- Three stories that look set to dominate newsflow this week. (What We’re Tracking Today)

- It looks like we’re not quite going to make our deficit target. (Speed Round)

- Nassar denies Trade Ministry is looking for two-year delay on 0% customs duties for EU cars. (Speed Round)

- Amid heavy demand, CIRA prices IPO at EGP 6 per share. (Speed Round)

- LSE-listed Soco to acquire Egypt-focused Merlon. (Speed Round)

- SDX in talks with BP to acquire assets in Egypt. (Speed Round)

- Sawiris, other gold bugs look to goose miners’ share prices. (Speed Round)

- Egypt edges one step closer to EU migration pact as officials agree to begin formal talks. (Speed Round)

- AWB defendants freed on EGP 100k bail. (Speed Round)

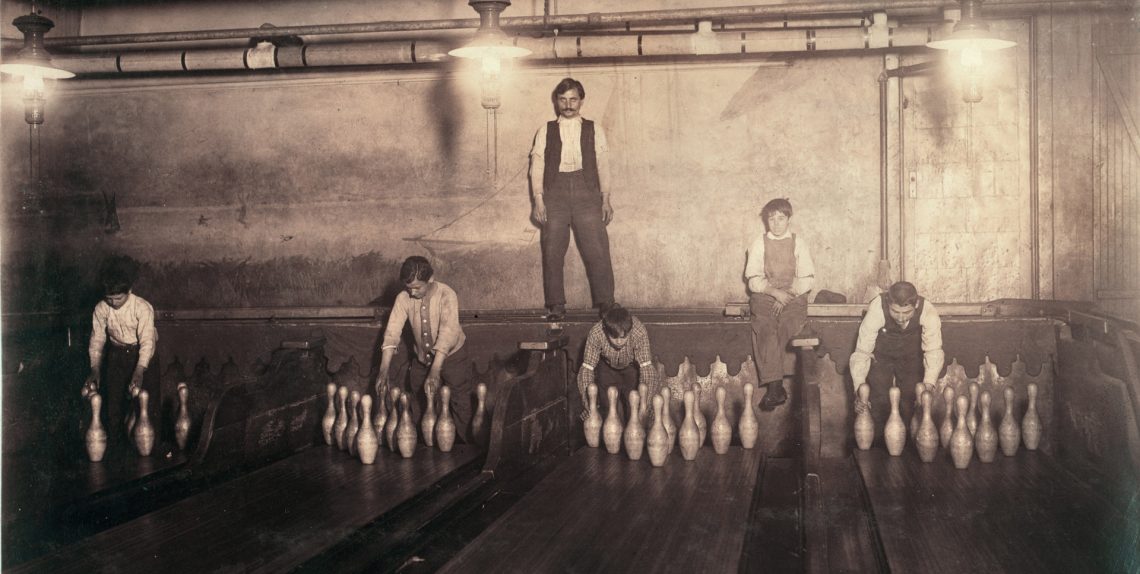

- Global warming threatens Gabal Elba protectorate. (Image of the Day)

- The Market Yesterday

Sunday, 23 September 2018

Deficit target miss?

TL;DR

What We’re Tracking Today

It’s a busy news day here in Cairo, ladies and gentlemen.

But first, let’s start the morning with some good news: Leading private-sector schools outfit CIRA has priced its IPO — and the offering is more than 10x oversubscribed on the back of heavy demand from global institutional investors. It’s the first IPO of the fall season, and you can look for consumer and structured finance player Sarwa to go out next. We have chapter and verse in this morning’s Speed Round, below.

Also: There’s lots of international interest in our hydrocarbon industry at the moment. LSE-listed Soco has entered an agreement to acquire Merlon. SDX is talking to BP about buying a “significant package” of BP’s Egyptian assets. A German LNG import terminal is looking to Africa as a source of cargoes. We have the rundown in today’s Speed Round.

**#1 Three stories look set to dominate the news agenda this week, and two of them are closely linked:

- Will the sell-off on the EGX continue as foreign and domestic investors alike squirm in the face of the EM Zombie Apocalypse and this week’s interest rate decision? The EGX lost right around 8%, erasing its gains for the year. The benchmark index is now down -6.2% YTD.

- Central bank to decide interest rates: The central bank’s monetary policy committee meets on Thursday to review rates. The consensus among analysts is that it will leave rates on hold.

- Diplomacy will be all the rage with President Abdel Fattah El Sisi in New York for the United Nations’ annual fall love-in.

Turkey’s economic woes have raised concerns about whether Egypt can withstand the emerging market crisis, Jared Maslin writes in a piece for the Wall Street Journal. Maslin all but suggests that the situation for Cairo (and other EM) could get as bad as it did for Ankara. Vice Minister of Finance Ahmed Kouchouk tells him, however, that in addition to the ongoing economic reform agenda, authorities are taking “the right steps” to make sure that Egypt remains attractive for foreign investment throughout the EM selloff and beyond. “Imagine if this happened before our reform program,” he added. The EGX sell-off last week came after the sons of former president Hosni Mubarak and other high-profile execs were implicated in an insider trading case. The impact from the case compounded the effect of the wider EM selloff, which has seen currencies including Turkey’s and Argentina’s drop to record lows, the WSJ says.

(In other Turkey news: The Nutter to our North’s coast guard detained a number of Egyptian fishermen on a Cypriot boat in Cypriot waters claimed by Turkey, the Associated Press reports.)

El Sisi is looking to take relations with the United States to the next levelwhile in New York to attend the UN General Assembly, which opened on Tuesday last. The president’s remarks are expected to focus on security and economic challenges, Egypt Today reported. El Sisi is expected to sit down for a one-on-one with The Donald on the sidelines of the UNGA, Reuters reports, citing the White House. The meeting will be the first between the two presidents since El Sisi won a second term — and since the Trump administration normalized annual military aid to Egypt, Ahram Online says, quoting state news agency MENA. The president is also expected to meet with US business leaders to pitch investment here.

Plenty more where that came from: We had previously reported that El Sisi will also hold talks in Washington with German Chancellor Angela Merkel and French President Emmanuel Macron. Look, too, for talks on the sidelines with the leaders of Israel, Britain, France, South Korea and Japan.

Wait, physical retail isn’t dead? The death of brick-and-mortar retail is effectively ‘conventional wisdom’ in many circles — but if you read closely enough, it’s clear that the future of retail is “clicks-to-bricks.” Online retailers are opening physical stores (and sometimes using them to showcase collections that haven’t yet been released online) and ‘traditional’ retailers are upping their online games.

Case studies: Witness Young shoppers love real stores full of real stuff, wherein an FT columnist writes with amazement about a family trip to a Walmart. Or Hard Lessons (Thanks, Amazon) Breathe New Life Into Retail Stores, courtesy of the NYT. You read that you may be surprised to hear that restoration hardware is doing great (perhaps we would, if we cared about the brand) and that “uniqueness and experiences’ seem to be paying off” for France’s grands magazins. TJMaxx, you will be told, offers you a masterclass on how to survive the retail crisis.

The granddaddy of them all: The future of retail in the age of Amazon in Wired, from late last fall. The takeaways? Amazon, its local skirmishers (hello, Souq) and its imitators (hi, Jumia) will pressure many outlets, but successful retailers will:

- feature products that customers can’t get elsewhere

- deliver a satisfying experience

- challenge the fundamental assumptions of commerce

- resurrect the art of selling

You know veganism has gone mainstream when it makes the Financial Times. We love steak in these parts. A juicy hamburger. Lobster. Even the humble chicken breast. We would also rather not cook in our own juices as the planet warms — and thoroughly despise factory agriculture. If you’re curious about vegetarianism taken to the next level, the FT’s package on Vegan food and drink includes:

Enterprise+: Last Night’s Talk Shows

The airwaves are clogged with political and foreign relations pundits offering nothing in the way of original analysis President Abdel Fattah El Sisi makes his latest fall visit to New York for the UN General Assembly.

But before we get to that, Hona Al Asema dove into last week’s abysmal performance on the EGX, which saw the benchmark EGX30 fall to its lowest point this year on Wednesday. CFA Society Ahmed Abou El Saad puts the primary blame on the emerging markets selloff (watch, runtime: 16:54). He also pointed to news of the arrest of the Al Watany Bank defendants and (for some reason) talk of the state confiscating funds from Ikhwan-affiliated companies (watch, runtime: 2:19).

El Hekaya’s Amr Adib met with one of the defense attorney’s on the Al Watany Bank defense team. We note highlights of that talk, which took a turn to the political, in the Speed Round below.

El Sisi at the UN will be an economic mission: Amid the usual, insipid talking points trotted out, Al Masry Al Youm journalist Mohsen Smeeka’s interview with Masaa DMC stood out. He noted that the economy will feature heavily in El Sisi’s trip, which will see the president meet with World Bank CEO Kristalina Georgieva and a delegation of US companies in a meeting set up by the American Chambers of Commerce. El Sisi will also meet with UAE Foreign Minister Abdullah bin Zayed (watch, runtime: 7:11).

Foreign Minister Sameh Shoukry spoked to Masaa DMC from New York, saying this UN meeting is an important showcase for Egypt’s growing international role. Egypt will lead a meeting of the G77 and head the African Union in 2019. He talked of the importance of US-Egypt cooperation on a number of regional issues, including the current violence in Gaza, where Egypt is currently mediating between Israel and Hamas (watch, runtime: 14:35).

Also in diplomacy, Turkey’s arrest of Egyptian fishermen off the northern coast of Cyprus received a vitriolic reaction from El Hekaya’s Amr Adib, who attacked what he believes to be a Turkey-Qatar plot against Egypt (watch, runtime: 2:15).

Amr Adib hosted makers of the famed “Raafat El Haggan” series on the 30th anniversary of its airing. Adib used the talk to lambast the makers of Netflix’s Ashraf Marwan spy thriller, The Angel, a view with which we concur wholeheartedly (watch, runtime: 3:12).

Hona Al Asema covered briefly El Gouna Film Festival and the death of screenwriter Sameer Khafaga (watch, runtime: 4:06).

Speed Round

**#2 EXCLUSIVE- It looks like we’re not quite going to make our deficit target: The Finance Ministry is planning to amend the FY2018-19 budget deficit target at the end of the month on projections that we may — just barely — miss it, a government source told Enterprise. The deficit for the year is projected to fall to 8.6% of GDP, but the initial estimate was for a decline to 8.4%, the source said. The source blamed rising US interest rates and a spike in oil prices this year for the amended targets. Initial budget projections had assumed an oil price of USD 65/bbl. Oil prices have been hovering in the USD 80 neighborhood since the summer, prompting the Madbouly government to look into hedging strategies.

You had best be paying your taxes: The source said the ministry’s strategy to keep the budget on target this time will be to “ensure the state gets what it is owed” in addition to the state privatization program. The change in the deficit target is expected to be officially announced once the government releases macro indicators for 1Q2018-19, the official said.

**#3 EXCLUSIVE- Tariffs on EU cars will still fall to zero next year, says Nassar: Trade and Industry Minister Amr Nassar told Enterprise overnight that the government has no plan to put on hold a tariff cut on cars imported from the European Union. Automobiles imported from the EU will enjoy zero-duty access to Egypt as of 1 January under our trade liberalization agreement with the European Union.

Nassar was reacting to media reports yesterday that the government would delay the customs cut. In a statement to Enterprise, the minister said he had no idea where the rumor had originated. An official from the Customs Authority also told us yesterday that there have been no preparatory meeting between the authority and the ministry to coordinate on such a move. As far as the Customs Authority is concerned, our source said, duties on EU car imports will fall to zero on New Year’s day.

Reports of a delay started early on Saturday as newspapers picked up a story broken by Youm7, which cited an anonymous government source. The source told the newspaper that government was set to announce a two-year delay of the cut after reaching an agreement with EU trade officials. In a call-in to Sada El Balad’s Salat Tahrir TV show, Alaa El Saba, who runs an automotive distributor and is a member of the Federation of Egyptian Chambers of Commerce’s auto division, said the tariff cuts have already been postponed twice. El Saba called on the government to clarify the situation.

Winners and losers: Pure importers of EU-assembled models would be winners if duties fall to zero as they gain a price advantage over domestically assembled vehicles. Local manufacturers have been pushing for what is localled called the “automotive directive”: A package of incentives that would give local assemblers a measure of protection if they were to go up the value chain into manufacturing.

Where is the automotive directive? All of this comes as the Madbouly Cabinet has yet to clarify its plan for the directive, which is currently being reviewed by a committee of three ministries. A senior government source told us in July that the expectation was for the committee to substantially alter the plan. The shift would nix a general nationwide policy of investment and tax incentives to automotive assemblers to move up the value chain to manufacturing, to a system of special economic zones for car manufacturing with incentives. Nassar had said last month that the ministry is planning to have the automotive directive drafted and ready before the House of Representatives reconvenes for the fall legislative session in October.

**#4 IPO WATCH- CIRA prices IPO at EGP 6 per share; offering is more than 10x oversubscribed amid heavy demand from institutional investors: Leading private sector education outfit Cairo for Investment and Real Estate Development (CIRA) has priced its IPO at EGP 6.00 per share, above the midpoint of the EGP 5.45 to EGP 6.30 per share on which it had previously guided. That’s enough to give the company a market capitalization of EGP 3.29 bn at the opening bell on 1 October, when the company’s shares are due to begin trading on the EGX.

International demand for CIRA’s shares was heavy, with the institutional offering of nearly 193 mn shares being 10.34x oversubscribed, the company said in its final price announcement (pdf). CIRA is offering some 207 mn shares (or about 38% of the company) during the IPO, which includes a retail offering for which the subscription period is due to end on Tuesday, 25 September. Proceeds from the transaction will be earmarked for growth in Egypt and beyond, the company has previously said.

On a related note, the New Urban Communities Authority (NUCA) has approved selling CIRA 120k sqm plot of land in New Mansoura to build a school there, Al Shorouk reports.

Advisers: EFG Hermes is sole global coordinator and bookrunner for the transaction. Al Tamimi & Co. is acting as the issuer’s local counsel, while Zulficar & Partners is domestic counsel to the underwriter. White & Case is international counsel to the issuer, while Gide Loyrette Nouel is doing duty for the global coordinator and bookrunner. Inktank Communications is serving as investor relations advisor to CIRA.

Fate of natural gas pipeline from Cyprus hinges on Nicosia’s talks with Aphrodite field partners: Construction of an underwater pipeline linking Cyprus’ Aphrodite natural gas field with liquefaction facilities in Egypt will reportedly start in 1Q2019, just as the final contracts for the project are signed, Oil Ministry sources claimed to Al Mal on Thursday. Work on the pipeline should take at most two and a half years to complete, they added. Oil Minister Tarek El Molla had signed an agreement last week with his Cypriot counterpart Yiorgos Lakkotrypis under which both countries are meant to collaborate on establishing the USD 800 mn-USD 1 bn pipeline. Details on the timeline had not been provided, but Lakkotrypis had said last month that he expects Royal Dutch Shell’s liquefaction plant in Idku to begin processing gas from Cyprus by 2022. The output should be used both locally and re-exported back to Europe as part of a plan to turn Egypt into a regional energy hub.

Tough talks ahead? Last week’s intergovernmental agreement was but the “first link in the chain…[which] by itself does not guarantee gas sales,” said state-owned Cyprus Hydrocarbons Company CEO Charles Ellinas. Shareholders in the Aphrodite field are looking to revise their profit-sharing agreement with Cyprus, and the talks “are still to start and will take some time, with no certainty that they will be completed successfully,” Ellinas told New Europe. He explained that the consortium made up of Noble Energy, Israel’s Delek, and Shell was asking to flip the profit-sharing agreement, which currently gives the Cypriot government c. 60% and the partners around c. 40%. Cyprus has also been studying a separate proposal to export gas from Aphrodite to Europe through a pipeline that would carry natural gas from Israel’s Leviathan field to Italy through Greece, he noted.

Selling gas to Egypt is likely on the table either way, according to Ellinas. Tapping the potential of liquefaction facilities in Idku and Damietta could open the door for gas exports to Asia, as well as Europe, he said, hinting that the Cypriot government would continue to pursue a pact with Egypt, especially as it expects to make more EastMed gas discoveries in the time to come.

More European demand for East Med gas: This comes as Germany’s RWE looks towards African markets as potential sources of LNG for its new import terminal near Hamburg, the company’s Chief Commercial Officer for Supply and Trading, Andree Stracke, tells Bloomberg. RWE is already in talks with players in the region, Stracke said. He did not reveal the identities of the companies, but Qatar Petroleum and Nigeria LNG both confirmed they had opened talks. “Some African LNG is very likely to show up in Europe, therefore why not allocate it?” He said..

**#5 M&A WATCH- LSE-listed Soco to acquire Egypt-focused Merlon Petroleum: London-listed Soco International announced in a statement on Thursday that it has reached an agreement to acquire Merlon Petroleum El Fayoum Co. in a USD 215 mn transaction. The transaction, if executed, would give Soco a 100% working interest in the Western Desert’s Fayum Concession. That would give the company, whose website says it currently operates in Vietnam and Angola, a “strategic platform” for “future organic and inorganic growth in Egypt and the wider MENA region,” as it is expected to add “working interest reserves of 24 mmbbls working interest resources of 37 mmbbls” to the company’s total output, in addition to around 1,570 sqm of explorable land.

Transaction structure: The USD 215 mn cash-and-shares agreement will see Soco pay USD 136 mn in cash and offer 66 mn new Soco shares equivalent to just under 20% of the company’s current issued capital. Soco will also repay Merlon’s net debt of about USD 22 mn (as of the end of last year). Merlon President and CEO Jason Stabell and his team are expected to retain their positions. The transaction should be complete some time in the first half of 2019, the statement said.

Advisors: Evercore Partners was financial advisor and sponsor. Jeffries and JP Morgan Cazenove were corporate brokers. Matouk Bassiouny served as local legal counsel for Soco.

**#6 M&A WATCH- SDX in talks with BP to acquire assets in Egypt: SDX Energy announced on Thursday that it was in open talks with BP to acquire “a significant package of [its] assets in Egypt.” It’s not immediately clear which assets SDX hopes to acquire, but the company said in a press release (pdf) that the transaction would take the form of a reverse takeover, allowing SDX entry to the London Stock Exchange’s main market. SDX is currently listed on junior London market AIM, but trading on its shares has been suspended until negotiations wrap-up.Trading on the company’s shares on the Canadian TSX Venture Exchange has also been suspended until further notice.

Background: We had reported in March that BP was already meeting with prospective buyers for its stake in its 50-year-old JV with the EGPC, the Gulf of Suez Oil Company (GUPCO), as part of a plan to sell USD 2-3 bn’s worth of maturing assets this year in an effort to shore up finances. Sources had then valued the GUPCO transaction at EGP 500 mn but others had said that BP was hoping to raise as much as USD 1 bn from the sale.

Eni, Tharwa to begin Noor field drilling this week: Italy’s Eni and Egypt’s Tharwa Petroleum will reportedly begin drilling this week their first exploratory well in the offshore Noor gas field in North Sinai, an unnamed EGAS official tells Reuters. Eni had signed a USD 105 mn concession agreement with the government last month to begin exploration activities in the East Mediterranean field alongside Tharwa Petroleum, which holds a 15% stake in Noor.

Expectations are high: Eni, which holds an 85% stake in the field, denied in recent months reports claiming that it had discovered 90 tcf of reserves there, or 3x as much as the supergiant Zohr field. The company signed two other agreements with the government last month for exploration in the Nile Delta and Western Desert. Oil Minister

On a related note: Egypt’s gas production is expected to record strong growth on the both the short- and long-terms as “several major offshore development[s] ramp up output over 2018,” according to a report from Fitch carried by Rigzone. Oil Minister El Molla had previously said that Egypt would reach natural gas self-sufficiency and begin exports by January 2019, as gas fields including Zohr connect more capacities to the national grid. “As production exceeds domestic demand, we see the potential for gas to be exported via LNG to European and Middle Eastern markets, where LNG demand is expected to rise over the long-term,” the report notes.

Strong international interest: Egypt signed last week new exploration agreements worth more than USD 1 bn with Shell and Malaysia’s Petronas, as well as Rockhopper, Kuwait Energy and Canada’s Dover Corporation. A delegation from Petronas also met with El Molla last week to explore new opportunities to expand its business in Egypt

**#7 Sawiris, other gold bugs look to goose miners’ share prices: Naguib Sawiris’ La Mancha Group and a number of other investors have joined New York-based hedge fund Paulson & Co. on an initiative that means to “promote constructive engagement between the gold mining industry and the investment community,” according to a press release picked up by the Financial Times. The move is meant to reverse a sharp drop in gold miner shares, which witnessed a 25% decrease in prices this year. It’s unclear how exactly the group, which goes by the name Shareholders’ Gold Council, intends to remedy the problem.

In other news from the Egyptian bn’aire, Naguib tweeted on Thursday that the UN has exempted his North Korean telecom operation, Koryolink, from sanctions. Reports that Sawiris’s Telecom Media and Technology Holding (OTMT) withdrew its North Korea operation amid mounting pressure from the US and UN Security Council surfaced last year, but an official from OTMT had denied the claims and Sawiris had confirmed he had no plans to exit the market.

New disbursals from international lenders coming: The World Bank’s board has unanimously approved a USD 300 mn loan to Egypt as part of the planned upgrade of water and wastewater infrastructure in rural communities, Investment and International Cooperation Minister Sahar Nasr said. The program, which was launched back in 2015, has already drawn in USD 550 mn in foreign funding, according to a ministry statement.

Meanwhile, the African Development Bank (AfDB) will disburse its third and final USD 500 mn tranche of a USD 1.5 bn loan to Egypt “within days,” AfDB Vice-President Khaled Sherif said on Thursday, according to an Investment Ministry statement (pdf). Nasr had finished the paperwork for the final tranche back in January.

Egypt’s sukuk market is full of untapped potential -Moodys: Egypt is one of 18 African countries that have a lot of unexplored potential to tap in the sukuk market, Moody’s Investor Service said in a press release about a recent report. The agency expects at least USD 1 bn in sukuk to be issued in Africa between now and the end of 2019 — a piddling sum, but a start, we suppose. “As African sovereigns seek to diversify their funding base, the amount of sukuk they issue will likely increase.”

Why should you care? Finance Minister Mohamed Maait had previously said that Egypt could issue USD or EUR-denominated Islamic bonds, reviving a plan that has been collecting dust since 2013. Maait also said last week that Egypt could tap the global debt market with a USD 5 bn bond issue in 2019.

**#8 Egypt edges one step closer to EU migration pact as officials agree to begin formal talks: It looks as though Austrian Chancellor Sebastian Kurz swayed his EU counterparts to open formal talks with Egypt on expanding cooperation on stemming illegal migration, according to an Associated Press report on Thursday. “Egypt is the first country in north Africa that is ready to intensify talks with the EU…[and] has proved that it can be efficient,” Kurz said. “We’ve agreed on in-depth cooperation on issues such as migration, but also economic cooperation with Egypt.” Kurz gave little in the way of detail, but he did note that he doesn’t expect Egypt to sign on to build detention facilities for refugees (the EU prefers to call them “disembarkation centers”) an idea Egyptian authorities had previously rejected (catch an excerpt from Kurz’s news conference here, courtesy of Bloomberg TV, runtime: 0:50). (The Financial Times also has coverage.)

Word on the street is that talks have already started. European Council President Donald Tusk is set to meet with President Abdel Fattah El Sisi today to discuss the matter further, an unnamed EU officials tell the Wall Street Journal that talks have already started, cautioning they are “still at an early stage with nothing in writing at this point.”

What are we offering the EU? Under the agreement, Egypt would be expected to “step up its policing of coastal waters and divert refugees intercepted on the Mediterranean Sea to the North–African country,” the officials claimed.

What is the EU offering us? “In exchange, the EU would offer Egypt substantial investments and other financial incentives as well as diplomatic accolades, including high-profile visits to Cairo by European heads of governments.” The EU will be reaching out to other North African countries over the coming few weeks to discuss similar arrangements, Tusk said. A summit with Arab League states on the issue has also been slated for February 2019 in Egypt.

Background: Kurz, alongside EC president Tusk, had made a case to EU leaders last week that some form of agreement with Egypt and other North African countries was in order to ensure there are incentives to continue stemming the flow of migrants into Europe. Egypt and the EU had signed an MoU last year for a EUR 60 mn grant to stem the flow of illegal migrants to Europe, but it lacked the depth and structure — and total financial value — of the EU’s pact with Turkey on refugee management and assistance, despite calls from officials including German Chancellor Angela Merkel that a Turkey-style agreement with Egypt would help stem the flow of illegal migrants.

**#9 AWB defendants freed on EGP 100k bail: The sons of former president Hosni Mubarak and three others were freed on a EGP 100k bail each on Thursday, following their arrest the previous weekend on charges of insider trading stemming from the sale of Al Watany Bank of Egypt to the National Bank of Kuwait in 2007. A new hearing has been set for 20 November, Reuters reports, citing statements from a court witness. The defendants, whose arrest led the stock market to suffer its biggest one-day dip in a year and half, have denied the charges and were reportedly divided on whether or not to accept settlement terms. The group — which includes former EFG co-CEOs Yasser El Mallawany and Hassan Heikal, among others — were given until 20 October to decide.

Judge to be replaced? The ruling came just after an appeals court approved a motion by defense lawyers to replace the judge presiding over the case, according to the Associated Press. Bloomberg also has the story.

Separate court ruling kills any chance Gamal will be able to get back into politics: The Court of Cassation rejected a motion by Hosni Mubarak and his sons to overturn their conviction for having embezzled public funds, AMAY reports. By upholding the conviction, for which they have already served their jail sentences, the Court of Cassation effectively ended any chance the Mubaraks have in returning to the political scene, writes the AP’s Hamza Hendawi. The decision comes weeks after pro-administration journalists lambastic public appearances by the Mubaraks and warned them against trying to return to political life.

Story featured heavily on the airwaves last night: Defense attorney Mohamed Hamouda, who was part of the AWB defense team, began his discussion with El Hekaya’s Amr Adib on the legal nuances of the case. But before any interesting facts came up, the discussion quickly fell to politics, where Hamouda said that his clients had no political ambitions (watch, runtime: 2:13). The politics angle also ran through a panel discussion that included Al Shorouk Editor-in-Chief Emad Al Din Hussein, who turned the talk into an analysis of what constitutes a “political crime,” of which he claims Hosni Mubarak was guilty (watch, runtime: 3:04). Hamouda’s response: Let history be the judge of “political crimes” and not the courts (watch, runtime 3:47).

The story is topping coverage of Egypt in the foreign press this morning, with the return to politics angle being widely noted.

CABINET WATCH- Cabinet signs off on various int’l funding agreements at weekly meeting: The Madbouly Cabinet signed off on a number of international funding and aid agreements on Thursday, according to an official statement. including a EUR 243 mn agreement with South Korea for the supply of 32 metro cars for the Cairo Metro lines 3 and 4. In addition to approving to a USD 3.7 mn MoU between Egypt and the International Labor Organization for a three-year program to support private sector and SME development, ministers also signed off on amendments to three US aid agreements, including a USD 200 mn higher education support package, a USD 64.67 mn grant for agricultural development, and a USD 20 mn agreement on science and tech cooperation.

Also on Thursday, Cabinet signed off on:

- A decision allocating government-owned land in Sharqiya for free to the Egyptian Electricity Holding Company to build a new transformer station, as well as land in Beheira to the Beheira Distribution Company for a new control unit;

- A presidential pardon for some inmates on 6 October anniversary;

- A decision that outlines the roles and responsibilities of deputy ministers for the ministries of planning and agriculture.

KUDOS- EFG Hermes Foundation boss named 2018 SDG pioneer by UN Global Compact: Hanaa Helmy is “is creating initiatives that directly better people’s lives by curbing disease, delivering education and jobs and improving local infrastructure” by “integrating the best efforts of governments, civil society and the private sector,” the UN Global Compact writes in a piece explaining how Helmy was one of 10 people chosen this year. You can read the UNGC’s profile of Hanaa, check out the others on this year’s list, or check the 17 sustainable development goals the UN thinks you can integrate into your business.

Emirates is looking to acquire its UAE rival airline Etihad in a merger that could form the largest airline in the world, people familiar with the matter tell Bloomberg. Talks are already underway, but are at a preliminary stage, the sources added. The two companies have denied they are in talks to combine their businesses.

In other international news, gunmen attacked a military parade in Iran killing at least 25 people on Saturday, CNN reports. A local Sunni separatist group, Patriotic Arab Democratic Movement in Ahwaz, claimed it carried out the attack, according to state news agency IRNA. Supreme Leader Ayatollah Ali Khamenei accused the GCC of masterminding the attack, BBC reports.

Image of the Day

**#10 Global warming is taking a toll on biodiversity at Gabal Elba, a protectorate in Egypt’s Halayeb border area that is only accessible with permission from intelligence services, Jihad Abaza writes for The National. “Many plants are now incapable of surviving in their original locations, and fewer plants mean less plant-eating animals and eventually fewer carnivores,” says environmentalist Noor Noor. Climate change, which has resulted in less rain and smaller amounts of vegetation on the mountain, is also harming the native Bishara and Ababda tribes, who depend mainly on livestock for their livelihood. Activists say that encouraging conscious eco-tourism may be helpful for the locals.

Diplomacy + Foreign Trade

Defense Minister Mohamed Zaki met yesterday with his Indian counterpart Nirmala Sitharaman to discuss Egypt-India military cooperation during the latter’s visit to Egypt over the weekend, according to a statement by the Indian Defense Ministry.

Energy

Siemens to run Egypt’s 3 new massive power plants for 8 years

Egypt signs USD 352 mn management contract with Siemens for combined-cycle power plants: Egypt signed on Thursday a USD 352 mn, eight-year contract with Germany’s Siemens AG and its subsidiary Siemens Technologies to operate, maintain, and manage the three combined-cycle plants power plants in Beni Suef, Burullus, and the new administrative capital, Reuters reports, citing the state news agency. Sources had said that payment for the contract, which is due to start in four years, would be split into an EUR 176 mn foreign-currency tranche and a EGP 2.6 bn LCY-denominated component.

Amalie Oil Co and ACPA to explore partnership in Egypt

US motor oil and auto fluids manufacturer Amalie Oil Company signed an MoU with state-owned Alexandria Company for Petroleum Additives (ACPA) which would see them explore the possibility of partnering together on manufacturing or marketing motor oils, according to an oil ministry statement picked up by Al Mal.

EETC signs EGP 163.8 mn contract to build Assiut transformer station

The Egyptian Electricity Transmission Company signed on Thursday a EGP 163.8 mn contract with a consortium comprised of China’s Sieyuan Electric Co and Singapore’s Eastern Green Power PTE to build a 66/ 22 – 11 kV power transformer station in Assiut, according to a ministry statement cited by Al Mal. The project is expected to be completed within 12 months of the signing date.

Infrastructure

EAC issues tender for developing cargo zone in Port Said airport

The Egyptian Airports Company (EAC) issued a tender this month to the private sector for the development of a dedicated cargo zone in Port Said airport, sources from the company said, reports Al Mal.

Basic Materials + Commodities

USDA report expects Egypt wheat imports to slightly increase

Egypt’s wheat imports are expected to increase by 1.62% y-o-y in FY2018-19 to 12.5 mn tonnes from 12.3 mn tonnes, according to a report from the US Agriculture Department’s foreign service. Production should remain flat this year at 8.45 mn tonnes. Meanwhile, Egypt is expected to import 300k tonnes of rice as production drops to 2.8 mn tonnes, down from a projected 3.3 mn tonnes.

Automotive + Transportation

Malaysia’s Proton to resume car shipments to Egypt in October

Malaysia’s Proton-brand cars to Egypt are due to start again next month after a three-year hiatus, according to Paultan. The first batch of 225 cars, out of a total 1,000 slated for a 2018 delivery, are due to arrive at the Alexandria port on 6 October. Another 280 cars will be shipped out after, deputy CEO Datuk Radzaif Mohamed said. The new Saga and Exora models will be among the vehicles made available through local distributor Alpha Ezz El-Arab. Shipments from Proton had ceased after the EGP float in 2016 “made it impossible to price new stock competitively.”

Tuk-tuk drivers given conditions to be allowed to be licensed

Local Development Minister Mahmoud Shaarawy approved a decision that requires tuk-tuk drivers to offer set fares to customers, after registering their vehicle and obtaining a permit to operate in designated routes, ministry spokesperson Khaled Kassem said, according to Al Shorouk. The move comes as the government is taking steps to integrate tuktuks within a regulatory framework.

Dryve partners up with Uber to offer vehicle rental for Uber drivers

Online car rental platform Dryve announced earlier this month that it was partnering up with Uber to launch a new service that would allow clients to rent out their cars to licensed Uber drivers for a share of the profit. Clients are expected to make a monthly profit of EGP 5,000-12,000. The company is collaborating with insurance firm AXA to offer comprehensive car insurances for the registered vehicles, according to Al Mal.

Egypt Politics + Economics

CAPMAS to begin national economy survey in November

State census agency CAPMAS will launch its quinquennial survey of Egyptian business and the economy this November and announce the results by October 2019, Planning Minister Hala El Saeed said, according to Al Shorouk.

Prosecutor General brings corruption charges against Env. Ministry official

Prosecutor General Nabil Sadek brought charges against an official in the Environmental Protection Fund (EPF) for allegedly attempting to embezzle EGP 3 mn in public funds, according to Egypt Today. The EPF is an Environment Ministry initiative that provides financing to eco-friendly projects.

Sports

Aguirre announces the 12 foreign-based players for Egypt-Swaziland AFCON qualifier games

National football team coach Javier Aguirre announced on Thursday the full lineup of overseas-based players set to play Egypt’s third 2019 Africa Cup of Nations qualifier against Swaziland on 12 October, according to KingFut. The squad list includes the same players who took on Niger 6-0 earlier this month, except for Ramadan Sobhi who is yet to recover from his injury. The Pharaohs will be meeting Swaziland on 16 October again in Manzini for the team’s fourth match-up. Egypt currently ranks second in its group with three points from two matches.

On Your Way Out

SIS releases previously unseen Camp David peace accord documents: Egypt’s State Information Service (SIS) released last week official documents from the Camp David summit, outline the terms of the accords on the 40th anniversary of their signing.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 14,083 (-0.1%)

Turnover: EGP 1.4 bn (81% above the 90-day average)

EGX 30 year-to-date: -6.2%

THE MARKET ON THURSDAY: The EGX30 index ended Thursday’s session down 0.1%. CIB, the index heaviest constituent ended up 0.6%. EGX30’s top performing constituents were TMG Holding up 4.9%, Abu Qir Fertilizers up 4.6%, and EFG Hermes up 4.5%. Thursday’s worst performing stocks were Orascom Investment Holding down 8.1%, Egyptian Iron and Steel down 7.2%, and Porto Group down 7.1%. The market turnover was EGP 1.4 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +279.7 mn

Regional: Net Long | EGP +72.5 mn

Domestic: Net Short | EGP -352.2 mn

Retail: 38.9% of total trades | 34.6% of buyers | 43.1% of sellers

Institutions: 61.1% of total trades | 65.4% of buyers | 56.9% of sellers

Foreign: 38.5% of total | 48.4% of buyers | 28.6% of sellers

Regional: 8.1% of total | 10.7% of buyers | 5.6% of sellers

Domestic: 53.4% of total | 40.9% of buyers | 65.8% of sellers

WTI: USD 70.78 (+0.65%)

Brent: USD 78.80 (+0.13%)

Natural Gas (Nymex, futures prices) USD 2.98 MMBtu, (+0.03%, Oct 2018 contract)

Gold: USD 1,201.30 / troy ounce (-0.83%)

TASI: 7,768.31 (+0.50%) (YTD: +7.50%)

ADX: 4,883.42 (-0.01%%) (YTD: +11.03%)

DFM: 2,764.38 (+0.86%) (YTD: -17.97%)

KSE Premier Market: 5,362.75 (+0.77%)

QE: 9,766.33 (-0.40%) (YTD: +14.58%)

MSM: 4,495.31 (+0.23%) (YTD: -11.84%)

BB: 1,340.06 (+0.08%) (YTD: +0.63%)

Calendar

23-24 September (Sunday-Monday): Arab Security Conference on cyber security, Nile-Ritz Carlton, Cairo.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

25 September (Tuesday): President Abdel Fattah El Sisi in New York for UN General Assembly.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

06 October (Saturday): Armed Forces Day, national holiday.

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday- Wednesday) World Travel Market London exhibition, London, England, UK.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.