- Don’t get your hopes up for a big pay raise in 2018 — but do expect Egyptian banks to do better than their African competitors next year. (Speed Round)

- INVESTMENT WATCH- China’s TBEA Sunoasis to invest in EGP 2 bn PV solar panel factory. (Speed Round)

- INVESTMENT WATCH- Arby’s is coming back to Egypt, franchisee looks to open 50 restaurants this year. (Speed Round)

- Ibnsina shares pop 16% in EGX debut. (Speed Round)

- House Economics Committee looks into Companies Act. (Speed Round)

- Moselhy isn’t backing down on demand that food manufacturers print prices on packaging. (Speed Round)

- EM to outperform developed economies in 2018, Goldman Sachs says in its 2018 investment outlook. (The Macro Picture)

- The Market Yesterday — Egypt’s Universal Healthcare Act — A Primer

Wednesday, 13 December 2017

Expect a 15% raise — and you’ll still be underwater when you factor in inflation

TL;DR

What We’re Tracking Today

Finance Minister Amr El Garhy heads to Paris today for the annual Organization f or Economic Cooperation and Development (OECD) / European Union meetings on economic governance and public administration reform, a ministry statement says. El Garhy’s agenda includes meeting with French investors to discuss the improved economic climate under the reform program and a sit down with the OECD’s Director of the Center for Tax Policy and Administration Pascal Saint Aman.

Markets are waiting for news out of the Federal Reserve’s Federal Open Market Committee meeting to review interest rates. The expectation is that the meeting, which concludes today and is the FOMC’s last of the year, will see a quarter-point rate hike. Stock pickers need to think carefully about what this means for 2018, the Wall Street Journal warns, writing: “Typically, the prospect of Fed rate increases tightens financial conditions by pushing up borrowing costs for companies and governments, lifting the value of the U.S. dollar against its peers, and restraining a rise in the stock market. But that hasn’t happened this time around.”

The European Central Bank, Bank of England and Bank of Mexico are also meeting this week to review interest rates. The Central Bank of Egypt will follow suit in a couple of weeks’ time when its Monetary Policy Committee on 28 December. With the surprise uptick in month-on-month inflation in November and inflation cooling slower than expected Y-o-Y, don’t expect a rate cut here at home until sometime in the new year.

Meanwhile, Bitcoin hit another record high in its march toward USD 20k, according to Reuters, and emerging markets look set to close 2017 having posted their “best gains in eight years,” Bloomberg reports. High-profile investor and EM champion Mark Mobius tells the business information service he expects emerging markets could “see at least another 20% growth going forward” in a video that accompanies a very nice region-by-region rundown of what happened in emerging markets this year — with a hint of what to expect in 2018.

You’ve probably never heard of Susan Fowler, but she’s the FT’s Person of the Year. The “the 26-year-old from rural Arizona who had to teach herself at the local library to get into university” became an Uber engineer — and blew the doors off the company’s conspiracy to keep quiet widespread [redacted] harassment in the workplace, helping catalyse what became the #MeToo campaign that is taking down politicians, business leaders, media figures and others. You can read Fowler’s blog post, which got it all started, here.

Across the pond, Americans are watching an Alabama Senate race that pit Republican (and alleged serial [redacted] harasser) Roy Moore against a Democratic challenger in a contest the New York Times writes has “national importance” and could “illustrate the enduring limitations of Democrats in the deeply conservative South.” As we were preparing to hit “send” this morning, the New York Times was reporting that the Democrat, Doug Jones, had pulled off an upset victory.

***Take our end-of-year survey — get a bag of Enterprise-branded coffee and cool mugs from which to drink it: It’s that time of the year again — we want you to help us gauge how well business went during the year. What are the biggest challenges you faced during the year? Where will the exchange rate stabilise? Do you expect big raises in 2018? Are you hiring? Help us find out. You’ll get the chance to become one of 25 people who’ll get our end of year giveaway package consisting of Enterprise swag and our first-ever Enterprise-branded batch of coffee, which we’ve put together with good friends in the coffee business. (More on that in a later issue.)

The latest Star Wars film — The Last Jedi — hits theatres in Cairo today and early reviews are not looking too shabby. The Washington Post’s Ann Hornaday says it “honors the franchise with affection and humor,” while the New York Times’ Manohla Dargis says it “embraces the magic and mystery.” The Financial Times makes Jedi one of its six films to watch this week, giving it a glowing review and saying the “final battle scene is phenomenal” in this “work of human imagination.” You can read the Times’ primer “How Did Luke Skywalker become The Last Jedi?” or check out the trailer here (runtime 2:34). The film debuts today in the US and tomorrow in Canada.

Apple fans have plenty to which to look forward this morning. The company, which confirmed that it has reached an agreement to purchase Shazam, according to Reuters, will release the iPhone X in Egypt this Friday and its powerful new iMac Pro is launching tomorrow with a USD 5k per unit starting price in Amreeka. High-profile tech blogger Marques Brownlee has spent a week playing with a review unit and came away impressed — and notes that the price tag is fair compared to an equivalent PC, which he spec’ed out at USD 5,100.

A number of us are planning some time off in the coming weeks, and it seems we’re all heading for colder climes. Had we not already made arrangements / had family plans, we would heartily recommend heading to phenomenal Croatia — yes, even in winter. The Wall Street Journal concurs. Read its Dubrovnik: A Winter Escape to a Beloved Summer Town, where it says the “off season” has been turned into “the most wonderful time of the year” thanks to a new festival.

Sleep or exercise? Why do we have to choose…?

What We’re Tracking This Week

Egypt drumming up more international pressure on Ethiopia? Irrigation and Water Resources Minister Ahmed Abdel Ati is in Paris this week to participate in a climate change conference at which he intends to bring up Egypt’s case with the Grand Ethiopian Renaissance Dam (GERD) in an appeal to international audiences, Al Borsa says. Discussions over the GERD had reached a stalemate when both Ethiopia and Sudan refused to acknowledge the results of environmental impact reports proving the dam would have severely cut into Egypt’s Nile water supply.

We’re still waiting for news from the new capital of a contract that should see China Fortune Land Development Company (CFLD) develop 14k feddans in phase one. CFLD is eyeing USD 4 bn of work over the next five years — a figure it sees rising to USD 13.5 bn after ten years.

On The Horizon

The IMF may disburse the third USD 2 bn tranche of Egypt’s USD 12 bn Extended Fund Facility as late as January, an unidentified government source tells Al Shorouk. Finance Minister Amr El Garhy had previously said that the disbursal is expected before the end of December. The IMF’s Executive Board will meet on 20 December to review progress on Egypt’s economic reform program ahead of voting to disburse the third tranche.

Enterprise+: Last Night’s Talk Shows

The airwaves served up a (somewhat boring) mixed bag of nuts last night as the talking heads finally grew weary of discussing Jerusalem.

Hona Al Assema’s Lamees Al Hadidi spent a chunk of her evening talking about bitcoin, starting with a general overview of the cryptocurrency (watch, runtime: 8:08).

Banque Misr Vice Chairman Akef El Maghraby explained that banks in Egypt and around the world aren’t yet dealing in bitcoin or other virtual currencies because they remain unregulated, are highly volatile, and come with high security risks (watch, runtime: 3:32).

Lamees also talked to information technology expert Hossam Saleh about the current darling of global risk takers (watch, runtime: 7:35) — and chatted with the chairman of a hotel furnishing company, who told the host about his own experience with bitcoin (watch, runtime: 10:47).

Over on Kol Youm, Amr Adib spoke to Education Minister Tarek Shawki about the ‘new education system’ currently in the works. The system, which will come into effect as of the next academic year, will encompass students at all grade levels from nursery through high school. A prominent feature of the new model is the diversification of tests across different schools to stop encouraging students to memorize a “model answer” for standardized questions (watch, runtime: 7:35).

Adib also talked about the collapse of a building in Shobra’s Rod El Farag, which he attributed to corruption that gives unlicensed and unsafe buildings a free pass. MP John Talaat joined Adib to discuss the issue (watch, runtime: 5:26).

Masaa DMC’s Osama Kamal also spoke to deputy head of the House Housing Committee Mohamed Ismail about the building collapse, which he also attributed to building code violations overlooked by local officials. Ismail called on increased oversight from the Housing Ministry (watch, runtime: 6:43).

Separately, Trade and Industry Minister Tarek Kabil phoned in to Al Hayah Al Youm to tell host Tamer Amin about the ongoing World Trade Organization’s ministerial conference in Buenos Aires. According to Kabil, Egypt is acting as a leader of sorts in presenting African countries’ trade issues during negotiations (watch, runtime: 4:37).

Meanwhile on Yahduth fi Masr, Sherif Amer spoke to sources about an upcoming list of presidential pardons for some 250 individuals, most of them apparently jailed for acts of political protest.

Speed Round

Employees in Egypt, Albania, and the UK can apparently kiss their 2018 pay raises goodbye, as HR consultancy Korn Ferry predicts that raises will be offset entirely by inflation and price hikes. “In Egypt, top-line salaries will increase by 15%, but an 18.8% inflation rate means employees will see a cut in real wages of -3.8%.” It’s not looking that great for the rest of the world either. You can read a detailed summary of the report here or play with their salary forecast tool, but be warned that you’ll need to give them tons of personal information as a marketing lead before you get your data.

Also from the Department of Prognostication: Banks in Egypt, Morocco, and Nigeria are expected to perform better than their counterparts elsewhere in the continent in 2018, according to Banks — Africa, 2018 Outlook (paywall), a report now out from Moody’s (press release here). The report has an overall negative outlook on the African banking sector in 2018, a reflection of “high macroeconomic risks that expose banks to asset quality pressures, reduced government support and sovereign, credit risk.”

INVESTMENT WATCH- China’s TBEA Sunoasis will be investing in a EGP 2 bn in a PV solar panel manufacturing plant in Aswan in partnership with the Military Production Ministry, government sources tell Al Mal. TBEA will put up 49% of the capital in the project, the source added. Both parties have yet to settle on how to finance the project, and are mulling whether to reach out to Egyptian banks and regional financial institutions or having TBEA fund the entire project. The factory is expected to supply the Benban solar park.

INVESTMENT WATCH- Arby’s is coming back to Egypt. Atlanta fast food chain Arby’s signed a development agreement to open 50 restaurants in Egypt in 2018 with franchisee Vantage Egypt for Tourism and Entertainment, according to the Atlanta Business Chronicle. “We are very determined to make Arby’s one of the most successful restaurant concepts in the Egyptian market,” said Mohamed Halawa, head Vantage Egypt, which owns and operates Papa John’s Pizza in Egypt. Arby’s is also opening locations in Kuwait and Saudi Arabia through Kharafi Global as part of Middle East expansion. Last month, the company had made a bid to acquire Buffalo Wild Wings for USD 2.4 bn. Arby’s had a toehold in Egypt 17 years ago when one of us was a fresh-off-the-boat khawaga, but closed its last outlet soon thereafter.

Do you want fries with that? Buffalo-based specialty french fry cafe, Get Fried, is also coming to Egypt and other locations in the Middle East, Buffalo Business First says (paywall). The french fry restaurant currently has branches in New York, Texas, and California.

IPO WATCH- Shares of Ibnsina Pharma debuted on the EGX yesterday under the stock symbol ISPH.CA, rising 16% to EGP 6.73 from EGP 5.80 at the opening bell.

The first-day success of the IPO is a sign of investor confidence in Egypt’s pharma sector, said the company’s Chairman Mohsen Mahgoub at the opening bell (pdf) where he was joined by Investment Minister Sahar Nasr and EGX Chairman Mohamed Farid. He added in a statement to the press that the company was anticipating sales this year will reach EGP 9.6 bn, up from EGP 7.6 bn in 2016. The company had begun exporting to Libya a month ago and plans to tap into new markets in Africa in the future, said Mahgoub. Beltone Financial, which quarterbacked the offering as sole global coordinator and bookrunner, said yesterday that it has a pipeline of nearly a dozen IPOs and M&As for potential execution in 2018. Matouk Bassiouny acted as counsel to the issuer, while Inktank Financial is investor relations advisor.

LEGISLATION WATCH- The House of Representatives’ Economic Affairs Committee has started looking into amendments to the Companies Act, Ahram Gate reports. While the most visible change to the law seems to be allowing the establishment of sole proprietorship companies, the law also includes amendments to corporate governance regulations. The Ismail cabinet has been tight-lipped about the amendments since approving them back in August. One article, which apparently gives the board of directors the right to suspend a member if they “divulge corporate secrets,” has kicked up quite a debate in the committee, Al Wafd reports. Many committee members have objected to the article, saying it could encourage companies to be less transparent.

The committee’s session on the Companies Act apparently segued into a debate on what some members claim to be the slow implementation of the Investment Act. MP Amr Ghallab was particularly critical of the investor centers not being ready yet, demanding that there should be a deadline for when they will be ready. As we noted yesterday, the committee wants to question Investment Minister Sahar Nasr over “conflicts” between different ministries, which has delayed the establishment of the center and the release of the ministry’s investment map of 600 projects.

Cleopatra Hospital Group’s Nile Badrawi Hospital has been served with a court order placing it under the Nile Transport Authority’s (NTA) administrative control to compel the hospital to pay the authority EGP 7 mn for allegedly using its land, Cleopatra Group said in a statement to the EGX. Cleopatra notes, however, that the Court for Urgent Matters issued a ruling on 27 November annulling the NTA’s 2016 claim against the hospital. The NTA had requested that the hospital pay EGP 36 mn for the land upon which Nile Badrawi Hospital is built.

Egypt will reportedly receive the first tranche of a loan from Russia for the construction the Dabaa nuclear power plant in January, sources at the Electricity Ministry tell Daily News Egypt. Russia is expected to cover 85% of the plant’s construction costs, but the initial amount will be used to cover the costs of nuclear reactor designs and additional studies on safety and environmental impact of the USD 30 bn facility, the agreement for which President Abdel Fattah El Sisi signed when Russian counterpart Vladimir Putin visited earlier this week.

Construction should officially start in 2020, once the Russian nuclear energy company Rosatom obtains the necessary approvals on the exact location and designs from the Egyptian Atomic Energy Authority (EAEA), which are also a prerequisites for the issuing of commercial licenses, the sources add. Electricity Minister Mohamed Shaker said on Monday that commercial operations on the first nuclear reactor, with a generation capacity of 1.2 GW, should begin in 2026.

Could red tape delay construction? The EAEA will not only have to review site plans, technical studies, and environment impact reports before giving its approval — the project will also need a sign-off from the Environment Ministry before construction can begin, sources tell Al Borsa. They did not state whether the recently-established Nuclear Power Plant Authority, which would be directly responsible for the regulating plants, will be required to weigh in as well.

While the EAEA sifts through the Dabaa paperwork, a delegation from Russia’s State Duma is expected in Cairo today to discuss security cooperation with the House Defense and National Security Committee, Ahram Gate reports. The visit comes just a few short weeks after Russia and Egypt signed an agreement allowing each to use the other’s airspaces and air bases for warplanes.

In other Russia news, a feasibility study on an Egyptian logistics and trade hub in Russia will be completed in two months, Egyptian-Russian Business Council Alaa Ezz said, according to state news agency MENA. The logistics zone, which was first announced by the Trade and Industry Ministry in 2016, will be used to market and sell Egyptian exports in Russia. "The hub will focus in its first phase on agricultural and food products," he added.

The Supply Ministry has plans to rework the country’s bread subsidy system by May 2018, Minister Ali El Moselhy announced at a meeting with the Cairo Chamber of Commerce yesterday, Al Mal reports. The ministry is looking to curb the rising price of baking and to legislate profit margins for bakeries that are part of the subsidy system, El Moselhy said, without providing further details. The ministry had raised the cost of bread production in July to EGP 180 per each 100 kg sack of flour, which yields 1,250 loaves. The subsidy system currently covers 81 mn citizens and the state is prepared to add more beneficiaries if needed, the minister said, according to Youm7. Ration card holders are allowed to purchase subsidized goods from any retailers across the country as long as the retailer is linked to the electronic system, the minister said. He had previously issued a decision to restrict cardholders’ access to subsidized bread to bakeries in the governorate where they officially reside, but later decided to postpone the move.

The ministry is also working with the Council of State (Maglis Al Dawla) to amend domestic trade laws to “match current political and economic conditions,” Al Masry Al Youm reports. The story offers no further detail, and we can’t even begin to tease out what this means. This comes as the ministry is implementing a new logistics-focused domestic trade strategy, which El Moselhy unveiled in September.

One thing that will remain unchanged is the policy requiring food manufacturers to clearly list prices on their packaging. El Moselhy said the policy will be strictly implemented once the grace period granted to manufacturers ends as of February 2018, and that all products that do not comply with the policy will be confiscated, AMAY reports. According to the minister, manufacturers do not necessarily have to print individual price labels on the products’ packaging. Any means of “clearly listing” the price will do, including providing retailers with a price list to hang in their shops. El Moselhy stressed that this is not a mechanism to impose price controls.

Europe risks another wave of refugees “if aid programs are not sustained in five neighboring countries hosting the bulk of them,” the UN said on Tuesday, according to Reuters. Egypt, Turkey, Lebanon, Jordan, and Iraq house a collective 5.3 mn registered Syrian refugees, according to UNHCR statistics. The agency has only received 53% of a total USD 4.63 bn package for 2017, UNHCR MENA bureau director tells the newswire. Egypt is meant to receive a EUR 60 mn grant from the EU to help stem the flow of illegal migrants to Europe.

The Macro Picture

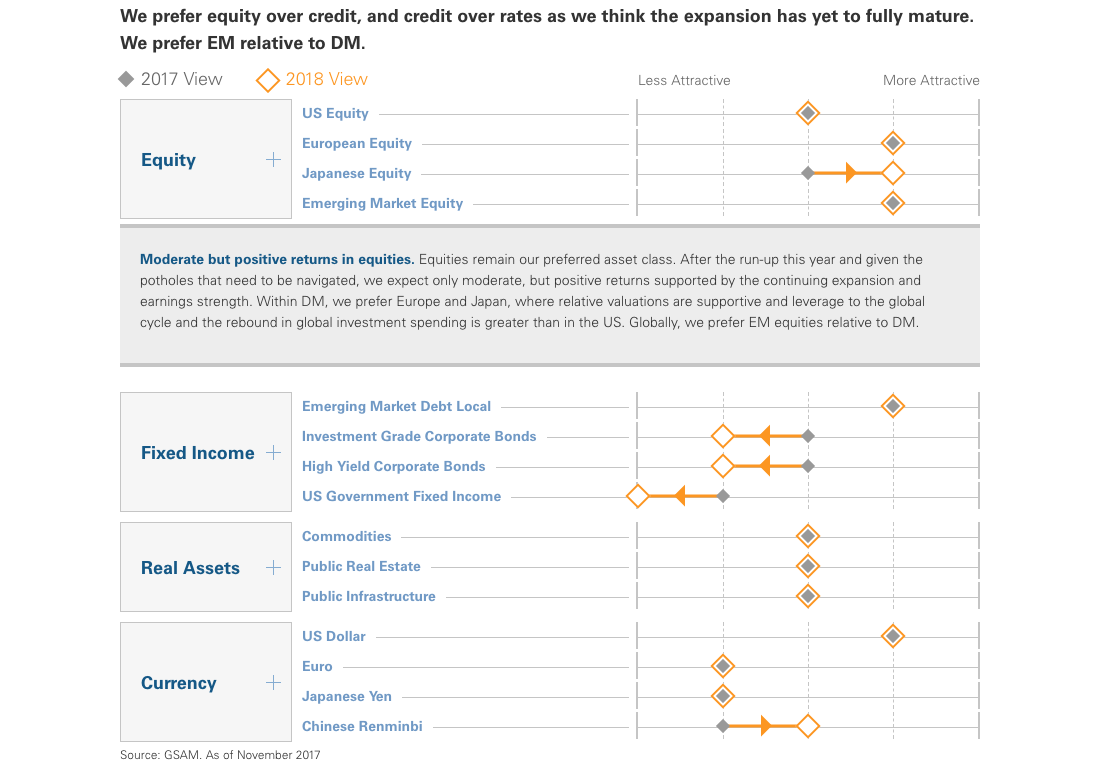

Goldman Sachs Asset Management (GSAM) expects emerging markets will outperform developed economies, supporting EM assets in its 2018 Investment Outlook.

GSAM has a laundry list of advice for investors heading into 2018, saying they will need to invest for continued global growth, manage the risks of elevated valuations, diversify income sources as central banks tighten, navigate the forces of disruption, and uncover insights from Big Data. The report notes that “with the global economic expansion likely to continue, we prefer equities over credit and credit over rates.”

“EM, outside of China, is a bright spot and we continue to prefer EM over developed market assets,” Goldman writes, noting that US and other developed market government bonds are overvalued (US equities, though, may not be). Valuations in Europe, Japan, and EM are particularly attractive, they think. GSAM believes central bank tightening will be a catalyst for volatility in 2018 with market expectations for Federal Reserve interest rates hikes unrealistically low. “The bottom line for us [in 2018] is we expect increased volatility throughout the year, but we think it’s too early to begin positioning for underweighting risk assets broadly,” says Kane Brenan, Global Head of Goldman Sachs Asset Management.

Egypt in the News

It’s a morning of barley-warmed leftovers for Egypt in the international press this morning, and for that we give thanks. The top two stories: Plenty of ink is being spilled on little-known singer Shaymaa, who is entering the final seconds of her 15 minutes of fame after having been sentenced to two years for “debauchery.” And a UK woman alleged to have smuggled opioids into the country is said by the tabloid press to be losing her hair in jail after being told her Christmas Day hearing may be postponed a month.

The Financial Times is getting into the leftovers game, too, barely able to summon the energy to “update” stories that ran earlier this year for a package headlined Doing Business in the Arab World 2017. Included here is Heba Saleh’s piece from July on the private sector’s war with interest rate hikes and inflation. The piece, which followed the CBE’s 700 bps interest rate hike and when inflation was still over the 30s mark, spoke to the frustrations of the business community unable to pass the costs over to the consumer. Other pieces from the series include:

- The Arab world: 2017 in rewind

- Will ‘world’s biggest IPO’ reach its USD 2 tn prediction?

- Amazon buys into the Middle East

- Gulf banks face up to Qatar fallout

- Middle Eastern disrupter airlines fly into heavy turbulence

Irish-Egyptian national Ibrahim Halawa says “dozens” of his cellmates in Egypt were radicalized to support Daesh’s views, the AP’s Brian Rohan writes. Halawa, who was released from jail in October after four years of being held in pretrial detention, says jail conditions in Egypt led many to “the brink of despair.” “In the beginning, no one had even heard of Daesh, but by the time I left, maybe 20 percent were openly supporting their ideas. It could have been just talk … but after all those years of being in jail with no explanation, many wanted revenge,” says Halawa.

Also worth a skim this morning:

- 70% of Palestinians polled by Reuters said they do not trust Egypt to broker peace with the Israelis, while 80% said they do not trust Saudi. (Super, we say. Go broker your own peace deal and we’ll focus on growing our economy.)

- Doctors diagnosed a 2,000-year-old mummy with cancer after analyzing it for 11 years, according to the Daily Caller. Good thing it was already dead.

On Deadline

Nearly a week after US President Donald Trump’s declaration, Jerusalem is still “top of mind” (as the marketing drones say) for the nation’s columnists. Al Shorouk’s Emad El Din Hussein and Al Masry Al Youm’s Manar El Shorbagy say that the US’ decision to move its embassy in Israel from Tel Aviv has effectively destroyed, or at least significantly rerouted, Palestinian-Israeli peace talks. Hussein and Alaa El Hadidi both see the decision as a window into US President Donald Trump’s thought process and political priorities. While El Watan’s Yasser Abdel Aziz and AMAY’s Amr El Shobaky say that Trump is unlikely to reverse his decision because Arab countries’ internal struggles have made them too weak to exert enough influence over the US or pay enough attention to the Palestinian cause.

Diplomacy + Foreign Trade

Egypt, Switzerland agree on USD 87 mn 2017-2020 cooperation framework: Swiss State Secretary for Economic Affairs Marie-Gabrielle Ineichen-Fleisch and Investment and International Cooperation Minister Sahar Nasr launched yesterday the CHF 86 mn (USD 87 mn) Swiss Cooperation Strategy in Egypt, according to a Swiss embassy statement. “Switzerland funds development projects across Egypt in three domains: democratic processes and human rights, inclusive sustainable economic growth and employment, and migration and protection.”

The Swiss minister also sat down with acting Prime Minister Mostafa Madbouly to talk about potentially increasing Swiss investments in Egypt and boosting bilateral economic cooperation. Ineichen-Fleisch also met with Finance Minister Amr El Garhy to discuss Egypt’s progress on its economic reform program and improving the investment climate.

Egypt and Brazil are studying forming a joint economic committee to facilitate trade, said Trade and Industry Minister Tarek Kabil, Ahram Gate reports. His statements follow a meeting with his Brazilian counterpart Marcos Pereira and Brazil’s Foreign Minister Aloysio Nunes on the sidelines of the World Trade Organization (WTO) ministerial meetings in Buenos Aires. Other avenues off economic cooperation discussed include Egypt’s membership in the Mercosur agreement and setting up the Brazilian side of the Egyptian-Brazilian Business Council, Kabil added.

An Armed Forces delegation is reportedly in South Sudan to provide training and assistance to the Sudanese People’s Liberation Army (SPLA) in the development of agriculture, animal resources, and mining, according to South Sudanese outlet Gurtong. SPLA General Dau Alier said that the training will not be for military purposes.

Energy

Oil Ministry expecting Egypt’s natgas output to reach 6.4 bcf/d by mid-2018

Egypt’s natural gas output is expected to reach 6.4 bcf/d by mid-2018, by which time Zohr will be producing 750 mcf/d and the Nooros gas field will be producing 100 mcf/d, Oil Ministry sources tell Al Borsa. Oil Minister Tarek El Molla had previously said natural gas output will reach 6.2 bcf/d by the end of FY2017-18, and that Egypt will reach self-sufficiency by the end of 2018. Egypt currently produces 5.2 bcf/d of natural gas.

Naftogaz’ Egypt operations see profits this year for the first time since 2007

Ukraine’s Naftogaz reported that its oil and gas operations have seen a profit for the first time since 2007. “This year we’ve received a net cash surplus of USD 5 mn. Prior to that, our losses were estimated at USD 20-30 mn every year," Naftogaz Chief Commercial Officer Yuriy Vitrenko, according to UNIAN. The announcement comes just as the company looks into selling its assets in Egypt. The company hired France’s Lazard to advise on the possible sale of Egypt assets back in August.

Misr Petroleum begins trial runs on Badr oil storage complex

Misr Petroleum has begun trial runs on its USD 30 mn petroleum storage complex in Badr City, Ahram Gate reports. The facility, which can store up to 33 mn liters of oil, is a crucial storage component for fuel destined for the Greater Cairo area, Oil Minister Tarek El Molla said at launch ceremony.

Infrastructure

Irrigation Ministry planning new dam in Shalatin area

Egypt’s Irrigation Ministry is planning a 12m-high dam in the disputed Shalatin area, head of the ministry’s ground water department Sameh Sakr said earlier in the week, Mubasher reports. The dam, with the ministry says will be the biggest in Egypt’s Eastern Desert, will have a storage capacity of 7 mn cubic meters of water and will be built by Egyptian Armed Forces’ National Service Projects Organization, said Sakr in a statement to MENA news agency. He reassured that the project will not be an obstacle in the road to the Upper valleys, nor will it affect the ecological balance in anyway. The sovereignty of the Shalatin region, along with Halayeb, is being disputed by Sudan.

Basic Materials + Commodities

Delegation of grape exporting companies to visit Canada in February

A group of grape exporters will visit Canada in February 2018 to attempt to tap into the country’s USD 650 mn grape import market, according to Egypt Today. The Food Export Council will also choose 10 companies to participate in the SIAL Canada food and beverage exhibition in May 2018, where meetings will be arranged with Canadian retailers to negotiate export agreements. El Bially added that a USD 120k Canadian funded program to educate SMEs on procedures for exporting to Canada is being launched with expansion plans to include more sectors in mind.

Obour Land to import 1,500 heifers for their new dairy farm

Obour Land plans to import 1,500 heifers from Germany for the dairy farm the company plans to establish under the brand name Obour Farm, the company’s head of IR Ahmed Abdel Moneim tells Al Borsa. 500 cows will initially be used when the farm kicks off operation in January 2018, he added. Obour Land announced they were starting a dairy farm to be able to source cheaper dairy for its cheese operations.

GASC receives eight offers in int’l wheat tender

The General Authority for Supply Commodities (GASC) purchased 295k tonnes of Russian and Ukrainian wheat in a tender yesterday, traders tell Reuters’ Arabic service. Of those, 60k tonnes were acquired from the Ukraine at USD 208 per tonne, while the other four shipments are Russian and range in price from USD 207.89-209.15 per tonne, they add. The shipments from Tuesday’s international tender are meant for delivery on 21-31 January.

Tourism

EHCAAN spending USD 57 mn on security

The Egyptian Holding Company for Airports and Air Navigation (EHCAAN) is spending USD 57 mn to upgrade and develop its security hardware and systems, Chairman Mohamed Said said yesterday, Al Borsa reports. The upgrades will be implemented over two phases, he said, without providing additional detail on the plan.

Tourism Ministry bars companies from booking with unlicensed travel agents

The Tourism Ministry issued a decision which bars tourism companies from booking trips with travel agents that are not licensed by the ministry. The decision was published on the Official Gazette on Tuesday, Al Borsa reports.

Banking + Finance

PHD considers upping securitized bond issuance to EGP 1.6 bn next year

Palm Hills Development (PHD) is considering increasing its securitized bond issuance to EGP 1.6 bn from EGP 500 mn, PHD Chairman Yassin Mansour tells Al Borsa. The company is looking into making the first issuance of EGP 800 mn in February 2018, and have the second half in mid-2018, he added. PHD had said last month that it was planning to delay the issuance until the CBE’s Monetary Policy Committee reduces interest rates. With inflation dropping to 26% in November, the company clearly sees interest rates falling before February. Mansour added in statements to Daily News Egypt that no one has been appointed manager or advisor on the bond issuances yet.

National Security

Armed Forces to hold defense exhibition in 2018

The Armed Forces will hold their first defense exhibition, the Egypt Defence Expo (EDA), from 3-5 December 2018, Ahram Online reports. The event, which will be held every two years, will showcase Egyptian-made military hardware and global high-tech defense systems.

Defense Minister to hold cooperation talks in Cyprus

Defense Minister Sedki Sobhi arrived in Cyprus yesterday to meet with top Cypriot officials and military commanders, Egypt’s Armed Forces said in a statement. Sobhi’s visit, which will last “several days,” is aimed at increasing security cooperation between Egypt and Cyprus, the statement says.

Sports

Atletico Madrid to play Al Ahly in charity game for Rawda victims

Atletico Madrid will play a friendly game against local football club Al Ahly on 30 December at Alexandria’s Borg El Arab stadium, according to ESPN. Proceeds from the match will be used to support victims of the Al Rawda mosque attack, which left over 300 dead.

The Market Yesterday

EGP / USD CBE market average: Buy 17.76 | Sell 17.86

EGP / USD at CIB: Buy 17.75 | Sell 17.85

EGP / USD at NBE: Buy 17.69 | Sell 17.79

EGX30 (Tuesday): 14,590 (+1.1%)

Turnover: EGP 1.6 bn (53% above the 90-day average)

EGX 30 year-to-date: +18.2%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.1%. CIB, the index heaviest constituent closed up 1.4%. EGX30’s top performing constituents were Heliopolis Housing up 5.7%; SODIC up 4.4%; and Pioneers Holding up 2.1%. Yesterday’s worst performing stocks were Egyptian Resorts down 1.9%; Arab Cotton Ginning down 1.2%; and Global Telecom down 0.3%. The market turnover was EGP 1.6 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +153.5 mn

Regional: Net Short | EGP -95.5 mn

Domestic: Net Short | EGP -58.0 mn

Retail: 58.7% of total trades | 51.7% of buyers | 65.8% of sellers

Institutions: 41.3% of total trades | 48.3% of buyers | 34.2% of sellers

Foreign: 20.0% of total | 24.8% of buyers | 15.2% of sellers

Regional: 14.5% of total | 11.5% of buyers | 17.5% of sellers

Domestic: 65.6% of total | 63.7% of buyers | 67.4% of sellers

***

PHAROS VIEW

Egypt’s Universal Healthcare Act — A Primer: Pharos Holding gives an overview on the c.EGP 600 bn Universal Healthcare Act, the government’s health coverage plan for the country. The report will address some of the key elements of the law, namely: what is the act and what it hopes to achieve; a breakdown of the three new regulators which will administer the plan; costs and funding planned; why is the act positive for the healthcare sector in Egypt; as well as providing some trading multiples for pharma companies and hospitals. You can read the full report here (pdf).

***

WTI: USD 57.21 (-1.35%)

Brent: USD 63.54 (-1.78%)

Natural Gas (Nymex, futures prices) USD 2.69 MMBtu, (-4.88%, January 2018 contract)

Gold: USD 1,245.6 / troy ounce (-0.1%)

TASI: 7,123.06 (+0.32%) (YTD: -1.21%)

ADX: 4,381.8 (+0.59%) (YTD: -3.62%)

DFM: 3,453.99 (+1.17%) (YTD: -2.18%)

KSE Weighted Index: 394.14 (+0.95%) (YTD: +3.7%)

QE: 8,033.28 (+1.39%) (YTD: -23.03%)

MSM: 5,050.54 (+0.19%) (YTD: -12.66%)

BB: 1,264.13 (-0.08%) (YTD: +3.58%)

Calendar

15 December (Friday): The Law Magazine’s Law Talks event, Zamalek palace, Cairo.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

29-30 January (Monday-Tuesday): Seamless North Africa, The Nile Ritz-Carlton, Cairo

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

29 April – 1 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.