- Egypt records full-year primary budget surplus for first time in 15 years in FY2017-18. (Speed Round)

- Egypt remains an attractive play for emerging market investors –Emirates NBD. (Speed Round)

- FT’s Lex gives Egypt some love, and so does Citi. (What We’re Tracking Today)

- Sisi administration has begun rolling out the first phase of the new Universal Healthcare Act. (Speed Round)

- The executive regulations of the Ride-Hailing Apps Act will be issued in September. (Speed Round)

- Shafik Gabr says he has nothing to do with a US probe into Volkswagen emissions testing imbroglio. (Speed Round)

- Egypt could ink an agreement with France as early as this year to purchase another 24 Rafale fighter jets. (National Security)

- Prosecutor General overturns gag order on corruption, to investigate Supreme Media Council head (Last Night’s Talk Shows)

- The Market Yesterday —

Sunday, 8 July 2018

Egypt records full-year primary budget surplus

TL;DR

What We’re Tracking Today

There’s plenty of ‘meh’ news for Egypt in the international press this morning, most of it our own doing (we have chapter and verse in Egypt in the News, below). After all, we appear now to live in a parallel dimension in which the Prosecutor General’s Office is siding with a free press while the Press Syndicate takes the side of the censor, as we outline in Last Night’s Talk Shows.

But let’s start the week with two bright notes, shall we?

Lex likes us… In only its second mention of Egypt in the last five years, the Financial Times’ influential Lex column gives Omm El Donia a nice shout-out. Lex notes the country’s continued attractiveness to the carry trade, the nascent recovery in tourism, and the outperformance of the EGX relative to the MSCI EM gauge — and cites Carbon Holdings’ USD 10.9 bn petrochemical complex as a “glimpse of the future.” “Prosaic industrial investment,” Lex writes, will be more valuable in the long-run for Egypt than big dreams such as the USD 500 bn Egyptian arm of Neom, Saudi Arabia’s planned robot utopia.

…and so does Citi. Frontier markets have had their worst half-year performance since 2012, Citi said as it released a six-month update to its FM ranking model, but all is not lost: Egypt remains the bank’s fifth most attractive frontier economy from an investment point of view, behind Romania, Nigeria, Kuwait and Sri Lanka, the Wall Street Journal notes.

It’s going to be a big week for: Emerging markets. The pundits doing a rain dance in the hope that skies get cloudier for EM will get more to chew over this week if Reuters’ Take five: World market themes for the week ahead is anything to go by. Those clouds range from a trade war to further flattening of the yield curve, “the signal that recession is coming.”

Let’s unpack some of that, shall we?

A global trade war kicked off on Friday: US tariffs on USD 34 bn of Chinese goods came into effect on Friday, unleashing the global trade war everyone was afraid would come, the New York Times reports. China retaliated by imposing a similar 25% tariff on 545 US products, including cars and soybeans worth a combined USD 34 bn. Russia also announced that it will introduce tariffs on a range of US products including on road-building equipment, products for the oil and gas industry, and tools used in mining, the BBC reports. “The US tariffs imposed so far would affect the equivalent of 0.6% of global trade and account for 0.1% of global GDP,” said Morgan Stanley. The WSJ argues the US can absorb China’s retaliatory tariffs for now, while the NYT says Chinese consumers are possibly the losers in the first round.

Last week marked the eleventh consecutive weeks of heavy outflows from emerging markets, the “longest such streak since 2016,”the Financial Times writes. “Net outflows from EM bond funds clocked in at USD 1.52 bn in the week to July 4,” data from Jefferies showed. “Over the 11-week period, investors have pulled nearly USD 16 bn from the asset class, representing 3.4% of assets under management.” EM and European markets have been weighed down by rising US interest rates and a strengthening USD. That made June the “quietest month in the [EM] bond market for nearly three years” the salmon-colored paper notes elsewhere.

You can practically feel the FT aching for the EM Zombie Apocalypse to get worse, even in its choice of guest opinion columns: Financial crisis warning sign is flashing red.

Elsewhere this morning: The global business press is openly questioning whether the Aramco IPO will ever happen. Summer Said leads a Wall Street Journal team in a solid take on the transaction’s prospects. Bloomberg goes even further, musing about “Saudi Aramco’s USD 2 tn zombie IPO.”

A record USD 2.5 tn in mergers were announced in the first half of 2018. The New York Times has an awesome drill-down for the M&A geeks among you. It’s the “most rewarding time in history to be a global M&A banker” but the Financial Times wonders “what exactly do they do for the money? When asked this question, [bankers] turn sheepish and talk vaguely about the art of persuasion rather than the science of valuation.”

Closer to home: Foreign Minister Sameh Shoukry is in China today for a two-day visit, according to a ministry statement. Shoukry is scheduled to meet with Chinese Vice President Wang Qishan and Foreign Minister Wang Yi, as well as participate in the eighth Arab-Chinese Cooperation forum.

And in miscellany this morning:

It’s also a big week for: Football fans, as the 2018 World Cup draws to a close:

- Tuesday: The first semifinal match sees France play Belgium at 8:00pm CLT.

- Wednesday: The second semi sees Croatia face England at 8:00pm CLT

- Saturday: Third-place match, kickoff at 4:00pm CLT

- Sunday: Final, kickoff at 5:00pm CLT

Want to lose weight? Don’t give yourself the opportunity to succumb to temptation. In other words: Don’t buy that cheesecake to make the resident 10-year-old happy and presume you’ll have the willpower to resist. That’s the message from the New York Times’ Smarter Living column, which zeroes in on a new study that found those with the best self-control aren’t “more strong-willed or dedicated: They simply [make certain they] experience temptation less [frequently].”

Required reading for any exec who, like us, is planning holidaytime: “Taking a holiday? Here’s how to disconnect,” courtesy the Financial Times.

What We’re Tracking This Week

Are folks with back-due taxes about to get a break? Finance Minister Mohamed Maait said a new initiative this week could “support businessmen with overdue tax payments to achieve the desired growth levels,” Al Shorouk reports. The move comes a few weeks after the Central Bank of Egypt announced a separate initiative that could see some struggling companies offered a measure of debt relief.

Enterprise+: Last Night’s Talk Shows

Freedom of speech was the theme of the evening on the airwaves last night, thanks to a gag order on the corruption investigation at 573757 Children’s Cancer Hospital and the sentencing of a Lebanese tourist for eight years for cursing out Egypt on social media.

Prosecutor General Nabil Sadek summoned Supreme Media Council head Makram Mohamed Ahmed for questioning after Ahmed banned reporting on an ongoing investigation into allegations of corruption at the 573757 Children’s Cancer Hospital. Sadek overturned the gag order, calling Ahmed’s decision an “infringement” on press freedoms in a statement. Summoning Ahmed for questioning “is a highly unusual step given the seniority of his position and that he was hand-picked for the job by the president,” the Associated Press notes. The story has received widespread coverage in the foreign press.

Ahmed took to the local press and the airwaves to defend his position, saying the move was necessary to “preserve the hospital’s reputation” throughout the investigation. He tells Hona Al Asema that he had taken similar decisions in the past that were not met by such a backlash (watch, runtime: 8:29).

Ah, cronyism: Prosecutors are more interested in press freedoms than is the Press Syndicate. The Press Syndicate is standing by Ahmed, with syndicate boss Abdel Mohsen Salama saying he will accompany Makram when the latter meets prosecutors on Wednesday. Salama called in to Hona Al Asema (watch, runtime: 6:07) and Masaa DMC (watch, runtime: 7:12) to defend Salama and his decision.

Lebanese tourist Mona El Mazbouh was sentenced to eight years in prison and a EGP 10,700 fine on Saturday on charges she “defamed” Egypt and spreading false rumors “that aim to undermine society and attack religions,” her lawyer Emad Kamal tells Reuters. El Mazbouh had posted a 10-minute video in which she used profanities to describe her harassment while on vacation in Egypt. Her arrest, along with another activist who posted her protest on Facebook, had brought Egypt heavy criticism over press freedoms, notes the AP.

Pundits are calling for the tourist’s head, with lawyer Essam Aggag telling Masaa DMC that El Mazbouh should remain in custody for the duration of the appeals process. He said El Mazbouh’s apology video should not count — and even attacked her lawyer for defending her (watch, runtime: 8:17). Wait — a lawyer arguing a defendant has no right to legal counsel because she was … mean?

FinMin continues to try and calm concerns on real estate levy: For the second time in under a week Finance Ministry adviser Fathy Shaaban was on the airwaves to discuss a 2.5% tithe on real estate sales, reiterating that the tax has been in place in 1978 and would only impact property owners. He then delved into the nuances of the tax, saying that the penalties for not paying the tax, which include denying property owners power and water until they pay it, will applicable to both the buyer and seller of the property. Both sides of the transaction have 30 days from the sale to register it with the Finance Ministry and another 30 days to pay the tax. Failure to pay the tax will result in an annual fine of 13-14% of the sale, he noted. Realtors involved in the sale will also be obliged to ensure both parties have paid the tax (watch, runtime: 40:38).

Speed Round

Egypt records full-year primary budget surplus for first time in 15 years in FY2017-18: Egypt achieved a primary budget surplus of EGP 4 bn in FY2017-18, its first in 15 years, according to a Finance Ministry statement. The figure translates to around 0.2% of GDP, Finance Minister Mohamed Maait told the press on Thursday, adding that the overall budget deficit is expected to have narrowed to 9.8% for the fiscal year just ended, “slightly above the 9.1% [the government] said last year it was targeting.” The Cabinet and House of Representatives had signed off last month on a EGP 70 bn overdraft for the current fiscal year to cover “necessary expenditures,” including importing fuel at higher prices than had been anticipated. Former finance Minister Amr El Garhy had said that the overdraft would not impact the target deficit for the year.

Building on the foundation set by Amr El Garhy, the Madbouly government is aiming for a primary surplus of 2% of GDP in FY2018-19, Maait added, on total revenues of around EGP 989 bn.

Although Egypt is looking to wean itself off debt in the long run, Maait suggests that foreign-denominated bond issuance was coming in FY2018-19. The ministry still needs to set the size, scope and terms of the issuance with the Cabinet before announcing anything on this, he added.

Upcoming regulatory changes: The Finance Ministry is looking at what legislative and regulatory change will have to take place before the government issues sukuks (shariah-compliant bonds), Maait also said. Maait had previously told us a sukuk offering was unlikely to be feasible this fiscal year. The ministry is also planning to institute amendments to the tax code in the coming two weeks, in time to catch what’s left of the House of Representatives’ current session, Maait said at a press conference. The change will focus on late payment of taxes and interest on overdue fees, Tax Authority boss Emad Samy reportedly said at the same conference.

A faint signal that reform of the public service may be in the works? President Abdel Fattah El Sisi directed the Finance Ministry last week to begin reassessing public sector wages as part of the government’s administrative reform drive, Maait said at the presser. He implied that public sector wages, which are covered under the Civil Service Act, are a mess, calling them “dysfunctional.”

One step closer to the privatization program? The committee tasked with managing the state privatization program will soon brief cabinet as a whole on where things stand, Finance Minister Mohamed Maait said in a statement. While the official Finance Ministry statement does not include a deadline, the local press is claiming that Maait said at a presser that announcement will be coming on this in two weeks. Sources in government had told us last weekthat the timeline’s big reveal is expected to come sometime this week. It’s part of a litany of preparations: Public Enterprises Minister Hisham Tawfik has ordered state holding companies to look into stock splits, Al Masry Al Youm reports, and the general assembly of the Chemicals Industries Holding Company’s (CICH) approved raising its capital to EGP 4 bn on Saturday, Ahram Gate reports. CICH is the parent company of Eastern Tobacco Company, which is set to pilot the privatization program with a 4% stake sale.

Egypt’s net foreign reserves rose to USD 44.26 bn at the end of June 2018, up from USD 44.14 bn in at the end of May, the central bank announced.

Egypt remains an attractive play for emerging market investors, Emirates NBD asset management boss Salman Bajwa told Bloomberg in an interview last Wednesday. Despite a recent “wobble,” triggered mainly by global conditions such as a stronger USD and higher oil prices, “if we look at the Egyptian story over the last 12 months, it’s been a fantastic play … Inflation has been coming down, interest rates have been coming down, the macro story looks intact … and foreign net reserves have been growing.” Bajwa says that what Egypt needs now is for tourism to rebound far enough to contribute to FX reserves and for the internal consumption story to pickup. “Emerging market valuations really do look attractive, relative to developed markets and relative to history,” Jupiter Asset Management’s Head of Strategy, Ross Teverson, also said, noting that companies in EM have been delivering strong earnings despite the global economic downturn (watch here, runtime: 4:23).

Reforms are repositioning Egypt as a global investment destination, says Sahar Nasr: Egypt is repositioning itself “as a global investment destination” through its ongoing reform program, including “comprehensive improvements” to the country’s business climate, Investment and International Cooperation Minister Sahar Nasr said in an interview with CNBC. Nasr highlighted efforts to cut red tape and bureaucracy to bump up FDI, including new legislation such as the Investment Act, the Bankruptcy Act, and the Companies Act.

International institution have noticed we’re on the right track, according to Nasr. She took note of several encouraging economic indicators, including unemployment dropping to 10.6% in 1Q2018, GDP growth crossing the 5% threshold, and Egypt’s balance of payments recording a surplus. We still have a long way to go, Nasr acknowledged, admitting that improving private sector participation in the country’s economic landscape is “a work in progress.”

You can watch the minister’s full appearance here (runtime: 5:19).

M&A WATCH- Fiber Misr acquires Equinox International: Egypt-based IT systems integrator Fiber Misr has acquired technology and infrastructure solutions provider Equinox International, Equinox said in a statement on Friday. The transaction, the value of which was not disclosed, will see Fiber Misr acquire Equinox’s regional business operations. “This acquisition will increase Fiber Misr’s clientele base by adding 200+ of Equinox’s clients across the MEA region, which would enhance its competitive capacity in the different sectors it operates in while achieving its aggressive expansion plans.” Advisors: Alliance Law Firm served as legal counsel for the transaction.

M&A WATCH- Did EMG buy Al Hayat TV from Falcon Group’s Tawassol? Egyptian Media Group (EMG) has acquired struggling television station Al Hayat, EMG announced on Thursday, Youm7 reports. The brief statement provides no detail on the transaction value. Al Hayat ran into financial trouble last year that saw Egyptian Media Production City cutting off services to Al Hayah for allegedly failing to make good on EGP 20 mn in overdue payments.

LEGISLATION WATCH- The El Sisi administration has begun rolling out the first phase of the new Universal Healthcare Act, according to an Ittihadiya statement. The new system will be piloted first in Port Said with aims that include cutting wait times for treatment and testing some 45 mn citizens for hepatitis C over the course of two years in partnership with private pharma companies. The first phase will see renovation work start at 47 government-run hospitals across the country, with a focus first on Port Said. The government will also be completing a census of beneficiaries over the coming year before the system next rolls out in Suez, Ismailia, and North and South Sinai.

Background: Health Minister Hala Zayed had said last month that her primary priority as minister will be to drive implementation of the Universal Healthcare Act, which President Abdel Fattah El Sisi had signed into law back in January. The bill will set premiums for employers of 4% of each employee’s monthly salary, while employees will pay premiums of 1% of their salary into the system. It also sets a 0.25% tax on sales revenues for every company operating in Egypt to fund the system.

LEGISLATION WATCH- The executive regulations of the Ride-Hailing Apps Act will be issued in September, government sources said on Saturday. The regulations will outline licensing requirements and fees for ride-hailing companies such as Uber and Careem. Under the act, which was signed into law last month, companies will be required to pay up to EGP 30 mn (up from the EGP 10 mn cap previously suggested) for a five-year operating license. Companies will also pay a 25% down payment on these licenses and will pay the remaining fees in instalments over the five-year licensing period. Companies have six months to comply with the act (we’re hoping that’s six month from the time the regulations are issued, but…).

Shafik Gabr says he has nothing to do with a US probe into Volkswagen emissions testing imbroglio: Artoc Auto Shafik Gabr has “rejected the allegation that he was manipulating a US House panel’s inquiry” into Volkswagen over allegations the German auto company had cheated on emissions testing overseas, according to a statement by Artoc (pdf). Bloomnerg carried reports last week that Gabr had fueled the investigation into VW in a bid to “pressure the company into paying him an unreasonable amount to settle a commercial dispute in Egypt. Gabr’s Artoc Auto had the rights to VW in Egypt until late 2017.

EgyptAir MS804 flight crash caused by cockpit fire, say French investigators: The EgyptAir flight MS804, which crashed in 2016 on route from Paris to Cairo killing all 66 passengers, was likely caused by a fire in the cockpit, France’s Bureau of Investigations and Analysis agency (BEA) said in a press release on Friday. The plane’s black boxes had recorded the pilots talking about afire on board; automated satellite messages sent by the plane showed smoke in the bathrooms and the avionics bay, which holds the plane’s computers, French investigators said. The report contradicts earlier findings by Egyptian authorities that traces of explosives were found on human remains. Reuters called the BEA statement a “rare criticism of another country’s crash probe.” The story topped coverage on Egypt by the foreign press with pickups from Bloomberg, and the Wall Street Journal.

Image of the Day

A World Cup trophy-shaped hookah brings together Egyptians’ two biggest passions: A World Cup trophy-shaped hookah has been a “big hit” around cafes in Egypt after the Pharaohs exited the championship during the group stages following a disappointing run, according to Reuters. “We were not able to win the real World Cup, so we just got it as a shisha (hookah), Ramadan lantern and whichever way we can,” one shisha enthusiast tells the newswire.

Egypt in the News

It’s a thoroughly ‘meh’ morning for Egypt in the international press. Consider:

- A debate over free speech debate in which prosecutors are siding with the press and the Press Syndicate with the censors;

- A Lebanese tourist sentenced to eight years in jail for being mean to us all in a Facebook video;

- An appeals court siding with so-called “bearded police officers” (read: Islamists) appealing their dismissal from service;

- The French saying a cockpit fire was likely behind a 2016 Egypt Air crash.

Also this morning:

The Minya Textile City project maybe the industry’s saving grace, Patrick Werr writes in a piece for Reuters, where he revisits a 2016 argument he had made claiming that textile exports stand to benefit from the EGP’s flotation.

Egypt’s emergence as a global energy hub is receiving foreign press attention once again. The country will continue to make strides towards that goal as it uncovers more oil and gas reserves, Indrajit Sen writes for MEED, noting that there are “prolific basins” in the area around Zohr waiting to be tapped. Meanwhile, MIDOR’s USD 1.7 bn agreement with Italy’s Technip is another step in Egypt’s drive to become a regional energy hub, according to Arab Weekly.

US soybean exports to Egypt almost quadrupled in two months between April and June 2018, according to the WSJ.

Worth Watching

Egyptian entrepreneur lauches garbage-for-food barter system: An Egyptian entrepreneur has launched Bekia, an online platform that allows people to exchange waste for food and other commodities, according to TRT World. Bekia accepts all forms of recyclable waste and gives users points that they can use to buy everything from food to refurbished electronics, co-founder Alaa Kamal says (runtime: 2:33).

Diplomacy + Foreign Trade

Egypt, Hungary sign five MoUs for investment, agriculture, ICT, sports: Egypt and Hungary signed on Thursday five MoUs to increase investments and cooperation in agriculture, ICT, sports, and accreditation, according to an Investment and International Cooperation Ministry statement (pdf). The agreements were signed on the sidelines of the third Egyptian-Hungarian Joint Committee on Economic, Scientific, and Technical Cooperation.

Egypt and Hungary are also set to sign an agreement in the next week or so to supply the Egyptian National Railways with 1,300 railway cars, Hungary’s Parliamentary Affairs Minister Levente Magyar said, according to Al Mal. Hungary will amend the conditions of its offer ahead of the signing, according to Magyar. Transport Minister Hisham Arafat had said previously that the contract would be valued at around EGP 19-20 bn. The ministry had narrowed down the competition to two offers from a Hungarian-Russian consortium and a Chinese company.

Egypt, Sudan, Ethiopia agree on joint investment fund framework: Officials from Egypt, Sudan, and Ethiopia agreed on the goals and framework of a joint investment fund to finance development and investment projects, Al Mal reports.

Energy

Arrears to oil producers are now below pre-2011 levels, El Molla promises no more subsidy cuts this calendar year

Egypt’s arrears to oil producers have fallen to their lowest levels yet, coming in at USD 1.2 bn at the end of FY2017-18, lower than the previous trough of USD 1.35 bn in 2010, Oil Minister Tarek El Molla announced on Thursday. Egypt intends to fully repay amounts owed to international oil companies by the end of 2019, he said. Total arrears are down from USD 2.1 bn in February.Sources had said earlier this month that the EGPC was planning to deliver USD 200-500 mn in payments to producers before the end of September 2018.

The oil and gas sector is expected to drive economic growth this fiscal year as production from the Zohr gas field ramps up and focus turns towards turning Egypt into a regional export hub, El Molla said at a Thursday press conference (watch, runtime: 16:13). Production from Zohr is on track to hit 1.75 bcf/d by the end of August, up from a current 1.2 bcf/d and on its way to reach c. 2 bfc/d by the end of 2018. Exploration work on the Noor gas field is also expected to start in two months’ time, according to the minister.

No more fuel subsidy cuts this year: El Molla promised no further cuts to fuel subsidies this year, Ahram Online reports. “There will be no hike in fuel prices in Egypt during this [calendar] year,” El Molla said late Friday in a phone in to Mehwar TV. Egypt had hiked fuel prices by around 50% on average for consumers and industry late last month, the third such move since the IMF Extended Fund Facility was signed.

SDX Energy begins drilling at final well in South Disouq concession

SDX Energy announced on Thursday that it began drilling the final well at its South Disouq concession in Egypt, the SD-3X. “The well is anticipated to take up to 30 days to drill and if successful, will be completed, flow tested, and connected to the infrastructure being developed at the SD-1X discovery location,” the company said in a press release (pdf). Well testing at the SD-4X discovery will also start in 10 days’ time.

Infrastructure

IDA signs EGP 4 bn contracts with SDM, Pyramids Industrial Parks to develop 4 mn sqm in Sadat City

The Industrial Development Authority (IDA) signed contracts on Thursday with Elsewedy Group subsidiary SDM and Pyramids Industrial Parks to develop two 2 mn sqm industrial zones in Sadat City at a combined investment cost of EGP 4 bn, Al Mal reports. Under the contracts, the two companies will be required to complete Infrastructure and development works and hand over the land to investors within two years, according to IDA head Ahmed Abdel Razek.

Basic Materials + Commodities

Egyptian-Chinese Black Sands Company to invest USD 24 mn in first phase mineral extraction

The Egyptian-Chinese Black Sands Company is planning to invest USD 24 mn in the first phase of its mineral extraction project in Ghalyoun Lake, Deputy Chairman Ahmed Shaltout said, Al Ahram reports. The company, a JV between the Egyptian Black Sands Company and an unnamed Chinese investor, expects to extract 500k tonnes of minerals per annum for domestic use and exports.

Eastern Tobacco denies raising cigarette prices

Eastern Tobacco Company has not raised the prices of any of its cigarette products, the company said in a statement to the EGX (pdf). The local press had reported last week that the company announced price increases on four local cigarette brands following last month’s fuel price hikes.

Tourism

Thomas Cook targets 500k tourists to Egypt in 2018

Thomas Cook is planning to bring in 500k tourists to Egypt this year from various countries, said Moudy El Shaer, chairman of Blue Sky Travel, which markets travel packages for Thomas Cook. The company reported a 50% y-o-y jump in the number of inbound tourists during 1H2018, according to El Shaer. Marsa Alam and Hurghada are seeing the biggest jump in bookings, while winter bookings to Luxor are up 20% y-o-y. Thomas Cook raised the number of its trips to Egypt, especially from Germany to Sharm El Sheikh, he added.

Officials are mulling making some beaches in Alexandria exclusive to foreigners

Officials are mulling making some beaches in Alexandria exclusive to foreigners in a bid to lure tourists to the coastal city, according to the Sun. The idea is meant to create the privacy that foreigners seek. Several locals are naturally disgruntled, saying that there is “already a class barrier in place” when it comes to accessing good beach spots in Alexandria, and that the move would further exacerbate the situation.

Automotive + Transportation

Transport, housing ministries to issue terms for Alamein-Ain Sokhna train, new capital monorail

The transport and housing ministries are set to issue the terms and conditions for the tenders for the Alamein-Ain Sokhna train and the new capital-6 October City monorail projects this week, unidentified sources tell Al Mal. The tender will be opened to 16 local and international companies and consortia that had pre-qualified for the two projects.

Other Business News of Note

Green Valley to invest EGP 35 mn to reclaim 1,000 feddans to plant olives

Green Valley for Reclamation and Agriculture is planning to invest EGP 35 mn to reclaim 1,000 feddans in Wadi El Natrun to plant olives, Managing Director Sayed El Sammak tells Al Mal. The company expects to pick its first harvest to take place in three years’ time, according to El Sammak.

Legislation + Policy

House prepares unifying legislation to govern state retail outlets

The House of Representatives is looking to introduce new legislation to govern government cooperatives, according to Rep. Abdel Hady Kassabi, Al Mal reports. A House committee met last week to begin reviewing the separate laws on state retail outlets, which they claim have not been updated in 28 years, with the aim of amending them to create one universal law to govern the different types of outlets that sell subsidized commodities.

Egypt Politics + Economics

Cairo Criminal Court sentences 14 to life in prison for Ikhwan membership

A Cairo Criminal Court sentenced 14 people to life in prison on Thursday on charges of belonging to the outlawed Ikhwan, “possessing firearms, violating citizens’ personal freedoms, and disrupting constitutional provisions,” the Associated Press reports. Six other defendants were handed down 15-year sentences and another defendant was given a 10-year prison sentence. The verdicts can be appealed.

National Security

Egypt to buy another 24 Rafale fighter jets from France this year?

Egypt could ink an agreement with France as early as this year to purchase another 24 Rafale fighter jets, French daily La Tribune reported last Wednesday, citing statements made by French Armed Force Minister Florence Parly in April. Egypt had quietly signed a communications agreement with the US back in January, removing an obstacle that had been blocking the sale of 12 Rafale fighter jets from France’s Dassault Aviation, equipped with US-made Scalp cruise missiles. The US had refused the sale claiming it violates US International Air Traffic in Arms Regulations. Egypt has received 14 of 24 jets from its original EUR 5.2 bn order to date, according to Defence Blog. The news comes as Egyptian and French naval forces have conducted joint drills in the Red Sea over the past several days, according to an Armed Forces statement.

Sports

Egyptian football players face fines, int’l bans for paid interviews at World Cup

Some players from Egypt’s national football team are facing fines and bans on playing internationally after reportedly accepting up to USD 5,000 for giving unauthorized interviews to a Saudi television channel at the World Cup, Egyptian Football Association (EFA) head Hany Abo Rida said, ESPN reports. According to Abo Rida, the interviews violate the EFA’s sponsorship agreements. The EFA boss did not disclose the names of the players that are facing the potential ban.

On Your Way Out

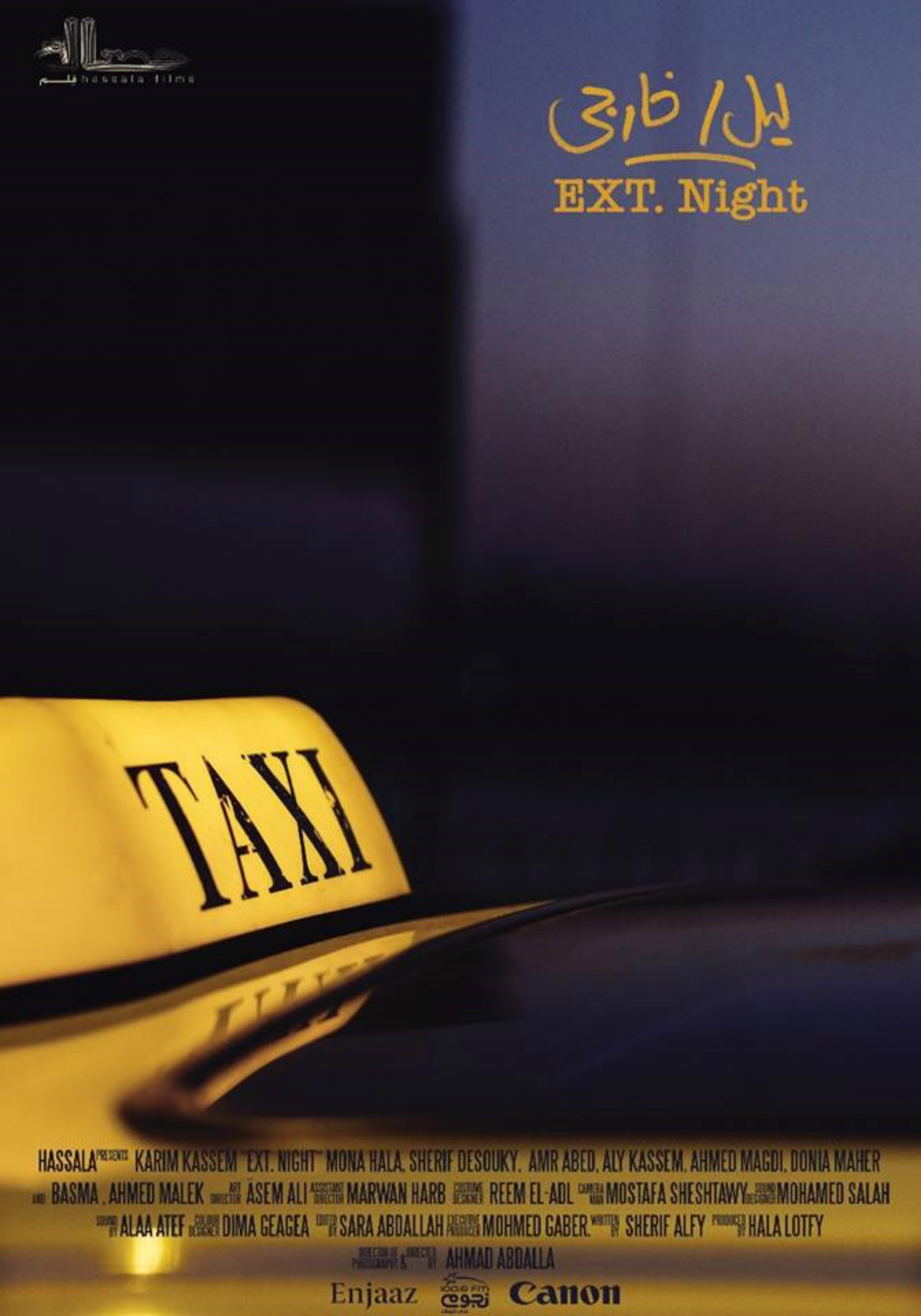

Night/Ext was selected as the first Egyptian film to participate in this year’s Cairo International Film Festival (CIFF), the festival’s president announced last week. The film follows the story of three individuals “breaking the social norm and flirting with its boundaries” after meeting one night. Last year’s edition of the festival did not feature any Egyptian entries, Reuters’ Arabic service notes. The festival runs from 20-29 November.

The Market Yesterday

EGP / USD CBE market average: Buy 17.83 | Sell 17.93

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 16,125 (-1.1%)

Turnover: EGP 829 mn (17% below the 90-day average)

EGX 30 year-to-date: +7.4%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 1.1%. CIB, the index heaviest constituent ended down 1.3%. EGX30’s top performing constituents were Pioneers Holding up 4.9%, Telecom Egypt up 1.6%, and Orascom Construction up 0.7%. Thursday’s worst performing stocks were Heliopolis Housing down 4.5%, Palm Hills down 4.2%, and Porto Group down 3.7%. The market turnover was EGP 829 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -178.9 mn

Regional: Net Long | EGP +34.4 mn

Domestic: Net Long | EGP +144.5 mn

Retail: 45.7% of total trades | 49.7% of buyers | 41.7% of sellers

Institutions: 54.3% of total trades | 50.3% of buyers | 58.3% of sellers

Foreign: 19.6% of total | 12.0% of buyers | 27.2% of sellers

Regional: 6.7% of total | 8.2% of buyers | 5.3% of sellers

Domestic: 73.7% of total | 79.8% of buyers | 67.6% of sellers

WTI: USD 73.80 (+1.18%)

Brent: USD 77.11 (-0.36%)

Natural Gas (Nymex, futures prices) USD 2.86 MMBtu, (+0.74%, August 2018 contract)

Gold: USD 1,255.80 / troy ounce (-0.24%)

TASI: 8,177.61 (-0.85%) (YTD: +13.16%)

ADX: 4,603.20 (+0.20%) (YTD: +4.66%)

DFM: 2,880.42 (+0.67%) (YTD: -14.53%)

KSE Premier Market: 5,180.40 (+0.95%)

QE: 9,259.95 (+0.32%) (YTD: +8.64%)

MSM: 4,523.79 (+0.02%) (YTD: -11.29%)

BB: 1,330.82 (+0.63%) (YTD: -0.07%)

Calendar

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.