- Egypt faces USD 230 bn investment gap in infrastructure over the coming 20 years, the vast majority of it in transport. (Speed Round)

- Fitch Solutions sees Egypt’s fiscal debt narrowing to 6.4% of GDP by FY2019-20. (Speed Round)

- Startup Wasla lands USD 180k in its pre-seed investment round. (Speed Round)

- Elsewedy, Afreximbank ink USD 500 mn loan agreement. (Speed Round)

- Retailers generally compliant with price-printing policy. Plus: MPs aren’t playing hooky — and there are no punishments if they do, anyway. (Last Night’s Talk Shows)

- Goldman Sachs prefers emerging markets to developed economies for 2019. (Macro Picture)

- Egypt’s iconic Cleopatra cigarettes are being undercut by a state-owned maker of counterfeits in Montenegro. (Worth Reading)

- The Market Yesterday

Wednesday, 12 December 2018

Our USD 230 bn infrastructure investment gap is a massive opportunity

TL;DR

What We’re Tracking Today

** If you’re reading this and a friend or colleague isn’t, tell them to head to www.enterprise.press to read this morning’s edition. They should also check the folder to which bad email is directed and (on Gmail) the non-inbox tabs to which unsolicited email goes. We’re working to resolve some deliverability issues we’ve had in the past two weeks and are trying a new dispatch system. Bear with us while we get up to speed.

** Enterprise is always available on the web by 6:30am, and as a bonus: The tl;dr links above work on the web. They don’t work in email clients on your iOS or Android devices thanks to changes in how Apple and Google support code.

The EFG Hermes Egypt Day Summit continues today and will wrap up on Thursday. Some 27 investors from 22 firms and institutions with aggregate assets under management of USD 5.5 tn are in town to meet face-to-face with senior government officials and C-suite execs from top publicly traded companies, EFG said in a statement (pdf).

The big international stories this morning: China may be offering something of an olive branch to the United States (while throwing a punch at Canada) in a bid to de-escalate their trade war. And there is the prospect of a leadership coup in the UK after Theresa May bungled her Brexit vote after rumors emerged that “rebels have secured the names of 48 Tory MPs needed to trigger a confidence vote.”

MUST READ- A top IMF official says governments and central banks may not be ready for the “storm clouds gathering over the global economy,” reports Reuters. First Deputy Managing Director David Lipton said despite IMF efforts to urge governments to be cautious, too few policymakers are taking the measures they need to take if they want to weather the storm.

Policymakers may have to turn to risky solutions? “Central banks would likely end up exploring ever-more unconventional measures. But with their effectiveness uncertain, we ought to be concerned about the potency of monetary policy,” Lipton said, adding that high debt levels piled up through stimulus policies could leave governments with limited options. “We should not expect governments to end up with the ample space to respond to a downturn that they had 10 years ago.”

The biggest immediate threat: The trade war between the US and China. The IMF has estimated that if all of the proposed tariffs were imposed, global GDP could take a significant hit by 2020.

Time Magazine has named Jamal Khashoggi and other journalists as its Person of the Year for 2018 in a series of four black-and-white covers headlined The Guardians and the War on Truth. Also included: Journalists at the Capital Gazette in Maryland, where five journalists were gunned down last June; Maria Ressa, a chief executive of a Philippine news website who was indicted last month on tax evasion charges as part of a wider crackdown on dissent by president Rodrigo Duterte; and the wives of Wa Lone and Kyaw Soe Oo, two Reuters journalists who were arrested one year ago in Myanmar while working covering the persecution of Rohingya Muslims.

Enterprise+: Last Night’s Talk Shows

It was another night of miscellany on the airwaves as the flurry of state-sponsored conferences came to an end.

Around 80% of merchants are complying with the price-printing policy introduced by the Supply Ministry earlier this year, head of the ministry’s Central Administration for Monitoring Osama Mekhamer said on Hona Al Asema. The ministry launches daily campaigns to ensure retailers have products’ prices clearly visible on their wares (watch, runtime: 03:59). Ministry spokesman Ahmed Kamal also phoned in to give an update on the ongoing purge of the country’s subsidy rolls (watch, runtime: 05:01).

House spokesman Salah Hasaballah denied that MPs are playing hooky, saying on Al Hayah Al Youm that only a small minority of MPs miss sessions (the number of bills whose passing was held up due to lack of quorum suggests otherwise…). Parliamentarians whose moms write them notes to stay at home are generally absent because they are following up on issues in their district and, in any case, House regulations do not include provisions to address poor attendance records, Hasaballah said (watch, runtime: 05:06).

Are we getting complimentary Wi-Fi at tourist spots? Egypt is set to sign an agreement with an unnamed private company that will provide complimentary Wi-Fi at select tourist attractions and provide organized transportation for tourists at these sites, Supreme Antiquities Council Secretary General Mostafa Wazery said on Al Hayah Al Youm (watch, runtime: 10:24).

Wazery also addressed the tired topic of the Danish tourist and his explicit photos allegedly taken atop one of the Giza Pyramids on Hona Al Asema, saying that the matter is in the hands of the judiciary now (watch, runtime: 07:57).

Egypt is officially home to a population of 98 mn, and one baby is born every 15 seconds, Population Council President Amr Hassan told Yahduth fi Masr’s Sherif Amer. Hassan explained the perils of the population boom, saying that the birth rate has outstripped the growth of the state’s resources (watch, runtime: 04:30)

Egypt’s revived relations with Africa was the name of the game on Hona Al Asema, where economist Sherif El Khereby prophesied that the breakthrough in diplomatic ties will be egged on by the number of events Egypt has organized this year (watch, runtime: 04:11).

…That includes the Intra-African Trade Fair, which Trade and Industry Minister Amr Nassar told Masaa DMC’s Osama Kamal will host some 32 countries and 1,000 companies (watch, runtime: 02:59).

Speed Round

Egypt faces a USD 230 bn investment gap in infrastructure over the coming 20 years — and the vast majority of that is in transportation, according to a World Bank analysis. Some USD 180 bn of the projected gap is in transport, while water infrastructure needs USD 45 bn in investment above current baseline projections.

Pay attention to agriculture and energy, too: While the investment gap is significantly lower here, the agriculture and agribusiness sector accounts for 30% of GDP and “has the highest potential for job creation” among the four priority sectors the Madbouly government and the World Bank identified for the study.

Before you get too down, remember: This means massive potential investments. The solution? Empower the private sector, the WB says, and transition from “taxpayer funding to user funding” — with plenty of emphasis on public-private partnerships.

Among the World Bank’s key recommendations by sector:

Transport: A USD 10 bn, 10-year investment plan to rehabilitate the railroad. Also: “Invite the private sector to develop … container and cargo terminals, river transport, railway projects, dry ports, bus rapid transit and light rail.”

Energy: USD 10 bn in fresh investment to upgrade and build new refineries. Also: Build another 3.6 GW in generation capacity right away to “eliminate power outages,” bring the private sector into a liberalized electricity market, and find new ways to promote private investment in renewables.

Agriculture: Improve water management systems and irrigation networks, reclaim more land, develop logistics networks that will sharply cut the massive percentage of crops lost between farm and market, develop the food processing industry through “efficiently located agro-industrial parks” and restructure the Agricultural Bank of Egypt.

Water and wastewater: The recommendations are the most bland here, talking about “fiscal policy reforms to encourage sustainable consumption patterns of water” (we’re reading that as “price hikes”), improved management systems and awareness campaigns.

But all of this will need the government to loosen price controls, stick to a clear policy framework against which businesses can budget and plan — and develop the ability of state institutions to run as full partners of the private sector by improving their abilities to plan and manage bid processes.

The document is more than 100pp long. What should I read? Page 5 focuses on short-term solutions for each sector — it’s essentially a great list of business ideas if you let your mind wander as you read. The World Bank’s recommendations are summarized on pp 15-16.

Visit the landing page for the reportor download the full document here (pdf).

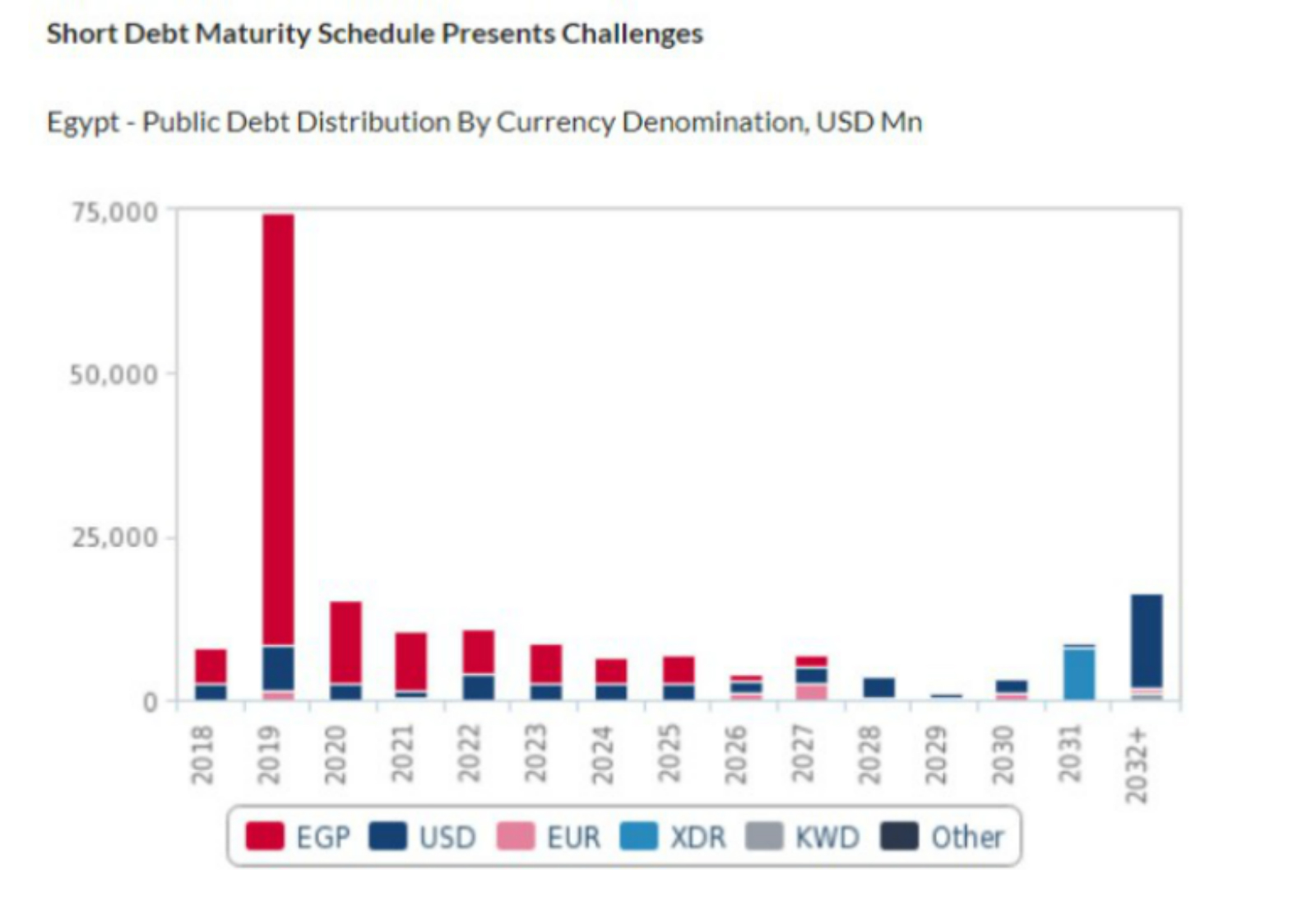

More optimism on Egypt’s debt as Fitch sees Egypt’s fiscal debt narrowing to 6.4% of GDP by FY2019-20: Fitch Group’s Fitch Solutions (formerly BMI Research) also expects Egypt’s fiscal debt to narrow to 6.4% of GDP by FY2019-20, down from 9.4% in FY2017-18 on the back of “robust economic growth and fiscal reforms,” according to a report out yesterday. A projected increase in tax revenues and inflows from the gas sector, paired with the government’s continued subsidy cuts, will help increase government revenues while cutting down on expenditures, the firm said. Egypt’s public debt-to-GDP ratio is also expected to fall in the next fiscal year, reaching 78.6% of GDP, down from 84.3% of GDP this fiscal year.

The biggest risk to Egypt’s fiscal consolidation is the country’s debt composition and short debt maturity schedule, Fitch Solutions says. “Egypt’s debt maturity schedule is relatively short, heightening rollover risks. Indeed, 50.0% of the debt is set to mature by end-2020 and in an environment of tightening global financing conditions, this could leave the country more exposed to a jump in borrowing costs. Nevertheless, our core view remains for continued fiscal reforms and resultant positive investor sentiment to suppress such costs to some extent, helping to keep debt service broadly manageable for the government.”

INVESTMENT WATCH- Amaar to set up EGP 1 bn shopping centers with Saudi investors: Egyptian real estate developer Amaar Group aims to partner up with unnamed Saudi investors to set up two shopping centers at a combined investment cost of EGP 1 bn in Six October City, Chairman Abeer Essam said. No details were provided on the timeframe of the project.

INVESTMENT WATCH- Startup Wasla lands USD 180k in its pre-seed investment round: Android browser Wasla landed USD 180,000 in a pre-seed investment roundfrom a group of angel investors led by our friend Omar Barakat, Wasla said in a press release (pdf). The funding will be allocated towards the launch of a beta version, growing its user base, and the development of the company’s marketing and technology infrastructure. The goal of the platform is “to provide over 500 mn people in emerging markets with [mobile internet without charge],” Wasla’s co-founders Serag Meneassy, Taymour Sabry, and Mahmoud El Said said. In Egypt, Wasla is targeting 50 mn people between the ages of 13-40, given that 55% of Egyptian households rely on mobile internet. The platform has been in the works for a year and organically gained 2k users in its first 48 hours post-launch.

Elsewedy, Afreximbank ink USD 500 mn loan agreement: Elsewedy Electric signed a USD 500 mn loan agreement with the African Export-Import Bank (Afreximbank) to finance its projects in Africa, Elsewedy marketing director Ahmed Hassouna said, according to Youm7. The funds will go toward the USD 3 bn hydroelectric dam in Tanzania, for which the final contracts will be signed today. Prime Minister Moustafa Madbouly is heading to Tanzania for the project’s signing ceremony, while Tanzanian President John Magufuli announced he will sign the Tanzanian dam project this week. Elsewedy will also direct the funding to an electricity generation equipment factory in Uganda, on which it is set to break ground next year. Elsewedy Electric and partner Arab Contractors will sign the USD 3 bn agreement today, Hassouna added.

The Madbouly government will release details on its 1Q2019 international bond issuances sometime in January, according to remarks attributed to Finance Minister Mohamed Maait by the domestic press. Egypt will target “untapped” European and Asian markets for the issuances, the timing and size of which will be made clearer in January, according to the report.

Background: Egypt has been preparing to issue USD 4-7 bn worth of yen-, yuan-, USD-, and EUR-denominated bonds in 1Q2019, we reported earlier this month. Egypt has also been waiting on global markets to stabilize before moving ahead with its issuances, government source had previously told us. Maait had earlier suggested Egypt could next tap the bond market in February or April.

CORRECTION- Monthly inflation came in at “-0.8%” in November — which means prices declined 0.8% throughout the month. Please excuse our tired fingers (and minds) at the end of a busy news day. The story has since been corrected on our website.

** WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

Up Next

IDC will be hosting a gathering headlined CyberSecurity Strategies in the Banking Sector today at the Four Seasons Nile Plaza. You can register for the event here.

Get briefed on Egypt’s tourism reform program when Tourism Minister Rania Al Mashat speaks at AmCham on 13 December. Members and their guests may register here.

The Autotech auto exhibition starts this Friday, December 14, at the Cairo International Exhibition and Convention Center.

The Macro Picture

Goldman Sachs prefers EMs to DMs in 2019 Outlook: Goldman Sachs is heading into 2019 with a preference for emerging market equities,according to its 2019 Investment Outlook (pdf). Goldman’s outlook recognized that the underperformance of EM assets in 2018 was due to “lower-than-expected growth in EM markets.” GS sees the outlook for EM improving in 2019, noting that emerging markets are in the early phases of a longer-term expansion.

EM equities are “trading at an attractive 25% discount to DM equities while offering potentially higher expected earnings growth.” Emerging economies are in the “early stages of recovery with room to run” — at the same time as US growth will likely remain moderate.

Goldman also likes EM currencies, saying they’re undervalued by as much as 23%.

Goldman sees China as the biggest EM risk factor: China is the “biggest risk to our view in both 2019 and over the medium- to long-term,” singling out “vast credit creation in recent years,” which it says will present risks as “growth transitions to a lower trend level and rotates from investment- to consumption-led.” With trade wars looming, China’s 6.9% growth forecast (already its lowest since the ‘90s) looks iffy. Potential risks are considerable in 2019 and will likely increase by years end.

Geopolitical risk will remain high and likely be key driver of drawdowns in the markets in 2019. With the bar for next year now set a lot lower when it comes to “macro expectations and asset prices” in comparison to 2018, that means “positive surprises” in 2019 could lift asset prices.

Image of the Day

Do Egyptian streets make sense? Apparently there’s a method to the madness. UC Berkeley’s urban planning scholar and geographer Geoff Boeing developed a method to visualize cities’ structures, or “logic,” that plots a city’s streets to explain their orientation and direction. Some cities, like Chicago and Beijing, have perpendicular and parallel grids that make it easy to follow a compass, while cities like Boston and Cairo have more complex and circular (hello, Maadi) grids. A similar interactive tool that works in your browser window was also created by Mapbox software engineer Vladimir Agafonkin.

Egypt in the News

The #MeToo movement is hurting Egyptian women, Egyptian playwright Dalia Basiouny said according to The National. “As soon as a woman makes [an accusation] public, society accuses her,” the Fulbright Arts Grant recipient said at a panel discussion at NYU Abu Dhabi, in reference to the previous arrest of women for speaking out on harassment.

A sense of normalcy returns to those living in North Sinai’s largest city, El-Arish, following years of terrorist attacks on the city, according to the Associated Press. For the past six to seven months, residents of El-Arish have resumed their normal lives with schools in session, a new housing project underway and a factory back to work. The Armed Forces launched an all-out offensive 10 months ago. Military presence is still prevalent in El-Arish to ensure the city remains safe and protected.

Other headlines worth noting this morning:

- The Egyptian Competition Authority (ECA)’s fight with Apple is gaining international attention. Bloomberg has taken note of accusations against the US iPhone maker violated competition laws. AFP, AppleInsider and Venturebeat also have the story. We had chapter and verse earlier this week here and here.

- An Egyptian lawyer was arrested in Alexandria yesterday after posting a picture of himself wearing a yellow vest similar to those worn by French protesters, according to Reuters. Egypt has restricted the sale of yellow vests to avoid copycat protests ahead of the eighth anniversary of the 25 January uprising.

On The Front Pages

Egypt’s commitment to bolstering ties with Africa and investing in the continent continue to lead the conversation in the three main state-owned newspapers this morning. The primary focus is on Prime Minister Moustafa Madbouly saying that Egypt’s total investments in Africa have reached USD 8 bn (Al Ahram | Al Akhbar | Al Gomhuria). Al Gomhuria also makes brief mention of the report the World Bank released on Egypt (which we recap in Speed Round, above).

Worth Reading

Egypt’s iconic homegrown brand of cigarettes, Cleopatra, is being undercut by a state-owned factory in Montenegro manufacturing counterfeits, according to an investigation by BalkanInsight and Arab Reporters for Investment Journalism. (There is some irony in this: Cleopatra was established in 1961 at the request of then-president Gamal Abdel Nasser, who wanted a local version of his preferred American Kents.) Montenegro ignored diplomatic overtures and warnings from Egypt, Britain, and the EU itself, who suspected that the fakes were being smuggled across the Mediterranean to Libya and transported from there to Egypt.

This was no small operation. Officially, the Montenegrin factory was contracted by an offshore company called Liberty to produce 400 mn packs, or about eight bn individual cigarettes, between 2010 and 2016. British customs officials estimated that number at 100 mn cigarettes per month. There is an ongoing EU investigation into the movement of ‘cheap white’ cigarettes through Montenegro. The estimated number of counterfeit cigarettes on the Egyptian market skyrocketed to 20% in 2012 from less than 1% in 2010.

Though Liberty claims they have a trademark registration for Cleopatra, the Eastern Company, which owns Cleopatra brand cigarettes, said it did not license the brand to Liberty. Even if Liberty had a trademark for the Montenegrin factory, it would only be valid in Montenegro. That same factory also produced smaller quantities of Tunisian Mars 20, Algerian Rym and Libyan Riyadi. Registered in the Emirate of Ras Al Kheima, Liberty is owned and operated Greek businessmen with connections deep in the Balkans

Diplomacy + Foreign Trade

KFAED allocates USD 500 mn to finance projects in Egypt over three years: The Kuwait Fund for Arab Economic Development (KFAED) has earmarked USD 500 mn to finance energy, water and sanitation projects in Egypt over the next three years, said KFAED Advisor Mohammad Sadeqi. To date, Egypt has received USD 3.3 bn in loans from KFAED as of November, including USD 1.6 bn that went to the energy sector, Sadeqi said.

Energy

Egypt-Saudi power grid interconnection “partly operational” September 2021

The USD 1.6 bn, 3,000 MW interconnection project linking Egypt and Saudi’s national power grids will be “partly operational” in September 2021, Electricity Minister Mohamed Shaker said yesterday. The project’s inauguration, previously slated for 2020, was delayed after Saudi’s USD 500 bn Neom City mega project derailed plans. The project tenders also seem to be back on track — but the results have yet to be announced, Shaker said.

Shell’s Idku plant steps up LNG exports as winter curbs local consumption

Royal Dutch Shell’s Idku liquefaction plant has increased exports of natural gas to 500 mcf/d, up from 300 mcf/d previously, a source from EGAS said, attributing the move to a further decline in local consumption levels during winter. Just last month, the company increased LNG exports to 300 mcf/d from 250 mcf/d in October. Shell and the Oil Ministry had agreed in 2016 to gradually ramp up production at the Idku LNG plant.

Automotive + Transportation

Brilliance plans to assemble Jinbei H1 Minibuses in Egypt

Brilliance Bavarian Auto is looking into establishing a facility for the assembly of Jinbei H1 minibuses in Egypt, company executive Mahmoud Allam said, according to Al Mal. The company will break ground on the facility mid-2019. No further details were provided on the expected investment value.

Legislation + Policy

House Committee approves draft law regulating fatwas in Egypt

The House Religious Affairs Committee has approved a draft law to regulate fatwas (religious edicts) issued by Dar Al-Ifta, according to Al Masry Al Youm. The committee will refer the bill to Parliament’s general assembly for a final review and vote.

Egypt Politics + Economics

Government to set up specialized committee to oversee loans, grants to Egypt

The Madbouly government will form a specialized committee to monitor loans and grants given to Egypt, Finance Minister Mohamed Maait said, according to Al Mal. The House’s Economic Committee had recommended the move to the government as delays in the disbursals of several loans led to higher interest payments.

National Security

Egypt, Jordan hold joint military drills

Egyptian military forces arrived yesterday in Jordan to participate in the joint military exercises “Aqaba-4,” which will run until 21 December, according to an Armed Forces statement. The drills included land and naval exercises to exchange military expertise between the two sides.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 12,664 (+1.5%)

Turnover: EGP 914 mn (15% above the 90-day average)

EGX 30 year-to-date: -15.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.5%. CIB, the index heaviest constituent ended up 1.8%. EGX30’s top performing constituents were Global Telecom up 8.1%, and SODIC up 3.8%, and Elsewedy Electric up 3.8%. Yesterday’s worst performing stocks were Eastern Co. down 2.2%, Telecom Egypt down 1.3% and Ezz Steel down 0.1%. The market turnover was EGP 914 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +11.3 mn

Regional: Net Short | EGP -63.5 mn

Domestic: Net Long | EGP +52.2 mn

Retail: 46.3% of total trades | 46.0% of buyers | 46.5% of sellers

Institutions: 53.7% of total trades | 54.0% of buyers | 53.5% of sellers

WTI: USD 52.02 (+0.72%)

Brent: USD 60.20 (+0.38%)

Natural Gas (Nymex, futures prices) USD 4.39 MMBtu, (-0.48%, January 2019 contract)

Gold: USD 1,248.30 / troy ounce (+0.09%)

TASI: 7,838.94 (+0.25%) (YTD: +8.48%)

ADX: 4,815.91 (+0.56%) (YTD: +9.49%)

DFM: 2,535.46 (+1.42%) (YTD: -24.77%)

KSE Premier Market: 5,406.6 (+0.09%)

QE: 10,482.14 (-0.70%) (YTD: +22.98%)

MSM: 4,497.64 (-0.13%) (YTD: -11.80%)

BB: 1,317.89 (+0.01%) (YTD: -1.04%)

Calendar

December: The government will announce the second phase of its privatization program before year-end, Public Enterprises Minister Hisham Tawfik said. The committee overseeing the state privatization program is also scheduled to hold a meeting next month to look into how market conditions developed since the privatization program was put on ice.

11-13 December (Tuesday-Thursday): The EFG Hermes Egypt Day Summit. Four Seasons Hotel, Cairo.

11-17 December (Tuesday-Monday): Egypt-Russia business forum.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

12 December (Wednesday): Arab Contractors and Elsewedy Electric will sign the final contracts to build Tanzania’s USD 3 bn, 2.1 GW hydroelectric dam.

13 December (Thursday): Minister of Tourism Rania Al Mashat speaking on “Egypt’s Tourism Reform Program (E-TRP) Revealed,” AmCham, Cairo.

13-15 December (Thursday-Saturday): Forum on “The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheikh, venue TBD.

13-15 December (Thursday-Saturday): Vodafone Developers 010 Innovation Hackathon, Smart Village.

14-16 December (Friday-Sunday): AutoTech 2018, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

14-16 December (Friday-Sunday): NEXUS Arab Future Summit 2018, The Nile Ritz Carlton, Cairo.

15 December (Saturday) The Administrative Court is expected to issue a ruling on an appeal by Beltone Financial against the six-month suspension of its investment banking arm.

17 December (Monday): The Financial Regulatory Authority will hear a grievance appeal by Beltone against a six-month suspension handed to its investment banking arm over “irregularities” the authority says it found in Sarwa’s IPO, according to Al Mal.

18 December: The Planning Ministry will launch its end-of-year report (pdf) at the Sonesta Cairo Hotel.

18-19 December (Tuesday-Wednesday): Federation of Egyptian Chambers of Commerce leaders are scheduled to meet with their Saudi counterparts in Aswan to launch a collaboration project to support SME development in Egypt and Saudi Arabia, head Ahmed El Wakeel said.

19 December (Wednesday): Cairo Economic Court to rule into an appeal by pharma companies

Mid-late December: The bylaws and articles governing Egypt’s upcoming, EGP 200 bn sovereign wealth fund will be completed, Planning Minister Hala El Said said. Cabinet is currently conducting its final review.

Mid-late December: The Electricity Ministry is set to sign an MoU with Cypriot officials to begin constructing the USD 1.5 bn subsea power cable to link Egypt’s electricity grid with Cyprus’, minister Mohamed Shaker said, according to Al Mal.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

Early January 2010: Government to release details about its international bond issuance.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

01 January 2019 (Tuesday): Custom duties on EU-made car imports will fall to 0%, and we still have no automotive directive or any policy incentivizing local car manufacturing.

07 January 2019 (Monday): Coptic Christmas.

10-13 January 2019 (Thursday): International Property Show (IPS), Egypt International Exhibition Center

19 January 2019 (Saturday) Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case

21-22 January 2019 (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December 2019: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.