- 2018 will be a busy IPO year in Egypt -Bloomberg. (Speed Round)

- M&A WATCH- Two bidders make separate offers for majority stake in “100% Egyptian” retailer HyperOne, Pharos said to be advising. (Speed Round)

- 13 Egyptian startups on Forbes ME’s top 100 Arab Startups list. (Speed Round)

- Retail clients should be able to open bank accounts with only national ID and telephone number –CIB’s Ezz Al Arab. (Worth Watching)

- Cairo named most dangerous megacity for women in Thomson Reuters Foundation poll. (Speed Round)

- “Egypt, despite its shortcomings, treats Syrians better than any other Arab country” –Irish Times (Egypt in the News)

- Sinai terrorists net mns in bank heist during coordinated attack in Al Arish yesterday. (Last Night’s Talk Shows)

- The Market Yesterday

Tuesday, 17 October 2017

The IPO outlook for 2018 looks bright

TL;DR

What We’re Tracking Today

The EGX30 got slammed yesterday, retreating 2.7% on a volumes that were about 52% above the trailing 90-day average — and underperforming on the regional and global fronts. The selling pressure came in the way of foreign institutions, which looked as though they were locking in profits after a good run and a clear resistance point on the charts. We have more in The Market Yesterday, below, and as always expanded data coverage in our web edition.

The House of Representatives’ Transport Committee is expected to review the Egyptian National Railways’ USD 575 mn agreement with GE for the purchase of 100 new locomotives today. The committee is also waiting on the Ismail cabinet to send over legislative amendments that would allow the private sector to participate in the development, management, and operation of state rail assets.

Foreign Minister Sameh Shoukry landed in Slovenia yesterday for a two-day visit, where he’s set to hold cooperation talks with President Borut Pahor, Prime Minister Miro Cerar, and his counterpart Karl Erjavec, reports Ahram Gate.

The Financial Times’ annual global executive MBA ranking is out. The FT’s lead story on its package is here, and you can view the full rankings here. The top five are:

- Kellogg-HKUST EMBA (China)

- EMBA-Global Asia (China / UK / US)

- Tsinghua-Insead Dual Degree EMBA (China / Singapore / France / UAE)

- EMBA-Global Americas & Europe (US / UK)

- Trium Global EMBA (France / UK / US)

Credit Suisse is the target of an activist shareholder campaign that’s looking to unlock value for shareholders by breaking the lagging institution up into an investment bank that revives the old First Boston brand, an asset manager, and a wealth management group that also includes the bank’s retail and business banking operations, the Financial Times reports this morning. The campaign is being mounted by Rudi Bohli’s RBR Capital Advisors, which has successfully run activist campaigns “against GAM, the asset manager, and Gategroup, the airline catering company.” The story is the lead piece on the FT’s homepage as about 5am CLT this morning.

Your wifi connection is not secure — nobody’s is, and you’re going to be waiting a while for a solution. That’s the bottom line on a news story yesterday that suggests there is a vulnerability in the WPA2 protocol that lets hackers read data over secure wifi. Just about every wifi-connected device will be vulnerable until patches are pushed out. The Guardian and Reuters have the story.

What We’re Tracking This Week

Irrigation Minister in Addis Ababa to take part in GERD technical studies ministerial meeting: Irrigation Minister Mohamed Abdel Aty flew to Ethiopia on Sunday ahead of the tripartite ministerial meeting on the technical studies of the Grand Ethiopian Renaissance Dam scheduled to take place on Wednesday, Ahram Online reports. Abdel Aty will also be visiting the dam itself to observe construction work. The Addis Ababa meeting has been highly anticipated, after Egypt voiced concerns in September on a lack of progress on the technical studies. The Supreme Council for Nile Water gave a preliminary nod to the French consultancy firms’ impact studies this week.

Enterprise+: Last Night’s Talk Shows

A raid on a National Bank of Egypt (NBE) branch in North Sinai’s Al Arish, likely by terrorists,played out heavily on the airwaves last night, as did widespread debate about [redacted] harassment and “debauchery.”

The background on the Sinai bank raid: Seven people were reported killed in North Sinai’s Al Arish yesterday when terrorists launched “a two-pronged assault,” attacking security forces guarding an unused church while others robbed a local branch of the National Bank of Egypt, the Associated Press reports. Among the victims were three civilians, including a child. This comes a day after terror attacks in North Sinai’s Karam El Kawadis left 24 terrorists and six soldiers dead. The American embassy in Cairo condemned yesterday’s attacks.

NBE’s CEO for Retail and SMEs, Hazem Hegazy, told Hona Al Asema’s Lamees Al Hadidithat a group of armed men stormed the branch and proceeded to steal somewhere between EGP 5 and 10 mn from its vaults. The attackers killed three soldiers in addition to the bank’s security personnel, while four other people were injured (watch, runtime 4:04).

Security sources told Yahduth fi Masr’s Sherif Amer that the robbers got their hands on some EGP 17 mn, and that security forces thwarted another attempted robbery on a Banque Misr branch in North Sinai. That figure more or less gels with reporting from AP.

Banque Misr temporarily closed two branches after the attack on NBE for security purposes, and will coordinate with security forces to reopen them today, Vice Chairman Akef El Maghraby told Lamees. The bank is also trying to reduce the amount of cash being held at these branches as much as possible while maintaining the necessary amounts to supply customers, according to El Maghraby (watch, runtime 3:17).

Kol Youm’s Amr Adib tried to make some vague point about the Arish attacks and the need to present a united front against terror (watch, runtime 6:08) and then dove deeply into a Thomson Reuters Foundation Poll on the most dangerous megacities for women, which Cairo topped (we have more in Speed Round, below). The host was particularly irked by the prevalence of [redacted] harassment of women in the workplace (watch, runtime 6:12). AUC sociology professor Hany Henry told Adib that many victims are wary of speaking out about their experience in a victim-shaming culture (watch, runtime 5:35).

National Women’s Council chief Maya Morsi called in to tell Adib that there is a law currently in the works that will outline penalties for harassment in the workplace and encouraged harassment victims to report incidents to the council (watch, runtime 6:47).

Back on Hona Al Asema, Moushira Khattab told Lamees that internal divisions among African and Arab countries caused “scattered voting” that cost her the top UNESCO job and played out in France’s interest. Lebanon apparently notified Khattab’s campaign that it had not voted for the Egyptian candidate. She also said that Egypt has officially submitted an investigation request into alleged violations during the election process, saying that the final round of voting was fishy (watch, runtime 44:53).

Masaa DMC’s Eman El Hosary was still fixated on efforts to contain the LGBTQcommunity in Egypt, talking to MPs about a draft law that would make it a criminal offense to “encourage” homosexuality. House Religious Committee chair Shoukry El Gendy downplayed the issue overall, saying the LGBTQ community in Egypt is too small to warrant new legislation — existing laws will do just fine to suppress them (watch, runtime 7:17). There are no words, we swear.

Speed Round

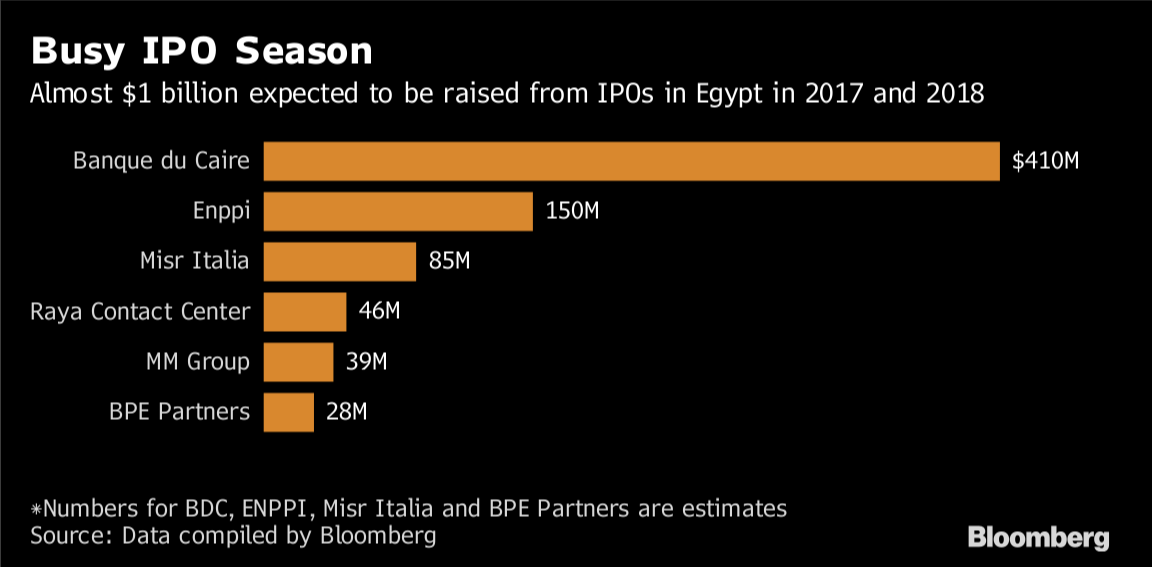

We’re heading into a busy IPO season: The EGX is “shaping up to be the Middle East’s hot spot for initial public offerings next year,” Tamim Elyan and Filipe Pacheco write for Bloomberg. At least six companies are planning to IPO in 2018, up from an average of three a year in the past three years, and none at all between 2011 and 2014. “Egypt is on the investment map and people are looking at it. Now there is a chance to do an IPO,” BPE Partners Chairman Hazem Barakat, whose company is planning a 1Q2018 issuance, says. Other IPOs expected during the year include state-owned Banque du Caire and Enppi as well as Misr Italia Group. Beltone’s IPO of Ibnsina Pharma, which announced in September its intention to float, should also be on the list.

“Egypt’s market cap remains fairly underrepresented compared to the economy and liquidity is still low, although improving, which limits international participation in the market,” Salah Shamma, Franklin Templeton Investments’ head of MENA equities, cautions. There could be regional competition as well, EFG Hermes Strategist Simon Kitchen suggests, saying: “Egypt is one of the busier markets in the region, but low oil prices and ongoing economic restructuring means that we are likely to see IPOs of state-controlled assets in the GCC as well.” Kitchen expects appetite for broader emerging market IPOs to remain robust in 2018 and for Egypt to have a “bigger piece of the pie.”

M&A WATCH- Retailer HyperOne has reportedly received two separate bids from investors looking to acquire a controlling stake, sources tell Al Mal. The sources say one of the bids is from the Egyptian American Enterprise Fund and the other is from “a foreign investment company” entering Egypt for the first time. Al Mal says HyperOne hired Pharos Holding as a sell-side advisor and Al Tamimi & Co as legal counsel. There is no announced timeline for the transaction.

13 Egyptian startups were listed in Forbes Middle East’s Top 100 Startups of the Arab World 2017, with clinic and physician booking platform Vezeeta leading the pack at fifth place. Instabug, an app that reports bugs on more than 12,000 apps and was a graduate of Flat6Labs and Y Combinator, came in at 40. The third highest-ranked Egyptian startup on the list was e-payments firm Edfa3ly which came in at number 43.

Holding our collective heads in shame: Cairo is the world’s most dangerous megacity for women, according to a poll of expert carried out by the Thomson Reuters Foundation. The survey “asked experts in women’s issues in 19 megacities how well women are protected from [redacted] violence, from harmful cultural practices, and if they have access to good healthcare, finance and education." Cairo fared worst globally, followed by Karachi in Pakistan, Kinshasa in Democratic Republic of the Congo, then the Indian capital New Delhi.” In contrast, London was named the best city, “buoyed by Britain’s free and universal National Health Service, as well as coming top for economic opportunities.” The poll is receiving wide coverage, including from Deutsche Welle and The National.

On a related note, thousands of Egyptian women are circulating the anti-harassment hashtag ‘MeToo,’ with stories of their own sour experiences to go with it. US actress Alyssa Milano was first to launch the campaign after Hollywood actresses leveled harassment charges against producer Harvey Weinstein, according to Egyptian Streets.

Chinese state-owned oil companies PetroChina and Sinopec are offering to buyup to 5% of Saudi Aramco directly, Reuters reports in an exclusive. The companies have been corresponding with Aramco over the past weeks to express interest in a direct sale of a stake to a consortium made up of both companies, which will include China’s sovereign wealth fund, industry sources said. The move could give Saudi Arabia the flexibility to consider various options for its plan to float shares in Aramco. Reports had emerged earlier in the week that Saudi Arabia was considering delaying the international tranche of its IPO of Aramco until at least 2019.

In other international IPO news, Chinese video streaming platform Baidu has selected Bank of America, Credit Suisse, and Goldman Sachs to manage its USD 1 bn IPO, according to Reuters.

Iraqi forces occupied several positions in Kirkuk yesterday, including its provincial administration, in a military operation aimed at regaining control of the country following last month’s Kurdish referendum, Bloomberg reports. Iraqi Prime Minister Haider al-Abadi had previously vowed to avoid such military actions. Egypt’s Foreign Affairs Ministry issued a statement yesterday urging both sides to “show restraint” and instead engage in dialogue. An escalation of tension in the area risks pushing oil prices up.

Is Wall Street growing accustomed to global catastrophes? “Whether it’s the threat of nuclear war, hurricanes, or Russian meddling, it seems nothing can unnerve investors bent on pushing the US stock market higher and higher,” says Bloomberg. Although market-moving events have been in no short supply this year, they seem to have had an inexplicably minimal impact on Wall Street. Brexit has been central to “the shift in market psychology,” serving as an example for investors on how to wait and see, rather than act immediately. Yet, “is the risk priced into the market appropriate to what the real risk is?” It may not be, says one analyst. “People have grown more complacent and certainly more speculative, and it’s a little bit frightening.”

The Macro Picture

Janet Yellen isn’t the only prominent central bank governor who may not keep their job, as the Bank of Japan and the People’s Bank of China may all have new bosses in early 2018. The European Central Bank will also see its governor replaced the following year, according to Reuters. This quartet of central bank governors led the wave of global reform policies on the back of the global financial crisis, with the Fed, ECB and BoJ buying up some USD 10 tn in assets to prop up their economies. Their departure comes as their reforms remain unfinished and the rise of nationalism threatens to weaken central bank controls on the financial system. In the case of the Fed, US President Donald Trump is weighing between continuity of reforms or deregulation as he debates between keeping Yellen or replacing her with opponents of her policies such as Stanford academics John Taylor and Kevin Warsh, according to the FT (paywall).

Image of the Day

Afghan pilot Shaesta Waiz, 30, recently became the youngest woman to ever circumnavigate the globe in a single engine aircraft, according to National Geographic. Waiz, who grew up in a refugee camp in Afghanistan before eventually moving to the US, completed her mission in 145 days, with stops in Afghanistan, Egypt, Sri Lanka, and Australia, among others. Waiz also founded a charity named Dreams Soar that seeks to encourage women to pursue careers in aviation.

Egypt in the News

It’s another relatively quiet news day for Egypt in the international press.

Egypt is the “best of the worst” option for Syrian refugees, Paul Cullen writes for the Irish Times. More than 120k Syrians have been granted asylum in Egypt, which is “one of the few countries in the developing world that does not house refugees in camps, and allows freedom of movement.” Although UNHCR-registered refugees are safe from deportation, life in Egypt is getting harder for refugees and locals alike because of the challenging economic conditions, Cullen notes. Most Syrian refugees would rather be in Europe, but they are getting messages that they are “not welcome” and the journey there is cost prohibitive and dangerous. “Egypt, despite its shortcomings, treats Syrians better than any other Arab country, according to one Syrian student. It is, he says, ‘the best of the worst.’”

The EGP float has made Egypt’s real estate market attractive to Saudis who have reportedly been flocking to buy apartments in Omm El Donia, writes Renam Ghanem for the Saudi Gazette. With apartment prices starting at around USD 80,000, many from Saudi Arabia have been buying homes primarily in Cairo, Ain Sokhna, the North Coast, and Sharm El Sheikh. And apparently it’s not just apartments, with villas also enticing Saudi buyers.

It’s hard for a journalist to cover a revolution without being involved on some level, Jack Shenker for the New York Times. Shenker draws parallels between John Reed’s coverage of the Bolshevik Revolution of 1917 and his own experiences covering Egypt in 2011, writing that while traditional journalistic norms dictate a neutral stance toward the subject matter, revolutions present such a storm of passions that the real story is often lost if we ignore “the mundane spaces where norms are shifting.”

Also making the rounds this morning:

- The Hyderabad-based combat simulator Zen Technologies is looking towards Egypt under a plan to expand its business to international markets, according to Telangana Today.

- Indonesia’s parliament is considering an Egypt-style ban on LGBT-related content on TV, Reuters reports.

- African rulers are growing rather fond of Egypt and Tunisia’s 2011 example of “pulling the plug” on the internet to quell dissent, Reuters says.

- Al Azhar is organizing “intensive training camps” for imams across Egypt as part of its efforts to renew religious discourse among preachers, Menna Farouk writes for Al Monitor.

- The Chairman of Qatar’s National Human Rights Council urged his Egyptian counterpart in a meeting to try and intervene to resolve issues facing Qatari students and property owners as a result of boycott, Gulf Times says.

On Deadline

The delay in issuing the executive regulations for the Investment Act is putting investment on hold, EK Holding Chairman Moataz Al Alfi says in a letter published by Al Ahram’s Salah Montaser. El Alfi pins the blame on Prime Minister Sherif Ismail, who he says put the regs on the back burner after receiving them from the Investment Ministry. Al Alfi says Ismail should recognize the urgency in the matter, especially since the government is working hard to attract investors.

Worth Watching

Egypt’s economic reforms were long overdue, our friend Hisham Ezz Al-Arab, Chairman of CIB and the Federation of Egyptian Banks, told The Banker’s James King at the IMF meetings in Washington. “It was life or death to implement the reforms,” Ezz Al-Arab says. “What the government did by removing the subsidies is that they started to redirect their investment to the people in need … below the poverty line.” He does note that the reforms have created “winners” and “losers,” impacting the rich, the middle class, and, to a lesser extent, the poor. Those losses mean that it will take time for the middle and upper class to catch up again with their previous spending behaviour, Ezz Al-Arab says.

Ezz Al-Arab also praised the domestic banking system, noting that the banking sector came through the “volatile times” on solid ground built since the reforms of 2004 and tested in 2008 with the financial crisis, in 2011, and during last year’s reforms. “The banking sectors is … one of the most successful pillars for the reforms in Egypt,” he says.

Financial inclusion drive: He added that CIB is pressing ahead with innovations to promote financial inclusion and mobile payments and is calling for regulatory reform in this field. “What we are trying to say is: below a certain threshold, people should not fill forms,” Ezz Al-Arab explains. Opening an account should only require national ID and telephone number data to authenticate accounts at this level, he says (runtime 07:01).

Diplomacy + Foreign Trade

The World Bank has sent over USD 125 mn to help fund development in Upper Egypt, according to Ahram Gate. The funds have reportedly been transferred to the CBE.

Nasr meets with potential investors in New York: Investment Minister Sahar Nasr met yesterday with executives from US-based investment firms with an aggregate AUM of USD 600 bn for a roundtable debate organized by Egypt’s CI Capital in New York, a company press release says (pdf). The discussion centered around investment prospects in Egypt in light of economic reform, the upcoming investment map, and the state’s IPO program.

Also in the US yesterday, EGX head Mohamed Farid met with several investors in Washington, D.C on the sidelines of the World Bank Fall Meetings to discuss the steps the bourse is taking to develop capital market activity, Youm7 reports.

A delegation of 10 French companies is planning to visit Egypt on 18 November to look at potential investments in the new administrative capital and the Suez Canal Economic Zone (SCZone), Al Borsa reports. The delegation, which will mostly be made up of construction and sustainable urban design firms, are expected to meet with Housing Minister Moustafa Madbouly.

Also coming next month is a delegation of some 30 Romanian companies in the industrial, agriculture, chemical, and transport industries, says the head of the Egyptian-Romanian Business Council Hassan El Shafei. The new capital and the SCZone are also hot items for the companies, he tells the newspaper. Railway investments appear to also be high on their agenda as they intend to meet with railway authorities, he says.

Egypt has invited Belarus to invest in oil and gas projects in the Red Sea and the Mediterranean, the Belarusian Telegraph Agency reported. The conversation came during a meeting between House Speaker Ali Abdel Aal and Chairman of the Council of the Republic of the National Assembly of Belarus Mikhail Myasnikovich.

The Arab-Brazilian Chamber of Commerce said that the Mercosur freetrade agreement has come into effect, AMAY reports, citing a statement from the group. The 2010 agreement, which alleviates tariffs on some products, was supposed to come into effect in August, with the last reports saying it would go live before the end of the year.

Indonesian President Joko Widodo is planning to visit Cairo, though the timing of the trip has yet to be determined, Egypt’s ambassador to Jakarta Amr Mouawad said on Monday, according to Ahram Online.

Energy

KPC renews crude storage agreement with SUMED

Kuwait Petroleum Corporation (KPC) announced renewing the crude oil storage and transportation contract with SUMED, according to KUNA. “The contract is one of the important strategic contracts aims at expanding KPC’s presence in the Mediterranean Region and North West Europe to increase Kuwait’s market share in that region, KPC said.”

Beheira to build USD 225 mn waste-to-energy plant

The Beheira governorate is in the process of acquiring the necessary licenses and approvals to establish a waste-to-energy plant at an investment cost of USD 225 mn, Al Borsa reports. The project is expected to process a daily 500 tonnes of garbage. No details on funding or project timeline have emerged.

TransGlobe says its production drops q-o-q over delays in Egypt

TransGlobe Energy said production in 3Q2017 dropped q-o-q and was impacted by delays in well servicing in Egypt during August and September, in its 3Q2017 Operations Update. It had released the workover/completion rig supporting the Eastern Desert operations in early August due to escalating safety and performance issues but that a second workover rig was contracted in early October to accelerate removal of the backlog of well workovers. The company says it sold approximately 793,000 bbl of entitlement crude oil in Egypt during the quarter through one tanker lifting (September) and direct sales to EGPC for net proceeds of USD 34.5 mn (inclusive of realized hedging loss). TransGlobe also says it began testing at its South Alamein concession.

Electricity Ministry delays bidding on USD 8 bn Hamrawein power plant

The Electricity Ministry has delayed bidding on the USD 8 bn Hamrawein “clean coal” power plant to next month from mid-October, sources tell Al Mal. The delay reportedly came at the request of the bidding companies, sources added. As we noted back in June, General Electric, Shanghai Electric, and a Marubeni-Mitsubishi JV were the top players bidding on the plant. The ministry is looking to sign contracts for the plant by the end of 2018, with an eye to completing the project by 2025.

NREA to offer EUR 400 mn wind farm to Masdar under BOO framework

The New and Renewable Energy Authority (NREA) will no longer partner up with the UAE’s Masdar on a planned wind farm, but will offer the project to Masdar under a build-own-operate framework, sources from NREA tell Al Mal. The costs of partnering on the EUR 400 mn project would have been too high, which has led to delays in implementing the project, sources added.

XD Egemac begins operating first transformer station connecting Benban solar plants to grid

XD Egemac has begun operating the first transformer station connecting the Benban solar farm to the grid, company chairman Medhat Ramadan tells Al Borsa. The second transformer station will be operational at the end of November, he added. Four stations in total are under development at a cost of EGP 1.3 bn.

Basic Materials + Commodities

Domty to launch branch in Rwanda

Cheese maker Domty announced plans to launch a branch and distribution center in Kigali, Rwanda. The distribution center is expected to begin operations in 1Q2018 and will focus primarily on white cheese products.

Supply Minister, Italian ambassador meet to discuss silos project

Supply Minister Ali El Moselhy met yesterday with Italy’s ambassador in Cairo, Giampaolo Cantini, to discuss the ten wheat silos Italy is building in Egypt at a total cost of EGP 128 mn, Al Masry Al Youm reports. El Moselhy and Cantini agreed to meet again next week to sign off on minor design changes.

Manufacturing

EBSC to receive USD 60 mn worth of equipment for black sands separation from Australia’s Mineral Technologies

The Egyptian Black Sand Company (EBSC) is expected to sign next week a USD 60 mn contract with Australian mineral processing company Mineral Technologies, which will provide the company with necessary equipment, EBSC head Ashraf Sultan tells Al Borsa. Mineral Technologies was awarded the tender to supply the drilling equipment back in August. EBSC had received an 80-feddan plot of land from the Kafr El Sheikh governorate on a right-to-use basis for 20 years to establish a factory for black sand separation, according to Sultan. EBSC had conducted aerial photography studies, which revealed black sands deposits in 11 locations across the country, Al Shorouk reports.

Eastern Company indefinitely puts off cigarette plant in Borg El Arab

Eastern Company has indefinitely put off plans to build a 110k sqm cigarette manufacturing complex in Borg El Arab, company chairman Mohamed Haroun tells Al Mal. The decision came from the Chemical Industries Holding Company (Eastern’s parent company) which saw the capex required to build the complex as too high at this time, said Haroun. Eastern may use part of the land it acquired for the complex to build a tobacco packaging facility to maintain the industrial license it has on the land.

Tetra Pack sales down 25% y-o-y as a result of 40% drop in overall food industry sales

Tetra Pak’s sales in Egypt this year are down 25% compared to last due to a 40% decline in overall sales from the food production sector, the packaging company’s Egypt Managing Director Konstantin Kolesnik tells Al Borsa. Kolesnik attributed the decline to the drop in consumer purchasing power as a result of inflation, which he says has also caused many producers to delay expansion plans.

Largest desalination plant in Africa set to open in Hurghada

“The largest water desalination plant in Africa” is set to open in December in Hurghada, Red Sea Governor Ahmed Abdalla said yesterday, according to Youm7. The government has recently been considering opening up desalination to the private sector.

Tourism

AS Roma and the Egyptian Tourist Organization in Italy announce partnership

Italian football club AS Roma and the Egyptian Tourist Organization in Italy have announced an agreement that will see Egypt become the team’s Official Tourism Partner. “The agreement will last for the whole season and will see the club supporting and promoting Egypt … as well as organizing shared initiatives involving the general public and the media… Roma will publicize the partnership using advertising space at the Stadio Olimpico and across its digital and social media platforms,” the club said.

British tourism delegation tours Luxor and Aswan

The Tourism Promotion Authority (TPA) is touring Luxor and Aswan with a delegation from the UK as part of efforts to promote Egypt as a destination and improve tourism arrivals from the country, according to Al Shorouk. With the flight ban on Sharm El Sheikh still in place, it seems unlikely for us to see an influx of British tourists soon.

Banking + Finance

Careem signs agreement with CIB to manage cash flow using Smart Wallet

Ride-hailing app Careem will be managing its cash inflows and payments using CIB’s Smart Wallet app under a new agreement the two organizations signed yesterday, Al Borsa reports. The agreement will also allow Careem to pay out bonuses and special incentives to its drivers using the platform.

Legislation + Policy

Criminal Procedures Act still being studied

The House of Representative’s Legislative Committee is studying proposed amendments to the Criminal Procedures Act before putting together an updated draft, according to Al Shorouk. Chief amongst the proposals are changes that would allow more avenues of mediation outside the courts system, including for murder cases. Other aspects being addressed include the abolition of convictions made in absentia. Review of the Criminal Procedures act began in August, primarily in response to terror attacks that MPs said required faster court proceedings.

Egypt Politics + Economics

Gov’t working out a two-year plan to manage domestic, foreign debt

The government is currently working on a strategy to reduce Egypt’s domestic and foreign debt levels, and a framework for paying debt obligations over the coming two years, Finance Minister Amr El Garhy said yesterday, according to a ministry statement. The Finance Ministry has presented a draft plan to Cabinet, according to El Garhy.

Sports

Calls for Aboutrika to join Egypt squad ignite debate

A hashtag calling for exiled soccer star Mohamed Aboutrika to come out of retirement for the 2018 World Cup has gone viral has ignited a firestorm of a debate across the country, according to Fox Sports. While Aboutrika responded in a gentlemanly way to the calls, that hasn’t stopped the debate turning political with many labeling him a traitor and pointing to the government freezing his assets due to his alleged ties to the Muslim Brotherhood.

On Your Way Out

ON THIS DAY- On this day in 1968, the famed 1968 Olympics Black Power salute took place at the 1968 Summer Olympics in the Olympic Stadium in Mexico City. Athletes Tommie Smith and John Carlos, gold and bronze medallists in the 200m, stood with their heads bowed and a black-gloved hand raised as the American National Anthem played during the victory ceremony. Also on this day, Mae Jemison was born in 1956. Jemison is an American physician and the first African American woman to become an astronaut. In 1992 she spent more than a week orbiting Earth in the space shuttle Endeavour. Also, rapper Eminem was born on this day in 1972. In Enterprise, readers got the news on this day last year that Etisalat Misr and Vodafone Egypt gave in and signed agreements to acquire 4G licenses.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5937 | Sell 17.6937

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.6 | Sell 17.7

EGX30 (Monday): 13,525 (-2.7%)

Turnover: EGP 1.4 bn (52% above the 90-day average)

EGX 30 year-to-date: +9.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 2.7%. CIB, the index heaviest constituent closed down 1.9%. EGX30’s top performing constituent was: Egyptian Iron and Steel up 2.6%; Kima down 0.7%; and Eastern Co down 1.3%. Yesterday’s worst performing stocks were: AMOC down 7.8%; Porto Group down 6.4%; and Amer Group down 5.4%. The market turnover was EGP 1.4 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -78.2 mn

Regional: Net Short | EGP -4.1 mn

Domestic: Net Long | EGP +82.3 mn

Retail: 68.8% of total trades | 72.1% of buyers | 65.6% of sellers

Institutions: 31.2% of total trades | 27.9% of buyers | 34.4% of sellers

Foreign: 16.1% of total | 13.3% of buyers | 18.9% of sellers

Regional: 6.8% of total | 6.7% of buyers | 7.0% of sellers

Domestic: 77.1% of total | 80.0% of buyers | 74.1% of sellers

WTI: USD 51.88 (+0.02%)

Brent: USD 57.82 (+1.14%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu, (+0.44%, November 2017 contract)

Gold: USD 1,297.3 / troy ounce (-0.44%)

TASI: 6,976.97 (+0.56%) (YTD: -3.24%)

ADX: 4,523.51 (+0.11%) (YTD: -0.5%)

DFM: 3,657.48 (-0.00%) (YTD: +3.59%)

KSE Weighted Index: 431.99 (+0.35%) (YTD: 13.65%)

QE: 8,299.71 (-0.5%) (YTD: -20.48%)

MSM: 5,095.29 (-0.85%) (YTD: -11.89%)

BB: 1,278.26 (+0.31%) (YTD: +4.74%)

Calendar

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

21 October (Saturday): The African Leadership Academy will hold its “Beyond Education” seminar on university readiness and the future of leadership in Africa, at the Dusit Thani, Lakeview, New Cairo and the Hilton Pyramids Golf, 6 October City.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.