Arab youth currently see the United States as an enemy, according to the 2018 Arab Youth Survey. In 2016, 32% of Arab youth saw the United States as an enemy. Today, that figure stands at 57%. You an explore the full survey here.

So, investing in non-public private equity general partners is now a thing, the Financial Times’ Sujeet Indap tells us this morning. Some of you won’t like the snark in the opening grafs (it made us smile), but push through: This is required reading for our subscribers in PE, whether you’re at an established firm or tending to a relative startup.

And for our readers in marketing / comms / advertising: Ousted WPP boss Martin Sorrell thinks the agency model he helped build is now broken. In the few short weeks since he left WPP, Sorrell says he has found “a better perspective on which parts of the industry were growing and adapting and which were held back by the ‘warts and problems that legacy companies have.’” He’s setting out to create a new agency that would be “more agile, more responsive, less layered, less bureaucratic, less heavy” than traditional advertising companies, he said, with a focus on technology, data and content,” according to the Financial Times. You and everyone else, brother.

Elsewhere this morning:

- Argentina is now in talks with the IMF for some form of assistance after finding its drastic interest rate hikes failed to stop the slide of the peso. (Financial Times)

- Slack hits 3 mn subs mark: Slack, the workplace messaging tool we have used every day since we started Enterprise to produce your morning briefing, now has more than 3 mn paid users, but won’t go public this year. (Wall Street Journal)

- No, you cannot wear shorts to the office, gentlemen, unless “you are a park ranger and your office is a park.” But you can up your game elsewhere. (Wall Street Journal)

Odds are good your teenagers will be watching this: The trailer for season two of the gut-wrenching teen suicide series 13 Reasons Why has now been released. The second season debuts on Netflix on 18 May. You can watch the trailer here (runtime: 2:15)

We’re beaming with pride this morning because Egyptian indie film Yomeddine premieres today at the 71st Cannes Film Festival. Yomeddine will compete in the prestigious event for the Palme d’Or — the highest prize awarded at the annual festival. Directed by first-time Egyptian-Austrian filmmaker Abu Bakr Shawky, Yomeddine follows the story of a leper who leaves a leper colony in hopes of finding his family, who had left him there as a child with unfulfilled promises to return. Yomeddine is meant to “tell the story of the underdog, the outsider, the labeled ‘nobody’ who grows to understand the workings of a world that refuses to accept him,” Shawky said of his work (pdf). You can catch the trailer here (watch, runtime: 5:04).

PSA- Bad weather ahead: Hot dusty winds could turn into a sandstorm on Thursday, the national weather service warns. Cairo, Sinai, and Upper Egypt will see the worst of it. Look for a high of 39°C in the capital city tomorrow — and for temps to drop as much as 7°C on Friday.

What We’re Tracking This Week

Inflation numbers should come out on or about this Thursday, 10 May. This month is all the more significant as the central bank’s Monetary Policy Committee will meet on 17 May to set interest rates.

On The Horizon

EETC to issue tender for electricity grid interconnection with Sudan “within days”: The Egyptian Electricity Transmission Company (EETC) will issue a local and global tender for power lines and transformers for the electricity grid interconnection project with Sudan “within days,” sources had said.

Contracts to connect our electric grid to Saudi Arabia’s could be signed by the end of June, sources say.

Enterprise+: Last Night’s Talk Shows

Foreign relations in general, and the Iran nuclear agreement in particular, dominated the airwaves last night, with every talking head save Henry Kissinger making the rounds. But the most surprising news from the talking heads was that the government could be bowing down to pressure over education reform.

Is the government really caving to public pressure on its education reform drive? After taking heat over the new education reform strategy, Education Minister Tarek Shawky apparently decided to postpone implementing reform plan for middle schools (grades 7-9) to FY2019-2020 instead of launching it in September. He tells Hona Al Asema’s Lamees Al Hadidi that K-6 classes in public schools and in the new Japanese schools will see changes in the fall. He said an assessments of the new strategy would be held in the summer of 2019 to gauge whether the system can be implemented nationwide (watch, runtime: 5:38).

Shawky dismiss the notion that the ministry was pressured to take this decision but acknowledged that the controversy arose due to a lack of understanding by the public. He reiterated that the strategy has been put forth after consultations with experts. He urged people to refrain from worrying about insignificant nooks and cracks and attempt to see the bigger picture of reform — something which had long been called for (watch, runtime: 14:38).

Background: The new primary school system aims to make it mandatory to teach subjects including STEM (science, technology, engineering and math) in English at ht the middle school level. Primary school education in public schools will be taught in Arabic. The reforms build on the ministry’s drive to do away with rote memorization by Thanaweaya Amma (high school), as does its plan to do away with examinations for students below third grade. Readers should note that the reforms have no bearing on private and international schools.

Allow us to beat the drum a moment, please: The minister should not give up. The reforms appear sensible and very much in line with what members of the business community (to say nothing of hundreds of thousands of parents) have been saying for years. But cabinet as a whole needs to learn from Shawky’s experience: As in the past, the problem isn’t in the reform, it is in the fact that cabinet did nothing to sell it to the nation.

Trump’s withdrawal from the Iran nuclear accord choked the airwaves with political and economic analysts. Kol Youm’s Amr Adib spoke with former IMF consultant Fakhry El Fiky, who spoke on the risk and impact the decision would have on oil prices and how that would impact Egypt. A tumultous oil market leaves next year’s budget in a precarious situation, he says (watch, runtime: 39:28). Hona Al Asema’s Lamis Al Hadidi sat down with a slew of commentators and political analysts to discuss the ramifications of the move on international relations among Western powers and impact on the Middle East (watch, runtime: 5:55).

Talk on diplomacy continued with President Abdel Fattah El Sisi’s meeting with his Ugandan counterpart Yoweri Museveni and the whole GERD issue. Adib added that the dispute with Ethiopia over the Nile makes relations with other Nile Basin countries like Uganda all the more important (watch, runtime: 5:12). He later called for awareness campaigns be made encouraging rationing water use (watch, runtime: 4:08). Ittihadeya spokesman Bassam Rady highlighted Uganda’s importance as another source of Nile water, noting that 15% of the river’s waters flow from the Lake Victoria (watch, runtime: 8:30). It was also covered on Masaa DMC (watch, runtime: 3:32). Former Irrigation Minister Mohamed Nasr Al Din Allam echoed Adib’s point. In an interview with Yahduth fi Masr, he noted Uganda’s political weight in Africa, which may help with political manoeuvring or pushing for an agreement with Nile basin countries.

He also noted the strategic importance of South Sudan and a transit point for river from Uganda, and a place where large amounts of Nile water heading to Egypt is lost (watch, runtime: 2:00).

Egypt’s debt levels and the budget deficit appear to be the two biggest concerns in the House of Representatives on the FY2018-19 budget, parliament spokesperson Salah Hassaballah tells Al Hayah A Youm (watch, runtime: 3:44). Just as last year. And the year before. And so on.

Speed Round

House passage of the ride-hailing legislation is a step forward for the industry -Uber Egypt GM. Uber Egypt GM Abdellatif Waked said the act, which passed the House of Representatives on Monday, is one of the first of its kind in the region and will help drive growth of his industry. Uber is “quite happy” with the changes to the law, particularly clauses on data sharing and privacy, he told us yesterday. Here’s why:

Ride-Hailing Apps Act won’t force companies to share real-time data with the government. The controversial Articles 9 and 10 now strike a balance between data privacy and national security, Waked said. The two articles, which have changed drastically from their initial form, now “provide a lot of details on preserving user data privacy,” he said, explaining that article 9 especially was “toned down a lot,” as clauses that would have given the government unrestricted access to real-time data were scrapped and replaced with others that mandate ride-hailing companies to make information accessible only upon request.

Clauses stipulating onshore data storage were also removed from article 10 after Uber managed to convince legislators that cloud storage is the much safer option recommended by global tech companies and experts. “We take national security very seriously, but we also take our user privacy very seriously,” Waked said. “Uber never provides any government with real-time access to customer data and we always fight to protect their privacy.”

(We were wrong yesterday in our assertion that the House had signed off on the act without amending articles 9 and 10. The final text of the act requires ride hailing companies operating in Egypt to retain local user data for 180 days and to make information available to state agencies when requested. We’ve updated yesterday’s story on our website accordingly.)

So, what about the white taxis? The act gives ride-sharing companies three months to come up with a strategy to incorporate white taxis into their fleets. Earlier versions of the act had given the prime minister authority to essentially force ride-sharing companies to abide by a single set of guidelines to add regular cabs to their service. “Now it’s in the hands of the companies,” Waked said. “Uber already works with taxis in other countries, so we’ll take our learnings from there and spend the next three months studying the best way to incorporate them, because to us, it’s an absolute necessity to maintain a certain level of quality and safety.”

As usual, the fine print will be in the executive regulations, which will set final licensing fees and fines, which Uber believes are too high. The most important among those are the high licensing fees of EGP 1,000 the law sets for drivers, according to Waked. “We will be working over the next two months to make sure that the executive decrees that are issued take the drivers’ side,” he said, stressing the importance of keeping the service both economically sensible for drivers and affordable for users. Waked also expects the regulations to adjust licensing fees that companies have to pay, which could hinder new players from entering the market after they jumped “in the last minute” to a maximum of EGP 30 mn in the final draft from EGP 10 mn initially. The fee is payable by operators every five years.

As for the identifier or symbol that drivers will have to display, “those will likely be inside the car… [and] are not new to the industry,” Waked said, explaining that more than 65% of Uber’s drivers work on a part-time basis using their own private cars and “don’t necessarily want to brand themselves.”

Thinking along similar lines is Uber’s Dubai-based competitor Careem, which described the Ride-hailing Apps Act as a “a remarkable step for Egypt, Careem and our region,” in an emailed statement yesterday, the National reports. “It is the first time in any of Careem’s operating markets that a regulatory framework for ride-hailing has emerged from a consultative legislative and parliamentary process.”

LEGISLATION WATCH- Prime Minister Sherif Ismail issued the executive regulations of the Universal Healthcare Act on Tuesday, according to a cabinet statement. The statement did not provide the final draft of the regs, but copies leaked by Al Ahram last month show that focus on the roles, jurisdictions and functions of the new healthcare regulators and how the system itself would be operated.

What we haven’t seen from the leaks is a clearly defined role for the private sector mapped out. Vice Minister of Finance Mohamed Maait had said that the role of the private sector would be clarified in the executive regulations.

Qalaa eying additional stake in Egyptian Refining Company: Qalaa Holdings announced yesterday that it is looking to increase its ownership of its greenfield Egyptian Refining Company (ERC) by acquiring or subscribing to additional shares in its subsidiary Orient Investment Properties, Qalaa said in a regulatory filing (pdf). ERC recently completed a project finance restructuring that saw the company take on new loans and equity commitments valued at around USD 500 mn, bringing the 4.2 mn tonne-capacity refinery’s overall cost to around USD 4.5 bn. The refinery is expected to go online by the end of 2018 or early 2019, with trial operations set to start as early as next month.

EARNINGS WATCH- CIB posts record first quarter earnings. Our friends at Egypt’s largest private-sector bank delivered a 17% y-o-y rise in net income to EGP 2.0 bn in 1Q2018 on revenues of EGP 4.2 bn (up 25% y-o-y). In comment on the results, management noted that top line and bottom line growth were more impressive when excluding the one off gains from the sale of investments in 1Q2018 and 1Q2017, which would bring both to 33%. Management attributed the growth to a surge in its local currency balance sheet and an impressive pick up in foreign currency lending. Furthermore, “CIB remains well-covered in terms of capital adequacy, as evident in its CAR surging to 18% by end of the first-quarter in 2018, comfortably above minimum regulatory requirements and sufficiently accommodating upcoming increases in minimum requirements in 2019, along with any unanticipated alterations in the macroeconomic environment.”

What’s the outlook? “We remain confident, in the Bank’s solid fundamentals to accommodate macroeconomic and regulatory developments, while reacting cautiously to interest rate movements in a way that does not forego the Bank’s profitability,” said management. The bank notes that it expects to see the impact of the two consecutive interest rate cuts this quarter on lending growth over the coming quarters. You can read CIB’s full earnings filing here (pdf).

EARNINGS WATCH- CI Capital reported a net profit after tax and minority interest of EGP 81.9 mn in 1Q2018, up 35% y-o-y, the company reported in its first earnings release since going public last month (pdf). Total revenues for the quarter jumped 34% y-o-y to EGP 542.1 mn. In comment on the firm’s maiden earnings, Group CEO Mahmoud Attallah noted that the CI is “clearly seeing signs” of an economic recovery that leaves it optimistic about its outlook for the rest of the year.

London-based private equity firm Alta Semper Capital opened yesterday a new regional office in Cairo, according to an emailed statement. The office will serve Egypt and the region through investments in the consumer and healthcare sectors. “There are many interesting investment prospects in Egypt to which we can apply our international experience,” said Managing Partner and CEO Afsane Jetha. Former CI Capital Director of Investment Banking Ahmed Rady will head the new office. Alta Semper had partnered with CI Capital Partners back in 2016 to acquire stake in healthcare products outfit Macro Pharma. The transaction was Alta Semper’s first investment in Egypt.

Alta Semper deserves credit: With all due respect to our friends in the Emirates: post the devaluation of the EGP, there is little economic rationale for buysiders, PE types, financial services companies, lawyers or other service providers to base their regional HQs out of Dubai.

M&A WATCH- B Investments kicking tires on multiple opportunities: B Investments has taken “serious steps” towards acquiring a controlling stake in an unlisted food and beverage company, founding partner Alaa Sabaa tells Youm7. Sabaa stopped short of disclosing the company’s name or the expected value and timeline of the transaction, but said it would be the first of many transactions B Investments is eyeing. The firm is also planning to buy a solar power plant in the Benban solar park, Sabaa said, without disclosing further details.

Meanwhile, Sabaa said his downtown re-development firm Al-Ismaelia for Real Estate Development could someday look at an EGX listing if it can create a portfolio of projects as successful as its development of the La Viennoise building in downtown Cairo, which was unveiled recently.

BUDGET WATCH- Parliament subcommittee to study fixed power prices for lowest consumption brackets: Electricity Minister Mohamed Shaker has reportedly agreed with Parliament’s Budgeting Committee to form a subcommittee to study a proposal to leave power prices unchanged for the lowest consumption tiers in the next fiscal year, MP Yasser Omar tells Al Mal. MPs are suggesting that the ministry direct all proceeds from an upcoming increase to electricity bills in FY2018-19 towards subsidizing power for the lowest brackets, according to Omar, who says that the subcommittee will begin its work next week. Shaker had previously rejected the proposal, insisting that the 47% cut in electricity subsidies slated for July would impact all users, with bills rising by 30% for the lowest consumption bracket and 45% for the highest. Prices of power for industry are also expected to increase at the start of the new fiscal year.

Education could get larger budget? Meanwhile, a request to increase the earmark for education in next year’s budget has been tabled for discussion, Education Minister Tarek Shawky said in a statement yesterday after meeting with MPs, according to Al Shorouk. MPs had earlier this week announced plans to make an official request to the government to increase the amounts allocated to education and health in FY2018-19, particularly as the K-12 educational reform program and new Universal Healthcare Act launch this year. Leaked documents had said that the budget for healthcare would increase 12.5% y-o-y to EGP 61.81 bn in FY2018-19, while spending on education would grow 8% to EGP 115.66 bn.

MOVES- Prime Minister Sherif Ismail appointed Amir Nabil Ibrahim to head the Egyptian Competition Authority (ECA), Al Masry Al Youm reports. Ibrahim succeeds Mona El Garf, who resigned from her post in November to return to teaching. Ismail also formed a new ECA board comprised of the deputy head of the Council of State (Maglis El Dawla), the head of the Trade and Industry Ministry’s internal trade policies department, a representative of the Supply Ministry, and an economic and a legal expert.

MOVES- Finance Minister Amr El Garhy appointed Gamal Abdel Azim as the new head of the Customs Authority, Al Masry Al Youm reports. Abdel Azeem, who headed the Port Said Customs Department, succeeds Magdy Abdel Aziz, who moved on to become El Garhy’s advisor for customs affairs.

MOVES- Emirates NBD Egypt has hired Mohamed Berro as its new CEO, the bank announced in a statement on Tuesday. Berro, who is a member of the Emirates NBD Group Executive Committee, joins the bank from Abu Dhabi’s Al Hilal Islamic Bank, where he served as CEO for six years. He also held leading positions in several other banks, including the Arab Bank, Crédit Agricole CIB, and the National Bank of Kuwait.

FRA passes new rules for investment funds established by banks, non-banking financial services firms: The Financial Regulatory Authority (FRA) issued new regulations to govern the establishment of investment funds, FRA boss Mohamed Omran said in a statement yesterday carried by Youm7. The new regulations allow banks, micro financing firms, insurance companies, as well brokerage and securities firms to set up any type of investment fund apart from real estate, independently or with local, regional, or international partners, after obtaining FRA and central bank approval. They also stipulate that securities firms — which received the greenlight last month from FRA to establish mutual funds — need to have been in the market for at least three years to seek regulatory approval. Institutions also need to set aside a minimum EGP 5 mn for fund activities and provide at least 51% of that amount, according to Omran.

In related news, the FRA also signed off on new regulations that allow insurance companies to invest up to 40% of their available reserve in securities, up from 30% previously, FRA deputy head Khaled El Nashar tells Reuters’ Arabic service. Companies can choose to invest in listed or non-listed securities, according to the new regulations, which FRA’s board approved at the end of April.

The Donald withdraws US from Iran nuclear agreement: US President Donald Trump announcing last night that the US is withdrawing from the 2015 Joint Comprehensive Plan of Action (JCPOA) with Iran. In a statement last night, Trump called Iran agreement “one of the worst and most one-sided transactions the United States has ever entered into.” Trump said he would reinstate economic sanctions on Iran that would “target critical sectors of Iran’s economy, such as its energy, petrochemical, and financial sectors. Those doing business in Iran will be provided a period of time to allow them to wind down operations in or business involving Iran. Those who fail to wind down such activities with Iran by the end of the period will risk severe consequences,” read a White House statement. The withdrawal has everyone worrying of an of regional tension in the Middle East.

The move could represent the biggest break yet between the US and its Western allies. UK Prime Minister Theresa May, German Chancellor Angela Merkel, and French President Emmanuel Macron issued a joint statement that they would abide by the treaty, saying that it is "the best way of neutralizing the threat of a nuclear-armed Iran," DW reports.

Iran too insisted that the nuclear agreement is alive and well with the other four signatories. President Hassan Rouhani said that Iran will continue to work with the UK, Germany, France, Russia, but warned that it could step up enrichment if those talks do not yield results, Bloomberg reports.

The GCC is ecstatic: The governments of Saudi Arabia and the UAE both issued statements in strong support of the decision and calling on the international community to join the new policy shift.

Egypt said it would closely monitor the situation, according to a Foreign Ministry statement. Egypt reaffirmed the need for Iran to curb nuclear testing, while stressing the need for stability in the region.

The Macro Picture

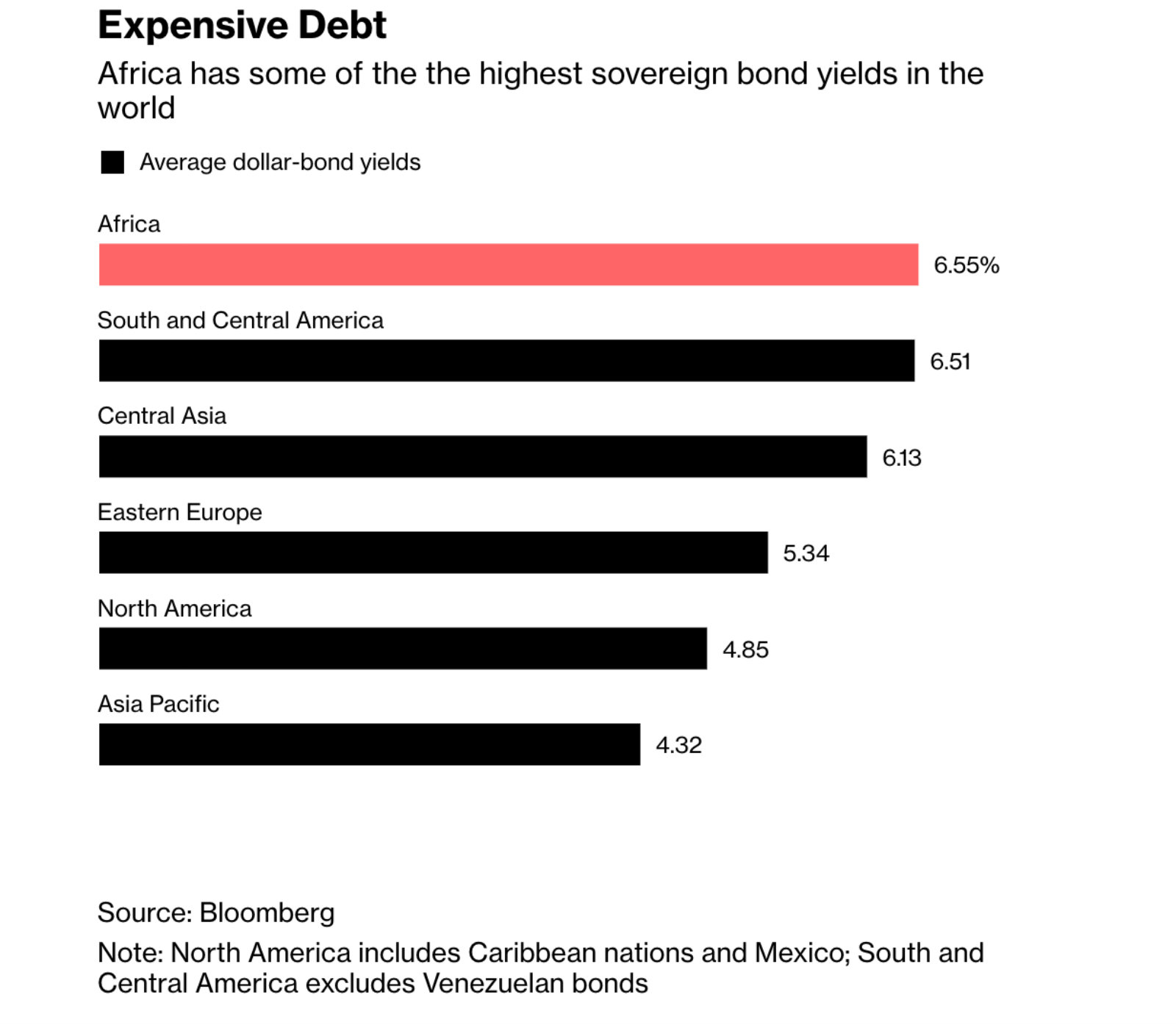

Are African countries overstraining themselves with foreign debt issuances? With African countries offering some of the world’s highest bond yields, there have been growing concerns about debt-service costs, particularly as their currencies fall against the USD, African Development Bank (AfDB) President Akinwumi Adesina tells Bloomberg in an interview. While high interest rates are attractive for outside investors, several African countries are failing to take into consideration the “extent” of their debt load.

African issuers are paying a premium compared with other EM: “USD bonds sold by African governments now yield 6.91% on average, compared with 5.66% in early January” according to Standard Bank Group data. “That compares with 6% for emerging markets generally.” African countries, including Egypt, Kenya, Nigeria, and Senegal, have already sold USD 18.3 bn-worth of EUR and USD denominated bonds this year, “already beating full-year records.” Adesina suggests that to raise funds, some African nations should consider more local currency issuances to bypass the problems presented by a weak exchange rate when repaying the debt.

Image of the Day

The iconic La Viennoise building reopened this week as Downtown Cairo’s first eco-friendly historic property following restoration by Al Ismaelia for Real Estate Investment, Nile FM reports. Al Ismaelia had been carrying out conservation and renovation work at historic properties it owns in Downtown Cairo that it plans to rent out for commercial purposes.

Sarwa Capital moving in: Ismaelia CEO Karim El Shafei said the historic property will become the new headquarters of our friends at Sarwa Capital.

Egypt in the News

Just like rival Blom, Lebanon’s Bank Audi sees a lot of potential for growth from its Egyptian business, particularly on the private banking side, which requires fairly low capital and generates around 12-15% of the bank’s bottom line in the country, Chairman Samir Hanna tells Bloomberg in an interview (watch, runtime: 6:12).

The government does not seem to have a realistic plan for attracting citizens to the new administrative capital, says the Guardian’s Ruth Michaelson. Although the new megacity is meant to leave behind the “ugliness” of crowded Cairo, real estate prices are likely to make it difficult for low-income government employees to relocate. Employees who opt to commute to the new capital — which will house government buildings, and potentially foreign embassies — might also find the cost of taking the monorail too high, Michaelson says, suggesting that the new capital might meet the same fate as “half-empty” satellite cities, “each a failed monument to their developers’ inability to draw the bulk of the population away from downtown Cairo.”

Also worth a skim this morning:

- For the first time since 2011, the Israeli embassy in Cairo celebrated the anniversary of its country’s founding, the Associated Press reports.

- Egyptian archaeologists have unearthed a tomb belonging to a “great army general” of Ramses II at the Saqqara burial complex near Cairo, the Associated Press reports.

Worth Watching

The Economist thinks universal basic income can make capitalism more fair: As the debate on the merits of universal basic income, the Economist appears to have been one over from the looks of this video (watch, runtime: 1:41). The publication suggests that a social welfare system under which the government pays every citizen a regular livable wage for doing absolutely nothing (a Kramer’s paradise if you will) could help mitigate the ills of rising inequality in the West.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi and his Ugandan counterpart Yoweri Museveni signed yesterday a number of agreements and MoUs for energy, industrial, and agricultural projects in Uganda, according to an Ittihadiya statement. The projects will include a 4 MW solar power plant, industrial zone development, and a potential Nile river shipping route. The two also discussed the latest developments on the Grand Ethiopian Renaissance Dam (GERD), with Museveni stressing his support for the 2015 Declaration of Principles signed by Egypt, Ethiopia and Sudan, which preserves the rights of all countries to their share of the Nile. Museveni also invited El Sisi to visit the source of the Nile, which would be a historic first for an Egyptian leader, Ahram Gate reports.

Basic Materials + Commodities

Egypt, Italy to build 15 vertical wheat silos worth EGP 250 mn

The Internal Trade Development Authority reached an agreement with the Italian Development Authority to cooperate on building 15 vertical wheat silos at a total cost of EGP 250 mn, according to an emailed statement (pdf). Under the agreement, Egyptian companies will be tapped to construct the silos, while Italian companies will be mandated with carrying out the electromechanical works. Italy previous built ten wheat silos in Egypt at a total cost of EGP 128 mn.

REMD targets 30% increase in sales this year

Confectioner REMD El Rashidy El Asly is targeting a 30% increase in its sales this year to reach EGP 260 mn, and plans to almost quadruple sales to EGP 1 bn by 2023, CEO Mohamed Kandil tells Reuters’ Arabic service. Kandil had said yesterday that REMD is also planning an IPO of 20% of the company’s shares next year.

Manufacturing

UK’s iBrit studies opening mobile phone factory in Egypt

London-based smart devices manufacturer iBrit has partnered with Egypt’s electronic products distributor One Trading to open a factory in Egypt, One Trading announced. The exclusive partnership agreement, through which iBrit targets a 5% market share in Egypt during the first year, is part of the company’s plans to expand into the MENA region.

Military Production Authority, China’s Poly Group agree to establish tire factory

The Military Production Authority signed an MoU with China’s Poly Group yesterday to jointly establish a tire production facility, Al Mal reports. No further details were provided on the expected investment value, timeline of implementation, or location of the facility.

Health + Education

Health Ministry shuts down Golf Specialized Hospital in Heliopolis over “life threatening” violations

The Health Ministry shut down the Golf Specialized Hospital in Heliopolis yesterday over what it says are “life threatening” violations, Al Masry Al Youm reports. The alleged violations include failing to meet infection control requirements in operation theaters and the ICU. The inspectors also found that the hospital stores expired medications and uses loaded syringes without an expiry date. If that wasn’t enough, the allegations include the hospitals not ventilating its waste disposal room properly and hiring an unlicensed pharmacist.

Tourism

Milan Bergamo airport receives Air Arabia Egypt’s first Europe-bound flight

Milan Bergamo Airport became Air Arabia Egypt’s first European service destination from the carrier’s base at Borg El Arab, eTN reports. The biweekly flights mark the reopening of the Milan route following a four-year hiatus. Sharjah-based Air Arabia uses Borg el Arab as its operational hub in Egypt.

Automotive + Transportation

Metro company to sign maintenance contract with Mitsubishi for Cairo Metro Line 2

The Egyptian Company for Metro Management and Operation is expected to sign a contract with Japan’s Mitsubishi to maintain four trains on the Cairo Metro Line 2, an unnamed source tells Al Mal. The contract, whose duration remains unclear, will see the metro company paying EGP 3 mn per month for the maintenance works. Separately, the National Authority for Tunnels has received offers from four global companies, including a French-Egyptian consortium, for the contract to construct the Cairo Metro Line 2 extension, an unnamed source tells the newspaper. The authority is currently looking into the offers and plans to complete the extension’s feasibility studies and designs before year’s end, the source says.

Banking + Finance

Sarwa Capital to invest EGP 200 mn to establish insurance companies

Sarwa Capital is planning to establish two separate life and insurance companies, each of which will have a capital of around EGP 100 mn, CEO Hazem Moussa tells Al Mal. Sarwa has received preliminary approval from the Financial Regulatory Authority for the planned companies, whose establishment is part of the company’s expansion strategy that includes new services such as factoring, leasing, and consumer financing. Sarwa plans to launch factoring services sometime in 2H2018, Moussa said.

Egypt Politics + Economics

Singer Sherine acquitted in “Bilharzia” comment case

Egyptian pop singer Sherine Abdel Wahab was acquitted of “spreading false news” yesterday after winning an appeal against a six-month prison sentence for joking that drinking from the Nile leads to contracting the Schistosomiasis (Bilharzia), Ahram Gate reports.

On Your Way Out

On-demand home nursing service platform 7keema will be competing at seed-stage startup competition Seedstars in Switzerland next year, where it could receive up to USD 1 mn in equity investment, Disrupt Africa reports. 7keema won the Egypt round of the global competition, edging out auto parts e-commerce platform Odiggo, traveler-based shipment platform HitchHiker, education technology company Skolera, and payments platform Vapulus.

Fawanees everywhere: The traditional Ramadan fanoos (lantern) is hard to miss these days as Egyptians prepare for the holy month. Thousands of colourful lanterns are sold in all shapes and sizes across the country, including many honouring football star Mohamed Salah.

Charities and volunteers are out in full force to prepare staple food boxes and iftar tents for millions of Egyptians struggling to cope with economic hardship, Reuters reports.

…Yes, Ramadan is next week.

The Market Yesterday

EGP / USD CBE market average: Buy 17.67 | Sell 17.77

EGP / USD at CIB: Buy 17.66 | Sell 17.76

EGP / USD at NBE: Buy 17.62 | Sell 17.72

EGX30 (Tuesday): 17,814 (+1.7%)

Turnover: EGP 1.4 bn (21% ABOVE the 90-day average)

EGX 30 year-to-date: +18.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.7%. CIB, the index heaviest constituent ended up 2.1%. EGX30’s top performing constituents were Qalaa Holdings up 7.9%, Global Telecom up 6.5%, and Telecom Egypt up 5.5%. Tuesday’s worst performing stocks were Emaar Misr down 1.7%, Egypt Aluminum down 0.7%, and Orascom Construction down 0.7%. The market turnover was EGP1.4 bn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -72.7 mn

Regional: Net Long | EGP +87.4 mn

Domestic: Net Short | EGP -14.7 mn

Retail: 60.0% of total trades | 61.1% of buyers | 58.9% of sellers

Institutions: 40.0% of total trades | 38.9% of buyers | 41.1% of sellers

Foreign: 18.1% of total | 15.6% of buyers | 20.7% of sellers

Regional: 13.0% of total | 16.1% of buyers | 9.9% of sellers

Domestic: 68.9% of total | 68.3% of buyers | 69.4% of sellers

WTI: USD 69.98 (+1.33%)

Brent: USD 74.85 (-1.73%)

Natural Gas (Nymex, futures prices) USD 2.74 MMBtu, (+0.22%, June 2018 contract)

Gold: USD 1,316.30 / troy ounce (+0.20%)

TASI: 8,012.59 (-1.29%) (YTD: +10.88%)

ADX: 4,479.49 (-1.33%) (YTD: -1.84%)

DFM: 2,948.84 (-0.47%) (YTD: -12.50%)

KSE Premier Market: 4,785.82 (-0.2%)

QE: 8,870.16 (-1.26%) (YTD: +4.07%)

MSM: 4,691.37 (-0.43%) (YTD: -8.00%)

BB: 1,273.21 (-0.42%) (YTD: -4.39%)

Calendar

17 May (Thursday): Expected date for the start of Ramadan.

17 May (Thursday): CBE’s Monetary Policy Committee meeting.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.