2018 will be a busy IPO year in Egypt -Bloomberg

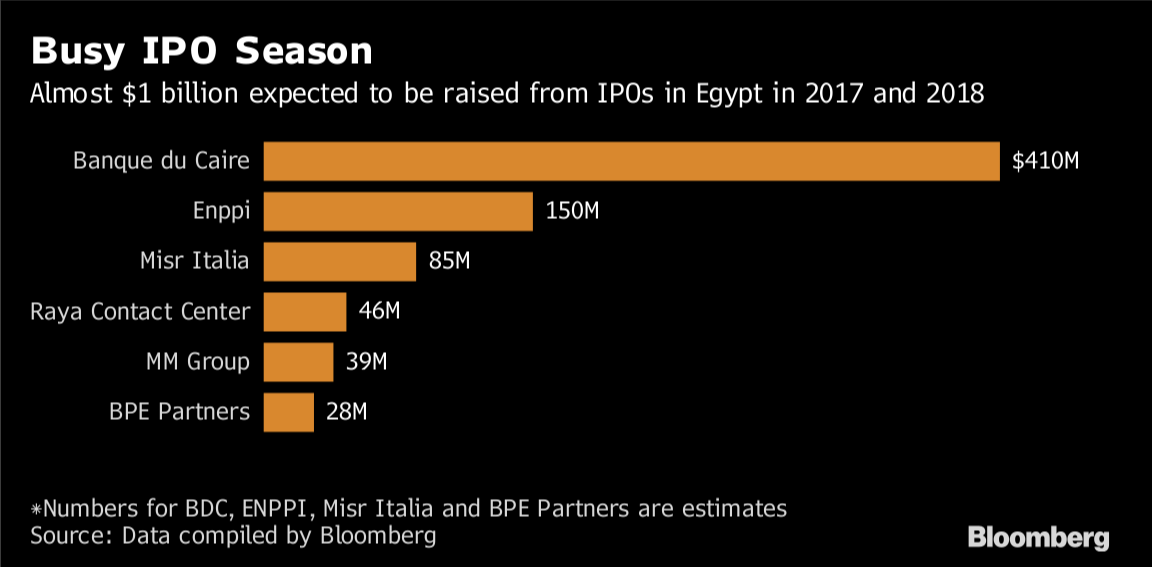

We’re heading into a busy IPO season: The EGX is “shaping up to be the Middle East’s hot spot for initial public offerings next year,” Tamim Elyan and Filipe Pacheco write for Bloomberg. At least six companies are planning to IPO in 2018, up from an average of three a year in the past three years, and none at all between 2011 and 2014. “Egypt is on the investment map and people are looking at it. Now there is a chance to do an IPO,” BPE Partners Chairman Hazem Barakat, whose company is planning a 1Q2018 issuance, says. Other IPOs expected during the year include state-owned Banque du Caire and Enppi as well as Misr Italia Group. Beltone’s IPO of Ibnsina Pharma, which announced in September its intention to float, should also be on the list.

“Egypt’s market cap remains fairly underrepresented compared to the economy and liquidity is still low, although improving, which limits international participation in the market,” Salah Shamma, Franklin Templeton Investments’ head of MENA equities, cautions. There could be regional competition as well, EFG Hermes Strategist Simon Kitchen suggests, saying: “Egypt is one of the busier markets in the region, but low oil prices and ongoing economic restructuring means that we are likely to see IPOs of state-controlled assets in the GCC as well.” Kitchen expects appetite for broader emerging market IPOs to remain robust in 2018 and for Egypt to have a “bigger piece of the pie.”