Money managers think that Standard & Poor’s new “Fragile Five” list is off

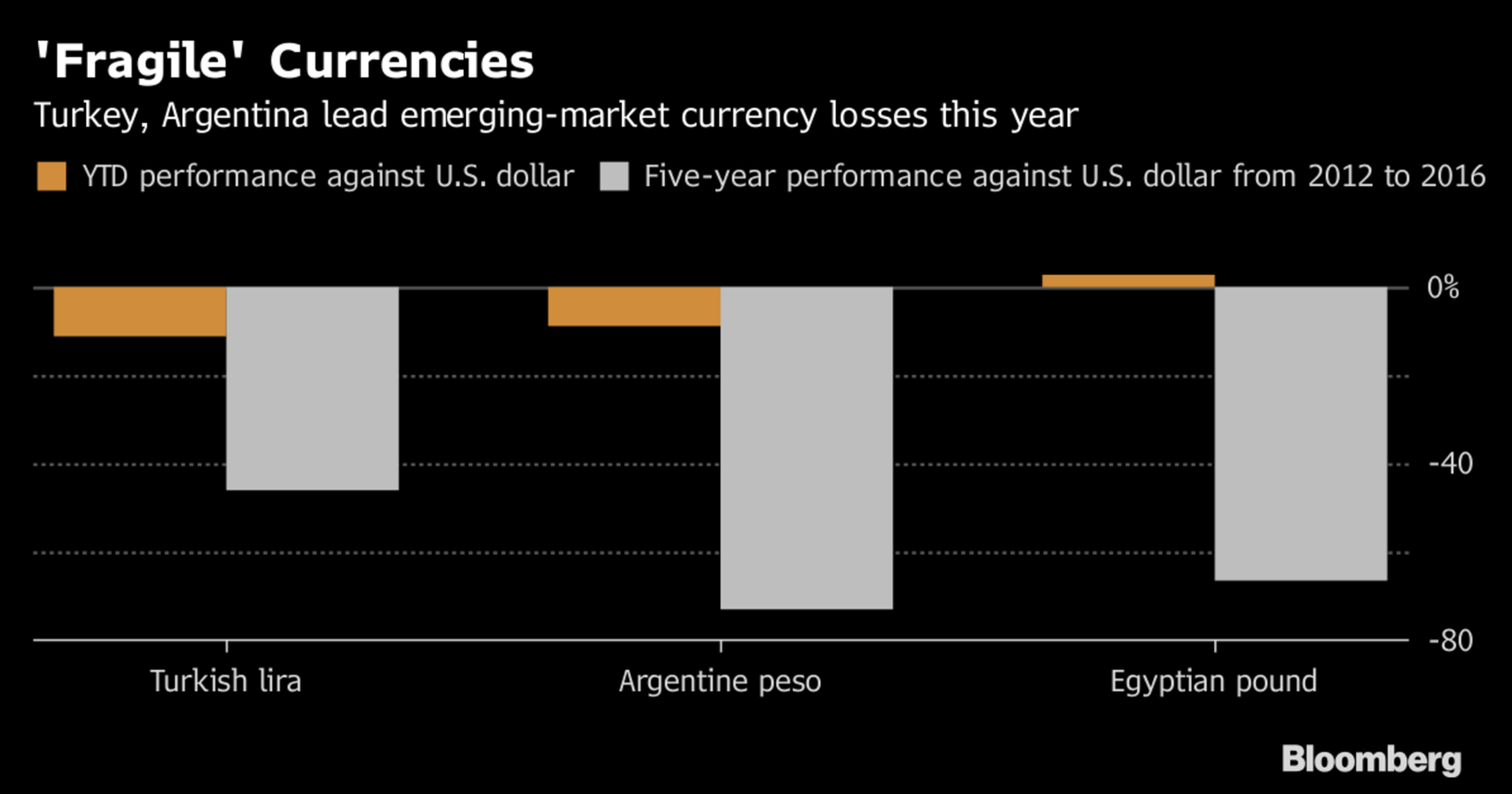

Didn’t we tell you S&P’s updated ‘Fragile Five” list is nonsense? Money managers including Goldman, BlackRock think that Standard & Poor’s new “Fragile Five” list is off. Wall Street has been wrong in the past about the BRICS and the PIGS, and data suggests it’s also off about the fragility of some emerging markets, Bloomberg says. Despite the risk factors associated with Egypt, Qatar, Turkey, Pakistan, and Argentina, “current-account and fiscal deficits, excluding Pakistan, haven’t deteriorated to the same level as past members. That’s created select buying opportunities.” Emerging markets on the list are also far more responsive to shocks than they were before and their long-term outlooks are a lot more positive. “Egypt’s painful economic adjustment has the chance to restore macroeconomic stability,” Goldman Sachs’ Angus Bell says. The new list “surveyed the 20 largest sovereigns by commercial debt outstanding to see who would be in the most peril should interest rates rise.” While that may make them vulnerable to USD liquidity shortages, “there’s no guarantee of when the tipping point will be reached,” a BlackRock PM said.