- Fall IPO season has officially begun as CIRA and Sarwa announce intentions to float. (Speed Round)

- Credit Suisse is bullish on Egypt, economic recovery pushed along by tailwinds next year. (Speed Round)

- Egyptian citizens are “footing the bill” for Egypt’s energy hub ambitions, says Wall Street Journal, glossing over that little thing called “subsidies.” (What We’re Tracking Today)

- West African consume finance player Oragroup rejects Beltone acquisition offer. (Speed Round)

- TAQA Arabia, Hassan Allam break ground on EGP 1.35 bn solar plant in Benban complex. (Energy)

- Advisors providing valuation services need to go register with the FRA starting today. (Legislation + Policy)

- Egypt, Vietnam aim to boost bilateral trade to USD 1 bn, ink MoUs. (Diplomacy + Foreign Trade)

- As the Mo Salah flap continues: When you can’t blame foreign fingers, blame the agent. (Better still: Maybe the agent is a foreigner?) (Last Night’s Talk Shows)

- The Market Yesterday

Tuesday, 28 August 2018

Fall IPO season begins as CIRA, Sarwa release ITFs

TL;DR

What We’re Tracking Today

The nation is deep in the grip of the summer news slowdown, which we would normally celebrate, except (a) the resident 11-year-old started middle school yesterday, so it feels like fall; (b) we see a busy fall as Egypt’s IPO pipeline runs headlong into mixed sentiment on emerging markets and (c) well, we just want to get on with business.

That said, two of the fall’s marquee IPOs were formally announced yesterday as both Sarwa Capital (the consumer and structured finance provider that effectively created from scratch the nation’s market for securitized offerings) and CIRA (the nation’s top private-sector education player) issued their intentions to float shares on the Egyptian Exchange. We have chapter and verse in Speed Round, below.

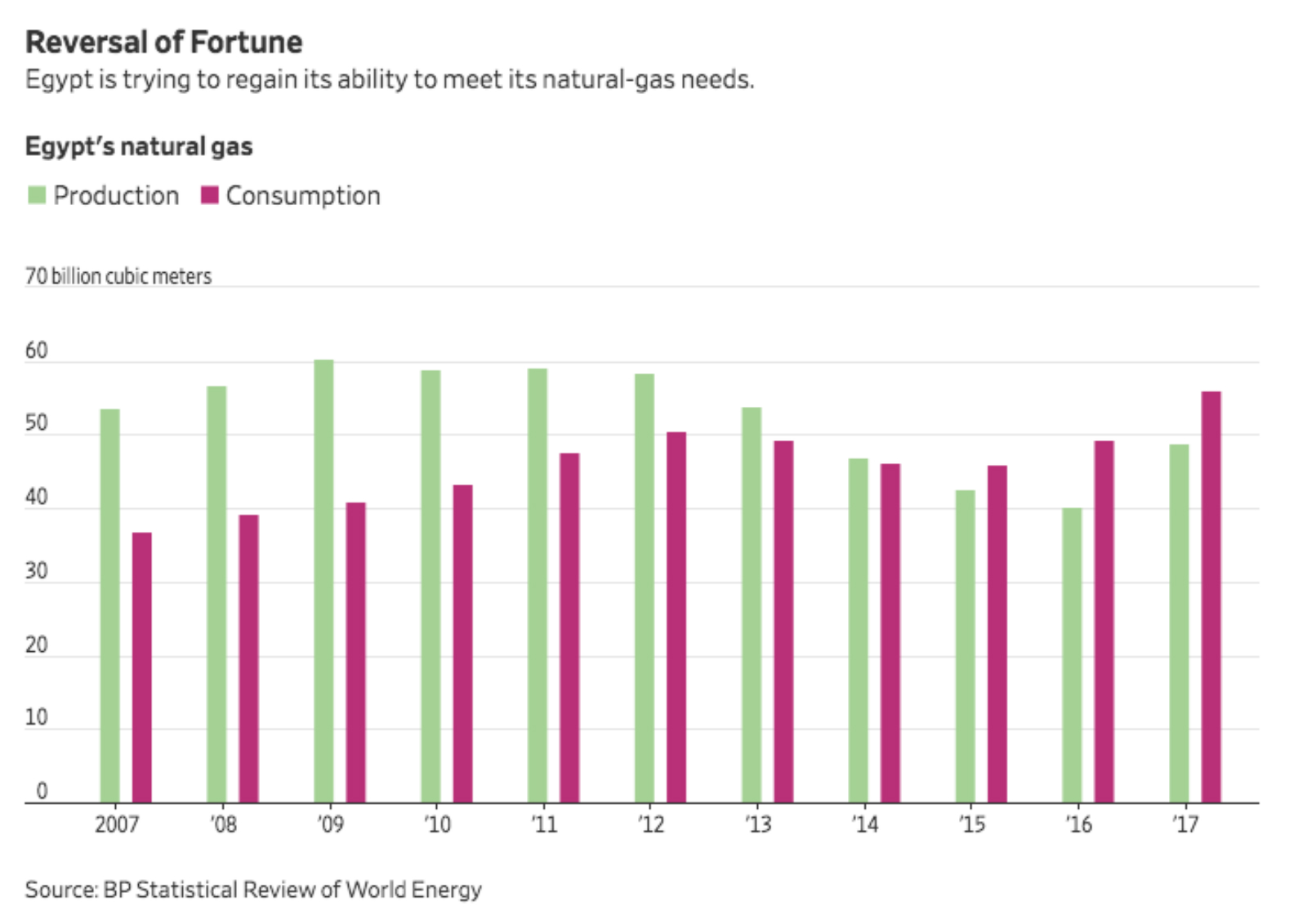

First they ignore you, then they laugh at you, then they fight you, then you win: Setting aside that Gandhi never uttered those words: You know one of your pet economic policies is getting traction when the international business press does a drive-by on it. And so it is with Egypt’s dream of emerging as the region’s premier energy hub, where the natural-gas side of the model gets scrutiny this morning from the Wall Street Journal.

The crux of the WSJ’s argument: Egyptian citizens are “footing the bill” for the country’s bid to become an energy exporter. The paper writes that the Sisi administration has “coaxed” major international oil companies to return to Egypt by paying them higher prices for natural gas and putting the burden of payment on consumers by raising electricity and gas prices. The strategy has attracted investment from the likes of Royal Dutch Shell, BP, and Eni, but some citizens are resentful: News of major hydrocarbon discoveries has come with rising costs of living.

One tiny problem: Nowhere does the story mention that those rising prices to consumers (and industry, let’s not forget) have come as the state phases-out ruinous energy subsidies that were (a) a key factor in our economic slump post-2011 and (b) disproportionately benefited not the poor, but rich folk whose energy-hungry businesses, SUVs and A/Cs, et cetera, were all subsidized at the cost of spending on social welfare and infrastructure.

But hey: Our energy dreams have made the front page (digital) of the Wall Street Journal, complete with a single-sentence kick in the pants to close it out from veteran analyst Robert Springborg, who has won attention in Egypt post-2011 for his views on the military’s involvement in the economy. Go read In Egypt’s Vision of Energy Independence, Egyptians Pay More.

Meanwhile:

There wasn’t a peep yesterday about Foreign Minister Sameh Shoukry and Egyptian intelligence chief Abbas Kamel, who were both due to have arrived in Addis Ababa for talks with Ethiopian Prime Minister Abiy Ahmed on the Grand Ethiopian Renaissance Dam (GERD). The biggest news of late out of Ethiopia of late: Ahmed has lined up USD 1 bn in direct budget support from the World Bank and continues to make nice with China, where he will be meeting with top officials during a September 3-4 visit to Beijing. China is Ethiopia’s largest trading partner and biggest foreign investor, according to Abiy’s chief of staff.

Mexico and the US may be edging toward a de-escalation of trade tensions, but it’s a bit early to be singing Hosanna to lords of trade. The global business press is making a lot of hay this morning out of news that the United States and Mexico agreed yesterday to renegotiate the terms of the North American Free Trade Agreement (Nafta) after more than a year of stalled negotiations, according to Reuters. The pressure is now on Canada “to agree to new terms on auto trade and dispute settlement rules to remain part of the three-nation pact.” Trump cranked up the heat, claiming the US would go for a bilateral agreement with Mexico if Canada opts out.

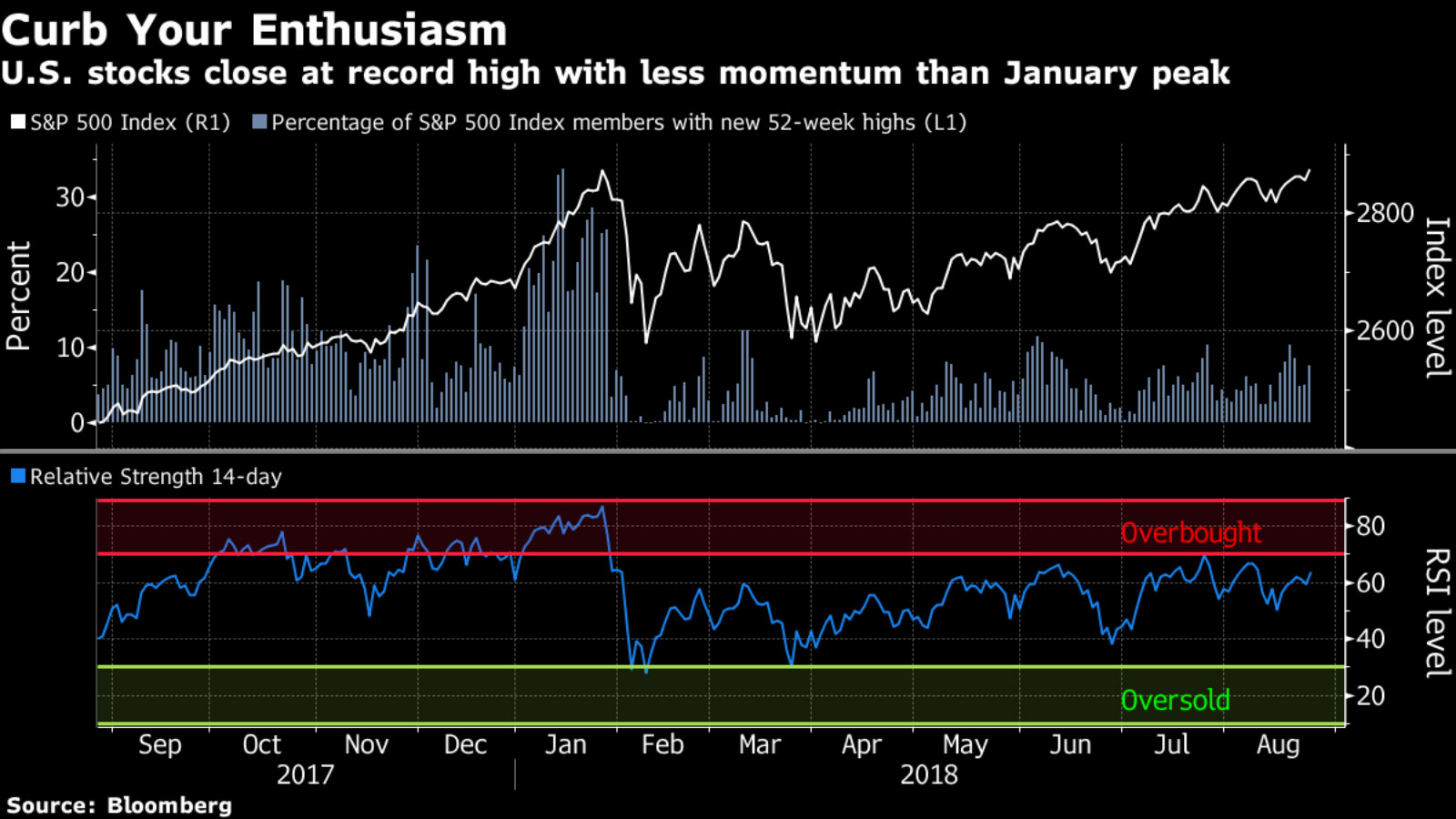

Markets rallied on expectations that Ottawa would sign on to a new agreement by the end of the week. Nasdaq and the S&P 500 both closed yesterday at record highs, while the MXN and CAD both rose against the USD. “With trade and Mexico, it is an indication to other countries, from a macro perspective, that the US is not inflexible, but just being firm in resolving trade disputes,” Capital Innovations’ Chief Investment Officer, Michael Underhill, tells the Financial Times.

But are the trade wars really coming to an end? So says MUFG Union Bank’s Chris Rupkey, who tells Bloomberg that “one by one the trade war dominoes are starting to fall backwards and are off the table for risks that threaten the global economy.” The USD has been “down in eight of the past nine trading days,” allowing EM currencies to begin to “claw back some of their recent losses,” according to the FT. Caveat lector The notion of trade wars ending is just the latest ‘tick’ in the tick-tock of a story that has a lot left to play out.

Indulging our inner Metternich: In the absence of Egyptian business news, we’re in a mood to pretend we know something about geopolitics, which we haven’t seriously studied since grad school. You may recall our suggestion on Sunday that we desert dwellers need to pay more attention to Arctic politics after Maersk launched a container ship on the Arctic Northern Sea route that could threaten the Suez Canal’s share of Asia-European trade. A handful of other strategy stories on our radar this morning:

- The UAE is emerging as the key to a new regional order as it flexes its muscles along the Red Sea after brokering last month of a rapprochement between Ethiopia and Eritrea.

- Qatar seems intent on making The Donald very happy with an agreement to expand two military bases, including “Udeid, which hosts the largest U.S. military facility in the Middle East.”

- What does a Chinese superpower look like? Nothing like the US, Bloomberg argues, saying debt, demographics and a “middle income trap” stand in the way of Beijing’s bid to expand its influence “from one polar cap to the other.”

- A Russian natural gas pipeline will give Moscow more sway over Europe in times of tension, raising hackles across Western and Eastern Europe.

iSheep, mark your calendars: Pundits are tipping Wednesday, 12 September as the most likely date for Apple’s fall product launch event. Wunderkind Apple reporter Mark Gurman writes for Bloomberg that three new iPhones, revamped iPads, a new Apple Watch and Updated AirPods could all be on the agenda.

Enterprise+: Last Night’s Talk Shows

Mo Salah’s dispute with the Egyptian Football Association (EFA) was the topic du jour on the airwaves last night. The governing body for Egypt’s de facto national sport said in a statement that it was intentionally not responding to messages from the footballer’s lawyer. Salah had lashed out at the EFA in a tweet on Sunday for “ignoring” his messages, which we had presumed were related to an image rights dispute from earlier this year.

Apparently, however, the letter from Salah’s lawyer was a rider with a list of demands. Those included bodyguards for Salah when he comes to Cairo next month for the 2019 Africa Cup of Nations qualifier on 8 September and a promise that he would not be asked to appear in interviews at the EFA’s behest, among other things, Salah said in a video posted to his Facebook page yesterday (watch, runtime: 6:25). The EFA found the letter “inappropriate” and said the requests were “exaggerated” and “unreasonable,” especially as the letter also threatened to demand the EFA board’s resignation if they refuse to meet the demands.

The Sports Ministry has reportedly contacted Salah to try and resolve the issue, Hona Al Asema’s Lama Gebril said, citing unnamed sources (watch, runtime: 8:31). She also spoke to EFA member Khaled Latif, who backed Salah’s demands, saying that the national team should be provided with every measure of comfort. He also defended the EFA, saying that members have been faced with a whirlwind of rumors and bad press lately (watch, runtime: 10:10). Sports critic Ihab El Khatib was of a similar mind.

When you can’t blame foreign fingers, blame the agent. (Better still: Maybe the agent is a foreigner?): EFA member Magdy Abdel Ghany told Masaa DMC’s Eman El Hosary that Salah is well-loved by the EFA — the problem is with Salah’s agent, who Abdel Ghany argues has blown the flap out of proportion and is making demands to the EFA “that are not within his right to make.” Sports critic Hassan El Mestikawy also blamed the agent, but said as well that EFA was at fault for not handling the matter more discreetly (watch, runtime: 8:09).

Yahduth fi Misr (watch, runtime: 9:10) and Al Hayah fi Misr also covered the story (watch, runtime: 5:45), which was also widely picked up by international news outlets, including the Associated Press.

Harassment was once again in the spotlight. On Masaa DMC, National Council for Women’s Rights head Maya Morsi declared her support for Menna Gubran, a woman who is being sued by the man she says harassed her after she posted a video of the incident (watch, runtime: 7: 28). Hona Al Asema’s Gebril also spoke to MP Ahmed Saeed and rights activist Janette Abdel Alim about Egypt’s [redacted] harassment problem] (watch, runtime: 35: 53).

Meanwhile on Al Hayah fi Misr, Kamal Magdy spoke to International relations expert Ayman Samir about Vietnamese President Tran Dai Quang’s meeting with President Abdel Fattah El Sisi in Cairo (watch, runtime: 7:33). He also chatted with the spokesman for the committee tasked with reclaiming state-owned land, Ahmed Ayoub, who said that the board was still receiving requests until 27 September (watch, runtime: 8:03).

Speed Round

Two of the fall’s most hotly-anticipated IPOs were made official yesterday. Both companies are friends of Enterprise, so we’re going to do this alphabetically:

IPO WATCH- CIRA announces plans to list 37.48% stake on the EGX: Leading private-sector education outfit Cairo Investment and Real Estate Development (CIRA) announced yesterday it plans to sell 207.3 mn ordinary shares, or 37.48% of the company, on the EGX. The transaction will include both an international private placement and a retail offering here in Egypt, according to the company’s intention to float (pdf). Selling shareholders will reinject a portion of the proceeds from the transaction into the company to fuel growth plans. “Our aim is to utilize the IPO to further enhance our robust growth plan in both higher education and the K-12 segments with a wider geographic footprint and versatile offering that builds on the current societal needs both on and off campus,” said CEO Mohamed El Kalla. The company is currently working on fulfilling “minor requirements” set by the Financial Regulator Authority to finalize registration and listing procedures for its return to the EGX. Sources had said earlier this week that the transaction could come as early as September.

Background: CIRA’s top line clocked in at around EGP 488 mn in the first nine months of 2018, and the margins are mouth-watering: 53% on the EBITDA line and nearly 34% at the bottom line. The company’s business model is unique, offering K-12 and post-secondary educations specifically to mobile middle-class families with a sharp emphasis on de-fanging the usual educational bureaucracy through technology. Readers will recognize brands including Badr University as well as K-12 schools including Futures, Rising Stars and Mavericks. The ITF (linked above) has chapter and verse on the company, its business model and future strategy. CIRA had previously counted Abraaj as an investor, but the Kalla family bought-out the one-time private equity titan earlier this year before Abraaj’s implosion.

Advisers: EFG Hermes is sole global coordinator and bookrunner for the transaction. White & Case is international legal counsel to the issuer, while Al Tamimi & Co. is acting as local counsel, and Zulficar & Partners is domestic counsel to the underwriter. Gide Loyrette Nouel LLP is serving as international counsel to the global coordinator and bookrunner. Inktank Communications is serving as investor relations advisor to the issuer.

IPO WATCH- Sarwa Capital to list 40% of its shares by early 4Q2018: Our friends at Sarwa Capital announced yesterday (pdf) that they plan to list 40% of the company’s shares on the EGX by late 3Q2018 or early 4Q2018. The IPO will consist of an international offering to global institutional investors and a retail offering here in Egypt. The offering will also include a secondary sale of existing shares held by Sarwa’s current stakeholders. The transaction, which is valued at around EGP 2.1 bn, is expected to see the Egyptian American Enterprise Fund, an anchor shareholder in Sarwa, sell off a portion of its stake, as we noted previously. “For 17 years since the founding of the business, we have worked tirelessly to build a strong institution that can serve all its stakeholders and partners. We look forward to continuing our growth story as a public company and to building a diverse institution that is truly tied to its market,” said CEO Hazem Moussa.

Advisers: Beltone Investment Banking is acting as sole global coordinator and bookrunner for the transaction, and Matouk Bassiouny has been tapped as legal counsel.

Credit Suisse is bullish on Egypt, sees tailwinds for economic recovery: Egypt’s economic growth cycle still has “several years ahead to go,” but next year is expected to bring tailwinds to our economic recovery, Credit Suisse Group AG head of Middle East research Fahd Iqbal tells Bloomberg TV. The most important of these tailwinds, Iqbal says, is Egypt’s anticipated transformation into a natural gas exporter, from being a net importer currently. Tourism is also expected to continue picking up next year, further stimulating growth.

As for asset allocations, Iqbal sees there remains a healthy window in Egypt for asset managers. Prior to the 2011 revolution — “when Egypt was in its heyday” — asset managers held more than double Egypt’s benchmark weight, he says. There is now more of “an allocation upside” as recovery and growth continue to pick up steam. You can check out the full interview here (watch, runtime: 4:10).

M&A WATCH- Oragroup rejects Beltone acquisition offer: West African consumer finance provider Oragroup has rejected Beltone Financial’s offer to acquire a controlling stake in Oragroup subsidiary Ora Bank, the company said in a statement to the EGX (pdf). According to the statement, Oragroup’s rejection is a result of the two companies disagreeing on the financial details of the proposed acquisition. Beltone’s board had approved in principle the acquisition bid in May.

Wait, are we finally getting some quality control on Egypt’s telecom sector? The CIT Ministry is planning to contract an international company to assess the quality of services offered by Egypt’s mobile network operators (MNOs), Minister Amr Talaat said yesterday. The ministry has shortlisted two companies and is currently conducting trial operations with each before settling on one. It’s not clear when the ministry expects to sign the final contracts. The contracted company would be mandated with carrying out tests on the four MNOs’ services and networks around the country, and publishing the results of these tests on the National Telecommunications Regulatory Authority’s website. Making this data available is meant to help consumers make an informed choice about their choice of provider. Based on the subpar quality of Wi-Fi and cellular coverage many of us here at Enterprise have been dealing with (particularly over the Eid Al Adha holiday) we expect consumers will wholeheartedly support the move.

Up Next

As many as 16 of the nation’s 27 governors will be replaced in a shuffle expected to take place this week. The announcement of the shuffle has been postponed multiple times since since June.

El Sisi in China next month: The president is expected to visit Beijing next month, at which time he will sign cooperation agreements in the education, transport, and housing sectors, according to a Cabinet statement.

Final contracts for Hamrawein coal power plant to be signed during El Sisi’s trip: The Egyptian Electricity Holding Company (EEHC) is expected to sign the final contracts for the USD 4.4 bn, 6 GW Hamrawein “clean coal” power plant during the president’s Beijing visit. The plant is being built by a consortium that includes China’s Shanghai Electric and Dong Fang and Egypt’s Hassan Allam.

The House of Representatives is in recess until October.

The Macro Picture

Chinese-funded infrastructure projects are jeopardizing growth, development in Africa: China’s “weighty engagement” in African infrastructure projects has had an adverse effect on economic growth and development in the continent, Luke Patey writes for the Financial Times. The Asian powerhouse has invested heavily in various projects across Africa in hopes of spurring industrialization, but the high costs and low quality have only served to create heavy burdens of debt and disincentivize new investments. “To be productive and contribute to economic development, infrastructure needs to be high-quality and high-performing. And the evidence shows that China’s infrastructure-driven economic model has been far from efficient and is one to avoid rather than emulate.” Patey suggests that African countries should wean themselves off of Chinese engagement, and instead look among themselves for more rewarding alliances.

Egypt in the News

It is a gloriously quiet morning for Egypt in the international press.

On Deadline

Egypt’s World Bank-backed education reform plan is not comprehensive enough to effect real change, Amr Hisham Rabie writes for Al Masry Al Youm. He argues that the K-12 education reform strategy, which the World Bank is backing with a USD 500 mn loan, considers only two things: Early education and the digital transformation that will see students receive government-issued tablets to use in the classroom and for exams. It does not, however, address overcrowded classrooms or the fact that curriculums are in need of a serious update, according to Rabie. He urged the government to develop a “real strategy” to tackle the issues facing education in Egypt as a first step to developing the sector.

Worth Watching

The woman who changed the notion that only men were physically capable of running marathons: Not too long ago, men were convinced that women were “physically incapable” of finishing a marathon — and took it upon themselves to bar women from participating in marathons, according to Makers. Kathrine Switzer set out to give women “the physical equivalent of the right to vote” by participating in and completing the Boston Marathon in 1967 despite being attacked during the race. Her advocacy after the marathon ultimately led to the creation of the women’s edition of the Olympic marathon in 1984 (watch, runtime: 1:27).

Diplomacy + Foreign Trade

Egypt and Vietnam signed a number of MoUs yesterday with the aim of bringing bilateral trade to a combined USD 1 bn per year, according to an Ittihadiya statement. The agreements — which cover fields including oil, finance, investment, exports, as well as agriculture — were signed during Vietnamese President Tran Dai Quang visit to Cairo, where het met with President Abdel Fattah El Sisi and other state officials. Quang is also yet to meet with Prime Minister Mostafa Madbouly and Parliament speaker Ali Abdel Aal.

A number of Egyptian ministers also met with the Vietnamese business delegation accompanying Quang to discuss investment opportunities, Investment Minister Sahar Nasr said, Youm7 reports. Business meetings are set to continue today. Vietnamese Planning and Investment Minister Nguyen Chi Dung is also scheduled to visit Egypt within the week to discuss opportunities in the Suez Canal Economic Zone.

Energy

TAQA Arabia, Hassan Allam break ground on EGP 1.35 bn solar plant in Benban complex

Qalaa Holdings subsidiary TAQA Arabia and Hassan Allam Holding have begun constructing their EGP 1.35 bn, 50 MW solar power plant in Aswan’s Benban complex, Qalaa said in a statement to the EGX (pdf). The project is being finance by five international institutions, including the International Finance Corporation, according to the statement. The power plant will be constructed under a build-own-operate framework. Trial operations are expected to begin by year’s end, and commercial operations are slated for the beginning of 2019.

Infrastructure

Al Nasr Contracting to complete EGP 1 bn projects in East Port Said by year’s end

Al Nasr Contracting expects to complete and hand over EGP 1 bn worth of projects at the East Port Said Port before the year is out, a company official said, according to Al Mal. The projects include a EGP 475 mn platform for commercial use and another EGP 449 mn platform for the Egyptian naval forces.

Basic Materials + Commodities

GASC issues tender for unspecified amount of wheat for October delivery

The General Authority for Supply Commodities (GASC) issued an international tender yesterday for an unspecified amount of wheat, to be shipped between 11-20 October, Vice Chairman Ahmed Yousuf tells Reuters’ Arabic service. The tender results are expected to be announced later today.

Gov’t reimposes tariffs on scrap plastic exports

Trade Minister Amr Nassar issued a decision yesterday reimposing a EGP 5,000 tariff on every tonne of exported scrap plastic for an additional year, according to local media reports. The decision aims to curb raw material exports to avoid shortages.

Real Estate + Housing

Manazel Egypt signs EGP 228 mn contract for development work on Sabbour’s Layan project

Manazel Egypt, a subsidiary of Kuwait’s Manazel Holding, signed a EGP 228 mn contract with Landmark Sabbour to develop a 53k sqm area in the latter’s Layan Compound, Manazel said in a statement to Boursa Kuwait.

Banking + Finance

Banque Misr intends to borrow USD 750 mn by end of FY2018-19

Banque Misr is in talks with international banks and financial institutions to borrow up to USD 750 mn by the end of this fiscal year, Banque Misr Deputy Chairman Akef Maghraby said, Reuters’ Arabic service reports. As of last May, the bank’s overseas loans portfolio reached USD 4.16 bn.

Other Business News of Note

CIB’s board approves capital increase through bonus shares

CIB’s board of directors approved on Sunday increasing the bank’s issued capital by EGP 2.98 bn to EGP 14.58 bn through a 1-for-4 bonus share issue, according to a company disclosure to the EGX (pdf). The increase will be funded through the bank’s reserves, and is still pending necessary approvals.

AIND files request to FRA for capital reduction

Arabia Investment and Development Holding’s (AIND) board of directors submitted a request to the Financial Regulatory Authority for a capital reduction to EGP 144 mn from EGP 480 mn. The company’s board of directors approved last week a decision to reduce both issued and authorized capital by EGP 336 mn to EGP 144.2 mn, and EGP 4.6 bn to EGP 1.4 bn, respectively, through a 70% reduction in the share’s par value.

Samcrete general assembly approves voluntary delisting

Construction firm Samcrete Egypt’s general assembly has approved voluntary delisting from the EGX, after failing to meet amended EGX listing requirements, reports Youm7. The EGX had given companies until the end of 2019 to meet the new requirements before facing mandatory delisting. Samcrete announced in July its plans to voluntarily delist and float shares again once it meets the new regulations.

Legislation + Policy

FRA’s registry for valuation and advisory firms now in full swing

The Financial Regulatory Authority’s (FRA) decision to establish a registry for financial advisory firms came into full effect yesterday after it was published in the Official Gazette, Al Shorouk reports. The new regulations, which were issued by the FRA in late July, require firms that conduct financial valuations and fair value studies, to register with FRA and update their data every three years. If they are found to be in violation of any laws, companies will be removed from the registry and risk losing their operating licenses.

Egypt Politics + Economics

Gov’t to insure 2.3 mn temporary and seasonal workers without charge

The government will provide around 2.3 mn temporary and seasonal workers with Aman insurance CDs, Manpower Minister Mohamed Saafan told Al Masry Al Youm. The move is part of the government’s plans to enroll temporary and seasonal workers in its new national insurance scheme for laborers, which offers CDs that pay both recurring and one-time insurance benefits.

Civil Democratic Movement coalition calls for release of ex-diplomat and 6 others

The Civil Democratic Movement coalition called on Egyptian authorities yesterday to “immediately release” ex-diplomat Masoum Marzouk and six others who have been detained on alleged terror charges, the Associated Press reports. The group of opposition parties claimed the arrests “were part of the government crackdown to silence opposition voices.” Prosecutors had earlier this week ordered Marzouk’s 15-day detention, shortly after he had called for a referendum on President Abdel Fattah El Sisi.

On Your Way Out

Heritage Daily put together a series of images showing sites of Ancient Egyptian monuments then and now. The photo essay compares pictures taken in the late 19th and early 20th century of archaeological sites — such as Luxor, the Colossi of Memnon, Saqqara, Edfu Temple, and the Great Sphinx of Giza — to others shot in 2018, to show how damaged they have become over the years.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.82 | Sell 17.92

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 15,237 (0.00%)

Turnover: EGP 765 mn (10% BELOW the 90-day average)

EGX 30 year-to-date: +1.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session flat. CIB, the index heaviest constituent ended down 1.0%. EGX30’s top performing constituents were Egyptian Resorts up 5.9%, Porto Group up 4.7%, and AMOC up 3.3%. Yesterday’s worst performing stocks were Egyptian Iron and Steel down 2.6%, Egyptian Aluminum down 1.2%, and CIB down 1.0%. The market turnover was EGP765 mn.

Foreigners: Net Short | EGP -42.9 mn

Regional: Net Long | EGP +9.8 mn

Domestic: Net Long| EGP +33.2 mn

Retail: 59.2% of total trades | 59.1% of buyers | 59.4% of sellers

Institutions: 40.8% of total trades | 40.9% of buyers | 40.6% of sellers

Foreign: 24.9% of total | 22.1% of buyers | 27.7% of sellers

Regional: 7.8% of total | 8.4% of buyers | 7.1% of sellers

Domestic: 67.3% of total | 69.5% of buyers | 65.2% of sellers

WTI: USD 68.99 (+0.17%)

Brent: USD 76.42 (+0.28%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (-0.07%, September 2018 contract)

Gold: USD 1,216.10/ troy ounce (+0.01%)

TASI: 8,000.13 (+0.27%) (YTD: +10.71%)

ADX: 4,938.92 (+0.60%) (YTD: +12.29%)

DFM: 2,829.72 (+0.14%) (YTD:-16.03%)

KSE Premier Market: 5,303.22 (-0.82%)

QE: 9,802.63 (+3.78%) (YTD: +15.01%)

MSM: 4,381.78 (+0.34%) (YTD: -13.94%)

BB: 1,347.94 (-0.27%) (YTD: +1.12%)

Calendar

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

06 October (Saturday): Armed Forces Day, national holiday.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.