- Prime minister seeks medical treatment in Germany; El Sisi to appoint caretaker for the next three weeks. (What We’re Tracking Today)

- Growth broke the 5% mark in the first quarter of the current state fiscal year. (Speed Round)

- The IMF’s new Egypt boss had glowing things to say about the reform program (even if we really, really disagree with him on interest rate policy). (Speed Round)

- IPO WATCH- Ibnsina Pharma has priced its initial public offering on the Egyptian Exchange at EGP 5.21-5.95 per share. (Speed Round)

- M&A WATCH- Saudi’s Elaj Group buys Alexandria International, Ibn Sina Specialized Hospital, continuing its acquisition spree. (Speed Round)

- Mamish insists it is a matter of time before Mercedes-Benz starts operating in Egypt. (Speed Round)

- Fawry nets USD 20 mn in funding, Flat6Labs to manage EGP 47 mn startup initiative for UK embassy and IFC. (Speed Round)

- Didn’t we tell you S&P’s updated ‘Fragile Five” list is nonsense? (What We’re Tracking Today)

- The Market Yesterday

Thursday, 23 November 2017

Prime minister seeks medical treatment in Germany

Plus: GDP growth hits 5.2%, Ibnsina Pharma prices IPO.

TL;DR

What We’re Tracking Today

Prime Minister Sherif Ismail is in Germany today to receive treatment and undergo surgery for an unspecified illness, according to a statement from the cabinet on Wednesday. Ismail will be there for three weeks, the statement added. Cabinet spokesperson Ashraf Sultan made the rounds on the talk and news shows last night to explain that the operation was a routine procedure on the PM’s digestive system and made it clear that there was no cancer. Ismail had previously taken medical leave from cabinet while oil minister..

In a call to Al Hayat Al Youm, Sultan added that President Abdel Fattah El Sisi will appoint someone to mind Ismail’s portfolio while the PM is out. The announcement came amid heightened speculation about the prime minister’s health, which saw cabinet deny a month ago that Ismail was ill.

A short week next week? The EGX announced yesterday that it will be off on Thursday 30 November, according to a statement (pdf). We have no statement from the CBE on whether it will declare next Thursday a holiday, but Al Masry Al Youm claims it will, citing a statement from the central bank. Prime Minister Sherif Ismail declared the day a holiday for the public sector to mark the occasion of Prophet Muhammad’s birthday, which actually falls on Friday 1 December.

Then again, maybe I won’t. (With apologies to Judy Blume.)Lebanese Prime Minister Saad Al Hariri announced yesterday he would hold off presenting his resignation as prime minister in response to a request from President Michel Aoun to allow more dialogue, Reuters reports. “I presented today my resignation to President Aoun and he urged me to wait before offering it and to hold onto it for more dialogue about its reasons and political background, and I showed responsiveness,” Hariri said.

A delegation from the British Civil Aviation Authority will wrap its fourth and final day of security inspections in Cairo International Airport today, says Egypt Independent.

The French-Egyptian Sustainable City Week continue through 28 November. French Ambassador Stéphane Romatet, former Prime Minister Ibrahim Mahlab, and Electricity Minister Mohamed Shaker are expected to be in attendance along with a number of CEOs of French and Egyptian companies. Yesterday saw Investment Minister Sahar Nasr signed for a EUR 500k grant from the French Development Agency. Details are below in the Diplomacy and Foreign Trade section.

It’s the second day of Schneider Electric’s 2017 Innovation Summit Egypt, which runs until Friday. The firm will launch its EcoStruxure architecture and platform for end-to-end IoT-enabled solutions. CEO and Chairman Jean-Pascal Tricoire is expected in attendance, alongside the ministers of electricity and CIT.

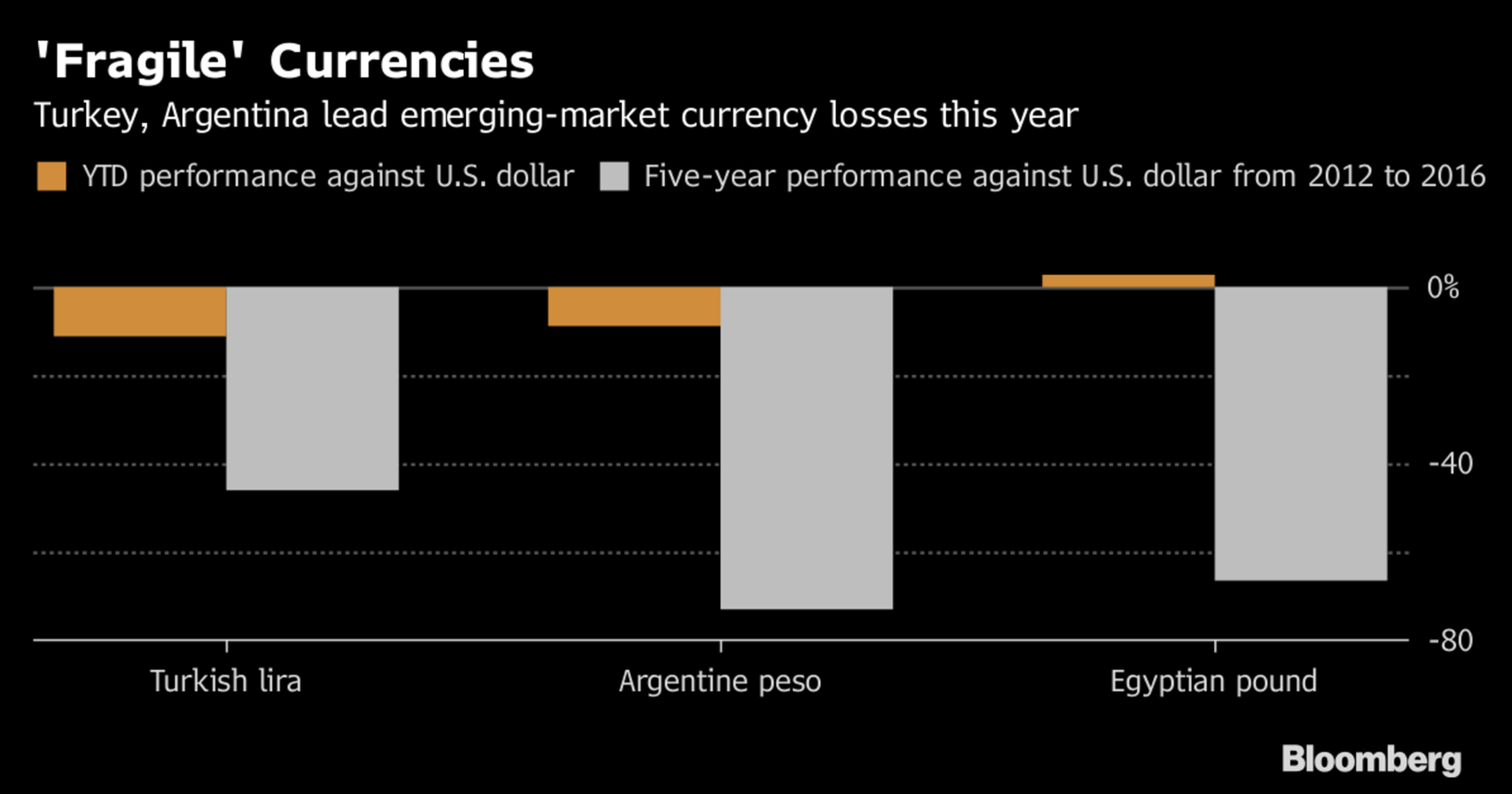

Didn’t we tell you S&P’s updated ‘Fragile Five” list is nonsense? Money managers including Goldman, BlackRock think that Standard & Poor’s new “Fragile Five” list is off. Wall Street has been wrong in the past about the BRICS and the PIGS, and data suggests it’s also off about the fragility of some emerging markets, Bloomberg says. Despite the risk factors associated with Egypt, Qatar, Turkey, Pakistan, and Argentina, “current-account and fiscal deficits, excluding Pakistan, haven’t deteriorated to the same level as past members. That’s created select buying opportunities.” Emerging markets on the list are also far more responsive to shocks than they were before and their long-term outlooks are a lot more positive. “Egypt’s painful economic adjustment has the chance to restore macroeconomic stability,” Goldman Sachs’ Angus Bell says. The new list “surveyed the 20 largest sovereigns by commercial debt outstanding to see who would be in the most peril should interest rates rise.” While that may make them vulnerable to USD liquidity shortages, “there’s no guarantee of when the tipping point will be reached,” a BlackRock PM said.

CORRECTION- Cigarette prices could see a net increase of EGP 0.75 for packs costing less than EGP 18, EGP 1.25 for those sold for EGP 18-30, and EGP 1.25 for packs sold for more than 30. The new increases represent a rise in the fixed tax per pack. The old fixed tax rates were EGP 2.75, EGP 4.25, and EGP 5.25, respectively. We calculated the increases incorrectly in yesterday’s issue as we did not take the existing tax into account. Still, it is not clear what the final market price on cigarettes will be as we await new price announcements by producers. Eastern Company announced yesterday that it has not taken any decision on pricing yet. The company also halted all cigarette deliveries to the market yesterday in anticipation of President Abdel Fattah El Sisi signing off on the tax increase, Chairman Mohamed Othman Haroun tells AMAY. H/t Zein M on this one.

**HAPPY THANKSGIVING to our American readers. May we suggest you read in the New York Times how to cook a turkey and then go blow off steam by downloading and playing Sonic the Hedgehog 2 (now available without charge from Sega for iOS devices on the game’s 25th anniversary) rather than throwing that bowl of yams at Uncle Louie’s head because he won’t stop droning on about everything he thinks you’ve done wrong in life?

On The Horizon

RiseUp Summit kicks off on 1 December. The three-day event will include more than 150 speakers, 150 exhibiting start-ups, 50 pitches, and 20 workshops. The full agenda can be found here.

Our friends at AmCham are hosting a conference on the Private Sector’s Role in Implementing Sustainable Development Goals on 4 December. The conference, which is being held in conjunction with the UNDP, aims to chart new and creative methods for local and regional partnerships between the private sector and governments, and identify business opportunities that align with the sustainable development goals. The keynote speakers for the event will be Investment and International Cooperation Minister Sahar Nasr, Planning Minister Hala Saeed, and UN Deputy Secretary General Amina Mohammed.

Egypt plans to launch its first electronic visa in December at the Cairo ICT expo running from 3-6 December.

The Investment Ministry’s investment map of some 600 projects will officially be unveiled at the Business for Africa and the World Forum that will be held in Sharm El Sheikh on 7-9 December.

December should also see the ICT Ministry inaugurate two new technology zones, one each in Sadat City and Beni Suef, where the first locally assembled smartphone will also be unveiled.

Enterprise+: Last Night’s Talk Shows

The talking heads delved into a variety of topics last night, the most pressing being Prime Minister Sherif Ismail taking time off to pursue medical treatment in Germany.

Cabinet spokesperson Ashraf Sultan made the rounds on the talk shows to downplay the seriousness of the threat to the PM’s health. He stressed that the government’s work continues as normal and repeated that Ittihadiya would tap someone to mind the shop in Ismail absence. Sultan’s talk with Kol Youm’s Amr Adib is representative (watch, runtime: 3:11).

Price fixing in media: The heads of DMC, ONTV, Al Hayah, CBC and Al Nahar channels have agreed to collectively set caps on guest fees and the price they pay to acquire content. The channels will offer no more than EGP 70 mn for new series and pay a maximum of EGP 250k for a guest appearance, the head of media division of the Chambers of Commerce tells Al Hayat Al Youm’s Tamer Amin. The decision came as mounting costs of buying new media have eaten into their profit margins. Amr El Fekky, CEO of D Media Group, owner of DMC Channels, called in to hammer the point across, adding that this is the first such agreement between rival television companies in Egypt (watch, runtime: 6:51).

Judicial reform topped the conversation over on Masaa DMC, with the head of the Supreme Constitutional Court (SCC) Abdel Wahab Abdel Razek acknowledging that reform was needed to expedite cases that have been lingering for ages. He added that guidelines and laws governing the judiciary date back to the ‘30s and ‘40s. He stressed however, that judges in the SCC are politically neutral and should not be party to any political dispute — undoubtedly a reference to the Tiran and Sanafir handover agreement, on which the Supreme Court is expected to deliver a ruling on early next year. (You can watch the full interview here, runtime: 59:01).

Hona Al Asema’s Lamees Al Hadidi spent the entirety of last night’s episode on a tribute to actress Hend Rostom, (watch, runtime: 1:52:12).

Speed Round

Egypt’s economy grew 5.2% in the first quarter of FY2017-18 from 3.4% in the same period last year, Planning Minister Hala El Said announced yesterday, reports Reuters. The government is targeting a growth rate of 5-5.25% for the full fiscal year.

The first quarter of the fiscal year also saw Egypt record its lowest primary budget deficit figure in a decade, according to a statement from the Ismail cabinet. The primary budget deficit dropped to 0.1% of GDP during the quarter, from 0.9% a year before. Results also show that Egypt, for the first time in years, achieved a primary surplus of around 0.2%. The overall budget deficit also shrunk to 1.9% of GDP, compared to 2.2% in the first quarter of the previous fiscal year. Government income also grew by 33% y-o-y, exceeding the 23% y-o-y growth in expenditures during the three-month period.

The IMF’s new Egypt boss, Subir Lall, had glowing things to say yesterday, noting that the nation’s economic reform program continues to pay off. He said in particular the drop in Egypt’s unemployment rate and rising FX reserves as other key metrics showing signs of improvement. Lall also praised the central bank’s monetary policy, saying he approved of the Monetary Policy Committee’s decision last week to leave our ridiculously high interest rates on hold, saying they will continue to keep inflation levels stable, Al Masry Al Youm reports.

(That last bit simply makes us want to scream: INTEREST RATES ARE NOT AN EFFECTIVE MEANS OF TRANSMITTING MONETARY POLICY IN A NATION WHERE AT LEAST 70% OF THE POPULATION IS UNBANKED. We get it, Mr. Lall. You let us here in Egypt off the hook and the IMF undercuts its bargaining position in the next market it needs to bail out — a market where, presumably, the majority of folks are banked. But still: Current interest rates are great for the carry trade, not so much for those of us looking to grow real businesses that create jobs and economic opportunities.)

Lall also had warnings on possible threats to the progress of the reform program. He pointed to regional instability and the rise in oil as some of the biggest risks facing the program. On the latter, he said that the government may need to reassess its spending if oil prices continue to rise. In an interview with Al Shorouk, Lall added that he does not see next year’s presidential election posing a risk to the reform agenda.

And speaking of the IMF, Egypt is set to receive its USD 2 bn loan tranche from the Fund in December, Finance Minister Amr El Garhy said yesterday. “The payment will bring total disbursements under the program to about USD 6 bn,” Reuters notes.

IPO WATCH- Ibnsina Pharma has priced its initial public offering on the Egyptian Exchange at EGP 5.21-5.95 per share, according to a statement released overnight (pdf). The transaction will see about 40% of the company (or some 269 mn shares) offered for sale, with the shares split between institutional investors (85% of the offering) and individual investors (15% of the offering). At the midpoint of the indicative price range, Egypt’s fastest-growing and second-largest distributor of pharma products would have a market cap of c. EGP 4 bn following completion of the associated capital increase. “The final price announcement will be determined in accordance with a book-building process and is expected to occur on 5 December 2017,” the company said. The offering to retail investors in Egypt will run 3-7 December, with trading expected to start on Monday, 11 December 2017. The announcement comes after the Financial Regulatory Authority approved Ibnsina’s public subscription notice. Beltone Investment Banking is acting as sole global coordinator and bookrunner and Matouk Bassiouny is acting as counsel to the issuer. Inktank Financial is investor relations advisor.

MOVES- Ibnsina has appointed our friend Mohamed Shawky as investor relations officer. Mohamed is well-known to veterans of the Egyptian IR community from his service as investor relations manager at Egyptian Resorts Company (2010-2014) and earlier runs on staff at the Egyptian Exchange. Shawky joined Ibnsina from Kuwait’s Mezzan Holding, where he was head of investor relations starting in late 2014.

M&A WATCH- Saudi Arabia’s Elaj Group has acquired Alexandria International Hospital and Ibn Sina Specialized Hospital, Al Mal reports citing sources close to the matter. (The latter is of no relation to Ibnsina Pharma, above). Elaj completed the transaction on Alexandria International earlier in the week, with the newspaper speculating that it had been done through over the counter transactions on the EGX over a period of a few weeks for an estimated EGP 35 mn. Elaj is planning an expansion to Ibn Sina following the acquisition.

Elaj is on something of a tear: The company acquired 74% of clinical laboratory group Cairo Labs for an estimated EGP 36 mn in October before adding to its portfolio a 15% stake in the International Eye Hospital.

INVESTMENT WATCH- Suez Canal Economic Zone (SCZone) Chairman Mohab Mamish is still saying that Mercedes-Benz had approved establishing a regional logistics and distribution hub in the zone. He said that the company had cleared their “tax hurdles” in Egypt and will launch operations “soon,” according to Al Mal. There has been no official confirmation from the company since Mamish first announced the auto maker was making a comeback in Egypt back in September. Mercedes said at the time it was still considering the move. Mamish is set to travel to Germany and the UK at the end of the month to drum interest in SCZone.

E-payments firm Fawry has locked down USD 20 mn in funding from a “foreign investment fund,” said CEO Ashraf Sabry, according to Daily News Egypt. Sabry did not disclose when the funding was closed or who was investing. The funding will be used to finance expansion plans with the aim of processing EGP 25 bn in electronic transactions by the end of the year and opening up branches and setting up infrastructure nationwide.

Meanwhile, the UK embassy launched a EGP 47 mn startup initiative called “Egypt Starts” in conjunction with the International Finance Corporation, the embassy said in a statement. The program, which will be managed by Flat6Labs, will provide mentorship and drum up seed funding for some 150 startups in Egypt. Ambassador John Casson said that the program aims attract EGP 100 mn in private investments. Entrepreneurs interested in the program can apply at http://www.startegypt.com/.

LEGISLATION WATCH- The Ismail Cabinet signed off on the Ride-hailing Apps Act and referred it the Council of State for review. The bill will regulate companies such as Uber and Careem and ostensibly aims to attract new investments to the ride-sharing and group transport industry. The law prohibits personal car users from extending ride-sharing services independently without being registered to an app. It also mandates the ministries of transport and interior to coordinate in issuing regulations on licensing procedures and fees for personal cars used in ride-sharing services.

The law will also introduce an Oyster Card-like type of ticket that will be valid across different modes of available transportation, said Transport Minister Hisham Arafat . We had reported this week that the House of Representatives’ ICT committee was gearing up to begin deliberating on the bill. The law will give companies and drivers six months to comply with new regulations once it’s issued.

There has been no official word from the government or ride-hailing companies on alleged provisions mandating that customer data be sent to authorities as first reported by the New York Times. Uber is currently in hot water with regulators in the US, the UK, and Australia after it was revealed that the company had hidden a data breach that saw hackers collect personal information of some 57 mn users worldwide, Reuters reports. Uber had paid USD 100k to the hackers so they would purge what they culled in the leak without informing the authorities or the victims of the hack.

The cabinet also signed off on a number other key decisions yesterday, including:

- The Finance Ministry’s agreement with consultancy firm EY to develop and digitize tax-related procedures and operations;

- Legislative amendments that will allow economic courts to handle consumer protection-related cases;

- Extending the deadline for tour companies in Luxor, Aswan, and South Sinai to settle government debt until 30 June 2018 from this December;

- Allowing contractors working on real estate projects another year to finalize their work;

- Amendments to the Civil Aviation Act that have now been referred to the Council of State.

Bookings for Turkey and Egypt in summer 2018 are already very strong, travel firm Thomas Cook says, according to Reuters. The company reported an 8% y-o-y increase in full year earnings, helped by a turnaround of its German airline Condor and improved customer demand. CEO Peter Fankhauser says Thomas Cook is redirecting capacity that went to Spain last summer to Egypt for 2018, according to TTG. He says Egypt is one of the destinations that provide a “fantastic” value for the money. He added: “We have a strong growth out of all the markets, especially out of the UK and even with the strong growth we are far away from the situation pre Arabian spring … There is big potential there still but we can only fly to Hurghada and Marsa Alam. There is no indication when Sharm airport may reopen and we totally rely on government advice for that.”

MOVES- Iflix appointed John Saad as CEO of Iflix Middle East and North Africa. Saad previously worked as chief consumer officer at Mobily in Saudi Arabia and before that held various roles at Vodafone, including consumer director at Vodafone Egypt and chief marketing officer at Vodafone Qatar.

Interior Ministry allows Qataris entry visas into Egypt? The Interior Ministry issued a directive reversing an earlier ban on granting Qatari citizens entry visa, a decision published on the Official Gazette on Wednesday, Al Shorouk reports. This comes as the Arab Quartet has expanded their terror list to include two organizations and 11 individuals, according to the Saudi Press Agency. The World Islamic Council and the International Union of Muslim Scholars were placed on the list for their connection to Qatar and the support it has provided them. Meanwhile, Qatar escalated opening a World Trade Organization dispute proceedings against the UAE, Saudi Arabia and Bahrain on Wednesday, according to Reuters.

Emaar Development’s first day of trading got off to a rocky start with shares trading sharply lower to start the session, according to The National. The stock closed the day down 4.3%, regaining some ground after diving 7% at the opening bell. Bloomberg reported last Saturday that the company had trouble completing the USD 1.3 bn IPO due to GCC stock markets falling victim to political turbulence in the region, and a massive corruption probe in Saudi Arabia. BofA Merrill Lynch, EFG Hermes, Emirates NBD Capital, First Abu Dhabi Bank and Goldman Sachs International were joint global coordinators for the offering. Emirates NBD and First Abu Dhabi Bank were the lead receiving banks.

On that front, a number of Saudi business leaders detained as part of the corruption probe have begun making payments to settle cases in exchange for their freedom, people with knowledge of the matter tell Bloomberg. “The government is looking to send a firm message in the recent sweep,” said Emad Mostaque, London-based co-chief investment officer of emerging-markets hedge fund Capricorn Fund Managers. No word yet on whether Alwaleed Bin Talal is among the businessmen settling.

Many US Federal Reserve policymakers said expect that interest rates will have to be raised in the “near term,” according to the minutes of the Fed policy meeting released on Wednesday. Fed policymakers said they still needed to see more data before deciding the timing of a rate hike, with many pointing to the low jobless rate and low inflation, Reuters reports.

Image of the Day

Archaeologists have found three Roman era shipwrecks off the coast of Alexandria, according to the Associated Press. The discovery was made by the European Institute of Underwater Archaeology in collaboration with the Supreme Council of Antiquities. Archaeologists also found “a head sculpture carved in crystal and three gold coins dating back to Rome’s first emperor, Augustus.” The discovery was made in Abu Qir bay where other historical finds have been made in the sunken city of Heraklion.

Egypt in the News

It’s a quiet morning for Egypt in the international press, with no one topic holding particular significance — a welcome change from the arrest of Egyptian artists being sued and arrested on moral grounds. The most interesting pieces if the morning:

Israel appears to be the odd one out in the East Mediterranean energy talks: The Nicosia talks between the presidents of Egypt and Cyprus have been getting play in the Israeli press, who are noting that Israel may be getting left out. Haaretz blames the lack of progress on a three-year old agreement to ship gas from the Tamar field to Egypt for processing before exporting to the EU. With the prospect of a Israel-to-EU supply line through Egypt materializing, Egypt and Cyprus are looking to be the EU’s gas supplier. The piece notes plans to hold an energy summit in December between Egypt, Cyprus, Greece and Italy, with Israel not being invited to take part.

Amendments to Egypt’s net-metering scheme are encouraging more businesses to consider photovoltaic installations, says PV Magazine. The upgraded scheme sets the upper power generation limit for a PV installation to 20 MW from 500 KW. That coupled with the “the global price drop of the PV technology and the steady increasing of the retail electricity price in Egypt mean we are heading towards the breaking point, where net metering PV investment will be profitable.” Under the scheme, which was originally launched in 2013, surplus power generated by PV setups is fed to the national grid and counts as credit in a customer’s accounts that can used in following months. The Electricity Transmission company buys any remaining surplus at the end of the year at the price set by the regulator.

Worth Watching

Red Bull’s Jamhoureya takes Cairo music producers to four cities to explore Egypt’s musical roots: Red Bull Music Academy asked four music producers from Cairo to each choose an Egyptian city whose musical roots they were curious to explore and connect with for an event dubbed Jamhoureya. In Aswan, Luxor, Siwa, and Marsa Alam, each of these artists — armed with computers and high-tech gear — came together with local musicians to explore each other’s wildly different backgrounds and infinite creative potential to make meaningful sound from their encounters (Watch here, runtime 1:00).

Diplomacy + Foreign Trade

Sudan’s statements on Egypt using more than its fair share of Nile water are “inaccurate,” Egyptian Foreign Minister Sameh Shoukry said yesterday, Al Masry Al Youm reports. Sudan has been receiving its full annual 18.5 bcf of Nile water for several years now, Shoukry said, clarifying that it’s true that in previous years Sudan didn’t have the capacity to receive its full share, which led to it being rerouted to Egypt with both countries’ knowledge and consent. This added capacity had in turn put pressure on the Aswan High Dam, despite Egypt’s efforts to redirect towards other destinations such as the Toshka project. Tensions have been flaring since discussions over the Grand Ethiopian Renaissance Dam (GERD) reached a stalemate, when both Sudan and Ethiopia refused to acknowledge the results of environmental impact studies confirming that GERD would impact Egypt’s Nile water share. President Abdel Fattah El Sisi said earlier this week that Egypt was unwilling to compromise on the matter. He is expected to meet with Ethiopia’s prime minister in Cairo in December in an effort to reach resolution.

Egypt to receive EUR 500k grant for transport sector support from France: Investment Minister Sahar signed an agreement yesterday that will see Egypt receive a EUR 500k technical grant for transport development from the French Development Agency’s Fund for Technical Expertise and Experience Transfers (FEXTE), according to a ministry statement. The funding will be used to finance upgrades to public transport and railway ticketing systems in Cairo and Alexandria, changes to the maintenance management system to decrease operational costs, and drafting a plan to maximize commercial benefit from metro and railway stations. The agreement was signed on the sidelines of the French-Egyptian Sustainable City Week.

In related news, the Transport Ministry is in talks with France’s public transport operator RATP, which is interested in a contract to manage and run Cairo Metro’s Line 3 on a profit sharing basis, ministry aide Amr Shaath tells Al Borsa. The ministry will also be looking for a foreign firm to manage Line 4, Shaath said, adding that ticket prices will be revised as new stations come into operation during 2018 to reflect the distance traveled.

Palestinian factions in Cairo for reconciliation talks yesterday agreed to hold general elections by the end of 2018, Reuters reports. While the exact date for the elections hasn’t been pinned down, the factions deferred to Palestinian President Mahmoud Abbas to choose the final date. The talks weren’t all smooth though with the Hamas side expressing concern about the lifting of sanctions on Gaza and the permanent opening of the Rafah border crossing with Egypt, two issues that the talks failed to address and that Abbas said he would work toward. The Fatah side still insists it will take complete administrative control of Gaza by 1 December as planned, with further talks and a visit by an Egyptian security delegation to Gaza to oversee the handover set for December.

Basic Materials + Commodities

Obour Land to set up subsidiary for dairy production

Obour Land’s board of directors approved establishing Obour Farm, a subsidiary that will focus on producing dairy products, according to a bourse statement. The company will be 98% owned by Obour Land and will have EGP 50 mn in issued capital and EGP 500 in authorized capital.

Manufacturing

Indian business delegation discusses collaboration in textile, petrochems, shipbuilding with FEI

An Indian business delegation discussed investment prospects with Federation of Egyptian Industries’ (FEI) boss Mohamed Elsewedy yesterday, Youm7 reports. The delegation included investors in the fields of textile, petrochemicals, motorbike manufacturing, electronics, locomotives, shipbuilding, railway, and food production. Company representatives also sat down with Prime Minister Sherif Ismail to discuss their potential investments in the country, according to a statement from the Ismail cabinet.

Telecoms + ICT

Orange to pay TE EGP 72 mn to settle connectivity and infrastructure dispute

The board of Orange Egypt has approved a settlement agreement with Telecom Egypt (TE), according to a bourse statement. Orange will pay TE c. EGP 72 mn to resolve a dispute over local and international connectivity and infrastructure services. The Government Accountability Office had flagged issues relating to TE’s inadequate provisioning in a number of issues including major court disputes in a limited audit last September.

Automotive + Transportation

Shell launches new fuel efficient, heavy duty line of lubricants in October Milan event

Shell Rimula unveiled its newest generation of heavy duty diesel lubricants, API CK-4, at a global event in Milan last month to emphasize how the new product was designed with an eye for environmental concerns and fuel efficiency. The new line of lubricants was engineered to be thinner than previous products — which makes it easier to pump and therefore cuts down on fuel consumption, Global OEM Technological Manager, Dan Arcy explained. Shell relied on a fuel economy model to develop a lubricant that increases fuel efficiency without deviating from its core function of protecting the vehicle’s internal component against expected wear and tear.

Egypt was one of the priority destinations for the company’s research for the new line. “We do know that [Egypt is] a diverse environment. The driving conditions are a bit different, the terrain is a bit different … you’re seeing a lot of stop-and-go when you’re dealing with high traffic,” Global Brand Marketing Manager for heavy duty diesel oils Chris Guerrero told Enterprise. The Egyptian market is largely in up to speed with the trends and developments in the lubricants industry, but one of the largest concerns identified among its consumers at the moment is the need to increase road safety. These concerns feed back into Rimula’s research process to provide a more comprehensive portfolio of products.

Algerian automakers ready to start exporting cars to Egypt

Algeria is planning on exporting fully-assembled personal cars to Egypt free of customs under the Greater Arab Freetrade Agreement (GAFTA), an unnamed Algerian government official tells Al Masry Al Youm. Various auto factories in Algeria locally assemble global brands, including Skoda, Peugeot, and Renault, which they are hoping to begin exporting in exchange for incentives from their government. The official said the Algerian government was ready to begin negotiations with Egypt.

Four offers so far for Sokhna Alamein rail project tender

The Transport Ministry has received four offers from international firms for the first phase of the Sokhna-Alamein rail project,Transport Minister Hisham Arafat told Al Borsa. The first phase is the line from Ain Sokhna to 6 October and the deadline for submissions will be in February 2018. A Chinese consortium led by AVIC, which submitted their plans late September, is amongst the four applicants.

Chinese car manufacturer studying potential USD 30 mn electric car operation in Egypt

A Chinese car manufacturer is looking to invest USD 30 mn to produce electric cars in Egypt, Federation of Egyptian Industries’ Int’l and Public Affairs Director Khaled Abdel Azim tells Ahram Gate. The company, which Abdel Azim doesn’t name, is conducting studies to learn if it can source 40% of its components locally and so benefit from incentives offered under the new Investment Act.

Banking + Finance

Oriental Weavers to borrow EUR 9 mn from QNB Alahli

Oriental Weavers will borrow EUR 9 mn or the equivalent in USD from QNB Alahli, the company announced. The company did not disclose its intended use for the proceeds.

Other Business News of Note

GAFI waiting for SCZone to sign off new public freezones in East Port Said

The General Authority for Freezones and Investment (GAFI) is waiting for the Suez Canal Economic Zone to sign off on its plan to establish a 35,000 sqm public freezone in East Port Said, sources tell Al Mal. Infrastructure work on the area should be done by June 2018, they add. GAFI is looking to establish more freezones around Egypt as a way of encouraging local industry and boosting export levels.

Egypt Politics + Economics

Mubarak-era tourism minister Garana acquitted of all graft charges

A Cairo court acquitted Mubarak-era tourism minister Zoheir Garana and his family of all graft charges against them yesterday, Youm7 reports. Garana, his wife, and four children were accused of profiteering and wasting public funds.

National Security

29 ordered detained on charges of spying for Turkey

The intelligence service has ordered the arrest of 29 people suspected of membership in a terrorist organization and of committing acts of espionage for Turkey, Reuters reports. “According to the results of an investigation by the General Intelligence Services, the group has been recording phone calls and passing information to Turkish intelligence as part of a plan to bring the Muslim Brotherhood back to power in Egypt, MENA said. The nationalities of the suspects were not specified. They are also accused of money laundering and trading currency without a licence.”

Sports

Bradley convinces Gaber to join him in LA FC

Bob Bradley has convinced defender Omar Gaber to join his Major League Soccer side Los Angeles FC, according to the BBC. Gaber joins the club in hopes of getting more time on the field. This will be the second time the two work together since Bradley coached the national team from 2011-2013.

On Your Way Out

ON THIS DAY- On this day in 2005, Ellen Johnson-Sirleaf was elected president of Liberia, becoming the first woman to lead an African country. Lyndon Johnson took over as US President in 1963, a day after the assassination of John F Kennedy. In 2011, Yemen’s President Ali Abdullah Saleh agreed to step down amid a fierce uprising to oust him. The Ley Juárez was passed on this day in 1855 in Mexico, abolishing special courts for the clergy and military in an attempt by justice minister Benito Juárez to eliminate the remnants of colonialism in Mexico and promote equality. The first issue of Life magazine was issued on this day in 1936. The magazine later became a pioneer in photojournalism and one of the major forces in that field’s development. British author Roald Dahl died on this day in 1990. This time last year we were saddened by the news of veteran banker Nevine Loutfy’s passing. Solar energy plans were being hampered by FX shortage two years ago and in 2014 we got the dates for the EEDC in Sharm El Sheikh.

The Market Yesterday

EGP / USD CBE market average: Buy 17.63 | Sell 17.73

EGP / USD at CIB: Buy 17.61 | Sell 17.71

EGP / USD at NBE: Buy 17.62 | Sell 17.72

EGX30 (Wednesday): 13,839 (+0.8%)

Turnover: EGP 995 mn (on par with the 90-day average)

EGX 30 year-to-date: +12.1%

THE MARKET ON WEDNESDAY: The EGX30 closed Wednesday’s session up 0.8%. CIB, the index heaviest constituent closed flat. EGX30’s top performing constituents were: Eastern Co up 5.2%; Emaar Misr up 4.7%; and Egyptian Iron & Steel up 3.5%. Today’s worst performing stocks were: Porto Group down 2.8%; Cairo Oils & Soap down 0.7%; and Ezz Steel down 0.5%. The market turnover was EGP 995 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -12.6 mn

Regional: Net Long | EGP +13.1 mn

Domestic: Net Short | EGP -0.5 mn

Retail: 44.2% of total trades | 42.9% of buyers | 45.6% of sellers

Institutions: 55.8% of total trades | 57.1% of buyers | 54.4% of sellers

Foreign: 45.7% of total | 45.3% of buyers | 46.2% of sellers

Regional: 5.4% of total | 5.8% of buyers | 4.8% of sellers

Domestic: 48.9% of total | 48.9% of buyers | 49.0% of sellers

WTI: USD 57.99 (+2.04%)

Brent: USD 63.23 (+1.05%)

Natural Gas (Nymex, futures prices) USD 2.97 MMBtu, (-1.69%, DEC 2017 contract)

Gold: USD 1,292.1 / troy ounce (+0.81%)

TASI: 6,822.45 (+0.65%) (YTD: -5.38%)

ADX: 4,273.71 (-0.85%) (YTD: -6.0%)

DFM: 3,444.93 (+1.0%) (YTD: -2.43%)

KSE Weighted Index: 394.89 (+0.03%) (YTD: +3.89%)

QE: 7,798.39 (+0.38%) (YTD: -25.28%)

MSM: 5,078.03 (+0.02%) (YTD: -12.19%)

BB: 1,269.06 (+0.43%) (YTD: +3.98%)

Calendar

22-24 November (Wednesday-Friday): Schneider Electric’s Innovation Summit Egypt 2017, Royal Maxim Palace Kempinski New Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

05 December (Tuesday): Egypt’s Emirates NBD PMI reading for November to be announced.

03-06 December (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.