EM to outperform developed economies in 2018, Goldman Sachs says in its 2018 investment outlook

Goldman Sachs Asset Management (GSAM) expects emerging markets will outperform developed economies, supporting EM assets in its 2018 Investment Outlook.

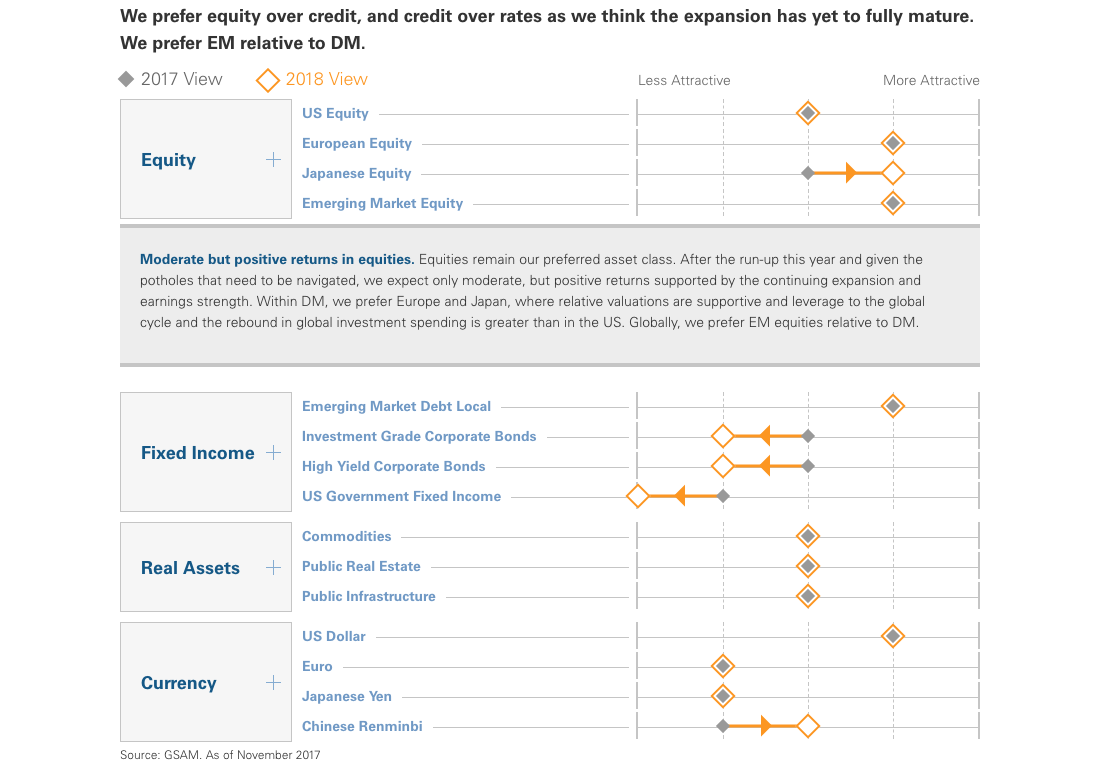

GSAM has a laundry list of advice for investors heading into 2018, saying they will need to invest for continued global growth, manage the risks of elevated valuations, diversify income sources as central banks tighten, navigate the forces of disruption, and uncover insights from Big Data. The report notes that “with the global economic expansion likely to continue, we prefer equities over credit and credit over rates.”

“EM, outside of China, is a bright spot and we continue to prefer EM over developed market assets,” Goldman writes, noting that US and other developed market government bonds are overvalued (US equities, though, may not be). Valuations in Europe, Japan, and EM are particularly attractive, they think. GSAM believes central bank tightening will be a catalyst for volatility in 2018 with market expectations for Federal Reserve interest rates hikes unrealistically low. “The bottom line for us [in 2018] is we expect increased volatility throughout the year, but we think it’s too early to begin positioning for underweighting risk assets broadly,” says Kane Brenan, Global Head of Goldman Sachs Asset Management.