- Euroclear is looking to tap domestic banks to help settle government debt. (Speed Round)

- ADIB Capital to manage the Egypt’s first corporate sukuk issuance. (Speed Round)

- Government to decide on new electricity rates by the end of May. (Speed Round)

- Cabinet greenlights amendments to Mineral Resources Act. (Speed Round)

- What’s the best age at which to start a business? (What We’re Tracking Today)

- Egypt isn’t over-investing in infrastructure — in fact, we’re not yet investing enough. (The Macro Picture)

- What’s happening now in global markets is bad for EM, but good for our future robot overlords. (What We’re Tracking Today)

- Have iftar with us. (What We’re Tracking Today)

- The Market Yesterday

Monday, 13 May 2019

Egypt, like other EM, is not over-investing in infrastructure

TL;DR

What We’re Tracking Today

Week one of Ramadan is now over, ladies and gentlemen.

Look for amendments to the mineral resources act to go to the House of Representatives today. We have the full rundown in this morning’s Speed Round, below.

Did the unexpected cooling-off of inflation in April give the central bank room to cut interest rates when it meets a week from Thursday? That’s what Beltone’s Alia Mamdouh suggests in a report (pdf) out yesterday. “Favorable global conditions, with the ease in monetary tightening, will continue to provide the buffer for the CBE to resume its monetary easing [in May]. Meanwhile, the most likely scenario for us will remain a 100 bps cut in rates by the end of the year, accounting for the expected inflationary repercussions of the wider implementation of the fuel indexation mechanism.”

Market watchers are paying close attention to the opening bell in Europe and the US of A today as traders try to get their heads around what’s in store for global equities after recent events including the sudden heating up of the US-China trade war. Asian shares are edging lowerthis morning and futures suggest the S&P will open 200 points lower in New York this afternoon.

The result? Early signs this morning that traders are scrambling for safe havens.

All of this is bad news for emerging markets… “The standoff between the U.S. and China is back at the top of emerging-market investor concerns as they assess how far they should price in a full-blown trade war,” Bloomberg suggests

…but good news for our future robot overlords: There are concerns that “computer driven funds [that] amassed big equity positions while markets were sleepy” could suddenly be “scrambling to sell their stocks and move into safer assets like treasuries” now that market volatility appears to be back on the menu, the Wall Street Journal warns.

You know who’s looking particularly prescient right now? Deutsche Bank, which warned at the end of 2018 that an algorithm-driven fire sale in equities and credit would be the biggest risk to global markets this year.

How bad could it get? JPMorgan has previously suggested that there are some USD 7.4 tn in stocks that would be “subject to forced selling by passive funds during the next downturn.”

In our diary for the rest of the week:

- The Egyptian Private Equity Association is having its annual sohour tomorrow. Public Enterprise Minister Hisham Tawfik is the special guest. If we didn’t work during the appointed hour, we would be in attendance.

- Expect 1Q earnings to keep rolling in over the next few days. We have a spate of earnings releases in this morning’s Speed Round.

Tales of our friends and Allies #1: Pakistan has reached a staff-level agreement with the IMF for a three-year, USD 6 bn facility, the IMF announced yesterday. The agreement remains subject to approval from the IMF’s Executive Board. Islamabad, which is no novice when it comes to IMF financing, has been in talks for a bailout package for nearly a year. Since the 1980s, the IMF has provided Pakistan with a total of 12 packages, the most recent of which was a USD 5.3 bn backstop in 2013.

Tales of our Friends and Allies #2- Wait, they haven’t Brexited yet? UK Prime Minister Theresa May is apparently under pressure to step down. (FT)

Tales of our Friends and Allies #3- Wait, he hasn’t formed a government yet? Israeli Prime Minister Benjamin Netanyahu is going to ask for more time to form a government. (Reuters)

In miscellany this morning:

- Mo Salah will share the Golden Boot award as the Premier League’s top scorer with fellow Liverpool player Sadio Mane and Arsenal’s Pierre-Emerick Aubameyang, as each of the African players put away 22 goals this season, according to Reuters.

- Salah’s Liverpool lost its campaign for top place in the Premier League yesterday despite a 2-1 victory over Wolverhampton as Manchester City edged Brighton 4-1, the BBC reports.

- The UK arm of Abraaj founder Arif Naqvi’s Aman Foundation is facing closure as UK regulators increase pressure in the wake of the private equity fund’s collapse, the National reports.

Image presented without comment or context:

(Photo via the Economist’s Instagram feed. Those of you who know us may now commence with the Batreek jokes…)

What we’re tracking today, the Ramadan Edition:

MUST READ- How old are successful tech entrepreneurs?In their 40s, argues “a definitive new study” from Northwestern’s Kellogg School of Management. The paper found that “among the very fastest-growing new tech companies, the average founder was 45 at the time of founding. Furthermore, a given 50-year-old entrepreneur is nearly twice as likely to have a runaway success as a 30-year-old.”

What’s more, successful entrepreneurs tend to have experience in the industry in which they build their startup: “founders with three or more years of experience in the same industry as their startup are twice as likely to have a one-in-1,000 fastest-growing company.”

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- The best way to make a decision in tough times: Take the “newspaper test,” Warren Buffett suggests. Imagine how you would feel about “about any given action if [you] know it was to be written up the next day” in the press by “‘a smart but pretty unfriendly reporter’ and read by their family, friends and neighbors.” (CNBC)

- New addition to our TBR pile: Origins: How Earth's History Shaped Human History will make its debut tomorrow, arguing that “there is a clear causal chain taking us from the politics and socio-economic conditions of today, to their roots in historical agricultural systems, and then further back to the geological tapestry of the ground beneath our feet.” The WSJ has a review that appealed to our inner science and history nerd.

Still have five minutes to spare? Go read how Pamela Anderson (yes, the Baywatch Pamela Anderson) landed an interview with the Financial Times.

Also: We (Enterprise. Egyptians. Humans.) are not the only ones who occasionally make a typo. Witness Australia’s new AUD 50 note, which drops the “i” from “responsibility” in the microprint (below). The NYT has the back story and you can just tap here for a larger view.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

So, when do we eat? Maghrib is at 6:40 pm CLT today in Cairo. You’ll have until 3:24 am tomorrow morning to caffeinate / finish your sohour.

WANT TO HAVE IFTAR WITH US? Take our very short survey, in which we ask you which sector you would most like to see us explore in a dedicated weekly vertical. You can choose from the seven sectors we have included or name a sector yourself. We would also like to know what it is you enjoy and like about Enterprise and what it is you don’t. The survey will run all week.

We’ll be drawing the names of at least 10 survey takers and inviting them to join us for iftar on Wednesday, 29 May at the Four Seasons Cairo at the First Residence. Think of it as a chance to get to know some of you and discuss the survey questions, your views on Enterprise, the economy, life and the universe, so please mark the date. We’ll announce the winners on Tuesday, 21 May.

IF YOU WANT TO ENTER THE DRAW, you need to make sure to give us your name, company, phone number and email at the end of the survey.

Become a sponsor of an industry vertical: If you would like to be a sponsor of an Enterprise vertical, contact Fady Sherif on fsherif@inktankcommunications.com. We’ll talk about your interests and our editorial goals and see if we can’t do something amazing together.

Enterprise+: Last Night’s Talk Shows

Move along, ladies and gentlemen. Our roundup of last night’s talk shows will resume after Ramadan.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- Euroclear is looking to tap domestic banks to help settle government debt: Belgium-based clearinghouse Euroclear is to select a number of local banks from among primary dealers to assist in the settlement of government debt, a senior government official told Enterprise. Chosen banks will be among those with the highest holdings of government debt and whose systems align best with Euroclear, the official said. Misr for Central Clearing, Depository and Registry will also play a role, our source added, but declined to provide further details. Amendments to the rules governing the primary dealer system will necessary to allow the banks to operate in the primary and secondary market through the Euroclear system.

Background: The Finance Ministry signed an MoU with Euroclear last month to make EGP-denominated debt Euroclearable. Having domestic debt available on Euroclear will facilitate settlement for overseas investors, who can currently only access the debt market through a few local banks licensed to operate as primary dealers. Finance Minister Mohamed Maait, who opened talks with Euroclear last September, said that Egypt will not issue yen- and yuan- denominated bonds — or green bonds or sukuk, for that matter — before the next fiscal year to give the government more time to prepare and comply with Euroclear regulatory requirements.

ADIB Capital to manage the Egypt’s first corporate sukuk issuance: ADIB Capital, the investment banking arm of Abu Dhabi Islamic Bank, will managing a USD 50 mn sukuk issuance that it claims is the first to come out of the nation’s corporate sector, unidentified sources told Hapi Journal. Hapi says its sources declined to disclose the name of the company making the issuance, saying only it is a private-sector player. ADIB, which is acting as financial advisor, is currently working on wrapping up procedures and preparing a prospectus to submit to the Financial Regulatory Authority (FRA). The FRA issued regulations governing the issuance and listing of sukuks last month, stipulating that the shariah-compliant bond issuances be approved by a religious committee, among other things.

Government to decide on new electricity rates by the end of May: The Egyptian Electrical Utility and Consumer Protection Regulatory Agency (Egyptera) has completed scenario planning for a hike in residential electricity prices expected by the start of the government’s next fiscal year starting in July, the local press reports. Cabinet is expected to sign off on the new rates by the end of this month. Households with the highest monthly consumption levels will once again face the sharpest price increases.

Background: The Finance Ministry expects spending on subsidies to drop to EGP 312 bn, from EGP 332 bn in FY2019-20 budget on the back of the subsidy cuts. The government has raised prices by an average of 26% since last July as part of its plan to phase out electricity subsidies. Subsidies were originally due to be lifted in FY2019-20 but the period was extended to FY2020-21 to avoid placing too much pressure on household budgets.

LEGISLATION WATCH- Cabinet greenlights amendments to Mineral Resources Act: The Madbouly Cabinet has approved amendments to the Mineral Resources Act and will send the draft bill to the House of Representatives today, a source from the Oil Ministry told the local press. The proposed amendments will have to make it through House committee-level approval and be put up for a final vote before being signed into law by President Abdel Fattah El Sisi.

The changes will set up a new authority in charge of licensing mines and quarries, the source said, adding that the previous 16k sqm area limit would be lifted, allowing the authority to issue licenses to areas of unlimited size. The legislation would, if passed, allow licenses to be renewed for more than one term, while licenses would be revoked after six consecutive months of inactivity (rather than three). Mines and quarries licensed under the current legislation would remain valid and be subject to prior terms until renewal, the source noted. Among other clauses, the law would also include provisions to encourage the development of value-added industries that take advantage of the country’s mineral wealth.

We thought this package had already made it to the House: We noted late last year that the amendments — which have been praised by the industry for their promise to scrap the oil-and-gas-style production sharing agreement and move to a tax, rent and royalty model — had been sent to the House after receiving cabinet approval. Reading the coffee grinds, it seems a ministerial working group subsequently made changes after consultations with the Federation of Egyptian Industries and provincial governors.

S&P sees strong growth prospects in Egypt: Egypt’s economy is expected to expand by 5.3% in real terms in the current state fiscal year, ratings agency Standard & Poor’s said in a report. S&P’s outlook for the Egyptian economy remains stable, predicting the economy will continue to grow at a 5.5% clip over the next three years, according to a Zawya pickup of a report in the Saudi Gazette.

What’s driving growth? Pickups in natural gas exploration and production, manufacturing, tourism, and construction, S&P says. Better yet, the rating agency sees a “robust pipeline of projects,” increasing natural gas production and a rebound in tourism are all expected to attract greater FDI inflows in the near future. Sustained growth in construction will be supported by significant investments in infrastructure, including the New Suez Canal Economic Zone and the new administrative capital.

DISPUTE WATCH- Arbitrators oversee survey of disputed Uptown Cairo land: Experts from the Cairo Regional Centre for International Commercial Arbitration (CRCICA) last Tuesday oversaw a land survey of Emaar Misr’s Uptown Cairo project as part of an ongoing dispute with state-owned El Nasr Housing, government sources told Al Shorouk. The surveyors are expected to compile a report on the case, which could verify whether El Nasr’s claims against Emaar Misr are true. El Nasr brought the arbitration case against the local subsidiary of UAE-based Emaar in June 2017, alleging the company had failed to develop 3 mn sqm of land allotted to it in 2005 and that it unlawfully took 215k sqm within Uptown’s borders.

The case may be resolved soon: Public Enterprises Minister Hisham Tawfik was quoted in the press last month as saying that the two companies will sign final contracts to resolve the dispute in a week’s time.

M&A WATCH- RX Healthcare Fund to finalize Al Mottahedoon Pharma acquisition next week: EFG Hermes’ RX Healthcare Fund is expected to finalize its acquisition of 80% of meds producer Al Mottahedoon by the end of next week, according to a local press report. Look for a ticket size in the EGP 360 mn range, the report says. A group of Egyptian investors and a Kuwait investor who together own 92% of the company will be selling part of their stakes.

INVESTMENT WATCH- Odiggo receives USD 180k Saudi investment: Egyptian e-commerce platform Odiggo has received USD 180k of investment from an unnamed Saudi investor, taking the value of the company to USD 1.25 mn, according to an emailed statement (pdf). Odiggo connects customers to Egyptian car parts suppliers and service providers.

EARNINGS WATCH- Ibnsina Pharma 1Q2019 profits surge 46.6% y-o-y on rapid business growth: Medical products distribution company Ibnsina Pharma reported net profits of EGP 41 mn in 1Q2019 compared to EGP 28 mn a year earlier, a 46.6% y-o-y increase, the company said in a statement (pdf). Quarterly gross revenues jumped 29.3% y-o-y to EGP 3.7 bn. Revenues were boosted by “across-the-board growth at all the company’s business segments.” The company’s hospitals segment was its fastest growing during the quarter.

The company’s board of directors agreed to pay a reduced EGP 160 mn fine imposed in a case brought by the Competition Authority pending the outcome of its appeal to the Court of Cassation, the nation’s highest appeals court.

Ibnsina looking to invest: “We continue to explore opportunities for expansion,” said co-CEO Mahmoud Abdel Gawad. “Ibnsina Pharma has more than tripled the resources invested in upgrading and expanding its distribution sites to EGP 54.1 mn in 1Q2019. What happens there determines the efficiency and timeliness with which we are able to execute our everyday operations and allows us to leverage economies of scale to provide the highest quality of service. These are the prime considerations we take into account when formulating our plans for expansion and further investment,” he said.

GB Auto net profit falls 52% in 1Q2019: GB Auto posted net profits of EGP 16 mn in 1Q2019, down 52.2% y-o-y from EGP 34 mn last year, according to a company earnings release (pdf). The losses come despite a 23.5% y-o-y rise in revenues in 1Q to EGP 5.89 bn. The bulk of the revenues came from the company’s Auto & Auto Related (A&AR) segment, which took EGP 4.95 bn over the quarter — a 23.3% rise from 1Q2018. A&AR posted a EGP 124.7 mn loss despite the strong revenue growth. “We continue to operate in a market that is experiencing the transitory effects of a changing regulatory and macroeconomic landscape,” CEO Raouf Ghabbour said, voicing his hopes for regulatory changes in the months ahead. “We have taken a proactive approach to these external shifts and continue to employ a combination of sales mix and portfolio adjustments,” he said. The company signaled it is looking for relief on the regulatory front that will allow the “booming three-wheeler space” to continue to grow and flagged up its recent launch of a mortgage finance partnership with EFG Hemes and TMG as a key development for its well-positioned non-bank financial services arm.

Amer Group flips to loss in 1Q2019: Amer Group reported net losses of EGP 4.5 mn in 1Q2019, compared to profits of EGP 18.9 mn a year earlier, the company said in a bourse filing (pdf). Revenues grew by 27.3% y-o-y to 383.6 mn.

ODE reports EGP 111.3 mn net profit in 1Q2019: Orascom Development Egypt (ODE) has reported a net profit of EGP 111.3 mnin 1Q2019, up 33.9% from EGP 83.1 mn in 1Q2018, according to the company’s earnings release (pdf). Revenues for the quarter climbed 27.9% to EGP 837.6 mn, up from EGP 654.9 in 1Q2018.

Ezz Steel reports EGP 1.6 bn in 2018 net losses: Ezz Steel has reported a consolidated net loss of EGP 1.64 bn in 2018, down from a EGP 1.58 bn loss the previous year, according to the company’s financial statement (pdf). Top line net sales came at EGP 49.2 bn for the year, up from 41.7 bn in 2017.

Sidi Kerir Petrochemicals’ net profit declined 31.8% y-o-y in 1Q2019 to EGP 193 mn compared, the company said in an EGX filing (pdf). Revenues slipped fractionally to EGP 1.23 bn from EGP 1.24 bn the previous year.

MOVES- The National Bank of Kuwait-Egypt has named Yasser El Tayeb (LinkedIn) as its new managing director, according to a bourse filing. El Tayeb was formerly the bank’s deputy managing director.

MOVES- Schneider Electric Egypt has appointed Sherif Abdel Fattah as deputy CEO,Al Ahram reports. Abdel Fattah has worked at the company since 1991.

MOVES- Fadi Abi Nader (LinkedIn) has been appointed Mars-Wrigley’s strategic initiatives and reinvention management office director. Abi Nader has worked in the company for 15 years, most recently as the market director for Egypt, Libya and Sudan. Abi Nader and his team doubled the size of the Egypt business over the past four years and tripled absolute earnings. Dalia Salib (LinkedIn) will move into Abi Nader’s post, entering the company after 12 years’ working as a marketing director at PepsiCo.

MOVES- Mahmoud El Ghetany has been named CFO and IR director at Amer Group, replacing Riad Refaat, who has been made a non-executive board member.

** WE’RE HIRING: We’re looking for a podcast producer with a strong track record with audio production. The ideal candidate will have experience and background in audio production and journalism. This includes familiarity with audio production software, such as Adobe Audition. A background in business / economics / finance, and/or entrepreneurship and technology is also preferred, but not a requirement. Check out the job posting here for more information. The producer should be highly fluent in the English language.

To apply, please submit 2-3 audio samples and a solid cover letter telling us a bit about who you are, why you’re a good fit and what interests you in Enterprise. A CV is nice, but we’re much more interested in your clips. Please direct your applications to jobs@enterprisemea.com.

The Macro Picture

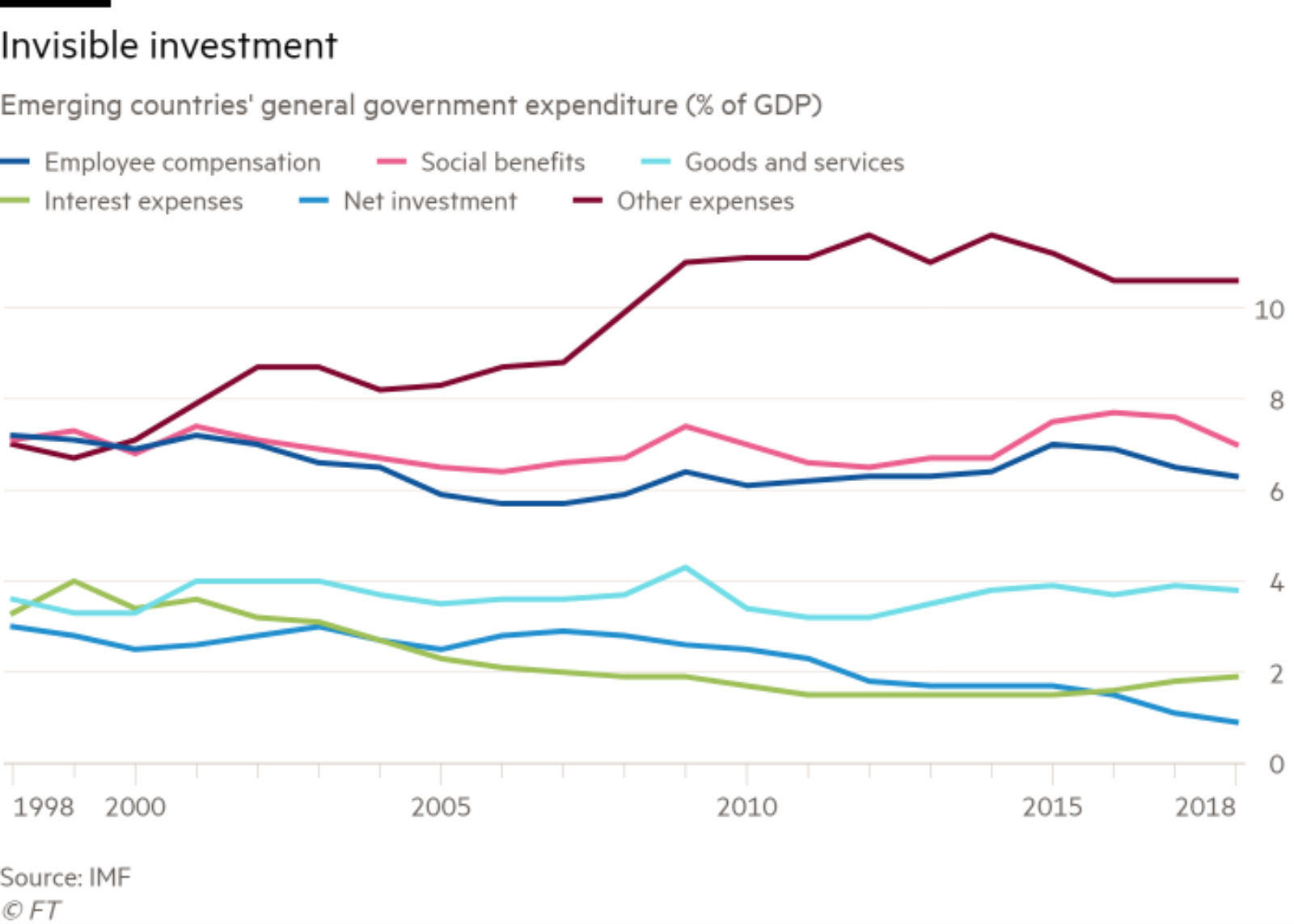

Emerging markets risk widening infrastructure gaps as public investment falls to record low: Emerging market governments are spending less than 1% of GDP on public investment for the first time ever, marking a historic low, according to IMF data cited by the Financial Times. Infrastructure such as transport, hospitals, schools and power currently receive just 0.9% of national output in emerging markets, down from 3.3% in 1997, the data indicates. This is raising fears in policy circles that growing infrastructure gaps could stifle the development of emerging economies. “Whether you look at [public investment] in gross or net terms you are talking about a decline,” Paolo Mauro, deputy director of fiscal affairs at the IMF, told the FT. “This is something that should be reversed. Emerging economies, as they develop, need to build infrastructure.”

Egypt isn’t over-investing in infrastructure — in fact, we’re not yet investing enough: The World Bank said last year that Egypt’s infrastructure gap is set to grow to USD 230 bn over the next 20 years. The country’s transport sector will require an extra USD 145 bn in the coming two decades while water infrastructure will need a further USD 45 bn. Putting this into perspective, total investment into transportation in FY2016-17 came in at around USD 3 bn, USD 1.9 bn of which came from the state and USD 1.1 bn from the private sector. Just USD 339 mn was invested into water infrastructure that year, none of which came from the private sector. The World Bank recommended priorities including seeking USD 10 bn worth of investment for the nation’s railways and USD 10 bn for refinery upgrades.

Global targets: IMF figures estimate that EM governments are required to put a further 4.1% of GDP (USD 2.06 tn) into public investment each year until 2030 in order to perform well against the UN’s development goals. Mauro meanwhile claims that emerging markets will need to spend an extra USD 2.2 tn each year on transportation alone until 2035 in order to close the funding gap. “These require big increases in revenues, but with good policies there are reasons to think that it can be done,” he said.

Egypt in the News

Successful lobbying from Egypt and Saudi Arabia is behind Washington’s recent decision to throw support behind Libyan military leader Khalifa Haftar, reports The Wall Street Journal. The US for years had supported the UN-backed government in Tripoli, but reversed that decision after President Abdel Fattah El Sisi and Crown Prince Mohammed bin Salman voiced concerns to Trump that the Libyan government is allied with Islamic extremists, according to statements from unidentified Washington and Saudi officials.

Other headlines worth a moment of your time include:

- One-star reviews for Egypt’s first streaming app: Egypt’s recently-launched video-streaming app Watch iT has attracted widespread criticism for technical difficulties and being too expensive, AFP reports.

- Human rights: Human Rights Watch and other organizations haveissued a statement condemning a “defamation campaign” against DC-based Egyptian advocacy worker Mohamed Soltan.

- An Egyptian court sentenced two men to death and eight others to between three years and life in prison over an attack on a church and Christian-owned shop in Cairo that killed 10 people, which Daesh claimed responsibility for, reports Reuters.

- Egyptian actress comes under fire for blackface: Shaimaa Seif appeared on a comedy show attempting to imitate a Sudanese woman by speaking in the Sudanese dialect and wearing blackface, sparking backlash over the racist undertones, reports the Associated Press.

On The Front Pages

Talks between President Abdel Fattah El Sisi and Hamad bin Isa Al Khalifa are top news on the front pages of state run dailies Al Ahram and Al Gomhuria. In their meeting, the state leaders discussed boosting regional ties in the face of obstacles and combating attempts of foreign intervention.

Worth Watching

The day that changed the world as we know it: The launch of Telstar 1, the first active communication satellite in space, on 10 July 1962, sowed the seeds for everything from advances in television and radio to the ability to track greenhouse gas emissions, refugee movements, and urban traffic flows, this Bloomberg video tells us (watch, runtime: 6:56).

Diplomacy + Foreign Trade

Exports from Egypt’s customs-exempt SEZs reach USD 6 bn in 4M2019: The country’s customs-exempt special economic zones (SEZs) exported USD 6 bn-worth of products in the first four months of the year, according to an Investment Ministry statement. Projects in the zones reached 1,095 with capital of USD 12.5 bn, in addition to USD 2.15 bn of foreign direct investment, and an investment cost of USD 26.3 bn. The government is currently working on setting up seven new zones in Minya, South Sinai, New Ismailia, Giza, Dakahlia, Aswan and Kafr El Sheikh, which are expected to house over 1,000 projects and create some 120k jobs.

Energy

Saudi’s Alfanar to build USD 250 mn wind plant in Egypt

Saudi-based Alfanar Company is planning to build a USD 250 mn wind power plant in Egypt by no later than 2021, CEO Gamal Wadi said, without revealing any further details. The plant comes as part of the company’s global strategy to invest USD 1.6 bn in renewable energy projects producing a total 1.6 GW of power by 2021, including plants in Spain, India and the UK. Alfanar has recently inaugurated a 50 MW solar plant in Aswan’s Benban complex under the feed-in-tariff program.

Tourism

Egyptian hotel market revenue grows 34% y-o-y in 1Q2019

Revenue per available room (RevPAR) growth in Egypt’s hotel market grew 34% during 1Q2019 on the back of “relaxed” travel sentiment, according to a report by Colliers International cited by the local press. RevPAR is forecast to grow by an average 21% through 2019, with hotels in Cairo growing 99%, Alexandria 69%, Hurghada 42%, and Sharm El Sheikh 30%.

Banking + Finance

Makasa Sport to increase capital by EGP 58 mn, list on EGX

Makasa Sport is undergoing a capital increase as a preliminary step to listing on the Egyptian Exchange (EGX), Mohamed Abdel Salam, president of Misr Clearing Company and Central Depository, told the local press. Makasa Sport’s capital will increase to EGP 100 mn from EGP 42 mn in 2Q2019, with an IPO expected to take place next year, he said.

Other Business News of Note

Egypt’s state-owned HHD puts 32 land plots in Sheraton, Heliopolis up for sale

Heliopolis Housing and Development (HHD) is selling 32 land plots it owns in Sheraton, Heliopolis, through direct order agreements, the company said in an EGX disclosure (pdf). HHD’s Sahar Al Damati said in March the company is planning to sell off part of its land portfolio in the coming months to finance investment plans. The company sold a separate 1,980-feddan piece of land in Sheraton last week for EGP 99.3 mn. HHD is among the lineup of state-owned companies planning to sell additional stakes on the EGX as part of the state privatization program.

Legislation + Policy

House approves bill on inland water transport

The House of Representatives has approved in principle a bill regulating inland water transport, Al Masry Al Youm reports. The bill would require motorboats to install GPS tracking devices. Infractions would result in imprisonment of no less than two years and a fine of no more than EGP 5,000.

Egypt Politics + Economics

Egypt’s parliament gives preliminary nod to 15% increase in military pensions

The House of Representatives' general assembly approved yesterday the text of a draft law to raise military pensions by 15%, but postponed a final vote due to lack of quorum, according to local press reports. Former military employees will see a minimum pension raise of EGP 150, and an increase in the minimum pension payout to EGP 900, beginning 1 July. The raises received committee-level approval last month, and are the same as the pension increases for civil servants announced by President Abdel Fattah El Sisi in March.

On Your Way Out

CNN has released a teaser for its promotional campaign for tourism in Egypt under its recently-signed partnership agreement with the Tourism Ministry. The video is complete with dramatic panning shots of all your favorite tourist destinations in Om El Donia (watch, runtime: 2:20).

The Market Yesterday

EGP / USD CBE market average: Buy 17.07 | Sell 17.17

EGP / USD at CIB: Buy 17.06 | Sell 17.16

EGP / USD at NBE: Buy 17.07 | Sell 17.17

EGX30 (Sunday): 14,122 (+0.4%)

Turnover: EGP 244 mn (70% below the 90-day average)

EGX 30 year-to-date: +8.30%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.4%. CIB, the index heaviest constituent ended down 0.1%. EGX30’s top performing constituents were Arab Cotton Ginning up 6.4%, Egyptian Iron & Steel up 5.5%, and Qalaa Holdings up 5.0%. Yesterday’s worst performing stocks were Cairo Investment & Real Estate Development down 5.1%, Eastern Co. down 0.8% and Egyptian Kuwait Holding down 0.5%. The market turnover was EGP 244 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -2.5 mn

Regional: Net Short | EGP -5.3 mn

Domestic: Net Long | EGP +7.8 mn

Retail: 56.7% of total trades | 54.6% of buyers | 58.8% of sellers

Institutions: 43.3% of total trades | 45.4% of buyers | 41.2% of sellers

WTI: USD 61.66 (-0.06%)

Brent: USD 70.62 (+0.33%)

Natural Gas (Nymex, futures prices) USD 2.62 MMBtu, (+0.92%, Jun 2019)

Gold: USD 1,287.40 / troy ounce (+0.17%)

TASI: 8,674.66 (-2.06%) (YTD: +10.83%)

ADX: 5,098.30 (+0.90%) (YTD: +3.73%)

DFM: 2,629.90 (-1.60%) (YTD: +3.96%)

KSE Premier Market: 6,163.19 (-2.22%)

QE: 9,928.22 (-0.99%) (YTD: -3.60%)

MSM: 3,865.51 (+0.06%) (YTD: -10.60%)

BB: 1,427.71 (-0.60%) (YTD: +6.76%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

14 May (Tuesday): Egyptian Private Equity Association annual sohour. Four Seasons Hotel, Cairo.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.