- CBE launches EGP 16.8 bn debt relief program. (Speed Round)

- Green bonds coming to Egypt? (Speed Round)

- Israeli energy investors worry that the Noor gas field could be a gamechanger. (Speed Round)

- Late export subsidies could be disbursed sooner than we thought. (Speed Round)

- M&A WATCH- Ezdehar acquires strategic stake in loyalty and rewards player Dsquares. (Speed Round)

- M&A WATCH- Misr Cafe pulls out of sale talks. (Speed Round)

- OC begins commercial production at Natgasoline in US. (Speed Round)

- It’s interest rate day. Plus: Madbouly gov’t to present policy program to House on Monday. (What We’re Tracking Today)

- Talking heads can’t stop bloviating about the World Cup. Let it go, already. (Last Night’s Talk Show)

- Emerging markets private equity faces another scandal. (What We’re Tracking Today)

- The Market Yesterday

Thursday, 28 June 2018

Enjoy your three-day weekend

TL;DR

What We’re Tracking Today

It’s MPC day… The central bank’s Monetary Policy Committee meets today to review interest rates. The consensus among analysts is that the CBE will leave rates on hold to help contain the shock of recent subsidy cuts. The prevailing wisdom is that inflation for June will come in at around 4%.

…and the last business day before a three-day weekend after the Madbouly government made Sunday a national holiday substituting for 30 June, which falls on Saturday. We’ll be back in your inboxes on Monday morning at the appointed hour.

…and the last business day of June and of the state’s fiscal year. Where is 2018 going? Why does time accelerate as you age?

The Madbouly Cabinet will present its policy program to the House of Representatives on Monday, 2 July, House spokesperson Salah Hassaballah told Al Hayah fi Misr’s Nahawand Serry last night (watch, runtime: 28:05).

Getting fiscal and monetary policy on the same page? Finance Minister Mohamed Maait and CBE governor Tarek Amer have agreed to establish a new committee to coordinate on monetary policy. The CBE-Finance Ministry committee will meet once a month, according to a Finance Ministry statement. Background: At the height of the FX crisis in 2016, the government tried to ‘align’ the two sides of the house through what it called the “Coordination Council,” a body through which cabinet and the central bank coordinated fiscal and monetary policy. Members included the outstanding Mohamed El-Erian, former CBE Governor Farouk El-Okdah, a presidential economic advisor, the ministers of finance, investment, and trade and industry, as well as the governor of the CBE and members of his senior staff.

A shuffle of governors could be announced today. Prime Minister Moustafa Madbouly had sent the list of candidates to President Abdel Fattah El Sisi for review earlier this week. Government sources said at the time the shuffle would be announced this week.

The Finance Ministry was to send the House a report this week on the government’s ‘private accounts’ (or slush funds, as we prefer to see them). We’ve seen no update on that front as of this morning.

GAFI to break ground on Nuweiba freezone this Saturday: The General Authority for Freezones and Investment (GAFI) expects to break ground on the Nuweiba freezone on Saturday.

The latest disaster to befall emerging markets private equity: A massive alleged fraud in India, where two high-profile hedge funds have “accused one of India’s biggest real estate developers of defrauding its foreign investors out of as much as USD 1.5 bn, potentially one of the largest private equity scams ever.” IREO Management stands accused of having created a “web of shadow companies connected to his relatives, friends and business associates to siphon money from the fund,” Bloomberg reports.

Random observation of the morning: Tunisia is the world’s best-performing stock market. Yeah, Tunisia — up 22% in USD terms YTD, according to Bloomberg, which cites AlphaMena’s head of equity strategy as suggesting the market is probably looking at a correction as Tunisian banks are “affected by the economic crisis.”

Bahrain is about to get a support package from Saudi Arabia, the UAE and Kuwait “as the kingdom’s currency and bonds come under pressure…Bahrain’s finances, reeling since the slump in oil prices in 2014, have worsened in recent weeks. The BHD hit a 17-year low against the USD on Tuesday on a sell-off of bonds held by the small Gulf kingdom,” the Financial Times reports.

Ongoing fear of the still-unfolding trade war between the US and China sent shares on Wall Street tumbling yesterday after a brief recovery on Tuesday. The S&P 500 was down 0.86%, while Nasdaq fell 1.54%, according to Reuters.

Investors might be beginning to abandon hope that a “global economic upswing” is due this year, Kate Allen writes for the Financial Times, citing research by Absolute Strategy Research (ASR). “The quarterly survey of 214 asset allocators who manage USD 4.1 tn of funds found that expectations of an improvement in global business confidence had declined sharply since the start of the year,” especially now with mounting trade tensions between the US and China threatening to derail markets further. Investors have already started pulling their cash out of emerging markets, which are witnessing major selloffs and the outlook on US corporate credit is “deteriorating,” said ASR’s David Bowers, who expects the shift in mindset to filter in investment decision during the second half of the year. “There is clearly a loss of confidence coming through in corporate credit, and it is very rare for stocks to do well when that happens.”

It could happen here, too: Convenience store chains are battling to modernize Vietnam’s convenience store industry, a “sector built on small business … that’s attracting foreign supermarkets and convenience stores,” the FT writes.

It wasn’t just you: Workplace messaging platform Slack, which powers both Enterprise and our parent company Inktank, was indeed out for an extended period yesterday. You can always use Slack’s status page to see whether it’s down or it’s just you.

Your hate-read of the morning: It shouldn’t surprise anyone reading this that we like small, focused audiences we’re not building BuzzFeed seeking 10s of mns of ‘uniques’ each month, none of whom we know. Apparently, there’s a dating app that feels the same, populated by “movie stars, fashion designers, pro athletes, tech executives and too many Instagram models to count,” the New York Times writes. You can hate-read it as a sign of all that’s wrong in the world, or you can read it for the underlying message that niche is often much more valuable than ‘scale.’ It’s about knowing your audience, whatever its size.

On The Horizon

Penguins are coming next weeks to Ski Egypt at Six of October’s Mall of Egypt, according to the indoor ski hill (bump?)’s Facebook page.

Next tranche of IMF loan in July? The IMF’s executive board will meet on 29 June to decide on the fourth USD 2 bn tranche of Egypt’s USD 12 bn extended fund facility.

Enterprise+: Last Night’s Talk Shows

Post-World Cup recriminations still dominate talk on the airwaves, with the Egyptian Football Association’s (EFA) press conference yesterday the primary topic of discussion.

The talking heads were overwhelmingly unimpressed with the EFA’s press conference, accusing the association of failing to provide definitive or concrete responses to appease the public discontent over the national team’s performance at the 2018 World Cup. Witness: Hona Al Asema’s Reham Ibrahim (watch, runtime: 6:50), Masaa DMC’s Osama Kamal (watch, runtime: 3:30), and Yahduth fi Misr’s Sherif Amer (watch, runtime: 1:30).

The timing of the press conference was inappropriate given the extent of public resentment, sports analyst Omar Rabie Yassin told Ibrahim on Hona Al Asema. If anything, the conference only added insult to injury, he said (watch, runtime: 2:14).

Meanwhile, the Egyptian Competition Authority (ECA) appears to have made some headway in negotiations with beIN Sports, which has agreed to air more World Cup matches on its free-to-air satellite channels, ECA head Amir Nabil told Masaa DMC’s Kamal. He said that beIN had previously been fined EGP 800 mn in 2016 for being scant with its broadcast rights (watch, runtime: 5:08).

Be thorough when checking your power bill. One man, lawyer Nagy Amer, filed and won a lawsuit against the state power supplier when he discovered that his bill was much higher than his consumption, he told Kamal (watch, runtime: 7:44), who spent a good chunk of his episode dissecting Egypt’s power production and consumption habits (watch, runtime: 4:07).

The government should rationalize its expenditures in the same way that it asks people to conserve water and electricity, House rep. Amr El Gohary said on Masaa DMC, adding that he has yet to receive a response about a formal inquiry he filed into the impact of state bureaucrats’ wage increases on the new fiscal year’s budget (watch, runtime: 14:14).

1,000 Ancient Egyptian artefacts that had been smuggled out of the country were retrieved from Italy, Cabinet spokesperson Ashraf Sultan told Al Hayah fi Misr (watch, runtime: 8:19).

Speed Round

CBE launches EGP 16.8 bn debt relief program: The central bank has launched a sweeping debt relief initiative that could forgive some EGP 16.8 bn worth of interest payments on non-performing loans held by state-owned banks, according to a CBE statement (pdf) issued on Wednesday. The program will help around 3,500 business with assets less than EGP 10 mn, as welll as some 337k individual borrowers, who have taken out loans from nine state banks, including the National Bank of Egypt, Banque Misr, Banque du Caire, and the United Bank, the CBE said. Anyone looking to have interest forgiven has until the end of this year to pay down the principal on the loan that was owed as of December 2017. In return, state banks will drop all outstanding lawsuits, restore any collateral provided by borrowers, and will have domestic credit reporting agency iScore scrub the debtor’s name from its black list. The statement notes that business targeted by the initiative will see a total of EGP 12 bn in relief, while individual borrowers will see some EGP 4.8 bn.

Egypt may tap the global sukuk market in FY2018-19, Finance Minister Mohamed Maait tells Bloomberg in an interview. The plan to issue Islamic Sharia-compliant bonds in USD or EUR “would mark a revival of a plan shelved since 2013 when the government under then-Islamist President Mohamed Morsi issued the law to pave the way for the country’s first Islamic bond.” The legislative framework for the issuance of sovereign sukuks is still under study, according to Maait, who said he expects an offering to generate a lot of interest. Background: The idea of issuing sovereign sukuk was first revived back in 2016, at which time Maait said the government would begin drafting a mechanism for their launch during FY2016-17.

Other highlights: Maait repeated what he told us earlier this week about the possibility of additional stake sales in state-owned companies in July and August (note we’re talking sales of stakes in already-listed companies here, not yet new IPOs). The minister also telegraphed that Egypt will continue nudging its deficit funding mix toward “long term borrowing rather than costly short-term debt.”

Green bonds coming to Egypt? The International Finance Corporation (IFC) and the Financial Regulatory Authority (FRA) have kicked off consultations on what guidelines for green bonds might look like, according to a statement from IFC (pdf) on Wednesday. What are green bonds you ask? Think regular bonds, but whose proceeds go towards funding green projects. “Our partnership with IFC helped us provide the necessary information to both issuers and investors, providing a comprehensive reference guide for the market to develop a new financial tool to support green growth in Egypt,” said FRA Chairman Mohammed Omran. “This is also in line with our strategy to develop new financial instruments within the Egyptian market over the next four years,” he added.

Israeli energy investors worry that the Noor gas field could be a gamechanger: Reports of that the Noor gas field in the East Mediterranean coast off of North Sinai could hold reserves 3x as much as Zohr sent Israeli energy stocks down on Wednesday, according to Haaretz. Israeli gas shares fell by about 4% on the Tel Aviv Stock Exchange in mid-day trading, the newspaper noted. “Israeli energy investors might be concerned that developing Noor could stymie plans by Israeli companies to export gas extracted from in Tamar and Leviathan, two fields in Israeli territorial waters in the Mediterranean.” Leviathan operators Delek and Noble Energy were reportedly close to acquiring a stake in East Mediterranean Gas in a bid to begin exporting gas from the field to Egypt for processing before re-exporting the gas to Europe. The new discovery is also significant as Leviathan isn’t productive yet, and the longer that remains the case, the less Egypt will need it as it moves forward with developing new fields.

Then again, maybe not: Egypt is positioning itself as the premier regional energy hub, whether that’s on natural gas or electricity (through the ongoing grid upgrade and interconnection programs). And surplus hydrocarbons sloshing around could be catalysts for domestic manufacturing, as Basil El Baz suggests with his planned USD 10.8 bn Tahrir Petrochemical Corporation. In this sense, the more gas available to Egypt, the better.

EXCLUSIVE- Late export subsidies could be disbursed sooner than we thought: Finance Minister Mohamed Maait will meet with Trade and Industry Minister Amr Nassar early on in the new fiscal year (which starts next week) to devise a strategy for disbursing overdue payments from the Export Subsidy Fund — an issue Maait previously told us he is keen to resolve as soon as possible. A source at the Finance Ministry had previously told us that overdue payments currently stand at EGP 7 bn. We had heard before that the ministry was planning to disburse the late payments over an unspecified number of years. Industry export associations have been lobbying for the government to resume payments, particularly after the state raised earmarks for export subsidies to EGP 4 bn in FY2018-19 from EGP 2.6 bn this fiscal year, the source noted.

M&A WATCH- Ezdehar closes acquisition of ‘strategic’ stake in loyalty programs provider Dsquares: Our friends at Ezdehar Management have completed the acquisition of a strategic stake in in digital marketing and IT solutions firm Dsquares, the company said in a press release. “We are excited to back the Dsquares team as it grows its footprint. Dsquares’ growth track record over the past few years is a testament to Dsquares’ leadership in the loyalty and rewards space in Egypt and the region,” said Ezdehar Managing Director Emad Barsoum. The company declined to size the acquisition, but sources close to the transaction tell us it was “a significant minority stake.”

M&A WATCH- Misr Cafe pulls out of sale talks: Misr Cafe has ended all talks with prospective suitors to sell a stake in the company, sources close to the negotiations tell Enterprise. Misr Cafe apparently broke off negotiations few months back, sources added. We were told that the company probably will not revisit talks on a potential stake sale until 4Q2018. Prospective buyers previously noted in the local press include Ezdehar’s midcap fund and NBK Capital.

M&A WATCH- Mondi Paper Sales is reportedly planning to delist Suez Bags from the EGX after it completes the acquisition of a 70.1% stake in the company, Al Mal reports, providing no reason for the decision. The Financial Regulatory Authority had signed off this week on Mondy’s mandatory tender offer to buy 7,666,435 shares in Suez Bags in a transaction valued at EGP 199.4 mn. Mondi, which is reportedly self-financing the transaction, had originally acquired stake in Suez Bags from Heidelberg Cement subsidiaries Suez Cement and Tourah Cement in a separate transaction. Zaki Hashem & Partners represented Mondi in the transaction.

Orascom Construction (OC) has begun commercial production at Natgasoline, the largest methanol production facility in the US, the company said in a statement on Wednesday (pdf). The production facility, located in Beaumont, Texas, will have a capacity of up to 1.8 mn tonnes per annum. Our friends at OC had announced in April that they had reached mechanical completion at the facility. The main contractor for the project was Orascom Engineering & Construction USA.

INVESTMENT WATCH- Agility Kuwait expects to invest USD 100 mn in the first phase port of East Port Said logistics zone, Suez Canal Authority (SCA) boss Mohab Mamish said, Al Mal reports. Agility signed an MoU with the SCA on Tuesday to establish the zone. Feasibility and financial studies will take a combined 14 months to complete, after which the two sides will set up a joint company to manage the zone. No details were provided on when the construction of the zone will be completed.

INVESTMENT WATCH- It looks like this “100% Arab car” is happening, and it’s happening here: The Arab Organization for Industrialization (AOI) has signed a cooperation agreement with the UAE’s Sandstorm Automotive to manufacturing four-wheel-drive vehicles, according to AOI head Abdelaziz Seifeldin. Under the agreement, AOI will begin assembling vehicles for Sandstorm in Egypt. No details were provided on the timeline or value of the agreement. We had first heard of the car back in December of last year, when Sandstorm said it would produce 3,000-5,000 vehicles here in an initial run, sourcing many components locally. Sandstorm “purchased glass, batteries, seats, and car horns from the Egyptian market,” MEA Manager Karim Saleh had said at the time, adding that the cars would be exported to Africa. Saleh also said that the company was in talks with Geyushi Motors, El Saba Automotive, Abou Ghali Automotive, and El Sharkawy Automotive over distribution rights and after-sale services in Egypt.

Supply Ministry’s domestic wheat purchases fall short of target as 2018 harvest season comes to a close: The Supply Ministry’s domestic wheat buying season ended yesterday with the state having bought 3.15 mn tonnes at a cost of EGP 12 bn, according to a statement. That’s significantly short of the ministry’s short of its initial target of 3.5-4 mn tonnes and is also less than the state purchased last year, Reuters’ Eric Knecht notes. Private sector mills had bought some of the wheat from local farmers at higher prices than the government price, traders tell the newswire. The private millers capitalized on local wheat as a way to reduce their wheat imports, for which they pay in hard currency. The government’s “lower procurement figure means [the General Authority for Supply Commodities] will have to import more wheat from abroad to fill its supply gap.”

That would explain the int’l wheat tenders taking place: The shortfall in the state’s domestic buying offers an explanation as to why the government had been tapping global wheat markets during the domestic harvest season, which the government had always avoided to prevent mixing of subsidized imported wheat and locally harvest wheat. The government has even amended wheat policies of late to encourage traders to bid in global tenders, following the drawn out confusion over zero-tolerance on ergot policy.

CABINET WATCH- Contractors Compensation Act high on Madbouly Cabinet agenda: The focus of the Madbouly Cabinet’s weekly meeting yesterday appears to have been paying out compensation to government contractors under the Contractors Compensation Act, according to a cabinet statement. Ministers reviewed a report, which showed that EGP 2.7 bn were disbursed to contractors out of a total EGP 3.2 bn in requested compensation for pre-November 2016 contracts that suddenly went underwater with the float of the EGP that month.

Cabinet also approved amendments to the Government Accounting Act that would make it mandatory for all government transactions be electronic. Finance Minister Mohamed Maait had issued a decision earlier in the day that would make all transactions between the government and private sector worth more than EGP 100k exclusively electronic. All transactions with the government will be electronic starting from January 2019, according to a ministry statement. The move to e-payments for government services was mandated by the National Payments Council. Other decisions taken by the cabinet yesterday include:

- Approving procedures to handle environmental disasters, which include tallying the list of facilities at risk of causing widespread environmental damage;

- Allowing the Military Productions Ministry to sign with the Aviation Information Technology company and Smart Tech to produce bread ration cards;

- Appropriating some 27,633 feddans for the development of new cities including New Luxor.

Saudi Arabia reportedly plans to pump a record 10.8 mn barrels of crude a day starting July under a pact with OPEC that should see global oil output rise by 1 mn bpd for the second half of the year, unnamed sources tell Bloomberg. Energy Minister Khalid Al Falih said last week that Saudi would contribute “hundreds of thousands” of oil barrels to global supply as of next month, without specifying an amount. Months of underproduction had sent oil prices surging beyond the USD 80 bbl mark last month, before falling back to USD 75-76 per bbl. Higher oil output and lower prices are good news for Egypt, which has been in talks with international firms over fuel hedging strategies.

Peace in South Sudan: Salva Kiir, the South Sudan president and longtime Egypt ally, signed a peace agreement on Wednesday in the Sudanese capital of Khartoum with rebel leader and former Vice President Riek Machar. The pact aims to end a five-year civil war between the two factions. “The parties will continue talks in Khartoum to discuss the arrangements for implementing the ceasefire, and after it comes into place the issue of power-sharing will be discussed,” Sudanese Foreign Minister Al Dirdiri Mohamed Ahmed told Reuters. Other rebel factions are opposed to the agreement.

The Macro Picture

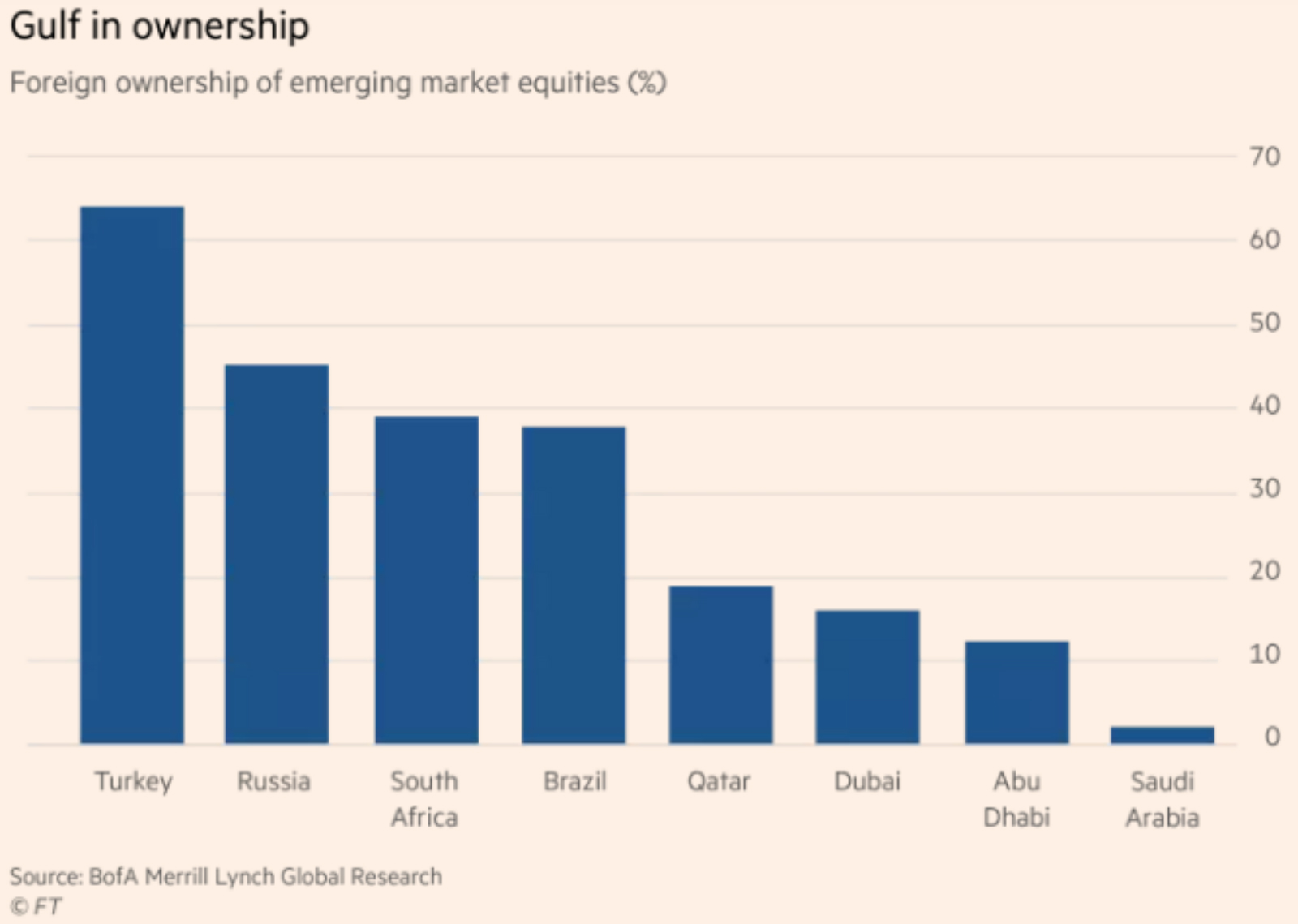

Saudi’s MSCI EM classification gives GCC a significant position in the index: Saudi Arabia’s entry last week to the MSCI Emerging Markets equity index had given the GCC an outsized role in the index and increased GCC ownership stakes in EMs, writes Steve Johnson for the FT. This is especially true when taking into account the low foreign ownership in GCC stocks. “All told, the Gulf could conceivably account for about 7%of the index by 2020, more than index stalwarts South Africa, Brazil and Russia and behind only China, South Korea, Taiwan and India,” he writes. Saudi is the biggest new entrant to the MSCI index since Malaysia was readmitted. Analysts estimate that based on current prices, the USD 520 bn Tadawul bourse will constitute 2.6% of the index when it assumes its full weight in August 2019. That coupled with the UAE and Qatar’s combined 1.4% and Kuwait’s expected classification in 2020, should give the GCC a dominant position in the index, says Johnson.

Egypt in the News

It is a blessedly slow morning for Egypt in the international press.

On Deadline

In the unlikely event you needed a reminder: Not everyone in this country thinks the private sector should take the lead in the economy. Witness Ashraf El Berbery, who writes for Al Shorouk that the government is neglecting its role in providing public services to low-income groups as it looks to close its budget deficit. The “blurred line” between public and private sector responsibilities, he says, is particularly clear at the ministries of housing, transportation, health and education, where he claims the government is looking for “profit” and not focusing on how to provide low-cost services to a wider segment of society.

Worth Reading

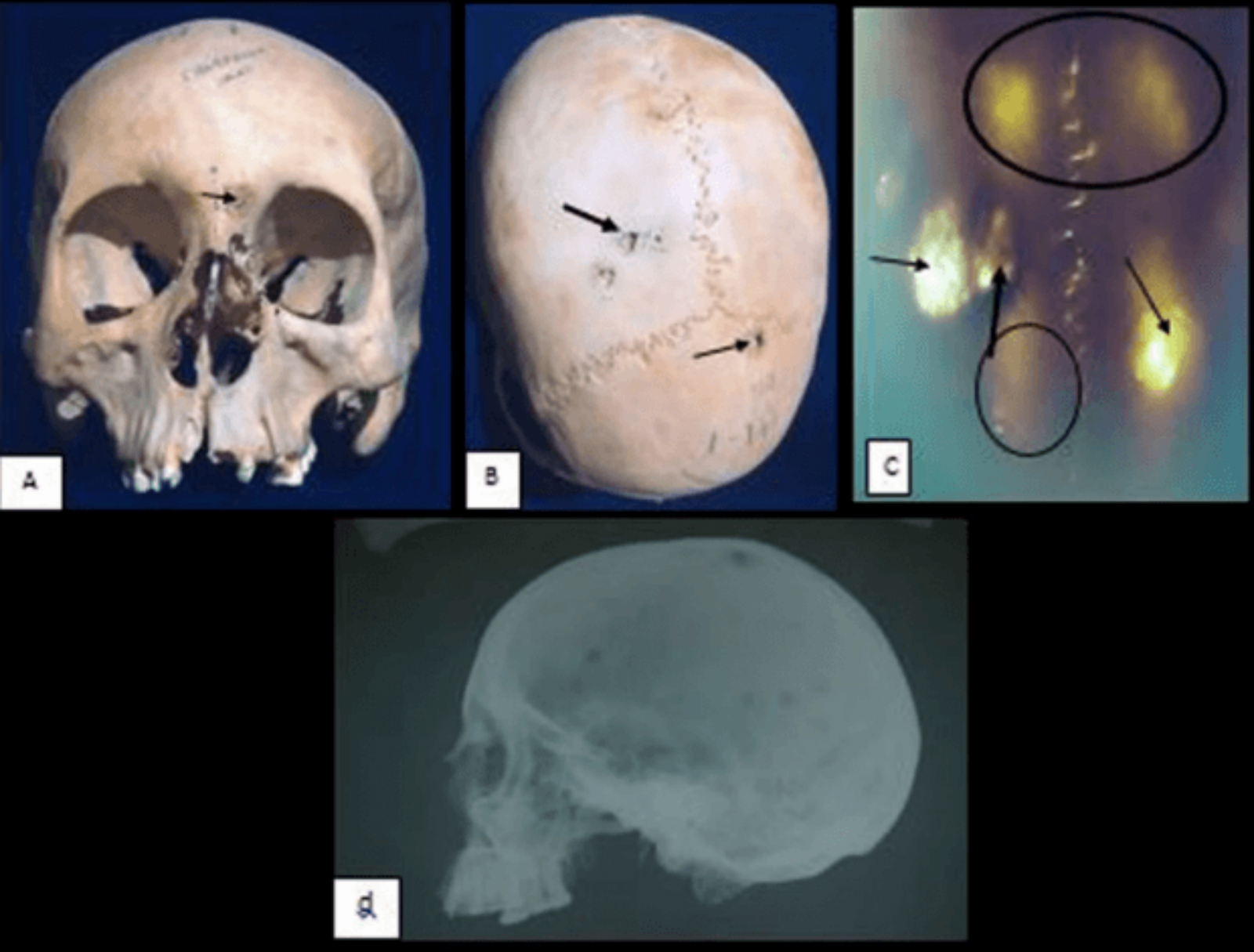

Skeletal records from Ancient Egypt hint that cancer rates have been “actively getting worse”: An analysis of 1,087 skeletons from Ancient Egypt’s western desert found lesions “likely consistent with carcinoma” in only six of them, according to Alphr. “Using this data, we can estimate that the Egyptian cancer rate was around one in 1,000. The current lifetime cancer risk for the western world in 2018? Close to 50%.” That means the lifetime cancer risk today is around 100 times greater than in Ancient Egypt.

No need to start panicking just yet: The researchers were specifically looking for lesions in the skeletons as evidence of cancer, but not all cancers leave behind a lesion, meaning some of the skeletons that were analyzed actually did have cancer but there was no physical evidence left behind. Furthermore, “cancer rates increase with age, and just 7.7% of ancient Egyptians lived beyond the age of 60. Given that half of all cancers affect those over the age of 70, that’s not insignificant.”

Worth Watching

This robot turns your wall into an art canvas: If you wish you could draw a mural on one of your walls but have exactly zero artistic skills, a wall-hanging robot called Scribit could be the answer to your prayers. The robot uses dry-erase markers to draw any content sourced from the web onto a vertical surface, including walls and glass, according to the product’s Kickstarter campaign video. Once you get bored with one mural, Scribit can erase the entire thing and start fresh (watch, runtime: 3:56). Forget art: Think of what this thing could do for your next brainstorming session in front of the whiteboard?

Diplomacy + Foreign Trade

Egypt, Italy prosecutors say Regeni not seen on metro station footage: Prosecutors from Cairo and Rome said that slain PhD Giulio Regeni does not appear in surveillance footage from the metro station where he was last seen before he disappeared back in 2016. The footage contains gaps that need “further sophisticated examinations,” a joint statement picked up by Al Masry Al Youm said. Egyptian authorities had handed the CCTV footage retrieved from the metro station to a team of Italian prosecutors visiting Cairo last month. Rumors surfaced that the tape had been doctored.

AFD pledges EUR 60 mn for Egypt’s social welfare: The French Development Agency (AFD) has agreed to provide Egypt with a EUR 60 mn loan to support social welfare in Egypt, AFD’s Deputy Chief Executive Officer Jeremie Pellet told Investment and International Cooperation Minister Sahar Nasr during a meeting in Paris yesterday, according to an emailed ministry statement (pdf). The agency will also offer a EUR 2 mn technical grant, according to Pellet. No further details were provided on the funding.

Egypt signs MoU to promote investment, cooperation with Euro-Mediterranean countries: Nasr also signed an MoU with the Mediterranean World Economic Foresight Institute (IPEMED) to increase cooperation and investment among Euro-Mediterranean countries, and promote investments in Egypt through its recently unveiled Investment Map, the statement says.

Arab Quartet files ICJ lawsuit against Qatar over airspace dispute: The Arab Quartet filed yesterday a lawsuit with the International Court of Justice against Qatar over a dispute following the quartet’s decision to close their airspaces to Doha, according to the Saudi Press Agency. The four countries boycotting Qatar — Egypt, Saudi Arabia, the UAE, and Bahrain — said the International Civil Aviation Organization (ICAO), which received two complaints from Qatar over the issue, is “not competent to consider that dispute,” the SPA reports. The ICJ began hearing a separate lawsuit Qatar filed against the UAE yesterday, the AP notes. Bloomberg also has the story.

El Sisi meets with China’s Communist Party delegation to talk trade, investment: President Abdel Fattah El Sisi met yesterday with a delegation from the Communist Party of China’s political bureau to discuss increasing trade and investment between Egypt and China, according to an Ittihadiya statement.

Energy

Sisi meets with Chairman of Euro Africa Interconnector to discuss linking Egypt, Cyprus’ electricity grids

President Abdel Fattah El Sisi met yesterday with Chairman of the EuroAfrica Interconnector, Ioannis Kasoulides, to discuss plans to implement a USD 4 bn electrical connection project with Cyprus and Greece, according to an Ittihadiya statement. EuroAfrica had presented the government the day before with feasibility studies for a 1,707 km, 2,000 MW subsea power cable between Egypt and Cyprus. Shaker said that the ministry will review the studies before entering final talks with Cyprus on the details of the connection. No details are provided on the expected timeline for the project, which is expected to become part of a larger interconnection project between Europe and Africa.

Infrastructure

SCA denies seeking EUR 300 mn from Gulf banks to finance dredger purchase

The Suez Canal Authority (SCA) denied reports that it’s looking for a EUR 300 mn loan from the Gulf to purchase two dredgers, SCA spokesperson Tarek Hassanein said yesterday, Ahram Online reports. We noted a Reuters report yesterday claiming that the SCA was in talks with Gulf banks for a loan to finance its agreement with Dutch Royal IHC for the dredgers. A consortium made up of CIB, the National Bank of Egypt, Banque Misr, and the Arab African International Bank had offered to provide the SCA with the loan earlier this year, but banking sources had said at the time that the SCA was likely to borrow from international institutions that offered better rates and repayment conditions.

Basic Materials + Commodities

Military Production in talks with Except Integrated Sustainability to cooperate on building silos

Military Production Minister Mohamed El Aassar met yesterday with Chairman of Dutch firm Except for Integrated Sustainability Tom Bosart to discuss joint cooperation to build silos for the storage of agricultural produce, according to Al Masry Al Youm. The Dutch company said it was interested in developing sustainable farming systems in Egypt. No additional details were provided.

Health + Education

Japanese-style schools to begin accepting online applications 2 July

Education Minister Tarek Shawki announced that the government’s new Japanese-style schools will begin accepting online applications for the 2018-19 school year as of 2 July, according to Al Mal. The schools had pushed their inaugural semester for a year from last fall. 22 out of a planned 45 schools are expected to be ready for September. Egypt and Japan had signed in February a USD 175.7 mn loan agreement to finance the construction of schools in Egypt that operate using Japanese curricula.

Real Estate + Housing

NACCUD to tender 1,000 feddans in new administrative capital next week

The New Administrative Capital Company for Urban Development (NACCUD) will issue a tender for 1,000 feddans for development in the new capital next week, company Chairman Ahmed Zaki Abdeen tells Al Mal.

Telecoms + ICT

Egypt gets recognition for growing outsourcing sector by IAOP

Egypt is “an ideal” outsourcing location due to its young population, large industry sector, and growing services sector, the International Association of Outsourcing Professionals (IAOP) says. The country is also improving its infrastructure through technology and business parks, and the reform program is helping to “unleash the economy’s potential,” the report notes. The report notes Egypt’s young and educated population as one of the key reasons why outsourcing is growing in the country. However, “Egypt also has a lot of catching up to do with respect to developing human capital, adoption of new age technologies and improving ease of doing business in order to compete with other prime outsourcing destinations,” the report notes.

SICO launches first Egyptian-made tablet, to raise CAPEX to EGP 1 bn

Egyptian electronics manufacturer SICO launched yesterday the first Egyptian-made tablet PC, the SICO Express 3, Ahram Gate reports. The company plans to bring its total investments to EGP 1 bn over the coming three years, up from a current EGP 422 mn, CEO Mohamed Salem said yesterday.

Egypt Politics + Economics

Former assistant health minister sentenced to 10 years in prison

A criminal court sentenced yesterday former Assistant Health Minister Ahmed Aziz to 10 years in prison and handed him a EGP 500k fine for accepting bribes worth EGP 4 mn, Al Masry Al Youm reports. The court acquitted a co-defendant in the case. The two were arrested back in May 2016.

Sports

EFA says sorry, not sorry, for horrendous World Cup performance

Egyptian Football Association (EFA) head Hany Abu Rida apologized yesterday for the national team’s “very bad” performance at the World Cup. Speaking at a press conference, Abu Rida said the EFA is expecting to receive a technical report from team coach Hector Cuper on the reasons behind the team’s successive match losses, according to Youm7. However, Abu Rida brushed off allegations that the EFA is in hot water with national star Mohamed Salah for helping Chechnya’s dictator Ramzan Kadyrov use him as a publicity pawn, saying that Salah was only upset due to his shoulder injury, AMAY reports. Abu Rida also said that the EFA’s board of directors would not submit its resignation. Meanwhile, Kadyrov rejected the notion that he made the team or Salah uncomfortable, saying that Egypt’s national team “voiced no complaints” about their stay in Grozny, according to TASS.

Weightlifter Gaber Mohamed clinches two golds at 2018 Mediterranean Games

Egypt’s Gaber Mohamed scored two gold medals for the men’s weightlifting 105 kg class at the 2018 Mediterranean Games yesterday, the official website for the tournament shows. He brings the total number of Egypt’s medals at the Mediterranean Games tournament to 34.

On Your Way Out

Adrenaline junkies over the Pyramids: Sixty five world-record skydivers from twenty countries around the world gathered in Cairo this week to take part in the a 15k feet skydive dubbed “Jump Like the Pharaoh.” The organizers say their aim is to “support tourism, but we also want to advocate establishing a permanent drop zone in Egypt to be able to operate whenever we need,” co-founder of Skydive Egypt Mahmoud Sharaf tells Egypt Independent.

The Market Yesterday

EGP / USD CBE market average: Buy 17.83 | Sell 17.93

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 16,176 (-0.1%)

Turnover: EGP 1 bn (90% below the 90-day average)

EGX 30 year-to-date: +7.7%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.1%. CIB, the index heaviest constituent ended down 0.9%. EGX30’s top performing constituents were GB Auto up 4.5%, Global Telecom up 4.4%, and Qalaa Holding up 2.8%. Yesterday’s worst performing stocks were AMOC down 2.6%, Heliopolis Housing down 2.3% and TMG Holding down 2.0%. The market turnover was EGP 1 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -30.0 mn

Regional: Net Short | EGP -16.0 mn

Domestic: Net Long | EGP +46.0 mn

Retail: 51.1% of total trades | 53.6% of buyers | 48.6% of sellers

Institutions: 48.9% of total trades | 46.4% of buyers | 51.4% of sellers

Foreign: 27.7% of total | 26.2% of buyers | 29.2% of sellers

Regional: 6.4% of total | 5.7% of buyers | 7.2% of sellers

Domestic: 65.8% of total | 68.1% of buyers | 63.6% of sellers

WTI: USD 72.35 (-0.56%)

Brent: USD 77.62 (+1.72%)

Natural Gas (Nymex, futures prices) USD 2.99 MMBtu, (+0.30%, August 2018 contract)

Gold: USD 1,254.10 / troy ounce (-0.16%)

TASI: 8,317.27 (+0.22%) (YTD: +15.10%)

ADX: 4,544.67 (-0.46%) (YTD: +3.32%)

DFM: 2,814.89 (-0.74%) (YTD: -16.47%)

KSE Premier Market: 4,925.57 (+0.08%)

QE: 8,928.74 (+0.38%) (YTD: +4.76%)

MSM: 4,576.73 (+0.14%) (YTD: -10.25%)

BB: 1,306.26 (+0.32%) (YTD: -1.91%)

Calendar

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

29 June (Friday): IMF’s executive board meeting to review progress on Egypt’s reform program.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.