- FinMin mulls tapping Asian liquidity with issuance of JPY-, CNY-denominated bonds. (Speed Round)

- Gamal, Alaa Mubarak are detained (again). (Speed Round)

- Gov’t signs >USD 1 bn in exploration agreements with Shell, Petronas, others. (Speed Round)

- An update on fall IPOs of Sarwa, Hassan Allam, Rameda. (Speed Round)

- Gov’t expects EGP 2.8 bn in proceeds from sale of 20% stake in AMOC; HSBC confirmed as manager. (Speed Round)

- Daytime heavy truck ban on Ring Road starts today. (Speed Round)

- El Sisi in New York next week. (Up Next)

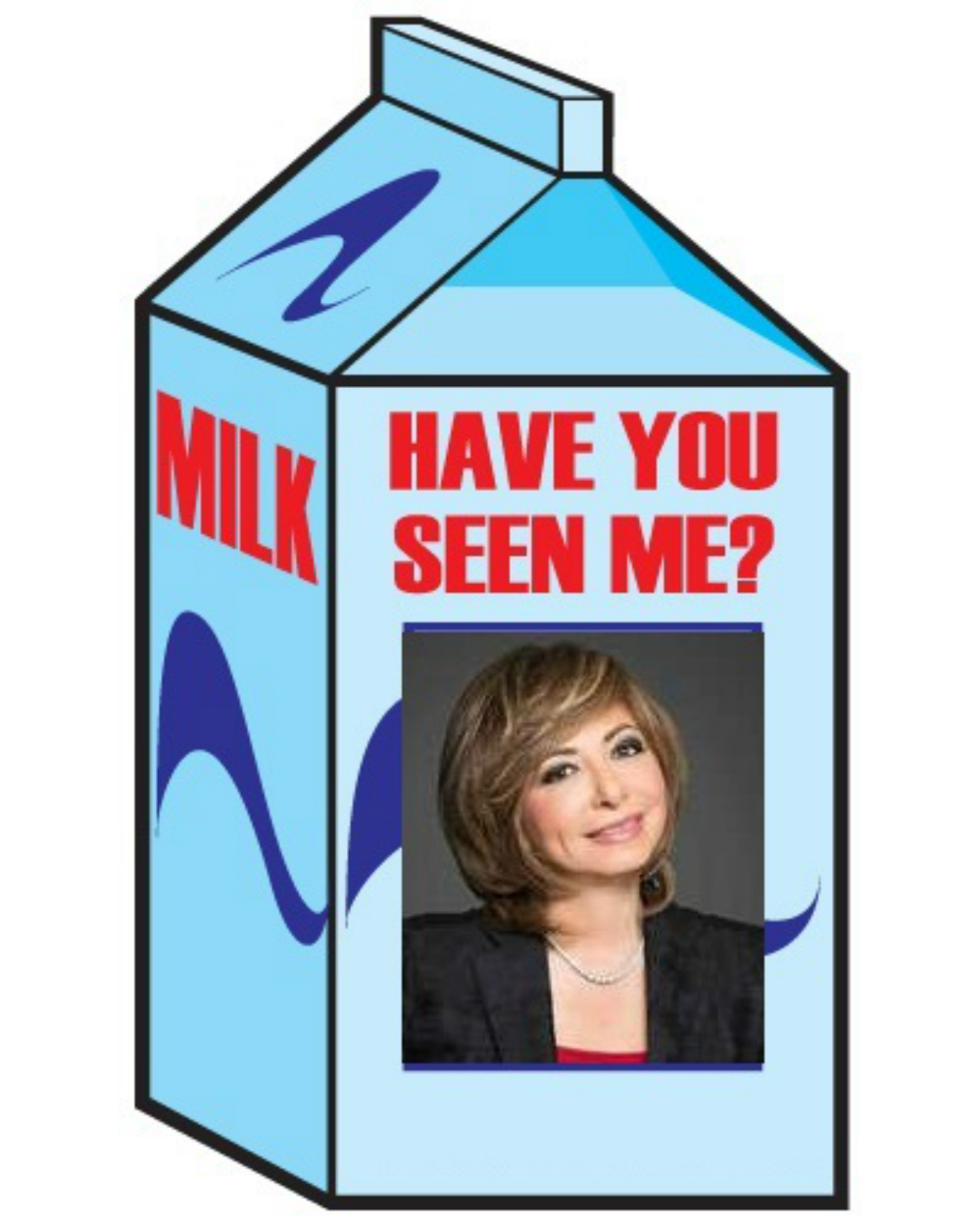

- Our talk show report is back from hiatus. Lamees? Not so much. (Last Night’s Talk Shows)

- The Market Yesterday

Sunday, 16 September 2018

Gamal and Alaa arrested (again)

TL;DR

What We’re Tracking Today

**#6 Daytime ban on heavy trucks on Ring Road starts today: Heavy trucks will only be allowed on the Ring Road around the nation’s capital between midnight and 6:00 am under a ban that came into effect overnight, according to a state news agency report picked up by Ahram Online. Heavy trucks carrying more than four tonnes of cargo will be required to use the Regional Ring Road instead. Would that pickup trucks were included in the ban…

President Abdel Fattah El Sisi will inaugurate today new schools following the Japanese curriculum, Al Masry Al Youm reports. Education Minister Tarek Shawky had announced last week that 34 Japanese schools across 19 governorates will be operational by 22 September.

Pope Tawadros II is on a pastoral tour of the United States. The pope presided yesterday over mass during the inauguration of the Holy Family Coptic Church in Boston and the Queen Helen Coptic Church in New York.

A Slovak business delegation is in town kicking the tires on potential trade and investment opportunities.

Ethiopia and Eritrea will sign a peace agreement today in Jeddah, Saudi Arabia. United Nations Secretary General Antonio Guterres is due to attend, according to Washington Post. The move comes just a week after the two countries reopened their shared border for the first time in 20 years.

Abu Dhabi Financial Group revises bid to for Abraaj’s ME funds: Abu Dhabi Financial Group (ADFG) submitted a revised bid to acquire the management rights for Abraaj’s Middle East funds, according to a letter from ADFG seen by Reuters. The new offer includes up to USD 6 mn for the audit and litigation financing as well as a USD 10 mn credit facility to fund the operations of the Middle East funds. This is in on top of USD 10 mn earmarked separately for the fund manager’s liabilities. “This means there is a zero capital call requirement from all the 200 unique investors in the Middle East funds which will clear one of the major hurdles going forward for the protection of the assets,” says the letter. ADFG is up against Actis, a consortium formed by Kuwait’s Agility, and New York-based Centerbridge Partners in its bud to acquire management of the funds.

Turkey’s central bank raised interest rates on Thursday, giving the TRY a much-needed boost, the Financial Times says. Currencies in South Africa, Russia, and Mexico all gained against the USD last week, slightly calming investor worries. Turkish President Recep Tayyip Erdogan, who last week appointed himself manager of his country’s sovereign wealth fund, had called on the central bank to slash rates further.

And the investment bankers shall inherit the earth: With Lloyd Blankfein set to step down by the end of the month, it’s increasingly clear that Goldman’s investment bankers are in the driver’s seat, writes Bloomberg. “Three of the most important roles now are going to be held by executives who rose through the dealmaking unit, overhauling the masthead of a firm that for years was Wall Street’s dominant trading powerhouse.” The Wall Street Journal is taking the same angle. Meanwhile, Reuters thinks JPMorgan CFO Marianne Lake is the most likely candidate to succeed Jamie Dimon whenever he decides to head off into retirement.

Mary “Queen of the Internet” Meeker is leaving Kleiner Perkins to start her own firm amid a split over how to balance between growth-stage and later-stage investing. “The Silicon Valley firm’s growth-investment team focused on later-stage funding is leaving the firm, spurred partly by internal differences over investing strategy and resulting in the departure of famed former Morgan Stanley analyst Mary Meeker,” the Wall Street Journal reports. The NYT also has the story. Meeker is best known for her exhaustive annual internet trends report. You can catch the 2018 edition here.

Also “de-merging” is the South Africa-UK hybrid Investec, the Financial Times’ Lex column notes, saying the firm is spinning off its (potentially undervalued) asset management franchise.

It’s Financial Crisis Week in the international business press, with many looking set to continue their 10-year anniversary coverage after zeroing in on the 15 September collapse of Lehman Bros. We’ll have picks throughout the week. Start today with the FT’sInvestment winners and losers 10 years after the crash.

92% of scripted TV shows have no series regulars from our part of the world. And if they do? There’s a 78% chance the actor is playing a “terrorist, agent, soldier or tyrant,” according to activist group MENA Arts Advocacy Collection. Check out founder Azita Ghanizada’s twitter (one of her co-founders is the son of Egyptian immigrants) and then go read the group’s Terrorists & Tyrants report (pdf). Tap / click the image above for a larger version if you want to pinch and zoom.

The secrets of Jeff Bezos’ success? “Make three good decisions a day and no meetings before 10 a.m.,” the WSJ suggests, picking up on remarks he made at a Thursday event. He’s in bed early and tries to have finished making important decisions by 5pm. Read more here.

Enterprise+: Last Night’s Talk Shows

**#8 LAMEES WATCH- We return to our regular daily talk show reports with the Lamees Watch segment, where it’s now three weeks since she was due to return to the host’s chair at Hona Al Asema. We cannot ascertain where she is or why she’s missing, but there are rumored sightings of her working undercover as a McDowell’s sweeper in Queens, NY.

The Other One is back, though. Amr Adib is now helming MBC Masr’s “Al Hekaya.” The show will run from Saturday to Monday, sharing a time slow with Yaduth fi Masr, which will now run from Tuesday to Thursday. This first episode of Al Hekaya focused everything from political and economic conditions in Turkey to the banning of trucks on the Ring Road (effective today) and a recently launched anti-bullying campaign (watch, runtime: 1:16).

El Ebrashi tapped to replace Adib as Kol Youm host: Dream TV host Wael El Ebrashi is now the host of of Kol Youm, replacing Adib following his resignation, Al Mal reports. El Ebrashi’s three-year run as host will begin next month.

Elsewedy will not seek another term as Support Egypt leader: Mohamed Elsewedy — leader of the Support Egypt Coalition, the largest block of MPs in the House of Representatives — announced that he would not seek another term as coalition head, in a statement picked up by Al Masry Al Youm. Elsewedy, who also heads the Federation of Egyptian Industries, gave no explanation other than to say there was a need for “new blood.” House of Representatives spokesman Salah Hassaballah told Al Hayah fi Masr that the coalition’s general assembly will be held tomorrow to pick a new leader (watch, runtime: 21:27).

Hospital deaths in the spotlight: Featuring heavily on the airwaves and in the local press are the deaths of three people following dialysis sessions at Derb Negm hospital in Sharqiya, Sharqiya governor Mamdouh Ghorab told Hona Al Asema’s Lama Rady that 13 others are currently receiving medical treatment following dialysis sessions at the hospital. Health ministry spokesman Khaled Megahed spoke with Al Hekaya’s Adib on the topic (watch, runtime: 4:21).

The Prosecutor General has opened has opened an investigation into the deaths and the hospital’s dialysis unit has been shut down, Megahed tells Masaa DMC (watch, runtime: 8:04).

Last week’s hike in custom duties is still being chewed over, with Customs Authority head El Sayed Negm being interviewed on Hona Al Asema. He played up cuts to tariffs that came into effect at the same time, saying including green vehicles, meds and TV sets would face lower levies. Negm said the changes will help bolster local manufacturing (watch, runtime: 41:03).

In miscellany last night: Hona Al Asema brought in Interior Minister Medhat Koretam to discuss the daytime ban on trucks on the Ring Road (watch, runtime: 1:47:00). The decision, which took effect overnight, was also covered on Masaa DMC (watch, runtime: 6:55) and Al Hekaya (watch, runtime: 7:47). Meanwhile, the selection of Yomeddine as Egypt’s entry for the Best Foreign Language category at the Oscars saw co-producer Mohamed Hefzy make an appearance last night (watch, runtime: 7:55).

Speed Round

**#1 FinMin mulls tapping Asian liquidity with issuance of JPY-, CNY-denominated bonds: The Finance Ministry appears to have revived plans to hold a foreign currency-denominated bond issuance, according to remarks by Finance Minister Mohamed Maait in an interview with state-owned daily Al Ahram. The Finance Ministry had earlier suggested it may back away from FX-denominated issuances as the global selloff in emerging markets assets prompted concerns about Egypt’s foreign debt position. The Madbouly government had said this summer that it would revisit the bond issuance this fall and has since made debt-control a key fiscal policy.

Ministry dusts off plan for JPY- and CNY-denominated bonds: The ministry appears to be reviving a plan to issue international bonds in the Japanese and / or Chinese currencies. Maait suggested Asian markets are liquid and would have appetite for Egyptian issuances. The plan was first proposed in January 2017, with sources saying at the time saying the ministry had reached out to the Japanese Bank for International Cooperation for a guarantee on JPY-denominated bonds.

Roadshow in the GCC for longer tenor bonds: Maait also hinted that the ministry could be taking a longer-tenor bond offering to the Gulf Cooperation Council markets. He implied that the ministry was planning a road show there, though he gave no details on the timing. Issuing longer tenor bonds is a key plank of the government’s debt control strategy.

Analysts see central bank leaving rates on hold when it meets a week from Thursday: Where once the orthodoxy was that the central bank would cut rates heading into the fourth quarter, now the pundits see rates left on hold — and you can thank the Emerging Markets Zombie Apocalypse, as we’ve been arguing for some time now.

What they’re saying: Leaving rates where they are preserves Egypt’s global competitiveness in the battle for hot money amid a global sell-off in EM assets, Pharos’ Radwa El Swaify told Al Shorouk. With headline inflation seen easing to 13% in September, from 14.2% in August, the MPC could move to cut rates by 100 bps in the final quarter of the year, according to El Swaify, who notes that the scenario hinges on an improvement in global economic conditions. CI Capital’s Hany Farahat and Beltone Financial’s Alia Mamdouh hold similar views, suggesting the CBE will keep rates high to mitigate outflows from government bonds and treasuries as well as to curb rising inflation. Annual Inflation had inched up last month after easing slightly in July from a 14.4% high in June increases to the costs of fuel, power, and transportation in July, as the government continued to gradually phase out subsidies.

**#2 Gamal, Alaa Mubarak are detained (again) along with Hassan Heikal, Yasser El Mallawany: A Cairo Criminal Court ordered the arrest of Gamal and Alaa Mubarak and seven others in the latest long-drawn out saga of what the local press likes to call the “stock market manipulation” case. The sons of ousted President Hosni Mubarak and their co-accused were detained on Saturday on charges of insider trader in the sale of Al Watany Bank of Egypt to the National Bank of Kuwait, Reuters reports. Other defendants in the case include Former EFG Hermes Co-CEOs Hassan Heikal and Yasser El Mallawany. The trial has been adjourned to 20 October.

Surprise arrest comes despite court panel report exonerating defendants: The surprise arrest comes despite a report by a panel of experts appointed by the Cairo Criminal Court to give their views on the case, which appears to recommend most charges against the defendants be dropped. The report concludes that the trades made by the defendants during the sale of Al Watany complied with capital market regulations of the time. The panel reportedly includes Vice Minister of Finance Ahmed Kouchouk, deputy head of the Financial Regulatory Authority Reda Abdel Moaty, and the former deputy head of the EGX Mohsen Adel. You can catch part 1 (pdf) and part 2 (pdf) of the report courtesy of Al Mal.

It is still unclear why the court disregarded the report. El Watan reporter Haitham Boraai told Masaa DMC that the court concluded that the report was somehow incomplete (watch, runtime: 4:52).

The story is topping coverage of Egypt in the foreign press, with a number of publications questioning the timing of the surprise arrests given that the trial has been proceeding without incident. The Associated Press’ Hamza Hendawi is noting that the arrests came after some local press outfits warned the Mubaraks against seeking a role in public life after Gamal Mubarak recently became more publicly visible. Others, including the Wall Street Journal, are stressing the brothers’ notoriety before the 2011 uprising.

**#3 Gov’t signs >USD 1 bn in exploration agreements with Shell, Petronas, others: The Oil Ministry signed a deep-water oil and gas exploration agreement with Royal Dutch Shell and Malaysia’s Petronas worth around USD 1 bn, according to an Oil Ministry statement on Saturday (pdf). The agreement would see the two companies drill eight wells in the West Nile Delta area. The government also signed a second USD 10 mn agreement with Rockhopper, Kuwait Energy and Canada’s Dover Corporation for exploration in the Western Desert, a ministry statement said.

**#4 IPO WATCH- Update on the fall season. The public subscription notice for Sarwa Capital’s sale of up to 40% of the company’s shares on the EGX should be out soon, sources close to the transaction said on Thursday. Youm7, meanwhile, suggests that Sarwa should wrap bourse paperwork necessary for its offering within a week. CEO Hazem Moussa had previously pegged the transaction’s value at USD 120-125 mn. Hassan Allam Holdings and pharma manufacturer Rameda Pharma have reportedly also submitted their paperwork to the EGX ahead of their planned IPOs, the sources added. We had previously been told that Rameda was hoping to list 35-45% of the company to raise EGP 1.9-2.3 bn. We had also heard chatter last month that Hassan Allam was eyeing an October offering that may also include a global depository receipt program.

**#5 IPO WATCH- Gov’t expects EGP 2.8 bn in proceeds from sale of 20% stake in AMOC; HSBC confirmed as manager: The government is hoping to raise EGP 2.8 bn from the sale of a 20% stake of the Alexandria Mineral Oils Company (AMOC) on the EGX, according to a Finance Ministry statement on Friday picked up by Reuters. The ministry also confirmed our exclusive report from last week that HSBC has been tapped to manage the transaction. Talks are ongoing with HSBC to determine the best time for the offering, Minister Mohamed Maait said. AMOC is expected to pilot phase one of the state’s privatization program in October alongside Eastern Company, Maait said last week. EFG had also been tapped to manage Eastern’s 4.5% stake sale. Heliopolis Housing, Abu Qir Fertilizers, and Alexandria Containers & Cargo Handling are also in line to to sell shares this year. A second wave of companies is expected to follow in early 2019.

IPO WATCH- BPE Partners could be offering shares of real estate subsidiary Al Ismaelia on the EGX in 2020, founding partner and Managing Director Alaa Sabaa said. Al Ismaelia is carving out a niche for itself as the “Solidere” (the company, not the district) of Downtown Caio, where it is leading an urban renewal drive. BPE is also grooming SME finance subsidiary Ebtikar for an EGX listing within the coming two years. Sabaa said Al Ismaelia will spend EGP 150 mn over the next 12 months on work at six historic buildings in Downtown Cairo. The work will drive revenue growth until the company’s initial public offering. Al Ismaelia will begin putting the buildings up for rent as of next year, according to Sabaa. Al Ismaelia had previously done widely acclaimed work on the Viennoise building and rented it out to out friends at Sarwa Capital.

BPE is also in advanced talks to exit its investment in the Cairo Kidney Center and dissolve its midcap fund as it continues to prune its portfolio, Sabaa added. No further details on the transaction were provided.

INVESTMENT WATCH – French companies including Air Liquide and L’Oréal are looking expand their investments in Egypt, according to a an Investment Ministry statement. Air Liquide will invest as much as EGP 2 bn in the coming three years and L’Oreal has allocated some EUR 50 mn to build a Cairo-based facility that it hopes will become an export hub for the MENA region, the companies told Minister Sahar Nasr during a meeting in Cairo. Also on the list was Groupe SEB, which said it would invest more than EUR 30 mn in FY2018-19. A number of other companies — including Schneider Electric, Carrefour, NAOS, Mortimer Harvey, Edison, Sanofi, Credit Agricole Bank — also said they were eyeing potential investments, the ministry suggested.

LEGISLATION WATCH- Housing Ministry, NUCA committee to draft new legislation to govern real estate investment: Prime Minister Mostafa Madbouly established a new committee on Thursday tasked with drafting legislation regulating investment in real estate, according to a statement carried by Al Mal. The move aims to remedy the absence of a clear legal framework to manage and regulate relationships between different parties involved in the sector, according to the statement, which gives no indication of when we can expect to see a draft bill. The committee is made up of officials from the Housing Ministry and New and Urban Communities Authority (NUCA), as well as members of investor and business associations to represent the interests of the private sector.

Russia institutes tougher checks on outbound wheat: Russian watchdog Rosselkhoznadzor said on Friday that it would institute new and tougher checks on wheat exports after a rise in complaints in the past three months from its major grain buyers including Egypt, Vietnam, and Indonesia, Reuters reports. Rosselkhoznadzor said checks of 5-10 days were needed for shipments bound for Egypt, Ecuador, Vietnam, Sudan, Venezuela and Israel, but noted that these were not new and were not aimed at limiting exports. Some traders said the new controls were excessive and could cause delivery disruptions on signed contracts.

Traders are also fearful that the move would usher in new trade restrictions. Traders had previously said Russia could consider restricting exports once they reach 30 mn tonnes of grain this season, which started on July 1. The country has exported 9.8 mn tonnes of grain so far.

MOVES- Ashraf Halim has stepped down as deputy CEO of Orange Egypt, he told Youm7. Halim was appointed as deputy CEO in July 2017 and was from 2011 the company’s chief commercial officer.

Egypt is Africa’s top investment destination, according to Rand Merchant Bank’s (RMB) latest edition of Where to Invest in Africa. According to the research, Egypt boasts the continent’s highest GDP and consumer market, followed by South Africa, Morocco, Ethiopia, and Kenya. That said, the research also finds that “efficient infrastructure is essential to uncovering opportunities and unlocking Africa’s growth potential,” says South Africa’s IOL (The full report is presently available only for RMB clients and is accessible here.)

Up Next

The Emmys are tomorrow. The entertainment nerds among us are excited.

Finance Minister Mohamed Maait will be at AmCham on Tuesday, 18 September for a lunch. The minister will speak about “Egypt’s financial reform agenda.” Members and their guests can register here.

**#7 El Sisi in New York: President Abdel Fattah El Sisi will be in New York on 25 September to attend the general assembly of the United Nations, according to Al Masry Al Youm. Expect the president to meet on the sidelines with world leaders including US President Donald Trump, German Chancellor Angela Merkel nand French President Emmanuel Macron.

The E-Commerce Summit in Egypt takes place on Wednesday, 26 September.

The president of Italy’s Chamber of Deputies, Roberto Fico, is set to visit Cairo this month, Ahram Online reports.

The Egyptian-Sudanese ministerial committee will meet at the end of this month ahead of a presidential summit set to be held in Khartoum in October.

The Egypt-Romania business council will meet in Bucharest from 7-11 October, according to Al Mal.

Image of the Day

Egyptian photographer on NYT list: Egyptian photographer Hadeer Mahmoud made it onto the New York Time’s list of 12 up and coming photographers to watch. Mahmoud was recognized for her project “Love, Loss and Longing,” which focuses on the stories of three women whose partners have been detained. “My goal was to show the injustice the women face in every way,” she said.

Egypt in the News

Driving the conversation on Egypt this morning: The arrest of Gamal and Alaa Mubarak in the ongoing (neverending) Al Watany Bank case. As we note in Speed Round, above, former EFG Hemes bosses Hassan Heikal and Yasser El Mallawany were also reportedly arrested yesterday and ordered detained until the next hearing in the case, presently scheduled for late October.

Lebanese insult-video tourist out of jail, leaves the country: The Lebanese tourist jailed for posting a crude video on Facebook deemed “insulting” to Egypt has left the country after she was released from custody. The Wall Street Journal and Reuters have coverage.

Other headlines worth a look this morning:

- Let’s grow soy: Egypt’s climate offers perfect conditions for growing soy, which requires four times less water than rice, Cargill says, according to Hellenic Shipping News.

- The latest in Holiday-gate: The UK will begin on Tuesday inquests into the death last month of a couple in Hurghada, BBC reports.

- 802 tombs located: A joint Egyptian-foreign expedition pinpointed the locations of 802 tombs under the desert in Lisht village, south of Al Ayyat, in Giza, according to National Geographic.

- We hide stuff from our families? Young Egyptian women are often forced to hide their true worldviews from their families, writes Eman El Sherbiny for Open Democracy.

- FGM: African countries, including Egypt, are failing to enforce laws that protect women from FGM, according to a report by the Thomson Reuters Foundation.

- Death sentences: An Egyptian court sentenced three men to death and another 41 to life on Thursday over a 2013 attack on a police station south of Cairo, AP said in a report.

Energy

Egypt signs EUR 20 mn solar energy agreement with TSK

Egypt’s New and Renewable Energy Authority signed a EUR 20 mn agreement with Spanish energy giant TSK Grupo on Thursday to set up a 26 MW solar park in Kom Ombo in Upper Egypt, Ahram Online reports, citing the state news agency. The park will be complete by mid-2019 and will be funded by the French Development Agency through a EUR 40 mn loan program to renewable energy companies.

Infrastructure

Maersk to go on Asian tour to win back shipping alliances to East Port Said

Maersk is embarking on a new Asian tour in October that will aim to win back shipping alliances that had ceased operations at East Port Said, which it helps operate, due to protest high fees, Al Mal reports. Maersk will also be approaching new shipping companies and alliances in the hopes of attracting them to the port in East Port Said. Last month, Ocean Alliance — which includes CMA CGM Group, APL, Evergreen, and China’s COSCO Shipping — had decided to suspend operations at East Port Said due to high costs. An alliance made up of Yang Ming, Hapag-Lloyd, K Line, Mitsui O.S.K. Lines, and the NYK Group had retired from East Port Said last year after the government decided to raise fees by nearly 100%. Egypt has been offering discounts and other incentives to attract more traffic to its ports, with President Abdel Fattah El Sisi suggesting that port fees would be reduced to make them competitive.

Basic Materials + Commodities

Egypt to begin exporting garlic to Indonesia

Egypt will start exporting garlic to Indonesia after quarantine officials successfully concluded talks, the agriculture ministry said in a statement on Thursday picked up by Youm7. Agriculture officials have been targeting new export markets lately and are eyeing countries in East Asia as potential export markets for products include dates, grapes, and pomegranates.

Government starts buying locally produced rice until mid-November

The Supply Ministry began yesterday purchasing locally produced rice for this harvest season which ends in mid-November, Al Shorouk reports. The government had announced it will pay its farmers EGP 4,400-4,700 a tonne for rice paddy. It’s not yet clear how much the Egyptian government is seeking to purchase.

Manufacturing

Date packager HB to install three new production lines worth USD 15 mn

Date packager HB signed contracts to install three production lines at its facilities from Italy and China worth USD 15 mn, head of exports Basma Al Banna said, according to Fresh Plaza. The new lines, which will be set up at the company’s factories in New Valley and Menofiya factories, are expected to add around 300 tonnes per day to the company’s production capacity. 80% of the output is earmarked for export, Al Banna added

Health + Education

Egypt launches nationwide Hepatitis C survey in October

Egypt will run a nationwide screening from October to April 2019 to detect and treat Hepatitis C patients, according to an Ittihadiya statement. The program was announced last February and aims to rid Egypt of Hepatitis C by 2020. The program, which has received funding from United Nations World Health Organization, aims to identify around 50 mn patients.

Telecoms + ICT

TE allocates USD 10 mn to maintenance and operations work on subsea MENA cable

Telecom Egypt has reportedly allocated USD 10 mn to installation and maintenance work on its subsea MENA cable, sources tell Al Mal. TE had acquired MENA Cables from Orascom Telecom Media and Technology earlier this year in a USD 90 mn transaction, of which USD 40 mn represented the cost of the cable, with USD 50 mn meant to settle old debts (pdf). MENA Cable is licensed in Egypt and Italy to operate a submarine telecoms system connecting Europe to the Middle East and Southeast Asia. EFG Hermes Investment Banking was buy-side advisor on the transaction.

Automotive + Transportation

Russian car makers interested in El Nasr Automotive

Russian car makers are interested in partnering up with the Egyptian government to restart operations at El Nasr Automotive, Moscow’s trade representative in Cairo Nikolai Aslanov said, according to Ahram Gate. This came despite statements from Public Enterprises Minister Hisham Tawfik that the government had no intention of giving ownership stake to foreign investors in El Nasr but was looking to sign a development agreement. He did not elaborate. The government has been in on-again-off-again talks with various foreign companies in the last few years in hopes of resurrecting the defunct Nasser-era car manufacturer. The company signed a partnership agreement with Romanian tractor manufacturer Tractorul UTB S.A. Universal on Saturday to begin producing Romanian U650 tractors, company chairman Atef El Qelini told Al Ahram.

Auto sales jump to 96.3k vehickes in 7M2018

Total auto sales jumped 38.1% y-o-y in the first seven months of 2018 with 96,381 vehicles sold, according to figures from the Automotive Information Council (AMIC). Passenger car sales grew 29% in 7M2018 to 69,901 cars, up from 49,617 last year. Bus sales also rose 13.9% compared to the same period last year.

Other Business News of Note

Souq opens up new logistics center in 10 Ramadan City

Amazon subsidiary Souq.com inaugurated a new logistics center in 10 Ramadan City, according to Youm7. No details on the investment value was disclosed, but we had earlier noted that Mintra Group was teaming up with Souq to establish two logistics centers with initial investments of EGP 1 bn.

Nasr approves new model contract for establishing companies under new Companies Act

Investment Minister Sahar Nasr signed off on Thursday on the new model contract to establish joint stock, limited liability, and single-shareholder companies, according to a ministry statement. The amendments bring the contracts in line with the new Companies Act.

Legislation + Policy

Gov’t to use fines to enforce e-payments for gov’t services and transactions in Jan

The Finance Ministry will enforce mandatory electronic payments to government bodies in January 2019 as per the newly amended Government Accounting Act, according to a ministry statement cited by the local press. This will include fines.

Egypt Politics + Economics

El Sisi ratifies amendments to two education aid agreements with US

President Abdel Fattah El Sisi ratified on Thursday amendments to aid agreements with the US government related for education initiatives targeting school and higher education degrees, according to local media reports. The two agreements were signed on 26 September 2017.

Egypt court suspends ruling that allows bearded police to return to work

An Egyptian court has suspended a ruling that allowed bearded policemen to return to work, AFP cited a judicial source as saying in a report picked up by News24. An appeals court in July had ruled that bearded officers could stay on the force.

National Security

Egyptian, Pakistani navies holds drills in the Mediterranean

Egypt’s naval forces held joint military exercises with their Pakistani counterparts on Thursday, as Pakistani military ship SAIF PNS passed through the country, Youm7 reports. The drills featured a series of field exercises and military maneuvers.

Sports

Egypt finishes first with 44 medals in the 13th CANA African swimming championships

Egypt claimed the first place in the 13th CANA African swimming championships, which wrapped up on Saturday in Algiers, winning 27 gold, 14 silver, and 4 bronze medals, Al Ahram reports. Egyptian swimmer Mohamed Sami won best player award after snatching 11 golds.

Egypt meets England in the final of women’s world squash championships

Egypt will face England this morning (9:30 CLT) at the final of this year’s CGG WSF Women’s World Team Squash Championship held in Dalian, China reports insidethegames.biz. In other squash news, Youssef Soliman secured a win at The International Squash Tournament in Hong Kong and Rowan El Arabi secured women’s honour at The International Squash Tournament in Pakistan, according to Dawn.

On Your Way Out

The International Samaa’ Festival for Spiritual Music & Chanting will kick off in Cairo next week, with musicians from 20 countries expected in attendance, Reuters’ Arabic service reports. Tap or click here for more about the event.

Around 200 objects discovered from Egypt’s sunken cities will be exhibited at the USA’s Minneapolis Institute of Art on 4 November, according to Star Tribune. The items include some 16-foot-tall sculptures of pharaohs and queens, gold coins, and jewelry.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 15,309 (-1.2%)

Turnover: EGP 601 mn (25% below the 90-day average)

EGX 30 year-to-date: +1.9%

THE MARKET ON THURSDAY: The EGX30 index ended Thursday’s session down 1.2%. CIB, the index heaviest constituent ended down 0.7%. EGX30’s top performing constituents were Global Telecom up 0.8%, Emaar Misr up 0.7%, and Qalaa Holding up 0.6%. Thursday’s worst performing stocks were Porto Group down 4.4%, Elsewedy Electric down 3.7%, and Egyptian Iron and Steel down 3.5%. The market turnover was EGP 601 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -44.5 mn

Regional: Net Long | EGP +19.6 mn

Domestic: Net Long | EGP +24.9 mn

Retail: 56.8% of total trades | 58.0% of buyers | 55.7% of sellers

Institutions: 43.2% of total trades | 42.0% of buyers | 44.3% of sellers

Foreign: 29.1% of total | 25.4% of buyers | 32.8% of sellers

Regional: 8.6% of total | 10.3% of buyers | 7.0% of sellers

Domestic: 62.3% of total | 64.4% of buyers | 60.2% of sellers

WTI: USD 68.99 (+0.58%)

Brent: USD 78.09 (-0.12%)

Natural Gas (Nymex, futures prices) USD 2.77 MMBtu, (-1.77%, October 2018 contract)

Gold: USD 1,201.10/ troy ounce (-0.59%)

TASI: 7,590.65 (-0.59%) (YTD: +5.04%)

ADX: 4,934.44 (-1.17%) (YTD: +12.19%)

DFM: 2,809.87 (-0.82%) (YTD: -16.62%)

KSE Premier Market: 5,348.79 (+0.36%)

QE: 10,021.96 (+0.32%) (YTD: +17.58%)

MSM: 4,558.51 (+0.62%) (YTD: -10.60%)

BB: 1,345.04 (+0.34%) (YTD: +1.00%)

Calendar

16 September (Sunday): Creative Industry Summit 2018, Four Seasons Nile Plaza, Cairo.

17-19 September (Monday-Wednesday): INTERCEM Cairo to Cape Town cement industry conference, Dusit-Thani LakeView, Cairo.

18-21 September (Tuesday-Friday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Cairo, Egypt.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

23-24 September (Sunday-Monday): Arab Security Conference on cyber security, Nile-Ritz Carlton, Cairo.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

25 September (Tuesday): President Abdel Fattah El Sisi in New York for the UN General Assembly.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

06 October (Saturday): Armed Forces Day, national holiday.

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday- Wednesday) World Travel Market London exhibition, London, England, UK.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.