- Friendlier oil and gas terms and contracts coming by early 2019. (Speed Round)

- Egypt ranks 94 out of 140 on WEF’s Global Competitiveness Index. (Speed Round)

- First sovereign sukuk issuance coming next fiscal year, Maait confirms. (Speed Round)

- Sutherland plans to double its Egypt outsourcing business. (Speed Round)

- SWF search committee to have shortlist soon. (What We’re Tracking Today)

- El Sisi, Putin sign cooperation agreement, but nothing on Red Sea flights. (Speed Round)

- Papermaker Fine looks to move Middle East factories to Egypt. (Speed Round)

- FEI aiming to convince FinMin not to raise taxes on entertainment venues? (Speed Round)

- The Market Yesterday

Thursday, 18 October 2018

Friendlier oil and gas contracts are coming in 1Q2019

TL;DR

What We’re Tracking Today

It’s a slow news morning in Egypt and global markets alike. The biggest news here at home as we slide into the weekend is the prospect of better terms on oil and gas contracts. Globally, the conversation is dominated by the Khashoggi affair and Canada becoming yesterday the second country in the world to legalize pot.

** #5 A search committee is vetting potential CEOs to lead Egypt’s first sovereign wealth fund and will soon have a short list, a source close to the search tells us. “The position needs careful consideration to guarantee that the CEO builds and leads a strong independent institution” that helps Egypt make the best of its assets and resources, the source said. Meanwhile, the executive regulations for the law governing the SWF are being finalized and should be ready for cabinet review by the beginning of November, we’re told.

A ray of sunshine for EM as earnings season in American unfolds: A better-than-expected earnings season in the US drove global equity markets yesterday, Reuters reports. Asian and European shares each recorded gains throughout the day, with easing Saudi-US tensions and the improvement of Turkey’s currency situation improving sentiment. “The more cheerful mood also favored emerging-market currencies and took steam out of the safe-haven yen. The latest investor survey by BofA Merrill Lynch found fund managers now considered emerging-market currencies the most undervalued ever against the USD.”

The Khashoggi Affair: Turkey isn’t easing off the gas as it keeps pressure on Saudi Arabia — and mends fences with United States. Turkish intelligence officials leaked highlights of what they claim are audio recordings of dissident Saudi’s journalist Jamal Khashoggi’s final moments. The recordings reportedly reveal that Khashoggi “was dead within minutes, beheaded, dismembered, his fingers severed,” an unnamed Turkish official tells the New York Times. “Within two hours the killers were gone.” US Secretary of State Mike Pompeo is in KSA to help contain the affair, and rumors had surfaced earlier this week, suggesting Saudi was about to admit Khashoggi was killed during an interrogation gone wrong. President Donald Trump said the US has asked for a copy of the recording “if it exists,” according to the FT. As we noted yesterday, an investigation led by former NYT Cairo bureau chief David Kirkpatrick found that nine of the 15 suspects implicated by Turkey “worked for the Saudi government, military or security services.”

IMF boss Christine Lagarde is the latest to pull out of a Saudi’s “Davos in the Desert,” the Financial Times reports. The Wall Street Journal says Saudi Arabia is now “relying on its regional allies to salvage” the conference. Axios has an epic list of the business leaders who have pulled out.

Canada became only the second country in the world to legalize pot yesterday, where happy would-be tokers found long lines and supply chain kinks — and shares in cannabis producers closed down as analysts said the likely upside of legalization had already been priced in. Heck, a former Canadian prime minister even joined the board of directors of a US weed grower, the Financial Times reports. Read more in the Globe & Mail or the Wall Street Journal.

The best business advice we’ve read in ages is encoded in a piece on artificial intelligence. It boils down to this:

- Can the CEO understand in five minutes or less how we add value? “If there is not an exceptionally clear business case for the pitch, then it is almost certainly not worth pursuing.”

- There’s a certain type of project so important that the CEO has to be driving. Anything less is a recipe for failure, and the art is in picking the right projects.

The piece is also spot-on if you have an interest in AI and “big” data, whether you’re a CEO, an entrepreneur or an investor. Read Artificial intelligence: Winter is coming in the Financial Times.

Your weekend must-read: Could an ex-convict become an attorney? I intended to find out.A moving, visceral, thought-provoking and well-written piece by a Yale law grad. What more do you want in a Friday-morning read?

Enterprise+: Last Night’s Talk Shows

The airwaves had little of value to offer last night after what was a relatively quiet news day.

Egyptian expats can update their bourse data using passports now: The Financial Regulatory Authority (FRA) approved a decision yesterday that will allow Egyptian expats to update their information on the EGX’s database using their passports, as opposed to before when they had to use their national ID cards (watch, runtime: 6:12).

Train fares will not rise any time soon — at least not until service improves, Railway Authority head Ashraf Raslan told Yadhuth fi Masr’s Sherif Amer. Raslan was in the studio to discuss ongoing upgrades in the sector (watch here, runtime: 1:25, here, runtime: 2:12, and here, runtime: 2:13).

The committee tasked with recovering state-owned land will be reviewing ownership status requests over the coming few months, committee spokesperson Ahmed Ayoub told Al Hayah Al Youm. The committee which expects to complete its work by year’s end (watch, runtime: 7:02).

Hona Al Asema was off last night. And Lamees is still MIA.

Speed Round

** #1 Friendlier terms on oil and gas production-sharing agreements to take effect in 1Q2019: The Oil Ministry is reportedly planning to roll out new production sharing contracts with friendlier terms for international oil companies in the first quarter of 2019, after it concludes its next tender for Red Sea exploration blocks at the end of this year, unnamed ministry sources tell Bloomberg. The new framework would see companies “bear the cost of exploration and production in return for a share of the output,” which will vary from one concession to the other, based on the cost of investment, according to the sources. It would also allow companies to sell their share of production to any entity of their choosing, as opposed to the current system, which gives them only one-third of output and allows the government to “buy the producer’s entire share at predetermined prices.” Existing contracts will not be affected by the new system, the sources added, noting it would only be applicable to “undeveloped frontier areas.”

Background: We had noted last month that the Oil Ministry was mulling the roll-out of a friendlier system to attract more oil and gas producers to Egypt, which is looking to become a regional hub for energy. Sources had then said that the framework — which was drafted with input from some oil and gas majors — would give producers larger portions of output in a bid to cut the time it takes for them to hit profitability on any one concession, as well as raise the cost-recovery ceiling on contracts to 40% up from 35%. Changes would also eliminate a clause in the model contract that requires companies to cede additional points in their concessions to the government every two years.

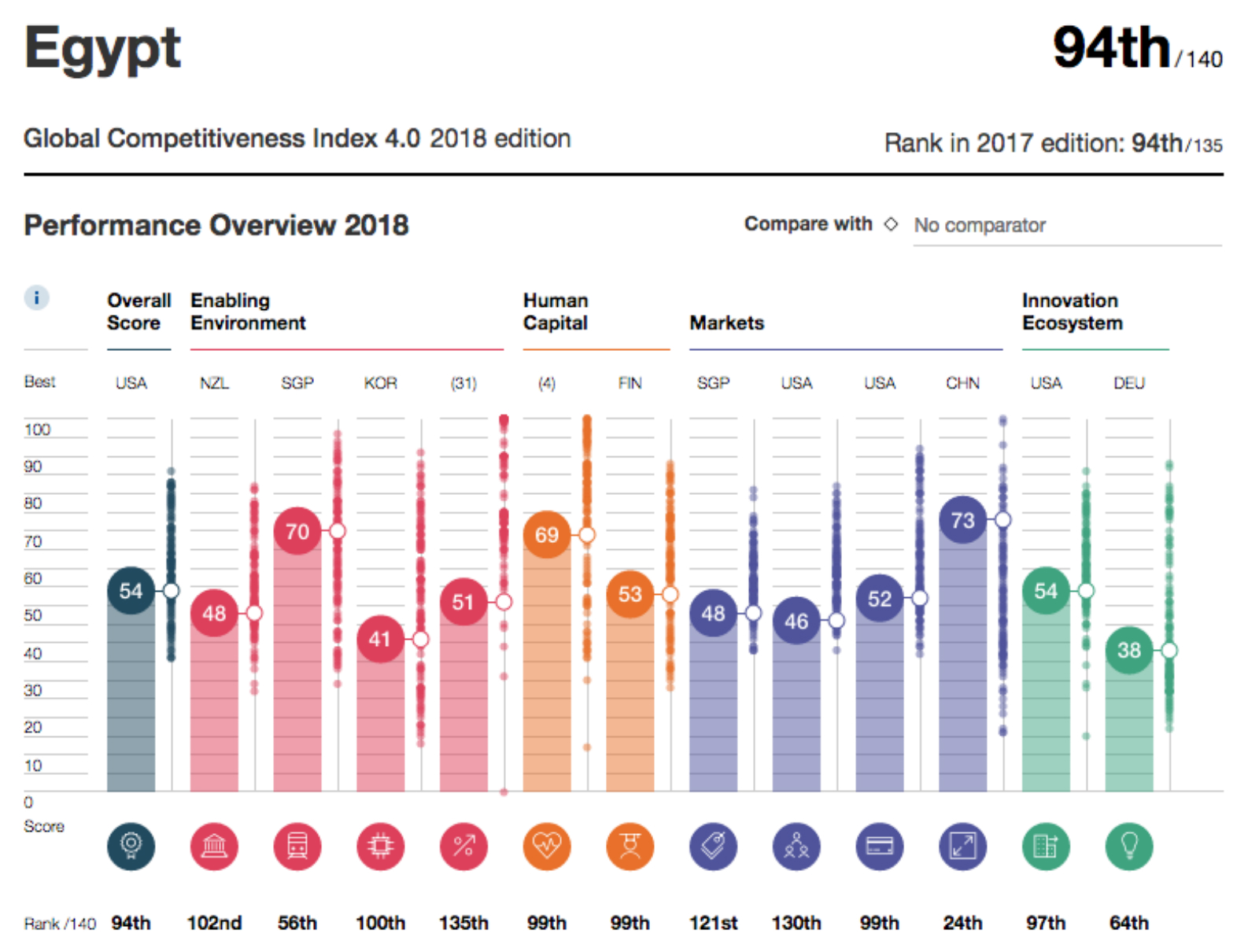

** #2 Egypt ranked 94th out of 140 countries on the World Economic Forum’s Global Competitiveness Index.

Where we’ve improved: Egypt’s innovation capability improved slightly from last year’s reading, as did the efficiency of the country’s legal framework in settling disputes, while the cost of starting a business has declined. Although we continue to lag behind the remainder of the MENA region on ICT adoption, Egypt’s score on that indicator improved from last year. Egypt also has a significantly larger market size than the regional average.

Where we haven’t: Egypt fared worst in terms of macroeconomic stability — which trended downwards largely due to inflation — the skill level of its labor market, female participation in the workforce, and the general attitude toward entrepreneurial risk. The report also points to corruption and the burden of government regulation as factors bogging down business in Egypt and two areas where we are apparently faring worse than last year.

Want more? You can look through the entire GCI here or download the Egypt-specific indicators (pdf).

** #3 First sovereign sukuk issuance coming next fiscal year, Maait confirms: Egypt’s first sovereign issue of Sharia-compliant sukuks in FY2019-2020, Finance Minister Mohamed Maait confirmed to Reuters. The minister did not disclose the expected size of the issuance. A senior government official had told us earlier this week that the Finance Ministry is looking at regulatory amendments that would pave the way for the issuance of a sovereign sukuk offering as early as 2019.

Background: Maait had told us in September that the government was unlikely to issue sukuks this fiscal year as there remains no legislative framework in place allowing it. Recent legislative and regulatory changes allowed sukuk for corporates, but did not explicitly authorize sovereign issues. Plans to issue sukuk have been shelved since 2013, but the ministry believes the bonds — which could be issued in USD or EUR, if the new regulatory amendments come into effect — could be an integral part of its long-term debt-management strategy.

IPO WATCH- Giza Spinning to kick off IPO roadshow “soon” ahead of December offering: Privately-owned Giza Spinning and Weaving is finalizing the plans for an international roadshow for its IPO, which is slated for December, sources with knowledge of the matter tell Al Mal. The roadshow will take the company to Saudi Arabia, the UAE, London, South Africa, and the US. BDO is conducting the fair value report, which should be ready by the end of November. The company had announced in August its plans to list a 40% stake on the EGX, the proceeds of which will be used to finance a EGP 250 mn project to expand its yarn and garment production capacities.

Advisers: Beltone Financial is serving as global coordinator and bookrunner and Matouk Bassiouny is legal counsel to the issuer.

** #4 INVESTMENT WATCH- ْOutsourcing service provider Sutherland Global Services is planning to double its business in Egypt, according to an Information Technology Industry Development Agency press release (pdf). The expansion came as Sutherland signed an agreement with ITIDA that will see it open a new call center in Cairo and hiring 750 full-time employees at its Alexandria center. The statement did not include the value of the investment.

** #6 INVESTMENT WATCH- Fine Hygienic Holding looks to move Middle East factories to Egypt: Fine Hygienic Holding is considering closing some of its Middle East factories and building up production capacity in Egypt in the coming period to meet local demand and make Egypt it’s regional export hub, said company executive Rawan Amish. She did not specify a timeframe for the potential move. Fine has 14 factories in the Middle East, including four in Egypt. The company — which will have invested EGP 1.25 bn in Egypt by the end of this year compared with EGP 1 bn last year — had said in February that it plans to invest as much as EGP 120 mn in 2018 to add new tissue and diaper production lines, as well as expand its sales point network and distribution fleet, in an effort to boost exports and tap new African markets.

** #7 El Sisi, Putin sign cooperation agreement — but nothing yet on bringing back Red Sea flights: President Abdel Fattah El Sisi and Russian President Vladimir Putin signed yesterday a cooperation and partnership protocol designed to improve ties and grow bilateral trade, according to an Ittihadiya statement. The two presidents discussed everything from the Russian Industrial Zone to the progress on the Dabaa nuclear power plant, but did not emerge from their meeting with an agreement on when direct flights from Russia to Red Sea tourist destinations will officially resume.

Putin acknowledged after their sit-down that “Egyptian officials have done ‘everything necessary to enhance flight security’” and said nothing more than that charter flights will resume “in the nearest time,” the AP notes. The State Information Service had suggested earlier this week that the two presidents were all but certain to emerge from yesterday’s meeting with a concrete agreement on the resumption of flights.

The meeting was naturally all over the airwaves last night, with extensive coverage from Al Hayah Al Youm (watch here, runtime: 3:45 and here, runtime: 2:36) and Masaa DMC (watch here, runtime: 7:07, here, runtime: 5:45 and here, runtime: 5:30).

In other news from Russia, the two countries are expected to sign soon contracts for the delivery of Russian Ka-52K helicopters to Egypt, Russian Federal Service for Military-Technical Cooperation head Dmitry Shugaev said yesterday. Negotiations are in the “active phase,” he said. The contract was awarded to Russia in 2016.

** #8 LEGISLATION WATCH- FEI aiming to convince FinMin not to raise taxes on entertainment venues? Members of the Federation of Egyptian Industries’ (FEI) cinema production division are expecting to meet Finance Ministry officials in the coming days to discuss their reasons for rejecting proposed legislative amendments that would hike cinema ticket prices, the division’s deputy head Safwat Ghattas said yesterday. Higher ticket prices would have a sharply negative impact on the film industry, which is already struggling, Ghattas said, adding that he is hoping the two sides can come to a “middle-ground solution” during their meeting.

Background: Sources had told us earlier this month that the government was considering reviving legislative changes from 2016 that would raise taxes on tickets for Arabic-language films to 15% from a current 5%, and on foreign-language films to 30% from a current 20%. The changes would also impact other entertainment venues, including theaters and nightclubs. A domestic newspaper subsequently claimed that the government was not planning on raising the tax on entertainment venues, but officials have made it clear that higher tax receipts were key to taking some of the pressure off the state budget, which is under pressure from high oil prices and high interest rates.

CABINET WATCH- Madbouly presses cabinet to do more for investors: Prime Minister Moustafa Madbouly urged the cabinet to work on improving the investment environment and expedite tendering of new projects, according to a cabinet statement. He gave ministers one week to submit any projects in their pipelines that they plan to tender to investors. No decisions were taken at the meeting. Cabinet spokesperson Nader Saad phoned into Al Hayah Al Youm to discuss ongoing measures to reduce red tape and improve the overall climate for investors (watch, runtime: 6:21).

***

WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

***

Up Next

We have yet to hear from NI Capital on the selection of a manager for Alexandria Containers & Cargo Handling’s stake sale, which the state-owned investment bank was expected to announce by the second week of October.

An IMF delegation is due in town mid-October for a review of Egypt’s progress on its reform program ahead of the disbursal of the fifth USD 2 bn tranche of the country’s extended fund facility.

The House will convene for its first general assembly of the new session on 21 October.

The 2018 Narrative PR Summit will take place at the Four Seasons Nile Plaza on Sunday, 28 October.

Image of the Day

Egypt has once again started restoration work on Cairo’s 13th century al-Zahir Baybars mosque almost eight years after work ground to a halt when funding dried up after the 25 January 2011 uprising, according to an Antiquities Ministry statement. The mosque, built by the Mamluk Sultan Al-Zahir Baybars in 1268, will be open to the public in around 12-18 months.

Egypt in the News

It was another pleasantly quiet morning for Egypt in the foreign press, with the suspected killing of Saudi journalist Jamal Khashoggi in Turkey overshadowing most other news in the region.

A couple of brief headlines worth noting:

- Egypt canceled a planned visit to Gaza to mediate reconciliation talks between rival Palestinian factions on Wednesday amid an escalation in violence between the Israeli and Palestinian sides. Reuters and Jerusalem Post have the story.

- Former lawmaker Mustafa El Nagar and dentist Walid Shawki have been missing for three weeks and are believed to have been detained by Egyptian authorities, their wives told AP.

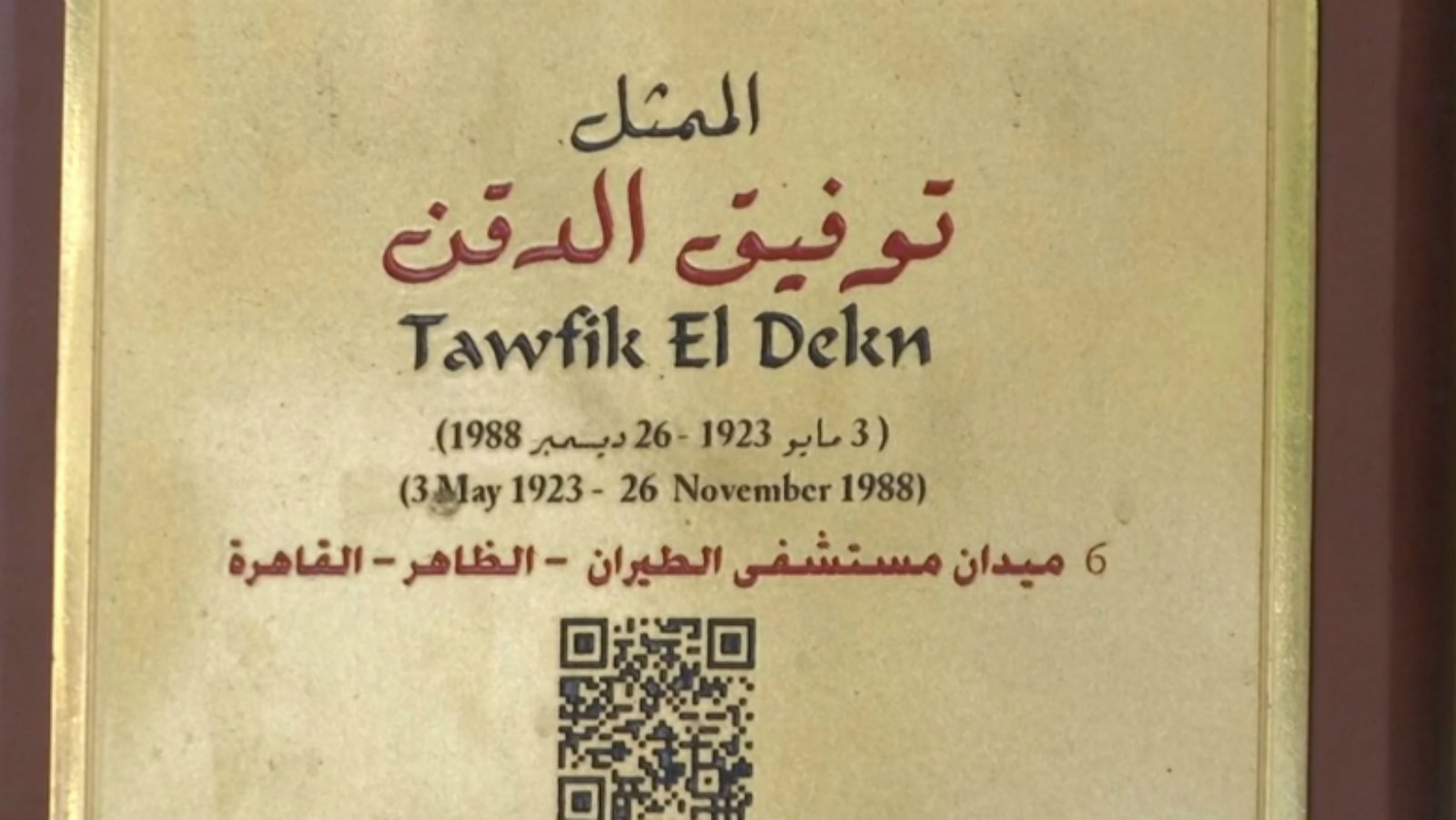

Worth Watching

A government initiative is keeping the memory of iconic figures alive by placing placards on buildings where they once lived with information about their lives, Reuters reports. Using a phone application, a matrix barcode can be scanned to bring up information on the figures’ achievements and careers is also available for download. Launched last month, the initiative has so far managed to put up over 200 placards across the country.

Diplomacy + Foreign Trade

The European Investment bank (EIB) approved a EUR 214 mn loan for Egypt’s Kitchener Drain depollution project, according to an Investment Ministry statement (pdf). The loan brings up the total financing pledged for the project to EUR 400 mn, with EUR 148 mn approved by the European Bank for Reconstruction and Development earlier this year and a separate EUR 46 mn grant from the EU Neighborhood Investment Facility. The funds will be used to renovate 24 treatment plants, extend six others, and rehabilitate the entire Kitchener drain passing through Kafr El Sheikh, Gharbiya and Daqahliyah. EIB and Egypt signed last month on EUR 32 mn-worth of grants to support sewage treatment projects in Kafr el Sheikh.

Meanwhile, the EU is looking to grant Egypt as much as EUR 120 mn over the next three years to support its water security plans, EU ambassador Ivan Surkos said yesterday, according to Al Shorouk. The grants will be offered as part of the “EU4 Water in Egypt” program that is yet to launch.

Energy

China’s United Energy to raise investments in Egypt

China’s United Energy Group is planning to make new investments in Egypt’s energy sector, company representatives told Oil Minister Tarek El Molla at a meeting on Wednesday, Youm7 reports. The meeting was one of several El Molla had with IOCs, including Kuwait Energy. The size of these potential investments was not disclosed.

EGAS agrees to purchase gas from Eni’s Faramid at USD 2.6/MMBtu

The Egyptian Natural Gas Holding Company (EGAS) reportedly agreed to purchase natural gas produced from Eni’s Faramid South asset at USD 2.6/MMBtu, sources from EGAS said. The well, which is in Eni’s East Obayed concession in the Western Desert, has been closed pending Eni reaching an agreement with Royal Dutch Shell over the terms of constructing a pipeline connecting the field to Shell’s processing plant.

BP to produce 60 mcf/d of natgas from Katameya well in 2020

BP will begin producing 60 mcf/d of natural gas from its Katameya Shallow-1 exploration well in the North Damietta East Delta marine concession by 2020, a source from the industry told Youm7. Early works on the well are due to begin soon as BP had promised in April to begin production by no later than early 2020. The well has 90 bcf of reserves.

Real Estate + Housing

CGP to invest EGP 5 bn in mixed-use compound Alburouj in 2019

Capital Group Properties is planning to invest EGP 5 bn in its mixed-use compound Alburouj in 2019, Chief Projects Officer Amgad Hassanein said. The funding will be directed toward completing the construction of units in the compound’s first phase and develop a new smart village complex. CGP had launched the EGP 700 bn Alburouj project in 2015, to be completed in ten years over four phases.

Tourism

Austria’s VAMED eyes Egypt’s medical tourism market

Global healthcare provider VAMED AG has expressed interest in investing in Egypt’s medical tourism sector in a meeting between officials from the Austrian company and Prime Minister Moustafa Madbouly that included the Health Minister Hala Zayed on Wednesday, according to a cabinet statement. Madbouly highlighted his government’s policy to develop the medical tourism sector, especially in Oyoun Moussa. The Middle East has become the fastest growing market for medical tourism due to high healthcare costs in the West, according to a MENA Research Partners (MPR) report we noted back in May.

Telecoms + ICT

SICO looks to enter joint-manufacturing partnerships with foreign companies

Egyptian electronics manufacturer SICO is in talks with foreign companies to enter into joint-manufacturing agreements, ICT Minister Amr Talaat told Amwal Al Ghad. Talaat did not give specific names of companies and did not provide further details about the plan.

Automotive + Transportation

Uber announces new safety features for passengers and drivers in Middle East, Europe, Africa

Uber will be rolling out new safety measures over the next few weeks for drivers and riders across the Middle East, Africa, and Europe, Uber Egypt said in a press release (pdf). In addition to introducing caller privacy — which will allow drivers and riders to call each other without revealing the other’s number — the new safety tool kit includes a feature that will allow riders to share their live locations from the app with five trusted contacts who can monitor and track their movements. The tool kit also adds more secure measures for driver verification and will include a safety center that will contain any and all important information for riders. The measures were introduced to boost accountability and transparency across the platform.

Drshal Egypt to convert eight diesel buses to electric

The Holding Company for Maritime and Land Transport inked an agreement with Drshal Egypt to convert eight diesel-operated buses to electric-powered vehicles, Chairman Hassan El Dessouky said, according to Al Mal. Drshal, which is set to start work on the buses next month, will use the state-owned Engineering Automotive Company’s production lines for the project.

Banking + Finance

CIB, NBE and Banque Misr agree to fund waste-to-energy projects

CIB, the National Bank of Egypt (NBE), and Banque Misr have agreed to provide funding for waste-to-energy projects with a capacity of up to 10 MW, sources told a local newspaper. The banks will begin extending loans once the government reaches a decision on final tariff rates.

NBE, CIB, QNB Alahli, IDBE to fund projects aimed towards curbing industrial pollution

The Environment Ministry has reportedly signed agreements with four local banks to help run a financing scheme for projects aimed at curbing industrial pollution, unnamed ministry sources said. CIB, National Bank of Egypt, QNB Alahli, and the Industrial Development Bank. The agreement is part of a wider EUR 145 mn program between Egypt, the European Investment Bank, the French Development Agency, and the KfW to control industrial pollution.

NRA to receive USD 114.98 mn from Korea to automate Naga Hamady-Luxor railway

The National Railways Authority (NRA) is finalizing procedures to receive a USD 114.98 mn loan from Korea’s Economic Development Cooperation Fund to automate the signaling system for the 118 km Naga Hamady-Luxor rail line, NRA head Ashraf Raslan tells Youm7. Raslan did not specify when the loan will be disbursed. The authority hired a Korea-based technical consultant to design and study the project.

NBE, NAT, Metro Company, sign agreement for e-payments at the metro

The National Bank of Egypt (NBE), the National Authority for Tunnels (NAT), and the Egyptian Co. For Metro Management & Operation have signed an agreement to introduce electronic payments for Cairo Metro commuters, Al Mal reports. The agreement, part of the government’s transition towards a “cashless economy,” will bring points of sale to metro ticket kiosks, increase ATMs around stations, introduce a top-up smart card to use on the metro, and allow metro users to apply for prepaid NBE-issued debit cards.

Egypt Politics + Economics

Egypt renews ex-diplomat Masoum Marzouk’s detention for 15 days

The Supreme State Security Prosecution renewed the detention of ex-diplomat Masoum Marzouk and six others for 15 days pending investigations into alleged terror charges, according to Al Shorouk. Marzouk was detained in August, shortly after he had called for a referendum on President Abdel Fattah El Sisi.

Sports

Egypt wins three gold medals ahead of final day of 2018 youth Olympics

Egypt snatched a total of 11 medals — three gold, two silver, and six bronze — in individual competitions at the 2018 Buenos Aires Youth Olympic Games (YOGs),according to the Olympic Channel. Gold was won by modern pentathletes Salma Abdel Maksoud and Ahmed El Gendy and Karate Olympic athlete Yasmine El Gewely. Egypt will compete today in three more futsal and boxing events, ahead of the closing ceremony later in the day.

On Your Way Out

House rep. wants to abolish punishments for drug use, suggests therapy instead: House Rep. John Talaat is planning to propose amendments to the penal code that would scrap punishments like prison sentences and fines for drug use, replacing them with provisions that would see drug users ordered into rehab. Talaat told Egypt Today that he would submit his proposal to the assembly on 21 October.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 13,816 (+0.9%)

Turnover: EGP 634 mn (10% below the 90-day average)

EGX 30 year-to-date: -8.0%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.9%. CIB, the index heaviest constituent ended up 0.7%. EGX30’s top performing constituents were Edita up 7.7%, Ibnsina Pharma up 5.8%, and Egyptian Iron and Steel up 3.6% up. Yesterday’s worst performing stocks were Heliopolis Housing down 0.9%, Egypt Aluminum down 0.8%, and Madinet Nasr Housing down 0.8%. The market turnover was EGP 634 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +94.5 mn

Regional: Net Long | EGP +26.9 mn

Domestic: Net Short | EGP -121.4 mn

Retail: 61.2% of total trades | 55.7% of buyers | 66.8% of sellers

Institutions: 38.8% of total trades | 44.3% of buyers | 33.2% of sellers

Foreign: 17.5% of total | 24.3% of buyers | 10.7% of sellers

Regional: 7.8% of total | 9.8% of buyers | 5.9% of sellers

Domestic: 74.7% of total | 65.9% of buyers | 83.4% of sellers

WTI: USD 69.93 (+0.26%)

Brent: USD 80.05 (-1.67%)

Natural Gas (Nymex, futures prices) USD 3.32 MMBtu, (-0.12%, November 2018 contract)

Gold: USD 1,225.50 / troy ounce (-0.15%)

TASI: 7,657.87 (-0.12%) (YTD: +5.97%)

ADX: 4,956.97 (+0.53%) (YTD: +12.70%)

DFM: 2,741.50 (+0.50%) (YTD: -18.65%)

KSE Premier Market: 5,180.55 (+0.17%)

QE: 10,157.48 (+1.25%) (YTD: +19.17%)

MSM: 4,452.91 (+0.03%) (YTD: -12.68%)

BB: 1,313.22 (+0.12%) (YTD: -1.39%)

Calendar

Mid-October: IMF delegation due in town for its fourth review of Egypt’s economic reform program.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

28 October (Sunday): 2018 Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

November: A delegation of French pharmaceutical and medical equipment companies is set to visit Egypt sometime in November to explore potential investments, according to a Trade Ministry statement.

01-02 November (Thursday-Friday): Annual Middle East Conference on Business Angel Investment, El Gouna, Egypt

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

17-19 November (Saturday-Monday) ElectricX-Energizing the Industry, Egypt International Exhibition Center, Cairo, Egypt

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “the Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.