- FinMin is not looking to impose 10% capital gains tax on all corporates, officials confirm to us. (Speed Round)

- Egypt snags right to host African Cup of Nations 2019 from South Africa. (Speed Round)

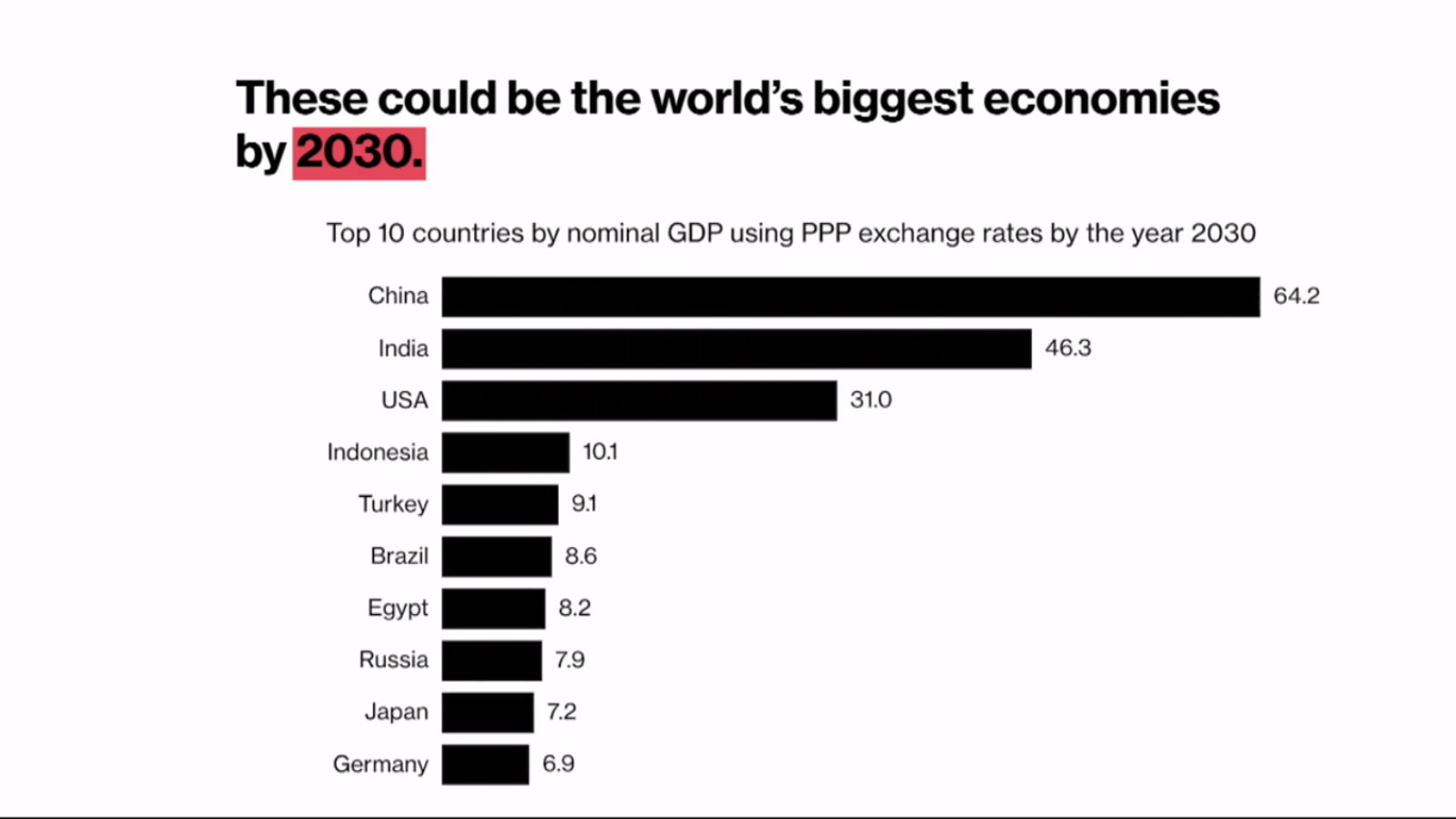

- Standard Chartered sees Egypt as one of world’s top 10 economies in 2030. (Speed Round)

- FinMin receives cabinet approval to move ahead with tender for eurobond managers, legal advisors, sources tell Enterprise. (Speed Round)

- The EGX issued on Sunday the regulations allowing brokerage firms to act as market makers. (Speed Round)

- MSA University considers listing on the EGX. (Speed Round)

- Are zero customs on EU cars helping lower prices? (Last Night’s Talk Shows)

- US Secretary of State Mike Pompeo is due in Cairo tomorrow to deliver a speech (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 9 January 2019

AFCON 2019 is ours.

TL;DR

What We’re Tracking Today

For those whose real estate agents have convinced them the bottom side of a rock is the best place to live: We’re hosting the African Cup of Nations 2019, which will run from 15 June to 13 July 2019. Those unfortunate to not have been here in 2006 when Egypt was both host and winner of the tournament will be in for a treat, as the entire country turned into one big party. Chances for another win look good (World Cup performance notwithstanding), with Mo Salah being named African footballer of the year. Egypt has a lot of work to get a tournament like this ready in such a short time, so here’s hoping the FA gets it together and puts on another great show. We have the story in greater detail in the Speed Round below.

US Secretary of State Mike Pompeo is due in Cairo tomorrow, where he will deliver a speech that is expected to “serve as yet another rejection” of former US President Barack Obama, according to the Washington Post. Pompeo’s speech will likely lean on “[repudiating] the Middle East vision of former President Barack Obama,” which Obama presented in his 2009 speech at Cairo University — but will still mimic the same sentiment of the US having the Middle East’s best interests at heart, says Politico’s Nahal Toosi.

Citigroup affirms status as an EM bear despite new year rebound: While the skies are certianly not cloudy for Asian stocks, the MSCI Emerging Markets equity benchmark index, fell Tuesday after posting the biggest two-day gain in two months, according to Bloomberg. Citigroup has now joined UBS in becoming an emerging markets bear, despite signs that conditions that led EM debt, stocks, and currencies to go apocalyptic will not be present, others will sabotage the bull’s projected rebound. UBS is arguing that potential declines in economic growth and trade as a result of global tensions will play a bigger role in determining the fate of EMs over moves by the US Federal Reserve on interest rates.

While economic down cycle is normal can a new world order make recession a reality? Global economy pessimists have found another voice in the FT’s Martin Wolf, who says that while it is perfectly normal to expect a down cycle in the global economy, the changing political and economic structural systems may make overcoming these down cycles more difficult in the long term. These new structural changes include a breakdown of global cooperation mechanisms in light of global tensions between the US and China (and the EU) in addition to a rise in global tensions.

Goldman Sachs sees oil averaging USD 62.50 / bbl this year: Citing a spike in OPEC oil output at the end of last year and resilient US shale production, Goldman Sachs has lowered its forecasts for global oil prices in 2019 to USD 62.50 / bbl from USD 70 previously, Bloomberg reports. This puts it within the ballpark range that sources from the Finance Ministry tell us. Saudi Arabia has been trying to get prices up to USD 80/bbl. This comes as Egypt has begun the process if implementing its fuel pricing mechanism for 95 octane fuel, which could see prices fluctuate by up to 10%.

2018 was not a good year for hedge funds: The Hedge Fund Research’s main index was down 4.07% in 2018 — it’s worst year in seven years — “as financial market turmoil in the fourth quarter of 2018 caught many off-guard,” according to the FT. The bright spot? The index apparently beat the S&P 500 index for the first time in a decade, as the latter saw a 4.38% decline.

Also drawing our attention in the world of finance — Wall Street firms look to a low cost stock exchange: Some of Wall Street’s biggest players are planning to launch a low-cost alternative to the New York Stock exchange and NASDAQ, which they say have been charging “unjustifiably high fees … for data on stock trades,” Reuters reports. The alternative bourse — dubbed MEMX or Members Exchange — will be both controlled and financed by the likes of Morgan Stanley, Citadel, Bank of America Merrill Lynch, and Charles Schwab Corp.

Enterprise+: Last Night’s Talk Shows

Are zero customs on EU cars helping lower prices? Egypt hosting the 2019 African Cup of Nations (AFCON) dominated the airwaves last night (and we have that coverage in the SR below), but what’s really got us interested is Hona Al Asema’s look at the impact of customs on European cars falling to zero on car prices.

1600cc and 2000cc European cars see prices fall by up to 20%: European cars with 1600cc engines have gone down between EGP 10,000 to EGP 50,000, Federation of Egyptian Chambers of Commerce’s auto division member Alaa El Saba told Hona Al Asema. Prices of 1600cc cars decreased 3-8% while prices of cars with engines of 2000cc or more were down by 15-20% (watch, runtime: 05:32).

Background: Auto assemblers have long sought to get the automotive directive — which sets incentives for assemblers to move up the value chain to manufacturing to compete with EU and regional cars — passed before customs on these cars fall to zero. Some, including GB Auto Chairman Raouf Ghabbour have claimed that customs falling to zero would not have the desired effect on prices. Regardless of where prices fall, it can only be helped further by competitive domestic manufacturing industry.

Speed Round

EXCLUSIVE- Tax Authority not looking to impose 10% capital gains tax on all corporates: The Tax Authority is not planning to impose an across-the-board 10% capital gains tax on all corporates, authority head Abdel Azim Hussein tells Enterprise. According to Hussein, the proposed amendments to the Income Tax Act that look to unify the capital gains tax for listed and privately held companies were drafted by the House of Representatives and have yet to make their way to the Finance Ministry for review or sign-off. Hussein stressed that the levy remains suspended for listed companies until 2020, and that the Finance Ministry has yet to settle on how to impose the tax should it decide to revive it. A separate ministry source also tells us that there are studies underway on the matter.

Background: The House Planning and Budgeting Committee is planning on discussing this week the proposed amendments to the Income Tax Act, Committee Chair Yasser Omar said earlier this week. As it currently stands, the law imposes a 22.5% capital gains tax on unlisted companies, while listed corporations are subjected to a 10% tax. The Mehleb government had half-baked plans in 2015 to impose the tax on retail investors, but ultimately backed down after coming under pressure.

Standard Chartered sees Egypt as one of world’s top 10 economies in 2030: Egypt will be one of the world’s top 10 economies by 2030, Standard Chartered said, according to Bloomberg (watch, runtime 01:07). The long-term forecast by Standard Chartered, which uses purchasing power parity exchange rates and nominal GDP to predict the world’s GDP rankings, placed Egypt in 7th place, ahead of Russia, Japan and Germany. China topped the list, followed by India and the US, respectively. Asia’s share of global GDP could be as large as the US and Europe combined by 2030, at 35%. As many as seven of the world’s top 10 economies in 2030 may be currently classified as emerging markets.

Other key observations include:

- Slowed reform momentum in EMs drags down productivity growth;

- Dusk closing in on the quantitative easing era may put pressure on economies to reform and revive productivity trends;

- A majority of the world’s population will enter the middle class by 2020;

- The growth of the middle class should help counter the rapid population aging trend in many countries.

EXCLUSIVE- FinMin moves ahead with tender for eurobond managers, legal advisors: The Finance Ministry has received the green light from Cabinet to move ahead with issuing a tender for investment banks and law firms to act as joint lead managers and legal advisors for Egypt’s upcoming eurobond issuance, a senior government official tells Enterprise. The ministry expects to settle on the advisors for the issuance within the next few weeks, once the holiday season passes and officials get a chance to meet with “international partners” (presumably the IMF). The timing of the issuance remains undetermined, and will likely only be decided on once the full team of advisors is on board. A government official had previously told us that the ministry is looking to select at least one Asian bank to join the final lineup of bookrunners, since the government’s planned issuances will largely be concentrated in Asian markets. HSBC, Citigroup, JPMorgan Chase & Co, Morgan Stanley, and National Bank of Abu Dhabi had led past eurobond issuances.

Background: Egypt has been preparing to issue USD 4-7 bn worth of yen-, yuan-, USD-, and EUR-denominated bonds in 1Q2019, we reported last month. Egypt has also been waiting on global markets to stabilize before moving ahead with its issuances, government sources had previously told us. Finance Minister Mohamed Maait had also said earlier this month that the Madbouly government will release details on its 1Q2019 international bond issuances sometime next month.

Will the EM New Year rebound bode well for the issuance? The decision on the timing of the eurobond issuance will undoubtedly factor the substantial rebound in emerging markets witnessed since the new year. The MSCI currency index rose to its highest level since July 2018 on Sunday, while indices across the region saw gains. Morgan Stanley’s EM sovereign credit outlook for 2019 expected international bond issuance to rise 15% to USD 158 bn from the previous year, with Egypt expected to issue international treasury bonds “sooner than later.”

M&A WATCH- Italy’s Azimut Group acquires 100% of Rasmala subsidiary: Italy-based asset manager Azimut Group inked an agreement yesterday to acquire 100% of Rasmala Egypt Asset Management (REAM) from its parent company Rasmala Group, according to a company press release (pdf). REAM, one of Egypt’s largest independent asset managers, will be renamed Azimut Egypt Asset Management. Azimut says it sees potential in Egypt’s youthful population and the fact that the country has “one of the highest GDP-PPP adjusted per capita in the EM complex excluding energy/commodity exporters countries.”

IPO WATCH- MSA University mulling IPO: October University for Modern Sciences and Art (MSA) is considering listing its shares on the EGX to finance its expansion plans to set up a new campus in New Alamein, according to Al Mal. MSA has already submitted a request to the Madbouly Cabinet to allocate a land plot for the new university branch, on which it expects to break ground sometime this year, MSA’s Board of Trustees Chairman Nawal El Degwi said.

REGULATION WATCH- The EGX issued on Sunday the regulations allowing brokerage firms to act as market makers, allowing them to both buy and sell securities from their own inventory at prices they have a measure of control over, according to a statement (pdf). The tool is one of several financial instruments and trading options that will be made available on the EGX under amendments to the Capital Markets Act that were formalized last May. Under the regulations, brokerages are required to receive approval from the Financial Regulatory Authority (FRA) to act as market makers, after which they must register with the EGX before carrying out any transactions.

The regulations allow T+0 trading and margin trading on any EGX-listed securities. Prior to the issuance of these regulations, same-day trading and margin trading were only allowed on stocks that are on the EGX’s category ‘A’ or ‘B’ list of securities. The regulations also set the maximum difference between the buy and sell price of any security market makers trade. Market makers are also required to allocate the equivalent of at least 20% of a security’s average daily price on the EGX to act as collateral in order to be able to carry out the transaction.

A specialized EGX committee will determine which securities can and cannot be used in market making transactions. Ineligible securities include those belonging to companies that have faced legal action from the Financial Regulatory Authority pertaining to wrongdoing, or companies that have committed “grave violations” that prompted action from the EGX’s listing committee over the preceding six months.

REGULATION WATCH- Madbouly sets framework for leasing and factoring companies to appeal FRA decisions: Prime Minister Moustafa Madbouly issued on Saturday a decree outlining the avenues for leasing and factoring players to appeal administrative decisions from the Financial Regulatory Authority (FRA) in accordance with the Leasing and Factoring Act. Under the decision, companies will have one month to lodge appeals against any of the authority’s decrees, and will be required to make an EGP 20k payment to the FRA’s appeals committee, which will be reimbursed if their appeal is accepted. The regulations are part of a Leasing and Factoring Act the House of Representatives passed last year, which regulates leasing and factoring as non-banking financing tools that are subject to oversight by the FRA.

This comes as the FRA sets solvency standards for companies: The newly announced framework was followed by fresh standards to ensure leasing and factoring companies can remain solvent, according to an FRA statement. A fixed capital base and a borrowing threshold that’s equivalent to 9x the size of the base level were among the standards, which also require companies to diversify their risk portfolios and deposit a proportion of their revenues with the FRA to hedge customer default risks. The required level of capital will be calculated based on operational and credit risk. The regulator also set conditions for companies to cross off irrecoverable debt from their loan portfolios.

CBE looks to make Takaful and Karama payouts available through Meeza: The central bank is currently in talks with state-run electronic payments company E-Finance on making cash handouts under the Takaful and Karama social welfare programs available through the “Meeza” national debit cards, a source told Masrawy. Beneficiaries currently have specific cards for the Takaful and Karama programs, but these cards can only be used with machines at the post office. Making the handouts available through Meeza would allow beneficiaries to access their payments through any ATM machine.

Background: The central bank had said in September that it plans to roll out Meeza, a state-backed debit card, by December. The card, which comes as part of the government’s new e-payments drive, would make state benefits available electronically to pensioners, civil servants, and subsidy recipients.

MOVES- Egypt gets new World Bank country director: The World Bank has appointed Marina Wes as Country Director for Egypt, Yemen and Djibouti,according to a WB statement. The Dutch national — who joined the WB in 2000 — was formerly country director for the West Bank and Gaza and, separately, for Poland. She also held the position of lead economist for Turkey. Her area of expertise is emerging markets, but has written extensively on public finances, trade and foreign direct investment. She takes over from Samia Msadek who served as acting director.

Could the World Bank be getting its first non-American president? Although the World Bank has traditionally been run by an American, and the IMF — its sister organization — by a European, some countries are trying to lobby to bring an emerging markets representative to the bank’s helm following the resignation of Jim Yong Kim, says Bloomberg’s Andrew Mayeda. US President Donald Trump is expected to nominate a US national for the top job, but is likely to be met with resistance from within the lender, whose executive board has the final say. Jim Yong Kim is reportedly joining New York-based private equity fund Global Infrastructure Partners, according to the FT.

MOVES- Global life insurer, New York-based MetLife has tapped its US and EMEA business chief Michel Khalaf (bio) as CEO, according to Reuters. The veteran top executive will step in on 1 May, and succeeds Steven Kandarian — who held the position for the past eight years. Khalaf joined MetLife in 2010 as an executive vice president when the company acquired American Life Insurance Company (Alico), where he spent 21 years in various leadership roles.

MOVES- Vodafone Egypt has appointed Karim Shehata (LinkedIn) as head of the corporate division and Mohamed Abdullah (bio) as head of the commercial division, according to an emailed statement. The two will assume their new positions this April. Abdullah joined Vodafone in 1998 upon his graduation with a BA in commerce. Shehata joined more recently, in 2015, and was formerly senior manager at Visa.

Egypt to host AFCON 2019, Mo Salah named top Africa player: Egypt was selected to host the 2019 African Cup of Nations (AFCON) for the second time this summer, after receiving 16 out of 17 votes, the Confederation of African Football (CAF) announced yesterday. The competition will be held from 15 June to 13 July 2019.

Egypt was up against South Africa for the hosting gig, but South Africans were reportedly not too keen on hosting the (expensive) tournament for the second time in less than a decade. This year’s edition of the championship will see 24 African teams competing for the title — which Egypt has taken home seven times — up from 16 teams previously.

The story is, far and away, topping coverage of Egypt in the foreign press, with Reuters, the BBC, CNN and Goal among those taking note.

The story topped coverage on the airwaves with Sports Minister Ashraf Sobhy telling Al Hayah Al Youm that documents to host the tournament were prepared in less than two days before bringing them forward to CAF (watch, runtime: 02:25). Sabry also denied rumors that Egypt’s Premier League will be canceled as a result of hosting the tournament (watch, runtime: 00:44) and invited those with suggestions on organization to share them with the ministry via its website (watch, runtime: 03:36).

The news comes as Mohamed Salah is named African Footballer of the Year for the second consecutive year at the CAF’s 2018 awards ceremony in Dakar on Tuesday. Salah is now the fourth player to claim back-to-back wins of the prestigious award, alongside African legends El Hadji Diouf, Samuel Eto’o and Yaya Toure. "I’m proud to win it twice, I must thank my family and my team mates, and I dedicate this award to my country, Egypt," Salah said after accepting the award (watch, runtime 4:02). The Associated Press, Sky Sports and the BBC also have the story.

Meanwhile, Qatar’s beIN Sports has cut its service to Egypt over disagreements with service provider Cable Network Egypt (CNE) over commercial terms, it said in a statement. No further details were provided on the dispute, but the move means mns of Egyptians will no longer be able to watch top sporting events, including Premier League. Reuters also has the story.

CNE says it’s working on it: Cable Network Egypt has responded to the decision by reassuring its subscribers that it’s working on solving the problem asap and that refunds will be made in case the issue was not resolved. CNE’s board of directors met on Tuesday to discuss the latest developments and will publish a detailed statement soon disclosing its next moves, boss Mohamed Ahmed Hamdeen told Al Mal.

Masaa DMC ‘s Osama Kamal suggested that beIN Sports’ decision to stop broadcasting in Egypt is political and related toour win to host AFCON. (watch, runtime: 06:48).

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

LEGISLATION WATCH- The Social Solidarity Ministry will present a draft of the new Social Welfare Act to the House of Representatives “within days,” Minister Ghada Wali said on Sunday, according to Al Mal. The bill, if passed, would require the government to provide families eliminated from the Takaful or Karama social welfare programs with jobs.

Supply Minister Ali El Moselhy will present his ministry’s food security strategy to the Madbouly Cabinet “soon,” the minister said at a press conference on Sunday, according to a local source. The new strategy will track the country’s commodity production and consumption rates to able crop production forecasts and better anticipate shortages. The ministry expects the new strategy to reduce the country’s EGP 50 bn wheat subsidy bill by 10-15%, according to El Moselhy.

Egypt, Sudan begin trial runs on electricity grid connection project in two weeks: Egypt and Sudan will begin trial runs for the first phase of a USD 60-70 mn electricity interconnection project in two weeks at a capacity of 100 MW, local news reported. A government source said 95% of the project has been completed.

A government committee mandated with defining Egypt’s informal economy is set to meet for the first time this month. The committee’s work comes in light of the Madbouly government’s bid to convince the World Bank and the IMF to agree to include the informal economy in calculations of Egypt’s GDP.

Egypt in the News

With the African Cup of Nations 2019 falling to Egypt topping coverage in the foreign press, here are some choice headlines that caught our eye:

Egypt doesn’t need to worry about France’s “yellow vest” protests sparking a renewed uprising here at home, because the French protests were specifically about a domestic issue, Dawn Brancati and Adrian Lucardi write for the Washington Post’s Monkey Cage blog. “In general, protests in neighboring countries do not provoke new discontent in other countries [remind citizens of their own discontent]; nor do they bring people together on behalf of existing [that] discontent,” the two researchers argue. However, it seems that symbols of revolution do transgress borders easily, even if they are used to symbolize discontent about very different issues, suggesting that Egypt’s decision to ban sales of yellow vests “may not be absurd after all.”

Delayed GEM inauguration gets Egypt eliminated from NYT’s travel list: The New York Times eliminated Egypt from its influential “52 Places to Travel” list for 2019 due to the delayed inauguration of the Grand Egyptian Museum, which has been pushed to 2020 instead of this year.

On The Front Pages

Talks between President Abdel Fattah El Sisi and his government about electricity and renewable energy projects dominated the front pages of the country’s three main state-owned dailies (Al Ahram | Al Akhbar | Al Gomhuria). El Sisi urged the government to move forward with projects to connect national power grids with neighboring countries amid government efforts to improve the country’s power industry and its infrastructure. In a separate meeting with Prime Minister Moustafa Madbouly and relevant officials, El Sisi stressed the state’s keenness to support SMEs as a driving force of economic growth.

Worth Reading

Media has become a key soft power tool in the contemporary world — especially the Middle East, where Saudi Arabia in particular has been wielding this secret weapon against its regional rivals, Simon Kerr writes for the Financial Times. As an answer to Qatar’s controversial Al Jazeera Network, a Saudi publishing firm controlled by the royal family partnered with Bloomberg to produce news channel Bloomberg Alsharq — though its future is unclear in the wake of the Jamal Khashoggi murder. Iran International, a Farsi-language news channel based in London, is reportedly backed by Saudi investors. And MBC Group, which came under majority government ownership after the great MbS Purge of 2017, has launched video streaming service Shahid in an attempt to wrangle influence away from Netflix.

Diplomacy + Foreign Trade

Egyptian authorities limit passage through Rafah crossing: Egyptian authorities are allowing Palestinians in Egypt to enter Gaza through the Rafah border crossing but have not permitted crossing in the other direction, Reuters reports. This comes after Hamas’ takeover of the border crossing — the sole exit point for some 2 mn Gazans — led Egypt to close the crossing completely.

Basic Materials + Commodities

Export fees on fresh and frozen fish removes

Trade and Industry Minister Amr Nassar decided to scrap export fees on fresh and frozen fish for one year, according to a decision published in the Official Gazette, Youm7 reported. Nassar also renewed export fees on animal feed raw materials for one year to encourage local processing, Pyramid Poultry company chairman Anwar El Abd said.

Manufacturing

Al Ahram Security Group partners with Italian investors for door accessory company

Al Ahram Security Group is setting up a JV with unnamed Italian investors to establish a EGP 750 mn door accessory production factory in Tenth of Ramadan City, reports Al Mal. Ownership of the JV, Securo, will be split 75:25, with Al Ahram holding the balance, head Samir Aref said.

Egyptalum estimates expansion project at EGP 13.9 bn

Egypt Aluminum (Egyptalum) has revised to EGP 13.9 bn its cost estimation for a planned capacity expansion project, the company said in a bourse disclosure (pdf). The company had previously said that the project, which will aim to increase its production capacity to 570K tonnes from 320K tonnes, will cost some USD 600 mn (c. EGP 10.76 bn). Egyptalum had also said it would review on 31 December offers it received in a tender for the project and is looking to finance 70% of the project cost through bank loans.

Tourism

Egypt recovers ancient artefact from London auction house

The Antiquities Ministry announced yesterday it has reclaimed a cartouche of King Amenhotep I that was illegally smuggled into the UK, according to a ministry statement. The 18th dynasty artefact was spotted at an auction house in London, and had been with the Egyptian embassy since September. It was reportedly stolen from the open museum of Luxor’s Karnak temple.

Automotive + Transportation

Transport Ministry prepares to purchase new trains from Spanish company

The Transport Ministry has selected an unnamed Spanish company to supply six new trains for EUR 126 mn, and is seeking Cabinet approval before signing final contracts, sources tell Youm7. The purchase will be financed through a facilitated loan from the European Bank for Reconstruction and Development.

Banking + Finance

Beshay Steel subsidiary seeking EGP 3.5 bn loan from local banks

Egyptian Sponge Iron and Steel (ESIS), a subsidiary of Beshay Steel, is holding talks with a number of local banks, including Banque Misr, NBE, CIB, QNB, and the Arab African International Bank, for a EGP 3.5 bn loan to finance expansions, according to Al Mal. The company is looking to finalize the loan agreement in 1Q2019.

Banque du Caire in talks for USD 30 mn loan for SMEs

Banque du Caire is in talks with the Arab Fund for Social and Economic Development over a USD 30 mn loan for SMEs, sources tell Amwal Al Ghad. The two sides are expecting to reach a final agreement over the loan sometime during 1H2019.

Other Business News of Note

GTH planning EGP 11.2 bn rights issuance on the EGX

Global Telecom Holding (GTH) is planning to raise its capital through a rights issue on the EGX worth EGP 11.2 bn to existing shareholders, according to a company statement (pdf). “GTH intends to use the net proceeds from the rights offering to meet the Company’s financial obligations through to the end of 2019, including loans from its main shareholder, the VEON Group, on a timely basis and provide sufficient liquidity needed to meet its operating companies’ near-term needs.” GTH is seeking regulatory approvals and will hold on 28 January an ordinary general assembly meeting to receive shareholder approval.

Sports

Egyptian defender Aly Ghazal joins Portuguese club

Egyptian footballer Aly Ghazal has joined Portuguese club Feirense, according to the BBC. The 26-year-old, who was released by the Vancouver Whitecaps, joins Feirense as they struggle to avoid relegation from the top echelon of the Portuguese league.

On Your Way Out

Meet Egypt’s first woman underwater engineer: A 26-year-old Egyptian oil engineer is one of only five women in the Middle East who practice commercial diving, and is the only woman in the region to train technicians in the field, Xinhua reports. Basant Bastawy, who specializes in underwater welding, constructs, inspects, and repairs oil pipeline connections in both fresh and saltwater. Bastawy’s work is in a male-dominated field, but she tells the Chinese newswire that she has trained some 200 men in underwater welding and commercial diving.

The Market Yesterday

EGP / USD CBE market average: Buy 17.87 | Sell 17.96

EGP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.79 | Sell 17.89

EGX30 (Tuesday): 13,403 (+0.5%)

Turnover: EGP 1,030 mn (29% above the 90-day average)

EGX 30 year-to-date: +2.8%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.5%. CIB, the index heaviest constituent ended down 1.2%. EGX30’s top performing constituents were Egypt Aluminum up 5.7%, Sidi Kerir Petrochemicals up 3.9%, and Porto Group up 3.8%. Yesterday’s worst performing stocks were Orascom Construction down 2.3%, CIB down 1.2% and Juhayna down 1.1%. The market turnover was EGP 1,030 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -60.9 mn

Regional: Net Long | EGP +7.6 mn

Domestic: Net Long | EGP +53.4 mn

Retail: 62.3% of total trades | 61.3% of buyers | 63.3% of sellers

Institutions: 37.7% of total trades | 38.7% of buyers | 36.7% of sellers

WTI: USD 49.65 (+2.33%)

Brent: USD 58.51 (+2.06%)

Natural Gas (Nymex, futures prices) USD 3.01 MMBtu, (+2.17%, Feb 2019 contract)

Gold: USD 1,285.80 / troy ounce (-0.32%)

TASI: 8,057.04 (+0.12%) (YTD: +2.94%)

ADX: 4,927.04 (-0.15%) (YTD: +0.24%)

DFM: 2,528.72 (-0.24%) (YTD: -0.04%)

KSE Premier Market: 5,400.65 (-0.04%)

QE: 10,458.85 (-0.34%) (YTD: +1.55%)

MSM: 4,310.85 (-0.03%) (YTD: -0.30%

BB: 1,332.33 (-0.37%) (YTD: +0.11%)

Calendar

10-13 January (Thursday-Sunday): International Property Show (IPS), Egypt International Exhibition Center.

17 January (Thursday): Talent in the Digital Era, Galleria40, Cairo, Egypt.

19 January (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January (Sunday): Cairo Court of Urgent Matters to hear an amendment to the constitutional to extend the presidential term limits.

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

3 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

7 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

10-12 February (Sunday-Tuesday): Third African Forum: “Building on Science, Technology and Innovation to Boost Private Sector and Socio-Economic Transformation in Africa”, Venue TBD, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.