- Medhat Khalil looks set to make a mandatory bid for 100% of Raya’s shares. (Speed Round)

- Emaar Properties boss Mohamed Alabbar is looking to acquire a hotel in Cairo. (Speed Round)

- When government policy works, part II: The Black Cloud. (Speed Round)

- Burgeoning relationship with Beijing is “win-win” for Cairo. (Speed Round)

- Orientals for Urban Development eyeing 2019 IPO. (Speed Round)

- Date of auction for “unused” state land to be announced in two weeks’ time. (Speed Round)

- Planning to have your kid in Amreeka? The Donald says you’re not getting that pretty blue passport. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 31 October 2018

Why the black cloud over Cairo disappeared

TL;DR

What We’re Tracking Today

Happy Halloween, ladies and gentlemen. We’re celebrating with a game (or two) of Stranger Things Monopoly with the family tonight — and hope you have something similarly enjoyable planned. We love holidays — of all nations, religions and persuasions — but Halloween really appeals to the kid in each of us. Because chocolate.

Power purchase agreement for USD 2.3 bn plant today? The Electricity Ministry is set to sign a power purchase agreement today with Saudi’s ACWA Power, and its partner Hassan Allam Holding, for its USD 2.3 bn power plant in Luxor, Minister Mohamed Shaker said, according to Al Masry Al Youm. Talks on the 2.25 GW plant had previously stalled after it was pushed to the ministry’s 2022-2027 five-year plan from the 2017-2022 plan due to a current production surplus. The facility is expected to go live in four years’ time.

** #7 Planning to have your kid in Amreeka? You may be in a tight spot. US President Donald Trump wants to abolish citizenship by birthright, a process by which nearly anyone born on American soil can claim US citizenship. The Donald made his plan public yesterday in an exclusive interview with Axios in which he said he would “sign an executive order that would remove the right to citizenship for babies of non-citizens and unauthorized immigrants born on US soil.”

Why you may need to worry: The move would call into question a booming bicoastal cottage industry that helps Egyptians of a certain walk of life obtain US citizenship for their kids. MDs on each coast have built thriving “birth tourism” practices bundling together the cost of prenatal care in the final months of pregnancy and the actual delivery together with an apartment, a nanny and other services.

Why you may not (yet) need to freak out: First, there seems to be consensus that the executive order would be forward-looking — if you or your kid were born in the US to parents who were not American citizens, you’re not likely to lose your passport. Second, The Donald is in for a court challenge — the right to citizenship by birthright is enshrined in the fourteenth amendment to the US constitution, which guarantees a pretty blue passport to “all persons born or naturalized in the United States.” The New York Times has more.

Where is oil headed? Down, think the hedgies, who may be “losing confidence” in the “once hot” oil market after crude prices tumbled 13% this month from a four-year high, the Wall Street Journal writes. That comes as oil prices climbed yesterday for the first time in three days, Reuters adds.

But oil may not be sinking on the trade fears that Reuters cites: Saudi Arabia and Russia decided to “set aside” OPEC’s pact to reduce oil output in September and began ramping up their oil production to fill the void left by other countries, according to Bloomberg. “That increase has been offset by a freefall in Venezuela, where an economic crisis has dragged output to record lows. The South American nation’s production was 58 percent of what it was in October 2016, the reference month for supply cuts.” The spike in output from KSA and Russia has balanced out declining supply from other oil exporters.

Caveat lector: All of this speculation is moot until next week, when US sanctions on Iran will take Iranian crude off the (legal) import menu.

In miscellany this morning:

Worrying indicator of the day: Credit card companies in the US are tightening credit limits in “an unusual move in a strong economy that may signal longer-term concerns about consumers’ financial health.” (WSJ)

Is the GCC following Egypt’s lead on Israel a generation later? “Prime Minister Benjamin Netanyahu’s surprise visit to Oman pried open a door to the Persian Gulf usually shut to Israelis, and several of his cabinet members are following him through.” (Bloomberg)

A USD 6.5 bn IPO in … Kazakhstan? “Kazakhstan’s state-run oil and gas company KazMunaiGas is finalizing plans for an initial public offering that could raise as much as USD 6.5 bn, in what could be central Asia’s largest ever stock market listing.” The offering on the London Stock Exchange and a local Kazak bourse will probably take place in late 2019. (Financial Times)

The election of a hard-right leader in Brazil has some asking whether the BRICs still matter as an investment construct. Read Axios’ take or go back and skim theoriginal 16-page Goldman Sachs paper that coined the term (pdf).

The Financial Times is diving deep into impact investing with a package that includes stories on:

- Lack of clarity hinders education impact investing: Despite huge scope globally, where and how to invest funds is often confused

- ‘Profit with purpose’ in Africa and Asia: One investor has proved there is often value in businesses no one else will touch

- Impact investing at family offices: Socially responsible investment can be a way of bringing the generations together

- Is social impact compatible with financial returns? Capital manager Chris West and impact investor Bill McGlashan offer their perspective

- Impact investing faces barriers to scaling up: Challenges in measuring impact and pitching for capital stymie start-ups

There’s plenty more where those came from — tap here for the landing page of the report.

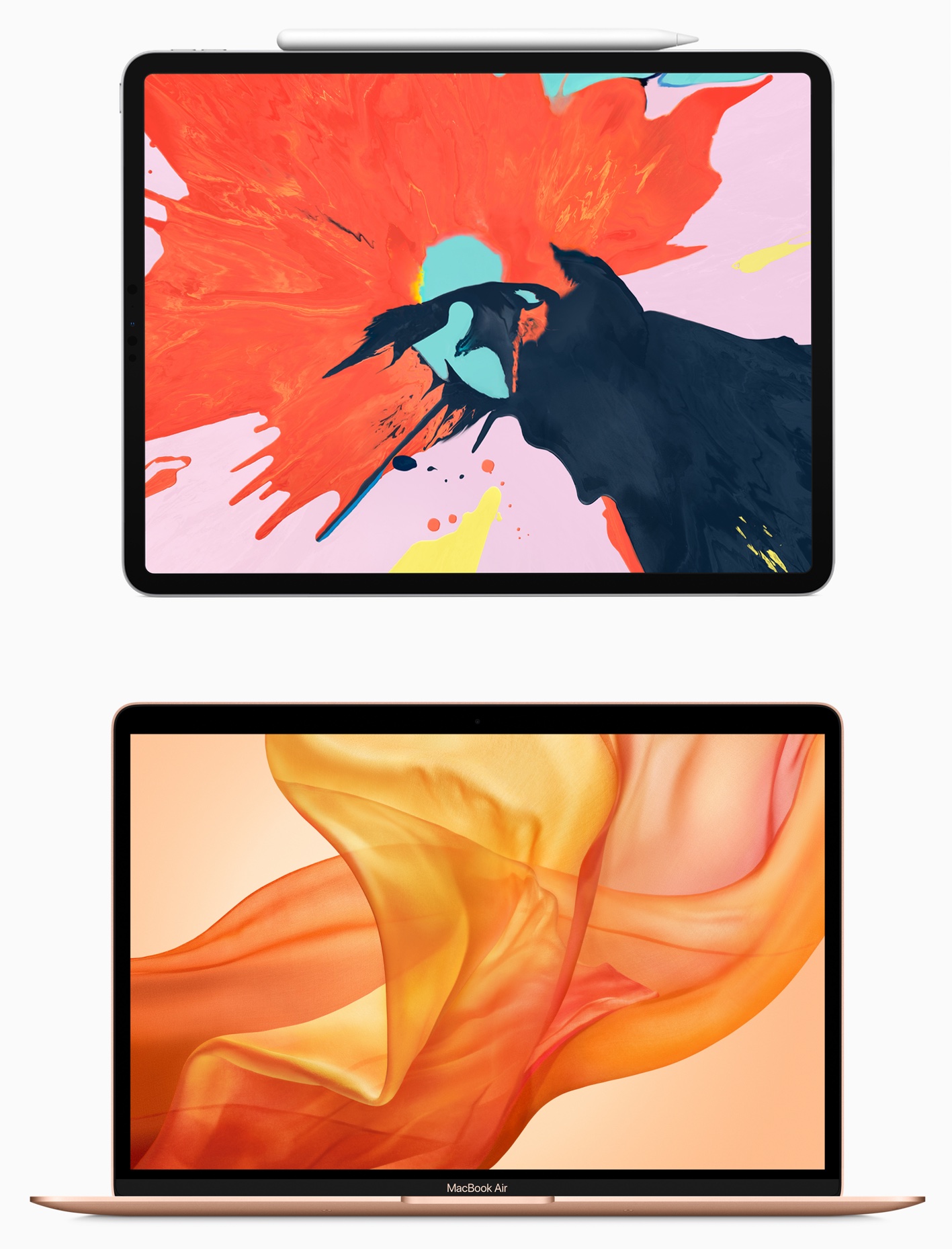

Apple unveiled yesterday a new MacBook Air and a new iPad Pro, so forgive us for feeling that Christmas came early this year. The new MacBook Air could well be the most perfect MacBook yet released: We love the MacBook Pro’s raw power (we’re using it to work on this morning’s issue — the successor to the one that took a coffee bath just before dispatch time a few weeks back), but the Air’s form factor is stunning. The new iPad Pro features FaceTime, a faster processor and — in the larger model — the same size screen in a much smaller package. It also introduced a new Mac Mini but, well, whatever. Fellow iSheep may want to:

- Watchthe keynote presentation (runtime: 1:30)

- Check out Apple’s new iPad Pro page

- Check out Apple’s new MacBook Air page

- Go hands on with the iPad Pro on either the Verge or iMore

- Go hands on with the MacBook Air, also at the Verge or iMore

Enterprise+: Last Night’s Talk Shows

It was another quiet night on the airwaves after what was a fairly slow news day.

The government is considering amendments to a 2010 law that regulates private sector participation in national infrastructure projects, cabinet spokesperson Nader Saad told Al Hayah Al Youm. He explained that the law was due for an update since it was passed and its executive regulations issued before the events of 2011. Saad said that it contains provisions that regulate private financing of public projects. A committee made up of finance and planning ministry officials has been formed to study possible revisions to the act, according to Saad (watch, runtime: 6:35).

University-affiliated hospitals are lagging when it comes to research, the assistant secretary of the Supreme Council of Universities, Hossam Abdel Ghaffar, told Lama Gebril during an appearance on Hona Al Asema. He said that a new law regulating medical and scientific research is expected to help catapult Egypt forward (watch, runtime: 3:43).

Arming the workforce with appropriate training and skills is key to developing local industry, according to Masaa DMC. Host Osama Kamal had a chat yesterday with the head of the Badr Investors Association Bahaa El Adly and the deputy head of the Chemicals and Fertilizers Export Council Hani Cassis (watch, runtime: 6:38).

Meanwhile, Al Hayah Al Youm spoke to Egypt’s wannabe-tomb raider Zahi Hawass about the state of antiquities around the country (watch, runtime: 1:58).

Speed Round

** #1 M&A WATCH- Medhat Khalil & Co to submit mandatory offer for 100% of Raya? Conflicting media reports emerged yesterday over reports that Raya founder Medhat Khalil is leading a group that will submit a mandatory tender offer (MTO) to acquire 100% of Raya Holding for Financial Investments by 27 November. Khalil, the company’s chairman, was quoted in the local press (here and here) as saying he would submit an MTO next month to acquire 100% of Raya at EGP 10 per share. The reports claim that Khalil is making the bid after the Financial Regulatory Authority (FRA) ordered that he do so or reduce his holdings, having found that Khalil and related parties control a combined 42% stake in the company. Under securities regulations, going over the 33% ownership mark triggers the MTO requirement.

The MTO wasn’t ordered by the regulator? Khalil denied in a statement to the EGX (pdf) that his company had received any such notice from FRA — and said that he and his immediate family own less than one third of Raya’s shares.

Unwinding Raya trades: The news prompted the EGX yesterday to reverse all transactions on Raya’s shares from Monday and Tuesday, the local press claims, meaning the stock is expected to open today’s session at EGP 6.49 per share.

Khalil is buying at a premium if he goes ahead with the MTO by month’s end. EGP 10 is nearly 45% above the company’s share price prior to the announcement. Shuaa Securities Egypt said in a research note yesterday that “not only is it relatively [inexpensive], but it is also trading at below book value.”

What is Raya, anyway? It’s not the same beast that once sold you your beloved Nokia and that bet the house on becoming the nation’s third mobile network operator, losing to Etisalat, well over a decade ago. Today, Raya is an investment company with a private-equity-like mindset. That attitude saw it spin off Raya Contact Centers (Egypt’s largest provider of outsourcing services) last year in an IPO. In addition to Raya Contact Center (where it is still majority shareholder), Raya’s investments today include:

- BariQ, an exporter of recycled PET;

- E-payments outfit Aman;

- Plenty of food investments, including Ovio (one of our favorite restaurants in our fair town) and frozen food producers, a pasta business (in Poland, of all places);

- A partnership to build a washing machine plant with Samsung;

- And other ventures ranging from data centers to a tuktuk partnership with Piaggio and venture into Uganda.

M&A WATCH- NBE to acquire another 2% of Arab Contractors subsidiary? Arab Contractors reportedly sold another 2% of its shares in Mostakbal Urban Developments to state-owned National Bank of Egypt (NBE) in an EGP 1.2 bn transaction yesterday, unnamed sources tell Al Mal.

Advisers: HC Securities acted as the sell-side advisor to Arab Contractors while Beltone Securities was buy-side legal counsel.

** #2 INVESTMENT WATCH- Emaar Properties boss Mohamed Alabbar is looking to acquire a hotel in Cairo amid plans to grow his company’s investments in Egypt, Al Mal reports, citing unnamed sources. No details on the size of the potential investment or the name of the hotel were provided. The iconic UAE business leader reportedly expressed interest in the potential transaction to Tourism Minister Rania Al Mashat, according to the sources. Alabbar said in July he would invest EGP 6 bn to develop six hotels by 2021 at Marassi, his company’s North Coast resort. He had also said he aims to double Emaar’s Egypt investments to EGP 100 bn over the next five years.

** #3 When government policy works, part II: The Black Cloud. For as long as many of us at Enterprise have been alive, Cairenes have choked each fall on the acrid “black smoke” that blankets our fair city. The cause? The burning of straw by rice farmers. But this autumn has been particularly smoke-free, and you can thank a government program that gave traders an EGP 50 per-ton incentive to buy the straw from farmers, Reuters reports, citing remarks by Mohamed Salah, head of the Egyptian Environmental Affairs Agency. The straw is then sold as animal feed, the newswire reports, though we have primarily seen it used in waste-to-energy programs.

This is the second time this week we’ve found evidence that smart policy can make a difference. The government’s white cab program, which pulled ancient taxis off the roadways by providing subsidized finance for new vehicles, slashed Egypt’s carbon dioxide emissions by 310k tonnes in 2013-2017, according to a World Bank report we noted on Monday.

** #4 Burgeoning relationship with Beijing is “win-win” for Cairo: Egypt’s ties with China have been taking strides since 2014, when the two countries signed a strategic agreement to boost trade, investment, and political ties as President Abdel Fattah El Sisi began looking to diversify Egypt’s allies, Heba Saleh writes for the Financial Times. Since then, Chinese tourists and investment have been flowing into Egypt, making both countries happy as Beijing pushes its Belt and Road initiative and Cairo attracts investment for major infrastructure projects. “There are economic powers who have the ability to help us but not the desire, and others who have the desire but not the ability,” said Mostafa Ibrahim, deputy head of the China committee in the Egyptian Businessmen’s Association. “China tops the list of those who have both the ability and the desire.” China also serves as the perfect kind of friend for Egypt in that — unlike the US and Europe — it remains unconcerned with rights issues and maintains a “policy of non-interference in other countries’ affairs,” Saleh notes.

Also in the China file this morning: Chinese electric car manufacturers see Egypt as a market with potential, according to China Daily. The drive to for EVs is being led by Darshal, the local agent of China’s Dongfeng and Vasworld Power. The Egyptian market “has a great potential with its high purchasing power and unique location as a gateway to Africa and the Arab countries,” said Vasworld Power CEO Wang Li. “Wang said now is the right time to enter the Egyptian market and prepare to reap benefits of the Belt and Road Initiative and the close ties between Egypt and China.”

Saleh’s piece anchors a package from the FT headlined New Trade Routes: Arab World. Other entries include:

- Turkish Abraaj bosses to team up with western manager: Canada’s Brookfield expected to buy unit amid investor nervousness on emerging markets

- Djibouti row with DP World embodies power struggle: Ethiopia’s reforming new leader shakes up regional dynamics

- Rosneft’s KRG oil and gas play angers Baghdad: Kremlin-controlled oil major ignores political obstacles to throw KRG $3.5bn lifeline

- Moscow and Riyadh tie up much of the global oil market: Oil partnership opens way to arms deals and expanded Mideast role for Putin

- Syria-Jordan border opening boosts trade: Lebanese traders hope to reconnect with markets in the Gulf as land routes open up

Also on the foreign policy front: Turkey is setting up a confrontation in the Eastern Med over natural gas exploration rights. Ankara, having already its regional rivals against further exploration in Cypriot waters, has deployed its “first deep-sea drilling ship, flanked by Turkish war vessels” to explore for “natural gas and oil in contested waters of the Mediterranean.” The move is likely to “exacerbate longstanding tensions with Greece,” Bloomberg reports.

Background: Turkey sent naval forces earlier this year into Cypriot waters to try to block the deployment of an Eni exploration rig. The move came just months before Egypt and Cyprus — anchors of a regional triad with Greece that is cooperating on economic and security policies — signed an agreement that paves the way for the export of Cypriot natural gas to Egypt, which is emerging as the premier energy hub in the Eastern Med.

Egypt and Germany signed a four-year economic cooperation protocol yesterday worth EUR 129 mn, according to an Investment Ministry statement. Of the total, EUR 45 mn will be allocated to economic development initiatives, while EUR 43 mn will be spent on energy projects, and EUR 39 mn on water-related projects, and another EUR 2 mn on youth-targeted projects. The two sides also signed MoUs that cover vocational training and scientific research, as well as an agreement to establish a German university for applied sciences at the new administrative capital.

Siemens AG CEO Joe Kaeser had plenty of nice things to say about Egypt and efforts to revitalize the economy and improve infrastructure, Egypt Today reports. Kaeser’s comments came in his speech yesterday addressing the G20 Africa Investment Summit in Berlin, where President Abdel Fattah El Sisi was in attendance, alongside 11 other African leaders and heads of major international organizations.

This came as German Chancellor Angela Merkel pledged yesterday to establish a new African-focused development fund that would “tackle unemployment in Africa,” which she sees as a main reason behind illegal migration to Europe, Reuters says. Illegal migration was among the issues that came up during El Sisi’s talks with Merkel yesterday, which focused mainly on bilateral cooperation across the board, as well as regional issues, Ittihadiya said in a statement. (For background on Africa’s unemployment problem, see yesterday’s Worth Reading.)

El Sisi’s visit to Germany had the talking heads buzzing, with coverage yesterday on Yadhoth fi Masr (watch, runtime: 2:37), Hona Al Asema (watch, runtime: 9:27), Masaa DMC (watch here, runtime: 6:16, here, runtime: 7:52, and here, runtime: 1:01:18), and Al Hayah Al Youm (watch here, runtime: 11:12 and here, runtime: 7:44).

Stretching for relevance, any kind of relevance: How the Khashoggi case could spell trouble for Egypt’s economy. The spillover effect from the killing of Saudi journalist Jamal Khashoggi serves as a “potential economic risk” for Egypt, Rob Cox writes for Reuters’ BreakingViews. Egypt is heavily dependent on remittances from its expats working in the kingdom, and Saudi visitors comprised a significant chunk of Egypt’s tourist arrivals. “Any fallout, such as U.S. sanctions, from the killing of the Saudi journalists by agents of the Riyadh government could dent Egypt’s recovery. Following a currency devaluation in 2016 and austerity measures, a steady flow of USD from Saudi is critical to buttressing reserves as the Egyptian central bank struggles to reduce inflation and interest rates.” If investors are scared out of KSA as a result of Khashoggi’s death, the ripple effect would be certain to hit Egypt as well, Cox says.

Please don’t get us started. It’s Halloween. All we want is chocolate. Lots and lots of chocolate.

The Khashoggi case is receding from the headlines, with most notable coverage in recent days including a New York Times op-ed by Obama administration national security advisor Susan Rice calling MbS “a partner we can’t depend on” and the Wall Street Journal suggesting that MbS’ position as crown prince is “appears secure” as “Saudi Arabia’s royal family is closing ranks to protect the monarchy from a storm of criticism.” Meanwhile, former NYT Cairo reporter Kareem Fahim is part of a Washington Post team with a long, solid take in the form of Crown prince Mohammed bin Salman is ‘chief of the tribe’ in a cowed House of Saud.

** #5 IPO WATCH- Orientals for Urban Development eyeing 2019 IPO: Oriental Weavers sister company Orientals for Urban Development (OUD) is looking at a potential IPO in 2H2019, Chairman Asser Hamdy said. According to Hamdy, the company is studying hiring an adviser for the transaction, and expects to make a choice in 2019. The company is also planning to invest EGP 3 bn next year in its residential and commercial projects and hotels, including the inauguration of two new hotels in the North Coast and Marsa Alam, as well as construction works on a mall in East Cairo and two residential compounds — Janoub in the new capital and Heliopolis Hills in Obour City.

EARNINGS WATCH- Edita Food Industries recorded a net profit of EGP 89.4 mn in 3Q2018, up 34.1% y-o-y, up from EGP 66.7 mn, according to the company’s earnings release (pdf). Net revenue for the quarter was up 22.2% to EGP 1.02 bn, driven by “higher volumes and improvements in product mix,” as well as export sales. “Our third quarter results clearly reflect Edita’s ability to capture market growth and capitalize on new fundamentals and consumer dynamics. Our volumes continued to grow compared to both the previous year and last quarter, while our profitability is witnessing marked improvement as we control costs and benefit from economies of scale,” Edita Chairman Hani Berzi said. The quarter also saw the leading snack producer maintaining its market position in its core segments, holding a nearly 54% share of the cake market and growing its share of the croissant market to 64.5%. Edita’s primary focus for the coming year will be driving volumes and sales upwards while defending its market share, as well as expanding its footprint in the region.

REGULATION WATCH- FRA signs off on same-day trading for category B of securities eligible for ‘special activities’: The Financial Regulatory Authority (FRA) signed off yesterday on a proposal from the EGX that allows same-day trading on stocks that are on its category ‘B’ list of securities eligible for “specialized activities.” The policy will allow brokerage firms freedom to decide which securities from the list to make eligible for T+0 trades, according to an FRA statement.

Background: The move is the latest in string of policy amendments that aim to boost stock market liquidity by introducing new trading tools and mechanisms. Earlier this month, the FRA was said to be scraping a rule requires listed companies to seek approval from the FRA and the EGX for stock splits. The authority had also had also decided to slash annual service fees for listed companies, introducing a new tiered system that sets fees based on capital.

LEGISLATION WATCH- Foreign embassies to be subject to reciprocal tax treatment on real estate tax: When it comes to paying real estate taxes, foreign embassies in Egypt will get reciprocal treatment, meaning they’ll pay (or not pay) the same taxes as Egyptian embassies do in each of those countries, Real Estate Tax Authority head Samia Hussein said yesterday, Al Mal reports. The House of Representatives’ economics and housing committee are expected to meet this month to discuss the government’s proposed amendments to the Real Estate Tax Act, which are expected to cover everything from new real estate tax formula to how rented properties would be taxed, how properties would be appraised, and avenues for appeals. Reps. said they expect to complete their review by the end of 2018.

MOVES- Mustafa Mousa (not to be confused with the former presidential candidate) has been made partner at Bahaa-Eldin Law Office in cooperation with BonelliErede, Al Mal reports. Mousa previously served as chairman of Assiut Islamic National Trade and Development.

Up Next

** #6 The government will announce in two weeks’ time the date of the first auction it will hold for the sale of unused state land, Public Enterprise Minister Hisham Tawfik said yesterday, according to a ministry press release (pdf). The move — which comes as part of state efforts to draw in funds necessary to reform public sector companies — will see the government sell over 10 mn sqm of state-owned land in 10 governorates in a public auction to real estate developers who are willing to put them to use, the minister said. Priority will be awarded to developers who can make cash payments or complete their installments within six years at most.

The draft SMEs Act is expected to be made public within a week. The draft law sets out incentives — mainly in the form of services and subsidized access to finance — for owners of micro-, small- and medium-sized enterprises to go legit and pay taxes.

The first annual Middle East Conference on Business Angel Investment will take place on Thursday, 1 November in El Gouna, according to a statement from the Middle East Angel Investment Network (MAIN). The conference will bring together angel investors, venture capitalists and others to discuss the latest trends in fintech, clean tech, health technology and transportation technology.

Egypt’s World Youth Forum 2018takes place in Sharm El Sheikh on Saturday, 3 November.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning is economist Abdel-Khalek Farouk’s release on bail, after he was detained and accused of spreading fake news ahead of the publication of his new book. The AP has the story. Farouk’s arrest means Egypt’s crackdown on dissent has expanded to include dissenting economists, Zvi Bar’el writes for Haaretz.

News that the Interior Ministry intervened to stop a potato shortage from turning into a crisis is also making the rounds.

Other headlines worth a look:

- Egypt’s prosecutor general referred 43 people to military trial on Monday for their involvement in the deadly attack that killed 16 policemen in Wahat last year, Ahram Online reports.

- Victims of organ trafficking are forced to sign papers claiming they’re donors, France 24 reports.

Diplomacy + Foreign Trade

Amira Oron was appointed as Israel’s new ambassador to Egypt, Israel’s Foreign Ministry said yesterday, according to Xinhua. Oron — Israel’s first woman ambassador to Egypt since the countries’ establishment of diplomatic relations — succeeds David Govrin, and had previously been a staff member at the embassy. She had also served as chargé d’affaires of the Israeli embassy in Istanbul between 2015-2016.

Energy

Oil Ministry expects Egypt’s crude oil production at 670-680k in FY2018-19

The Oil Ministryexpects Egypt’s production of crude oil to record 670-680k bbl/d in FY2018-2019, up from 660k bbl/d in FY2017-2018, a ministry official tells Youm7. The ministry expects local production to ramp up as a number of fields go online within the next few months. The ministry had previously said it is aiming to have 88% of daily demand covered by local production by 2021.

GES to build 263 MW wind farm in Egypt

Spain’s Global Energy Services (GES) will complete a 263 MW wind farm near Ras Ghareb by the end of 1Q2019, according to a company press release. The farm will be executed over three phases and work and is set to become “the first wind farm executed under a Build-Own-Operate scheme.” Energy will be sold under a Power Purchase Agreement with the Egyptian Electricity Transmission Company. GES will be supplying the equipment for the project, whose investment value was not disclosed.

Basic Materials + Commodities

Egypt fruit exports dipped last season as a result of bans

Egypt exported 4.1 mn tonnes of fruits last season for a total USD 2.18 mn, which is 5% more in terms of volume and 1% less in terms of value, Agricultural Export Council head Abdel Hamed El Demerdash said, Youm7 reports. He attributed the drop to some exporters’ failure to abide by rules on pesticide usage, which had led some Arab countries to ban imports of various Egyptian crops, including peppers, guavas, and strawberries. The bans have since been reversed after Egypt implemented strict quality control measures, which should be in full swing for the upcoming export season.

Health + Education

Al Safa Hospital to acquire Al Fayrouz Hospital assets for EGP 136.5 mn

Al Safa Hospital has won a court-ordered liquidation auction for Al Fayrouz Hospital’s assets, for which Al Safa will pay EGP 136.5 mn. The National Bank of Egypt, the Egyptian Arab Land Bank, and the Arab Banking Corporation had auctioned off Al Fayrouz’s assets for failing to meet interest payments, sources from the banks said.

Samsung delivers 250k educational tablets for new academic year

The Education Ministry has received a first batch of 250k tablets from Samsung Egypt, which are set to be handed out to public school students enrolled under the first phase of the ministry’s K-12 educational reform program. Samsung is expected to deliver another 708k tables, an unnamed company exec tells Youm7. Egypt had contracted Samsung in September to supply 1 mn educational tables for USD 240 mn.

Tourism

Cairo was the world’s fastest-growing tourism destination in 2017

Cairo was the world’s fastest-growing tourist destination in 2017, witnessing a 34.4% y-o-y growth in tourism and travel GDP, according to the World Travel and Tourism Council’s annual report (pdf). China’s Macu came in second place (14.2%), followed by Istanbul (13.1%), and Dublin (11.5%). The report attributes the growth to “improved political stability.”

Automotive + Transportation

Uber cuts off local recruitment agents

Uber has decided to cut off its local recruitment agents and instead have new drivers register directly through the ride-hailing app, sources close to the company tell Al Mal. The motives behind the decision remain unclear, but the sources noted that Uber previously provided its agents with a EGP 500 per head hiring bonus for each driver they brought in after completing 40 rides. An unnamed agent tells the newspaper that he intends to file a lawsuit against Uber for the “abrupt” move, and will be seeking monetary compensation.

Banking + Finance

MIDOR signs USD 1.2 bn loan agreement with three EU banks

State-owned company Middle East Oil Refinery (MIDOR) was meant to have signed yesterday the final contracts for a 10-year USD 1.2 bn syndicated loan from Crédit Agricole, BNP Paribas, and Italy’s CDP, sources said. The loan, which should carry an interest rate of 6%, will be used to finance USD 2.2 bn-worth of expansions at MIDOR’s refinery. The company expects to obtain a loan warranty from the Finance Ministry within a week and reach financial close before end-2018. MIDOR had reached a preliminary agreement for the loan amount back in 2016. Shearman & Sterling and Shalakany acted as legal advisers to the banking consortium, while Zaki Hashem & Partners and Descartes Solicitors advised the Egyptian General Petroleum Corporation (EGPC) and the First Abu Dhabi Bank was financial adviser.

Legislation + Policy

Gov’t looking to legislate insurance on state buildings

The government is studying drafting a law that would insure state buildings, Finance Minister Mohamed Maait said, without providing further details on what the legislation would entail. The bill would come as part of several initiatives the government, Financial Regulatory Authority (FRA), and the Insurance Federation of Egypt are looking to introduce to stimulate the country’s insurance sector, according to Maait. The three are also eyeing opening the door for healthcare and insurance companies to contribute to the implementation of the Universal Healthcare scheme. The minister did not offer further details. The Insurance Act, which is currently under review by the FRA board, is expected to introduce compulsory insurance for SMEs and public gatherings and venues, including malls and concerts.

Jumia execs to discuss e-commerce tax with ICT Ministry officials this week

Executives from online retailer Jumia are meeting with ICT Ministry officials this week to discuss the government’s new framework for taxing e-commerce platforms, CEO Hesham Safwat said, according to local news reports. The company will ask that the law — which is expected to be introduced to the House of Representatives during the current legislative session — differentiate between the different types of platforms and transactions they perform. The Finance Ministry had announced earlier this year that it was planning to introduce a framework for taxing e-commerce platforms, which would be introduced as part of amendments to the Income Tax Act. Sources had told us this month that the ministry has also notified online retailers that they should begin charging value-added tax on all their transactions.

On Your Way Out

Luxor’s alabaster industry has suffered as the result of the drop in tourist numbers in recent years, according to Al Monitor. Smaller workshops in Luxor are now being threatened with closure as they fail to make ends meet with barely any visitors around to sell their handcrafted souvenirs to (watch, runtime: 2:10)

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 13,155 (+0.6%)

Turnover: EGP 741 mn (6% above the 90-day average)

EGX 30 year-to-date: -12.4%

THE MARKET ON TUESDAY: The EGX30 index ended Tuesday’s session up 0.6%. CIB, the index heaviest constituent ended up 0.4%. EGX30’s top performing constituents were Egyptians Resorts up 4.4%, and Qalaa Holding up 3.2%, and Egyptian Iron and Steel up 2.9%. Yesterday’s worst performing stocks were Ezz steel down 2.3%, Juhayna down 1.5% and TMG Holding down 0.8%. The market turnover was EGP 741 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +42.0 mn

Regional: Net Short | EGP -19.1 mn

Domestic: Net Short | EGP -22.9 mn

Retail: 70.8% of total trades | 69.4% of buyers | 72.2% of sellers

Institutions: 29.2% of total trades | 30.6% of buyers | 27.8% of sellers

Foreign: 13.4% of total | 16.2% of buyers | 10.6% of sellers

Regional: 14.3% of total | 13.1% of buyers | 15.6% of sellers

Domestic: 72.3% of total | 70.7% of buyers | 73.8% of sellers

WTI: USD 66.43 (+0.38%)

Brent: USD 76.25 (+0.45%)

Natural Gas (Nymex, futures prices) USD 3.22 MMBtu, (+0.91%, December 2018 contract)

Gold: USD 1,223.50/ troy ounce (-0.15%)

TASI: 7,832.98 (-0.19%) (YTD: +8.40%)

ADX: 4,855.94 (-0.32%) (YTD: +10.40%)

DFM: 2,743.54 (+1.06%) (YTD: -18.59%)

KSE Premier Market: 5,224.69 (+0.15%)

QE: 10,163.41 (-0.28%) (YTD: +19.24%)

MSM: 4,420.67(-0.18%) (YTD: -13.31%)

BB: 1,312.90 (-0.16%) (YTD: -1.41%)

Calendar

November: A delegation of French pharmaceutical and medical equipment companies is set to visit Egypt sometime in November to explore potential investments, according to a Trade Ministry statement.

01-02 November (Thursday-Friday): Annual Middle East Conference on Business Angel Investment, El Gouna, Egypt.

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.15 November (Thursday) The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

17-19 November (Saturday-Monday) ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “the Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.